Annual Review 08-09 - Eastern Cape Development Corporation

Annual Review 08-09 - Eastern Cape Development Corporation

Annual Review 08-09 - Eastern Cape Development Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EASTERN CAPE DEVELOPMENT CORPORATION<br />

<strong>Annual</strong> <strong>Review</strong><br />

20<strong>08</strong>/<strong>09</strong><br />

Published by:<br />

<strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong><br />

Ocean Terrace Park, Moore Street<br />

Quigney, East London<br />

PO Box 11197<br />

Southernwood<br />

5213<br />

South Africa<br />

© <strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong>,<br />

20<strong>09</strong><br />

Enquiries:<br />

Marketing Department<br />

<strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong><br />

Telephone: +27 (0) 43 704 5600<br />

Fax: +27 (0) 43 704 5700<br />

info@ecdc.co.za<br />

www.ecdc.co.za<br />

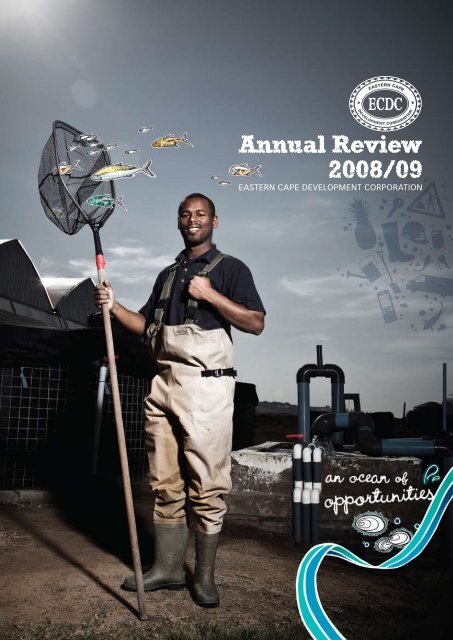

Johnathon Philander is the Hatchery Manager at Espadon Marine in East London<br />

where fish is farmed for consumption in top-end restaurants in Gauteng and <strong>Cape</strong><br />

Town. As the business grows with the assistance of the <strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong><br />

<strong>Corporation</strong>, clients will include restaurant chains and supermarket suppliers, with<br />

30% of production earmarked for export.<br />

ECDC is to be positioned in the minds of its shareholders, stakeholders, and markets<br />

alike as a visionary steward of development assets within the <strong>Eastern</strong> <strong>Cape</strong>.<br />

As such, ECDC is the entity that is able to bring ideas to life, to assist in developing<br />

“an ocean of opportunities” and to do so across a broad range of sectors,<br />

disciplines, and areas within the province.

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Contents<br />

6 | Foreword by the Chairperson of the board<br />

10 | Introduction and highlights by the Chief Executive Officer<br />

14 | Executive management<br />

Share their thoughts on development in 20<strong>08</strong>/<strong>09</strong><br />

18 | Investing resources:<br />

A review of the <strong>Development</strong> Investment Unit<br />

26 | Creating platforms:<br />

A review of the <strong>Development</strong> Properties Unit<br />

34 | Channels of development:<br />

A review of the <strong>Development</strong> Services Unit<br />

52 | Board of directors<br />

Background and previous experience<br />

57 | Financial reports and <strong>Annual</strong> Financial Statements<br />

59 | Auditor-General’s report<br />

62 | Audit Committee’s report<br />

64 | Directors’ report<br />

| Consolidated <strong>Annual</strong> Financial Statements<br />

68 | Balance sheet<br />

69 | Income statement<br />

70 | Statement of changes in equity<br />

74 | Cash flow statement<br />

75 | Accounting policies<br />

83 | Notes to the consolidated <strong>Annual</strong> Financial Statements<br />

107 | Supplementary information<br />

1

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

<strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong> is the<br />

visionary steward of development assets in the<br />

<strong>Eastern</strong> <strong>Cape</strong>. Our mandate is to identify and<br />

implement sustainable economic opportunities that<br />

will transform the currently underdeveloped economic<br />

landscape of the province by reducing unemployment,<br />

poverty and historic inequalities. This we achieve by<br />

providing value-adding services to developmental<br />

initiatives facilitated by local or foreign investments<br />

in the private sector.<br />

2<br />

The Difference ECDC<br />

ECDC lends a<br />

helping hand<br />

Over the last year, ECDC has assisted various projects in the <strong>Eastern</strong> <strong>Cape</strong>, with business<br />

planning and set-up, loans, or simply by sharing our solid advice and expertise.<br />

In this <strong>Annual</strong> <strong>Review</strong> 20<strong>08</strong>/<strong>09</strong> we feature a photographic selection of a small number of these<br />

projects to demonstrate the difference ECDC is making in our province, the<br />

<strong>Eastern</strong> <strong>Cape</strong>:<br />

• aquaculture programmes such as Amalinda Fish Farm, where Koi fish are being grown for<br />

the local and international ornamental fish wholesale market, and Espadon Marine, where<br />

marine fish for consumption are being commercialised, are breaking new ground in South<br />

African fish-farming practices (see pages 9 and 32)<br />

• Mitrock Community outside Queenstown are working in partnership to produce hazelnuts for<br />

Italian international chocolate company Ferrero (see page 38)<br />

• the set-up of Mathomo Protective Clothing manufacturer with a staff of 700 in Dimbaza<br />

(see page 24)<br />

• Nozulu Civils, a construction company, growing its business nationwide (see page 51)<br />

• the growth of Niqua Juice, a juice-bottling factory (see page 17)<br />

• the phenomenon of the turnaround of the pineapple industry outside Port Alfred, including<br />

the growth of Summerpride pineapple products business (see page 55).<br />

The map opposite indicates the extent to which <strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong> is<br />

lending a hand in the <strong>Eastern</strong> <strong>Cape</strong>: the table alongside details disbursed ECDC loans throughout<br />

the province in 20<strong>08</strong>/<strong>09</strong>. People are coming together in the <strong>Eastern</strong> <strong>Cape</strong> to form part of a larger<br />

and exciting momentum that is providing skills, creating projects and businesses and benefiting<br />

the local economy. We are proud to be part of this.

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

zimbabwe<br />

botswana<br />

mozambique<br />

Namibia<br />

Johannesburg<br />

Bloemfontein<br />

Durban<br />

eastern cape<br />

Bhisho<br />

East London<br />

<strong>Cape</strong> Town<br />

Port Elizabeth<br />

south africa<br />

Aliwal North<br />

Mount Frere<br />

Middelburg<br />

Queenstown<br />

Mthatha<br />

Lusikisiki<br />

Port St Johns<br />

Graaff-Reinet<br />

Cradock<br />

Butterworth<br />

Willowmore<br />

Aberdeen<br />

EASTERN CAPE<br />

King Williams Town<br />

Bhisho<br />

East London<br />

Humansdorp<br />

Uitenhage<br />

Grahamstown<br />

Nelson Mandela Bay<br />

Port Elizabeth<br />

Port Alfred<br />

Jeffreys Bay<br />

Disbursed loans<br />

Total disbursed<br />

amount 20<strong>08</strong>/<strong>09</strong><br />

Imbewu Micro loans 294 R 11,000,000<br />

Nexus Trade loans 341 R 73,000,000<br />

Termcap loans 65 R 77,000,000<br />

Workflow contractor loans 105 R 141,000,000<br />

839 R 312,000,000<br />

3

“My teacher says that the grass is not<br />

greener on the other side.<br />

Well, my Dad reckons that’s not true.<br />

He says there’s a secret world not far<br />

away with beautiful mountains and<br />

forests and rivers that shine...<br />

There are people there who work hard<br />

everyday to build this magical home.<br />

And there are giants and castles and<br />

kings, where the sunrise is like a<br />

promise.<br />

My Dad says he’ll take us there<br />

because it is greener on the other<br />

side!”<br />

Make it yours.<br />

The <strong>Eastern</strong> <strong>Cape</strong><br />

5<br />

The Difference ECDC<br />

EC “Make it Yours” commercial<br />

captures the heart of province<br />

Peter Gird and Jason Xenopoulos, Producers, Media 2.0 & SMG Africa<br />

A young boy’s narrative of a secret, magical home is the backdrop of the television commercial that flighted<br />

on various DSTV and SABC channels from April to June <strong>09</strong>. Combining the province’s unique natural<br />

landscapes, family life and business, the commercial tells a story of an area with diverse and matchless<br />

offerings.<br />

The advert was designed to contrast the busy city life, a key characteristic of metropolitan areas in South<br />

