Certificate in Investment Management - cert im

Certificate in Investment Management - cert im

Certificate in Investment Management - cert im

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

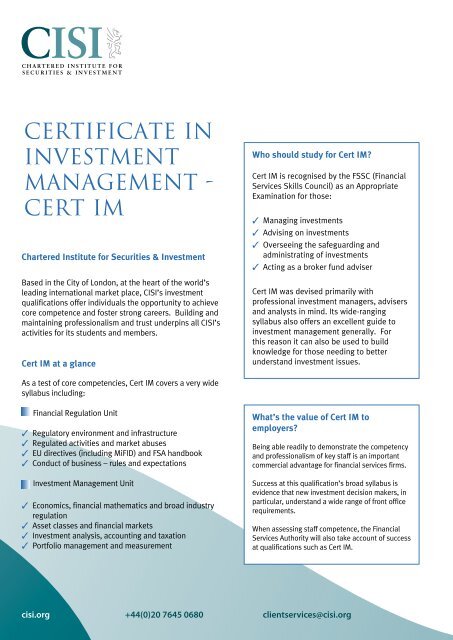

<strong>Certificate</strong> <strong>in</strong><br />

<strong>Investment</strong><br />

<strong>Management</strong> -<br />

<strong>cert</strong> <strong>im</strong><br />

Chartered Institute for Securities & <strong>Investment</strong><br />

Based <strong>in</strong> the City of London, at the heart of the world’s<br />

lead<strong>in</strong>g <strong>in</strong>ternational market place, CISI’s <strong>in</strong>vestment<br />

qualifications offer <strong>in</strong>dividuals the opportunity to achieve<br />

core competence and foster strong careers. Build<strong>in</strong>g and<br />

ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g professionalism and trust underp<strong>in</strong>s all CISI’s<br />

activities for its students and members.<br />

Cert IM at a glance<br />

Who should study for Cert IM?<br />

Cert IM is recognised by the FSSC (F<strong>in</strong>ancial<br />

Services Skills Council) as an Appropriate<br />

Exam<strong>in</strong>ation for those:<br />

3 Manag<strong>in</strong>g <strong>in</strong>vestments<br />

3 Advis<strong>in</strong>g on <strong>in</strong>vestments<br />

3 Oversee<strong>in</strong>g the safeguard<strong>in</strong>g and<br />

adm<strong>in</strong>istrat<strong>in</strong>g of <strong>in</strong>vestments<br />

3 Act<strong>in</strong>g as a broker fund adviser<br />

Cert IM was devised pr<strong>im</strong>arily with<br />

professional <strong>in</strong>vestment managers, advisers<br />

and analysts <strong>in</strong> m<strong>in</strong>d. Its wide-rang<strong>in</strong>g<br />

syllabus also offers an excellent guide to<br />

<strong>in</strong>vestment management generally. For<br />

this reason it can also be used to build<br />

knowledge for those need<strong>in</strong>g to better<br />

understand <strong>in</strong>vestment issues.<br />

As a test of core competencies, Cert IM covers a very wide<br />

syllabus <strong>in</strong>clud<strong>in</strong>g:<br />

F<strong>in</strong>ancial Regulation Unit<br />

3 Regulatory environment and <strong>in</strong>frastructure<br />

3 Regulated activities and market abuses<br />

3 EU directives (<strong>in</strong>clud<strong>in</strong>g MiFID) and FSA handbook<br />

3 Conduct of bus<strong>in</strong>ess – rules and expectations<br />

<strong>Investment</strong> <strong>Management</strong> Unit<br />

3 Economics, f<strong>in</strong>ancial mathematics and broad <strong>in</strong>dustry<br />

regulation<br />

3 Asset classes and f<strong>in</strong>ancial markets<br />

3 <strong>Investment</strong> analysis, account<strong>in</strong>g and taxation<br />

3 Portfolio management and measurement<br />

What’s the value of Cert IM to<br />

employers?<br />

Be<strong>in</strong>g able readily to demonstrate the competency<br />

and professionalism of key staff is an <strong>im</strong>portant<br />

commercial advantage for f<strong>in</strong>ancial services firms.<br />

Success at this qualification’s broad syllabus is<br />

evidence that new <strong>in</strong>vestment decision makers, <strong>in</strong><br />

particular, understand a wide range of front office<br />

requirements.<br />

When assess<strong>in</strong>g staff competence, the F<strong>in</strong>ancial<br />

