111211232-MOSt Focused 25 Fund Form 150413 - Motilal Oswal

111211232-MOSt Focused 25 Fund Form 150413 - Motilal Oswal

111211232-MOSt Focused 25 Fund Form 150413 - Motilal Oswal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

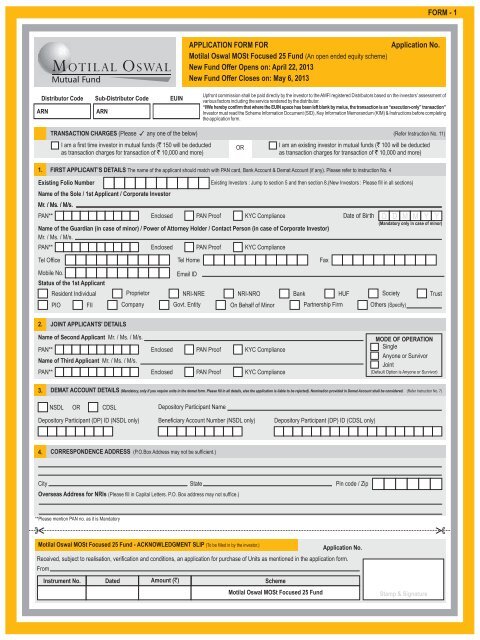

FORM - 1<br />

APPLICATION FORM FOR<br />

<strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> (An open ended equity scheme)<br />

New <strong>Fund</strong> Offer Opens on: April 22, 2013<br />

New <strong>Fund</strong> Offer Closes on: May 6, 2013<br />

Application No.<br />

Distributor Code<br />

ARN<br />

Sub-Distributor Code<br />

ARN<br />

EUIN<br />

Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of<br />

various factors including the service rendered by the distributor.<br />

“I/We hereby confirm that where the EUIN space has been left blank by me/us, the transaction is an “execution-only” transaction”<br />

Investor must read the Scheme Information Document (SID), Key Information Memorandum (KIM) & Instructions before completing<br />

the application form.<br />

TRANSACTION CHARGES (Please 3any one of the below)<br />

I am a first time investor in mutual funds (` 150 will be deducted<br />

as transaction charges for transaction of ` 10,000 and more)<br />

OR<br />

(Refer Instruction No. 11)<br />

I am an existing investor in mutual funds (` 100 will be deducted<br />

as transaction charges for transaction of ` 10,000 and more)<br />

1.<br />

FIRST APPLICANT’S DETAILS The name of the applicant should match with PAN card, Bank Account & Demat Account (if any). Please refer to instruction No. 4<br />

Existing Folio Number<br />

Name of the Sole / 1st Applicant / Corporate Investor<br />

Mr. / Ms. / M/s.<br />

PAN**<br />

Existing Investors : Jump to section 5 and then section 8.(New Investors : Please fill in all sections)<br />

Name of the Guardian (in case of minor) / Power of Attorney Holder / Contact Person (in case of Corporate Investor)<br />

Mr. / Ms. / M/s.<br />

PAN**<br />

Enclosed<br />

Enclosed<br />

PAN Proof<br />

PAN Proof<br />

KYC Compliance<br />

KYC Compliance<br />

Tel Office Tel Home Fax<br />

Date of Birth<br />

D D M M Y Y<br />

(Mandatory only in case of minor)<br />

Mobile No.<br />

Email ID<br />

Status of the 1st Applicant<br />

Resident Individual<br />

Proprietor<br />

NRI-NRE<br />

NRI-NRO<br />

Bank<br />

HUF<br />

PIO FII Company Govt. Entity<br />

On Behalf of Minor Partnership Firm<br />

Society<br />

Others (Specify)<br />

Trust<br />

2.<br />

JOINT APPLICANTS' DETAILS<br />

Name of Second Applicant Mr. / Ms. / M/s.<br />

PAN**<br />

Name of Third Applicant Mr. / Ms. / M/s.<br />

PAN**<br />

Enclosed<br />

Enclosed<br />

PAN Proof<br />

PAN Proof<br />

KYC Compliance<br />

KYC Compliance<br />

MODE OF OPERATION<br />

Single<br />

Anyone or Survivor<br />

Joint<br />

(Default Option is Anyone or Survivor)<br />

3.<br />

DEMAT ACCOUNT DETAILS (Mandatory, only if you require units in the demat form. Please fill in all details, else the application is liable to be rejected). Nomination provided in Demat Account shall be considered. (Refer Instruction No. 7)<br />

NSDL OR CDSL<br />

Depository Participant Name<br />

Depository Participant (DP) ID (NSDL only) Beneficiary Account Number (NSDL only) Depository Participant (DP) ID (CDSL only)<br />

4.<br />

CORRESPONDENCE ADDRESS (P.O.Box Address may not be sufficient.)<br />

City State Pin code / Zip<br />

Overseas Address for NRIs (Please fill in Capital Letters. P.O. Box address may not suffice.)<br />

**Please mention PAN no. as it is Mandatory<br />

<strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> - ACKNOWLEDGMENT SLIP (To be filled in by the investor.)<br />

Application No.<br />

Received, subject to realisation, verification and conditions, an application for purchase of Units as mentioned in the application form.<br />

From<br />

Instrument No. Dated Amount (`) Scheme<br />

<strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong><br />

Stamp & Signature

5.<br />

INVESTMENT & PAYMENT DETAILS (Cheque to be drawn in favour of “Focus - <strong>25</strong>”)<br />

Payment Type (Please 3) : Non - Third Party Payment Third Party Payment (please fill the attached Third Party Payment Declaration <strong>Form</strong> - 4)<br />

Scheme - <strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> Plan - Direct* Regular (*Default Plan) Option - Growth** Div - Payout<br />

LUMPSUM INVESTMENT<br />

Payment Mode: Cheque DD RTGS NEFT <strong>Fund</strong>s transfer<br />

Amount (`)(i)<br />

DD charges, (`)(ii)<br />

Total Amount (`) (i) + (ii)<br />

Instrument No. Date D D M M Y Y<br />

Account No.<br />

Bank Name<br />

Branch & City<br />

Account Type<br />

Current Savings NRO NRE FCNR<br />

OR<br />

Div - Reinvest (**Default Option)<br />

SYSTEMATIC INVESTMENT PLAN (SIP) - ECS (please fill ECS Debit <strong>Form</strong> - 3)<br />