Africa, with the serenity of the <strong>Eastern</strong> <strong>Cape</strong>. Shots of Hole-in-the-Wall, Magwa Falls (both on the Wild<br />

Coast) and whales in Nelson Mandela Bay make the distinct impression that ‘the grass is greener on the<br />

other side’. ECDC commissioned the advert on behalf of the <strong>Eastern</strong> <strong>Cape</strong> Office of the Premier to ‘develop<br />

a new, bold TV advert aimed at creating national awareness of the <strong>Eastern</strong> <strong>Cape</strong> as a lifestyle destination’.<br />

The advert captivated some of the <strong>Eastern</strong> <strong>Cape</strong>’s most influential organisations including AsgiSA EC<br />

(provincial government’s special purpose vehicle for rural development) and <strong>Eastern</strong> <strong>Cape</strong> Tourism Board<br />

(the provincial tourism authority). As a pledge of support for the advert, both institutions provided funding<br />

for broadcast and print support of the advert.

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Foreword<br />

by the Chairperson<br />

of the board<br />

The newly appointed Board is now<br />

in place and is working diligently to<br />

prepare the canvas for a new and fresh<br />

expression of ECDC. To begin with, it<br />

gives us great satisfaction to announce<br />

that once again the <strong>Corporation</strong> received<br />

a clean financial audit, which bears<br />

testimony to the integrity employed in<br />

the management of the organisation’s<br />

resources. Due to the economic<br />

downturn and commercial lenders<br />

closing shop, ECDC provided a catalytic<br />

role of supporting businesses especially<br />

those that were vulnerable. Most of<br />

these were concentrated in the former<br />

homelands. The impact of that work<br />

cannot be totally quantified now, but<br />

it will be felt through jobs that were<br />

created and by families that were<br />

indirectly supported.<br />

Confronted by the reality of an economic downturn and its<br />

effect on the economy of South Africa and the <strong>Eastern</strong><br />

<strong>Cape</strong>, the <strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong> emerges from<br />

the review period poised for a long-term growth phase as it<br />

delivers its mandate to develop the economic landscape of the<br />

province. This it will achieve by exercising its core competencies<br />

of development finance, the development and management<br />

of properties, and development services which involve the<br />

disciplines of investment and trade promotion, enterprise<br />

development, and spatial and rural project development.<br />

The <strong>Corporation</strong> is not unfamiliar with turbulence, and is<br />

increasingly adept at holding its ground in uncertain political<br />

or adverse economic circumstances. The year 20<strong>08</strong>/<strong>09</strong> has<br />

presented both, and once again the <strong>Corporation</strong> remains resolute<br />

and determined to continue its course to develop the province<br />

in line with the Provincial Growth and <strong>Development</strong> Plan’s core<br />

goals of eradicating poverty, developing rural economies and<br />

improving food security, and diversifying manufacturing activity in<br />

the province.<br />

The previous review period saw the rigorous restructuring<br />

and establishment of sound governance principles within the<br />

organisation to focus resources and co-ordinate efforts for the<br />

provision of a more synergistic developmental value-add to the<br />

various initiatives in the province. The 20<strong>08</strong>/<strong>09</strong> year brought<br />

the continuation of the <strong>Corporation</strong>’s turnaround as its base of<br />

strategic trajectory built purposefully on the foundation laid in<br />

2007/<strong>08</strong> by refining the internal processes within each of its three<br />

core units, namely <strong>Development</strong> Finance, <strong>Development</strong> Properties<br />

and <strong>Development</strong> Services. These refined efficiencies have<br />

resulted in an organisation that is well positioned for growth and<br />

expansion in the coming year and beyond.<br />

The R312 million disbursed to business<br />

initiatives during the year constituted<br />

a 112% outperformance on the<br />

budgeted target of R147 million. The<br />

<strong>Corporation</strong>’s 630% growth in its contract finance<br />

portfolio not only supported critical short term<br />

poverty alleviation projects such as the Department<br />

of Education’s school nutrition scheme and the<br />

Department of Health’s food parcel distribution to<br />

those in abject poverty, but strategically enabled<br />

economic growth in line with the Provincial Growth<br />

and <strong>Development</strong> Plan’s objectives to develop the<br />

province. These projects saw the ECDC facilitating<br />

the building of new roads, completion of government<br />

construction projects, development of infrastructure<br />

and the development of new enterprises.<br />

R312 million<br />

112%<br />

630%<br />

253%<br />

6

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Statement BY THE CHAIRPERSON OF THE BOARD<br />

Government’s increased spending on infrastructure development saw the Workflow construction contractor’s loan exceeding<br />

its targets by 253%. <strong>Development</strong> Properties embarked on a drive to redeem years of mismanagement of ECDC properties,<br />

which resulted in the tracking of debtors and the efficient collection of outstanding rentals owed to ECDC. The end result was<br />

the recovery of R18 million in old debt and an updated database of tenants who are servicing their lease agreements.<br />

<strong>Development</strong> Services demonstrated the heart and mind<br />

of the <strong>Corporation</strong> when they reached out to the pineapple<br />

industry in Port Alfred, Peddie, and Bathurst, and initiated a<br />

truly sustainable, innovative and developmental overhaul of<br />

the industry that has been suffering annual losses for nearly<br />

a decade. We anticipate the preservation of existing jobs, and<br />

the creation of new ones, which will alleviate the poverty that<br />

has been experienced in the Ndlambe area as a result of the<br />

sector’s stagnation in recent years.<br />

Achievements such as this, which the reader will no doubt<br />

learn of in this <strong>Review</strong>, inspire hope and courage as we venture<br />

out into the unknown waters of another year. The Board<br />

remains optimistic about the <strong>Corporation</strong>’s future and we are<br />

committed to seeing the economic landscape of the province<br />

change for the better of all who call this magnificent<br />

province “home”.<br />

In closing, I wish to thank the Honorable Mcebisi Jonas,<br />

MEC for Economic <strong>Development</strong>, Mxolisi Matshamba,<br />

CEO of the <strong>Corporation</strong>, the ECDC Board, and indeed<br />

the executive managers and their team for their<br />

continued faith and support, and look forward to<br />

the feats, challenges and expansion that await the<br />

organisation as it sets out on a mission to further<br />

enhance its presence and developmental value-add<br />

in the province of the <strong>Eastern</strong> <strong>Cape</strong>.<br />

Patrick Ncita, Production Supervisor at<br />

Summerpride Foods in East London – one of many<br />

growing businesses assisted by ECDC and part of<br />

the pineapple industry turnaround in the<br />

<strong>Eastern</strong> <strong>Cape</strong>.<br />

Summerpride Foods is owned by its growers, staff<br />

and agents and has a consistent supply of 115,000<br />

tons of fruit supplied by its own 38 EUREPGAP<br />

(Good Agricultural Production) accredited growers.<br />

Mr Bhekokuhle Sibiya<br />

Chairperson<br />

<strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong><br />

Loans disbursed to business initiatives<br />

Outperformance on the budgeted target of R147 million<br />

The <strong>Corporation</strong>’s growth in its contract finance portfolio<br />

Percentage exceeded by Workflow Construction Contractor’s Loan<br />

7

9<br />

The Difference ECDC<br />

Fishing where the<br />

fish are<br />

Johnathan Philander, Hatchery Manager,<br />

Espadon Marine<br />

As Hatchery Manager at Espadon Marine, Philander and his<br />

colleagues farm marine fish, with Cob (Kabeljou) being the species<br />

they have commercialised. <strong>Cape</strong> Salmon (Geelbek), Spotted Grunter<br />

and Yellowtail are still at the pilot commercial and research and<br />

development stages.<br />

Espadon Marine supplies top-end restaurants in Gauteng and <strong>Cape</strong><br />

Town and, as production grows, they are focusing on new clients such<br />

as larger restaurant chains and supermarkets – and 30% of production<br />

has been earmarked for export to the European Union (France and<br />

Spain) and the United Kingdom.<br />

ECDC was instrumental in assisting Espadon Marine in relocating<br />

from the Western to the <strong>Eastern</strong> <strong>Cape</strong>. “The climate in the <strong>Eastern</strong><br />

<strong>Cape</strong> is just about perfect for the farming of marine fish,” says<br />

Philander and Guy Masson, Managing Director, “ and ECDC assisted<br />

us directly with permitting and other authority approvals necessary.”

