Annual Report 2007 - LivePerson

Annual Report 2007 - LivePerson

Annual Report 2007 - LivePerson

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LIVEPERSON, INC.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(In Thousands, Except Share and per Share Data)<br />

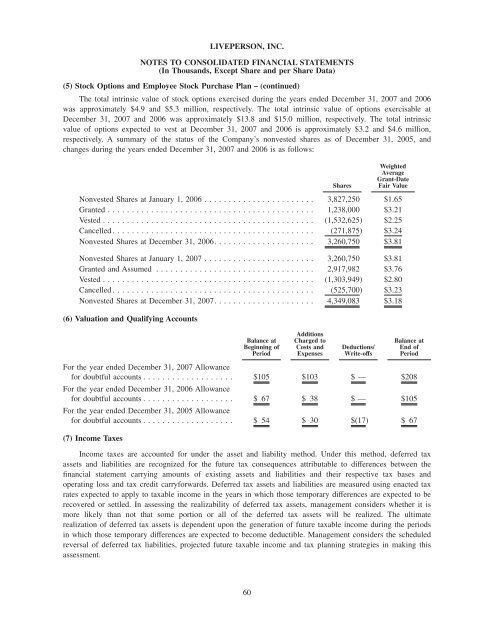

(5) Stock Options and Employee Stock Purchase Plan − (continued)<br />

The total intrinsic value of stock options exercised during the years ended December 31, <strong>2007</strong> and 2006<br />

was approximately $4.9 and $5.3 million, respectively. The total intrinsic value of options exercisable at<br />

December 31, <strong>2007</strong> and 2006 was approximately $13.8 and $15.0 million, respectively. The total intrinsic<br />

value of options expected to vest at December 31, <strong>2007</strong> and 2006 is approximately $3.2 and $4.6 million,<br />

respectively. A summary of the status of the Company’s nonvested shares as of December 31, 2005, and<br />

changes during the years ended December 31, <strong>2007</strong> and 2006 is as follows:<br />

Shares<br />

Weighted<br />

Average<br />

Grant-Date<br />

Fair Value<br />

Nonvested Shares at January 1, 2006 ....................... 3,827,250 $1.65<br />

Granted ........................................... 1,238,000 $3.21<br />

Vested ............................................ (1,532,625) $2.25<br />

Cancelled .......................................... (271,875) $3.24<br />

Nonvested Shares at December 31, 2006. .................... 3,260,750 $3.81<br />

Nonvested Shares at January 1, <strong>2007</strong> ....................... 3,260,750 $3.81<br />

Granted and Assumed ................................. 2,917,982 $3.76<br />

Vested ............................................ (1,303,949) $2.80<br />

Cancelled .......................................... (525,700) $3.23<br />

Nonvested Shares at December 31, <strong>2007</strong>. .................... 4,349,083 $3.18<br />

(6) Valuation and Qualifying Accounts<br />

Balance at<br />

Beginning of<br />

Period<br />

Additions<br />

Charged to<br />

Costs and<br />

Expenses<br />

Deductions/<br />

Write-offs<br />

Balance at<br />

End of<br />

Period<br />

For the year ended December 31, <strong>2007</strong> Allowance<br />

for doubtful accounts ................... $105 $103 $ — $208<br />

For the year ended December 31, 2006 Allowance<br />

for doubtful accounts ................... $ 67 $ 38 $— $105<br />

For the year ended December 31, 2005 Allowance<br />

for doubtful accounts ................... $ 54 $ 30 $(17) $ 67<br />

(7) Income Taxes<br />

Income taxes are accounted for under the asset and liability method. Under this method, deferred tax<br />

assets and liabilities are recognized for the future tax consequences attributable to differences between the<br />

financial statement carrying amounts of existing assets and liabilities and their respective tax bases and<br />

operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax<br />

rates expected to apply to taxable income in the years in which those temporary differences are expected to be<br />

recovered or settled. In assessing the realizability of deferred tax assets, management considers whether it is<br />

more likely than not that some portion or all of the deferred tax assets will be realized. The ultimate<br />

realization of deferred tax assets is dependent upon the generation of future taxable income during the periods<br />

in which those temporary differences are expected to become deductible. Management considers the scheduled<br />

reversal of deferred tax liabilities, projected future taxable income and tax planning strategies in making this<br />

assessment.<br />

60