First NFO SIP Instalment Amount (`)<br />

First SIP Instalment Cheque / DD No. Date D D M M Y Y<br />

Drawn on Bank, Branch<br />

Subsequent SIP Instalment Amount (`)<br />

SIP Frequency<br />

SIP Date<br />

th<br />

5<br />

SIP Period From<br />

Monthly<br />

th<br />

7<br />

th<br />

10<br />

Quarterly<br />

th<br />

15<br />

th<br />

<strong>25</strong> of the Month / Quarter<br />

0 7 1 3 To 06/2016 06/2018 06/2020<br />

06/2099 Other M M Y Y<br />

6.<br />

BANK DETAILS (Mandatory) Redemption / Dividend / Refund payouts will be credited into this bank account in case it is in the current list of banks with whom <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> has Direct Credit facility.<br />

Name of the Bank<br />

Account Number<br />

Branch<br />

City<br />

Account Type Current Savings NRO NRE FCNR Others (please specify)<br />

MICR Code<br />

RTGS/NEFT Code<br />

I / We understand that the instructions to the bank for Direct Credit / NEFT / ECS will be given by the Mutual <strong>Fund</strong>, and such instructions will be adequate discharge of the Mutual <strong>Fund</strong> towards redemption / dividend /<br />

refund proceeds. In case the bank does not credit my /our bank account with / without assigning any reason thereof, or if the transaction is delayed or not effected at all or credited into the wrong account for reasons of<br />

incomplete or incorrect information, I / We would not hold <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> responsible. Further the Mutual <strong>Fund</strong> reserves the right to issue a demand draft / payable at par cheque in case it is not possible to<br />

make payment by DC/NEFT/ECS.<br />

If however the unit holders wish to receive a cheque (instead of a direct credit into their bank account) please tick the box alongside<br />

7.<br />

NOMINATION DETAILS (Mandatory information. Please select the desired option.)<br />

I/We wish to nominate.<br />

I/We DO NOT wish to nominate and sign here<br />

1st Applicant Signature (Mandatory)<br />

Nominee Name Guardian Name (In case of Minor) % (Percentage) Nominee Signature<br />

Nominee 1<br />

Nominee 2<br />

Nominee 3<br />

Address Total = 100%<br />

8.<br />

DECLARATION & SIGNATURES<br />

Having read and understood the contents of the Scheme Information Documents of the Scheme(s), I/We hereby apply for the units of the Scheme(s) and agree to abide by the terms, conditions, rules and regulations governing the Scheme(s). I/ We hereby<br />

declare that the amount invested in the Scheme(s) is through legitimate sources only and does not involve and is not designed for the purpose of the contravention of any Act, Rules, Regulations, Notifications or Directions of the provisions of the Income Tax Act,<br />

Anti Money Laundering Laws, Anti Corruption Laws or any other applicable laws enacted by the Government of India from time to time. I/ We have understood the details of the Scheme(s) & I / We have not received nor have been induced by any rebate or gifts,<br />

directly or indirectly in making this investment. I / We confirm that the funds invested in the Scheme(s), legally belong to me / us. In the event " Know Your Customer" process is not completed by me / us to the satisfaction of the Mutual <strong>Fund</strong>, I / We hereby<br />

authorise the Mutual <strong>Fund</strong>, to redeem the funds invested in the Scheme(s), in favour of the applicant, at the applicable NAV prevailing on the date of such redemption and undertake such other action with such funds that may be required by the Law.<br />

The ARN holder has disclosed to me / us all the commissions (in the form of trail commission or any other mode), payable to him for the different competing Schemes of various Mutual <strong>Fund</strong>s from amongest which the Scheme is being recommended to me / us.<br />

For NRIs only : I / We confirm that I am / we are Non Residents of Indian nationality / origin and that I / We have remitted funds from abroad through approved banking channels or from funds in my / our Non-Resident External / Non-Resident Ordinary / FCNR<br />

Account.<br />

I / We confirm that the details provided by me / us are true and correct.<br />

First / Sole Applicant / Guardian Second Applicant Third Applicant POA Holder<br />

<strong>Motilal</strong> <strong>Oswal</strong> Asset Management Company Limited<br />

<strong>Motilal</strong> <strong>Oswal</strong> Asset Management Co. Ltd.<br />

<strong>Motilal</strong> <strong>Oswal</strong> Tower, Jn. of Gokhale Road & Sayani Road,<br />

Prabhadevi, Mumbai - <strong>25</strong>,<br />

Email: mfservice@motilaloswal.com. Toll Free No.: 1800-200-6626

FORM - 2<br />

APPLICATION SUPPORTED BY BLOCKED AMOUNT (ASBA)<br />

<strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> (An open ended equity scheme)<br />

New <strong>Fund</strong> Offer Opens on: April 22, 2013<br />

New <strong>Fund</strong> Offer Closes on: May 6, 2013<br />

Application No.<br />

Distributor Code<br />

ARN<br />

Sub-Distributor Code<br />

ARN<br />

EUIN<br />

Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of<br />

various factors including the service rendered by the distributor.<br />

“I/We hereby confirm that where the EUIN space has been left blank by me/us, the transaction is an “execution-only” transaction”<br />

Investor must read the Scheme Information Document (SID), Key Information Memorandum (KIM) & Instructions before completing<br />

the application form.<br />

1.<br />

APPLICANT’S DETAILS The name of the applicant should match with PAN card, Bank Account & Demat Account (if any).<br />

Name of the Sole / 1st Applicant / Corporate Investor<br />

Mr. / Ms. / M/s.<br />

Name of the 2nd Applicant<br />

Mr. / Ms. / M/s.<br />

Name of the 3rd Applicant<br />

Mr. / Ms. / M/s.<br />

PAN**<br />

PAN**<br />

PAN**<br />

2.<br />

DEMAT ACCOUNT DETAILS OF FIRST APPLICANT (Mandatory, Please fill in all details, else the application is liable to be rejected). Nomination provided in Demat Account shall be considered.<br />

NSDL OR CDSL<br />

Depository Participant Name<br />

Depository Participant (DP) ID (NSDL only) Beneficiary Account Number (NSDL only) Depository Participant (DP) ID (CDSL only)<br />

3.<br />

SCHEME DETAILS<br />

Scheme - <strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> Plan - Direct* Regular (*Default Plan) Option - Growth** Div - Payout<br />

LUMPSUM INVESTMENT<br />

SYSTEMATIC INVESTMENT PLAN (SIP)<br />

Div - Reinvest (**Default Option)<br />

4.<br />

BANK DETAILS (Mandatory) Redemption / Dividend / Refund payouts will be credited into this bank account in case it is in the current list of banks with whom <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> has Direct Credit facility.<br />

