United Utilities Annual Report and Financial Statements for the year

United Utilities Annual Report and Financial Statements for the year

United Utilities Annual Report and Financial Statements for the year

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Financial</strong> review (continued)<br />

2003 2002 2001<br />

Restated Restated<br />

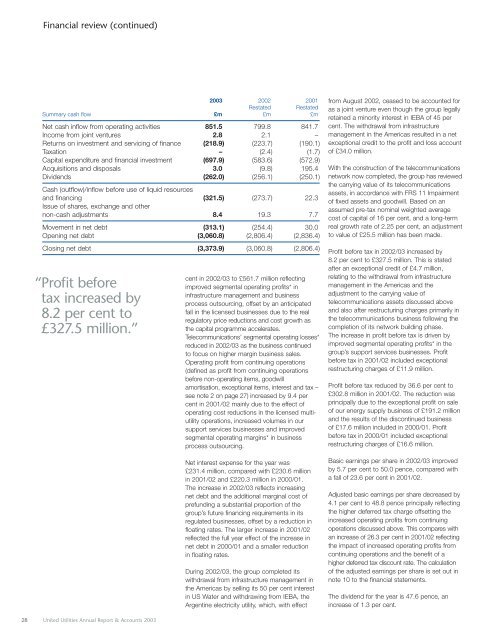

Summary cash flow £m £m £m<br />

Net cash inflow from operating activities 851.5 799.8 841.7<br />

Income from joint ventures 2.8 2.1 –<br />

Returns on investment <strong>and</strong> servicing of finance (218.9) (223.7) (190.1)<br />

Taxation – (2.4) (1.7)<br />

Capital expenditure <strong>and</strong> financial investment (697.9) (583.6) (572.9)<br />

Acquisitions <strong>and</strong> disposals 3.0 (9.8) 195.4<br />

Dividends (262.0) (256.1) (250.1)<br />

Cash (outflow)/inflow be<strong>for</strong>e use of liquid resources<br />

<strong>and</strong> financing (321.5) (273.7) 22.3<br />

Issue of shares, exchange <strong>and</strong> o<strong>the</strong>r<br />

non-cash adjustments 8.4 19.3 7.7<br />

Movement in net debt (313.1) (254.4) 30.0<br />

Opening net debt (3,060.8) (2,806.4) (2,836.4)<br />

Closing net debt (3,373.9) (3,060.8) (2,806.4)<br />

“Profit be<strong>for</strong>e<br />

tax increased by<br />

8.2 per cent to<br />

£327.5 million.”<br />

cent in 2002/03 to £561.7 million reflecting<br />

improved segmental operating profits* in<br />

infrastructure management <strong>and</strong> business<br />

process outsourcing, offset by an anticipated<br />

fall in <strong>the</strong> licensed businesses due to <strong>the</strong> real<br />

regulatory price reductions <strong>and</strong> cost growth as<br />

<strong>the</strong> capital programme accelerates.<br />

Telecommunications’ segmental operating losses*<br />

reduced in 2002/03 as <strong>the</strong> business continued<br />

to focus on higher margin business sales.<br />

Operating profit from continuing operations<br />

(defined as profit from continuing operations<br />

be<strong>for</strong>e non-operating items, goodwill<br />

amortisation, exceptional items, interest <strong>and</strong> tax –<br />

see note 2 on page 27) increased by 9.4 per<br />

cent in 2001/02 mainly due to <strong>the</strong> effect of<br />

operating cost reductions in <strong>the</strong> licensed multiutility<br />

operations, increased volumes in our<br />

support services businesses <strong>and</strong> improved<br />

segmental operating margins* in business<br />

process outsourcing.<br />

Net interest expense <strong>for</strong> <strong>the</strong> <strong>year</strong> was<br />

