Annual Report 2007 - LivePerson

Annual Report 2007 - LivePerson

Annual Report 2007 - LivePerson

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LIVEPERSON, INC.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(In Thousands, Except Share and per Share Data)<br />

(1) Summary of Operations and Significant Accounting Policies − (continued)<br />

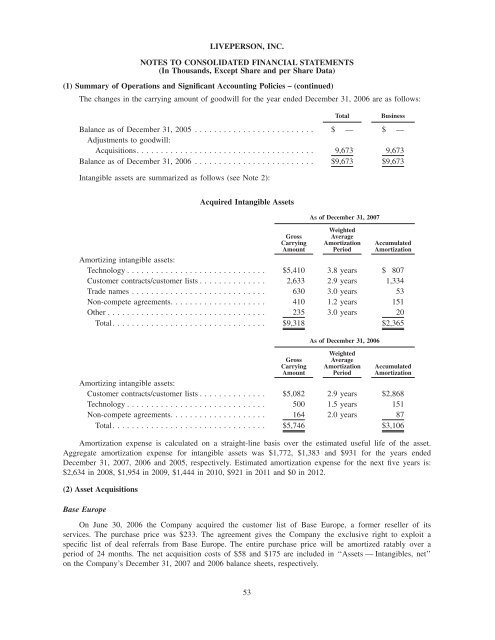

The changes in the carrying amount of goodwill for the year ended December 31, 2006 are as follows:<br />

Total<br />

Business<br />

Balance as of December 31, 2005 ......................... $ — $ —<br />

Adjustments to goodwill:<br />

Acquisitions. .................................... 9,673 9,673<br />

Balance as of December 31, 2006 ......................... $9,673 $9,673<br />

Intangible assets are summarized as follows (see Note 2):<br />

Acquired Intangible Assets<br />

Gross<br />

Carrying<br />

Amount<br />

As of December 31, <strong>2007</strong><br />

Weighted<br />

Average<br />

Amortization<br />

Period<br />

Accumulated<br />

Amortization<br />

Amortizing intangible assets:<br />

Technology ............................. $5,410 3.8 years $ 807<br />

Customer contracts/customer lists .............. 2,633 2.9 years 1,334<br />

Trade names ............................ 630 3.0years 53<br />

Non-compete agreements. ................... 410 1.2years 151<br />

Other ................................. 235 3.0years 20<br />

Total. ............................... $9,318 $2,365<br />

Gross<br />

Carrying<br />

Amount<br />

As of December 31, 2006<br />

Weighted<br />

Average<br />

Amortization<br />

Period<br />

Accumulated<br />

Amortization<br />

Amortizing intangible assets:<br />

Customer contracts/customer lists .............. $5,082 2.9 years $2,868<br />

Technology ............................. 500 1.5years 151<br />

Non-compete agreements. ................... 164 2.0years 87<br />

Total. ............................... $5,746 $3,106<br />

Amortization expense is calculated on a straight-line basis over the estimated useful life of the asset.<br />

Aggregate amortization expense for intangible assets was $1,772, $1,383 and $931 for the years ended<br />

December 31, <strong>2007</strong>, 2006 and 2005, respectively. Estimated amortization expense for the next five years is:<br />

$2,634 in 2008, $1,954 in 2009, $1,444 in 2010, $921 in 2011 and $0 in 2012.<br />

(2) Asset Acquisitions<br />

Base Europe<br />

On June 30, 2006 the Company acquired the customer list of Base Europe, a former reseller of its<br />

services. The purchase price was $233. The agreement gives the Company the exclusive right to exploit a<br />

specific list of deal referrals from Base Europe. The entire purchase price will be amortized ratably over a<br />

period of 24 months. The net acquisition costs of $58 and $175 are included in ‘‘Assets — Intangibles, net’’<br />

on the Company’s December 31, <strong>2007</strong> and 2006 balance sheets, respectively.<br />

53