Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

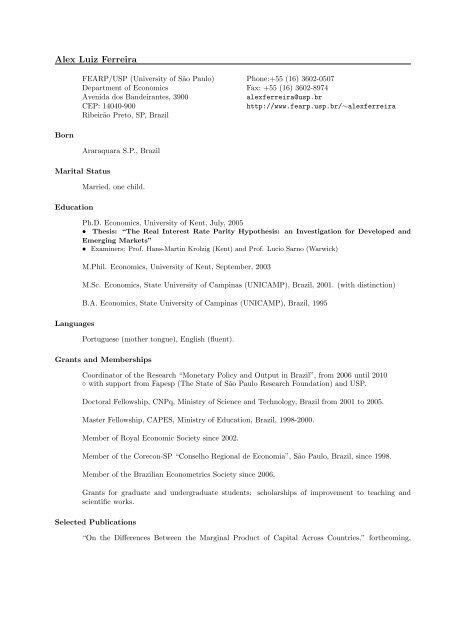

<strong>Alex</strong> <strong>Luiz</strong> <strong>Ferreira</strong><br />

Born<br />

FEA<strong>RP</strong>/<strong>USP</strong> (University of São Paulo) Phone:+55 (16) 3602-0507<br />

Department of Economics Fax: +55 (16) 3602-8974<br />

Avenida dos Bandeirantes, 3900<br />

alexferreira@usp.br<br />

CEP: 14040-900<br />

http://www.<strong>fea</strong>rp.usp.br/∼alexferreira<br />

Ribeirão Preto, SP, Brazil<br />

Araraquara S.P., Brazil<br />

Marital Status<br />

Education<br />

Languages<br />

Married, one child.<br />

Ph.D. Economics, University of Kent, July, 2005<br />

• Thesis: “The Real Interest Rate Parity Hypothesis: an Investigation for Developed and<br />

Emerging Markets”<br />

• Examiners: Prof. Hans-Martin Krolzig (Kent) and Prof. Lucio Sarno (Warwick)<br />

M.Phil. Economics, University of Kent, September, 2003<br />

M.Sc. Economics, State University of Campinas (UNICAMP), Brazil, 2001. (with distinction)<br />

B.A. Economics, State University of Campinas (UNICAMP), Brazil, 1995<br />

Portuguese (mother tongue), English (fluent).<br />

Grants and Memberships<br />

Coordinator of the Research “Monetary Policy and Output in Brazil”, from 2006 until 2010<br />

◦ with support from Fapesp (The State of São Paulo Research Foundation) and <strong>USP</strong>.<br />

Doctoral Fellowship, CNPq, Ministry of Science and Technology, Brazil from 2001 to 2005.<br />

Master Fellowship, CAPES, Ministry of Education, Brazil, 1998-2000.<br />

Member of Royal Economic Society since 2002.<br />

Member of the Corecon-SP “Conselho Regional de Economia”, São Paulo, Brazil, since 1998.<br />

Member of the Brazilian Econometrics Society since 2006.<br />

Grants for graduate and undergraduate students:<br />

scientific works.<br />

scholarships of improvement to teaching and<br />

Selected Publications<br />

“On the Differences Between the Marginal Product of Capital Across Countries,” forthcoming,

Manchester School, 2011.<br />

“The Determinants of Default Risk in Brazil,” Applied Economics Letters, 17(17), 1703 - 1708, 2010.<br />

“Is it Risk? An automated approach to explain the ex ante UIP deviations of Brazil,” Cuadernos<br />

de Economía, 46, 51-66, 2009.<br />

“Flex Cars and the Alcohol Price,” with Fernando Pigeard de Almeida Prado and Jaylson Jair da<br />

Silveira, Energy Economics, 31, 382-394, 2009.<br />

“Real Interest Rate Parity Decomposition,” with Roseli Silva, Estudos Econômicos, Instituto de<br />

Pesquisas Econômicas, vol.39, no.3, São Paulo. 2009<br />

“Does the Real Interest Rate Parity Hold?, Evidence for Emerging and Developing Countries,” with<br />

Miguel León-Ledesma. Journal of International Money and Finance, USA, 2007, 26, 364-382.<br />

“On the Transmission Mechanism of Monetary Constraints to the Real Side of The Economy,”<br />

International Review of Applied Economics, United Kingdom, 2007, 21, 43-54.<br />

“Thirlwall’s Law and Foreign Capital Service: The Case of Brazil,” with Otaviano Canuto, Revista<br />

Momento Económico, Jan-Feb 2003, 125, UNAM, Mexico.<br />

Working Papers<br />

“Does the Real Interest Rate Parity Hold?, Evidence for Emerging and Developing Countries” with<br />

Miguel León-Ledesma, Working Paper Series 03-01, Studies in Economics, 2003, University of Kent.<br />

