MOLE VALLEY DISTRICT COUNCIL

MOLE VALLEY DISTRICT COUNCIL

MOLE VALLEY DISTRICT COUNCIL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

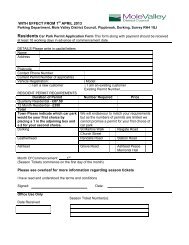

BUILDING ACT 1984, THE BUILDING REGULATIONS 2000<br />

THE BUILDING (LOCAL AUTHORITY CHARGES)<br />

REGULATIONS 1998<br />

GUIDANCE NOTE ON CHARGES<br />

Effective from 1/4/08<br />

1. Before you carry out building work to which the<br />

Building Regulations apply you or your agent must<br />

either deposit Full Plans or a Building Notice together<br />

with the appropriate charge. The charge<br />

payable is dependant upon the type of work carried<br />

out and can be calculated by reference to the<br />

following notes and schedules. Cheques should be<br />

made payable to Mole Valley District Council.<br />

2. CHARGES ARE PAYABLE AS<br />

FOLLOWS<br />

Plan Charge: Should you submit Full Plans<br />

you will generally pay a plan charge at the time of<br />

submission to cover their passing or rejection.<br />

Inspection Charge: With Full Plans submissions,<br />

for most types of work, an inspection<br />

charge covering all necessary site visits will be<br />

payable after we have made our first inspection. If<br />

applicable, you will be sent an invoice for this<br />

charge.<br />

Building Notice Charge: Should you<br />

submit a Building Notice the appropriate building<br />

notice charge is payable at the time of submission<br />

and covers all necessary checks and site visits in<br />

relation to the work described in the notice.<br />

Regularisation Charge: Should you<br />

apply for a regularisation certificate in respect of<br />

unauthorised building work, commenced on or after<br />

11 th November 1985, you will pay a regularisation<br />

charge to cover the cost of assessing your application<br />

and all inspections. The charge is equivalent to<br />

the Building Notice fee plus 20%.<br />

No VAT is payable on a regularisation charge.<br />

3. Schedule 1 - Charges for Small<br />

Domestic Buildings e.g. Certain<br />

new dwelling houses and flats (see<br />

Table 1) Applicable where the total internal floor<br />

area of each dwelling, excluding any garage or carport<br />

does not exceed 300 square metres and the building<br />

has no more than 3 storeys, each basement level<br />

being counted as one storey. In any other case,<br />

schedule 3 applies.<br />

4. Schedule 2 - Charges for Certain<br />

Small Buildings & Domestic Extensions<br />

(see Table 2) Where work<br />

comprises more than one domestic extension the<br />

total internal floor areas of all storeys of all the<br />

extensions shown on the application may be added<br />

together to determine the relevant charge. If the<br />

extension(s) exceeds 60 square metres or 3 storeys<br />

in height then schedule 3 applies.<br />

5. Schedule 3 - Charges for Other<br />

Work (see Table 3) Applicable to all other<br />

building work not covered by Schedules 1 or 2. Total<br />

estimated cost means an acceptable reasonable<br />

estimate that would be charged by a person in business<br />

to carry out the work shown or described in the<br />

application excluding VAT and any professional<br />

charges paid to an Architect, Engineer or Surveyor<br />

etc., and also excluding land acquisition costs.<br />

6. Exemptions/Reductions of<br />

Charges<br />

Where plans have been either approved or rejected<br />

no further charge is payable on resubmission for<br />

substantially the same work.<br />

Certain works to provide access and/or facilities for<br />

disabled people to existing dwellings and buildings to<br />

which the public have access are exempt from<br />

charges. In these regulations disabled person means<br />

a person who is within certain of the descriptions of<br />

persons to whom section 29(1) of the National Assistance<br />

Act 1948 applies.<br />

Where an application or building notice is in respect<br />

of two or more buildings or building work, all of which<br />

is substantially the same as each other, or such<br />

application or building notice have been previously<br />

dealt with by this authority, subject to certain criteria,<br />

a reduction of 25% on the plan charge or on the plan<br />

charge proportion of the building notice charge is<br />

allowable.<br />

7. General: These notes are for guidance only. Full<br />

details may be found in the Councils Building Control<br />

Charges Scheme which is available on request. If<br />

you have any difficulties calculating charges please<br />

contact the Building Control section 01306 879264.<br />

1<br />

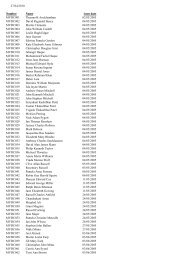

NUMBER<br />

OF<br />

DWELLINGS<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

SCHEDULE 1 - CHARGES FOR SMALL DOMESTIC BUILDINGS<br />

eg. Certain new dwelling houses and flats<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

