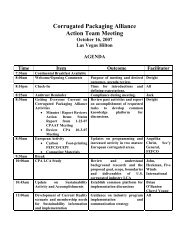

Agenda - Corrugated Packaging Council

Agenda - Corrugated Packaging Council

Agenda - Corrugated Packaging Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MEMO<br />

To:<br />

From:<br />

CC:<br />

Mike Adams – Georgia Pacific, Charles Feghali – Interstate<br />

Resources, Tom Hassfurther – <strong>Packaging</strong> Corporation of<br />

America, Glen Landau– International Paper, Mark Mathes –<br />

Vanguard <strong>Packaging</strong>, Andrew Pierson – Mid-Atlantic<br />

<strong>Packaging</strong>, Jim Porter – Rock-Tenn, Steve Strickland – Smurfit<br />

Stone, Raymond Tennison – Simpson, Ron Zimbelman –<br />

Temple-Inland<br />

Dwight Schmidt<br />

Jack Cooper – Foley & Lardner, Cathy Foley – AF&PA, Rachel<br />

Kenyon - FBA, Brian O’Banion – FBA, Cheryl Young – Cypress,<br />

Steve Young - AICC<br />

Date: March 12, 2009<br />

Re:<br />

CPA April 1, 2009 Meeting <strong>Agenda</strong><br />

Washington, DC<br />

The Willard Hotel<br />

10am – 1pm<br />

1. WELCOME AND INTRODUCTIONS – Tom Hassfurther, Co-Chair<br />

2. ANTITRUST STATEMENT – Jack Cooper<br />

3. APPROVAL 10- 7-08 MEETING MINUTES (see Attachment A)<br />

4. ACTION ITEMS REVIEW (from attached minutes)<br />

5. FINANCIAL UPDATE (see Attachment B)<br />

• Adoption of revised budget (see Attachment C)<br />

• Approval of LCA payment plan and split*<br />

*There are fewer mills and less data points and issues connected with the<br />

paperboard LCA. Staff had originally budgeted for and recommends a 60%<br />

corrugated, 40% paperboard split of the charges. This was not previously formally<br />

disclosed. This can be accomplished within our current reduced budget.<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

MEMO<br />

6. PROGESS REPORT ON DELIVERABLES<br />

• LCA<br />

o Draft Report – John Heckman of Five Winds<br />

• Critical Reviewer’s Comments<br />

• Executive Summary Content<br />

o LCA Model hosting & use proposal (see Attachment D)*<br />

*It is recommended that the attached proposal from NCASI be approved.<br />

o Recommendation on Breaking out 100% recycled data*<br />

*The technical sub-committee of the Sustainability committee has<br />

reviewed this issue and recommends against furnishing this information<br />

on an industry aggregated basis at this time due to the inability to break<br />

out the energy and climate burdens for recycled containerboard made at<br />

mixed mills. Once the LCI data is released, individual members who<br />

wish to explore the differences can substitute their disaggregated data to<br />

arrive at their own comparison.<br />

o Goal Setting for the future*<br />

*One of the stated goals of the LCA was to “identify areas where focused<br />

improvements will yield the maximum results.” In light of this we are<br />

already being asked by the Critical Review Panel to make some<br />

comment on our plans to communicate the results of this study to all<br />

industry members, identify areas in the mill and converting operations<br />

where focused efforts will have maximum impact, and set industry goals<br />

for reductions that will be measured in future LCAs. A recommendation<br />

has been made by the reviewers that once the major impact areas are<br />

defined for these unit processes a cross-function team of production,<br />

purchasing and environmental/quality personnel be tasked to identify<br />

both measures for improvement and goals for the industry to adopt and<br />

communicate.<br />

o <strong>Corrugated</strong> Carbon Calculator<br />

o 2008 Data Collection Plan*<br />

*This is the first LCA the industry has conducted and as such represents<br />

only one data-point. Our contract with the LCA provider required the<br />

completion of a model for future use by the industry and/or individual<br />

members. In an effort to develop trend information and monitor progress<br />

against goals it is recommend that the industry continue to update the<br />

model on a biennial basis in even numbered years.<br />

• Changes to AF&PA EH&S data request*<br />

*To improve the consistency and accuracy of the data for the 2008<br />

study the review panel recommends we revise the NCASI to allow<br />

all needed information to be sourced directly from the mill itself<br />

rather than some from NCASI and some from third-party sources<br />

like the Fisher database.<br />

• Changes to FBA Boxplant data request<br />

• Messaging – Mark Williams of Bader-Rudder<br />

o Tag Line and Copy development<br />

o Testing with primary audience<br />

o Collateral Material recommendations<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