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Introduction and highlights<br />

by the Chief Executive<br />

Officer<br />

The strategic intent mapped out by executive<br />

management for the year 20<strong>08</strong>/<strong>09</strong> was twofold.<br />

First, to improve our delivery on the mandated<br />

mission of the <strong>Corporation</strong>, which is to plan, finance,<br />

co-ordinate, market, promote and implement the<br />

development of the <strong>Eastern</strong> <strong>Cape</strong> and its people<br />

in the fields of industry, commerce, agriculture,<br />

transport and finance. This we have pursued in<br />

line with the core strategic goals of the Provincial<br />

Growth and <strong>Development</strong> Plan and broader national<br />

and local policy interventions designed to deliver<br />

economic growth, creation of employment, and<br />

poverty eradication.<br />

In channelling our energies and resources into<br />

the accomplishment of this mission, we have also<br />

purposed to refine our internal processes and<br />

efficiencies to eliminate those elements of our<br />

operations that were encumbering our sustainable<br />

success as an organisation. Hence we summarise<br />

the period as one of internal efficiency for<br />

sustainable external delivery, and we are pleased<br />

to report on a year that will position us accordingly<br />

for expansive growth in the next five years, starting<br />

20<strong>09</strong>.<br />

Begining in July 2007 with the loss of confidence by investors in the value<br />

of securitised mortgages in the United States, the global economic crisis<br />

resulted in a liquidity emergency that prompted a substantial injection of<br />

capital into financial markets by the United States Federal Reserve, Bank of<br />

England and the European Central Bank. The TED (T-bill and Eurodollar) spread,<br />

an indicator of perceived credit risk in the general economy, spiked up in<br />

July 2007, remained volatile for a year, then spiked even higher in September<br />

20<strong>08</strong>, reaching a record 4.65% on October 10, 20<strong>08</strong>. In September 20<strong>08</strong>, the<br />

crisis deepened, as stock markets worldwide crashed and entered a period<br />

of high volatility, and a considerable number of banks, mortgage lenders and<br />

insurance companies failed in the following weeks.<br />

10

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Statement BY THE Chief Executive Officer<br />

Economic landscape<br />

The global economic crisis has had a notable impact on the economic wellbeing of South Africa, and indeed<br />

the province. As a result, growth estimates for South African gross domestic product have been revised down<br />

to 3.5% per annum, which falls short of the PGDP target to maintain growth of 5-8%. While the province’s<br />

growth rate has been marginally higher than the national average in recent years, it is unlikely to fall within this<br />

range. Particular pressure has been placed on our automotive and manufacturing sectors as companies have<br />

been forced to slash overhead costs in order to survive. The other contributors to this trend have been inflated<br />

fuel prices, volatile interest rates, the electricity crisis, and reduced customer orders. Ultimately, the disposable<br />

income of households, particularly the 4.3 million poorer households in the province, has decreased while food<br />

prices have increased dramatically in the same time period. The medium-term trickledown effect of this trend<br />

is likely to manifest in the fiscus as depleted financial resources impact negatively on the government<br />

funding required by the <strong>Corporation</strong> to deliver on its developmental mandate.<br />

The emphasis of PGDP, being value addition and beneficiation to existing sectors of the economy,<br />

is strategically relevant when one considers the negative impact of the economic downturn on<br />

household income. Food security refers to the availability of food even in the midst of financial poverty.<br />

For this reason the agricultural production and agro-processing industries have received specific<br />

emphasis in the review period (as evidenced in the Ndlambe pineapple industry turnaround and the<br />

berry corridor project). Another important focus is the renewable energy sector, converting agroprocessing<br />

waste into energy.<br />

ECDC faces the task of creating sustainable jobs and alleviating poverty in the province, regardless<br />

of the global economic situation. The sectors most likely to deliver these returns, and hence those<br />

that will receive our most urgent attention and investment, are the agriculture and agro-processing,<br />

automotive, tourism and general manufacturing sectors. Bringing more rural people into the<br />

formal economy remains an imperative, and we also remain determined to facilitate Foreign Direct<br />

Investment (FDI) into the province. There are, however, tremendous prospects in emerging sectors<br />

such as Business Process Outsourcing and Off-shoring (BPO&O) and ICT, which the ECDC, together<br />

with its strategic partners will aggressively pursue. Our experience in the period under review has<br />

been that it pays well to look after existing companies as the potential for expansion abounds.<br />

While the <strong>Corporation</strong> has been, and will be, presented with formidable challenges to its ongoing<br />

efforts to ensure the economic upliftment of <strong>Eastern</strong> <strong>Cape</strong> communities, our steadfast response<br />

to these circumstances has been to consistently employ a fine balance of courage and financial<br />

prudence as we persist in our objective to develop the province and to complete the <strong>Corporation</strong>’s<br />

three year turnaround process. Despite glaring internal challenges surrounding the changes at Board<br />

level, as well as those external challenges we have discussed, we are pleased to present another<br />

impressive set of financial results this year despite the economic crisis, and stand by our rationale<br />

as we advance into the next financial year.<br />

11

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Statement BY THE Chief Executive Officer<br />

Refined internal efficiency<br />

In the previous review period, time was spent in the benchmarking and analysis of the <strong>Corporation</strong> and its performance<br />

against its mandate. The findings of that analysis were that we had not reached the critical mass required to secure sustainable<br />

operations through the disbursement of development investments, the provision of development properties, and the provision<br />

of development support services. We then embarked on a structural revision that saw a solid executive management force<br />

being restored to these three areas.<br />

The focus of the 20<strong>08</strong>/<strong>09</strong> review period was to improve operational effectiveness, enhance record keeping and reporting<br />

processes, and to maintain a more rigid control of what was happening at the coalface of the <strong>Corporation</strong>’s engagement with its<br />

clients, and operate our portfolio of services profitably by 2010.<br />

The marketing and communication campaign for ECDC business finance products, together with the operational efficiency<br />

and follow through employed by the <strong>Development</strong> Investment Unit, saw overall outperformance with respect to its stated<br />

performance plan for the review period. The unit offers short- and long-term business finance solutions to enterprises within the<br />