Name of the Bank<br />

Account Number<br />

Amount to be Blocked - (in figures)<br />

5.<br />

UNDERTAKING BY ASBA INVESTOR<br />

(in words)<br />

1) l/We hereby undertake that l/We am/are an ASBA lnvestor as per the applicable provisions of the SEBl (lssue of Capital and Disclosure Requirements), Regulations, 2009 (‘SEBl Regulations’) as amended from time to<br />

time. 2) ln accordance with ASBA process provided in the SEBl Regulations and as disclosed in this application, l/We authorize (a) the SCSB to do all necessary acts including blocking of application money towards the<br />

Subscription of Units of the Scheme, to the extent mentioned above in the “SCSB/ASBA Account details” or unblocking of funds in the bank account maintained with the SCSB specified in this application form, transfer of<br />

funds to the Bank account of the Scheme/<strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> on receipt of instructions from the Registrar and Transfer Agent after the allotment of the Units entitling me/us to receive Units on such transfer of funds,<br />

etc. (b) Registrar and TransferAgent to issue instructions to the SCSB to remove the block on the funds in the bank account specified in the application, upon allotment of Units and to transfer the requisite money to the<br />

Bank account of Scheme/Bank account of Mutual <strong>Fund</strong>. 3) ln case the amount available in the bank account specified in the application is insufficient for blocking the amount equivalent to the application money towards the<br />

Subscription of Units, the SCSB shall reject the application. 4) lf the DP lD, Beneficiary Account No. or PAN furnished by me/us in the application is incorrect or incomplete or not matching with the depository records, the<br />

application shall be rejected and the Mutual <strong>Fund</strong> or <strong>Motilal</strong> <strong>Oswal</strong> Asset Management Company Limited or <strong>Motilal</strong> <strong>Oswal</strong> Trustee Company Limited or SCSBs shall not be liable for losses, if any. All future communication in<br />

connection with NFO should be addressed to the SCSB/RTA/AMC quoting the full name of the Sole/First Applicant, NFO Application Number, ASBA Application Number, Depository Account details [if it has been provided],<br />

Amount applied for and the account number from where NFO amount was blocked.<br />

6.<br />

DECLARATION & SIGNATURES<br />

I/We have read and understood the contents of the SID of the Scheme of <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong>. I/We hereby apply for allotment/purchase of Unit in the Scheme and agree to abide by the terms and conditions<br />

applicable thereto. I/We hereby declare that I/we are authorised to make this investment in the above mentioned scheme and that the amount invested in the scheme is through legitimate sources only and does not involve<br />

and is designed for the purpose of any contravention or evasion of provision of any Act, Rules & Regulations, Notifications or Directions of the provision of Income Tax Act, Anti Money Laundering Act, Anti Corruption Act or<br />

any other applicable laws enacted by Government of India from time to time. I/We hereby authorise <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong>, its investment Manager and its agent to disclose details of my investment to my/our<br />

investment advisor and/or my bank(s). I/We confirm that the distributor has disclosed all commission (in the form of trail commission or any other mode) payable to the distributor for the different competing Schemes of<br />

various Mutual <strong>Fund</strong>s from amongst which the Scheme is being recommended to me/us.<br />

I/We have neither received nor been induced by any rebate or gifts, directly or indirectly, in making this investment.<br />

SIGNATURE(S)<br />

Branch<br />

City<br />

*Please mention PAN no. as it is Mandatory<br />

Sole / First Applicant Second Applicant Third Applicant<br />

ACKNOWLEDGEMENT SLIP TO THE ASBA INVESTOR<br />

<strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> - ACKNOWLEDGMENT SLIP<br />

DATE:<br />

Received from Mr./Ms./Mrs./M/s. SCSB Account details Total Amount to be Blocked<br />

A/c. No.<br />

` in figures<br />

Address Bank Name ` in words<br />

Branch Name<br />

Application No.<br />

SCSB Stamp, Signature<br />

Date & time of receipt

INSTRUCTIONS FOR FILLING ASBA APPLICATION FORM<br />

1. Meaning of ASBA: ASBA is an application for subscribing to a New <strong>Fund</strong> Offer<br />

(NFO), containing an authorisation to block the application money in a bank account.<br />

2. Self Certified Syndicate Bank (SCSB): SCSB is a banker to an issue registered<br />

with the SEBI which offers the facility of applying through the ASBA process. The list<br />

of SCSBs will be displayed by SEBI on its website at www.sebi.gov.in from time to<br />

time. ASBAs can be accepted only by SCSBs, whose names appear in the list of<br />

SCSBs displayed on SEBI”s website. As on April 15, 2010, 27 Banks have been<br />

recognised as SCSBs. Investors maintaining their accounts in any of these Banks<br />

may approach one of the designated branches of these SCSBs for availing this<br />

facility. Further it may be noted that from time to time new banks register themselves<br />

as SCSBs who become eligible to provide these services and also the existing<br />

SCSBs designate additional branches that also provide this facility. An updated list of<br />

all the registered SCSBs, their controlling branches, contact details and details of<br />

their contact persons, a list of their designated branches which are providing such<br />

services is available on the website of SEBI at the address http://www.sebi.gov.in.<br />

Further these details are also available on the websites of the Stock Exchanges at<br />

http://www.bseindia.com and http://www.nseindia.com. Alternatively, investors may<br />

also contact the AMC, R&TA for information about the SCSBs or the ASBA process.<br />

These SCSBs are deemed to have entered into an agreement with the Issuer and<br />

shall be required to offer the ASBA facility to all its account holders for all issues to<br />

which ASBA process is applicable. A SCSB shall identify its Designated Branches<br />

(DBs) at which an ASBA bidder shall submit ASBA and shall also identify the<br />

Controlling Branch (CB), which shall act as a coordinating branch for the Registrar to<br />

the Issue, Stock Exchanges and Merchant Bankers. The SCSB, its DBs and CB shall<br />

continue to act as such, for all issues to which ASBA process is applicable. The<br />

SCSB may identify new DBs for the purpose of ASBA process and intimate details of<br />

the same to SEBI, after which SEBI will add the DB to the list of SCSBs maintained by<br />

it. The SCSB shall communicate the following details to Stock Exchanges for making<br />

it available on their respective websites. These details shall also be made available<br />

by the SCSB on its website: (i) Name and address of the SCSB (ii) Addresses of DBs<br />

and CB and other details such as telephone number, fax number and email ids. (iii)<br />

Name and contact details of a nodal officer at a senior level from the CB.<br />

3. Eligibility of Investors: An Investor shall be eligible to apply through ASBA process,<br />

if he/she: (i) is a “Resident Retail Individual Investor, Non Institutional Investor, QIBs,<br />

Eligible NRIs applying on non-repatriation basis, Eligible NRIs applying on<br />

repatriation basis i.e. any investor, (ii) is applying through blocking of funds in a bank<br />

account with the SCSB; such investors are hereinafter referred as “ASBA Investors”.<br />