MEMO<br />

• 2009 Communications Plan – Cheryl Young & Rachel Kenyon<br />

o PR, Exhibits, Presentation, Articles<br />

o Web Page redesign - Cheryl<br />

o Our Planet Update – Rachel Kenyon<br />

7. WAL-MART UPDATE (Brian O’Banion)<br />

8. CURRENT MARKETPLACE REALITY (Dwight Schmidt)<br />

• Field Updates<br />

o Competing Materials<br />

• Produce<br />

• Case Ready Meat<br />

o Wax Replacement<br />

o RFID<br />

o Sustainability<br />

• Recommendations<br />

9. REVIEW OF 2009 PLAN DELIVERABLES AND BUDGET<br />

10. DISPOSITION OF EXISTING COLLATERAL MATERIAL (see<br />

Attachment E)<br />

11. REVIEW OF NEW ACTION ITEMS<br />

12. NEXT MEETING DATE<br />

13. ADJOURN<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

To:<br />

From:<br />

CC:<br />

Mike Adams – Georgia Pacific, Charles Feghali – Interstate<br />

Resources, Bill Hoel – International Paper, Mark Mathes –<br />

Vanguard <strong>Packaging</strong>, Andrew Pierson – Mid-Atlantic<br />

<strong>Packaging</strong>, Jim Porter – Rock-Tenn, Steve Strickland – Smurfit<br />

Stone, Raymond Tennison – Simpson, Tom Walton –<br />

<strong>Packaging</strong> Corporation of America, Ron Zimbelman – Temple-<br />

Inland<br />

Dwight Schmidt<br />

Bart Doney – Temple-Inland, Jack Cooper – Foley & Lardner,<br />

Cathy Foley – AF&PA, Rachel Kenyon - FBA, Brian O’Banion –<br />

FBA, Tom Hassfurther – <strong>Packaging</strong> Corporation of America,<br />

Cheryl Young – Cypress, Steve Young - AICC<br />

Date: December 31, 2008<br />

Re:<br />

CPA October 7, 2008 Meeting Minutes<br />

Washington, DC<br />

AF&PA Offices<br />

8am-11:30am<br />

1. WELCOME AND INTRODUCTIONS – Co-Chair Mike Adams welcomed<br />

all committee members and numerous guests from the AF&PA<br />

Containerboard and Kraft sector committee who also attended the<br />

meeting.<br />

2. ANTITRUST STATEMENT – A statement incorporating both AF&PA<br />

and FBA’s antitrust guidelines was given by Jack Cooper of Foley &<br />

Lardner, CPA’s Counsel.<br />

3. APPROVAL OF March 26, 2008 MEETING MINUTES (see Appendix<br />

A). The minutes were approved as submitted.<br />

4. ACTION ITEMS REVIEW (from attached minutes)<br />

• Issue joint press release announcing AICC joining CPA. (Completed)<br />

• Focus on OCC recovery improvement for communications (Ongoing)<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