£231.4 million, compared with £230.6 million<br />

in 2001/02 <strong>and</strong> £220.3 million in 2000/01.<br />

The increase in 2002/03 reflects increasing<br />

net debt <strong>and</strong> <strong>the</strong> additional marginal cost of<br />

prefunding a substantial proportion of <strong>the</strong><br />

group’s future financing requirements in its<br />

regulated businesses, offset by a reduction in<br />

floating rates. The larger increase in 2001/02<br />

reflected <strong>the</strong> full <strong>year</strong> effect of <strong>the</strong> increase in<br />

net debt in 2000/01 <strong>and</strong> a smaller reduction<br />

in floating rates.<br />

During 2002/03, <strong>the</strong> group completed its<br />

withdrawal from infrastructure management in<br />

<strong>the</strong> Americas by selling its 50 per cent interest<br />

in US Water <strong>and</strong> withdrawing from IEBA, <strong>the</strong><br />

Argentine electricity utility, which, with effect<br />

from August 2002, ceased to be accounted <strong>for</strong><br />

as a joint venture even though <strong>the</strong> group legally<br />

retained a minority interest in IEBA of 45 per<br />

cent. The withdrawal from infrastructure<br />

management in <strong>the</strong> Americas resulted in a net<br />

exceptional credit to <strong>the</strong> profit <strong>and</strong> loss account<br />

of £34.0 million.<br />

With <strong>the</strong> construction of <strong>the</strong> telecommunications<br />

network now completed, <strong>the</strong> group has reviewed<br />

<strong>the</strong> carrying value of its telecommunications<br />

assets, in accordance with FRS 11 Impairment<br />

of fixed assets <strong>and</strong> goodwill. Based on an<br />

assumed pre-tax nominal weighted average<br />

cost of capital of 16 per cent, <strong>and</strong> a long-term<br />

real growth rate of 2.25 per cent, an adjustment<br />

to value of £25.5 million has been made.<br />

Profit be<strong>for</strong>e tax in 2002/03 increased by<br />

8.2 per cent to £327.5 million. This is stated<br />

after an exceptional credit of £4.7 million,<br />

relating to <strong>the</strong> withdrawal from infrastructure<br />

management in <strong>the</strong> Americas <strong>and</strong> <strong>the</strong><br />

adjustment to <strong>the</strong> carrying value of<br />

telecommunications assets discussed above<br />

<strong>and</strong> also after restructuring charges primarily in<br />

<strong>the</strong> telecommunications business following <strong>the</strong><br />

completion of its network building phase.<br />

The increase in profit be<strong>for</strong>e tax is driven by<br />

improved segmental operating profits* in <strong>the</strong><br />

group’s support services businesses. Profit<br />

be<strong>for</strong>e tax in 2001/02 included exceptional<br />

restructuring charges of £11.9 million.<br />

Profit be<strong>for</strong>e tax reduced by 36.6 per cent to<br />

£302.8 million in 2001/02. The reduction was<br />

principally due to <strong>the</strong> exceptional profit on sale<br />

of our energy supply business of £191.2 million<br />

<strong>and</strong> <strong>the</strong> results of <strong>the</strong> discontinued business<br />

of £17.6 million included in 2000/01. Profit<br />

be<strong>for</strong>e tax in 2000/01 included exceptional<br />

restructuring charges of £16.6 million.<br />

Basic earnings per share in 2002/03 improved<br />

by 5.7 per cent to 50.0 pence, compared with<br />

a fall of 23.6 per cent in 2001/02.<br />

Adjusted basic earnings per share decreased by<br />

4.1 per cent to 48.8 pence principally reflecting<br />

<strong>the</strong> higher deferred tax charge offsetting <strong>the</strong><br />

increased operating profits from continuing<br />

operations discussed above. This compares with<br />

an increase of 26.3 per cent in 2001/02 reflecting<br />

<strong>the</strong> impact of increased operating profits from<br />

continuing operations <strong>and</strong> <strong>the</strong> benefit of a<br />

higher deferred tax discount rate. The calculation<br />

of <strong>the</strong> adjusted earnings per share is set out in<br />

note 10 to <strong>the</strong> financial statements.<br />

The dividend <strong>for</strong> <strong>the</strong> <strong>year</strong> is 47.6 pence, an<br />

increase of 1.3 per cent.<br />

28 <strong>United</strong> <strong>Utilities</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2003