province that present developmental value.<br />

During the year of review, the targeted R66 million<br />

in term loan disbursements was outperformed by<br />

17% as it disbursed R77 million, while the short-term<br />

Term loan disbursements 20<strong>08</strong>/<strong>09</strong><br />

finance disbursement goal of R62.5 million (comprised<br />

Target<br />

Disbursements<br />

achieved<br />

R66 million<br />

R77 million<br />

of R10 million in trade finance monies, R40 million in<br />

construction loans, and R12.5 million in micro-finance)<br />

was exceeded by 630% in the case of trade finance<br />

disbursements, 253% with regard to construction<br />

loans, and underperformance in the case of microfinance<br />

of -12%.<br />

+17%<br />

Short-term finance disbursements 20<strong>08</strong>/<strong>09</strong><br />

Target:<br />

Trade finance R10 million<br />

Construction loans R40 million<br />

Micro-finance R12,5 million<br />

Achieved:<br />

Trade finance R73 million Exceeded by 630%<br />

Construction loans R141 million Exceeded by 253%<br />

Micro-finance R11 million Underperformed by -12%<br />

<strong>Development</strong> Properties’ rental collection<br />

20<strong>08</strong>/<strong>09</strong> R42,3 million<br />

Escalation of 23% from<br />

previous year<br />

+23%<br />

The extensive drive to eliminate bottlenecks and<br />

inefficiencies within the unit, particularly in the case<br />

of short-term finance, resulted in the efficient delivery<br />

of finance to small, medium and micro enterprises<br />

requiring finance to deliver food parcels to school<br />

learners in marginalised areas, as well as the poverty<br />

stricken in the poorest regions of our province.<br />

The vigorous efforts of the <strong>Development</strong> Property Unit<br />

to recover old outstanding rentals, and to re-order<br />

its database of tenants with accurate information<br />

resulted in the recovery of R12 million, and the<br />

collection of R42.3 million which constituted a 23%<br />

escalation from the previous year.<br />

The refined efficiencies of the various units brought<br />

about a greater level of co-ordination amongst them.<br />

The <strong>Development</strong> Services Unit led the initiative to<br />

turn around the pineapple industry in the Ndlambe<br />

area. The project, led by the team from Project<br />

<strong>Development</strong> (a component of our <strong>Development</strong><br />

Services Unit), reflected the synergistic value-add of<br />

the <strong>Corporation</strong> as we facilitated loan financing deals<br />

as well as providing the initiative with development<br />

and support services.<br />

The intervention of the organisation in the industry has<br />

literally breathed hope into a situation weighed down<br />

by years of economic and social losses.<br />

12

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Statement BY THE Chief Executive Officer<br />

The recent review of the Provincial Growth and <strong>Development</strong> Plan’s (PGDP) core strategic goals re-iterates the role of<br />

the <strong>Corporation</strong> in the implementation of the reformative strategies formulated by government. The strengthening of the<br />

implementation of PGDP can only be delivered as developmental entities rally together behind its objectives. ECDC is resolute<br />

that it will continue to champion these objectives within the province by stewarding developmental resources for maximised<br />

developmental results.<br />

The <strong>Corporation</strong> engaged deliberately in the fulfilment of the stated PGDP objectives during the year of review. In this<br />

regard, the projects featured in the year 20<strong>08</strong>/<strong>09</strong> were as follows:<br />

• Department of Education’s school nutrition scheme: ECDC’s critical role,<br />

• Department of Health’s food parcel distributions: Bridging finance to SMMEs,<br />

• Integrated Emerging Contractors <strong>Development</strong> Model: <strong>Development</strong>al impact and improved government delivery,<br />

• ECDC/CIPRO registration synergy: <strong>Eastern</strong> <strong>Cape</strong> outperforms the rest,<br />

• Project scoping in Lusikisiki area: Industrial diversification for sustainable growth,<br />

• Independent Standards Organisation: Total quality management for SMMEs,<br />

• <strong>Eastern</strong> <strong>Cape</strong> from Above: Photographic exhibition of the province displayed in Europe,<br />

• Pineapple turnaround in the Ndlambe area: From primary production to beneficiation,<br />

• The SMME Conference and Business Expo: Aligning efforts to develop SMMEs in the province,<br />

• Pure Ocean Aquaculture and Espadon fin-fish farms: Pioneering out-of-sea production in the province,<br />

• Amalinda Fish Farm: Project administration and development,<br />

• Skills development within the province’s creative industries: World-class craft for world markets,<br />

• Internal alignment and improved efficiency of the <strong>Development</strong> Investment, <strong>Development</strong> Properties<br />

and <strong>Development</strong> Services Units: Preparing<br />

for growth and expansion.<br />

Not without our stakeholders<br />

The nature of our accomplishments that have been<br />

achieved during the review period are such that we<br />

would not be able to review the various milestones<br />

and project highlights without the continued valueadd<br />

of our external partnerships and relationships.<br />

Constructive engagements with clients and chambers<br />

were established and improved during the period<br />

to determine areas of common interest and to<br />

formulate strategies to overcome challenges faced<br />

by these players. Close working relationships were<br />

maintained with the Companies and Intellectual<br />

Property Registration Office (CIPRO), the two Industrial<br />

<strong>Development</strong> Zones in the province, the <strong>Development</strong><br />

Bank of South Africa, the Industrial <strong>Development</strong><br />

<strong>Corporation</strong>, the municipalities and government<br />

departments in the province.<br />

Johnathan Philander, Hatchery Manager,<br />

tends to the tanks at Espadon Marine in the<br />

East London Industrial <strong>Development</strong> Zone<br />

– where marine fish are being farmed for<br />

local and international consumption.<br />

Mr Mxolisi D Matshamba<br />

Chief Executive Officer<br />

<strong>Eastern</strong> <strong>Cape</strong> <strong>Development</strong> <strong>Corporation</strong><br />

13

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Executive management<br />

share their thoughts<br />

on development in 20<strong>08</strong>/<strong>09</strong><br />

<strong>Development</strong> Investments<br />

• Stated term loan disbursements target of R66 million – outperformed by 17%<br />

• Short-term finance disbursement goal of R62.5 million – trade finance disbursements exceeded by 630%<br />

construction loans exceeded by 253%<br />

<strong>Development</strong> Properties<br />

• R515 million property portfolio<br />

• R13 million in rental debt recovered<br />

<strong>Development</strong> Services<br />

• Turnaround of the pineapple industry in the Ndlambe area (Port Alfred, Bathurst and Peddie)<br />

• Three new aquaculture investments in the <strong>Eastern</strong> <strong>Cape</strong><br />

• Training of nearly 186 enterprises in ISO 22000/HACCP (Hazard Analysis and Critical Control Points), quality<br />

management systems (ISO 9001), or OHSAS (Occupational Health and Safety Advisory Services), as well as<br />

training of 133 crafters and 62 construction contractors<br />

• Hosting of the four day SMME Summit, which explored solutions to empower the province through enterprise<br />

• “<strong>Eastern</strong> <strong>Cape</strong> From Above” exhibition and the <strong>Eastern</strong> <strong>Cape</strong><br />

“Make it yours” television commercial<br />

Msulwa Daca<br />

Chief Financial Officer<br />

A chartered accountant by profession, Daca brings<br />

a wealth of experience after successful years at<br />

leading professional services firm KPMG and the<br />

South African Revenue Services. Before joining<br />

ECDC, he was chief director of accounting support<br />

services at National Treasury in Pretoria.<br />

“ECDC’s core business is to assist<br />

businesses to develop and grow, from<br />

start-ups to larger businesses seeking<br />

export opportunities. We provide an<br />

appropriate governance platform<br />

to allow ECDC to efficiently and<br />

economically deliver on its mandate.”<br />

Luyanda Tsipa<br />

<strong>Development</strong> Properties<br />

With 10 years’ experience in immovable asset management,<br />

Tsipa is a B Juris graduate of the University of Transkei, whose<br />

experience includes working in the Land Claims Commission and<br />

the National Department of Public Works. Her roles at this former<br />

employer include deputy director of asset management and<br />

leaseholds, director of prestige property management and chief<br />

director at the Johannesburg regional office.<br />

“<strong>Development</strong> Properties focuses on the<br />

conversion of non-income-generating properties<br />

into a strategically aligned property portfolio that<br />

supports and promotes the mandate of ECDC.<br />

I was born and bred in the <strong>Eastern</strong> <strong>Cape</strong> and its<br />

