CPS Annual Report 2005-2006 - PDF - Crown Prosecution Service

CPS Annual Report 2005-2006 - PDF - Crown Prosecution Service

CPS Annual Report 2005-2006 - PDF - Crown Prosecution Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

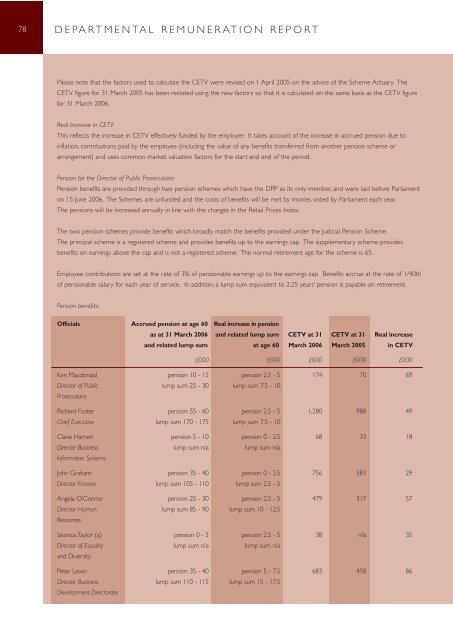

78 DEPARTMENTAL REMUNERATION REPORT<br />

Please note that the factors used to calculate the CETV were revised on 1 April <strong>2005</strong> on the advice of the Scheme Actuary. The<br />

CETV figure for 31 March <strong>2005</strong> has been restated using the new factors so that it is calculated on the same basis as the CETV figure<br />

for 31 March <strong>2006</strong>.<br />

Real Increase in CETV<br />

This reflects the increase in CETV effectively funded by the employer. It takes account of the increase in accrued pension due to<br />

inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or<br />

arrangement) and uses common market valuation factors for the start and end of the period.<br />

Pension for the Director of Public <strong>Prosecution</strong>s<br />

Pension benefits are provided through two pension schemes which have the DPP as its only member, and were laid before Parliament<br />

on 15 June <strong>2006</strong>. The Schemes are unfunded and the costs of benefits will be met by monies voted by Parliament each year.<br />

The pensions will be increased annually in line with the changes in the Retail Prices Index.<br />

The two pension schemes provide benefits which broadly match the benefits provided under the Judicial Pension Scheme.<br />

The principal scheme is a registered scheme and provides benefits up to the earnings cap. The supplementary scheme provides<br />

benefits on earnings above the cap and is not a registered scheme. The normal retirement age for the scheme is 65.<br />

Employee contributions are set at the rate of 3% of pensionable earnings up to the earnings cap. Benefits accrue at the rate of 1/40th<br />

of pensionable salary for each year of service. In addition, a lump sum equivalent to 2.25 years’ pension is payable on retirement.<br />

Pension benefits:<br />

Officials Accrued pension at age 60 Real increase in pension<br />

as at 31 March <strong>2006</strong> and related lump sum CETV at 31 CETV at 31 Real increase<br />

and related lump sum at age 60 March <strong>2006</strong> March <strong>2005</strong> in CETV<br />

£000 £000 £000 £000 £000<br />

Ken Macdonald pension 10 - 15 pension 2.5 - 5 174 70 69<br />

Director of Public lump sum 25 - 30 lump sum 7.5 - 10<br />

<strong>Prosecution</strong>s<br />

Richard Foster pension 55 - 60 pension 2.5 - 5 1,280 988 49<br />

Chief Executive lump sum 170 - 175 lump sum 7.5 - 10<br />

Claire Hamon pension 5 - 10 pension 0 - 2.5 68 33 18<br />

Director Business lump sum n/a lump sum n/a<br />

Information Systems<br />

John Graham pension 35 - 40 pension 0 - 2.5 756 583 29<br />

Director Finance lump sum 105 - 110 lump sum 2.5 - 5<br />

Angela O’Connor pension 25 - 30 pension 2.5 - 5 479 317 57<br />

Director Human lump sum 85 - 90 lump sum 10 - 12.5<br />

Resources<br />

Séamus Taylor (a) pension 0 - 5 pension 2.5 - 5 38 n/a 35<br />

Director of Equality<br />

and Diversity<br />

lump sum n/a lump sum n/a<br />

Peter Lewis pension 35 - 40 pension 5 - 7.5 683 458 86<br />

Director Business lump sum 110 - 115 lump sum 15 - 17.5<br />

Development Directorate