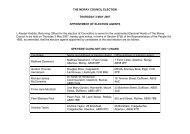

Section 5 - Home ownership and mortgage difficulties - The Moray ...

Section 5 - Home ownership and mortgage difficulties - The Moray ...

Section 5 - Home ownership and mortgage difficulties - The Moray ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5. <strong>Home</strong> <strong>ownership</strong> <strong>and</strong> <strong>mortgage</strong> <strong>difficulties</strong><br />

In <strong>Moray</strong>, approximately 64% 1 of the population own their own home. Many people<br />

want to own their own home but it can be difficult if you have limited financial<br />

resources.<br />

This section has information to help you become a home owner or to help those who<br />

own their home but are at risk of losing it.<br />

5.1 Buying or building a new home<br />

5.1.1 <strong>Home</strong> Report<br />

Although there are some exceptions, most properties marketed for sale in Scotl<strong>and</strong><br />

must have a <strong>Home</strong> Report. A <strong>Home</strong> Report gives prospective buyers information<br />

about the property before they make an offer.<br />

More information on <strong>Home</strong> Reports is available online at<br />

www.scotl<strong>and</strong>.gov.uk/Topics/Built-Environment/Housing/BuyingSelling/<strong>Home</strong>-<br />

Report.<br />

A home report is made up of three documents; a single survey, energy report <strong>and</strong><br />

property questionnaire. <strong>The</strong>se are explained in more detail below.<br />

Single survey <strong>and</strong> valuation<br />

A surveyor assesses <strong>and</strong> rates the accessibility <strong>and</strong> condition of a property. This<br />

will include a valuation, which buyers can use to secure a <strong>mortgage</strong>, <strong>and</strong> an<br />

accessibility audit for people with specific needs.<br />

Energy report (<strong>and</strong> Energy Performance Certificate)<br />

A surveyor assesses the property’s environmental impact, giving it an energy<br />

efficiency rating <strong>and</strong> practical advice on how to improve the rating of the property<br />

<strong>and</strong> save on energy bills. Properties are graded by b<strong>and</strong>ings which allow buyers to<br />

compare <strong>and</strong> identify which homes perform better.<br />

Property questionnaire<br />

<strong>The</strong> seller has to fill this in to give buyers helpful information such as Council Tax<br />

b<strong>and</strong>, available parking, service provider details <strong>and</strong> alterations that the seller has<br />

carried out to the property.<br />

1 <strong>Moray</strong> Housing Need <strong>and</strong> Dem<strong>and</strong> Assessment – Table 5.1 <strong>Moray</strong> Housing Tenure Profile 2001<br />

<strong>and</strong> 2010.<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 1

5.1.2 Buying a property<br />

Finding a property<br />

If you are interested in buying a property <strong>and</strong> want to know what is available, you<br />

can:<br />

Contact the solicitors or estate agents listed in Appendix B;<br />

Read the advertisements in the following local newspapers which are<br />

available from most newsagents or search online. Some newspapers have a<br />

housing supplement:<br />

Banffshire Advertiser out every Tuesday not available online<br />

Forres Gazette out every Tuesday www.forres-gazette.co.uk<br />

Northern Scot out every Friday www.northern-scot.co.uk<br />

Press <strong>and</strong> Journal out every weekday www.press<strong>and</strong>journal.co.uk<br />

<strong>and</strong> Saturday<br />

Scot-Ads<br />

out every<br />

Wednesday <strong>and</strong><br />

Saturday<br />

www.scot-ads.com<br />

<strong>The</strong> <strong>Moray</strong> Solicitors Property Centre publishes a property journal every<br />

month. You can get a copy by contacting them (see Appendix B) or visit their<br />

website at www.spcmoray.com.<br />

Check with developers in the area who may have a show home you can visit.<br />

Buying sheltered or retirement housing<br />

Sheltered or retirement housing is a development of purpose-built homes with<br />

certain amenities. A development could be a block of flats, or could consist of<br />

individual or linked bungalows. Some developments contain both. Amenities may<br />

include communal facilities such as a lounge, laundry <strong>and</strong> guest bedroom(s).<br />

