CPS Annual Report 2005-2006 - PDF - Crown Prosecution Service

CPS Annual Report 2005-2006 - PDF - Crown Prosecution Service

CPS Annual Report 2005-2006 - PDF - Crown Prosecution Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE DEPARTMENTAL RESOURCE ACCOUNTS 73<br />

26. Financial Instruments<br />

FRS 13, Derivatives and Other Financial Instruments, requires disclosure of the role which financial instruments have had during the<br />

period in creating or changing the risks an entity faces in undertaking its activities. Because of the largely non-trading nature of its<br />

activities and the way in which government departments are financed, the <strong>CPS</strong> is not exposed to the degree of financial risk faced by<br />

business entities. Moreover, financial instruments play a much more limited role in creating or changing risk than would be typical of the<br />

listed companies to which FRS 13 mainly applies. The Department has no power to borrow or invest surplus funds and financial<br />

assets and liabilities are generated by day-to-day operational activities and are not held to change the risks facing the Department in<br />

undertaking its activities.<br />

Liquidity risk<br />

The Department’s net revenue resource and capital requirements are financed by resources voted annually by Parliament.<br />

The <strong>CPS</strong> is not therefore exposed to liquidity risks.<br />

Interest-rate and Foreign currency risk<br />

The Department has no material deposits, and all material assets and liabilities are denominated in sterling, so it is not exposed to<br />

interest rate or currency risk.<br />

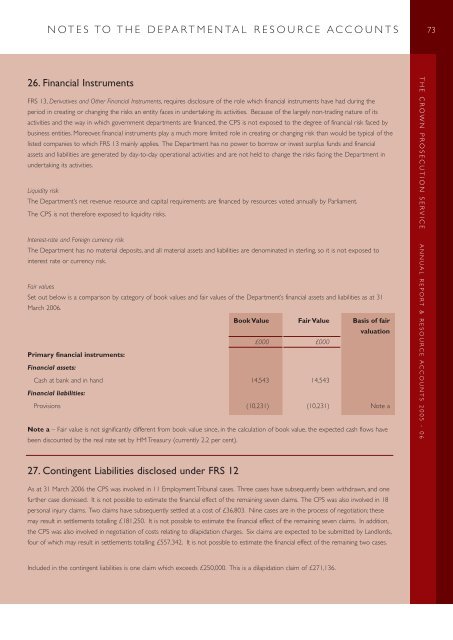

Fair values<br />

Set out below is a comparison by category of book values and fair values of the Department’s financial assets and liabilities as at 31<br />

March <strong>2006</strong>.<br />

Primary financial instruments:<br />

Financial assets:<br />

Book Value Fair Value Basis of fair<br />

valuation<br />

£000 £000<br />

Cash at bank and in hand 14,543 14,543<br />

Financial liabilities:<br />

Provisions (10,231) (10,231) Note a<br />

Note a – Fair value is not significantly different from book value since, in the calculation of book value, the expected cash flows have<br />

been discounted by the real rate set by HM Treasury (currently 2.2 per cent).<br />

27. Contingent Liabilities disclosed under FRS 12<br />

As at 31 March <strong>2006</strong> the <strong>CPS</strong> was involved in 11 Employment Tribunal cases. Three cases have subsequently been withdrawn, and one<br />

further case dismissed. It is not possible to estimate the financial effect of the remaining seven claims. The <strong>CPS</strong> was also involved in 18<br />

personal injury claims. Two claims have subsequently settled at a cost of £36,803. Nine cases are in the process of negotiation; these<br />

may result in settlements totalling £181,250. It is not possible to estimate the financial effect of the remaining seven claims. In addition,<br />

the <strong>CPS</strong> was also involved in negotiation of costs relating to dilapidation charges. Six claims are expected to be submitted by Landlords,<br />

four of which may result in settlements totalling £557,342. It is not possible to estimate the financial effect of the remaining two cases.<br />

Included in the contingent liabilities is one claim which exceeds £250,000. This is a dilapidation claim of £271,136.<br />

THE CROWN PROSECUTION SERVICE ANNUAL REPORT & RESOURCE ACCOUNTS <strong>2005</strong> - 06