United Utilities Annual Report and Financial Statements for the year

United Utilities Annual Report and Financial Statements for the year

United Utilities Annual Report and Financial Statements for the year

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Directors’ remuneration report (continued)<br />

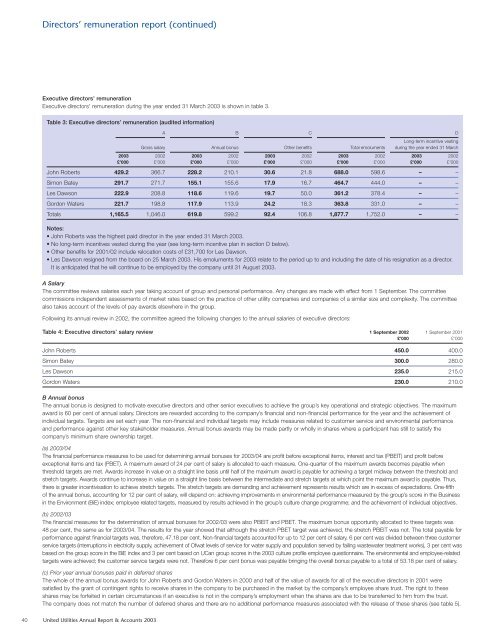

Executive directors’ remuneration<br />

Executive directors’ remuneration during <strong>the</strong> <strong>year</strong> ended 31 March 2003 is shown in table 3.<br />

Table 3: Executive directors’ remuneration (audited in<strong>for</strong>mation)<br />

A B C D<br />

Long-term incentive vesting<br />

Gross salary <strong>Annual</strong> bonus O<strong>the</strong>r benefits Total emoluments during <strong>the</strong> <strong>year</strong> ended 31 March<br />

2003 2002 2003 2002 2003 2002 2003 2002 2003 2002<br />

£’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000<br />

John Roberts 429.2 366.7 228.2 210.1 30.6 21.8 688.0 598.6 – –<br />

Simon Batey 291.7 271.7 155.1 155.6 17.9 16.7 464.7 444.0 – –<br />

Les Dawson 222.9 208.8 118.6 119.6 19.7 50.0 361.2 378.4 – –<br />

Gordon Waters 221.7 198.8 117.9 113.9 24.2 18.3 363.8 331.0 – –<br />

Totals 1,165.5 1,046.0 619.8 599.2 92.4 106.8 1,877.7 1,752.0 – –<br />

Notes:<br />

• John Roberts was <strong>the</strong> highest paid director in <strong>the</strong> <strong>year</strong> ended 31 March 2003.<br />

• No long-term incentives vested during <strong>the</strong> <strong>year</strong> (see long-term incentive plan in section D below).<br />

• O<strong>the</strong>r benefits <strong>for</strong> 2001/02 include relocation costs of £31,700 <strong>for</strong> Les Dawson.<br />

• Les Dawson resigned from <strong>the</strong> board on 25 March 2003. His emoluments <strong>for</strong> 2003 relate to <strong>the</strong> period up to <strong>and</strong> including <strong>the</strong> date of his resignation as a director.<br />

It is anticipated that he will continue to be employed by <strong>the</strong> company until 31 August 2003.<br />

A Salary<br />

The committee reviews salaries each <strong>year</strong> taking account of group <strong>and</strong> personal per<strong>for</strong>mance. Any changes are made with effect from 1 September. The committee<br />

commissions independent assessments of market rates based on <strong>the</strong> practice of o<strong>the</strong>r utility companies <strong>and</strong> companies of a similar size <strong>and</strong> complexity. The committee<br />

also takes account of <strong>the</strong> levels of pay awards elsewhere in <strong>the</strong> group.<br />

Following its annual review in 2002, <strong>the</strong> committee agreed <strong>the</strong> following changes to <strong>the</strong> annual salaries of executive directors:<br />

Table 4: Executive directors’ salary review 1 September 2002 1 September 2001<br />

£’000 £’000<br />

John Roberts 450.0 400.0<br />

Simon Batey 300.0 280.0<br />

Les Dawson 235.0 215.0<br />

Gordon Waters 230.0 210.0<br />

B <strong>Annual</strong> bonus<br />

The annual bonus is designed to motivate executive directors <strong>and</strong> o<strong>the</strong>r senior executives to achieve <strong>the</strong> group’s key operational <strong>and</strong> strategic objectives. The maximum<br />

award is 60 per cent of annual salary. Directors are rewarded according to <strong>the</strong> company’s financial <strong>and</strong> non-financial per<strong>for</strong>mance <strong>for</strong> <strong>the</strong> <strong>year</strong> <strong>and</strong> <strong>the</strong> achievement of<br />

individual targets. Targets are set each <strong>year</strong>. The non-financial <strong>and</strong> individual targets may include measures related to customer service <strong>and</strong> environmental per<strong>for</strong>mance<br />