In most developments there will be an emergency alarm system <strong>and</strong>/or the services<br />

of a warden who may or may not be resident. <strong>The</strong> main duties of a warden are to<br />

act as a good neighbour, summon help in an emergency <strong>and</strong> to make sure that the<br />

common areas are looked after. Provision will be made for the cleaning,<br />

maintenance <strong>and</strong> insurance of the communal parts. Services <strong>and</strong> amenities will be<br />

paid for by a service charge.<br />

You can search for sheltered or retirement housing online at www.housingcare.org.<br />

You can also search on the Scottish Government website at<br />

www.scotl<strong>and</strong>.gov.uk/Housekey/RetirementHousing.aspx.<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 2

5.1.3 House prices <strong>and</strong> local variations<br />

<strong>The</strong> following table shows median prices of residential house sales completed<br />

during 2010 <strong>and</strong> 2011 by Housing Market Area (HMA) (housing search area).<br />

Housing Market Area<br />

2010 2011 % change<br />

£ £<br />

<strong>Moray</strong> 125,000 125,000 -<br />

Buckie HMA 125,000 115,000 - 8%<br />

Cairngorms HMA* - - -<br />

Elgin HMA 142,000 125,000 -12%<br />

Forres HMA 141,000 151,000 7.1%<br />

Keith HMA 120,000 140,000 16.7%<br />

Speyside HMA 124,900 117,000 -6.3%<br />

Source: Scottish Government LHS Datapack: SASINES<br />

* Not enough house sales to reach a valid conclusion for area<br />

<strong>The</strong> number of house sales completed in <strong>Moray</strong> during 2011 was 1021, a decrease<br />

of around 22% on the previous year. <strong>The</strong>re was no change to the median price for a<br />

property in <strong>Moray</strong>.<br />

<strong>The</strong> areas with the biggest drop in house prices were Elgin (-12%), Buckie (- 8%)<br />

<strong>and</strong> Speyside (-6.3%). <strong>The</strong> Keith area had the largest increase at almost 17%,<br />

followed by the Forres area at 7%.<br />

5.1.4 MI New <strong>Home</strong><br />

It can be difficult for people to buy a home with a <strong>mortgage</strong>, if they have not been<br />

able to save enough of a deposit. <strong>The</strong> MI New <strong>Home</strong> scheme helps creditworthy<br />

borrowers with a 5-10% deposit who meet the lender’s affordability requirements to<br />

buy a new build property costing less than £250,000.<br />

Find out if you qualify for the scheme <strong>and</strong> get details for participating builders on the<br />

MI New <strong>Home</strong> website at www.homesforscotl<strong>and</strong>.com/mi_new_home.aspx.<br />

<strong>The</strong> scheme is expected to run until 31 March 2015.<br />

5.2 Low-cost Initiative for first time buyers (LIFT)<br />

5.2.1 New Supply Shared Equity<br />

This scheme aims to help people on low incomes who want to buy a new home from<br />

a Registered Social L<strong>and</strong>lord but who cannot afford to pay the full price. <strong>The</strong><br />

scheme is aimed at first time buyers but also aims to help those with a disability (see<br />

section 8) or those affected by a change in circumstances such as a marriage<br />

break-up.<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 3

You will normally be expected to pay a share of between 60% <strong>and</strong> 90% of the price<br />

of a property, with the rest held by a Registered Social L<strong>and</strong>lord using grant funding<br />

from the Scottish Government. In most cases you will have the option to increase<br />

your stake after two years.<br />

You can get more information online at www.scotl<strong>and</strong>.gov.uk/Topics/Built-<br />

Environment/Housing/BuyingSelling/lift/FTBNSSES or contact:<br />

<strong>The</strong> Scottish Government<br />

HaRCCoG - 1st Floor<br />

Longman House<br />

28 Longman Road<br />

Inverness<br />

IV1 1SF<br />

Phone: 0300 020 1200<br />

Fax: 0300 020 1201<br />

Email: housingsupply@scotl<strong>and</strong>.gsi.gov.uk<br />

5.2.2 Open Market Shared Equity<br />

This scheme aims to help people who want to own a home but who cannot afford to<br />

pay the full price on the open market. <strong>The</strong> scheme is aimed at priority groups who<br />

are first time buyers such as social renters, members of the armed forces, veterans<br />

who have left the armed forces within the past year, <strong>and</strong> widows, widowers <strong>and</strong><br />

other partners of service personnel.<br />

You will normally be expected to pay for a share of between 60% <strong>and</strong> 90% of the<br />

price of a property <strong>and</strong> the Scottish Government will help fund the rest. Your lender<br />

may need a modest deposit. In most cases you will have the option to increase your<br />

stake after two years, but you will not have the option to reduce your share.<br />