• Coordinate our Wal-Mart communications / status; make the<br />

information accessible. (Several updates have been issued to the<br />

committee.)<br />

• Develop technical articles regarding wax replacement to promote its<br />

use. (Awaiting FBA study of wax alternative implementation.)<br />

5. FINANCIAL UPDATE (see Appendix B)<br />

For the period ended August 31 st our fund balance stood at $226,412.<br />

However, this did not reflect FBA and AICC’s 2008 contributions that<br />

were billed in September. Overall, we project we have committed all of<br />

our $600,000 budget even though actual payments by year-end may not<br />

reflect this total due to lateness of LCA work and the communication<br />

program that cannot get underway until we receive the report.<br />

6. PROGESS REPORT ON DELIVERABLES<br />

• LCA Report – John Heckman of Five Winds gave an update on the<br />

current status. The report has been delayed due to the inability to<br />

address environmental discharges of mixed product mills which<br />

make up over 40% of the total containerboard output. It has been<br />

discovered recently that if we included like products (unbleached<br />

kraft) we could get to slightly over 80% which Five Winds felt was a<br />

high enough percentage to meet the approval of the expert review<br />

panel. The committee agreed that work should move ahead on this<br />

basis.<br />

o Key mill trend analysis – Since the LCA will represent only one<br />

point in time, and preliminary results show the bulk of<br />

environmental impact is at the mill level, Reid Miner of NCASI<br />

has investigated developing trend lines using 2002, 2004 and<br />

2006 data. All of the major trend emission and energy trend<br />

lines were positive and will be used to tell our story. Water<br />

usage and effluent were steady to slightly up and the group<br />

challenged us to look further back with these items since the<br />

90’s saw major focus on improving these areas.<br />

o Carbon Footprint Calculator – A carbon footprint calculator<br />

based on the industry average LCA result was approved and<br />

will be designed and made available to all industry members<br />

through the corrugated.org website.<br />

o LCA Model hosting & use – We specified one of the LCA<br />

deliverables would be a model that individual industry<br />

members could use to forego the expense of retaining an<br />

outside provider to conduct their company specific LCA. As<br />

long as they are part of our original dataset they will be able to<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

disaggregate their data and develop a result that can compare<br />

their company to the industry average. NCASI has the<br />

familiarity and capability to host the model and there may be<br />

others. Staff will develop parameters, ascertain costs and<br />

bring the plan back to the committee before moving ahead.<br />

o Policy on External Data release – One of our stated goals was<br />

to use the LCA information to populate external databases<br />

EPA, USLCI to show transparency and to remove older, less<br />

accurate information. The committee voted to move ahead<br />

with the release aggregated data including reference flows as<br />

soon as the study is complete.<br />

o Policy on Breaking out Recycled info – We have been<br />

requested to provide 100% virgin and 100% recycled<br />

information to populate the EPA WARM model. The concern<br />

is they will continue to use old information if we don’t provide<br />

new data from our study. While to committee agreed in<br />

principle that it is better to be in control the information by<br />

providing it, there was considerable concern over how it could<br />

be used to drive decisions based on incomplete information.<br />

Staff was asked to put the question in front of the technical<br />

sub-committee of the FBA Sustainability Committee for a<br />

recommendation as to how this could be handled. This<br />

committee would then consider their recommendation and<br />

make a decision prior to any information release.<br />

• Sustainability Messaging – Jon Dewitt of Artemis gave a<br />

presentation of the final messaging platform they had developed in<br />

conjunction with the marketing sub-committee of the Sustainability<br />

Committee. There was consensus that the reputation of our industry<br />

is about both doing and telling in a compelling way to adjust attitudes<br />

and behavior. Staff is to move ahead with these strategic message<br />

points, add data and proof points and use it as a foundation for our<br />

long-term Sustainability Communications plan.<br />

• Communications Plan for 2008 – Cheryl Young provided an update<br />

on communications activities completed in 2008:<br />

o Collateral Material - Sustainability Facts brochures were<br />

developed in 2008 based on available data, pending<br />

completion of the LCA study. Statistics were derived from<br />

AF&PA's EH&S report, recovery and recycling statistics,<br />

NCASI data and from FBA statistics.<br />

o Exhibits - Sustainability messages centering on renewability,<br />

recycling and reuse were promoted with exhibits and speaking<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

platforms at several industry venues and trade shows in 2008<br />

including:<br />

• FMI - Sustainability Committee*<br />

• Sustainable <strong>Packaging</strong> Coalition - Spring Meeting*<br />

• IoPP - <strong>Packaging</strong> Summit*<br />

• <strong>Packaging</strong> Strategies - Sustainable <strong>Packaging</strong> Forum<br />

