Analyze Investments

Analyze Investments

Analyze Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The balance sheet is sometimes reduced to a simple<br />

accounting equation: assets = liabilities + owner equity (see<br />

box on p. 2). Ultimately, all transactions appear within this<br />

basic equation.<br />

The balance sheet assigns values to equipment and<br />

other assets, describes amounts owed on both short- and<br />

long-term horizons, lists funds available for continued<br />

operation of the business, and determines the value of the<br />

stockholders’ equity.<br />

Keep in mind that balance sheets can become obsolete<br />

very quickly. Like your monthly bank statement, they reflect<br />

conditions on the compilation date.<br />

The major categories of assets are: current assets (items<br />

that turn over in a short period of time, such as cash, marketable<br />

securities, accounts receivable and inventories);<br />

fixed assets (buildings, land, mineral resources, heavy<br />

machinery, vehicles, etc., all of which are used over the long<br />

haul); and other assets (deposits and intangibles like copyrights<br />

and patents).<br />

Major liabilities include: current liabilities (obligations to<br />

distributors, tax authorities, employees and lenders due within<br />

one year); long-term liabilities (an assortment of debt instruments<br />

like mortgages and bonds); and owners’ equity (funds<br />

contributed by various classes of owners of<br />

the business as well as accumulated earnings<br />

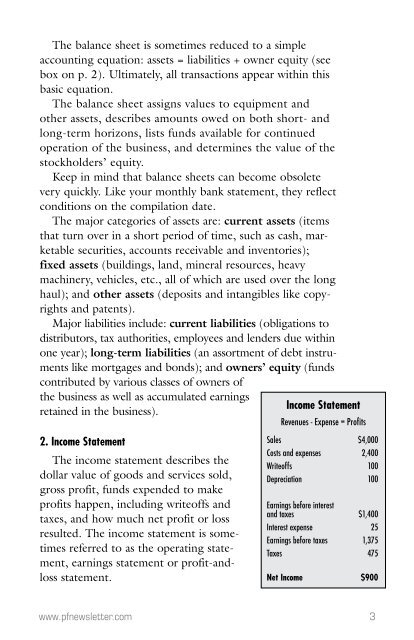

Income Statement<br />

retained in the business).<br />

Revenues - Expense = Profits<br />

2. Income Statement<br />

The income statement describes the<br />

dollar value of goods and services sold,<br />

gross profit, funds expended to make<br />

profits happen, including writeoffs and<br />

taxes, and how much net profit or loss<br />

resulted. The income statement is sometimes<br />

referred to as the operating statement,<br />

earnings statement or profit-andloss<br />

statement.<br />

Sales $4,000<br />

Costs and expenses 2,400<br />

Writeoffs 100<br />

Depreciation 100<br />

Earnings before interest<br />

and taxes $1,400<br />

Interest expense 25<br />

Earnings before taxes 1,375<br />

Taxes 475<br />

Net Income $900<br />

www.pfnewsletter.com<br />

3