<strong>The</strong>re are limits on the prices of homes bought under the scheme.<br />

You can get more information online at www.scotl<strong>and</strong>.gov.uk/Topics/Built-<br />

Environment/Housing/BuyingSelling/lift/FTBOMSEP or contact the following<br />

Registered Social L<strong>and</strong>lord who operates the scheme in this area:<br />

Grampian Housing Association Ltd<br />

Huntly House<br />

74 Huntly Street<br />

Aberdeen<br />

AB10 1TD<br />

Phone: 0800 121 4496<br />

Email: info@grampianhousing.co.uk<br />

Website: www.grampianhousing.co.uk<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 4

5.3 Finding a site <strong>and</strong> building a property<br />

5.3.1 Finding a site<br />

Local knowledge is a considerable asset in finding <strong>and</strong> buying suitable sites on<br />

which to build. Sites may be advertised in local newspapers, the <strong>Moray</strong> Solicitors<br />

Property Centre, estate agents, solicitors <strong>and</strong> possibly in the Council itself. Some<br />

will have outline planning consent for housing, some will be serviced with water,<br />

electricity <strong>and</strong> gas, some will have neither planning consent nor services. Do not<br />

buy a site until, at the very least, outline planning consent for housing has been<br />

granted.<br />

5.3.2 Taking the next steps <strong>and</strong> getting good professional advice<br />

Anyone wanting to build a house has to overcome a number of official hurdles<br />

before they are allowed to proceed to the bricks <strong>and</strong> mortar building stage. Even<br />

before a potential house site has been identified, or as soon as possible afterwards,<br />

you should get professional advice.<br />

5.3.3 Planning permission <strong>and</strong> building regulations<br />

Planning officials are more than happy to help anyone who is thinking of building a<br />

house with specific advice on the requirements of the planning system <strong>and</strong> more<br />

general advice on other aspects of the building process. <strong>The</strong>y have useful<br />

experience <strong>and</strong> would rather share it as early as possible to help potential housebuilders<br />

to avoid some of the pitfalls <strong>and</strong> delays that can arise from not knowing<br />

about what is needed to get planning permission.<br />

<strong>The</strong> planning officials will explain their policies on the site, design <strong>and</strong> location of<br />

any new house to be built in their area. <strong>The</strong>y will advise on the requirements for<br />

drainage from the house site, road access <strong>and</strong> water supplies <strong>and</strong> they will give<br />

advice <strong>and</strong> assistance with preparing applications for outline <strong>and</strong>/or full planning<br />

permission.<br />

For more information contact:<br />

Development Management<br />

Environmental Services<br />

<strong>The</strong> <strong>Moray</strong> Council<br />

High Street<br />

Elgin<br />

IV30 1BX<br />

Phone: 01343 563501<br />

Email: development.control@moray.gov.uk<br />

Website: www.moray.gov.uk (follow the link for environment <strong>and</strong> planning)<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 5

A Building Warrant will also be needed before work can start. Building Regulations<br />

apply to all aspects of the construction of a new dwelling or to the alteration or<br />

extension of an existing property. Once the Building St<strong>and</strong>ards Officer is satisfied<br />

that your proposals meet with Building Regulations, a Building Warrant will be<br />

approved, allowing work to start on the project. Before you move into a new<br />

property, or parts of an existing building that has been extended or renovated, it will<br />

be necessary to have your Completion Certificate accepted, confirming that the<br />

completed project complies with Building Regulations.<br />

A duty officer is available for consultation each weekday between 2pm <strong>and</strong> 4pm,<br />

either by visiting the Elgin Access Point or by contacting the Building St<strong>and</strong>ards<br />

Team on the details below.<br />

Elgin Access Point<br />

<strong>The</strong> <strong>Moray</strong> Council<br />

10 High Street<br />

Elgin<br />

IV30 1BY<br />

Phone: 01343 563243<br />

Email: building.st<strong>and</strong>ards@moray.gov.uk<br />

Website: www.moray.gov.uk (follow the link to environment <strong>and</strong> planning)<br />