4. ASBA Facility in Brief: Investor shall submit his Bid through an ASBA cum<br />

Application <strong>Form</strong>, either in physical or electronic mode, to the SCSB with whom the<br />

bank account of the ASBA Investor or bank account utilised by the ASBA Investor<br />

(“ASBA Account”) is maintained. The SCSB shall block an amount equal to the NFO<br />

application Amount in the bank account specified in the ASBA cum Application <strong>Form</strong>,<br />

physical or electronic, on the basis of an authorisation to this effect given by the<br />

account holder at the time of submitting the Application. The Bid Amount shall remain<br />

blocked in the aforesaid ASBA Account until the Allotment in the New <strong>Fund</strong> Offer and<br />

consequent transfer of the Application Amount against the allocated Units to the<br />

Issuer’s account designated for this purpose, or until withdrawal/failure of the Offer or<br />

until withdrawal/rejection of the ASBA Application, as the case may be. The ASBA<br />

data shall thereafter be uploaded by the SCSB in the electronic IPO system of the<br />

Stock Exchanges. Once the Allotment is finalised, the R&TA to the NFO shall send an<br />

appropriate request to the Controlling Branch of the SCSB for unblocking the relevant<br />

bank accounts and for transferring the amount allocable to the successful ASBA<br />

Bidders to the AMC account designated for this purpose. In case of withdrawal/<br />

Rejection of the Offer, the R&TA to the Offer shall notify the SCSBs to unblock the<br />

blocked amount of the ASBA Bidders within one day from the day of receipt of such<br />

notification.<br />

5. Obligations of the AMC: AMC shall ensure that adequate arrangements are made<br />

by the R&TA for the NFO to obtain information about all ASBAs and to treat these<br />

applications similar to non-ASBA applications while allotment of Units, as per the<br />

procedure specified in the Securities and Exchange Board of India (Issue of Capital<br />

and Disclosure Requirements) Regulations, 2009. Investors are requested to check<br />

with their respective banks about the availability of the ASBA facility.<br />

Other Information for ASBA Investors:<br />

1. SCSB shall not accept any ASBA after the closing time of acceptance on the last<br />

day of the NFO period.<br />

2. SCSB shall give ASBA investors an acknowledgement for the receipt of ASBAs.<br />

3. SCSB shall not upload any ASBA in the electronic system of the Stock<br />

Exchange(s) unless (i) it has received the ASBA in a physical or electronic form;<br />

and (ii) it has blocked the application money in the bank account specified in the<br />

ASBA or has systems to ensure that Electronic ASBAs are accepted in the system<br />

only after blocking of application money in the relevant bank account opened with<br />

it.<br />

4. SCSB shall ensure that complaints of ASBA investors arising out of errors or<br />

delay in capturing of data, blocking or unblocking of bank accounts, etc. are<br />

satisfactorily redressed.<br />

5. SCSB shall be liable for all its omissions and commissions in discharging<br />

responsibilities in the ASBA process.<br />

Grounds for rejection of ASBA applications<br />

ASBA application forms can be rejected by the AMC/Registrar/SCSBs, on the<br />

following technical grounds:<br />

1. Applications by persons not competent to contract under the Indian Contract Act,<br />

1872, including but not limited to minors, insane persons etc.<br />

2. Mode of ASBA i.e. either Physical ASBA or Electronic ASBA, not selected or<br />

ticked.<br />

3. ASBA Application <strong>Form</strong> without the stamp of the SCSB.<br />

4. Application by any person outside India if not in compliance with applicable<br />

foreign and Indian laws.<br />

5. Bank account details not given/incorrect details given.<br />

6. Duly certified Power of Attorney, if applicable, not submitted along with the ASBA<br />

application form.<br />

7. No corresponding records available with the Depositories matching the<br />

parameters namely (a) Names of the ASBA applicants (including the order of<br />

names of joint holders) (b) DP ID (c) Beneficiary account number or any other<br />

relevant details pertaining to the Depository Account.<br />

8. Insufficient funds in the investor’s account.<br />

9. Application accepted by SCSB and not uploaded on/with the Exchange /<br />

Registrar.<br />

<strong>Motilal</strong> <strong>Oswal</strong> Asset Management Company Limited<br />

<strong>Motilal</strong> <strong>Oswal</strong> Assest Management Co. Ltd.<br />

<strong>Motilal</strong> <strong>Oswal</strong> Tower, Jn. of Gokhale Road & Sayani Road,<br />

Prabhadevi, Mumbai - <strong>25</strong>,<br />

Email: mfservice@motilaloswal.com. Toll Free No.: 1800-200-6626

FORM - 3<br />

<strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> (An open ended equity scheme)<br />

ECS Autosave for Systematic Investment Plan<br />

New <strong>Fund</strong> Offer Opens on: April 22, 2013<br />

New <strong>Fund</strong> Offer Closes on: May 6, 2013<br />

Application No.<br />

Distributor Code<br />

ARN<br />

Sub-Distributor Code<br />

ARN<br />

EUIN<br />

Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of<br />

various factors including the service rendered by the distributor.<br />

“I/We hereby confirm that where the EUIN space has been left blank by me/us, the transaction is an “execution-only” transaction”<br />

Investor must read the Scheme Information Document (SID), Key Information Memorandum (KIM) & Instructions before completing<br />

the application form.<br />

ECS Debit facility for SIP is currently available for<br />

Account holders of all banks participating in local clearing at Agra, Ahmedabad, Allahabad, Amritsar, Anand, Asansol, Aurangabad, Bangalore, Bardhaman,Baroda,Belgaum,<br />

Bhavnagar, Bhilwara, Bhopal, Bhubaneshwar, Bijapur, Bikaner, Calicut, Chandigarh, Chennai, Cochin, Coimbatore, Cuttack, Davangere, Dehradun, Delhi, Dhanbad, Durgapur,<br />

Erode, Gadag, Gangtok, Goa, Gorakhpur, Gulbarga, Guwahati, Gwalior, Haldia, Hasan, Hubli , Hyderabad, Imphal, Indore, Jabalpur, Jaipur, Jalandhar, Jammu, Jamnagar,<br />

Jamshedpur, Jodhpur, Kakinada, Kanpur, Kolhapur, Kolkata, Kota, Lucknow, Ludhiana, Madurai, Mandya, Mangalore, Mumbai, Mysore, Nagpur, Nasik, Nellore, Patna,<br />

Pondicherry, Pune, Raichur, Raipur, Rajkot, Ranchi, Salem, Shillong, Shimla, Shimoga, Sholapur, Siliguri, Surat, Tirunelveli, Tirupati, Tiruppur, Trichur, Trichy, Trivandrum,<br />