• TAPPI - SuperCorrExpo<br />

• PMMI - Pack Expo<br />

o Tag Line and Copy development -- Message strategy<br />

research was completed in 2008 with Artemis Strategy Group,<br />

and a RFP was issued for creative resources to help formulate<br />

clear, concise, powerful messages for communications to be<br />

launched in 2009 and beyond. Creative will be developed<br />

along with a communications plan based on the LCA and<br />

NCASI's additional data, as well as the message strategy<br />

research conducted by Artemis.<br />

o Proof Point Development and testing -- Proof points<br />

supporting the industry message platform were developed and<br />

a draft list was distributed among committees for review. The<br />

LCA, when completed and NCASI will help fill in gaps. Final<br />

"proof points" list will provide supporting documentation for<br />

messages to be used according to audience needs. These<br />

proof points demonstrate transparency of the LCA and<br />

strengthens industry positioning. Their credibility and<br />

relevance will be tested with developed message concepts to<br />

be sure that our communications are believable and resonate<br />

with our target audiences.<br />

7. UPDATES<br />

• Sustainability – Brian O’Banion reported on the Wal-Mart<br />

sustainability activity as follows:<br />

o Work remains to correct scorecard and its underlying data.<br />

o The Extra Credit section of the scorecard has been revised.<br />

o FBA will submit updated data to EPA and GreenBlue for<br />

eventual incorporation into the WMT scorecard.<br />

o WMT is discussing scorecard phase II – country of origin;<br />

recycle content (with 100% recycle as separate material);<br />

recovery (separate value for selling and transport; also by<br />

package type (bottle vs. clamshell)).<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

o WMT is considering migrating supplier packaging data to third<br />

party database (GDSN) so other retailers could access for<br />

their own scorecard methodologies.<br />

o WMT is creating a Sustainability Index – by supplier; by<br />

product and package – as a broader tool. It will incorporate<br />

the packaging scorecard.<br />

• Competing Materials – Dwight Schmidt reported on the two areas<br />

he has been monitoring<br />

o Case Ready Meat – There has been no new developments in<br />

additional retail movement beyond Kroger to RPCs.<br />

o Produce – There are four new developments:<br />

• RPCs are very active in market areas (like the NW fruit<br />

area) that they had previously abandoned. They are<br />

using Wal-Mart as a lever, but checks with Wal-Mart<br />

confirm it is not a mandate and growers have to make<br />

sure it represents a viable economic alternative as the<br />

RPC poolers are requesting long-term contracts.<br />

Weyerhaeuser (now IP) has been working this area<br />

hard with Harry Turvey and Full Disclosure analysis<br />

that shows corrugated remains the most economically<br />

viable solution.<br />

• New tags have been developed that would allow asset<br />

as well as content tracking. RPCs are reportedly close<br />

to implementing this long-life RFID solution as soon as<br />

the price allows.<br />

• No new retailer RPC interest has been identified since<br />

the Kroger wet room item trial moved to full<br />

implementation. Further checks have substantiated<br />

that this roll-out will continue to other large SKU’s that<br />

can be easily implemented. Of course, this gives RPC<br />

poolers more critical mass to increase turns and reduce<br />

costs which, combined with our recent price increases<br />

could trigger a different economic result.<br />

• The Reusable Pallet and Container Coalition is<br />

changing its name to the Reusable <strong>Packaging</strong><br />

Association in a move to gain additional members<br />

beside traditional RPC produce poolers.<br />

• RFID – Brian O’Banion reported to the committee on the current<br />

status of RFID as follows:<br />

o There is continued activity in RFID, although much of the focus<br />

has shifted to areas beyond retail: identification, payment,<br />

reusable / returnable assets and real-time location.<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