(A) Plan Charge (£) (B) Inspection Charge (£) (C) Building Notice Charge (£)<br />

EXC. VAT INC. VAT EXC. VAT INC. VAT<br />

155.75<br />

213.62<br />

280.85<br />

348.94<br />

421.28<br />

493.62<br />

514.89<br />

535.32<br />

556.60<br />

561.70<br />

566.81<br />

571.92<br />

577.02<br />

582.13<br />

587.24<br />

593.19<br />

598.30<br />

603.41<br />

608.51<br />

613.62<br />

183.00<br />

251.00<br />

330.00<br />

410.00<br />

495.00<br />

580.00<br />

605.00<br />

629.00<br />

654.00<br />

660.00<br />

666.00<br />

672.00<br />

678.00<br />

684.00<br />

690.00<br />

697.00<br />

703.00<br />

709.00<br />

715.00<br />

721.00<br />

*<br />

Additional<br />

charge<br />

for each<br />

dwelling<br />

above the<br />

minimum<br />

number in<br />

the band<br />

in<br />

column 1<br />

431.49<br />

598.30<br />

759.15<br />

879.15<br />

972.77<br />

1097.03<br />

1170.22<br />

1362.56<br />

1549.79<br />

1757.45<br />

1919.15<br />

2085.96<br />

2251.92<br />

2381.28<br />

2542.98<br />

2708.94<br />

2870.64<br />

3036.60<br />

3161.71<br />

3322.56<br />

507.00<br />

703.00<br />

892.00<br />

1033.00<br />

1143.00<br />

1289.00<br />

1375.00<br />

1601.00<br />

1821.00<br />

2065.00<br />

2255.00<br />

2451.00<br />

2646.00<br />

2798.00<br />

2988.00<br />

3183.00<br />

3373.00<br />

3568.00<br />

3715.00<br />

3904.00<br />

*<br />

Additional<br />

charge<br />

for each<br />

dwelling<br />

above the<br />

minimum<br />

number in<br />

the band in<br />

column 1<br />

21 - 30 623.83 733.00 12 + VAT 3400.85 3996.00 115 + VAT<br />

31 & over 732.77 861.00 7 + VAT 4440.85 5218.00 85 + VAT<br />

The sum of the relevant Plan<br />

Fee and Inspection Fee<br />

(A) + (B)

2<br />

3<br />

SCHEDULE 2 - CHARGES FOR CERTAIN SMALL BUILDINGS & DOMESTIC EXTENSIONS<br />

TYPE OF WORK<br />

1. Erection or extension of a detached or attached building<br />

which consists solely of a garage or carport or both having<br />

a floor area not exceeding 40 square metres in total and<br />

intended to be used in common with an existing building,<br />

and which is not an exempt building.<br />

2. A garage or carport as in 1. above but having a floor area<br />

exceeding 40 and not exceeding 60 square metres..<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

Plan Charge (£) Inspection Charge (£) Building Notice Charge (£)<br />

EXC. VAT INC. VAT E XC.VAT<br />

INC. VAT EXC. VAT INC. VAT<br />

124.26 146.00 - - 124.26 146.00<br />

114.89 135.00 132.77 156.00 247.66 291.00<br />

NB. Where the total or the aggregation of the floor area of one or more extensions referred to in categories 1 & 2 above exceeds 60 square metres the charge should<br />

be calculated from estimated costs under schedule 3.<br />

3. Any extension of a dwelling the total floor area of which does<br />

not exceed 10 square metres including means of access<br />

and work in connection with that extension.<br />

4. An extension as in 3. above but having a floor area<br />

exceeding 10 and not exceeding 40 square metres.<br />

5. An extension as in 3. above but having a floor area<br />

exceeding 40 and not exceeding 60 square metres.<br />

6. The replacement of windows, rooflights or external doors<br />

in an existing dwelling<br />

114.89 135.00 132.77 156.00 247.66 291.00<br />

114.89 135.00 257.03 302.00 371.92 437.00<br />

114.89 135.00 380.43 447.00 495.32 582.00<br />

72.34 85.00 - - 72.34 85.00<br />

NB. Where the total or the aggregation of the floor area of one or more extensions referred to in categories 3, 4 and 5 above exceeds 60 square metres the charge<br />

should be calculated from estimated costs under schedule 3, subject to a minimum charge equivalent to the charge payable under category 5 above.<br />