economic development means the upliftment of a<br />

people who shaped me.”<br />

14

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Executive management<br />

Chris Bierman<br />

<strong>Development</strong> Investments<br />

Raised in Johannesburg, Bierman is a chartered accountant who<br />

has worked with the IDC, as well as lectured in Management<br />

Accounting at the University of the Witwatersrand. As a former<br />

business owner, he has extensive experience in large enterprises<br />

across various sectors in South Africa and Australia. In his role<br />

as corporate finance dealmaker, Chris has been instrumental<br />

in facilitating and structuring a large number of black economic<br />

empowerment (BEE) deals. He has also authored a book on BEE<br />

on the raising of finance for small to medium size businesses.<br />

Noludwe Ncokazi<br />

<strong>Development</strong> Services<br />

Ncokazi graduated with a Bachelor of Commerce<br />

from the University of Western <strong>Cape</strong> in 1994. Since<br />

then, she has completed her Honours degree in<br />

economics and is currently working on her Masters<br />

degree. Her roles have spanned four of South<br />

Africa’s provinces as educator, financial manager,<br />

chief executive officer, executive consultant<br />

and general manager in the public and private<br />

sectors. She joined ECDC after four years with the<br />

Buffalo City Municipality as its general manager<br />

for economic development, tourism and rural<br />

development.<br />

“<strong>Development</strong> Finance is about the promotion<br />

of entrepreneurship through the funding of<br />

technically sound and financially sustainable<br />

businesses and projects. It targets businesses and<br />

projects in high-poverty nodes where multiple<br />

socio-economic objectives can be achieved.<br />

It also provides low-income individuals and<br />

communities with investment opportunities in<br />

private sector partnerships that address their<br />

needs, like job creation, affordable housing and<br />

the launching of sustainable businesses.”<br />

“<strong>Development</strong> Services accelerates<br />

the development impact of projects,<br />

unlocks the latent development<br />

potential in previously disadvantaged<br />

areas and actively promotes<br />

entrepreneurship, and so strengthens<br />

the position of the <strong>Eastern</strong> <strong>Cape</strong> as a<br />

premier investment destination. ECDC<br />

is the critical link between government<br />

and the private sector.”<br />

15

17<br />

The Difference ECDC<br />

Juice the juice<br />

Eunice Mahote, Labelling and Staff Supervisor,<br />

Niqua Juice, Jeffrey’s Bay<br />

Niqua Juice in Jeffrey’s Bay bottles fruit juices and other beverages for clients<br />

such as supermarket retail giants Pick ‘n Pay, Shoprite/Checkers, Spar and<br />

OK Foods, as well as petrol station forecourt stores and corner grocery stores.<br />

Previous production focus was on the <strong>Eastern</strong> <strong>Cape</strong> alone, but being unable to<br />

produce enough juice stock for expansion held Niqua Juice back.<br />

Financing machinery is just one way that ECDC was able to assist the business<br />

to grow into other provinces, with export possibilities in the near future now also<br />

within range. “With ECDC’s involvement, it will enable us to focus on more<br />

products, expansion to other regions as well as bettering our service,” says Hein<br />

van Rensburg, Director.

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Investing resources:<br />

A review of the<br />

<strong>Development</strong> Investment Unit<br />

Successes in the realm of<br />

development investments<br />

As the mandated steward of provincial<br />

development capital, ECDC endeavours to<br />

identify projects that will have, or stimulate,<br />

maximum socio-economic impact within<br />

the <strong>Eastern</strong> <strong>Cape</strong>. The unit that specifically<br />

manages the applications, processing, risk<br />

and disbursement of these monies (in the<br />

form of loan capital) is the <strong>Development</strong><br />

Investment Unit, headed by Chris Bierman,<br />

CA (SA), who is proud to report on the<br />

successes of the <strong>Corporation</strong> in the realm of<br />

development investments within the review<br />

period.<br />

The statistical breakdown of<br />

loaned monies indicates that:<br />

• 85% was disbursed to companies turning over<br />

less than R500,000 per annum.<br />

• 60% was invested into rural projects,<br />

indicative of the <strong>Corporation</strong>’s renewed focus<br />

on rural development initiatives.<br />

• 45% of disbursed monies went to female<br />

applicants.<br />

• 22% of loans went to projects initiated by<br />

youth.<br />

• Contractors received R141 million and R73<br />

million was disbursed via the ECDC Nexus<br />

trade product to supply short term finance to<br />

chain contractors.<br />

• The micro-finance segment saw an<br />

R11 million loan amount, granted via the<br />

ECDC Imbewu and PowerPlus loans.<br />

• The <strong>Corporation</strong> maintains a balanced portfolio of shortand<br />

long-term development investments.<br />

• The launch of the new “ECDC Business Finance” products<br />

was successful after a marketing and advertising burst<br />

campaign was implemented to boost sales and increase<br />

our markets’ awareness of the ECDC short- and long-term<br />

development investments offering.<br />

• We disbursed R312 million to developmental initiatives,<br />

of which 25% constituted long-term, and 75% short-term<br />

loans.<br />

R312 million<br />

<strong>Development</strong> initiatives<br />

25% long-term<br />

75% short-term loans<br />

• Impairment (debt at risk of non-repayment) of total<br />

disbursements during the period under review amounted<br />

to R5 million, which constitutes a mere 1.6%. This can<br />

be celebrated as a major feat when held in contrast to<br />

the fact that during the period between 2001 and 2007,<br />

impairment estimates were in the region of 66%.<br />

• An increased focus on structured finance has resulted<br />

in good quality equity investments on the part of the<br />

organisation.<br />

• The completion of the <strong>Corporation</strong>’s <strong>Development</strong><br />

Investment Policy has meant that the <strong>Corporation</strong><br />

now employs a standard guideline with respect to risk<br />

management and the awarding of loans.<br />

18

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

<strong>Development</strong> investment<br />

Refined efficiencies in the<br />

<strong>Development</strong> Investment Unit<br />

Emerging contractors<br />

Emerging finance excellence<br />

The Integrated Emerging Contractors <strong>Development</strong><br />

Model, an initiative to improve the skills of emerging<br />

construction contractors contracted to both the<br />

public and private sectors, was conceptualised<br />

and implemented during the 20<strong>08</strong>/<strong>09</strong> year in a<br />

collaborative partnership between ECDC, the Council<br />

for Scientific and Industrial Research, and The<br />

University of the Witwatersrand.<br />

The programme, stewarded by our <strong>Development</strong><br />

Services Unit, created value for the <strong>Corporation</strong>’s<br />

management of loaned monies by training contractors<br />

in cost-management and technical operation issues.<br />

By capacitating contractors to manage their contracts<br />

appropriately, the <strong>Corporation</strong> experienced an<br />

improved loan repayment rate, and decreased default<br />

on loaned monies as a result. Because of this, the<br />

volume of loans granted increased, and a greater<br />

developmental effect was leveraged using ECDC<br />

resources.<br />

In addition to this, the Enterprise <strong>Development</strong><br />

Services team, a component of <strong>Development</strong> Services,<br />

assisted the <strong>Development</strong> Investment Unit with the<br />

initial development and implementation of its aftercare<br />

facility, which formed a central focus of the unit during<br />

the review period.<br />

In reflecting on the above cases, ECDC takes great<br />

delight in demonstrating its increased ability to create<br />

synergy and cross pollination between its various<br />

units.<br />

Drastically reduced turnaround times<br />

One of the challenges faced by ECDC in the review period was the<br />

perception of the <strong>Corporation</strong> in the mind of its target markets, which<br />

was typically one of ‘delayed turnarounds and inefficiency’.<br />

Having identified this challenge, the <strong>Corporation</strong> initiated a<br />

flagship-status project, ‘Address Turnaround Times’, to address the<br />

inefficiencies that had become incumbent to its development finance<br />

offering.<br />

The project targeted the improvement of our customer feedback<br />

process, the elimination of internal red tape and inefficiencies related<br />

to loan authorisations, to see ECDC as an organisation made up of<br />

units that depended on each other for proper functioning.<br />

One of the outcomes of the project was the need for a fully<br />

automated loan application and approval process, which we will<br />

endeavour to implement during the year following review.<br />

Negative feedback converted to positive results<br />

Having completed the project, the <strong>Development</strong> Investments<br />

team drastically reduced the turnaround time for an application<br />

for contractor finance (the Nexus trade and Workflow products)<br />

to less than 48 hours from the client’s application. This increased<br />

efficiency has led to the <strong>Corporation</strong>’s loan book reflecting short term<br />

disbursements of more than R50 million at any given point in time.<br />

The majority of complaints received from clients in the past related<br />

most strongly to short-term, micro-finance applications (loans less<br />

than R500,000). As a result, the <strong>Corporation</strong> never managed to gain a<br />

firm foothold in what the <strong>Development</strong> Investment Unit refers to as<br />