“Are Real Interest Differentials Caused by Frictions in Goods or Assets Markets, Real or Nominal<br />

Shocks?,” Working Paper Series 04-07, Studies in Economics, 2004, University of Kent.<br />

“Leaning against the Parity,” Working Paper Series 04-13, Studies in Economics, 2004, University<br />

of Kent.<br />

“The Determinants of Default Risk in Brazil,” Discussion Paper, Economics Series, 2005, University<br />

of São Paulo (<strong>USP</strong>), Campus of Ribeirão Preto, FEA-<strong>RP</strong>/<strong>USP</strong>.<br />

Other Publications<br />

“Oito Anos Construindo Popularidade,” Boletim de Economia & Tecnologia, Volume Especial, 5-16,<br />

UFPR, with Sakurai, S.N. e Oliveira,R.<br />

“Reflexões sobre a crise,” Boletim de Economia & Tecnologia, UFPR, 17(5), 33-44, 2009<br />

“A Âncora do Real,” Leituras de Economia Política, Instituto de Economia da UNICAMP, 2000, 7,<br />

Campinas, Brazil.<br />

Conference Presentations<br />

“Personal Charisma orth e Economy? Macroeconomic Indicators of Presidential Approval Ratings<br />

in Brazil,” presented at the Seminário de Economia de Belho Horizonte, 2010.<br />

“Monetary Policy, Fundamentals and Risk in Brazil,” presented at the XXXVII Encontro Nacional<br />

de Economia, 2009.

Editorship<br />

“On the Differences Between the Marginal Product of Capital Across Countries,” presented at the<br />

Money Macro and Finance Research Group 40th Annual Conference, 2008.<br />

“The Simultaneity Bias of the Uncovered Interest Rate Parity”, presented at the XXX Encontro<br />

Brasileiro de Econometria, 2008.<br />

“Income, Risk and Monetary Policy in Brazil”, presented at UNU-WIDER (United Nations University)<br />

Conference on “Southern Engines of Global Growth: China, India, Brazil, and South Africa<br />

(CIBS)”, September, 2007, Helsinki, Finland.<br />

“The Ethanol Prices and the Flex Cars”, with Fernando Pigeard and Jaylson Silveira, presented at<br />

Ecomod2007, July, 2007, São Paulo, Brazil.<br />

“Are Real Interest Differentials Caused by Frictions in Goods or Assets Markets, Real or Nominal<br />

Shocks?,” Presented at the International Conference on Policy Modelling, EconMod2004, University<br />

of Paris I - Sorbonne, Paris, France, June 30 until July 2, 2004.<br />

“On the Transmission Mechanism of Monetary Constraints to the Real Side of The Economy:<br />

The Brazilian Case” presented at the 1st ABEP/ Oxford Centre for Brazilian Studies Conference,<br />

19/03/2004, Oxford, United Kingdom.<br />

“Does the Real Interest Rate Parity Hold?, Evidence for Emerging and Developing Countries”<br />

with Miguel León-Ledesma. Presented at the International Conference on Policy Modelling, Econ-<br />

Mod2003, Istanbul, Turkey, July, 2003 and also at the 2003 European Workshop in European economics,<br />

from August 24 to August 31, University Campus in Rethymno, Crete, Greece.<br />

“Thirlwall’s Law and Foreign Capital Service: The Case of Brazil,” with Otaviano Canuto.Presented<br />

at the Workshop “Macroeconomia Aberta Keynesiana Schumpeteriana: uma Perspectiva Latino<br />

Americana”, UNICAMP, Campinas, Brazil, June 2001.<br />

I worked as the Editor, together with Walter Belluzzo Jr., of the Brazilian Journal of Applied<br />

Economics from 2006 to 2008.<br />

Referee Activities<br />

Journal of International Money and Finance(Wesleyan - 1), Journal of Economic Surveys(1), Applied<br />

Economics (Warwick - 3), International Review of Applied Economics (University of Leeds -<br />

1), Estudos Econômicos (<strong>USP</strong> - 1), Pesquisa e Planejamento Econômico (IPEA - 1), Economia e<br />

Sociedade (UNICAMP - 1), Journal of Economics Surveys (1), Journal of Developing Areas (1),<br />

International Review of Economics and Finance (1), Revista de Economia Aplicada (5).<br />

Newspaper Articles<br />

“A Lei de Thirlwall Aplicada ao Brasil”, Gazeta Mercantil, 02/07/01, with Otaviano Canuto. “Libertas<br />

Quae Sera Tamen”, Folha de São Paulo, 19/11/01. “Medo de Flutuar”, O Estado de São<br />

Paulo, 12/05/2003. “A Economia e o Dilema dos Juros”, Gazeta Mercantil, 17/12/03. “SMAR:<br />