Tumkur, Udaipur, Udipi, Varanasi, Vijaywada, Vizag<br />

Electronic Debit for the account holders of the following banks<br />

Allahabad Bank, Axis Bank, Bank of Baroda, Bank of India, Citi Bank, Corporation Bank, Federal Bank, ICICI Bank, IDBI Bank, IndusInd Bank, Kotak Mahindra Bank, Punjab<br />

National Bank, South Indian Bank, State Bank of India, State Bank of Patiala, UCO Bank, Union Bank of India, United Bank of India<br />

Authorization to pay SIP installments through Electronic Clearing Service (ECS) / Electronic Debit<br />

I/We hereby, authorise <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> or their authorised service provider for <strong>Motilal</strong> <strong>Oswal</strong> Asset Management Company Limited to debit my/our bank account by<br />

ECS (Debit Clearing) / Electronic Debit for the collection of SIP installments.<br />

1 UNIT HOLDER INFORMATION<br />

Existing Folio Number<br />

Name of the First Holder<br />

Mobile No.<br />

Email ID<br />

2 SYSTEMATIC INVESTMENT PLAN (SIP)<br />

Scheme - <strong>Motilal</strong> <strong>Oswal</strong> <strong>MOSt</strong> <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> Plan - Direct* Regular (*Default Plan) Option - Growth** Div - Payout<br />

SIP Frequency<br />

SIP Period From<br />

Monthly<br />

Subsequent SIP Instalment Amount (`)<br />

Quarterly<br />

SIP Date<br />

0 7 1 3 To 06/2016 06/2018 06/2020 06/2099 Other M M Y Y<br />

3 BANK DETAILS (Centralised Bank Account (CBS) Number is mandatory for ECS and Direct Debit)<br />

th<br />

5<br />

th<br />

7<br />

th<br />

10<br />

th<br />

15<br />

th<br />

<strong>25</strong> of the Month / Quarter<br />

Div - Reinvest (**Default Option)<br />

Name of the Account Holder<br />

Name of the Bank<br />

Account Number<br />

City<br />

Branch<br />

Account Type Current Savings NRO NRE FCNR Others (please specify)<br />

MICR Code<br />

Please specifically mention the MICR code of you bank branch in case you have a payable at par cheque book. In case of incorrect/ incomplete bank details it will be captured<br />

from attached cheque copy on a best effort basis.<br />

I/We hereby declare that the particulars given above are correct and express my willingness to pay the installments to pay the installments referred above through participation<br />

in ECS / Electronic Debit. If the transaction is delayed or not effected at all for reasons of incomplete or incorrect information, I/We would not hold the user institution<br />

responsible. I/We will also inform <strong>Motilal</strong> <strong>Oswal</strong> Asset Managment Company Ltd. about any changes in my bank account. I/We also agree to bear any charges pertaining to<br />

availing of this faciltiy.<br />

Place<br />

Signatures<br />

First / Sole Applicant Second Applicant Third Applicant Date<br />

4<br />

FOR BANK USE ONLY<br />

We, hereby, certify that the particulars furnished above are correct as per our records, and we, hereby, declare that a copy of this form, duly completed, has been submitted to us.<br />

Branch<br />

Date<br />

Signature of the Authorised Official from the Bank<br />

Bank Stamp<br />

5<br />

AUTHORISATION OF THE BANK ACCOUNT HOLDER<br />

This is to inform that I / We have registered for the RBI's ECS (Debit Clearing) / Electronic Debit and that my payment towards SIP installments shall be made from my / our<br />

below mentioned bank account with your bank. I / We authorise the representative carrying this ECS / Electronic Debit mandate form to get it verified and executed.<br />

Account Holder's Signature Joint Account Holder's Signature Account Number

FORM - 4<br />

THIRD PARTY PAYMENT DECLARATION FORM<br />

THIRD PARTY PAYMENT DECLARATION FORM should be completed in English and in BLOCK LETTERS only.<br />

(Please read the Third Party Payment Rules and Instructions carefully before completing this <strong>Form</strong>.)<br />

Declaration <strong>Form</strong> No.<br />

FOR OFFICE USE ONLY<br />

Date of Receipt Folio No. Branch Trans. No.<br />

1. BENEFICIAL INVESTOR INFORMATION<br />

FOLIO NO. (For existing investor)<br />

NAME OF FIRST/ SOLE APPLICANT (Beneficial Investor)<br />

Mr. / Ms. / M/s.<br />

Application No.<br />

2. THIRD PARTY INFORMATION<br />

NAME OF THIRD PARTY (Person Making the Payment)<br />

Mr. / Ms. / M/s.<br />

Nationality<br />

#<br />

PAN KYC** (Please ü) Attached (Mandatory for any amount)<br />

#Mandatory for any amount. Please attach PAN Proof.<br />

NAME OF CONTACT PERSON & DESIGNATION (in case of non-Individual Third Party)<br />

Mr. / Ms.<br />

Designation<br />

MAILING ADDRESS (P.O. Box Address may not be sufficient)<br />

City State Pin Code<br />

CONTACT DETAILS<br />

STD Code<br />

Tel. : Off. Tel. : Res. Mobile<br />

Fax<br />

Email<br />

RELATIONSHIP OF THIRD PARTY WITH THE BENEFICIAL INVESTOR [Please ü(”) as applicable.]<br />

Status of the Minor Fll Employee (s)<br />

Beneficial Investor<br />

Relationship of Third Party Parent Custodian Employer<br />

Client<br />

with the Beneficial Investor Grand Parent SEBI Registration No. of Custodian<br />

Related Person<br />

(Please specify)<br />

Registration Valid Till<br />

D D M M Y Y Y Y<br />

Declaration by I/We declare that the payment made on behalf I/We declare that the payment is made on behalf of FII/ I/We declare that the payment is made on<br />

Third Party of minor is in consideration of natural love and Client and the source of this payment is from funds provided behalf of employee(s) under Systematic<br />

affection or as a gift. to us by FII/Client. Investment Plans through Payroll Deductions.<br />

3. THIRD PARTY PAYMENT DETAILS<br />

Mode of Payment [Please ü(/)]<br />

Mandatory Enclosure(s)*<br />

Cheque In case the account number and account holder name of the third party is not pre-printed on the cheque then a copy of the bank passbook /<br />

statement of bank account or letter from the bank certifying that the third party maintains a bank account.<br />

Pay Order<br />

Demand Draft<br />

Banker's Cheque<br />

RTGS<br />

NEFT<br />

<strong>Fund</strong> Transfer<br />

Certificate from the Issuing Banker stating the Bank Account Holder's Name and Bank Account.<br />

