- Page 1 and 2:

THE US CONTACT CENTER DECISION-MAKE

- Page 3 and 4:

At Syntellect, we help our customer

- Page 5 and 6:

Changes in contact center size, ope

- Page 7 and 8:

LIST OF TABLES FIGURE 1: VERTICAL M

- Page 9 and 10:

FIGURE 83: AVERAGE TIME TAKEN TO RE

- Page 11 and 12:

INTRODUCTION AND METHODOLOGY The "U

- Page 13 and 14:

SIZE BAND Almost every survey quest

- Page 15 and 16:

DISTRIBUTION AND USE OF THIS REPORT

- Page 17 and 18: QUALITY MANAGEMENT AND IMPROVEMENT

- Page 19 and 20: Smaller contact centers are much le

- Page 21 and 22: • Demonstrating the investment a

- Page 23 and 24: Figure 5: Supervisor activities Sup

- Page 25 and 26: way, the real-time call statistics

- Page 27 and 28: functionality, in some form, althou

- Page 29 and 30: Management information systems inte

- Page 31 and 32: Public sector and outsourcing conta

- Page 33 and 34: Figure 13: Inhibitors to scripting

- Page 35 and 36: The following table shows how custo

- Page 37 and 38: The following figure shows that res

- Page 39 and 40: Despite customer satisfaction being

- Page 41 and 42: Looking in more depth about how dis

- Page 43 and 44: COMPLAINTS John Seddon uses the ter

- Page 45 and 46: can see customers calling into the

- Page 47 and 48: Virtual queuing and call-back, when

- Page 49 and 50: INDUCTION COURSE TRAINING METHODS R

- Page 51 and 52: TIME REQUIRED TO BECOME FULLY-PRODU

- Page 53 and 54: INDUCTION COURSE COSTS The cost of

- Page 55 and 56: ONGOING TRAINING AND COACHING Once

- Page 57 and 58: Quite apart from the time spent on

- Page 59 and 60: MAXIMIZING EFFICIENCY AND AGENT OPT

- Page 61 and 62: CONTACT CENTER PERFORMANCE METRICS

- Page 63 and 64: Customer loyalty / lifetime value /

- Page 65 and 66: Average call duration varies betwee

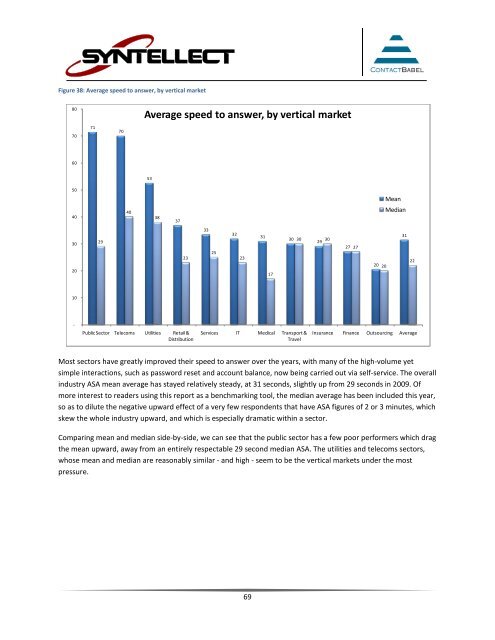

- Page 67: CALL ABANDONMENT Call abandonment r

- Page 71 and 72: FIRST-CALL RESOLUTION The ability t

- Page 73 and 74: message, the business has less oppo

- Page 75 and 76: CALL TRANSFERS This metric indicate

- Page 77 and 78: BUDGET This section looks at how co

- Page 79 and 80: CHANGES IN CONTACT CENTER SIZE, OPE

- Page 81 and 82: Respondents expect the next 12 mont

- Page 83 and 84: Looking at the change in capital ex

- Page 85 and 86: VIRTUAL CONTACT CENTERS The applica

- Page 87 and 88: Linking contact centers together ca

- Page 89 and 90: Figure 52: Benefits of virtualizing

- Page 91 and 92: HOMEWORKING AND TELECOTTAGES Homewo

- Page 93 and 94: center respondents are concerned ab

- Page 95 and 96: "Data security issues are a concern

- Page 97 and 98: "Many staff would not have anywhere

- Page 99 and 100: Knowledge workers can be incorporat

- Page 101 and 102: choose the applications that exactl

- Page 103 and 104: Figure 60: Current use of IP, by co

- Page 105 and 106: Figure 62: Main drivers for moving

- Page 107 and 108: INCREASING EFFICIENCY AND EFFECTIVE

- Page 109 and 110: Such an approach can have severe pr

- Page 111 and 112: The following table shows the knowl

- Page 113 and 114: VOICE BIOMETRICS Until a few years

- Page 115 and 116: The amount of time required to auth

- Page 117 and 118: THE FUTURE OF IDENTITY AUTHENTICATI

- Page 119 and 120:

