Consolidated - CHUNGHWA PICTURE TUBES, LTD.

Consolidated - CHUNGHWA PICTURE TUBES, LTD.

Consolidated - CHUNGHWA PICTURE TUBES, LTD.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

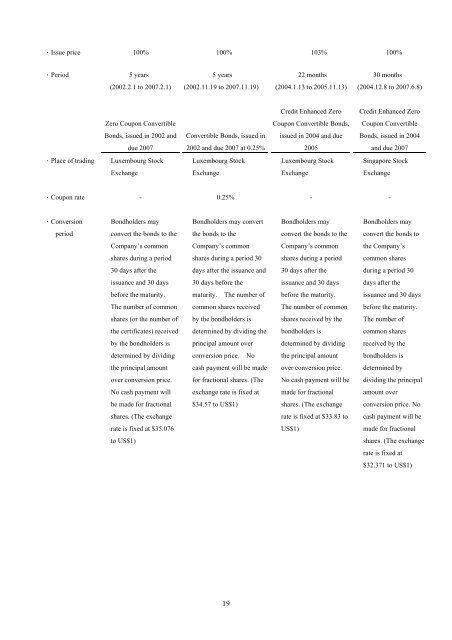

.Issue price 100% 100% 103% 100%<br />

.Period<br />

5 years<br />

5 years<br />

22 months<br />

30 months<br />

(2002.2.1 to 2007.2.1)<br />

(2002.11.19 to 2007.11.19)<br />

(2004.1.13 to 2005.11.13)<br />

(2004.12.8 to 2007.6.8)<br />

Credit Enhanced Zero<br />

Credit Enhanced Zero<br />

Zero Coupon Convertible<br />

Coupon Convertible Bonds,<br />

Coupon Convertible<br />

Bonds, issued in 2002 and<br />

Convertible Bonds, issued in<br />

issued in 2004 and due<br />

Bonds, issued in 2004<br />

due 2007<br />

2002 and due 2007 at 0.25%<br />

2005<br />

and due 2007<br />

.Place of trading<br />

Luxembourg Stock<br />

Luxembourg Stock<br />

Luxembourg Stock<br />

Singapore Stock<br />

Exchange<br />

Exchange<br />

Exchange<br />

Exchange<br />

.Coupon rate - 0.25% - -<br />

.Conversion<br />

Bondholders may<br />

Bondholders may convert<br />

Bondholders may<br />

Bondholders may<br />

period<br />

convert the bonds to the<br />

the bonds to the<br />

convert the bonds to the<br />

convert the bonds to<br />

Company’s common<br />

Company’s common<br />

Company’s common<br />

the Company’s<br />

shares during a period<br />

shares during a period 30<br />

shares during a period<br />

common shares<br />

30 days after the<br />

days after the issuance and<br />

30 days after the<br />

during a period 30<br />

issuance and 30 days<br />

30 days before the<br />

issuance and 30 days<br />

days after the<br />

before the maturity.<br />

maturity. The number of<br />

before the maturity.<br />

issuance and 30 days<br />

The number of common<br />

common shares received<br />

The number of common<br />

before the maturity.<br />

shares (or the number of<br />

by the bondholders is<br />

shares received by the<br />

The number of<br />

the certificates) received<br />

determined by dividing the<br />

bondholders is<br />

common shares<br />

by the bondholders is<br />

principal amount over<br />

determined by dividing<br />

received by the<br />

determined by dividing<br />

conversion price. No<br />

the principal amount<br />

bondholders is<br />

the principal amount<br />

cash payment will be made<br />

over conversion price.<br />

determined by<br />

over conversion price.<br />

for fractional shares. (The<br />

No cash payment will be<br />

dividing the principal<br />

No cash payment will<br />

exchange rate is fixed at<br />

made for fractional<br />

amount over<br />

be made for fractional<br />

$34.57 to US$1)<br />

shares. (The exchange<br />

conversion price. No<br />

shares. (The exchange<br />

rate is fixed at $33.83 to<br />

cash payment will be<br />

rate is fixed at $35.076<br />

US$1)<br />

made for fractional<br />

to US$1)<br />

shares. (The exchange<br />

rate is fixed at<br />

$32.371 to US$1)<br />

19