“the magic gap” of the R250,000 to R300,000 loan range, and hence<br />

was not able to have the developmental impact it desired. This began<br />

to change during the year as satisfied clients gave ‘word-of-mouth’<br />

referrals to their colleagues and friends, who were impressed with<br />

our efficient turnaround times and our new approach to aftercare<br />

and support, which provided entrepreneurs in this category a swift<br />

and well defined solution to their developmental ideas.<br />

ECDC reviewed and revised its portfolio<br />

of finance products<br />

• Adapted commercial designs/layouts for<br />

short-term products with specifications.<br />

• Long-term products with specifications.<br />

• Disclaimer that quoted rates and expenses<br />

pertain to the review period only.<br />

19

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

<strong>Development</strong> investment<br />

To achieve this, the <strong>Development</strong> Investment Unit ensured that:<br />

• the internal investment reporting process was streamlined and consolidated for a more diverse audience;<br />

• the financial model reflected a standardised approach to applications across the various loan categories;<br />

• the application documentation was reworked such that the applicant’s signature on the document constitutes a legally<br />

binding agreement in the event that their application is successful. This has eliminated the need for the ECDC agents to<br />

venture into remote areas of the province to source the signature of rural applicants whose applications were approved;<br />

• human capacity was bolstered to deal with micro-finance applications efficiently; six new interns were hired during the<br />

review period (sourced from the Sectoral Education and Training Authority), which has capacitated the unit to reduce<br />

complaints and increase client satisfaction.<br />

In addressing the issues and challenges we faced, the <strong>Corporation</strong> has begun to build a foundation for further growth in the<br />

realm of <strong>Development</strong> Investments. The improved performance of small loans in the <strong>Corporation</strong> has resulted in an internal shift<br />

in the perceptions of micro-finance. Once viewed by some as a ‘mickey mouse’ development finance area, these same ECDC<br />

members entertain a healthy respect for this loan category as a tool with which significant developmental impact can be made<br />

in the province.<br />

Some new investments into<br />

the <strong>Eastern</strong> <strong>Cape</strong><br />

The <strong>Eastern</strong> <strong>Cape</strong> expands its tents<br />

The <strong>Eastern</strong> <strong>Cape</strong> has attracted the investment of<br />

Bargain Tents, a national manufacturer of marquee<br />

tents and plastic chairs and tables recognised as the<br />

largest of its kind in South Africa. We as a <strong>Corporation</strong><br />

are pleased to report our central role in the facilitation<br />

of the investment process, which led ultimately to this<br />

operation becoming a new economic contributor in<br />

the province.<br />

ECDC offered the investor an ECDC Termcap loan<br />

of R18 million for new equipment to expand its<br />

manufacturing capacity and to cover the cost of its<br />

relocation from KwaZulu-Natal. Its investment into the<br />

area brings a new source of employment and a wider<br />

platform for economic activity in the province. The<br />

relocation of the manufacturer into the <strong>Eastern</strong> <strong>Cape</strong><br />

was imminent at the time of writing.<br />

Pioneering a new purpose for pineapples<br />

The <strong>Corporation</strong> demonstrated its synergistic offering<br />

during the review period when its <strong>Development</strong><br />

Investment and <strong>Development</strong> Services teams<br />

descended on the ailing pineapple industry in Port<br />

Alfred to initiate its turnaround after the demand for<br />

the fruit dipped, causing an economic slump.<br />

Having conducted the relevant project-scoping<br />

exercises to ascertain the viability of various<br />

pineapple-based products, ECDC closed a broadbased<br />

black economic empowerment deal to grant<br />

a R28 million TERMcap facility to Ndlambe Natural<br />

Industries Products (NNIP) (Pty) Ltd. The loan, made on<br />

the strength of the research findings, provided NNIP<br />

with the financial muscle to purchase a controlling<br />

stake in Summerpride Foods, an established fruit<br />

processing plant in East London which will soon<br />

be relocated to Bathurst in an effort to consolidate<br />

agricultural and industrial processes in the sector.<br />

This is a critical success factor of the project.<br />

20<br />

Flexing its muscles of synergy, ECDC was able to offer<br />

Bargain Tents an investment solution that packaged a<br />

lease agreement for it to operate from one of ECDC’s<br />

prime industrial facilities in Dimbaza, an established<br />

industrial area near King William’s Town.<br />

NNIP (Pty) Ltd constitutes a rural partnership between the<br />

following entities:<br />

• ECDC holds a 33.5% stake;<br />

• the Pineapple Growers Association (represented by Cayenne<br />

Pineapple Growers (Pty) Ltd, which holds 40.5%); and<br />

• the <strong>Eastern</strong> <strong>Cape</strong> Pineapple Industry Workers’ Trust, which holds<br />

a 26% share in the company, rendering the project one of true<br />

developmental value.

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

<strong>Development</strong> investment<br />

The Cob Creek Wine Estate<br />

A blend of shiraz red, chardonnay white<br />

and golfing greens<br />

ECDC client, Cob Creek Wine Estate Pty (Ltd), is on<br />

track to launch what will be the first wine estate in<br />

the <strong>Eastern</strong> <strong>Cape</strong>, having confirmed its vine-growing<br />

viability through scientific testing and research.<br />

Situated on a 254ha farm straddling the Kabeljouws<br />

River on the outskirts of Jeffrey’s Bay, the estate enjoys<br />

breathtaking views of the bay and the Kabeljouws<br />

Lagoon. Boasting a three-star, seven-bedroom guest<br />

house, a studio with capacity to accommodate<br />

100 people, and staff and management housing,<br />

the owners envisage that the land will become the<br />

premises for a five-star hotel, wine cellar and golfing<br />

estate.<br />

The planting of trellised vineyards on the Cob<br />

Creek Estate took place in 20<strong>08</strong>, when it was<br />

awarded an ECDC TERMcap loan of R3.2 million. The<br />

developmental aim of the project is to establish a<br />

second wine route in South Africa which will stimulate<br />

an exponential increase in the demand for wine by<br />

tourists seeking a unique <strong>Eastern</strong> <strong>Cape</strong> wine-tasting<br />

experience. To this end the owners of Cob Creek are<br />

encouraging other local farmers to plant vines so as<br />

to create the critical mass of wine production that<br />

would sustain such an initiative.<br />

ECDC envisages that this initiative (a combination of<br />

wine estate, tourist accommodation, golfing estate<br />

and conferencing) will have a notable developmental<br />

impact on the Jeffrey’s Bay area, creating 70 direct<br />

jobs, of which 30 will be permanent and 40 seasonal.<br />

Export <strong>Eastern</strong> <strong>Cape</strong> through<br />

organic growth<br />

The 20<strong>08</strong>/<strong>09</strong> year saw Mzondo Technologies, an organic juicer in Port<br />

Alfred being granted financial assistance through the ECDC Nexus<br />

trade contractor’s loan.<br />

The <strong>Corporation</strong>’s <strong>Development</strong> Investment team, together with the<br />

Trade Promotion team, provided an integrated financial assistance<br />

and trade-promotion solution to the juicer, which enabled them to<br />

expand operations to become the largest organic juice exporter in<br />

the <strong>Eastern</strong> <strong>Cape</strong>, and one of the largest in South Africa.<br />

