WEEKLY ECONOMIC BRIEF â 5 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 5 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 5 October 2012 Chief ... - LGsuper

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Market Update<br />

• The Reserve Bank of Australia surprised markets and economists by cutting the cash rate by 25 basis points on Tuesday. This<br />

helped the S&P/ASX 200 rise 1 per cent on the day, to finish up 1.6 per cent over the week to Thursday. The decision led<br />

Australian 10-year government bond yields to fall 4 basis points to 2.98 per cent and the Australian dollar to weaken against all<br />

major currencies, falling 1.9 per cent against the US dollar.<br />

• Global equity markets edged higher over the week, with the MSCI World Index rising 0.7 per cent. European equities continued<br />

to underperform, undermined by the ongoing debt crisis. French equities fell 1.1 per cent over the week after the government<br />

unveiled its most austere budget in 30 years. Japanese equities fell 1.4 per cent, weighed down by a further deterioration in<br />

manufacturing sentiment.<br />

• Major government bond yields were little changed over the week. As expected, the Bank of England and European Central Bank<br />

left policy unchanged at their <strong>October</strong> meetings. We continue to expect the Bank of England will increase its asset purchase<br />

program by a further £25 billion next month.<br />

• In other currency markets, the Japanese yen underperformed falling 1.1 per cent against the US dollar and almost 2 per cent<br />

against the euro. Weaker economic data, combined with increasing political pressure for further policy easing after the PM<br />

reshuffled the cabinet for the third time this year, weighed on the yen. The new economy minister, Seiji Maehara, an advocate<br />

for the Bank of Japan to purchase foreign government bonds (which would have the impact of weakening the currency)<br />

announced that he would attend the BOJ meeting this week, the first minister to do so since 2003. In addition, the new finance<br />

minister, Koriki Jojima, stated that “the yen’s recent appreciation is one-sided and doesn’t reflect the state of the Japanese<br />

economy” and that they are ready to take bold action, raising expectations of further foreign exchange intervention to devalue<br />

the yen.<br />

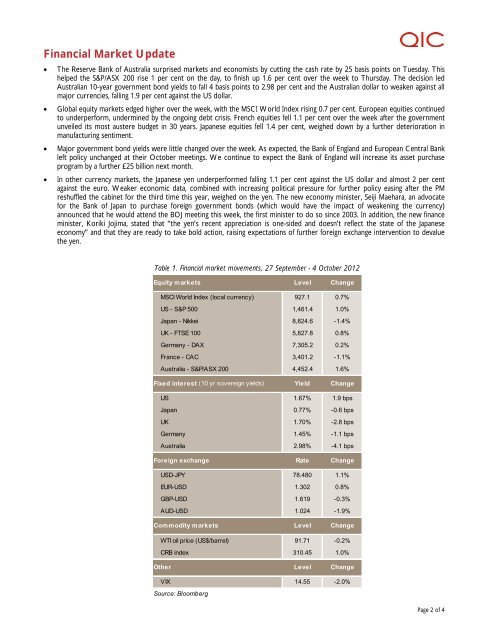

Table 1. Financial market movements, 27 September - 4 <strong>October</strong> <strong>2012</strong><br />

Equity markets Level Change<br />

MSCI World Index (local currency) 927.1 0.7%<br />

US - S&P 500 1,461.4 1.0%<br />

Japan - Nikkei 8,824.6 -1.4%<br />

UK - FTSE 100 5,827.8 0.8%<br />

Germany - DAX 7,305.2 0.2%<br />

France - CAC 3,401.2 -1.1%<br />

Australia - S&P/ASX 200 4,452.4 1.6%<br />

Fixed interest (10 yr sovereign yields) Yield Change<br />

US 1.67% 1.9 bps<br />

Japan 0.77% -0.6 bps<br />

UK 1.70% -2.8 bps<br />

Germany 1.45% -1.1 bps<br />

Australia 2.98% -4.1 bps<br />

Foreign exchange Rate Change<br />

USD-JPY 78.480 1.1%<br />

EUR-USD 1.302 0.8%<br />

GBP-USD 1.619 -0.3%<br />

AUD-USD 1.024 -1.9%<br />

Commodity markets Level Change<br />

WTI oil price (US$/barrel) 91.71 -0.2%<br />

CRB index 310.45 1.0%<br />

Other Level Change<br />

VIX 14.55 -2.0%<br />

Source: Bloomberg<br />

Page 2 of 4