Produzindo e Vendendo um Brasil Melhor”, Jornal a Cidade de Ribeirão Preto, 10/11/2004. “A Legitimidade<br />

do Copom”, O Globo, 13/01/2005. “Perguntas ao Ministro”, Jornal A Cidade, Ribeirão<br />

Preto, 03/2005 “A César o que é de César”, Jornal A Cidade, Ribeirão Preto, 03/2005 “Perigo”, O<br />

Globo, 23/04/2005<br />

Work Experience

• Academic:<br />

Assistant Professor 2006<br />

University of São Paulo<br />

Ribeirão Preto<br />

Teaching Econometrics and Macroeconomics for both graduate and undergraduate students (Economics<br />

and Applied Mathematics degrees).<br />

I have also been working since 2009 as the Director of Graduate Studies of the Department of<br />

Economics FEA-<strong>RP</strong>/<strong>USP</strong>.<br />

Teaching Assistant 2001–2005<br />

University of Kent<br />

Canterbury, UK<br />

Teaching Micro and Macroeconomics for undergraduate students<br />

Visiting Training Fellow 1999–2000<br />

University of Kent<br />

Canterbury, UK<br />

Research on Export-led Income Growth.<br />

• Other:<br />

Financial Consultant 1999–2001<br />

Independent Consultancy<br />

São Paulo, Brazil<br />

Consultancy to Unilever Latin America<br />

Co-ordinator of Financial Estimates 1997–1998<br />

Unilever<br />

São Paulo, Brazil<br />

Gathering and analyzing financial data<br />

Trainee 1996–1997<br />

Champion Paper and Pulp Brazil (actually,<br />

Mogi Guaçu, Brazil<br />

International Paper)<br />

Analyst of Politics and Economics<br />

Trainee 1995–1995<br />

Exxon<br />

Campinas, Brazil<br />

Training on the Marketing and Sales Department<br />

Trainee 1994–1995<br />

Shell<br />

Campinas, Brazil<br />

Training on the Strategic Planning Department<br />

Research Interests<br />

My research is concentrated on the area of applied macroeconomics. I am particularly interested<br />

on the study of International Finance but I also enjoy the fields of Economic Growth and Time-<br />

Series models. I had already worked with the empirics and the theory related to the Real Interest<br />

Rate Parity Hypothesis, such as the dynamics of real interest rate differentials and the determinants<br />

of real returns, bond spreads and uncovered interest rate parity deviations. I have been recently<br />

researching on the short and (possible) long run links between real and monetary variables.<br />

Invited Seminars<br />

Brazilian Central Bank (29/04/2004); Catholic University of Brasília (2004, 2008); University of São<br />

Paulo FEA -<strong>USP</strong>, Campus of São Paulo (23/04/2004); AEUDF, Associação de Ensino Unificado do<br />

Distrito Federal (29/04/2004); Getúlio Vargas Foundation (FGV EESP), (31/08/05); University of

São Paulo, FEA<strong>RP</strong>-<strong>USP</strong>, Campus of Ribeirão Preto (14/10/2005); Ibmec SP (20/10/2005); João Pinheiro<br />

Foundation (24/03/06); FAAP/<strong>RP</strong> (03/04/2006); “Unit Roots in Interest Rates?”, Course on<br />

Quantitative Methods, FIPE - São Paulo (19/11/05, 20/06/06, 12/05/2007, 10/11/2007); University<br />

of Kent (2005, 2007); UFSC(2009), UFPR(2011).<br />

Participation in Conferences<br />

“International conference on Modeling Structural Breaks, Long Memory and Stock Market Volatility,”<br />

Faculty of Finance, Cass Business School, London, 6 and 7 of December, 2002.<br />

Summer School - Workshop in European Economics, August 24 - August 31, 2003, University<br />

Campus in Rethymno, Crete, Greece.<br />

ANPEC (National Association of Postgraduate Economics Students) , Brazil<br />

• XXVII Meeting Belém/PA, December 07 - December 10, 1997<br />

• XXVI Meeting Vitória/ES, December 09 - December 12, 1998<br />

Relevant Computer Skills<br />

References<br />

Statistical and econometric packages: RATS, CATS, Oxmetrics, E-Views, Microfit, LIMDEP, S-Plus<br />

and Stata.<br />

Professor Tony Thirlwall Department of Economics, Keynes College, University of Kent; Canterbury,<br />

Kent, CT2 7NP, UK; Email: A.P.Thirlwall@kent.ac.uk<br />

Dr. Miguel A. León-Ledesma Department of Economics, Keynes College, University of Kent;<br />

Cantebury, Kent, CT2, 7NP; Email: M.A.Leon-Ledesma@kent.ac.uk<br />

Dr. Otaviano Canuto dos Santos Filho Executive Director, World Bank Group, MC 12-319,<br />

World Bank Group, 1818 H Street, NW, Washington, D.C., 20433, USA; Email: ocanuto@worldbank.org