Circular for Simplification and Revision of Softex Procedure ... - STPI

Circular for Simplification and Revision of Softex Procedure ... - STPI

Circular for Simplification and Revision of Softex Procedure ... - STPI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

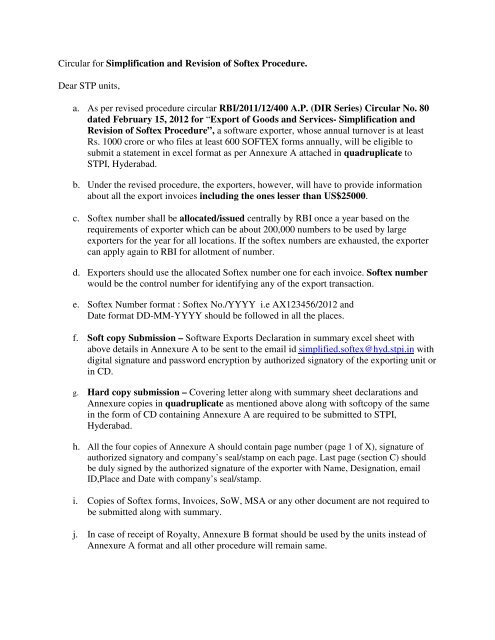

<strong>Circular</strong> <strong>for</strong> <strong>Simplification</strong> <strong>and</strong> <strong>Revision</strong> <strong>of</strong> S<strong>of</strong>tex <strong>Procedure</strong>.<br />

Dear STP units,<br />

a. As per revised procedure circular RBI/2011/12/400 A.P. (DIR Series) <strong>Circular</strong> No. 80<br />

dated February 15, 2012 <strong>for</strong> “Export <strong>of</strong> Goods <strong>and</strong> Services- <strong>Simplification</strong> <strong>and</strong><br />

<strong>Revision</strong> <strong>of</strong> S<strong>of</strong>tex <strong>Procedure</strong>”, a s<strong>of</strong>tware exporter, whose annual turnover is at least<br />

Rs. 1000 crore or who files at least 600 SOFTEX <strong>for</strong>ms annually, will be eligible to<br />

submit a statement in excel <strong>for</strong>mat as per Annexure A attached in quadruplicate to<br />

<strong>STPI</strong>, Hyderabad.<br />

b. Under the revised procedure, the exporters, however, will have to provide in<strong>for</strong>mation<br />

about all the export invoices including the ones lesser than US$25000.<br />

c. S<strong>of</strong>tex number shall be allocated/issued centrally by RBI once a year based on the<br />

requirements <strong>of</strong> exporter which can be about 200,000 numbers to be used by large<br />

exporters <strong>for</strong> the year <strong>for</strong> all locations. If the s<strong>of</strong>tex numbers are exhausted, the exporter<br />

can apply again to RBI <strong>for</strong> allotment <strong>of</strong> number.<br />

d. Exporters should use the allocated S<strong>of</strong>tex number one <strong>for</strong> each invoice. S<strong>of</strong>tex number<br />

would be the control number <strong>for</strong> identifying any <strong>of</strong> the export transaction.<br />

e. S<strong>of</strong>tex Number <strong>for</strong>mat : S<strong>of</strong>tex No./YYYY i.e AX123456/2012 <strong>and</strong><br />

Date <strong>for</strong>mat DD-MM-YYYY should be followed in all the places.<br />

f. S<strong>of</strong>t copy Submission – S<strong>of</strong>tware Exports Declaration in summary excel sheet with<br />

above details in Annexure A to be sent to the email id simplified.s<strong>of</strong>tex@hyd.stpi.in with<br />

digital signature <strong>and</strong> password encryption by authorized signatory <strong>of</strong> the exporting unit or<br />

in CD.<br />

g. Hard copy submission – Covering letter along with summary sheet declarations <strong>and</strong><br />

Annexure copies in quadruplicate as mentioned above along with s<strong>of</strong>tcopy <strong>of</strong> the same<br />

in the <strong>for</strong>m <strong>of</strong> CD containing Annexure A are required to be submitted to <strong>STPI</strong>,<br />

Hyderabad.<br />

h. All the four copies <strong>of</strong> Annexure A should contain page number (page 1 <strong>of</strong> X), signature <strong>of</strong><br />

authorized signatory <strong>and</strong> company’s seal/stamp on each page. Last page (section C) should<br />

be duly signed by the authorized signature <strong>of</strong> the exporter with Name, Designation, email<br />

ID,Place <strong>and</strong> Date with company’s seal/stamp.<br />

i. Copies <strong>of</strong> S<strong>of</strong>tex <strong>for</strong>ms, Invoices, SoW, MSA or any other document are not required to<br />

be submitted along with summary.<br />

j. In case <strong>of</strong> receipt <strong>of</strong> Royalty, Annexure B <strong>for</strong>mat should be used by the units instead <strong>of</strong><br />

Annexure A <strong>for</strong>mat <strong>and</strong> all other procedure will remain same.

k. The <strong>STPI</strong>, Hyderabad will r<strong>and</strong>omly select 5 to 10% <strong>of</strong> the entries in the Annexure A, as<br />

samples <strong>for</strong> verification <strong>and</strong> communicate to the unit to produce the supporting<br />

documents (like Invoices, Agreements/SOW/PO, Cost Break ups, Man power details,<br />

Data communication pro<strong>of</strong> etc).<br />

l. S<strong>of</strong>tware exports declaration is submitted to <strong>STPI</strong> in quadruplicate. After certification<br />

Triplicate copy is retained by <strong>STPI</strong>. Original copy sent to RBI by <strong>STPI</strong>. Duplicate copy is<br />

given to AD by S<strong>of</strong>tware exporter <strong>and</strong> the quadruplicate copy is retained with the<br />

exporter.<br />

m. Kindly Note, S<strong>of</strong>tware exporters will furnish the credit notes to Authorized Dealer <strong>for</strong><br />

invoices which have already been certified by <strong>STPI</strong> <strong>and</strong> settle the respective S<strong>of</strong>tex<br />

<strong>for</strong>ms.<br />

With Regards,<br />

<strong>STPI</strong>, Hyderabad.