United Utilities Annual Report and Financial Statements for the year

United Utilities Annual Report and Financial Statements for the year

United Utilities Annual Report and Financial Statements for the year

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

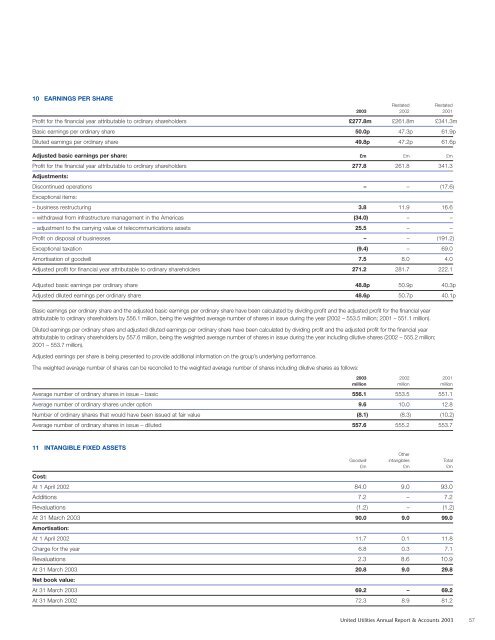

10 EARNINGS PER SHARE<br />

Restated<br />

Restated<br />

2003 2002 2001<br />

Profit <strong>for</strong> <strong>the</strong> financial <strong>year</strong> attributable to ordinary shareholders £277.8m £261.8m £341.3m<br />

Basic earnings per ordinary share 50.0p 47.3p 61.9p<br />

Diluted earnings per ordinary share 49.8p 47.2p 61.6p<br />

Adjusted basic earnings per share: £m £m £m<br />

Profit <strong>for</strong> <strong>the</strong> financial <strong>year</strong> attributable to ordinary shareholders 277.8 261.8 341.3<br />

Adjustments:<br />

Discontinued operations – – (17.6)<br />

Exceptional items:<br />

– business restructuring 3.8 11.9 16.6<br />

– withdrawal from infrastructure management in <strong>the</strong> Americas (34.0) – –<br />

– adjustment to <strong>the</strong> carrying value of telecommunications assets 25.5 – –<br />

Profit on disposal of businesses – – (191.2)<br />

Exceptional taxation (9.4) – 69.0<br />

Amortisation of goodwill 7.5 8.0 4.0<br />

Adjusted profit <strong>for</strong> financial <strong>year</strong> attributable to ordinary shareholders 271.2 281.7 222.1<br />

Adjusted basic earnings per ordinary share 48.8p 50.9p 40.3p<br />

Adjusted diluted earnings per ordinary share 48.6p 50.7p 40.1p<br />

Basic earnings per ordinary share <strong>and</strong> <strong>the</strong> adjusted basic earnings per ordinary share have been calculated by dividing profit <strong>and</strong> <strong>the</strong> adjusted profit <strong>for</strong> <strong>the</strong> financial <strong>year</strong><br />

attributable to ordinary shareholders by 556.1 million, being <strong>the</strong> weighted average number of shares in issue during <strong>the</strong> <strong>year</strong> (2002 – 553.5 million; 2001 – 551.1 million).<br />

Diluted earnings per ordinary share <strong>and</strong> adjusted diluted earnings per ordinary share have been calculated by dividing profit <strong>and</strong> <strong>the</strong> adjusted profit <strong>for</strong> <strong>the</strong> financial <strong>year</strong><br />

attributable to ordinary shareholders by 557.6 million, being <strong>the</strong> weighted average number of shares in issue during <strong>the</strong> <strong>year</strong> including dilutive shares (2002 – 555.2 million;<br />

2001 – 553.7 million).<br />

Adjusted earnings per share is being presented to provide additional in<strong>for</strong>mation on <strong>the</strong> group’s underlying per<strong>for</strong>mance.<br />

The weighted average number of shares can be reconciled to <strong>the</strong> weighted average number of shares including dilutive shares as follows:<br />

2003 2002 2001<br />

million million million<br />

Average number of ordinary shares in issue – basic 556.1 553.5 551.1<br />

Average number of ordinary shares under option 9.6 10.0 12.8<br />

Number of ordinary shares that would have been issued at fair value (8.1) (8.3) (10.2)<br />

Average number of ordinary shares in issue – diluted 557.6 555.2 553.7<br />

11 INTANGIBLE FIXED ASSETS<br />

O<strong>the</strong>r<br />

Goodwill intangibles Total<br />

£m £m £m<br />

Cost:<br />

At 1 April 2002 84.0 9.0 93.0<br />

Additions 7.2 – 7.2<br />

Revaluations (1.2) – (1.2)<br />

At 31 March 2003 90.0 9.0 99.0<br />

Amortisation:<br />

At 1 April 2002 11.7 0.1 11.8<br />

Charge <strong>for</strong> <strong>the</strong> <strong>year</strong> 6.8 0.3 7.1<br />

Revaluations 2.3 8.6 10.9<br />

At 31 March 2003 20.8 9.0 29.8<br />

Net book value:<br />

At 31 March 2003 69.2 – 69.2<br />

At 31 March 2002 72.3 8.9 81.2<br />

<strong>United</strong> <strong>Utilities</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2003 57