WEEKLY ECONOMIC BRIEF â 12 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 12 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 12 October 2012 Chief ... - LGsuper

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Market Update<br />

• Global equity markets fell in the last week as global growth projections from both the IMF and World Bank were revised lower,<br />

Spain’s credit rating was downgraded by Standard and Poor’s to just above junk status, and the US earnings reporting season<br />

kicked off on a poor note. Japanese equities underperformed, with falling machinery orders seen as evidence that territorial<br />

disputes with China are beginning to have a real impact on the economy. The MSCI World Index fell by 1.4 per cent during the<br />

week, but remains largely unchanged so far this month and is 10 per cent higher than the start of the year.<br />

• In the US, the S&P500 fell by 2.0 per cent this week, while the tech-heavy NASDAQ fell by 3.2 per cent as the technology<br />

sector underperformed. The key earnings report so far this week was from aluminium producer Alcoa, which reported a loss<br />

from continuing operations, and reduced its estimates for global aluminium demand due to weakness in China in the second half<br />

of the year. Oil company Chevron reported a fall in Q3 earnings driven by output losses from Hurricane Isaac and falling prices.<br />

Consumer stocks have fared better, however, with retailer Wal-Mart commenting that back-to-school sales were very strong,<br />

while Costco beat expectations with strong volume growth induced by discounting. Bloomberg reports that analyst<br />

expectations for Q3 are quite downbeat, with earnings-per-share of S&P500 companies expected to fall 1.7 per cent in the third<br />

quarter and sales falling by 0.6 per cent.<br />

• Ten-year government bond yields were unchanged in the US this week, but rose in Europe as hard economic data suggested<br />

that the European economy is not as weak as suggested by recent survey measures. In the US, non-farm payroll data for<br />

September were stronger than expected (after allowing for revisions to the last two months) and the unemployment rate fell<br />

from 8.1 per cent to 7.8 per cent. This helped offset the negative impact from IMF/World Bank growth projections.<br />

• In currency markets, the US dollar strengthened against the Euro and Sterling, but weakened slightly against the Yen and $A.<br />

The Euro was weighed down by an IMF report that estimated European banks may need to sell an additional $4.5 trillion of<br />

assets to restructure their balance sheets in a downside global growth scenario, up 18 per cent on their April estimate.<br />

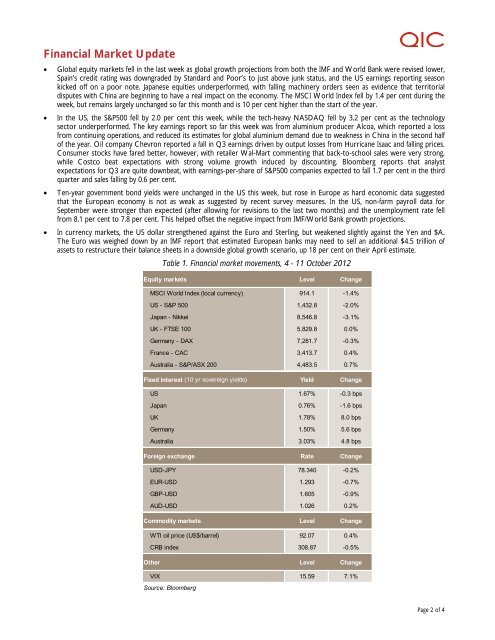

Table 1. Financial market movements, 4 - 11 <strong>October</strong> 20<strong>12</strong><br />

Equity markets Level Change<br />

MSCI World Index (local currency) 914.1 -1.4%<br />

US - S&P 500 1,432.8 -2.0%<br />

Japan - Nikkei 8,546.8 -3.1%<br />

UK - FTSE 100 5,829.8 0.0%<br />

Germany - DAX 7,281.7 -0.3%<br />

France - CAC 3,413.7 0.4%<br />

Australia - S&P/ASX 200 4,483.5 0.7%<br />

Fixed interest (10 yr sovereign yields) Yield Change<br />

US 1.67% -0.3 bps<br />

Japan 0.76% -1.6 bps<br />

UK 1.78% 8.0 bps<br />

Germany 1.50% 5.6 bps<br />

Australia 3.03% 4.8 bps<br />

Foreign exchange Rate Change<br />

USD-JPY 78.340 -0.2%<br />

EUR-USD 1.293 -0.7%<br />

GBP-USD 1.605 -0.9%<br />

AUD-USD 1.026 0.2%<br />

Commodity markets Level Change<br />

WTI oil price (US$/barrel) 92.07 0.4%<br />

CRB index 308.87 -0.5%<br />

Other Level Change<br />

VIX 15.59 7.1%<br />

Source: Bloomberg<br />

Page 2 of 4