Trellising has been completed on Cob Creek<br />

Estate’s 32 hectares, with around 22 000 poles<br />

and 500km of wire in place. Additional game<br />

fencing has been added to keep the antelope<br />

from helping themselves! Jonny Witbooi and<br />

Jaco Schoeman (above) check the nursery<br />

vines for viruses.<br />

The first Cob Creek wines will be available in<br />

November 2010, under a second label, as the<br />

volume will not warrant the full construction<br />

of the winery at this time. A restaurant and<br />

tasting room will open in November 20<strong>09</strong> to<br />

create awareness of the farm and increase<br />

wine appreciation in the area.<br />

21

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

<strong>Development</strong> investment<br />

<strong>Development</strong> Investments<br />

yielding fruitful returns<br />

Sparring with the best of them<br />

Young entrepreneurs in Lusikisiki<br />

In 2005, the <strong>Corporation</strong> granted the owners of<br />

Lusikisiki Spar a financial loan to fund the growth and<br />

expansion of their business.<br />

Three years later, Lusikisiki Spar has developed a solid<br />

customer base and has experienced rapid expansion.<br />

Both partners in the business are young entrepreneurs<br />

who have won awards from Spar, and are esteemed<br />

by their community as up-and-coming leaders.<br />

Demonstrative of the <strong>Corporation</strong>’s commitment to<br />

stimulating and sustaining business initiatives in the<br />

rural <strong>Eastern</strong> <strong>Cape</strong>, this story provides evidence that<br />

young minds in the rural areas can play a significant<br />

role in changing the face of the <strong>Eastern</strong> <strong>Cape</strong> through<br />

enterprise and perseverance.<br />

Giving credit where it is due<br />

Tabile Trade’s example<br />

Since its inception in 2003, Tabile Trade has continued<br />

to grow its business while reducing its loan debt –<br />

which is exemplary. The fruit and vegetable retailer in<br />

Mthatha does business with hawking groups, large<br />

businesses and walk in customers from the bustling<br />

Mthatha centre, as well as the nearby small towns.<br />

ECDC is proud to acknowledge Tabile Trade as a client<br />

that has flourished through tough times, and one that<br />

has responsibly managed its debt as an asset to fuel<br />

the growth of its business.<br />

Dlatu CZ<br />

Paid in full<br />

The <strong>Corporation</strong> esteems players such as the<br />

company Dlatu CZ, who can be described as one of<br />

its ‘strong horses’: it continues to build a sustainable<br />

business, having already settled two ECDC loans in<br />

full. The company’s clean, neat and well-stocked bottle<br />

store in Bizana offers a full spectrum of well-known<br />

brands, and the customer base encompasses a broad<br />

range of people, excluding children under 18 years<br />

of age. This venture is aligned with the <strong>Corporation</strong>’s<br />

mandate to continue its efforts to stimulate economic<br />

activity and growth in rural towns like Bizana in the<br />

province. To achieve this, the <strong>Corporation</strong> aims to<br />

offer the communities in these areas an increasingly<br />

strategic blend of financial resources and skills<br />

impartation.<br />

The <strong>Corporation</strong> has developed valuable<br />

partnerships with its various government<br />

stakeholders to facilitate a more efficient delivery<br />

of projects and services in the public sector.<br />

In most cases, other valued partners in these<br />

projects include the likes of the South African<br />

Social Security Agency (SASSA), the Independent<br />

<strong>Development</strong> Trust (IDT), and AsgiSA-EC<br />

(the provincial champion of the Accelerated<br />

Shared Growth Initiative of South Africa also<br />

known as AsgiSA).<br />

Spanning across the departments of Health,<br />

Education, Water and Environmental Affairs,<br />

Agriculture, and Transport, the wide humanitarian<br />

impact of these partnerships has seen countless<br />

disempowered small, medium and micro<br />

enterprises with no capital and little hope rising<br />

up to take their place as productive entrepreneurs<br />

in the province.<br />

ECDC takes over school nutrition programme<br />

One of the developmental initiatives that benefited immediately as a<br />

result of the increased efficiencies of the <strong>Development</strong> Investment<br />

offering was the Department of Education’s project to distribute daily<br />

food parcels to schools in marginalised areas.<br />

The project, aiming to feed in excess of 1.3 million learners in<br />

marginalised areas, nearly came to an abrupt end when its numerous<br />

cash-strapped SMME suppliers (represented by the National African<br />

Federated Chamber of Commerce, Nafcoc) were unable to deliver<br />

on their obligations, and were forced to cede their contracts with the<br />

Department to their key suppliers. The programme would have failed<br />

at that point were it not for ECDC’s R40 million injection of short-term<br />

loan finance into these emerging SMME operations.<br />

The efficiently disbursed bridging finance allowed the numerous<br />

contracted SMMEs to deliver the right goods at the right time, at the<br />

right locations, thereby redeeming the scheme and rendering it a<br />

successful initiative after all. Where problems arose between SMMEs<br />

and the Department (relating to the payment of service providers by<br />

the Department), ECDC was able to ensure that these were resolved<br />

efficiently and fairly.<br />

The current superintendent-general of the department, Professor<br />

Harry Nengwenkhulu, has endorsed this partnership between ECDC<br />

and the School Nutrition Suppliers, and has given his undertaking to<br />

support the programme to the maximum.<br />

22

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

<strong>Development</strong> investment<br />

The R203 million<br />

feeding scheme<br />

programme has<br />

fed 296,621<br />

schoolchildren to<br />

date, and provided<br />

162 new jobs in<br />

the province.<br />

Healthy teamwork to nourish the poor<br />

The <strong>Corporation</strong>’s <strong>Development</strong> Investment team, together with<br />

NAFCOC and SASSA, partnered with the Department of Health to<br />

distribute food parcels to the poorest of the poor as part of their<br />

nutrition programme in the province.<br />

Again ECDC provided the bridging finance to fund SMME orders that<br />

had been received by the Department of Health. Although the time<br />

deadlines and regional diversity of the project presented challenges,<br />

ECDC was able to facilitate the transfer of funds efficiently, and<br />

delivery took place as the Department had intended.<br />

The nutrition programme will continue into the year following review<br />

and the <strong>Corporation</strong> is privileged to participate in a programme<br />

that not only facilitates SMME development, but indirectly provides<br />

sustenance to the marginalised and disadvantaged.<br />

The <strong>Development</strong> Investments Unit and Coega<br />

An operational synergy<br />

In addition to the direct relationships with government, ECDC has<br />

also played a significant role in facilitating increased efficiencies<br />

and synergies within the two IDZs in the province. While the East<br />

London IDZ and the <strong>Corporation</strong> have collaborated synergistically<br />

to introduce two pioneering aquaculture investments (see pages 43<br />

and 44), its Coega counterpart has leveraged exemplary provincial<br />

capacity utilisation with various government departments and our<br />

<strong>Development</strong> Investment Unit.<br />

An example of this is found in the Department of Education’s<br />

building of schools in the <strong>Eastern</strong> <strong>Cape</strong> during the year. Experiencing<br />

a shortage of project management capacity at the time, the<br />

department tapped into the temporarily underutilised capacity of the<br />

Coega IDZ, which acted as the appointed implementation agent for<br />

the department. Having conducted the various scoping, research and<br />

Request For Proposals (RFP) processes, Coega sourced the various<br />

contractors who would build the schools and, where necessary,<br />

would refer those requiring short-term cash-flow assistance to<br />

our <strong>Development</strong> Investment Unit to apply for the ECDC Workflow<br />

