About Guggenheim Investments - Security Benefit Agent

About Guggenheim Investments - Security Benefit Agent

About Guggenheim Investments - Security Benefit Agent

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

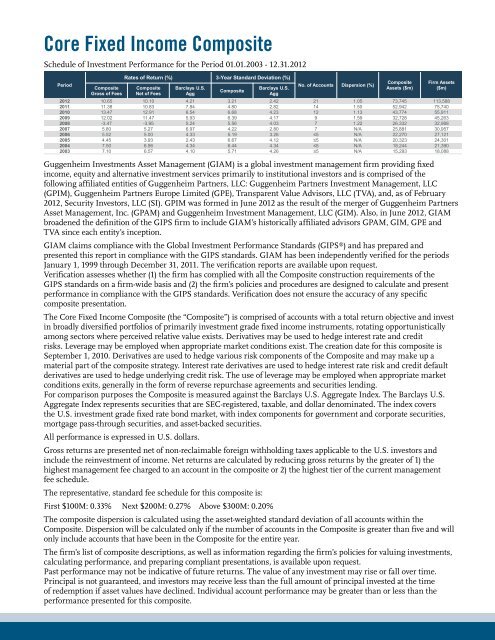

Core Fixed Income Composite<br />

Schedule of Investment Performance for the Period 01.01.2003 - 12.31.2012<br />

Period<br />

Composite<br />

Gross of Fees<br />

Rates of Return (%) 3-Year Standard Deviation (%)<br />

Composite<br />

Net of Fees<br />

Barclays U.S.<br />

Agg<br />

Composite<br />

Barclays U.S.<br />

Agg<br />

No. of Accounts Dispersion (%)<br />

Composite<br />

Assets ($m)<br />

Firm Assets<br />

($m)<br />

2012 10.65 10.10 4.21 3.21 2.42 21 1.05 73,745 113,588<br />

2011 11.38 10.83 7.84 4.80 2.82 14 1.50 52,942 75,740<br />

2010 13.47 12.91 6.54 6.68 4.23 12 1.13 43,774 55,911<br />

2009 12.02 11.47 5.93 6.39 4.17 9 1.59 32,728 45,263<br />

2008 -3.47 -3.95 5.24 5.56 4.03 7 1.22 26,332 32,988<br />

2007 5.80 5.27 6.97 4.22 2.80 7 N/A 25,881 30,957<br />

2006 5.52 5.00 4.33 5.19 3.26 ≤5 N/A 22,270 27,121<br />

2005 4.45 3.93 2.43 6.67 4.12 ≤5 N/A 20,323 24,301<br />

2004 7.50 6.96 4.34 6.44 4.34 ≤5 N/A 18,244 21,390<br />

2003 7.10 6.57 4.10 5.71 4.26 ≤5 N/A 15,293 18,088<br />

<strong>Guggenheim</strong> <strong>Investments</strong> Asset Management (GIAM) is a global investment management firm providing fixed<br />

income, equity and alternative investment services primarily to institutional investors and is comprised of the<br />

following affiliated entities of <strong>Guggenheim</strong> Partners, LLC: <strong>Guggenheim</strong> Partners Investment Management, LLC<br />

(GPIM), <strong>Guggenheim</strong> Partners Europe Limited (GPE), Transparent Value Advisors, LLC (TVA), and, as of February<br />

2012, <strong>Security</strong> Investors, LLC (SI). GPIM was formed in June 2012 as the result of the merger of <strong>Guggenheim</strong> Partners<br />

Asset Management, Inc. (GPAM) and <strong>Guggenheim</strong> Investment Management, LLC (GIM). Also, in June 2012, GIAM<br />

broadened the definition of the GIPS firm to include GIAM’s historically affiliated advisors GPAM, GIM, GPE and<br />

TVA since each entity’s inception.<br />

GIAM claims compliance with the Global Investment Performance Standards (GIPS ® ) and has prepared and<br />

presented this report in compliance with the GIPS standards. GIAM has been independently verified for the periods<br />

January 1, 1999 through December 31, 2011. The verification reports are available upon request.<br />

Verification assesses whether (1) the firm has complied with all the Composite construction requirements of the<br />

GIPS standards on a firm-wide basis and (2) the firm’s policies and procedures are designed to calculate and present<br />

performance in compliance with the GIPS standards. Verification does not ensure the accuracy of any specific<br />

composite presentation.<br />

The Core Fixed Income Composite (the “Composite”) is comprised of accounts with a total return objective and invest<br />

in broadly diversified portfolios of primarily investment grade fixed income instruments, rotating opportunistically<br />

among sectors where perceived relative value exists. Derivatives may be used to hedge interest rate and credit<br />

risks. Leverage may be employed when appropriate market conditions exist. The creation date for this composite is<br />

September 1, 2010. Derivatives are used to hedge various risk components of the Composite and may make up a<br />

material part of the composite strategy. Interest rate derivatives are used to hedge interest rate risk and credit default<br />

derivatives are used to hedge underlying credit risk. The use of leverage may be employed when appropriate market<br />

conditions exits, generally in the form of reverse repurchase agreements and securities lending.<br />

For comparison purposes the Composite is measured against the Barclays U.S. Aggregate Index. The Barclays U.S.<br />

Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers<br />

the U.S. investment grade fixed rate bond market, with index components for government and corporate securities,<br />

mortgage pass-through securities, and asset-backed securities.<br />

All performance is expressed in U.S. dollars.<br />

Gross returns are presented net of non-reclaimable foreign withholding taxes applicable to the U.S. investors and<br />

include the reinvestment of income. Net returns are calculated by reducing gross returns by the greater of 1) the<br />

highest management fee charged to an account in the composite or 2) the highest tier of the current management<br />

fee schedule.<br />

The representative, standard fee schedule for this composite is:<br />

First $100M: 0.33% Next $200M: 0.27% Above $300M: 0.20%<br />

The composite dispersion is calculated using the asset-weighted standard deviation of all accounts within the<br />

Composite. Dispersion will be calculated only if the number of accounts in the Composite is greater than five and will<br />

only include accounts that have been in the Composite for the entire year.<br />

The firm’s list of composite descriptions, as well as information regarding the firm’s policies for valuing investments,<br />

calculating performance, and preparing compliant presentations, is available upon request.<br />

Past performance may not be indicative of future returns. The value of any investment may rise or fall over time.<br />

Principal is not guaranteed, and investors may receive less than the full amount of principal invested at the time<br />

of redemption if asset values have declined. Individual account performance may be greater than or less than the<br />

performance presented for this composite.