Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

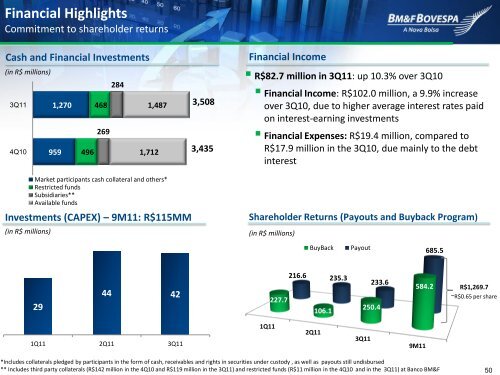

Financial Highlights<br />

Commitment to shareholder returns<br />

Cash and Financial Investments<br />

(in R$ millions)<br />

3Q11<br />

4Q10<br />

284<br />

1,270 468<br />

269<br />

1,487<br />

959 496<br />

1,712<br />

3,508<br />

3,435<br />

Financial Income<br />

• R$82.7 million in 3Q11: up 10.3% over 3Q10<br />

• Financial Income: R$102.0 million, a 9.9% increase<br />

over 3Q10, due to higher average interest rates paid<br />

on interest-earning investments<br />

• Financial Expenses: R$19.4 million, compared to<br />

R$17.9 million in the 3Q10, due mainly to the debt<br />

interest<br />

Market participants cash collateral and others*<br />

Restricted funds<br />

Subsidiaries**<br />

Available funds<br />

Investments (CAPEX) – 9M11: R$115MM<br />

(in R$ millions)<br />

Shareholder Returns (Payouts and Buyback Program)<br />

(in R$ millions)<br />

BuyBack<br />

Payout<br />

685.5<br />

29<br />

44 42<br />

227.7<br />

216.6 235.3<br />

106.1<br />

233.6<br />

250.4<br />

584.2<br />

R$1,269.7<br />

~R$0.65 per share<br />

1Q11 2Q11 3Q11<br />

1Q11<br />

2Q11<br />

3Q11<br />

9M11<br />

*Includes collaterals pledged by participants in the form of cash, receivables and rights in securities under custody , as well as payouts still undisbursed<br />

** Includes third party collaterals (R$142 million in the 4Q10 and R$119 million in the 3Q11) and restricted funds (R$11 million in the 4Q10 and in the 3Q11) at Banco BM&F<br />

50