Contractor’s Loan.<br />

We believe that this, albeit a simple concept, indicates<br />

the extent to which government departments and<br />

other developmental parastatals are integrating with<br />

the <strong>Corporation</strong> to maximise delivery in the province.<br />

Internal resources<br />

for external impact<br />

While the <strong>Development</strong> Investment Unit is excited<br />

and enthusiastic about the many successes and<br />

achievements of the review period, it would be<br />

an incomplete picture were the reader to miss<br />

the various internal shifts that made the year as<br />

successful as it was.<br />

• Executive Manager of <strong>Development</strong> Investments,<br />

Chris Bierman, expresses a true satisfaction<br />

with the performances and attitudes of his team<br />

members, indicating that their willingness to<br />

cultivate an ethic of diligence and effectiveness has<br />

been evident in their morale and sense of unity.<br />

• Members of the unit are experiencing a more open<br />

channel of communication between each other,<br />

resulting in a clear understanding as to what is<br />

required of them, and what they can expect from<br />

each other.<br />

• The recruitment of Siviwe Makasi, a construction<br />

specialist, has improved the capacity of the<br />

<strong>Corporation</strong> to assess the viability of applicants’<br />

construction projects, and to provide ongoing<br />

monitoring regarding the progress of each project.<br />

• The <strong>Development</strong> Investment Unit recently<br />

appointed a new credit and risk manager, Nelisia<br />

van Dyk, to manage the risk profile of the unit. The<br />

forthcoming review will detail the full benefit of this<br />

added capacity to the unit.<br />

23

24<br />

The Difference ECDC<br />

Quality breeds success<br />

Koliwe Mda, Supervisor, Mathomo Protective Clothing<br />

One is not prepared for the scope, activity and enthusiasm one encounters at the Mathomo<br />

Protective Clothing manufacturers in Dimbaza outside King William’s Town. With 700<br />

staff, the factory is well-equipped to supply protective clothing for both local and export<br />

markets.<br />

Koliwe Mda, a supervisor at the factory, specifies they “deal exclusively with the<br />

wholesale distribution channel.” Kevin Schroeder, Director, was impressed with ECDC’s<br />

speed and efficiency in helping set Mathomo up: “The ECDC was absolutely fantastic in<br />

that from the day I met the (then) CEO of ECDC on an aeroplane flight with the (then)<br />

Premier of the <strong>Eastern</strong> <strong>Cape</strong>, we were operating two weeks later – it was breathtaking.”

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

Creating platforms:<br />

A review of the<br />

<strong>Development</strong> Properties Unit<br />

ECDC’s <strong>Development</strong> Properties team is pleased to<br />

look back on a year to be remembered in the unit as<br />

one that brought with it true internal alignment that<br />

made internal efficiency and synergy a reality.<br />

The year under review saw the <strong>Development</strong><br />

Properties Unit giving priority to the refinement of<br />

its internal processes and systems in order to more<br />

efficiently manage its portfolio of properties. The<br />

key objective in doing so was to commence with a<br />

long-term drive to align the portfolio to the strategic<br />

goals of the organisation’s economic development<br />

mandate.<br />

In order to achieve this alignment, the unit<br />

identified four key areas upon which to focus for<br />

the foreseeable future. These are discussed in the<br />

sections that follow.<br />

Improving rental collections<br />

One of the fundamental efficiencies required in<br />

managing a portfolio of properties is that of rental<br />

collections and the management of lease agreements.<br />

The <strong>Corporation</strong> had its work cut out for it in this<br />

regard as it addressed the historic mismanagement<br />

of some of its properties where rental collections<br />

were poor, as well as a lack of accountability that<br />

had allowed the problem to continue unabated. The<br />

problem was two-fold: outdated information and poor<br />

tenant management.<br />

Data integrity<br />

Refreshing the database<br />

To remedy the problem of outdated information that<br />

resulted from a long season of poor tenant account<br />

management, the organisation’s newly formed team<br />

of property managers commenced with an intensive<br />

data verification exercise that would leave nothing<br />

to chance. Employing whatever means necessary to<br />

ensure a properly updated database of tenants, the<br />

team went to the point of conducting door-to-door<br />

physical checks of our properties where other means<br />

of verification had failed to generate convincing tenant<br />

identities and contact details.<br />

ECDC played an integral role in ensuring the success of the<br />

R1.3 billion Steinhoff/PG Bision chipboard plant investment in Ugie.<br />

Investment value:<br />

Quality tenancy<br />

The way forward<br />

R1,3 billion<br />

Milestones: • Pressed first board on Thursday, 13<br />

December 2007<br />

• 35 000m 2 per day melamine-faced<br />

board press<br />

Employment:<br />

Salary bill:<br />

Production:<br />

Size:<br />

Expenditure:<br />

3 000 (est)<br />

R88 million<br />

1 000 m 3 per day<br />

36 ha<br />

R56 million<br />

As profiled in the section, “Investing resources into the <strong>Eastern</strong><br />

<strong>Cape</strong>” (page 18), the <strong>Development</strong> Properties Unit worked with<br />

<strong>Development</strong> Investments to facilitate the investment of the largest<br />

manufacturer of marquee tents and plastic chairs and tables into<br />

the province. The manufacturer, who has entered into a lease<br />

agreement with the <strong>Corporation</strong> to operate its business from one<br />

of our industrial facilities in Dimbaza, will bring a qualitative (tenant<br />

profile) and quantitative (rental revenue) benefit to the <strong>Corporation</strong><br />

and the province, and constitutes the calibre of tenants sought by the<br />

<strong>Development</strong> Properties Unit.<br />

26

EASTERN CAPE DEVELOPMENT CORPORATION | ANNUAL REVIEW<br />

<strong>Development</strong> properties<br />

Ex-tenant identification and tracking<br />

Having conducted the data integrity and verification process, the<br />

<strong>Corporation</strong> was better positioned to pursue outstanding rentals from<br />

existing tenants. We faced another challenge, however: accessing<br />

ex-tenants of the <strong>Corporation</strong>’s properties who owed us a substantial<br />

amount in outstanding rentals. Many of these individuals could not be<br />

traced using available means, which resulted in the unit’s partnership<br />

with ECDC’s finance and support team and a contracted debt multimanager<br />

to formulate an identification and tracking process that<br />

would trace defaulters and call them to account.<br />

The debt multi-manager provided us with a debtor-coding system<br />

that risk profiled our attempts to trace each identified debtor. The<br />

debtors coded as high-risk cases were those who were probably<br />

untraceable or unable to settle their debt, and those coded as lowrisk<br />

or medium-risk cases presented a higher likelihood of being<br />

traced and being in a position to settle their debt. Lower risk cases<br />

were given priority, which improved our chances of success before<br />

venturing out to locate our debtors.<br />

The initial target for the year of review was to recover 20% of arrears<br />

owed to the organisation. In applying the data verification process<br />

and the ex-tenant identification and tracking process, we managed to<br />

recover 19% during the year.<br />

Eliminating the arrears status of<br />

the ECDC property portfolio<br />

Co-ordination between units for maximised<br />

debt recovery<br />

Rental received 20<strong>08</strong>/<strong>09</strong><br />

Target: 43.5 million<br />

Achieved: 42.3 million<br />

-3%<br />

The <strong>Corporation</strong>’s increased emphasis on integration<br />

between units translated to greater co-ordination<br />

between the Property <strong>Development</strong> Unit and the<br />

<strong>Development</strong> Investment Unit as they conceptualised<br />

and implemented a cross-unit checking process<br />

to ascertain the standing of loan applicants with<br />

respect to ECDC properties. Where the applicant for<br />

a financial loan was found to be a tenant of an ECDCowned<br />

property, and was in arrears with their rental<br />

payments, their loan application was declined until the<br />

outstanding amount had been settled in full.<br />

The process was a fruitful one facilitating the recovery<br />

of a substantial portion of old rental debt. This<br />

bears testimony to the critical importance of cooperation<br />

between the three units of the <strong>Corporation</strong><br />

(<strong>Development</strong> Investments, <strong>Development</strong> Properties<br />

and <strong>Development</strong> Services), which is an ongoing focus<br />

under current leadership.<br />

Debt recovery with a developmental spirit<br />

and a shrewd mind<br />

While ECDC is committed to the fulfilment of its mandate of<br />

economic development, it also needed to communicate a strong<br />

message to defaulting tenants and ex-tenants: we are not a charity,<br />

but we are resolute in our efforts to sustain the <strong>Corporation</strong> as a<br />

development finance institution for the development of the<br />

<strong>Eastern</strong> <strong>Cape</strong>.<br />

It is a requirement that the managers of the <strong>Development</strong> Property<br />

Unit think like entrepreneurs with a developmental spirit; this will<br />

bring to an assertive close the sense of entitlement that has become<br />