BSLI Guaranteed Bachat Plan - Citibank India

BSLI Guaranteed Bachat Plan - Citibank India

BSLI Guaranteed Bachat Plan - Citibank India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

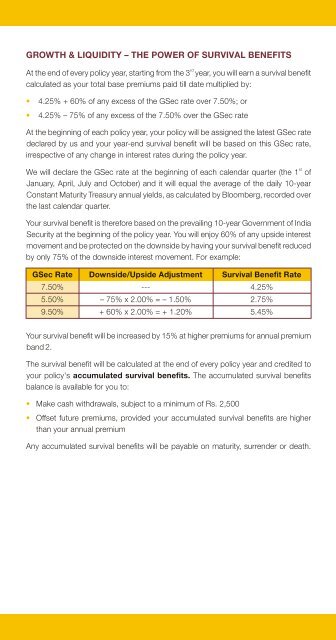

GROWTH & LIQUIDITY – THE POWER OF SURVIVAL BENEFITS<br />

rd<br />

At the end of every policy year, starting from the 3 year, you will earn a survival benefit<br />

calculated as your total base premiums paid till date multiplied by:<br />

• 4.25% + 60% of any excess of the GSec rate over 7.50%; or<br />

• 4.25% – 75% of any excess of the 7.50% over the GSec rate<br />

At the beginning of each policy year, your policy will be assigned the latest GSec rate<br />

declared by us and your year-end survival benefit will be based on this GSec rate,<br />

irrespective of any change in interest rates during the policy year.<br />

st<br />

We will declare the GSec rate at the beginning of each calendar quarter (the 1 of<br />

January, April, July and October) and it will equal the average of the daily 10-year<br />

Constant Maturity Treasury annual yields, as calculated by Bloomberg, recorded over<br />

the last calendar quarter.<br />

Your survival benefit is therefore based on the prevailing 10-year Government of <strong>India</strong><br />

Security at the beginning of the policy year. You will enjoy 60% of any upside interest<br />

movement and be protected on the downside by having your survival benefit reduced<br />

by only 75% of the downside interest movement. For example:<br />

GSec Rate Downside/Upside Adjustment Survival Benefit Rate<br />

7.50% --- 4.25%<br />

5.50% – 75% x 2.00% = – 1.50% 2.75%<br />

9.50% + 60% x 2.00% = + 1.20% 5.45%<br />

Your survival benefit will be increased by 15% at higher premiums for annual premium<br />

band 2.<br />

The survival benefit will be calculated at the end of every policy year and credited to<br />

your policy's accumulated survival benefits. The accumulated survival benefits<br />

balance is available for you to:<br />

• Make cash withdrawals, subject to a minimum of Rs. 2,500<br />

• Offset future premiums, provided your accumulated survival benefits are higher<br />

than your annual premium<br />

Any accumulated survival benefits will be payable on maturity, surrender or death.