Appellant's Appendix - Philip D. Stern

Appellant's Appendix - Philip D. Stern

Appellant's Appendix - Philip D. Stern

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

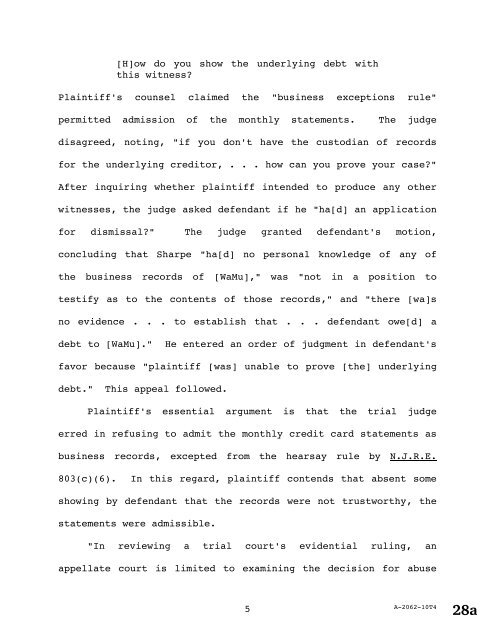

[H]ow do you show the underlying debt with<br />

this witness?<br />

Plaintiff's counsel claimed the "business exceptions rule"<br />

permitted admission of the monthly statements. The judge<br />

disagreed, noting, "if you don't have the custodian of records<br />

for the underlying creditor, . . . how can you prove your case?"<br />

After inquiring whether plaintiff intended to produce any other<br />

witnesses, the judge asked defendant if he "ha[d] an application<br />

for dismissal?" The judge granted defendant's motion,<br />

concluding that Sharpe "ha[d] no personal knowledge of any of<br />

the business records of [WaMu]," was "not in a position to<br />

testify as to the contents of those records," and "there [wa]s<br />

no evidence . . . to establish that . . . defendant owe[d] a<br />

debt to [WaMu]." He entered an order of judgment in defendant's<br />

favor because "plaintiff [was] unable to prove [the] underlying<br />

debt." This appeal followed.<br />

Plaintiff's essential argument is that the trial judge<br />

erred in refusing to admit the monthly credit card statements as<br />

business records, excepted from the hearsay rule by N.J.R.E.<br />

803(c)(6). In this regard, plaintiff contends that absent some<br />

showing by defendant that the records were not trustworthy, the<br />

statements were admissible.<br />

"In reviewing a trial court's evidential ruling, an<br />

appellate court is limited to examining the decision for abuse<br />

5<br />

A-2062-10T4<br />

28a