Number debited for issue of the instrument.<br />

Copy of the Instruction to the Bank stating the Bank Account Number which has been debited.<br />

* <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong>/ <strong>Motilal</strong> <strong>Oswal</strong> Asset Management Company Limited reserves the right to seek information and /or obtain such other additional documents/information from the<br />

Third Party for establishing the identity of the Third Party.<br />

#<br />

Amount in figures in words<br />

Cheque/DD/PO/UTR No.<br />

Pay- in Bank A/c No.<br />

Name of the Bank<br />

Branch<br />

Bank City<br />

Account Type [Please ü] SAVINGS CURRENT NRE NRO FCNR OTHERS<br />

# including Demand Draft charges, if any.<br />

Cheque/DD/PO/RTGS Date<br />

(please specify)<br />

D D M M Y Y Y Y

4. DECLARATIONS & SIGNATURE/S<br />

THIRD PARTY DECLARATION<br />

I/We confirm having read and understood the Third Party Payment rules, as given below and hereby agree to be bound by the same.<br />

I/We declare that the information declared herein is true and correct, which <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> is entitled to verify directly or indirectly. I agree to furnish such further information as <strong>Motilal</strong> <strong>Oswal</strong><br />

Mutual <strong>Fund</strong> may require from me/us. I/We agree that, if any such declarations made by me/us are found to be incorrect or incomplete, <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong>/<strong>Motilal</strong> <strong>Oswal</strong> AMC is not bound to<br />

pay any interest or compensation of whatsoever nature on the said payment received from me/us and shall have absolute discretion to reject / not process the Application <strong>Form</strong> received from the<br />

Beneficial Investor(s) and refund the subscription monies.<br />

I/We hereby declare that the amount invested in the Scheme is through legitimate sources only and does not involve and is not designed for the purpose of any contravention or evasion of any Act, Rules,<br />

Regulations, Notifications or Directions issued by any regulatory authority in India. I/We will assume personal liability for any claim, loss and/or damage of whatsoever nature that <strong>Motilal</strong> <strong>Oswal</strong> Mutual<br />

<strong>Fund</strong>/<strong>Motilal</strong> <strong>Oswal</strong> AMC may suffer as a result of accepting the aforesaid payment from me/us towards processing of the transaction in favour of the beneficial investor(s) as detailed in the Application<br />

<strong>Form</strong>.<br />

Applicable to NRIs only :<br />

I/We confirm that I am/We are Non-Resident of Indian Nationality/Origin and I/We hereby confirm that the funds for subscription have been remitted from abroad through normal banking channels or<br />

from funds in my / our Non-Resident External / Ordinary Account /FCNR Account.<br />

Please (ü) Yes No<br />

If yes, (ü)<br />

Repatriation basis<br />

Non-repatriation basis<br />

Signature of the Third Party<br />

I/We certify that the information declared herein by the Third Party is true and correct.<br />

I/We acknowledge that <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> reserves the right in its sole discretion to reject/not process the Application <strong>Form</strong> and refund the payment received from the aforesaid Third Party and<br />

the declaration made by the Third Party will apply solely to my/our transaction as the beneficial investor(s) detailed in the Application <strong>Form</strong>. <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong>/ <strong>Motilal</strong> <strong>Oswal</strong> AMC will not be<br />

liable for any damages or losses or any claims of whatsoever nature arising out of any delay or failure to process this transaction due to occurrences beyond the control of <strong>Motilal</strong> <strong>Oswal</strong> Mutual<br />

<strong>Fund</strong>/<strong>Motilal</strong> <strong>Oswal</strong> AMC.<br />

Applicable to Guardian receiving funds on behalf of Minor only:<br />

BENEFICIAL INVESTOR(S) DECLARATION<br />

I/We confirm that I/We are the legal guardian of the Minor, registered in folio and have no objection to the funds received towards Subscription of Units in this Scheme on behalf of the minor.<br />

SIGNATURE/S<br />

First / Sole Applicant / Guardian Second Applicant Third Applicant<br />

THIRD PARTY PAYMENT RULES<br />

1. In order to enhance compliance with Know your Customer (KYC) norms under the<br />

Prevention of Money Laundering Act, 2002 (PMLA) and to mitigate the risks associated<br />

with acceptance of third party payments, Association of Mutual <strong>Fund</strong>s of India (AMFI)<br />

issued best practice guidelines on "risk mitigation process against third party instruments<br />

and other payment modes for mutual fund subscriptions". AMFI has issued the said best<br />

practice guidelines requiring mutual funds/asset management companies to ensure that<br />

Third-Party payments are not used for mutual fund subscriptions.<br />

2a. The following words and expressions shall have the meaning specified herein:<br />

(a)<br />

(b)<br />

(c)<br />

"Beneficial Investor" is the first named applicant/investor in whose name the<br />

application for subscription of Units is applied for with the Mutual <strong>Fund</strong>.<br />

"Third Party" means any person making payment towards subscription of Units in<br />

the name of the Beneficial Investor.<br />

"Third Party payment" is referred to as a payment made through instruments<br />

issued from a bank account other than that of the first named applicant/ investor<br />

mentioned in the application form.<br />

Illustrations<br />

Illustration 1: An Application submitted in joint names of A, B & C alongwith cheque issued<br />

from a bank account in names of B, C & Y. This will be considered as Third Party payment.<br />

Illustration 2: An Application submitted in joint names of A, B & C alongwith cheque issued<br />

from a bank account in names of C, A & B. This will not be considered as Third Party<br />

payment.<br />

Illustration 3: An Application submitted in joint names of A, B & C alongwith cheque issued<br />

from a bank account in name of A. This will not be considered as Third Party payment.<br />

2b. <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong>/<strong>Motilal</strong> <strong>Oswal</strong> Asset Management Company will not accept<br />

subscriptions with Third Party payments except in the following exceptional cases, which is<br />

subject to submission of requisite documentation/ declarations:<br />

(i)<br />

(ii)<br />

(iii)<br />

Payment by Parents / Grand-Parents / Related Persons* on behalf of a minor in<br />

consideration of natural love and affection or as gift for a value not exceeding<br />

` 50,000/- each regular Purchase or per SIP installment.<br />

Payment by Employer on behalf of employee(s) under Systematic Investment Plan<br />

(SIP) Payroll deductions.<br />

Custodian on behalf of an FII or a Client.<br />

* 'Related Person' means any person investing on behalf of a minor in consideration of<br />

natural love and affection or as a gift.<br />

2c. Applications submitted through the above mentioned 'exceptional cases' are required to<br />

comply with the following, without which applications for subscriptions for units will be<br />

rejected / not processed / refunded.<br />

(i)<br />

(ii)<br />

Mandatory KYC for all investors (guardian in case of minor) and the person making<br />

the payment i.e. third party.<br />

Submission of a complete and valid 'Third Party Payment Declaration <strong>Form</strong>' from the<br />

investors (guardian in case of minor) and the person making the payment i.e. third<br />

party.<br />

2d. Investor(s) are requested to note that any application for subscription of Units of the<br />

Scheme(s) of <strong>Motilal</strong> <strong>Oswal</strong> Mutual <strong>Fund</strong> accompanied with Third Party payment other<br />

than the above mentioned exceptional cases as described in Rule (2b) above is liable for<br />

rejection without any recourse to Third Party or the applicant investor(s).<br />

The above mentioned Third Party Payment Rules are subject to change from time to time. Please contact any of the Investor Service Centres of <strong>Motilal</strong> <strong>Oswal</strong> AMC or visit our website for any further<br />

information or updates on the same.

