City of Greater Bendigo Annual Budget 2014/2015

The Budget for 2014/2015 continues to deliver programs and projects that will help to fulfil Council’s vision of: Greater Bendigo working together to be the most liveable regional city in Australia.

The Budget for 2014/2015 continues to deliver programs and projects that will help to fulfil Council’s vision of: Greater Bendigo working together to be the most liveable regional city in Australia.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

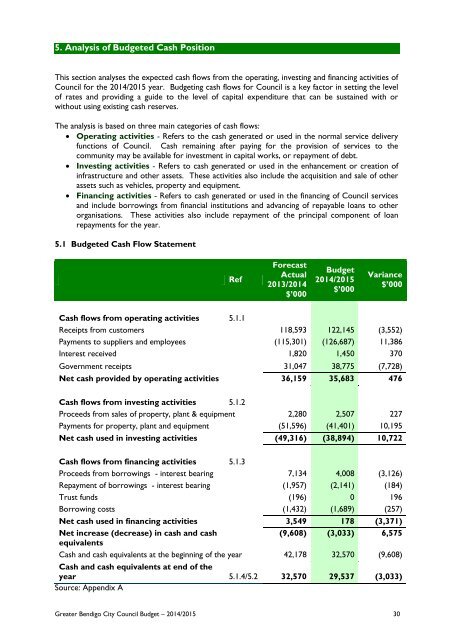

5. Analysis <strong>of</strong> <strong>Budget</strong>ed Cash Position<br />

This section analyses the expected cash flows from the operating, investing and financing activities <strong>of</strong><br />

Council for the <strong>2014</strong>/<strong>2015</strong> year. <strong>Budget</strong>ing cash flows for Council is a key factor in setting the level<br />

<strong>of</strong> rates and providing a guide to the level <strong>of</strong> capital expenditure that can be sustained with or<br />

without using existing cash reserves.<br />

The analysis is based on three main categories <strong>of</strong> cash flows:<br />

Operating activities - Refers to the cash generated or used in the normal service delivery<br />

functions <strong>of</strong> Council. Cash remaining after paying for the provision <strong>of</strong> services to the<br />

community may be available for investment in capital works, or repayment <strong>of</strong> debt.<br />

Investing activities - Refers to cash generated or used in the enhancement or creation <strong>of</strong><br />

infrastructure and other assets. These activities also include the acquisition and sale <strong>of</strong> other<br />

assets such as vehicles, property and equipment.<br />

Financing activities - Refers to cash generated or used in the financing <strong>of</strong> Council services<br />

and include borrowings from financial institutions and advancing <strong>of</strong> repayable loans to other<br />

organisations. These activities also include repayment <strong>of</strong> the principal component <strong>of</strong> loan<br />

repayments for the year.<br />

5.1 <strong>Budget</strong>ed Cash Flow Statement<br />

Ref<br />

Forecast<br />

Actual<br />

2013/<strong>2014</strong><br />

$’000<br />

<strong>Budget</strong><br />

<strong>2014</strong>/<strong>2015</strong><br />

$’000<br />

Variance<br />

$’000<br />

Cash flows from operating activities 5.1.1<br />

Receipts from customers 118,593 122,145 (3,552)<br />

Payments to suppliers and employees (115,301) (126,687) 11,386<br />

Interest received 1,820 1,450 370<br />

Government receipts 31,047 38,775 (7,728)<br />

Net cash provided by operating activities 36,159 35,683 476<br />

Cash flows from investing activities 5.1.2<br />

Proceeds from sales <strong>of</strong> property, plant & equipment 2,280 2,507 227<br />

Payments for property, plant and equipment (51,596) (41,401) 10,195<br />

Net cash used in investing activities (49,316) (38,894) 10,722<br />

Cash flows from financing activities 5.1.3<br />

Proceeds from borrowings - interest bearing 7,134 4,008 (3,126)<br />

Repayment <strong>of</strong> borrowings - interest bearing (1,957) (2,141) (184)<br />

Trust funds (196) 0 196<br />

Borrowing costs (1,432) (1,689) (257)<br />

Net cash used in financing activities 3,549 178 (3,371)<br />

Net increase (decrease) in cash and cash<br />

(9,608) (3,033) 6,575<br />

equivalents<br />

Cash and cash equivalents at the beginning <strong>of</strong> the year 42,178 32,570 (9,608)<br />

Cash and cash equivalents at end <strong>of</strong> the<br />

year 5.1.4/5.2 32,570 29,537 (3,033)<br />

Source: Appendix A<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 30