Annual Report 2007 - LivePerson

Annual Report 2007 - LivePerson

Annual Report 2007 - LivePerson

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LIVEPERSON, INC.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(In Thousands, Except Share and per Share Data)<br />

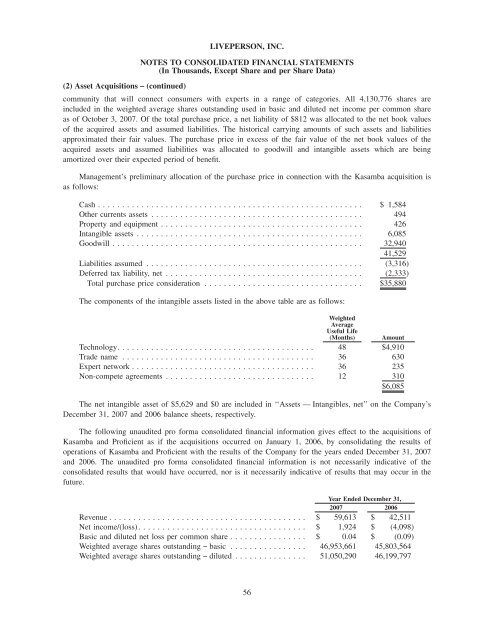

(2) Asset Acquisitions − (continued)<br />

community that will connect consumers with experts in a range of categories. All 4,130,776 shares are<br />

included in the weighted average shares outstanding used in basic and diluted net income per common share<br />

as of October 3, <strong>2007</strong>. Of the total purchase price, a net liability of $812 was allocated to the net book values<br />

of the acquired assets and assumed liabilities. The historical carrying amounts of such assets and liabilities<br />

approximated their fair values. The purchase price in excess of the fair value of the net book values of the<br />

acquired assets and assumed liabilities was allocated to goodwill and intangible assets which are being<br />

amortized over their expected period of benefit.<br />

Management’s preliminary allocation of the purchase price in connection with the Kasamba acquisition is<br />

as follows:<br />

Cash ....................................................... $ 1,584<br />

Other currents assets ............................................ 494<br />

Property and equipment .......................................... 426<br />

Intangible assets ............................................... 6,085<br />

Goodwill .................................................... 32,940<br />

41,529<br />

Liabilities assumed ............................................. (3,316)<br />

Deferred tax liability, net ......................................... (2,333)<br />

Total purchase price consideration ................................. $35,880<br />

The components of the intangible assets listed in the above table are as follows:<br />

Weighted<br />

Average<br />

Useful Life<br />

(Months) Amount<br />

Technology. ........................................ 48 $4,910<br />

Trade name ........................................ 36 630<br />

Expert network ...................................... 36 235<br />

Non-compete agreements ............................... 12 310<br />

$6,085<br />

The net intangible asset of $5,629 and $0 are included in ‘‘Assets — Intangibles, net’’ on the Company’s<br />

December 31, <strong>2007</strong> and 2006 balance sheets, respectively.<br />

The following unaudited pro forma consolidated financial information gives effect to the acquisitions of<br />

Kasamba and Proficient as if the acquisitions occurred on January 1, 2006, by consolidating the results of<br />

operations of Kasamba and Proficient with the results of the Company for the years ended December 31, <strong>2007</strong><br />

and 2006. The unaudited pro forma consolidated financial information is not necessarily indicative of the<br />

consolidated results that would have occurred, nor is it necessarily indicative of results that may occur in the<br />

future.<br />

Year Ended December 31,<br />

<strong>2007</strong> 2006<br />

Revenue ......................................... $ 59,613 $ 42,511<br />

Net income/(loss) ................................... $ 1,924 $ (4,098)<br />

Basic and diluted net loss per common share ................ $ 0.04 $ (0.09)<br />

Weighted average shares outstanding − basic ................ 46,953,661 45,803,564<br />

Weighted average shares outstanding − diluted ............... 51,050,290 46,199,797<br />

56