City of Greater Bendigo Annual Budget 2014/2015

The Budget for 2014/2015 continues to deliver programs and projects that will help to fulfil Council’s vision of: Greater Bendigo working together to be the most liveable regional city in Australia.

The Budget for 2014/2015 continues to deliver programs and projects that will help to fulfil Council’s vision of: Greater Bendigo working together to be the most liveable regional city in Australia.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong><br />

<strong>Annual</strong> <strong>Budget</strong> <strong>2014</strong>/<strong>2015</strong><br />

Enhancing our liveability

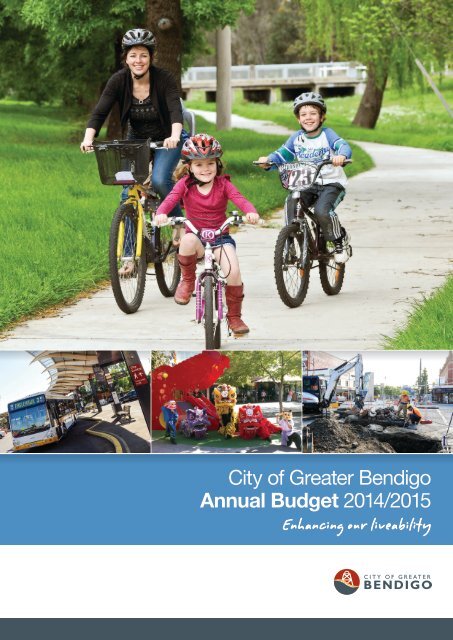

Main cover image:<br />

The Flanagan-Smith family enjoy the extended Back Creek-Spring Gully shared path.<br />

Sub images:<br />

1. <strong>Bendigo</strong> Railway Station.<br />

2. Fun Loong’s first birthday celebrations in Hargreaves Mall.<br />

3. Mitchell Street redevelopment works.

ADDENDUM<br />

This addendum should be read in conjunction with the budget initialed by the Mayor for<br />

identification.<br />

1. <strong>Budget</strong> Submissions<br />

On July 30, <strong>2014</strong>, in adopting the <strong>2014</strong>/15 <strong>Budget</strong>, Council resolved to make the following changes:<br />

<br />

<br />

Allocate additional funding <strong>of</strong> $16,820 to bring the former Marong Pre-school facility up to<br />

relevant standards to use as a Marong Community Hub. These funds will increase the<br />

allocation <strong>of</strong> Capital works in the Buildings class.<br />

Allocate additional funding <strong>of</strong> $21,000 to enable the progression <strong>of</strong> the Woodvale Recreation<br />

Reserve Master Plan. These funds will increase the allocation <strong>of</strong> Capital works in the Buildings<br />

class<br />

Note: <strong>Budget</strong> document pages affected: all financial statements are impacted (net impact is<br />

immaterial).<br />

i

TABLE OF CONTENTS<br />

Page<br />

Introduction from the Mayor, Cr Barry Lyons 1<br />

Chief Executive Officer’s Summary 2<br />

<strong>Budget</strong> Processes 6<br />

1. Linkage to the Council Plan 7<br />

2. Services, Initiatives and Service Performance Indicators 10<br />

3. <strong>Budget</strong> Influences 22<br />

4. Analysis <strong>of</strong> Operating <strong>Budget</strong> 25<br />

5. Analysis <strong>of</strong> <strong>Budget</strong>ed Cash Position 30<br />

6. Analysis <strong>of</strong> Capital <strong>Budget</strong> 33<br />

7. Analysis <strong>of</strong> <strong>Budget</strong>ed Financial Position 37<br />

8. Strategic Resource Plan and Financial Performance Indicators 40<br />

9. Rating Information 45<br />

10. Other Strategies 50<br />

Appendix A - <strong>Budget</strong>ed Statements 53<br />

Appendix B – Rates and Charges 60<br />

Appendix C - Capital Works Program 72<br />

Appendix D - Maps 84<br />

Appendix E – Capital Evaluation Framework 87<br />

Appendix F - Glossary <strong>of</strong> Terms 90<br />

ii

Introduction from the Mayor, Cr Barry Lyons<br />

The <strong>Budget</strong> for <strong>2014</strong>/<strong>2015</strong> continues to deliver programs and projects that will help to fulfil<br />

Council’s vision <strong>of</strong> working together to be the most liveable regional city in Australia.<br />

Revenue from rates, fees and user charges, together with Government grants and other<br />

contributions, will enable us to deliver an ambitious $62.2 million capital and major works program,<br />

while investing $151.5 million in service delivery through the <strong>City</strong>’s operating budget.<br />

Council’s Capital Works program includes completing the Ulumbarra Theatre, the redevelopment <strong>of</strong><br />

Canterbury Park and further progress planning for the <strong>Greater</strong> <strong>Bendigo</strong> Indoor Aquatic Leisure and<br />

Wellbeing Centre, the <strong>Bendigo</strong> Airport redevelopment and <strong>Bendigo</strong> Botanic Gardens.<br />

There is continued investment in ‘grassroots’ infrastructure, including $21.6 million for roads,<br />

bridges, drainage and footpaths and funds for existing assets to make sure they are well maintained<br />

and can meet the needs <strong>of</strong> our growing city. This includes $6.9 million for building improvements;<br />

$2.6 million for recreation properties and structures; and $925,000 towards conserving the <strong>City</strong>’s<br />

heritage properties.<br />

Council will also provide $715,000 towards a partnership project with the Federal Government and<br />

15 other local councils to upgrade 23,000 streetlights in north, west and central Victoria with energy<br />

efficient technology. This initiative is expected to save the <strong>City</strong> in the order <strong>of</strong> $19.4 million over the<br />

next 20 years.<br />

The operating <strong>Budget</strong> again demonstrates that service delivery is our core business and that the <strong>City</strong><br />

provides services across a wide spectrum. In Community Services, we have allocated $15.5 million,<br />

including $9.3 million for Aged and Disability Services, $2.4 million for Maternal and Children’s<br />

Health, $4.3 million for Child Care and $5.4 million to encourage an Active and Healthy Community.<br />

There is also $23.6 million for the maintenance and development <strong>of</strong> infrastructure assets such as<br />

roads, footpaths and drains and our magnificent parks, gardens and natural reserves.<br />

Waste management remains one <strong>of</strong> the <strong>City</strong>’s most expensive services with around 90,000 bins to<br />

be emptied from kerbsides three-and-a-half million times in <strong>2014</strong>/<strong>2015</strong>. Ongoing increases in the<br />

EPA levy add $3.5 million to these costs and result in higher landfill charges for residents. The<br />

<strong>Budget</strong> includes funding to start rolling out <strong>of</strong> 360 litre recycling bins, giving <strong>Greater</strong> <strong>Bendigo</strong> the<br />

option <strong>of</strong> being able to recycle more <strong>of</strong> their domestic waste and help meet targets in Council’s<br />

recently adopted Waste and Resource Management Strategy. For the first time, public place<br />

recycling bins will be located in high pr<strong>of</strong>ile areas.<br />

To help fund Capital Works and services rates will increase by 6.0%, which is in line with Council’s<br />

10-year financial plan. The Municipal Charge will be discontinued.<br />

The <strong>Budget</strong> is prudent and was developed using a more efficient and transparent process informed<br />

by the Independent Review <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>.<br />

It gives me great pleasure to present the <strong>Budget</strong> to the community <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>. I am<br />

confident that it will help achieve Council’s vision <strong>of</strong> being Australia’s most liveable regional city.<br />

Cr Barry Lyons<br />

Mayor<br />

Adopted <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> <strong>2014</strong>/<strong>2015</strong> 1

Chief Executive Officer’s Summary<br />

Council has prepared a <strong>Budget</strong> for the <strong>2014</strong>/<strong>2015</strong> financial year which seeks to balance the demand<br />

for services and infrastructure with the community’s capacity to pay. Key budget information is<br />

provided below about the rate increase, operating result, cash and investments, capital works,<br />

financial sustainability, financial position, and expenditure allocations <strong>of</strong> the Council.<br />

Any columns in graphs below labelled A2012/13 reflect actual figures for 2012/13, F2013/14 reflect<br />

forecast figures for 2013/14, A2013/14 reflects actual figures for 2013/14, columns labelled B<strong>2014</strong>/15<br />

reflect budget figures for <strong>2014</strong>/15 and columns labelled SRP reflect Strategic Resource Plan figures<br />

for the financial years <strong>2015</strong>/16 – 2017/18.<br />

1. Rates<br />

The general rates increase <strong>of</strong> 6.0% for the <strong>2014</strong>/<strong>2015</strong> year, will raise total rates and charges <strong>of</strong><br />

$93.39 million, including $12.2 million from garbage and recycling charges, and $1.93 million<br />

generated from supplementary rates.<br />

2. Income Statement Result<br />

The budgeted operating result for the <strong>2014</strong>/<strong>2015</strong> year is an operating surplus <strong>of</strong> $12.07 million,<br />

which is an increase <strong>of</strong> $3.21 million over the forecast result for 2013/<strong>2014</strong>. The increase is due<br />

mainly to the net effect <strong>of</strong> increases in the cost <strong>of</strong> service delivery, additional contract payments as a<br />

result <strong>of</strong> major project expenditure (refer section 4.3.2), increased depreciation, and the timing <strong>of</strong><br />

the Victorian Grants Commission funding which is based on receipt <strong>of</strong> two quarterly payments in<br />

2013/<strong>2014</strong>, which increases the number <strong>of</strong> quarters budgeted to be received in <strong>2014</strong>/<strong>2015</strong> to the full<br />

four quarters.<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 2

3. Cash and Investments<br />

Cash and investments are expected to decrease by $3.03 million during the year to $29.54 million as<br />

at 30 June <strong>2015</strong>. This reflects Council's strategy <strong>of</strong> using excess cash and investments to enhance<br />

service delivery and enable the renewal and upgrade <strong>of</strong> existing infrastructure and the creation <strong>of</strong><br />

new infrastructure.<br />

4. Capital Works<br />

The budgeted Capital Works program for the <strong>2014</strong>/<strong>2015</strong> year is $42.69 million. In addition to the<br />

budgeted Capital Works program, some projects will be carried forward for completion from the<br />

2013/<strong>2014</strong> year; however the carried forward projects are funded from the 2013/<strong>2014</strong> budget.<br />

Of the $42.69 million in Capital funding required, $26.79 million will come from Working<br />

Capital/Council operations, $9.11 million from external grants, contributions and asset sales, $4<br />

million from loan borrowings and the balance from cash and investments.<br />

The capital expenditure program has been prioritised based on an agreed evaluation criteria. (Note:<br />

In addition to the Capital Works, Council will undertake Major Works which equates to $19.55<br />

million total expenditure, substantially funded from Government Grants and Council Reserves.<br />

Major Works include the completion <strong>of</strong> Ulumbarra Theatre, and Lighting the Region Projects, and<br />

are assets not owned by COGB).<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 3

5. Financial Position<br />

The financial position is expected to improve with net assets (net worth) to increase by $115 million<br />

to $1.29 billion although net current assets (working capital) will reduce by $0.69 million to $11.64<br />

million as at 30 June <strong>2015</strong>. This is mainly due to the use <strong>of</strong> cash reserves to fund projects included in<br />

the Capital Works program.<br />

6. Financial Sustainability<br />

A high level Strategic Resource Plan for the years <strong>2014</strong>/15 to 2017/18 has been developed to assist<br />

Council in adopting a budget within a longer term prudent financial framework. The key objective <strong>of</strong><br />

the plan is financial sustainability in the medium to long term, while achieving the Council’s strategic<br />

objectives as specified in the Council Plan. The plan projects that Council’s underlying result, which<br />

is a measure <strong>of</strong> financial sustainability, shows an increasing surplus over the four year period.<br />

The underlying budget deficit expected to occur in <strong>2014</strong>/<strong>2015</strong> is due to the timing <strong>of</strong> financial<br />

transactions, these being the impact <strong>of</strong> payments in relation to the <strong>Bendigo</strong> Community Theatre, and<br />

Lighting the Region Project (refer section 4.3.2). If the timing <strong>of</strong> these transactions was adjusted, an<br />

underlying surplus would be budgeted to occur in <strong>2014</strong>/<strong>2015</strong>.<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 4

7. Council Expenditure Allocations<br />

The above chart provides an indication <strong>of</strong> how Council allocates its expenditure across the core<br />

services that it delivers.<br />

This budget has been developed through a rigorous process <strong>of</strong> preparation and review. More<br />

detailed budget information is available throughout this document.<br />

Craig Niemann<br />

Chief Executive Officer<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 5

<strong>Budget</strong> Processes<br />

This section lists the budget processes to be undertaken in order to adopt the <strong>Budget</strong> in accordance<br />

with the Local Government Act 1989 (the Act) and Local Government (Planning and Reporting) Regulations<br />

<strong>2014</strong> (the Regulations).<br />

Under the Act, Council is required to prepare and adopt an annual budget for each financial year.<br />

The budget is required to include certain information about the rates and charges that Council<br />

intends to levy as well as a range <strong>of</strong> other information required by the Regulations which support<br />

the Act.<br />

The <strong>2014</strong>/<strong>2015</strong> budget is for the financial year 1 July <strong>2014</strong> to 30 June <strong>2015</strong> and is prepared in<br />

accordance with the Act and Regulations. The budget includes financial statements, being a<br />

budgeted Income Statement, Balance Sheet, Cash Flow Statement, Capital Work Statement,<br />

Statement <strong>of</strong> Changes in Equity and Statement <strong>of</strong> Human Resources. These statements have been<br />

prepared for the year ended 30 June <strong>2015</strong> in accordance with the Act and Regulations, and are<br />

consistent with the annual financial statements which are prepared in accordance with Accounting<br />

Standards. The budget also includes detailed information about the rates and charges to be levied,<br />

the Capital Works program to be undertaken, the human resources required, and other financial<br />

information, which Council requires in order to make an informed decision about the adoption <strong>of</strong><br />

the budget.<br />

The preparation <strong>of</strong> the budget began with Officers preparing the operating and capital components<br />

<strong>of</strong> the annual budget between November and February. A draft consolidated budget was considered<br />

by Councillors at briefings in April. The proposed budget is submitted to Council in May for<br />

approval in principle, Council is then required to give public notice that it intends to adopt a budget.<br />

It must give 28 days notice <strong>of</strong> its intention to adopt the proposed budget and make the budget<br />

available for inspection. Any interested person has a right to make a submission on any proposal<br />

contained in the budget and any submission must be considered before adoption <strong>of</strong> the budget by<br />

Council.<br />

Council undertakes media briefings, promotion and displays copies <strong>of</strong> the proposed budget in the<br />

local media and on the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>'s website. Hard copies are also available at Council<br />

<strong>of</strong>fices. The final step is for Council to adopt the budget after receiving and considering any<br />

submissions from interested parties. The budget is required to be adopted and a copy submitted to<br />

the Minister by 31 August each year. The key dates for the budget process are summarised below:<br />

<strong>Budget</strong> process<br />

Timing<br />

1. Officers prepare operating and capital budgets Nov/Mar<br />

2. Council considers draft budget April<br />

3. Proposed budget submitted to Council for approval 28 May<br />

4. Public notice advising <strong>of</strong> Council’s intention to adopt the budget 31 May<br />

5. <strong>Budget</strong> available for public inspection and comment<br />

31 May to<br />

27 June<br />

6. Submissions period closes (28 days) 27 June<br />

7. Submissions considered by a Committee <strong>of</strong> Council 2 July<br />

8. <strong>Budget</strong> and submissions presented to Council for adoption 30 July<br />

9. Copy <strong>of</strong> adopted budget submitted to the Minister 1 August<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 6

1. Linkage to the Council Plan<br />

This section describes how the <strong>Annual</strong> <strong>Budget</strong> links to the achievement <strong>of</strong> the Council Plan within an<br />

overall planning framework. This framework guides the Council in identifying community needs and<br />

aspirations over the long term (<strong>Greater</strong> <strong>Bendigo</strong> 2036), medium term (Council Plan, Strategic<br />

Resources Plan) and short term (<strong>Annual</strong> Actions and <strong>Budget</strong>) and then holding itself accountable<br />

(<strong>Annual</strong> Report and Audited Statements).<br />

1.1 Strategic Planning Framework<br />

The Strategic Resource Plan, included in the Council Plan, is a rolling four year plan that provides a<br />

summary <strong>of</strong> the financial and non-financial impacts <strong>of</strong> the objectives and strategies and determines<br />

the sustainability <strong>of</strong> these objectives and strategies. The <strong>Annual</strong> <strong>Budget</strong> is developed and framed<br />

within the Strategic Resource Plan, taking into account the activities and initiatives which contribute<br />

to achieving the Council’s strategic objectives specified in the Council Plan. The diagram below<br />

depicts the strategic planning framework <strong>of</strong> Council.<br />

ENGAGEMENT<br />

ACTION<br />

PLANNING<br />

RESOURCE<br />

PLANNING<br />

REPORTING<br />

Community Plans<br />

- <strong>Greater</strong> <strong>Bendigo</strong> 2036<br />

- Small Town and<br />

Neighbourhood Plans<br />

Community<br />

Engagement<br />

Framework<br />

1. Deliberate<br />

Consultation Activities<br />

Council Plan<br />

Long Term<br />

Financial and<br />

Workforce Plan<br />

(Strategic Resource<br />

Plan)<br />

<strong>Annual</strong> Report to the<br />

Community<br />

2. Communications and<br />

Media<br />

3. Customer Service<br />

Requests<br />

COGB Strategies<br />

and Plans<br />

Report to councillors<br />

on achievements in<br />

strategies<br />

4. Small Towns<br />

5. Individual Contacts<br />

with Staff/Councillors<br />

Strategies<br />

Council Plan<br />

<strong>Annual</strong> Actions<br />

Council <strong>Budget</strong><br />

including <strong>Annual</strong><br />

Capital Expenditure<br />

Report to<br />

Councillors on<br />

progress against<br />

<strong>Annual</strong> Actions and<br />

<strong>Budget</strong><br />

Service Plans<br />

Unit <strong>Budget</strong><br />

Progress report to<br />

Director<br />

Note: Lighter shades<br />

are for "internal only"<br />

documents.<br />

Individual Work<br />

Plans<br />

Progress report to<br />

Supervisor<br />

Council's Planning and Reporting framework is underpinned by Federal, State and Regional Strategic Plans, Policies and<br />

Council's Planning and Reporting framework is underpinned by Federal, State and Regional Strategic Plans, Policies and Legislation<br />

Legislation.<br />

Note: lighter shades are for "internal only" documents<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 7

The timing <strong>of</strong> each component <strong>of</strong> the planning framework is critical to the successful achievement <strong>of</strong><br />

the planned outcomes. A new Council Plan, including the Strategic Resource Plan, is required to be<br />

completed by 30 June following a general election, and is reviewed each year in advance <strong>of</strong> the<br />

<strong>Annual</strong> <strong>Budget</strong> process.<br />

1.2 Vision and Values<br />

Council Vision<br />

Working together to be Australia’s most liveable regional city.<br />

Council Values<br />

Council wants the community to continue to have reason to be proud <strong>of</strong> the city and will do this<br />

through:<br />

Transparency - Information about Council decisions is readily available and easily<br />

understood;<br />

Efficiency and effectiveness - Council provides services based on evidence <strong>of</strong> need and<br />

demonstrates continuous improvement in the delivery <strong>of</strong> services;<br />

Inclusion and consultation - Council uses a range <strong>of</strong> engagement strategies to ensure<br />

community members can understand and take part in discussion that informs the<br />

development <strong>of</strong> new strategies and actions;<br />

Clear decisive and consistent planning - In a rapidly growing municipality, Council undertakes<br />

to plan effectively for our long-term future;<br />

Respect for community priorities and needs - Council will advocate for improved services<br />

for community members and will consider community impact and feedback the decisions it<br />

makes.<br />

Staff Organisational Values<br />

Our core values are aspiring to quality and achievement in everything we do by:<br />

Embracing challenges<br />

Encouraging and respecting each other<br />

Nurturing creativity and diversity<br />

to make a difference in our community.<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 8

1.3 Themes and Strategic Objectives<br />

The Council delivers services and initiatives under service categories or functional areas. Each<br />

contributes to the achievement <strong>of</strong> one <strong>of</strong> the five themes and the strategic objectives as set out in<br />

the Council Plan for the 2013-17 years and shown in the following table.<br />

Theme<br />

Strategic Objective<br />

1. Leadership<br />

and Good<br />

Governance<br />

2. Planning for<br />

Growth<br />

3. Presentation<br />

and vibe <strong>of</strong><br />

our city<br />

Council demonstrates leadership in its decisions and uses good governance<br />

principles to guide decision-making.<br />

Advocacy about our priorities is effective.<br />

Community members take an active part in democratic engagement.<br />

<strong>Greater</strong> <strong>Bendigo</strong> people receive responsive, accessible and inclusive customer<br />

service.<br />

Staff members are enabled to work effectively.<br />

Service delivery is <strong>of</strong> excellent standard.<br />

<strong>Greater</strong> <strong>Bendigo</strong> delivers major projects while maintaining its unique character,<br />

accommodating a growing population and diversifying the economy.<br />

<strong>Greater</strong> <strong>Bendigo</strong> residents and communities are connected with accessible<br />

transport options and access to essential built and communications<br />

infrastructure.<br />

Housing options meet current and future community expectations and needs.<br />

Public infrastructure across <strong>Greater</strong> <strong>Bendigo</strong> facilitates positive wellbeing and<br />

good quality <strong>of</strong> life.<br />

<strong>Greater</strong> <strong>Bendigo</strong> is a place <strong>of</strong> great places that celebrates people's active artistic,<br />

cultural, sporting and social lives.<br />

<strong>Greater</strong> <strong>Bendigo</strong> is a community that values its heritage and supports arts and<br />

cultural experiences.<br />

People are enabled to be the healthiest they can be.<br />

Residents have access to environments and settings that support safe and healthy<br />

living.<br />

The <strong>Greater</strong> <strong>Bendigo</strong> region is a drawcard for visitors.<br />

<strong>Greater</strong> <strong>Bendigo</strong> has inclusive and equitable communities where people feel<br />

welcome and connected to others.<br />

4. Productivity <strong>Greater</strong> <strong>Bendigo</strong> has a vibrant and diverse economy that grows jobs and enables<br />

good living standards.<br />

Support for innovation and creativity builds economic sustainability.<br />

<strong>Greater</strong> <strong>Bendigo</strong> enables lifelong learning opportunities.<br />

5. Sustainability Resources and assets are planned for, and managed wisely for long-term viability<br />

and to reduce the environmental footprint.<br />

<strong>Greater</strong> <strong>Bendigo</strong>'s natural heritage is restored and protected for the future.<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 9

2. Services, Initiatives and Service Performance Indicators<br />

This section provides a description <strong>of</strong> the services and initiatives to be funded in the <strong>Budget</strong> for the<br />

<strong>2014</strong>/<strong>2015</strong> year and how these will contribute to achieving the strategic objectives specified in the<br />

Council Plan as set out in Section 1. It also includes a number <strong>of</strong> initiatives, major initiatives and<br />

service performance outcome indicators. The Strategic Resource Plan (SRP) is part <strong>of</strong>, and prepared<br />

in conjunction with, the Council Plan. The relationship between these components <strong>of</strong> the <strong>Budget</strong><br />

and the Council Plan, along with the link to reporting in the <strong>Annual</strong> Report, is shown below.<br />

In order to demonstrate full cost <strong>of</strong> Council services, the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> allocates the cost<br />

<strong>of</strong> a number <strong>of</strong> internal support areas to other service units <strong>of</strong> Council. These include Finance,<br />

Information Management, People and Performance and Customer Service.<br />

2.1 Theme 1 – Leadership and Good Governance<br />

Council demonstrates leadership to assure the community that there is capacity and flexibility to<br />

plan for and manage emerging challenges, as well as responding to immediate needs and concerns.<br />

Good governance is evident in transparent and well-informed decision-making for the long term,<br />

sound management <strong>of</strong> resources and diverse and effective engagement with community members.<br />

Services<br />

Service Unit<br />

Executive<br />

Services<br />

Organisation<br />

Support<br />

Directorate<br />

Library Services<br />

Rating and<br />

Valuation<br />

Services<br />

Information<br />

Management<br />

Description <strong>of</strong> services provided<br />

The Executive Services Unit provides administrative and executive<br />

support to Council, the Mayor, the CEO and the Executive<br />

Management Team. The Unit ensures that systems and processes<br />

are in place to provide for good governance. Media,<br />

communications, community relations, government relations and<br />

legal services are supported through activities <strong>of</strong> the Unit.<br />

The Organisation Support Directorate enables, strengthens and<br />

enhances the organisation’s people, culture, systems, processes<br />

and finances to ensure sound corporate decision-making, the<br />

achievement <strong>of</strong> the organisation’s strategic objectives and the<br />

delivery <strong>of</strong> high quality services and programs.<br />

<strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> is one <strong>of</strong> the four member municipalities<br />

<strong>of</strong> the North Central Goldfields Library Corporation which<br />

provides a public library service to four sites throughout the<br />

municipality in <strong>Bendigo</strong>, Kangaroo Flat, Eaglehawk and Heathcote<br />

along with the mobile library.<br />

The Rating and Valuation Services Unit values properties for rating<br />

purposes, annually levies and collects rates and charges, as well as<br />

the State Government Fire Services Property Levy.<br />

The Information Management Unit is responsible for records<br />

management, corporate servers, computers/laptops and the<br />

corporate network which includes over 20 sites, mobile<br />

networking, telephone systems, mobile phones, Freedom <strong>of</strong><br />

Information requests and privacy matters.<br />

(Expenditure)<br />

Revenue<br />

Net Cost<br />

$'000<br />

(3,077)<br />

0<br />

(3,077)<br />

(417)<br />

0<br />

(417)<br />

(2,639)<br />

0<br />

(2,639)<br />

(2,522)<br />

1,021<br />

(1,501)<br />

(3.447)<br />

*3,294<br />

(153)<br />

9<br />

(144)<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 10

People and<br />

Performance<br />

Contracts and<br />

Project<br />

Coordination<br />

The People and Performance Unit supports the organisation to<br />

ensure it has the right people delivering the right outcomes. The<br />

Unit achieves its purpose through aligning the workforce<br />

availability, capability, and productivity to the organisation's<br />

strategy.<br />

The Contracts and Project Coordination Unit provides services,<br />

governance and capacity development to the organisation in the<br />

areas <strong>of</strong> tendering, contracts and project management.<br />

(3,295)<br />

*1,652<br />

(1,643)<br />

219<br />

(1,424)<br />

(630)<br />

1<br />

(629)<br />

Customer<br />

Support<br />

*Cost allocated across other units<br />

The Customer Support Unit is <strong>of</strong>ten the first point <strong>of</strong> contact for<br />

our customers. Committed to making a difference in our<br />

community, the Unit connects our customers to information,<br />

services, people and places. It is the "public face" <strong>of</strong> the Council<br />

as they interact with the community, and is also the thread that<br />

connects the internal organisation, assisting colleagues to respond<br />

to our community requests in a respectful and courteous way.<br />

(1,745)<br />

* 834<br />

(911)<br />

12<br />

(899)<br />

Initiatives<br />

Initiatives<br />

1) Employ internal graphic designer (1.00 FTE) to assist with publications reducing<br />

the need to outsource.<br />

Council<br />

Plan<br />

Reference<br />

2) Return the <strong>Greater</strong> <strong>Bendigo</strong> magazine to a quarterly publication. 1.4<br />

3) Increased administration support (0.60 FTE) to support Councillor’s increasing<br />

demands, requests and additional resources.<br />

4) Increase resources within the Contracts Unit (0.40 FTE) to undertake further<br />

improvements in project management.<br />

5) Develop future strategies for CoGB to reduce the burden <strong>of</strong> Defined Benefits<br />

liability, as per the Independent Review.<br />

6) Additional People and Performance staffing (1.00 FTE Temporary, 0.60 FTE<br />

Permanent) to implement actions arising from the Independent Review.<br />

7) Consulting time to manage numerous safety/risk projects to assist in fostering a<br />

proactive safety culture.<br />

8) Increase budget provision for administrative support to District Engagement<br />

meetings.<br />

Service Performance Outcome Indicators<br />

Service Indicator Performance Measure Computation<br />

1.6<br />

1.6<br />

1.6<br />

1.2<br />

1.5<br />

1.5<br />

1.6<br />

Governance Satisfaction<br />

Satisfaction with Council decisions<br />

(Community satisfaction rating out <strong>of</strong><br />

100 with how Council has performed in<br />

making decisions in the interests <strong>of</strong> the<br />

community)<br />

Community satisfaction rating<br />

out <strong>of</strong> 100 with how Council<br />

has performed in making<br />

decisions in the interests <strong>of</strong><br />

the community<br />

Libraries<br />

Participation Active library members<br />

(Percentage <strong>of</strong> the municipal population<br />

that are active library members)<br />

[Number <strong>of</strong> active library<br />

members / municipal<br />

population] x100<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 11

2.2 Theme 2 – Planning for Growth<br />

During this term Council has made a strong commitment to complete significant planning work to<br />

develop detailed and long term plans around integrated transport and future residential needs. This<br />

encompasses projects that contribute to achieving the vision <strong>of</strong> <strong>Bendigo</strong> becoming the most liveable<br />

regional city in Australia, and covers development <strong>of</strong> infrastructure that differentiates the<br />

municipality as an affordable, comfortable, connected and safe place to live and provides for modern<br />

and future lifestyle and cultural choices.<br />

It is essential that <strong>Greater</strong> <strong>Bendigo</strong> plans for the future and presents compelling arguments to the<br />

State and Federal Governments for funding to deliver on the plans, especially major infrastructure<br />

items. The completion <strong>of</strong> a number <strong>of</strong> major projects, identified in previous planning work, is also a<br />

high priority.<br />

There are competing demands in community priorities and internal funding decisions in the desires<br />

to plan for growth, maintain the existing infrastructure to safe and acceptable standards, and meet<br />

increasing demand for social services and new infrastructure.<br />

These strategies ensure <strong>Greater</strong> <strong>Bendigo</strong> adapts to the needs <strong>of</strong> a growing and increasingly diverse<br />

population smoothly and positively.<br />

Services<br />

Service Unit<br />

Planning and<br />

Development<br />

Directorate<br />

Statutory<br />

Planning<br />

Strategy<br />

Major Projects<br />

Description <strong>of</strong> services provided<br />

The Planning and Development Directorate ensures a better<br />

quality <strong>of</strong> life for all members <strong>of</strong> the <strong>Greater</strong> <strong>Bendigo</strong> community<br />

by fostering sustainable development and enhancing public safety.<br />

The Statutory Planning Unit facilitates quality developments<br />

including buildings and subdivisions, while maintaining and<br />

protecting the municipality’s environmental assets and respecting<br />

residents/community rights and amenities. Many <strong>of</strong> the services<br />

delivered by the Statutory Planning Unit are in accordance with<br />

State Government legislation and local strategies and policies<br />

adopted by Council following intensive community consultation.<br />

The Strategy Unit facilitates and coordinates the development <strong>of</strong><br />

strategies. The Unit’s integrated approach incorporates strategic<br />

land use planning, community and social planning, corporate,<br />

heritage and sustainable transport planning, and facilitating the<br />

renewal and implementation <strong>of</strong> the <strong>Greater</strong> <strong>Bendigo</strong> 2036<br />

Community Plan.<br />

The Major Projects Unit focusses on major projects that involve<br />

significant funding from external sources, significant stakeholder<br />

engagement and require detailed planning, design and delivery.<br />

The Unit contributes to the economic, cultural and social<br />

prosperity <strong>of</strong> our region by effectively delivering identified major<br />

projects, successfully co-operating and proactively developing the<br />

<strong>Bendigo</strong> Airport, and in doing so, continue to raise <strong>Greater</strong><br />

<strong>Bendigo</strong>'s pr<strong>of</strong>ile as an exceptional place in which to live, work,<br />

invest and visit.<br />

(Expenditure)<br />

Revenue<br />

Net Cost<br />

$'000<br />

(371)<br />

0<br />

(371)<br />

(3,105)<br />

724<br />

(2,381)<br />

(1,873)<br />

0<br />

(1,873)<br />

(766)<br />

120<br />

(646)<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 12

Initiatives<br />

Initiatives<br />

9) Employ Strategic Planner with GIS and Graphic Communication Skills (1.00 FTE).<br />

Convert consultancy costs to internal employment for more efficient result.<br />

10) Complete stage 2 <strong>of</strong> the White Hills and East <strong>Bendigo</strong> Heritage Study - Historical<br />

analysis and produce the heritage citation for the north eastern suburbs, due for<br />

completion in <strong>2015</strong>/2016.<br />

11) Legal and Consultancy advice to assist with the preparation <strong>of</strong> Airport<br />

Amendment.<br />

Council<br />

Plan<br />

Reference<br />

1.6<br />

3.3<br />

2.1<br />

Service Performance Outcome Indicators<br />

Service Indicator Performance Measure Computation<br />

Statutory<br />

planning<br />

Decision<br />

making<br />

Council planning decisions upheld at<br />

VCAT<br />

(Percentage <strong>of</strong> planning application<br />

decisions subject to review by VCAT and<br />

that were not set aside)<br />

[Number <strong>of</strong> VCAT decisions<br />

that did not set aside<br />

Council’s decision in relation<br />

to a planning application /<br />

Number <strong>of</strong> VCAT decisions<br />

in relation to planning<br />

applications] x100<br />

2.3 Theme 3 – The Presentation and vibe <strong>of</strong> our city<br />

When people in <strong>Bendigo</strong> describe it as being very liveable, they use phrases such as it ‘looks good’, is<br />

easy to get around, it is safe, it is affordable, and there is good access to health and education, and<br />

services for people who need help. There are choices in activities, education, housing and<br />

entertainment, and sporting facilities and open spaces are well maintained. People still say ‘Hello’ in<br />

the street.<br />

These are important features <strong>of</strong> the community to strengthen as <strong>Greater</strong> <strong>Bendigo</strong> grows and<br />

changes. New initiatives will be developed on the basis <strong>of</strong> equity to meet gaps in existing services or<br />

provide better access to existing services for members <strong>of</strong> the public. Outcomes that specifically<br />

encourage physical activity and those that promote mental and physical wellbeing are valued. At the<br />

same time preservation and/or promotion <strong>of</strong> the municipality's physical and cultural heritage remain<br />

important criteria.<br />

Services<br />

Service Unit<br />

<strong>Bendigo</strong> Art<br />

Gallery<br />

Description <strong>of</strong> services provided<br />

The <strong>Bendigo</strong> Art Gallery exhibits artworks, oversees the<br />

acquisition <strong>of</strong> artwork, manages bequests, and encourages<br />

philanthropy for the institution. The Gallery has an art collection<br />

<strong>of</strong> national significance housed within a facility that meets<br />

international standards.<br />

(Expenditure)<br />

Revenue<br />

Net Cost<br />

$'000<br />

(4,619)<br />

2,579<br />

(2,040)<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 13

The Capital,<br />

Ulumbarra,<br />

<strong>Bendigo</strong> Town<br />

Hall and <strong>Bendigo</strong><br />

Exhibition<br />

Centre<br />

Community<br />

Wellbeing<br />

Directorate<br />

Community<br />

Services<br />

Community<br />

Partnerships<br />

Active and<br />

Healthy<br />

Communities<br />

Environmental<br />

Health<br />

The Capital provides performing arts and venue management<br />

services to the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>. The Unit provides a<br />

diverse program <strong>of</strong> performing arts, high quality co-ordination and<br />

management services for a range <strong>of</strong> venues and facilities,<br />

custodianship and interpretation <strong>of</strong> significant heritage buildings,<br />

and contributes to the economic development <strong>of</strong> the <strong>City</strong> through<br />

excellent facilities and programs.<br />

The Community Wellbeing Directorate comprises the functional<br />

areas <strong>of</strong> Community Services, Customer Support, Active and<br />

Healthy Communities and Community Partnerships. The<br />

Community Wellbeing Directorate will support the people in our<br />

community to live their lives fully and be active, creative, engaged<br />

and healthy.<br />

The Community Services Unit delivers a broad range <strong>of</strong> services<br />

for the early childhood target group and their families including<br />

health promotion, prevention, care, education and advocacy. It<br />

provides support to frail older people, people with disabilities and<br />

their carers, whose capacity for independent living is at risk, or<br />

who are at risk <strong>of</strong> premature or inappropriate admission to long<br />

term residential care.<br />

The Community Partnerships Unit has an overarching community<br />

engagement, social inclusion, building capacity and advocacy focus.<br />

The Unit encourages and supports active engagement in<br />

community and civic life, strengthens community resilience by<br />

building social capital, and supports the planning and development<br />

<strong>of</strong> accessible and inclusive community facilities, programs and<br />

services that are responsive to identified community need and<br />

aspirations.<br />

The Active and Healthy Communities Unit is a multi-disciplinary<br />

team for the planning, design, management, maintenance and<br />

creation <strong>of</strong> public access to sport and leisure opportunities for the<br />

residents <strong>of</strong> and visitors to <strong>Greater</strong> <strong>Bendigo</strong>. The Unit improves<br />

the health and wellbeing <strong>of</strong> residents in the <strong>Greater</strong> <strong>Bendigo</strong><br />

region by encouraging and supporting healthy lifestyles in order to<br />

increase physical activity, fruit and vegetable consumption, and<br />

decrease smoking and harmful alcohol use. The Healthy<br />

Communities team connects with early year centres, primary and<br />

secondary schools, as well as medium to large scale businesses to<br />

assist in achieving and promoting healthy environments.<br />

The Environmental Health and Local Laws Unit keep the<br />

community safe through a variety <strong>of</strong> preventative and proactive<br />

actions and respond to issues raised by the community. The Unit<br />

improves the public health, wellbeing and safety <strong>of</strong> the community<br />

by reducing exposure to hazards associated with our surrounding<br />

environments through responsible and sustainable <strong>City</strong><br />

development, protecting surrounds, setting standards for civic<br />

behavior and ensuring good business practices <strong>of</strong> registered<br />

premises and major events.<br />

(4,098)<br />

2,189<br />

(1,909)<br />

(463)<br />

0<br />

(463)<br />

(15,497)<br />

12,249<br />

(3,248)<br />

(4,187)<br />

1,544<br />

(2,643)<br />

(5,407)<br />

1,164<br />

(4,243)<br />

(2,130)<br />

1,088<br />

(1,042)<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 14

Presentation<br />

and Works<br />

<strong>Bendigo</strong><br />

Livestock<br />

Exchange<br />

Parks and<br />

Natural<br />

Reserves<br />

Engineering and<br />

Public Space<br />

Presentation and Works includes maintenance and development <strong>of</strong><br />

sealed and unsealed roads, drains, concrete footpaths, kerb and<br />

channel, and bridges. It also includes traffic and pedestrian<br />

management, emergency response, supply <strong>of</strong> labour, plant and<br />

traffic management for community events.<br />

This unit also undertakes new civil construction projects for <strong>City</strong><br />

<strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> including roads, drainage, sporting fields and<br />

car parks, and undertakes civil works for other service authorities.<br />

The <strong>Bendigo</strong> Livestock Exchange provides for the efficient<br />

operation and management <strong>of</strong> weekly lamb/sheep and cattle sales,<br />

and fortnightly pig/calf sales.<br />

The Parks and Natural Reserves Unit manages a large portfolio <strong>of</strong><br />

parks, gardens, reserves, sports fields and areas <strong>of</strong> open space for<br />

the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>. The diversity <strong>of</strong> these assets<br />

requires a skilled and committed team that is responsible for the<br />

implementation <strong>of</strong> a range <strong>of</strong> specialist park management,<br />

horticultural and environmental techniques and practices.<br />

The Engineering and Public Space Unit develops and delivers<br />

physical infrastructure to support a broad range <strong>of</strong> services to the<br />

community. This includes the development <strong>of</strong> Capital Works<br />

projects to provide renewal and new assets to meet the expanding<br />

population <strong>of</strong> <strong>Bendigo</strong> and increasing community expectations, and<br />

the strategic planning <strong>of</strong> infrastructure through asset management<br />

and development <strong>of</strong> strategic plans for asset groups. The Unit also<br />

provides support services across the organisation in areas <strong>of</strong> asset<br />

management and GIS.<br />

(17,422)<br />

7,691<br />

(9,731)<br />

(935)<br />

1,071<br />

136<br />

(9,485)<br />

163<br />

(9,322)<br />

(6,239)<br />

3,754<br />

(2,485)<br />

Initiatives<br />

Initiatives<br />

12) Employee a Senior Technical Officer (1.00 FTE) at the <strong>Bendigo</strong> Art Gallery, as a<br />

result <strong>of</strong> the Gallery redevelopment.<br />

13) Create new Full-time Temporary Position (1.00 FTE, for 36 months) as Business<br />

Development Manager, to ensure successful marketing and operations <strong>of</strong><br />

Ulumbarra Theatre.<br />

14) Operations <strong>of</strong> the new Community Theatre. Cleaning, marketing, performances<br />

and all operations for 3-4 months.<br />

15) Create a Commercial use <strong>of</strong> Public Open Space Policy, and User Contribution<br />

for Facility Development Policy - within current resources.<br />

16) Design and develop a food 'hub' within the municipality making it easier for<br />

people to access fresh seasonal food for vulnerable communities.<br />

17) Undertake a pilot project with IGA supermarkets to support community<br />

initiatives to increase access to healthy food.<br />

18) Establish a food information portal - food information website to be hosted or<br />

linked to CoGB website.<br />

19) Implementation <strong>of</strong> Domestic Wastewater Management Plan as required by State<br />

Government legislation.<br />

20) Improving Access to Built Environment - project that will improve access to the<br />

physical environment for people living with a disability.<br />

Council<br />

Plan<br />

Reference<br />

3.2<br />

3.2<br />

3.2<br />

2.1<br />

3.5<br />

3.5<br />

3.5<br />

3.6<br />

1.3<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 15

21) Support advertising <strong>of</strong> related community engagement activities, venue hire and<br />

catering for Rural Communities strategies.<br />

22) Develop a Reconciliation Plan to help strengthen and build positive relationships<br />

between Aboriginal Torres Strait Islander people and non-indigenous people.<br />

23) Increased footpath maintenance as a result <strong>of</strong> changes to Road Management Plan. 3.1<br />

24) Address issue <strong>of</strong> overgrowing vegetation along roads and blocked drains, by<br />

increasing current budget.<br />

25) Complete restructure <strong>of</strong> Presentation and Works Unit (1.00 FTE). 1.6<br />

26) Employ staff members (2.00 FTE) in place <strong>of</strong> contractors to provide traffic<br />

management.<br />

27) Additional staff (2.00 FTE) for the Arboriculture and Passive Reserve teams to<br />

assist with growth <strong>of</strong> facilities across the <strong>City</strong>.<br />

28) Additional funding to assist with tree maintenance. 3.1<br />

29) Stormwater quality works introduced as a trial for possible inclusion in future<br />

Capital Works.<br />

3.6<br />

3.7<br />

5.2<br />

1.6<br />

1.6<br />

5.1<br />

Service Performance Outcome Indicators<br />

Service Indicator Performance Measure Computation<br />

Home and<br />

Community<br />

Care<br />

Participation Participation in HACC service<br />

(Percentage <strong>of</strong> the municipal target<br />

population who receive a HACC<br />

service)<br />

[Number <strong>of</strong> people that<br />

received a HACC service /<br />

Municipal target population<br />

for HACC services] x100<br />

Home and<br />

Community<br />

Care<br />

Participation Participation in HACC service by CALD<br />

people<br />

(Percentage <strong>of</strong> the municipal target<br />

population in relation to CALD people<br />

who receive a HACC service)<br />

[Number <strong>of</strong> CALD people<br />

who receive a HACC service<br />

/ Municipal target population<br />

in relation to CALD people<br />

for HACC services] x100<br />

Maternal<br />

and Child<br />

Health<br />

Maternal<br />

and Child<br />

Health<br />

Aquatic<br />

Facilities<br />

Participation Participation in the MCH service<br />

(Percentage <strong>of</strong> children enrolled who<br />

participate in the MCH service)<br />

Participation Participation in MCH service by<br />

Aboriginal children<br />

(Percentage <strong>of</strong> Aboriginal children<br />

enrolled who participate in the MCH<br />

service)<br />

Utilisation<br />

Utilisation <strong>of</strong> aquatic facilities<br />

(Number <strong>of</strong> visits to aquatic facilities per<br />

head <strong>of</strong> municipal population)<br />

[Number <strong>of</strong> children who<br />

attend the MCH service at<br />

least once (in the year) /<br />

Number <strong>of</strong> children enrolled<br />

in the MCH service] x100<br />

[Number <strong>of</strong> Aboriginal<br />

children who attend the<br />

MCH service at least once (in<br />

the year) / Number <strong>of</strong><br />

Aboriginal children enrolled<br />

in the MCH service] x100<br />

Number <strong>of</strong> visits to aquatic<br />

facilities / Municipal<br />

population<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 16

Roads Satisfaction Satisfaction with sealed local roads<br />

(Community satisfaction rating out <strong>of</strong><br />

100 with how Council has performed on<br />

the condition <strong>of</strong> sealed local roads)<br />

Food safety<br />

Animal<br />

Management<br />

Health and<br />

safety<br />

Health and<br />

safety<br />

Critical and major non-compliance<br />

notifications<br />

(Percentage <strong>of</strong> critical and major noncompliance<br />

notifications that are<br />

followed up by Council)<br />

Animal management prosecutions<br />

(Number <strong>of</strong> successful animal<br />

management prosecutions)<br />

Community satisfaction<br />

rating out <strong>of</strong> 100 with how<br />

Council has performed on<br />

the condition <strong>of</strong> sealed local<br />

roads.<br />

[Number <strong>of</strong> critical noncompliance<br />

notifications and<br />

major non-compliance<br />

notifications about a food<br />

premises followed up /<br />

Number <strong>of</strong> critical noncompliance<br />

notifications and<br />

major non-compliance<br />

notifications about food<br />

premises] x100<br />

Number <strong>of</strong> successful animal<br />

management prosecutions<br />

2.4 Theme 4 – Productivity<br />

Productivity is about encouraging innovation and diversity in education, commerce and industry. It is<br />

about responding to new economic opportunities, including making sure our local workforce is<br />

appropriately skilled. Council’s role involves supporting infrastructure projects that promote and<br />

enable investment, business opportunity and business security within the municipality.<br />

It is establishing the environment for investment, and making sure the infrastructure is in place to<br />

support economic activity. It involves creating the opportunity for all people to be actively<br />

employed. The focus is on the potential additional economic activity generated in the community,<br />

not a direct return on investment to the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>.<br />

Services<br />

Service Unit<br />

Economic<br />

Development<br />

<strong>City</strong> Futures<br />

Directorate<br />

Description <strong>of</strong> services provided<br />

The Economic Development Unit supports economic growth by<br />

business building, including existing business growth and the<br />

attraction <strong>of</strong> new industries. The Unit attracts and supports the<br />

provision <strong>of</strong> key infrastructure, supports initiatives that improve<br />

the attraction and retention <strong>of</strong> skilled workforce to meet the<br />

needs <strong>of</strong> <strong>Bendigo</strong>'s diverse economy, strengthens existing business<br />

stakeholder engagement, and facilitates new investments in the<br />

region.<br />

The role <strong>of</strong> the <strong>City</strong> Futures Directorate is to contribute to the<br />

economic, cultural and social prosperity <strong>of</strong> our region by<br />

identifying and supporting investment opportunities, employment<br />

generation and development <strong>of</strong> major projects, and in so doing<br />

continue to raise <strong>Greater</strong> <strong>Bendigo</strong>’s pr<strong>of</strong>ile as an exceptional place<br />

in which to live, work, invest and visit. Also includes funding <strong>of</strong> the<br />

<strong>Bendigo</strong> Trust.<br />

(Expenditure)<br />

Revenue<br />

Net Cost<br />

$'000<br />

(1,182)<br />

40<br />

(1,142)<br />

(1,125)<br />

165<br />

(960)<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 17

Major Events<br />

Unit<br />

Tourism Unit<br />

The Major Events Unit retains, attracts and nurtures major events (2,040)<br />

that deliver social and economic benefit for <strong>Greater</strong> <strong>Bendigo</strong>,<br />

319<br />

particularly in the high priority areas <strong>of</strong> sport, arts and culture, (1,721)<br />

food and wine, agriculture, car clubs, music and business events.<br />

The Unit organises, manages and presents the annual <strong>Bendigo</strong><br />

Easter Festival in conjunction with sponsors, community partners,<br />

volunteers, media and other interest groups.<br />

The Tourism Unit provides support and leadership to the <strong>Greater</strong><br />

<strong>Bendigo</strong> and region tourism industry. With over 1,600 (mainly<br />

small) tourism businesses in the region, the role <strong>of</strong> the Tourism<br />

Unit is to work with the industry to promote <strong>Greater</strong> <strong>Bendigo</strong> as a<br />

visitor and events destination, and work with local businesses to<br />

co-operatively market the destination across Melbourne, Victoria,<br />

Nationally and at times Internationally. The Unit provides<br />

pr<strong>of</strong>essional marketing services across the broad industry sector,<br />

delivers quality visitor services and works with the tourism<br />

industry to develop attractive visitor experiences.<br />

(3,206)<br />

1,107<br />

(2,099)<br />

Initiatives<br />

Initiatives<br />

30) Run workshops to assist business innovation within their businesses, conducted<br />

within current resource levels.<br />

31) Allow continuation <strong>of</strong> the Marong Business Park process through the Planning<br />

Scheme Amendment stage, to progress the Planning Panel.<br />

32) Small Business Support Program - Create a greater level <strong>of</strong> service for new and<br />

existing small businesses.<br />

33) <strong>City</strong> celebrates 100 year anniversary since first debutante ball held, in association<br />

with Variety Children Charity.<br />

Council<br />

Plan<br />

Reference<br />

34) To provide funds to assist centenary <strong>of</strong> ANZAC Day Commemoration. 2.1<br />

4.1<br />

2.1<br />

4.1<br />

3.3<br />

Service Performance Outcome Indicators<br />

Service Indicator Performance Measure Computation<br />

Economic<br />

Development<br />

Economic<br />

activity<br />

Change in number <strong>of</strong> businesses<br />

(Percentage change in the number <strong>of</strong><br />

businesses with an ABN in the<br />

municipality)<br />

[Number <strong>of</strong> businesses with<br />

an ABN in the municipality at<br />

the end <strong>of</strong> the financial year<br />

less the number <strong>of</strong><br />

businesses at the start <strong>of</strong> the<br />

financial year / Number <strong>of</strong><br />

businesses with an ABN in<br />

the municipality at the start<br />

<strong>of</strong> the financial year] x100<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 18

2.5 Theme 5 – Sustainability<br />

Sustainability means making good use <strong>of</strong> all our resources, so that the decisions made today do not<br />

limit the choices <strong>of</strong> future generations. Many people think <strong>of</strong> sustainability as the ongoing viability <strong>of</strong><br />

natural systems (air, water, energy, biodiversity) in a balanced relationship with human life. A<br />

changing climate threatens our future prosperity, environment and development. Without strong<br />

action globally, and at home, the projected impacts and costs <strong>of</strong> the changing weather patterns are<br />

significant. Projects specifically targeting a reduction in the communities or the <strong>City</strong> <strong>of</strong> <strong>Greater</strong><br />

<strong>Bendigo</strong>’s impact on the environment, including direct carbon reduction initiatives, new projects to<br />

repair or reduce environmental damage, encouraging environmentally sensitive design and<br />

community leading initiatives that promote better community behaviour toward the environment,<br />

including waste reduction, are supported. Preserving <strong>Bendigo</strong>’s unique natural heritage <strong>of</strong> being a<br />

‘city in a forest’ remains a priority. In the context <strong>of</strong> the Council Plan, built and natural assets and<br />

finances must also be managed in a way that is viable into the future.<br />

Services<br />

Service Unit<br />

Presentation<br />

and Assets<br />

Directorate<br />

Sustainable<br />

Environment<br />

Waste Services<br />

Building and<br />

Property<br />

Parking and<br />

Animal Control<br />

Description <strong>of</strong> services provided<br />

The Presentation and Assets Directorate provides and maintains<br />

high quality assets and services that help make the region a great<br />

place to live now while planning and delivering new assets and<br />

services to support <strong>Bendigo</strong>’s ongoing growth. Demonstrating<br />

environmentally responsible thinking and practices and encouraging<br />

this throughout the organisation and community is an important<br />

focus for the Directorate.<br />

The Sustainable Environment Unit provides a coordinated<br />

approach to the development <strong>of</strong> environmental policies, strategies,<br />

programs and processes to articulate clear directions to improve<br />

service delivery and enhanced environmental outcomes for the<br />

community. The Unit aims to reduce corporate carbon emissions,<br />

promote ecologically sustainable outcomes, identify effective and<br />

efficient directions for the management <strong>of</strong> municipal waste<br />

streams, and increase awareness <strong>of</strong> environmental matters.<br />

The Waste Services team provides the collection <strong>of</strong> garbage from<br />

domestic and commercial properties, collection and sorting <strong>of</strong><br />

kerbside recycling, operation <strong>of</strong> landfills and transfer stations,<br />

street cleaning, and drain and pit cleaning.<br />

The Building and Property Unit ensures that the community assets<br />

(buildings and properties) are developed, upgraded, maintained<br />

and utilised to ensure the greatest benefit and lifestyle for the<br />

members <strong>of</strong> the community. Delivering Capital Works projects<br />

that meet the current community needs and for the future is also<br />

a key objective for the team. The Unit ensures that Council<br />

owned facilities, as well as other businesses, are safe for public use<br />

and ensures the public comply with relevant building codes and<br />

standards.<br />

The Parking and Animal Control Unit manages the <strong>City</strong>'s Parking<br />

and Animal Services Program. This is to ensure safe and equitable<br />

use <strong>of</strong> parking resources, and to promote and maintain community<br />

safety, and public amenity and wellbeing in relation to the keeping<br />

<strong>of</strong> domestic animals and livestock.<br />

(Expenditure)<br />

Revenue<br />

Net Cost<br />

$'000<br />

(24,428)<br />

0<br />

(24,428)<br />

(1,088)<br />

50<br />

(1,038)<br />

(16,371)<br />

5,602<br />

(10,769)<br />

(7,439)<br />

1,657<br />

(5,782)<br />

(4,185)<br />

5,973<br />

1,788<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 19

Finance<br />

The Finance Unit provides sound and pr<strong>of</strong>essional stewardship<br />

over the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>'s finances. The Unit’s key<br />

functions include the development and maintenance <strong>of</strong> all<br />

legislative and government departmental reporting and financial<br />

control requirements, and developing financial strategies which<br />

provide for sound debt and cash flow management, ensuring that<br />

the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> is a viable organisation.<br />

(1,497)<br />

*1,300<br />

(197)<br />

61<br />

(136)<br />

Initiatives<br />

Initiatives<br />

35) Appointment <strong>of</strong> temporary Systems Manager (1.00 FTE) to review quality, OH&S<br />

and Environmental Systems.<br />

Council<br />

Plan<br />

Reference<br />

36) Introduce public place recycling at approximately 50 locations. 5.1<br />

37) Additional hours for Native Vegetation Coordinator (0.2 FTE) as a result <strong>of</strong><br />

increased demand.<br />

38) Implement elements <strong>of</strong> the new Waste and Resource Management Strategy. 5.1<br />

39) Develop and implement kerbside organic management service. 5.1<br />

40) Increased costs for Utilities, Service Contracts and Essential Safety Measures and<br />

services related to additional buildings now being managed.<br />

1.6<br />

5.2<br />

1.6<br />

Service Performance Outcome Indicators<br />

Service Indicator Performance Measure Computation<br />

Waste<br />

collection<br />

Waste<br />

diversion<br />

Kerbside collection waste diverted from<br />

landfill<br />

(Percentage <strong>of</strong> garbage, recyclables and<br />

green organics collected from kerbside<br />

bins that is diverted from landfill)<br />

[Weight <strong>of</strong> recyclables and<br />

green organics collected from<br />

kerbside bins / Weight <strong>of</strong><br />

garbage, recyclables and<br />

green organics collected from<br />

kerbside bins] x100<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 20

2.6 Major Initiatives<br />

Major Initiatives <strong>of</strong> Council for the <strong>2014</strong>/<strong>2015</strong> financial year relate to the continuation <strong>of</strong> planning,<br />

design and construction <strong>of</strong> significant capital or major projects. These projects are:<br />

Ulumbarra Theatre Construction<br />

Convert to energy efficient street lighting – Lighting the Regions<br />

Construction <strong>of</strong> Central Activity Area at Canterbury Park<br />

Planning and Design <strong>of</strong> <strong>Bendigo</strong> Indoor Aquatic Complex<br />

Design and Construction at <strong>Bendigo</strong> Botanic Gardens<br />

Planning and Design <strong>of</strong> <strong>Bendigo</strong> Airport<br />

Further details <strong>of</strong> these projects are included in Appendix C.<br />

2.7 Performance Statement<br />

The service performance indicators detailed in the preceding pages will be reported on within the<br />

Performance Statement which is prepared at the end <strong>of</strong> the year as required by section 132 <strong>of</strong> the<br />

Act and included in the <strong>2014</strong>/15 <strong>Annual</strong> Report. The Performance Statement will also include<br />

reporting on prescribed indicators <strong>of</strong> financial performance (outlined in section 8) and sustainable<br />

capacity, which are not included in this budget report. The full set <strong>of</strong> prescribed performance<br />

indicators are audited each year by the Victorian Auditor General who issues an audit opinion on<br />

the Performance Statement. The major initiatives detailed in the preceding pages will be reported in<br />

the <strong>Annual</strong> Report in the form <strong>of</strong> a statement <strong>of</strong> progress in the report <strong>of</strong> operations.<br />

2.8 Reconciliation with <strong>Budget</strong>ed Operating Result<br />

(Net Cost)<br />

Revenue<br />

$’000<br />

Expenditure<br />

$’000<br />

Revenue<br />

$’000<br />

Leadership and Good Governance (10,730) 17,722 7,042<br />

Planning for Growth (5,271) 6,115 844<br />

Presentation and Vibe <strong>of</strong> Our <strong>City</strong> (36,990) 70,482 33,492<br />

Productivity (5,922) 7,553 1,631<br />

Sustainability (40,365) 55,008 14,643<br />

Total activities and initiatives (99,278) 156,930 57,652<br />

Other non-attributable 11,350<br />

Deficit before funding sources (87,928)<br />

Other Funding Sources<br />

Rates and charges 93,392<br />

Capital grants 5,182<br />

Contributions to capital works 1,423<br />

Total funding sources 99,997<br />

Operating Surplus for the year 12,069<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> – <strong>2014</strong>/<strong>2015</strong> 21

3. <strong>Budget</strong> Influences<br />

This section sets out the key budget influences arising from the internal and external environment<br />

within which the Council operates.<br />

3.1 Snapshot <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council<br />

Located within central Victoria, <strong>Greater</strong> <strong>Bendigo</strong> has a catchment <strong>of</strong> over 200,000 people and a<br />

forecast population <strong>of</strong> 111,110 (ABS, Estimated Resident Population) in <strong>2014</strong>. The population is<br />

projected to increase to 145,608 by 2031. The area the municipality covers is approximately<br />

2,999kms 2 .<br />

<strong>Greater</strong> <strong>Bendigo</strong> is the second largest city in regional Victoria. Its gross economic output is<br />

attributable to major industries and employment sectors including health and community services,<br />

retail, manufacturing, education, construction, property and business services, government<br />

administration, accommodation and hospitality, and banking and financial services.<br />

<strong>Bendigo</strong> has a proud gold mining heritage, with some <strong>of</strong> the finest examples <strong>of</strong> Victorian architecture<br />

and streetscapes in Australia. <strong>Bendigo</strong> is the home <strong>of</strong> Australia's longest running annual festival, the<br />

<strong>Bendigo</strong> Easter Festival.<br />

The <strong>City</strong>'s cultural attractions include <strong>Bendigo</strong> Art Gallery, The Capital - <strong>Bendigo</strong>'s Performing Arts<br />

Centre, Golden Dragon Museum, Central Deborah Mine, <strong>Bendigo</strong> Tramways and <strong>Bendigo</strong> Pottery.<br />

The municipality includes two National Parks - <strong>Greater</strong> <strong>Bendigo</strong> and Heathcote Greytown, both <strong>of</strong><br />

which protect large areas <strong>of</strong> Box-Ironbark forest.<br />

3.2 Challenges and Opportunities<br />

The Council Plan has been a significant influence in preparing the <strong>2014</strong>/<strong>2015</strong> budget. In that<br />

document the challenges and opportunities for Council are outlined in detail, and listed below:<br />

Regional Growth and Sustainability<br />

Financial Sustainability<br />

Increasing expectations <strong>of</strong> service availability<br />

Community engagement and consultation<br />

Adapting to changing weather patterns<br />

Performance reporting<br />

Population growth and change<br />

Access to communications technology<br />

Skills replacement, succession planning and knowledge retention<br />

Maintenance <strong>of</strong> essential infrastructure<br />

3.3 External Influences<br />

In addition, external budget influences are:<br />

Constrained Federal and State Government fiscal environment<br />

Consumer Price Index (CPI) increases on goods and services <strong>of</strong> 2.7% through the year to<br />

December quarter 2013<br />