You can get <strong>and</strong> application form for planning permission <strong>and</strong>/or Building Warrant<br />

visit from our website www.moray.gov.uk or your local access point.<br />

5.3.4 Legal advice<br />

You should get good independent advice from a qualified solicitor at an early stage,<br />

particularly if you do not yet have legal title to the site.<br />

5.3.5 Designing <strong>and</strong> building the house<br />

Both the planning office <strong>and</strong> local solicitors can give you names <strong>and</strong> addresses of<br />

architects <strong>and</strong> building contractors. It would be wise to ask family/friends for<br />

recommendations. <strong>The</strong> "Yellow Pages" directory also gives names of the<br />

manufacturers <strong>and</strong> suppliers of ‘kit houses’.<br />

Some building contractors <strong>and</strong> all kit suppliers offer a range of designs which, if<br />

suitable, may avoid or reduce the need to employ an architect. On the other h<strong>and</strong>,<br />

an experienced architect will also reduce the amount of time <strong>and</strong> effort that you<br />

would otherwise spend on overcoming some, or all of the hurdles, involved in<br />

building a new house.<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 6

5.3.6 Self Build Guide for Scotl<strong>and</strong><br />

If you are thinking of building a new home you may find a guide produced by the<br />

Scottish Government helpful. It is available online at<br />

www.scotl<strong>and</strong>.gov.uk/Topics/Built-Environment/Housing/BuyingSelling/selfbuild/guide.<br />

5.4 Buying your home under the ‘Right to Buy’ scheme<br />

If you are a Council tenant (or in some cases, a housing association tenant) then<br />

you may have a legal right to buy your home at a discounted price.<br />

Your may not be able to buy your home if:<br />

you became a tenant after 1 March 2011;<br />

you have a short Scottish secure tenancy;<br />

you live in a new build or new supply property (built or bought since 25 June<br />

2005);<br />

you have rent arrears or other housing related charges such as Council Tax,<br />

water or sewerage charges;<br />

we have served a Notice of Recovery of Possession on you;<br />

the property has special features <strong>and</strong>/or housing support (for example, sheltered<br />

housing);<br />

your home has been marked for demolition; or<br />

you are living in an area that has been granted Pressured Area Status because<br />

of a shortage of affordable housing (this is explained in more detail in section<br />

5.5.1).<br />

<strong>The</strong> details of whether you have a right to buy your home are complex <strong>and</strong> depend<br />

on when your tenancy started.<br />

If your tenancy started before 30 September 2002<br />

You have the preserved right to buy. This means you may qualify to buy your home<br />

after two years. <strong>The</strong> minimum discount for a house is 32% <strong>and</strong> rises by 1% each<br />

year up to a maximum of 60%. For a flat this starts at 44% after 2 years <strong>and</strong> rises<br />

by 2% per year up to a maximum of 70%. You keep the original right to buy as long<br />

as you stay in the same house.<br />

If your tenancy started after 30 September 2002<br />

You have the modernised right to buy. This means you may qualify to buy your<br />

home if you have been a tenant for five years. For houses <strong>and</strong> flats the discount<br />

starts at 20% after 5 years <strong>and</strong> rises 1% each year up to a maximum of 35% of the<br />

market value or £15,000 whichever is the lower.<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 7

More information<br />

If you are thinking about buying your home you should contact us for an application<br />

form <strong>and</strong> a more detailed information booklet – these are available from your local<br />

access point. Your filled in form should be returned to our Legal <strong>and</strong> Committee<br />

<strong>Section</strong>. For more information contact us on 0300 123 4566.<br />

You should be aware that the right to buy transaction – from the date of application<br />

to the date of legal completion of the purchase – takes around six months.<br />

Remember, if you sell your home within three years of when you accepted our offer,<br />

you will have to pay back all or some of the discount.<br />

5.4.1 Pressured Area Status<br />

<strong>The</strong> purpose of a pressured area status designation is to protect the amount of<br />

affordable rented housing <strong>and</strong> to make sure that there are enough houses for<br />

people who need them.<br />

<strong>The</strong> Housing (Scotl<strong>and</strong>) Act 2010 introduced more flexibility <strong>and</strong> local control over<br />

pressured-area designations giving local authorities the power to make, amend <strong>and</strong><br />

revoke pressured designations.<br />

Before an area or property type can be designated as ‘pressured’, we must be able<br />

to show that:<br />

the need for social housing in the area is likely to exceed supply; <strong>and</strong><br />

this is likely to be made worse by tenants buying their homes.<br />

<strong>The</strong> effect of Pressured Area Status<br />

A pressured area designation suspends the ‘Right to Buy’ for the following tenants:<br />

tenants who have taken out a new tenancy in the area on or after 30 September<br />