CTI, CALL ROUTING AND SCREEN POPPIN

- Page 121 and 122:

control is of great value to any bu

- Page 123 and 124:

Fulfilling service levels while man

- Page 125 and 126:

Figure 74: Use of workforce managem

- Page 127 and 128:

HEADSETS There are various factors

- Page 129 and 130:

HEADSET REPLACEMENT AND COST Around

- Page 131 and 132:

IP headsets and homeworkers The hom

- Page 133 and 134:

Channel Current use Drivers Inhibit

- Page 135 and 136:

“A satisfied customer is the best

- Page 137 and 138:

physical store. Of course, not all

- Page 139 and 140:

SMS and web collaboration - are sti

- Page 141 and 142:

Email response handling times have

- Page 143 and 144:

MULTIMEDIA BLENDING There is no gen

- Page 145 and 146:

MULTIMEDIA BLENDING AND ATTRITION R

- Page 147 and 148:

NICHE CHANNELS Apart from email, wh

- Page 149 and 150:

CUSTOMER REACTION TO SMS Customer r

- Page 151 and 152:

VIDEO AND IVVR Away from the self-s

- Page 153 and 154:

Figure 90: Advantages and disadvant

- Page 155 and 156:

Although self-service is in widespr

- Page 157 and 158:

The utilities sector is a leader in

- Page 159 and 160:

FROM TOUCHTONE IVR TO AUTOMATED SPE

- Page 161 and 162:

SOCIAL NETWORKING Second Life and t

- Page 163 and 164:

Customer communities In her book, T

- Page 165 and 166:

• Firms with already strong brand

- Page 167 and 168:

Figure 94: What effect will social

- Page 169 and 170:

The business objective of CRM is to

- Page 171 and 172:

and insurance respondents were keen

- Page 173 and 174:

HOSTED AND MANAGED SOLUTIONS Buildi

- Page 175 and 176:

WHAT TYPES OF COMPANY SHOULD CONSID

- Page 177 and 178:

DRIVERS FOR HOSTED AND MANAGED SOLU

- Page 179 and 180:

o o Low-risk ability to start up or

- Page 181 and 182:

o Network solutions can provide bac

- Page 183 and 184:

CHECKLIST WHEN CHOOSING A HOSTED/NE

- Page 185 and 186:

OUTBOUND AUTOMATION The traditional

- Page 187 and 188:

Vertical market patterns are very d

- Page 189 and 190:

EFFECTS OF LEGISLATION The Do-Not-C

- Page 191 and 192:

THE ROLE OF MOBILE TELEPHONY ON OUT

- Page 193 and 194:

Figure 105: Agent positions by US d

- Page 195 and 196:

DIVISIONAL RATINGS The cost-effecti

- Page 197 and 198:

It is controversial, and worse, ris

- Page 199 and 200:

• Adverse affect on contact cente

- Page 201 and 202:

Around half of contact centers have

- Page 203 and 204:

It is the medium and large operatio

- Page 205 and 206:

The inbound sector has experienced

- Page 207 and 208:

METHODS OF MOTIVATING AND RETAINING

- Page 209 and 210:

DESTINATIONS OF DEPARTING AGENTS De

- Page 211 and 212:

The medical and outsourcing sectors

- Page 213 and 214:

RECRUITMENT Rather than just asking

- Page 215 and 216:

Figure 123: The effectiveness of re

- Page 217 and 218:

MOST IMPORTANT ATTRIBUTES OF A SUCC

- Page 219 and 220:

SALARIES The human element to conta

- Page 221 and 222:

NEW AGENT SALARIES Mean average sta

- Page 223 and 224:

SALARIES BY CONTACT CENTER ACTIVITY

- Page 225 and 226:

Small contact centers tend to pay b

- Page 227 and 228:

STRATEGIC DIRECTIONS Most of this r

- Page 229 and 230:

THE USE OF TACTICAL AND OPERATIONAL

- Page 231 and 232:

“Flexibility of quickly adding ag

- Page 233 and 234:

• Outsourcer's key IT supplier re

- Page 235 and 236:

Other areas that have grown in impo

- Page 237 and 238:

Increasing the levels of self-servi

- Page 239:

APPENDIX: ABOUT CONTACTBABEL Contac