<strong>and</strong> per<strong>for</strong>mance against o<strong>the</strong>r key stakeholder measures. <strong>Annual</strong> bonus awards may be made partly or wholly in shares where a participant has still to satisfy <strong>the</strong><br />

company’s minimum share ownership target.<br />

(a) 2003/04<br />

The financial per<strong>for</strong>mance measures to be used <strong>for</strong> determining annual bonuses <strong>for</strong> 2003/04 are profit be<strong>for</strong>e exceptional items, interest <strong>and</strong> tax (PBEIT) <strong>and</strong> profit be<strong>for</strong>e<br />

exceptional items <strong>and</strong> tax (PBET). A maximum award of 24 per cent of salary is allocated to each measure. One-quarter of <strong>the</strong> maximum awards becomes payable when<br />

threshold targets are met. Awards increase in value on a straight line basis until half of <strong>the</strong> maximum award is payable <strong>for</strong> achieving a target midway between <strong>the</strong> threshold <strong>and</strong><br />

stretch targets. Awards continue to increase in value on a straight line basis between <strong>the</strong> intermediate <strong>and</strong> stretch targets at which point <strong>the</strong> maximum award is payable. Thus,<br />

<strong>the</strong>re is greater incentivisation to achieve stretch targets. The stretch targets are dem<strong>and</strong>ing <strong>and</strong> achievement represents results which are in excess of expectations. One-fifth<br />

of <strong>the</strong> annual bonus, accounting <strong>for</strong> 12 per cent of salary, will depend on: achieving improvements in environmental per<strong>for</strong>mance measured by <strong>the</strong> group’s score in <strong>the</strong> Business<br />

in <strong>the</strong> Environment (BiE) index; employee related targets, measured by results achieved in <strong>the</strong> group’s culture change programme; <strong>and</strong> <strong>the</strong> achievement of individual objectives.<br />

(b) 2002/03<br />

The financial measures <strong>for</strong> <strong>the</strong> determination of annual bonuses <strong>for</strong> 2002/03 were also PBEIT <strong>and</strong> PBET. The maximum bonus opportunity allocated to <strong>the</strong>se targets was<br />

48 per cent, <strong>the</strong> same as <strong>for</strong> 2003/04. The results <strong>for</strong> <strong>the</strong> <strong>year</strong> showed that although <strong>the</strong> stretch PBET target was achieved, <strong>the</strong> stretch PBEIT was not. The total payable <strong>for</strong><br />

per<strong>for</strong>mance against financial targets was, <strong>the</strong>re<strong>for</strong>e, 47.18 per cent. Non-financial targets accounted <strong>for</strong> up to 12 per cent of salary. 6 per cent was divided between three customer<br />

service targets (interruptions in electricity supply, achievement of Ofwat levels of service <strong>for</strong> water supply <strong>and</strong> population served by failing wastewater treatment works), 3 per cent was<br />

based on <strong>the</strong> group score in <strong>the</strong> BiE index <strong>and</strong> 3 per cent based on UCan group scores in <strong>the</strong> 2003 culture profile employee questionnaire. The environmental <strong>and</strong> employee-related<br />

targets were achieved; <strong>the</strong> customer service targets were not. There<strong>for</strong>e 6 per cent bonus was payable bringing <strong>the</strong> overall bonus payable to a total of 53.18 per cent of salary.<br />

(c) Prior <strong>year</strong> annual bonuses paid in deferred shares<br />

The whole of <strong>the</strong> annual bonus awards <strong>for</strong> John Roberts <strong>and</strong> Gordon Waters in 2000 <strong>and</strong> half of <strong>the</strong> value of awards <strong>for</strong> all of <strong>the</strong> executive directors in 2001 were<br />

satisfied by <strong>the</strong> grant of contingent rights to receive shares in <strong>the</strong> company to be purchased in <strong>the</strong> market by <strong>the</strong> company’s employee share trust. The right to <strong>the</strong>se<br />

shares may be <strong>for</strong>feited in certain circumstances if an executive is not in <strong>the</strong> company’s employment when <strong>the</strong> shares are due to be transferred to him from <strong>the</strong> trust.<br />

The company does not match <strong>the</strong> number of deferred shares <strong>and</strong> <strong>the</strong>re are no additional per<strong>for</strong>mance measures associated with <strong>the</strong> release of <strong>the</strong>se shares (see table 5).<br />

40 <strong>United</strong> <strong>Utilities</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2003