2002 (the date of the introduction of the Scottish Secure Tenancy);<br />

tenants whose tenancy was created before the introduction of the Scottish<br />

Secure Tenancy who did not previously have the right to buy entitlement; <strong>and</strong><br />

tenants who have succeeded a tenancy following 30 September 2002 (unless<br />

they were a level one successor). That is a spouse, joint tenant or co-habitee<br />

(providing the house has been the co-habitee’s sole or principal home for six<br />

months prior to the tenant’s death). In all cases, the house of the deceased<br />

tenant must have been the only or principal home of the qualifying person.<br />

Tenancies created before the introduction of the Scottish Secure Tenancy <strong>and</strong><br />

which were converted to the Scottish Secure Tenancy will not be affected by the<br />

suspension as long as:<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 8

efore 30 September 2002 they had a Right to Buy entitlement as a result of<br />

having a secure or assured tenancy with the preserved right to buy; <strong>and</strong><br />

they have not succeeded to their tenancy after 30 September 2002.<br />

Which tenants does it affect?<br />

Essentially all tenants who have the modernised Right to Buy will have their<br />

entitlement suspended. It does not affect the rights of tenants with the original right<br />

to buy (except for tenants who have succeeded to the original right to buy after 30<br />

September 2002).<br />

Any tenant who has started a new tenancy in the area will be covered by pressured<br />

area status designation. This includes tenants who, after 30 September 2002:<br />

transfer from another house owned by us or another registered social l<strong>and</strong>lord;<br />

mutually exchange their home; or<br />

succeed to their tenancy (if they are a level two or three successor. That is they<br />

are a member of the deceased tenant’s family who is aged 16 years or a carer).<br />

Length of suspension of the Right to Buy<br />

<strong>The</strong> pressured designation allows for a suspension period of ten years or less.<br />

Although ten years is the maximum period, we may decide on a further period of<br />

pressured designation, if we feel that it is necessary. We will assess each area<br />

individually.<br />

Areas granted Pressured Area Status<br />

<strong>The</strong> locations on the next page have been granted pressured area status.<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 9

Housing market area Town/area Properties affected Right to buy<br />

suspended until<br />

Buckie Buckie – Buckpool All 26/01/2016<br />

Buckie – Central 1 bedroom <strong>and</strong> 4+<br />

bedroom properties<br />

only<br />

Cullen<br />

Lintmill<br />

Findochty<br />

Portessie<br />

Porgordon<br />

Portknockie<br />

Rathven<br />

05/03/2022<br />

Cairngorms Tomintoul All 17/05/2015<br />

Tomnavoulin<br />

Elgin Burghead All 26/01/2016<br />

Duffus<br />

Elgin<br />

Hopeman<br />

Lossiemouth<br />

Clackmarras 1 bedroom <strong>and</strong> 3+<br />

bedroom properties<br />

only<br />

Fochabers<br />

Garmouth<br />

Lhanbryde<br />

Miltonbrae<br />

Mosstodloch<br />

Urquhart<br />

05/03/2022<br />

Forres Forres All properties 16/02/2014<br />

Alves 26/01/2016<br />

Brodie<br />

Burghead<br />

Dallas<br />

Dunphail<br />

Dyke<br />

Findhorn<br />

Half Davoch Dunphail<br />

Kinloss<br />

Rafford<br />

Keith Drummuir 1 bedroom <strong>and</strong> 4+<br />

bedroom properties<br />

only<br />

Fife Keith<br />

Keith – Central<br />

Newmill<br />

Rothiemay<br />

05/03/2022<br />

Speyside Aberlour All properties 17/05/2015<br />

Archiestown<br />

Craigellachie<br />

Dufftown<br />

Glenallachie<br />

Glenlivet<br />

Knock<strong>and</strong>o<br />

Marypark<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 10

5.5 Mortgage arrears or payment problems<br />

If you are finding it hard to keep up with <strong>mortgage</strong> payments then you should try to<br />

discuss this with your lender as soon as possible. Repossession is a last resort, so<br />

you may be able to reach an agreement as to how you will address the arrears.<br />

5.5.1 Get free independent advice<br />

You could be at risk of losing your home if you fall behind with your <strong>mortgage</strong><br />

payments. If you are having problems paying your <strong>mortgage</strong> it is important that you<br />

get advice as soon as possible. Even if your lender has already taken court action,<br />

it may be possible to stop or delay repossession.<br />

You can get free help <strong>and</strong> practical advice from:<br />

Citizens Advice Bureau<br />

30-32 Batchen Street<br />

Elgin<br />

IV30 1BS<br />

Phone: 01343 550088<br />

E-mail: bureau@moraycab.casonline.org.uk<br />

<strong>Moray</strong> Council Trading St<strong>and</strong>ards<br />

Money Advice Service<br />

232 High Street<br />

Elgin<br />

IV30 1DJ<br />

Phone: 01343 554623<br />

E-mail: money.advice@moray.gov.uk<br />

5.5.2 <strong>Home</strong> Owners’ Support Fund<br />

If you own your home <strong>and</strong> are in danger of having it repossessed because you are<br />

having problems keeping up with <strong>mortgage</strong> payments then there are schemes that<br />

can help you to stay in your home.<br />

Before applying for either of the schemes you must have:<br />

1. Tried to reach an agreement on how to manage your arrears with the lender;<br />

<strong>and</strong><br />

2. Received independent advice about your financial situation from an approved<br />

advisor (see section 5.6.1).<br />

An advisor will be able to tell you if you are eligible for either of these schemes <strong>and</strong><br />

should be able to help you get <strong>and</strong> fill in an application form.<br />

You can get more information about either of the schemes online at<br />

www.scotl<strong>and</strong>.gov.uk/Topics/Built-<br />

Environment/Housing/privateowners/Repossession/hosf-1 or contact:<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 11

Scottish Government - <strong>Home</strong> Owners' Support Fund Team<br />

Phone: 0845 279 9999<br />

Email: homeownersfund@scotl<strong>and</strong>.gsi.gov.uk<br />

Mortgage to Rent Scheme<br />

If you apply successfully for the Mortgage to Rent scheme, your home will be bought<br />

by a social l<strong>and</strong>lord but you will continue to live there as a tenant. Your new<br />

l<strong>and</strong>lord will get funding from the Scottish Government to carry out any necessary<br />

repairs so they can charge you a reasonable rent.<br />

Due to changes introduced under the Housing (Scotl<strong>and</strong>) Act 2010, if you are<br />

accepted for the Mortgage to Rent scheme then you will not have the Right to Buy<br />

your home from the social l<strong>and</strong>lord.<br />

Mortgage to Shared Equity Scheme<br />

<strong>The</strong> Mortgage to Shared Equity (MSE) scheme allows home owners who can no<br />

longer afford their <strong>mortgage</strong>s <strong>and</strong> who have at least 25 per cent equity in their<br />

property to reduce their level of secured debt while keeping a stake in the home.<br />

Those that bought their home under the Scottish Government’s funded shared<br />

<strong>ownership</strong> or shared equity schemes will not be considered under the Mortgage to<br />

Shared Equity scheme.<br />

5.5.3 Help to pay <strong>mortgage</strong> interest<br />

Support for Mortgage Interest (SMI) payments can help homeowners with <strong>mortgage</strong><br />

interest payments <strong>and</strong> interest on loans for repairs <strong>and</strong> improvements. SMI is<br />

usually paid directly to the lender <strong>and</strong> will only help pay the interest, not the amount<br />

you borrowed.<br />

More information can be found at your local Jobcentre Plus or online at<br />

www.gov.uk/support-for-<strong>mortgage</strong>-interest/overview.<br />

If you were getting Support for Mortgage Interest (SMI) but your situation changes<br />

(for example because you are returning to work, working more hours or earning<br />

more) then you may be entitled to Mortgage Interest Run On (MIRO). You will need<br />

to tell your local Jobcentre Plus about the change to your circumstances, but you<br />

should get these payments automatically.<br />

Updated: 04 December 2012 <strong>Section</strong> 5 Page 12