7. Any extension or alteration of a dwelling consisting of the<br />

provision of one or more rooms in roof space, including<br />

means of access.<br />

To be calculated from estimated costs under Schedule 3, subject to a minimum charge equivalent<br />

to the charge payable under category 4 above.<br />

SCHEDULE 3 - CHARGES FOR OTHER WORK (NOT COVERED BY SCHEDULES 1 OR 2)<br />

TOTAL ESTIMATED<br />

COST OF WORK (£)<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

Plan Charge (£) Inspection Charge (£) Building Notice Charge (£)<br />

EXC. VAT INC. VAT EXC. VAT INC. VAT EXC. VAT INC. VAT<br />

0 - 2,000<br />

2,001 - 5,000<br />

100.00<br />

165.00<br />

117.50<br />

193.88<br />

- - 100.00<br />

165.00<br />

117.50<br />

193.88<br />

5,001 - 6,000<br />

6,001 -7,000<br />

7,001 - 8,000<br />

8,001 - 9,000<br />

9,001 -10,000<br />

10,001 -11,000<br />

11,001 -12,000<br />

12,001 -13,000<br />

13,001 -14,000<br />

14,001 -15,000<br />

15,001 -16,000<br />

16,001 -17,000<br />

17,001 -18,000<br />

18,001 -19,000<br />

19,001 -20,000<br />

43.50<br />

45.75<br />

48.00<br />

50.25<br />

52.50<br />

54.75<br />

57.00<br />

59.25<br />

61.50<br />

63.75<br />

66.00<br />

68.25<br />

70.50<br />

72.75<br />

75.00<br />

51.11<br />

53.76<br />

56.40<br />

59.04<br />

61.69<br />

64.33<br />

66.97<br />

69.62<br />

72.26<br />

74.91<br />

77.55<br />

80.19<br />

82.84<br />

85.48<br />

88.12<br />

20,001 -100,000 To 75.00 excl. VAT add 2.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

100,001 - 1m To 235.00 excl. VAT add 0.87 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

Over 1m- 10m<br />

Over 10m<br />

To 1022.50 excl. VAT add 0.70 excl. VAT<br />

for each 1,000 (or part thereof) over 1m<br />

up to 10m then ADD VAT<br />

To 7,210.00 excl. VAT add 0.50 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT<br />

130.50<br />

137.25<br />

144.00<br />

150.75<br />

157.50<br />

164.25<br />

171.00<br />

177.75<br />

184.50<br />

191.25<br />

198.00<br />

204.75<br />

211.50<br />

218.25<br />

225.00<br />

153.34<br />

161.27<br />

169.20<br />

177.13<br />

185.06<br />

192.99<br />

200.93<br />

208.86<br />

216.79<br />

224.72<br />

232.65<br />

240.58<br />

248.51<br />

256.44<br />

264.38<br />

To 225.00 excl. VAT add 6.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

To 705.00 excl. VAT add 2.63 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

To 3067.50 excl. VAT add 2.05 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

1m up to 10m then ADD VAT<br />

To 21,630.00 excl. VAT add 1.50 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT<br />

174.00<br />

183.00<br />

192.00<br />

201.00<br />

210.00<br />

219.00<br />

228.00<br />

237.00<br />

246.00<br />

255.00<br />

264.00<br />

273.00<br />

282.00<br />

291.00<br />

300.00<br />

204.45<br />

215.03<br />

225.60<br />

236.17<br />

246.75<br />

257.32<br />

267.90<br />

278.48<br />

289.05<br />

299.63<br />

310.20<br />

320.77<br />

331.35<br />

341.93<br />

352.50<br />

To 300.00 excl. VAT add 8.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

To 940.00 excl. VAT add 3.50 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

To 4090.00 excl. VAT add 2.75 excl. VAT<br />

for each 1,000 (or part thereof) over 1m up<br />

to 10m then ADD VAT<br />

To 28,840.00 excl. VAT add 2.00 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT