SVS Securities Pri SVS Securities Private Ltd. - svs securities pvt. ltd.

SVS Securities Pri SVS Securities Private Ltd. - svs securities pvt. ltd.

SVS Securities Pri SVS Securities Private Ltd. - svs securities pvt. ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

For private circulation only<br />

<strong>SVS</strong> <strong>Securities</strong> <strong>Pri</strong>vate ate <strong>Ltd</strong>.<br />

Volume No. I Issue No. 19 July 16, 2010<br />

Ajanta Pharma<br />

Rs 220<br />

Healthy growth<br />

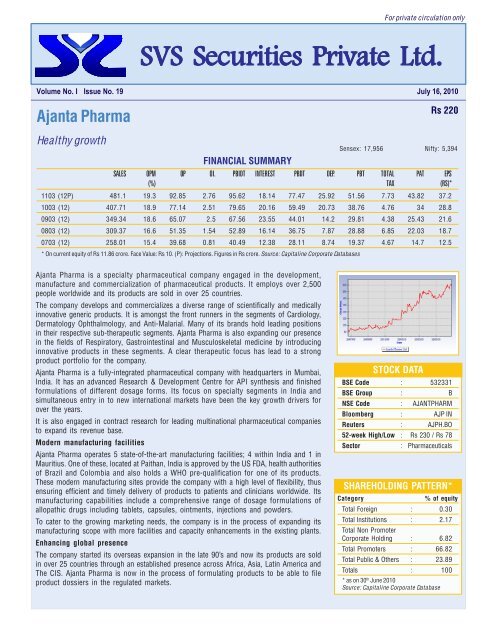

FINANCIAL SUMMARY<br />

Sensex: 17,956 Nifty: 5,394<br />

SALES OPM OP OI. PBIDT INTEREST PBDT DEP. PBT TOTAL PAT EPS<br />

(%) TAX (RS)*<br />

1103 (12P) 481.1 19.3 92.85 2.76 95.62 18.14 77.47 25.92 51.56 7.73 43.82 37.2<br />

1003 (12) 407.71 18.9 77.14 2.51 79.65 20.16 59.49 20.73 38.76 4.76 34 28.8<br />

0903 (12) 349.34 18.6 65.07 2.5 67.56 23.55 44.01 14.2 29.81 4.38 25.43 21.6<br />

0803 (12) 309.37 16.6 51.35 1.54 52.89 16.14 36.75 7.87 28.88 6.85 22.03 18.7<br />

0703 (12) 258.01 15.4 39.68 0.81 40.49 12.38 28.11 8.74 19.37 4.67 14.7 12.5<br />

* On current equity of Rs 11.86 crore. Face Value: Rs 10. (P): Projections. Figures in Rs crore. Source: Capitaline Corporate Databases<br />

Ajanta Pharma is a specialty pharmaceutical company engaged in the development,<br />

manufacture and commercialization of pharmaceutical products. It employs over 2,500<br />

people worldwide and its products are sold in over 25 countries.<br />

The company develops and commercializes a diverse range of scientifically and medically<br />

innovative generic products. It is amongst the front runners in the segments of Cardiology,<br />

Dermatology Ophthalmology, and Anti-Malarial. Many of its brands hold leading positions<br />

in their respective sub-therapeutic segments. Ajanta Pharma is also expanding our presence<br />

in the fields of Respiratory, Gastrointestinal and Musculoskeletal medicine by introducing<br />

innovative products in these segments. A clear therapeutic focus has lead to a strong<br />

product portfolio for the company.<br />

Ajanta Pharma is a fully-integrated pharmaceutical company with headquarters in Mumbai,<br />

India. It has an advanced Research & Development Centre for API synthesis and finished<br />

formulations of different dosage forms. Its focus on specialty segments in India and<br />

simultaneous entry in to new international markets have been the key growth drivers for<br />

over the years.<br />

It is also engaged in contract research for leading multinational pharmaceutical companies<br />

to expand its revenue base.<br />

Modern manufacturing facilities<br />

Ajanta Pharma operates 5 state-of-the-art manufacturing facilities; 4 within India and 1 in<br />

Mauritius. One of these, located at Paithan, India is approved by the US FDA, health authorities<br />

of Brazil and Colombia and also holds a WHO pre-qualification for one of its products.<br />

These modern manufacturing sites provide the company with a high level of flexibility, thus<br />

ensuring efficient and timely delivery of products to patients and clinicians worldwide. Its<br />

manufacturing capabilities include a comprehensive range of dosage formulations of<br />

allopathic drugs including tablets, capsules, ointments, injections and powders.<br />

To cater to the growing marketing needs, the company is in the process of expanding its<br />

manufacturing scope with more facilities and capacity enhancements in the existing plants.<br />

Enhancing global presence<br />

The company started its overseas expansion in the late 90’s and now its products are sold<br />

in over 25 countries through an established presence across Africa, Asia, Latin America and<br />

The CIS. Ajanta Pharma is now in the process of formulating products to be able to file<br />

product dossiers in the regulated markets.<br />

STOCK DATA<br />

BSE Code : 532331<br />

BSE Group : B<br />

NSE Code : AJANTPHARM<br />

Bloomberg : AJP IN<br />

Reuters : AJPH.BO<br />

52-week High/Low : Rs 230 / Rs 78<br />

Sector : Pharmaceuticals<br />

SHAREHOLDING PATTERN*<br />

Category<br />

% of equity<br />

Total Foreign : 0.30<br />

Total Institutions : 2.17<br />

Total Non Promoter<br />

Corporate Holding : 6.82<br />

Total Promoters : 66.82<br />

Total Public & Others : 23.89<br />

Totals : 100<br />

* as on 30 th June 2010<br />

Source: Capitaline Corporate Database

<strong>SVS</strong> <strong>Securities</strong> <strong>Pri</strong>vate <strong>Ltd</strong>.<br />

Ajanta has established a strong marketing set-up that is supplemented by a wide<br />

distribution network in many international markets. All activities are centered on<br />

establishing its brands in respective markets for sustained sales.<br />

Strong R&D base<br />

R&D is the first & foremost important component in the pharma value chain. Recognising<br />

this, Ajanta Pharma has been consistently investing in R&D. Its constant initiatives are<br />

in the direction of targeting, both identified market opportunities and challenge of<br />

unmet medical needs which enables it to work on difficult to make products, in existing<br />

as well as high potential new therapy areas.<br />

The company continues to focus on New Drug Delivery Systems (NDDS) and new<br />

combinations. With the help of its R&D capabilities, it now has 1380 product<br />

registrations in different markets of the world and over 1029 more are waiting in<br />

pipeline. Its R&D facility at ‘Advent’, Mumbai, which is approved by Department of<br />

Scientific and Industrial Research (DSIR), Ministry of Science & Technology, Government<br />

of India, is being expanded which will ensure consistent growth for the organisation in<br />

the coming years.<br />

Its R&D facility Advent has more than 150 diligent and committed scientists. Advent,<br />

located in Mumbai, houses a range of state-of -the-art equipment for formulation<br />

development, working on different dosage forms ranging from topical creams,<br />

ophthalmological preparations, nasal sprays and dry powder inhalers to name a few. It<br />

has an equally well equipped API lab at Advent to synthesize high value APIs for some<br />

of its key products.<br />

Few of its notable R&D achievements are in the segment of anti-malarial with flagship<br />

brand, ARTEFAN; the first generic product to have been pre-qualified by the World<br />

Health Organization (WHO), Geneva. Its other key brands include KAMAGRA (Sildenafil<br />

Citrate) & APCALIS-SX (Tadalafil), both used in the treatment of Male Erectile Dysfunction.<br />

These are available in the conventional tablet as well as in an innovative “jelly” form<br />

which is the world’s first of its kind dosage form for this molecule.<br />

Strong API player<br />

Another key component of pharma value chain is manufacturing of critical raw material,<br />

commonly known as Active Pharma Ingredient (API). Whenever a new formulation<br />

needs to be launched, it has to start from its basic compound, which during initial<br />

period, is not easily available in the market place. It is here that, in-house capability for<br />

producing such API becomes essential to reach the formulation to the needy patients<br />

at the earliest. Further, it also helps to reduce costs by process improvement, thereby<br />

improving profitability.<br />

Realising its need and importance in the pharma value chain, Ajanta Pharma has recently<br />

set up a state-of-the-art API facility at Waluj, Aurangabad. This plant is equipped to<br />

produce different scale of volumes right from laboratory to pilot to commercial level.<br />

This enables the company to carry out innovations in both product quality and cost.<br />

With this addition, it has mapped the complete pharma value chain. Addition of this<br />

component of pharma value chain will accelerate the company’s growth in the coming<br />

years.<br />

Impressive standalone performance; sales up 19% and PAT rise 33%<br />

For the FY 2010 Ajanta Pharma registered a strong 19% rise in standalone sales to Rs<br />

381.67 crore. As OPM remained unchanged at 18.7% OP also grew 19% to Rs 71.22<br />

crore.<br />

Other income fell 7% to Rs 1.27 crore and interest cost fell 13% to Rs 19.08 crore. Even<br />

as depreciation shot 50% to Rs 19.76 crore, PBT grew 30% to Rs 33.66 crore. As<br />

The company continues to<br />

focus on New Drug Delivery<br />

Systems (NDDS) and new<br />

combinations. With the help<br />

of its R&D capabilities, it now<br />

has 1380 product<br />

registrations in different<br />

markets of the world and<br />

over 1029 more are waiting in<br />

pipeline<br />

On standalone basis, over the<br />

last 5 years (from FY 2005 to<br />

FY 2010) Ajanta Pharma has<br />

registered 17% Compounded<br />

Annual Growth Rate (CAGR)<br />

in it sales. Net profit during<br />

the same period grew at a<br />

CAGR of 31%<br />

July 16, 2010<br />

2

<strong>SVS</strong> <strong>Securities</strong> <strong>Pri</strong>vate <strong>Ltd</strong>.<br />

taxation rose 12% to Rs 5.12 crore, net profit shot up 33% to Rs 28.54 crore.<br />

Consolidated yearly performance is higher and much better<br />

In FY 2010 on a consolidated basis Ajanta Pharma registered a 17% rise in its sales to Rs<br />

407.71 crore. As OPM improved by 30 basis points to 18.9% OP grew 19% to Rs 77.14<br />

crore. Other income rose 1% to Rs 2.51 crore and interest cost fell 14% to Rs 20.16 crore.<br />

Even as depreciation jumped 46% to Rs 20.73 crore, PBT grew 30% to Rs 38.76 crore. As<br />

taxation rose just 9% to Rs 4.76 crore, net profit shot up 34% to Rs 34.00 crore.<br />

Consolidated EPS is higher than standalone EPS<br />

In FY 2010 the company registered consolidated EPS of Rs 28.8 against standalone<br />

EPS of Rs 24.2.<br />

Impressive CAGR<br />

On standalone basis, over the last 5 years (from FY 2005 to FY 2010) Ajanta Pharma has<br />

registered 17% Compounded Annual Growth Rate (CAGR) in it sales. Net profit during<br />

the same period grew at a CAGR of 31%.<br />

On consolidated basis, over the last 5 years (from FY 2005 to FY 2010) Ajanta Pharma has<br />

registered 15.1% CAGR in it sales. Net profit during the same period grew at a CAGR of 28%.<br />

Appealing valuation; while standalone P/E is 6.3, consolidated P/E is just 5.5<br />

On standalone basis, in FY 2011 we expect the company to register sales of Rs 456<br />

crore and net profit of Rs 38.59 crore. On an equity of Rs 11.86 crore (66.82% held by<br />

the promoters) and face value of Rs 10 per share, standalone EPS works out to Rs 32.7.<br />

In FY 2011 on consolidated basis, we expect the company to register sales of Rs 481.10<br />

crore and net profit of Rs 43.82 crore. Thus consolidated EPS works out to Rs 37.2.<br />

Currently its consolidated book value stands at Rs 156, whish is likely to touch Rs 190<br />

mark by end of FY 2011.<br />

The share price trades at Rs 220. While the P/E on standalone EPS (of Rs 32.7) works<br />

out to 6.7, it falls to just 5.9 on our consolidated projected EPS (of Rs 37.2) for FY 2011.<br />

This formulation company<br />

has grown consistently over<br />

the years and prospects<br />

remain encouraging<br />

AJANTA PHARMA: STANDALONE FINANCIALS<br />

0703(12) 0803(12) 0903(12) 1003(12) 1103(P)<br />

Sales 238.69 285.13 319.48 381.67 458.00<br />

OPM (%) 15.1 16.1 18.7 18.7 18.7<br />

OP 36.08 45.93 59.74 71.22 85.87<br />

Other inc. 0.63 0.77 1.38 1.27 1.40<br />

PBIDT 36.71 46.70 61.12 72.50 87.27<br />

Interest 11.56 15.09 22.03 19.08 17.17<br />

PBDT 25.15 31.61 39.09 53.42 70.10<br />

Dep. 6.78 6.97 13.15 19.76 24.69<br />

PBT 18.37 24.64 25.94 33.66 45.40<br />

Total Tax 4.66 6.85 4.56 5.12 6.81<br />

PAT 13.71 17.79 21.38 28.54 38.59<br />

EPS (Rs)* 11.6 15.1 18.1 24.2 32.7<br />

* On current equity of Rs 11.86 crore. Face Value: Rs 10. (P): Projections.<br />

Figures in Rs crore. Source: Capitaline Corporate Databases<br />

AJANTA PHARMA: STANDALONE RESULTS<br />

1003(3) 0903(3) VAR.(%) 1003(12) 0903(12) VAR.(%)<br />

Sales 107.89 89.40 21 381.67 319.48 19<br />

OPM (%) 19.4 21.3 18.7 18.7<br />

OP 20.93 19.02 10 71.22 59.74 19<br />

Other inc. 0.63 0.08 661 1.27 1.38 -7<br />

PBIDT 21.56 19.10 13 72.50 61.12 19<br />

Interest 3.85 6.13 -37 19.08 22.03 -13<br />

PBDT 17.71 12.97 37 53.42 39.09 37<br />

Dep. 6.17 3.65 69 19.76 13.15 50<br />

PBT 11.54 9.33 24 33.66 25.94 30<br />

Total Tax 1.50 0.02 9144 5.12 4.56 12<br />

PAT 10.04 9.31 8 28.54 21.38 33<br />

EPS (Rs)* 34.0 31.6 24.2 18.1<br />

* On current equity of Rs 11.86 crore. Face Value: Rs 10. (P): Projections.<br />

Figures in Rs crore. Source: Capitaline Corporate Databases<br />

July 16, 2010<br />

3

<strong>SVS</strong> <strong>Securities</strong> <strong>Pri</strong>vate <strong>Ltd</strong>.<br />

Disclaimer : This document has been prepared by <strong>SVS</strong> SECURITIES PVT LTD and Capital Market Publishers India Pvt. <strong>Ltd</strong>. (the company) and is being distributed in India by<br />

<strong>SVS</strong> SECURITIES PVT LTD. The information in the document has been compiled by the research department. Due care has been taken in preparing the above document.<br />

However, this document is not, and should not be construed, as an offer to sell or solicitation to buy any <strong>securities</strong>. Any act of buying, selling or otherwise dealing in any <strong>securities</strong><br />

referred to in this document shall be at investor’s sole risk and responsibility.<br />

This document may not be reproduced, distributed or published, in whole or in part, without prior permission from the Company.<br />

© Copyright – 2009 - Capital Market Publishers India Pvt. <strong>Ltd</strong> and <strong>SVS</strong> SECURITIES PVT LTD.<br />

July 16, 2010<br />

4