WEEKLY ECONOMIC BRIEF â 12 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 12 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 12 October 2012 Chief ... - LGsuper

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Japan<br />

• Bank of Japan left monetary policy unchanged at their meeting last week.<br />

6<br />

5<br />

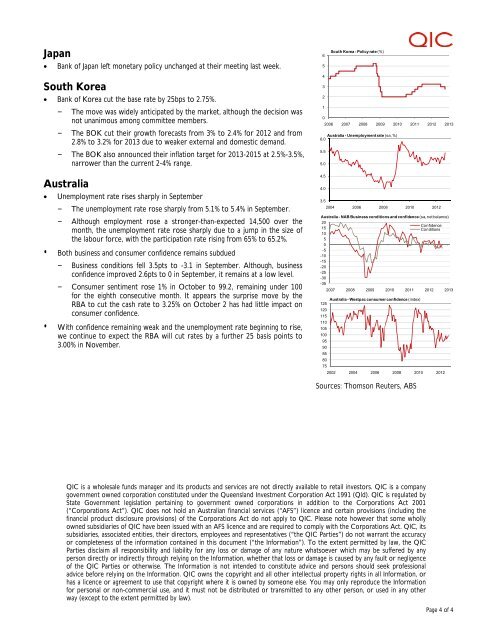

SouthKorea-Policy rate (%)<br />

South Korea<br />

• Bank of Korea cut the base rate by 25bps to 2.75%.<br />

– The move was widely anticipated by the market, although the decision was<br />

not unanimous among committee members.<br />

– The BOK cut their growth forecasts from 3% to 2.4% for 20<strong>12</strong> and from<br />

2.8% to 3.2% for 2013 due to weaker external and domestic demand.<br />

– The BOK also announced their inflation target for 2013-2015 at 2.5%-3.5%,<br />

narrower than the current 2-4% range.<br />

Australia<br />

• Unemployment rate rises sharply in September<br />

– The unemployment rate rose sharply from 5.1% to 5.4% in September.<br />

– Although employment rose a stronger-than-expected 14,500 over the<br />

month, the unemployment rate rose sharply due to a jump in the size of<br />

the labour force, with the participation rate rising from 65% to 65.2%.<br />

• Both business and consumer confidence remains subdued<br />

– Business conditions fell 3.5pts to -3.1 in September. Although, business<br />

confidence improved 2.6pts to 0 in September, it remains at a low level.<br />

– Consumer sentiment rose 1% in <strong>October</strong> to 99.2, remaining under 100<br />

for the eighth consecutive month. It appears the surprise move by the<br />

RBA to cut the cash rate to 3.25% on <strong>October</strong> 2 has had little impact on<br />

consumer confidence.<br />

• With confidence remaining weak and the unemployment rate beginning to rise,<br />

we continue to expect the RBA will cut rates by a further 25 basis points to<br />

3.00% in November.<br />

4<br />

3<br />

2<br />

1<br />

0<br />

2006 2007 2008 2009 2010 2011 20<strong>12</strong> 2013<br />

Australia -Unemployment rate (sa, %)<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

2004 2006 2008 2010 20<strong>12</strong><br />

Australia -NAB Business conditions and confidence (sa, net balance)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

-25<br />

-30<br />

-35<br />

2007 2008 2009 2010 2011 20<strong>12</strong> 2013<br />

Australia -Westpac consumer confidence (index)<br />

<strong>12</strong>5<br />

<strong>12</strong>0<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

Confidence<br />

Conditions<br />

2002 2004 2006 2008 2010 20<strong>12</strong><br />

Sources: Thomson Reuters, ABS<br />

QIC is a wholesale funds manager and its products and services are not directly available to retail investors. QIC is a company<br />

government owned corporation constituted under the Queensland Investment Corporation Act 1991 (Qld). QIC is regulated by<br />

State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001<br />

(“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the<br />

financial product disclosure provisions) of the Corporations Act do not apply to QIC. Please note however that some wholly<br />

owned subsidiaries of QIC have been issued with an AFS licence and are required to comply with the Corporations Act. QIC, its<br />

subsidiaries, associated entities, their directors, employees and representatives (“the QIC Parties”) do not warrant the accuracy<br />

or completeness of the information contained in this document (“the Information”). To the extent permitted by law, the QIC<br />

Parties disclaim all responsibility and liability for any loss or damage of any nature whatsoever which may be suffered by any<br />

person directly or indirectly through relying on the Information, whether that loss or damage is caused by any fault or negligence<br />

of the QIC Parties or otherwise. The Information is not intended to constitute advice and persons should seek professional<br />

advice before relying on the Information. QIC owns the copyright and all other intellectual property rights in all Information, or<br />

has a licence or agreement to use that copyright where it is owned by someone else. You may only reproduce the Information<br />

for personal or non-commercial use, and it must not be distributed or transmitted to any other person, or used in any other<br />

way (except to the extent permitted by law).<br />

Page 4 of 4