Mamut Payroll

Mamut Payroll

Mamut Payroll

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MAMUT PAYROLL<br />

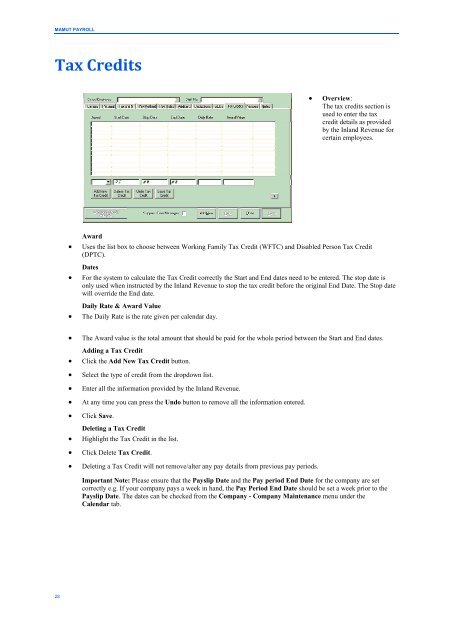

Tax Credits<br />

• Overview:<br />

The tax credits section is<br />

used to enter the tax<br />

credit details as provided<br />

by the Inland Revenue for<br />

certain employees.<br />

Award<br />

• Uses the list box to choose between Working Family Tax Credit (WFTC) and Disabled Person Tax Credit<br />

(DPTC).<br />

Dates<br />

• For the system to calculate the Tax Credit correctly the Start and End dates need to be entered. The stop date is<br />

only used when instructed by the Inland Revenue to stop the tax credit before the original End Date. The Stop date<br />

will override the End date.<br />

Daily Rate & Award Value<br />

• The Daily Rate is the rate given per calendar day.<br />

• The Award value is the total amount that should be paid for the whole period between the Start and End dates.<br />

Adding a Tax Credit<br />

• Click the Add New Tax Credit button.<br />

• Select the type of credit from the dropdown list.<br />

• Enter all the information provided by the Inland Revenue.<br />

• At any time you can press the Undo button to remove all the information entered.<br />

• Click Save.<br />

Deleting a Tax Credit<br />

• Highlight the Tax Credit in the list.<br />

• Click Delete Tax Credit.<br />

• Deleting a Tax Credit will not remove/alter any pay details from previous pay periods.<br />

Important Note: Please ensure that the Payslip Date and the Pay period End Date for the company are set<br />

correctly e.g. If your company pays a week in hand, the Pay Period End Date should be set a week prior to the<br />

Payslip Date. The dates can be checked from the Company - Company Maintenance menu under the<br />

Calendar tab.<br />

28