Services Authority will also take account of success<br />

at qualifications such as Cert IM.<br />

cisi.org +44(0)20 7645 0680 clientservices@cisi.org

Summary Syllabus<br />

ELEMENT 1 ECONOMICS<br />

1.1 Microeconomic Theory<br />

1.2 Macroeconomic Analysis<br />

ELEMENT 2 FINANCIAL MATHEMATICS AND STATISTICS<br />

2.1 Statistics<br />

2.2 F<strong>in</strong>ancial Mathematics<br />

ELEMENT 3 INDUSTRY REGULATION<br />

3.1 Corporate Governance<br />

ELEMENT 4 ASSET CLASSES AND INVESTMENT STRATEGIES<br />

4.1 Equities<br />

4.2 Fixed Interest<br />

4.3 Cash and Money Market Instruments<br />

4.4 Derivatives<br />

4.5 Property<br />

4.6 Alternative <strong>Investment</strong>s<br />

4.7 Retail versus Institutional Share Classes<br />

“<br />

”<br />

David Kanolik, Tra<strong>in</strong><strong>in</strong>g Development Manager<br />

<strong>Investment</strong> <strong>Management</strong> Association<br />

What does Cert IM consist of?<br />

The full Cert IM consists of two separate units:<br />

3 F<strong>in</strong>ancial Regulation, a one hour - 50 question - exam<br />

3 <strong>Investment</strong> management, a two hour - 100 question - exam<br />

So, what does this mean <strong>in</strong> terms of actual jobs<br />

covered?<br />

Cert IM is an ideal <strong>in</strong>troduction to a wide range of front office<br />

roles, particularly <strong>in</strong> the areas of:<br />

CISI’s Cert IM offers <strong>Investment</strong> <strong>Management</strong> firms’<br />

employees an opportunity to learn more about portfolio<br />

management and demonstrate their expertise with<strong>in</strong> a<br />

demand<strong>in</strong>g role<br />

ELEMENT 5 FINANCIAL MARKETS<br />

5.1 Exchanges<br />

5.2 Deal<strong>in</strong>g and Settlement<br />

5.3 International Markets<br />

5.4 Foreign Exchange<br />

ELEMENT 6 ACCOUNTING<br />

6.1 Basic pr<strong>in</strong>ciples<br />

6.2 Balance Sheet<br />

6.3 Income Statement<br />

6.4 Cash Flow Statement<br />

6.5 Consolidated Company Report and Accounts<br />

ELEMENT 7 INVESTMENT ANALYSIS<br />

7.1 Fundamental and Technical Analysis<br />

7.2 Yields and Ratios<br />

7.3 Valuation<br />

ELEMENT 8 TAXATION<br />

8.1 UK Corporation Tax<br />

8.2 UK Personal Taxes<br />

8.3 Overseas Taxation<br />

ELEMENT 9 PORTFOLIO MANAGEMENT<br />

9.1 Risk and Return<br />

9.2 The Role of the Portfolio Manager<br />

9.3 Fund Characteristics<br />

3 Private client asset management<br />

3 Discretionary and specialised portfolio management<br />

3 Instititutional asset managers<br />

3 <strong>Investment</strong> bankers work<strong>in</strong>g <strong>in</strong> asset management<br />

houses<br />

How can Cert IM help my career?<br />

Cert IM is a key step <strong>in</strong> career advancement, enabl<strong>in</strong>g the<br />

successful candidate to demonstrate a very wide knowledge of<br />

<strong>in</strong>vestment issues.<br />

There is also a great opportunity for successful candidates to<br />

make the Cert IM work for them:<br />

3 Success qualifies such candidates to jo<strong>in</strong> CISI as Associate<br />

members and employers usually meet the cost of CISI<br />

membership.<br />

3 Associates can use the ACSI designation on bus<strong>in</strong>ess<br />

correspondence<br />

3 They benefit from a wide range of career support services<br />

<strong>in</strong>clud<strong>in</strong>g free Cont<strong>in</strong>u<strong>in</strong>g Professional Development (CPD)<br />

events<br />

3 They enjoy unparalleled network<strong>in</strong>g and social events<br />

ELEMENT 10 PERFORMANCE MEASUREMENT<br />

10.1 Performance Benchmarks<br />

10.2 Performance Attribution<br />

10.3 Performance Measures<br />

cisi.org +44(0)20 7645 0680 clientservices@cisi.org

How is the qualification delivered?<br />

The qualification consists of two units.<br />

<strong>Investment</strong> Two-hour paper consist<strong>in</strong>g of 100<br />