INSTRUCTIONS FOR COMPLETING THE APPLICATION FORM<br />

1 General Information<br />

a. Please read the terms of the Key Information Memorandum and the Scheme Information<br />

Document (SID) and Statement of Additional Information carefully before filling the<br />

Application <strong>Form</strong>. Also refer to instructions for ASBA application. Investors are deemed to<br />

have accepted the terms subject to which this offer is being made and bind themselves to<br />

the terms upon signing the Application <strong>Form</strong> and tendering payment.<br />

b. The Application <strong>Form</strong> should be completed in ENGLISH and in BLOCK LETTERS only.<br />

Please tick in the appropriate box for relevant options wherever applicable. Please do not<br />

overwrite. For any correction / changes (if any) made on the Application <strong>Form</strong>, the sole/all<br />

applicants are requested to authenticate the same by canceling and re-writing the correct<br />

details and counter-signing the same. Applications completed in all respects, must be<br />

submitted at the Investor Service Centres (ISCs) / Official Points of Acceptance.<br />

Investors can also subscribe to the Units of Motial <strong>Oswal</strong> Most <strong>Focused</strong> <strong>25</strong> <strong>Fund</strong> through the<br />

mutual fund trading platforms viz. BSE StAR MF of Bombay Stock Exchange Limited and<br />

Mutual <strong>Fund</strong> Service System (MFSS) of National Stock Exchange of India Limited. For<br />

further details, investors are advised to contact ISCs of Karvy or visit our website<br />

www.motilaloswal.com and www.motilaloswal.com/assetmanagement. Please write the<br />

Serial Number of the Application <strong>Form</strong> / Folio Number on the reverse of the cheque /<br />

demand draft. Applications incomplete in any respect are liable to be rejected. The AMC /<br />

Trustee retains the sole and absolute discretion to reject any application. No request for<br />

withdrawal of application will be allowed after the closure of New <strong>Fund</strong> Offer Period.<br />

c. Investments through distributors<br />

As per directions of Securities and Exchange Board of India (SEBI), the distributors, agents<br />

or any persons employed or engaged or to be employed or engaged in the sale and/or<br />

distribution of mutual fund products are required to have a valid certification from the<br />

National Institute of Securities Markets (NISM) by passing the certification examination.<br />

Further, no agents / distributors are entitled to sell units of mutual funds unless the<br />

intermediary is registered with Association of Mutual <strong>Fund</strong>s in India (AMFI).<br />

d. Employee Unique Identification Number (EUIN)<br />

Further, SEBI has made it compulsory for every employee/ relationship manager/ sales<br />

person of the distributor of mutual fund products to quote in the Application <strong>Form</strong> the EUIN<br />

obtained by him/her from AMFI. EUIN would assist in addressing any instance of mis-selling<br />

even if the employee/ relationship manager/sales person later leaves the employment of the<br />

distributor. Hence, if your investments are routed through a distributor please ensure that<br />

the EUIN is correctly filled in the Application <strong>Form</strong>. However, if your distributor has not given<br />

you any advice pertaining to the investment, the EUIN box may be left blank. In this case you<br />

are required to provide the declaration to this effect as given in the form.<br />

e. Overseas Distributors<br />

Overseas Distributors are exempt from obtaining NISM certification and AMFI registration<br />

as per AMFI circular No. CIR/ ARN-14/ 12-13 dated July 13, 2012 and the EUIN requirement<br />

as per AMFI Circular No.135/BP/33/2012-13 dated December 31, 2012. However, such<br />

Overseas Distributors are required to comply with the guidelines/ requirements as may be<br />

issued by AMFI /SEBI from time to time and also comply with the laws, rules and regulations<br />

of jurisdictions where they carry out their operations in the capacity of distributors.<br />

f. Direct Investments<br />

Investors applying under Direct Plan must mention “Direct” in ARN No. column. In case<br />

Distributor code is mentioned in the Application <strong>Form</strong>, but “Direct Plan” is indicated against<br />

the Scheme/ Series name, the Distributor code will be ignored and the application will be<br />

processed under Direct Plan. In case of valid application received without indicating “Direct<br />

Plan” against the Scheme/ Series name and without any Distributor Code mentioned on the<br />

form, the application will be processed under “Direct Plan.<br />

g. All Applicants are subject to detailed scrutiny and verification. Application <strong>Form</strong> incomplete<br />

in any respect or not accompanied by a Cheque /Demand Draft are liable to be rejected<br />

either at the collection centre itself or subsequently after detailed verification at the back<br />

office of the Registrars.<br />

2 Compliance and Prevention of Anti Money Laundering<br />

Your attention is particularly drawn to the section on “Prevention of Money Laundering and Know<br />

Your Customer”. All the applications with incomplete/incorrect information/not accompanied<br />

with the necessary documents, shall be treated as invalid and shall be liable to be rejected.<br />

Prevention of Money Laundering Act, the SEBI Circulars on Anti Money Laundering (AML) and<br />

the Client Identification implementation procedures prescribed by AMFI inter alia require the<br />

AMC to verify the records of identity and address(es) of investors. It is mandatory for all<br />

applicants to submit necessary documents for compliance with Anti Money Laundering<br />

(guardian in case of minor). The AMC reserves the right to reject subscription requests in the<br />

absence of appropriate compliance with the AML Laws.<br />

3 Applicant’s Personal Information<br />

a. Please furnish your name and complete postal address with the Pin Code (P.O. Box No. Not<br />

enough) and your Contact Nos. This would help us reach you faster.<br />

b. Please furnish the name of Contact Person in case of investments by Company/ Body<br />