o Failure of RFID application today is most likely due to financial<br />

challenges, not technical.<br />

o Many retailers are looking to RFID for niche applications with<br />

strong return:<br />

• usually at item level for fast-moving , higher margin<br />

items (like DVDs & video games)<br />

• Promotional items and displays to verify promotion is<br />

where it should be, when it should be<br />

• Case and pallet level tagging is not primary focus for<br />

retailers except Sam’s Club<br />

o Sam’s Club has announced a timetable to rollout RFID at the<br />

pallet, case and item level in all DC’s by November 1, 2010, with<br />

penalties for non-compliance. This is a different approach than<br />

last attempt; they hope to generate critical mass to achieve<br />

measurable benefits for RFID implementation.<br />

• Short term – major suppliers will focus on compliance;<br />

probably “slap-and-ship”<br />

• Mid-term – suppliers to examine more strategic tagging<br />

solutions, perhaps third-party re-packers and contract<br />

packagers<br />

• Longer-term – most suppliers will migrate to managing<br />

the tagging process entirely in-house or outsource it<br />

entirely to logistics firms or re-packers. If sufficient<br />

volume is achieved, manual tagging will be replaced by<br />

other methods, including “source-tagging” (pre-enabled<br />

packaging).<br />

• Wax Replacement - Dwight Schmidt gave an update:<br />

o We now have 14 certifications, 2 of them by generic<br />

marketplace suppliers<br />

o A concern was registered by one of the generic wax<br />

alternative suppliers that retailers would feel better if the<br />

certification number was printed next to the symbol as a<br />

control. The FBA Executive Committee turned down request<br />

for labeling the certification number on box due to the<br />

complexity of administration vs. the implied value.<br />

o So we have evidence to show retailers we are making<br />

progress the FBA has approved a second survey of wax and<br />

wax alternative for comparison to the original conducted in<br />

2003. It will be undertaken in the first quarter of 2009.<br />

o In an effort to keep this implementation moving we plan on<br />

publishing an update article to industry in the first quarter<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

followed by wax reduction progress report in the second<br />

quarter.<br />

8. AICC/CPA INDUSTRY-WIDE SUSTAINABILITY MEETING<br />

• October 23 & 24 in Chicago (see Appendix C) – Steve Young<br />

reported on the jointly sponsored seminar that is the second in a<br />

series initiated by AICC. The CPA will provide speakers and content<br />

for the first day while AICC will coordinate the overall conference as<br />

well as the program for the second day. All committee members<br />

were encouraged to attend and invite others.<br />

9. REVIEW OF 2009 PLAN DELIVERABLES AND BUDGET (see<br />

Appendix D)<br />

The 2009 CPA budget of $600,000 was presented and approved with<br />

the following major deliverables:<br />

• Our Planet Update – Rachel Kenyon noted that all arrangements had<br />

been made with the producers and that the script writing and then<br />

shooting at industry facilities in the Chicago area are awaiting<br />

completion of the LCA. Any companies with “B” roll scenes of mill<br />

and boxplant production are encouraged to let her know as we will<br />

not be able to accomplish all shots in the one day of filming allocated.<br />

• 2009 Communications Plan – Cheryl Young & Rachel Kenyon<br />

discussed development of a communications plan to educate target<br />

audiences about LCA results and corrugated sustainability<br />

positioning. This plan will be created upon completion of the LCA<br />

report and reviewed by FBA's communications committee for<br />

implementation in 2009-2010.<br />

• A new Willard Bishop Study to update retail, foodservice and grower<br />

attitudes toward RPC implementation. The last study was completed<br />

in early 2005.<br />

• Web Page redesign - Cheryl explained that the "public" corrugated<br />

website, www.corrugated.org, will be enhanced and redesigned in<br />

2009 to accommodate new LCA information and sustainability<br />

positioning for the corrugated industry. This site is used as an<br />

information resource for target audiences outside of the corrugated<br />

industry, including retailers, end users, supply chain members,<br />

students, NGOs and activists, and general consumers.<br />

10. REVIEW OF NEW ACTION ITEMS<br />

• Complete LCA using like products mill data approach.<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment A<br />

MEMO<br />

• Move ahead with NCASI energy and emissions graphs to tell<br />

improvement story but look expand water and effluent graphs as<br />

major gains were made in the 90’s.<br />

• Move ahead with Carbon Footprint calculator<br />

• Develop parameters, ascertain costs and bring recommendation for<br />

LCA hosting back to the committee.<br />

• Ask the technical sub-committee of the FBA Sustainability Committee<br />

for a recommendation as to how to provide the EPA with data for<br />

their WARM model and bring to committee.<br />

11. NEXT MEETING DATE<br />

The next CPA meeting will be held in conjunction with the FBA Annual<br />

meeting, the AF&PA Containerboard and Kraft Sector meeting and the<br />

AICC Spring meeting at 10:00am on April 1 st at the J.W. Marriott in<br />

Washington, DC.<br />

Respectfully submitted,<br />

Dwight C. Schmidt<br />

President<br />

These minutes have been reviewed and approved by the CPA Co-Chairman and FBA<br />

