WEEKLY ECONOMIC BRIEF â 5 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 5 October 2012 Chief ... - LGsuper

WEEKLY ECONOMIC BRIEF â 5 October 2012 Chief ... - LGsuper

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Economic Update<br />

United States<br />

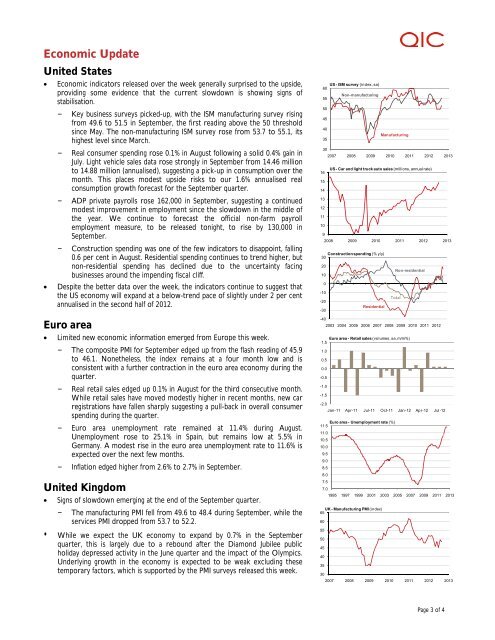

• Economic indicators released over the week generally surprised to the upside,<br />

providing some evidence that the current slowdown is showing signs of<br />

stabilisation.<br />

– Key business surveys picked-up, with the ISM manufacturing survey rising<br />

from 49.6 to 51.5 in September, the first reading above the 50 threshold<br />

since May. The non-manufacturing ISM survey rose from 53.7 to 55.1, its<br />

highest level since March.<br />

– Real consumer spending rose 0.1% in August following a solid 0.4% gain in<br />

July. Light vehicle sales data rose strongly in September from 14.46 million<br />

to 14.88 million (annualised), suggesting a pick-up in consumption over the<br />

month. This places modest upside risks to our 1.6% annualised real<br />

consumption growth forecast for the September quarter.<br />

– ADP private payrolls rose 162,000 in September, suggesting a continued<br />

modest improvement in employment since the slowdown in the middle of<br />

the year. We continue to forecast the official non-farm payroll<br />

employment measure, to be released tonight, to rise by 130,000 in<br />

September.<br />

– Construction spending was one of the few indicators to disappoint, falling<br />

0.6 per cent in August. Residential spending continues to trend higher, but<br />

non-residential spending has declined due to the uncertainty facing<br />

businesses around the impending fiscal cliff.<br />

• Despite the better data over the week, the indicators continue to suggest that<br />

the US economy will expand at a below-trend pace of slightly under 2 per cent<br />

annualised in the second half of <strong>2012</strong>.<br />

Euro area<br />

• Limited new economic information emerged from Europe this week.<br />

– The composite PMI for September edged up from the flash reading of 45.9<br />

to 46.1. Nonetheless, the index remains at a four month low and is<br />

consistent with a further contraction in the euro area economy during the<br />

quarter.<br />

– Real retail sales edged up 0.1% in August for the third consecutive month.<br />

While retail sales have moved modestly higher in recent months, new car<br />

registrations have fallen sharply suggesting a pull-back in overall consumer<br />

spending during the quarter.<br />

– Euro area unemployment rate remained at 11.4% during August.<br />

Unemployment rose to 25.1% in Spain, but remains low at 5.5% in<br />

Germany. A modest rise in the euro area unemployment rate to 11.6% is<br />

expected over the next few months.<br />

– Inflation edged higher from 2.6% to 2.7% in September.<br />

United Kingdom<br />

• Signs of slowdown emerging at the end of the September quarter.<br />

– The manufacturing PMI fell from 49.6 to 48.4 during September, while the<br />

services PMI dropped from 53.7 to 52.2.<br />

• While we expect the UK economy to expand by 0.7% in the September<br />

quarter, this is largely due to a rebound after the Diamond Jubilee public<br />

holiday depressed activity in the June quarter and the impact of the Olympics.<br />

Underlying growth in the economy is expected to be weak excluding these<br />

temporary factors, which is supported by the PMI surveys released this week.<br />

US -ISM survey (index, sa)<br />

60<br />

Non-manufacturing<br />

55<br />

50<br />

45<br />

40<br />

Manufacturing<br />

35<br />

30<br />

2007 2008 2009 2010 2011 <strong>2012</strong> 2013<br />

US -Car and light truck auto sales (millions, annual rate)<br />

16<br />

15<br />

14<br />

13<br />

12<br />

11<br />

10<br />

9<br />

2008 2009 2010 2011 <strong>2012</strong> 2013<br />

Construction spending (% y/y)<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

Residential<br />

-30<br />

-40<br />

Non-residential<br />

Total<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 <strong>2012</strong><br />

Euro area -Retailsales (volumes, sa, m/m%)<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12<br />

Euro area -Unemployment rate (%)<br />

11.5<br />

11.0<br />

10.5<br />

10.0<br />

9.5<br />

9.0<br />

8.5<br />

8.0<br />

7.5<br />

7.0<br />

1995 1997 1999 2001 2003 2005 2007 2009 2011 2013<br />

UK -Manufacturing PMI (index)<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

2007 2008 2009 2010 2011 <strong>2012</strong> 2013<br />

Page 3 of 4