<strong>Management</strong>:<br />

multiple-choice questions<br />

FSA F<strong>in</strong>ancial<br />

Regulation/<br />

Pr<strong>in</strong>ciples of F<strong>in</strong>ancial<br />

Regulation: One-hour paper consist<strong>in</strong>g of 50<br />

multiple-choice questions<br />

Each exam can be taken at one of the computer based test<br />

centres located worldwide. CBT is operated by the CISI’s<br />

global partner Prometric. Candidates can book an exam to<br />

fit <strong>in</strong> with employment and other commitments. Candidates<br />

receive their results when they leave the test centre; a<br />

formal <strong>cert</strong>ificate is issued at a later date to successful<br />

candidates.<br />

Over 40,000 CISI qualifications are taken every year at CBT<br />

centres worldwide. For a list of centres visit cisi.org/cbt<br />

Candidates sitt<strong>in</strong>g the exam by CBT will be required to<br />

answer up to 10% additional trial questions that will not be<br />

separately identified and do not contribute to the result.<br />

Candidates will be given proportionately more t<strong>im</strong>e to<br />

complete the test.<br />

Are there any entry requirements & exemptions?<br />

There are no entry requirements. However, there are various<br />

exemptions <strong>in</strong> place for the Regulatory unit. For a list of<br />

exemptions, please visit cisi.org/exemptions<br />

How do I register for the <strong>Certificate</strong> <strong>in</strong> <strong>Investment</strong><br />

<strong>Management</strong>?<br />

Step 1: Pay a one-off registration fee<br />

Step 2: Book your exam<strong>in</strong>ation/s<br />

Step 3: Fill out a Qualifications Registration Form<br />

at cisi.org/qrf<br />

Prices<br />

Visit cisi.org/prices to as<strong>cert</strong>a<strong>in</strong> current prices.<br />

How can I study for the qualification?<br />

Formal tra<strong>in</strong><strong>in</strong>g is available through CISI Accredited<br />

Tra<strong>in</strong><strong>in</strong>g Providers. The CISI accredits those providers that<br />

demonstrate that they deliver high quality tra<strong>in</strong><strong>in</strong>g and<br />

support to candidates prepar<strong>in</strong>g to sit CISI exams. To f<strong>in</strong>d an<br />

ATP near you, visit cisi.org/ATP<br />

In addition to, or <strong>in</strong>stead of, formal tra<strong>in</strong><strong>in</strong>g, candidates<br />

can choose the self-study route. The CISI publishes<br />

comprehensive workbooks for both units. CISI workbooks<br />

offer comprehensive coverage of every area of the syllabus<br />

and the end of chapter summaries and sample questions<br />

enable candidates to ensure they are fully prepared before<br />

the exam.<br />

Recommended study t<strong>im</strong>es:<br />

<strong>Investment</strong> <strong>Management</strong>:<br />

FSA F<strong>in</strong>ancial Regulation/<br />

Pr<strong>in</strong>ciples of F<strong>in</strong>ancial Regulation:<br />

CISI membership<br />

100 hours<br />

70 hours<br />

Candidates receive free student membership on complet<strong>in</strong>g<br />

the qualification registration form. Hav<strong>in</strong>g completed the<br />

<strong>Certificate</strong> <strong>in</strong> <strong>Investment</strong> <strong>Management</strong> they are eligible for<br />

Associate membership of the CISI.<br />

To progress to full membership <strong>in</strong>dividuals need either to<br />

have been an Associate member for six years or be able<br />

to demonstrate four years logged cont<strong>in</strong>u<strong>in</strong>g professional<br />

development (CPD).<br />

Student membership benefits <strong>in</strong>clude:<br />

3 Securities & <strong>Investment</strong> Review onl<strong>in</strong>e<br />

3 discounts on conferences and tra<strong>in</strong><strong>in</strong>g courses<br />

3 onl<strong>in</strong>e dictionary of securities & <strong>in</strong>vestment terms<br />

3 four free CPD events per year<br />

To jo<strong>in</strong> 40,000 f<strong>in</strong>ancial practitioners and enjoy the benefits<br />

of CISI membership, go to cisi.org/membership<br />

Revision Express<br />

This is a valuable onl<strong>in</strong>e revision aid to be used <strong>in</strong><br />

conjunction with CISI workbooks. It tests your knowledge of<br />

the subject matter and is designed to look and feel just like<br />

the exam you will have to face.

The CISI Qualifications Summary<br />

foundation<br />

qualify<strong>in</strong>g<br />

level<br />

wholesale wealth/retail operations specialists<br />

Level 3<br />

<strong>Certificate</strong>s <strong>in</strong>:<br />

Commodity<br />

Derivatives<br />

Derivatives<br />

F<strong>in</strong>ancial<br />

Derivatives<br />

<strong>Investment</strong><br />

<strong>Management</strong><br />

Securities<br />

International<br />

<strong>Investment</strong><br />

<strong>Management</strong><br />

Global Securities<br />

The Foundation Qualification - Introduction to <strong>Investment</strong><br />

International Introduction to <strong>Investment</strong><br />

<strong>Investment</strong><br />

Advice Diploma<br />

Level 4 Diplomas<br />

<strong>in</strong>:<br />

Derivatives<br />

Private Client<br />

Advice<br />

Securities<br />

International<br />

<strong>Certificate</strong><br />

<strong>in</strong> Wealth<br />

<strong>Management</strong><br />

<strong>Investment</strong><br />

Operations<br />

<strong>Certificate</strong> (IOC),<br />

also known<br />

as <strong>Investment</strong><br />

Adm<strong>in</strong>istration<br />

Qualification<br />

(IAQ)<br />

IT <strong>in</strong> <strong>Investment</strong><br />

Operations<br />

<strong>Certificate</strong><br />

<strong>in</strong> F<strong>in</strong>ancial<br />

Services for<br />

Directors<br />

Corporate<br />

F<strong>in</strong>ance<br />

Islamic F<strong>in</strong>ance<br />

Qualification<br />

Risk <strong>in</strong> F<strong>in</strong>ancial<br />

Services<br />

Combat<strong>in</strong>g<br />

F<strong>in</strong>ancial Cr<strong>im</strong>e<br />

International<br />

Compliance<br />

Membership<br />

There is a ladder<br />

of progression<br />

for members of<br />

the Institute from<br />

Students<br />

to<br />

Associates<br />

to<br />

Members<br />

and ult<strong>im</strong>ately to<br />

Chartered<br />

Members<br />

advanced<br />

level<br />

Level 5<br />

Private Client<br />

Advice unit<br />

Advanced<br />

<strong>Certificate</strong>s <strong>in</strong>:<br />

Global Securities<br />

Operations<br />

Operational Risk<br />

and<br />

Chartered<br />

Fellows<br />

postgraduate<br />

professional<br />

level<br />

Diploma units:<br />

Bonds & Fixed<br />

Interest Markets<br />

F<strong>in</strong>ancial<br />

Derivatives<br />

Fund<br />

<strong>Management</strong><br />

Regulation &<br />

Compliance<br />

CISI Diploma*<br />

<strong>Certificate</strong> <strong>in</strong><br />

Private Client<br />

<strong>Investment</strong><br />

Advice &<br />

<strong>Management</strong>*<br />

CISI Masters<br />

<strong>in</strong> Wealth<br />

<strong>Management</strong><br />

Diploma <strong>in</strong><br />

<strong>Investment</strong><br />

Operations<br />

Diploma <strong>in</strong><br />

<strong>Investment</strong><br />

Compliance<br />

depend<strong>in</strong>g on<br />

qualifications<br />

ga<strong>in</strong>ed<br />

currently under development<br />

* RDR transitional qualification requir<strong>in</strong>g top-up CPD.<br />

CISI Offices <strong>in</strong> Dubai Dubl<strong>in</strong> Ed<strong>in</strong>burgh London Mumbai S<strong>in</strong>gapore sri lanka<br />

CERTIFICATE IN INVESTMENT MANAGEMENT (CERT IM)<br />

© 10/2010<br />

Chartered Institute for Securities & <strong>Investment</strong><br />

8 Eastcheap<br />

London EC3M 1AE<br />

All rights reserved. No part of this publication may be reproduced,<br />

stored <strong>in</strong> a retrieval system, or transmitted <strong>in</strong> any form or by any<br />

means, electronic, mechanical, photocopy<strong>in</strong>g, recorded or otherwise<br />

without the prior permission of the copyright owner.<br />

Registered charity number 1036566.