Legal Counsel.<br />

25 Northwest Point Blvd. • Suite 510 • Elk Grove Village, Illinois 60007 USA<br />

• PH: 847.364.9600 • FX: 847.364.9639

Attachment B<br />

American Forest & Paper Association<br />

Statement of Revenue and Expense<br />

964 - SA, CRATE<br />

Period Ended February 28, 2009<br />

Draft<br />

964 - SA, CRATE<br />

000000<br />

Current Month YTD YTD YTD Original Year-End Annual<br />

Actual Actual Budget Difference Budget Projection Difference<br />

Revenue<br />

Member Dues 18,720 19,696 - 19,696 - - -<br />

Total Revenue $ 18,720 $ 19,696 $ - $ 19,696 $ - $ - $<br />

-<br />

Direct Expense<br />

Meetings - - 2,166 2,166 13,000 - 13,000<br />

Meals, Travel & Entertainment 1,374 1,374 1,334 (40) 8,000 - 8,000<br />

Dues & Subscriptions - - 666 666 4,000 - 4,000<br />

Postage & Freight 18 21 - (21) - - -<br />

Outsourced Work 7,200 7,200 70,834 63,634 425,000 - 425,000<br />

Communications Development - - 20,000 20,000 120,000 - 120,000<br />

Paid Media - - 5,000 5,000 30,000 - 30,000<br />

Reproduction 3 8 - (8) - - -<br />

Total Direct Expense $ 8,596 $ 8,604 $ 100,000 $ 91,396 $ 600,000 $ - $ 600,000<br />

Total Expense $ 8,596 $ 8,604 $ 100,000 $ 91,396 $ 600,000 $ - $ 600,000<br />

Change in Net Assets $ 10,124 $ 11,092 $ (100,000) $ 111,092 $ (600,000) $ - $ 600,000<br />

$ 239,102 Carryover Fund Balance<br />

$ 250,194 Current Fund Balance<br />

FALSE Control Total 18,720 19,696 - - -<br />

Control Total 8,596 8,604 100,000 600,000 -<br />

- Check - - - - -<br />

964.xls, 1. Issue 1 of 1

AF&PA BUDGET AND PLANNING WORKSHEET<br />

2009 LINE ITEM DETAIL BUDGET<br />

Attachment C<br />

ISSUE NAME - <strong>Corrugated</strong> <strong>Packaging</strong> Alliance<br />

ISSUE # - 964<br />

ISSUE MANAGER - Dwight Schmidt<br />

TOTAL<br />

ACTION/PROJECT/VENDOR Dues & Outsourced Commun Paid Other DIRECT EXPECTED<br />

Meetings MT&E Subs Coalitions Legal Work Development Media (specify) EXPENSES REVENUE<br />

Comparative and 'what if'<br />

scenarios, EPA coordination, etc<br />

- Five Winds Intl.as well as LCI<br />

management 45,000 $ 45,000<br />

SPC Compass Comparative<br />

work 15,000 $ 15,000<br />

"Our Planet" Video 15,000 30,000 5,000 $ 50,000<br />

Update look and content of<br />

corrugated.org web page 20,000 25,000 $ 45,000<br />

Conduct retailer, foodservice,<br />

grower/shipper and member<br />

study of RPC usage 3,000 85,000 5,000 $ 93,000<br />

Investigate various forms of<br />

"green" labels and monitor the<br />

FTC Green Guide development,<br />

Manage the W-M phase two<br />

scorecard development, and<br />

other sustainability programs 125,000<br />

Implement the Industry<br />

Sustainability messaging<br />

strategy 75,000 175,000 $ 250,000<br />

Monitor the current reality of all<br />

CPA Charter areas 10,000 8,000 4,000 20,000 $ 42,000<br />

$ -<br />

SUBTOTALS $ 13,000 $ 8,000 $ 4,000 $ - $ - $ 290,000 $ 120,000 $ 30,000 $ 200,000 $ 540,000<br />

0<br />

ADD: ADMIN. ITEMS (from Acctg.):<br />

Office Supplies<br />

Postage<br />

Telephone<br />

Reproduction<br />

TOTAL ADMIN. ITEMS $ -<br />

TOTAL DIRECT EXPENSES $ 13,000 $ 8,000 $ 4,000 $ - $ - $ 290,000 $ 120,000 $ 30,000 $ 200,000 $ 540,000<br />

0<br />

PRIOR YEAR BUDGETED/PROJECTED DIRECT EXPEN<br />

% INCREASE OR (DECREASE) FROM PRIOR YEAR =<br />

#DIV/0!<br />

COMMENT: _________________________________________________________________________________________

ncasi<br />

Attachment D<br />

NATIONAL COUNCIL FOR AIR AND STREAM IMPROVEMENT, INC.<br />

P.O. Box 13318, Research Triangle Park, NC 27709-3318<br />

Phone (919) 941-6400 Fax (919) 941-6401 Reid A. Miner<br />

Vice President -<br />

Sustainable Manufacturing<br />

Phone (919) 941-6407<br />

Fax (919) 941-6401<br />

e-mail RMiner@ncasi.org<br />

November 5, 2008 <br />

TO:<br />

CC:<br />

FROM:<br />

SUBJECT:<br />

Cathy Foley, AF&PA<br />

Dwight Schmidt, FBA<br />

Brian O’Banion, FBA<br />

Ron Yeske, Al Lucier, Jay Unwin, Caroline Gaudreault – NCASI<br />

Reid Miner<br />

Proposal for NCASI’s housing the containerboard and average corrugated container life cycle<br />

model<br />

As you requested, we have discussed with our Operating Committee the proposal for NCASI to house the<br />

containerboard and average corrugated container life cycle assessment model and use it for the industry’s benefit<br />

within defined parameters. The Operating Committee agrees that this is an appropriate role for NCASI and<br />

suggests the following arrangement.<br />

• NCASI agrees to house, and keep in working order for 10 years, the containerboard and average<br />

corrugated container LCA model. There would be no charge for this. The period could be extended by<br />

mutual agreement.<br />

• NCASI agrees to use the model to assist AF&PA and FBA in addressing issues that arise at the<br />

association level. There would normally be no funding needed for this, although NCASI would like to<br />

reserve the right to ask for funding in extraordinary cases where a substantial amount of effort is required.<br />

• NCASI agrees to work with AF&PA and FBA to update the model as needed based on decisions at<br />

AF&PA and FBA. NCASI would likely ask for funding to cover the staff time associated with such<br />

updates.<br />

• NCASI agrees to work with individual AF&PA, FBA and NCASI member companies that produce<br />

containerboard to develop LCA results from the model that incorporate company-specific data. NCASI<br />

will charge companies for this service an amount adequate to cover the NCASI staff time needed to<br />

develop these results. Note that we feel we should include NCASI member companies (which are, for the<br />

most part, the same companies as belong to AF&PA) in this arrangement because they have contributed<br />

to the cost of the study via the effort expended by NCASI in performing the containerboard study.<br />

We look forward to hearing your reaction to this proposed arrangement. If you agree that it is adequate, we would<br />

appreciate having your written concurrence for our records.<br />

Best Regards<br />

Reid Miner<br />

Environmental research for the forest products industry

Attachment E<br />

CPA Material Inventory<br />

Name of Materials Quantity FBA 800 #<br />

Sensitivity Factors Fact Sheet 1,349<br />

CCF Implementation Fact Sheet 1,649<br />

Wax Alternative Fact Sheet 3,152 50<br />

<strong>Corrugated</strong> Common Footprint Standard 149 yes<br />

<strong>Corrugated</strong> <strong>Packaging</strong> for Produce 809 65 yes<br />

<strong>Corrugated</strong> Common Footprint Research<br />

7,016 24 yes<br />

Results<br />

Apple Case Study 1,715 93<br />

CPA Folders 2,605 yes<br />

<strong>Corrugated</strong> Grapes Case Study 349 60<br />

<strong>Corrugated</strong> Citrus Case Study 349 20<br />

Case Ready Meat Brochure 10,809 120<br />

<strong>Corrugated</strong> Case Ready Meat Technical<br />

150 yes<br />

Specification<br />

<strong>Corrugated</strong> Common Footprint Stand Technical<br />

400<br />

Specification<br />

RFID in the Perishables Supply-Chain<br />

<strong>Corrugated</strong> RFID in the Perishables Supply-<br />

37<br />

Chain <strong>Corrugated</strong> Pkg. Supplies Have<br />

Wax Standards Poster/Package of 50 322 10<br />

Wax Standard Brochure/Package of 50 350<br />

Wax Standard Poster/Individual 2,849<br />

Wax Standard Brochure/Individual 849<br />

<strong>Corrugated</strong> Broccoli Case Study/ Package of 25 146 119 each