Corporate / Trust / Society / FIIs / Association of Person / Body of Individuals.<br />

c. KYC Compliance: KYC is mandatory for all investors (including joint holders, guardians of<br />

minors and NRIs) to enclose a copy of KYC compliance to the application for investing in<br />

mutual fund schemes.<br />

d. If you have not indicated your Tax Status in the Application <strong>Form</strong>, the same would be<br />

assumed to be others.<br />

4 Bank Account Details<br />

An investor at the time of purchase of units must provide the details of his / her pay-out bank<br />

account (i.e. account into which redemption/ dividend proceeds are to be paid).<br />

Bank account details provided in the application will be used for refunding rejected applications<br />

where DP ID is not matching. Investors are requested to provide Bank Account Detail linked with<br />

their Demat Account. In case of discrepancies Bank Account Details as per depository records<br />

will prevail.<br />

5 Payment Details<br />

a. Cheques should be crossed “A/c Payee only” and drawn in favour of “Focus - <strong>25</strong>”.<br />

b. During the New <strong>Fund</strong> Offer, Application <strong>Form</strong> along with the Cheque/Demand Draft may be<br />

lodged with Official Collection Centres.<br />

c. If you are residing / located in a city / town where we do not have an Official Collection<br />

Centre, please draw a demand draft payable at your nearest city where we have such office.<br />

d. Payment by Cash, Stock invests, Outstation Cheques and Non-MICR Cheques will not be<br />

accepted. Post-dated cheques will not be accepted.<br />

6 Restriction on acceptance of Third Party Payments for subscription of units<br />

a. Where payment is made through instruments issued from an account other than that of the<br />

beneficiary investor, the same is referred to as Third-Party payment. In case of a payment<br />

from a joint bank account, the first holder of the mutual fund folio has to be one of the joint<br />

holders of the bank account from which payment is made. If this criterion is not fulfilled, then<br />

this is also construed to be a third party payment.<br />

b. Application with Third Party payments will not be accepted except in the following cases:<br />

(i) Payment by Parents/Grandparents/related persons on behalf of a minor in<br />

consideration of natural love and affection or as gift for a value not exceeding<br />

` 50,000/- .<br />

(ii) Payment by Employer on behalf of employee under Systematic Investment Plans<br />

through Payroll deductions.<br />

(iii) Custodian on behalf of an FII or a client.<br />

7 Demat Account<br />

Investors who of opt for units in demat form should ensure that the sequence of names as<br />

mentioned in the application form matches that of the account held with the Depository<br />

Participant. Client ID, Names, Address and PAN details, other KYC norms mentioned in the<br />

application form will be verified against the Depository data which will be downloaded from<br />

Depository master. Only those applications where the details are matched with the depository<br />

data will be treated as valid applications. If the details mentioned in the application are<br />

incomplete/incorrect, not matched with the depository data, the application shall be treated as<br />

invalid and shall be liable to be rejected.<br />

8 NRIs/FIIs<br />

a. In case of NRI / Persons of Indian Origin, payment must be made either by cheque or<br />

demand draft by means of: (a) inward remittance through normal banking channels; or (b)<br />

out of funds held in the NRE / FCNR account, in the case of purchases on a repatriation<br />

basis or out of funds held in the NRE / FCNR / NRO account, in the case of purchases on a<br />

non-repatriation basis. (In case of Indian Rupee drafts purchased from abroad or<br />

payments from FCNR/NRE accounts, a certificate from the Bank issuing the draft<br />

confirming the debit and / or foreign inward remittance certificate (FIRC) issued by<br />

investor’s banker should also be enclosed. The Mutual <strong>Fund</strong> reserves the right to hold<br />

redemption proceeds in case the requisite details are not submitted).<br />

b. Payment by the FII must be made either by inward remittance through normal banking<br />

channels or out of funds held in foreign currency account or Non-Resident Rupee Account<br />

maintained by the FII with a designated branch of an authorised dealer in terms of<br />

paragraph 2 of Schedule 2 to the FEMA Regulations.<br />

9 Nomination Details<br />

Applicants applying for units singly / jointly can make a nomination at the time of initial<br />

investment or during subsequent investments / during the tenure of the investment.<br />

If Applicant wish to register a single nominee for his/her investments please fill in the nomination<br />

details in the Application <strong>Form</strong>. In case he/she wishes to register multiple nominees, please<br />

download nomination form available on our website.<br />

In case of units held in demat mode, the nomination details provided to the Depository<br />

Participant shall be applicable.<br />

10 Declaration and Signatures<br />

a. Signature can be in English or in any other Indian Language. Thumb impressions must be<br />

attested by a Magistrate or Notary Public or a Special Executive Magistrate under his/her<br />

official seal.<br />

b. Applications by minors must be signed on their behalf by their guardians.<br />

c. If you are investing through your constituted attorney, please ensure that the PoA document<br />

is signed by you and your constituted Attorney. The signature in the Application <strong>Form</strong>, then<br />

needs to clearly indicate that the signature is on your behalf by the Constituted Attorney.<br />

11 Transaction Charges<br />

In terms of SEBI circular, Cir/ IMD/ DF/13/ 2011 dated August 22, 2011, the distributors of mutual<br />

fund products are allowed to be paid transaction charges for purchase transactions :<br />

• @ `100/- per subscription of `10,000/- and above in respect of existing unitholders; and<br />

• @ `150/- for subscription of `10,000/- and above in respect of a first time investor in mutual<br />

funds.<br />

The transaction charge shall be deducted from the subscription amount and paid to the<br />

distributor; and the balance shall be invested in the Scheme. The transaction charges and the<br />

net investment amount and the number of units allotted will be clearly mentioned in the Account<br />

Statement issued by the Mutual <strong>Fund</strong>.<br />

There shall be no transaction charges on (i) ‘Direct’ investments; (ii) subscription below<br />

` 10,000/- and (iii) switch (including STP) and redemption (including SWP) transactions.<br />

12 Systematic Investment Plan (SIP)<br />

The first SIP debit after NFO will be effected from July 2013 following the receipt of vaild<br />

application.<br />

Monthly : Minimum ` 1000 & 6 instalments<br />

Quarterly : Minimum ` 2000 & 2 instalments<br />

The dates for the Auto Debit Facility shall be on the 5th, 7th, 10th, 15th or <strong>25</strong>th of every month /<br />

quarter. In case, the date fixed happens to be a holiday / non-business day, the same shall be<br />

affected on the next business day. No Post Dated cheques would be accepted for SIP.<br />

(Application not complying with any of the above instruction/guidelines would be rejected.)

![Electronic Contract Note [ECN] â DECLARATION (VOLUNTARY) To ...](https://img.yumpu.com/48604692/1/158x260/electronic-contract-note-ecn-a-declaration-voluntary-to-.jpg?quality=85)