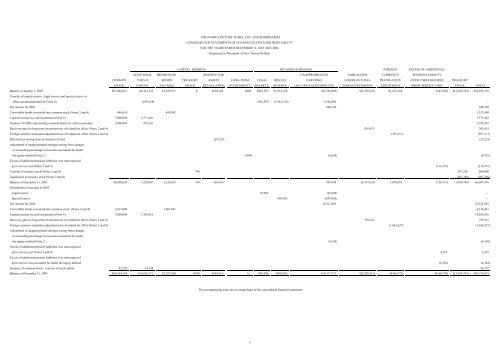

<strong>CHUNGHWA</strong> <strong>PICTURE</strong> <strong>TUBES</strong>, <strong>LTD</strong>. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY FOR THE YEARS ENDED DECEMBER 31, 2003 AND 2004 (Expressed in Thousands of New Taiwan Dollars) CAPITAL RESERVE RETAINED EARNINGS FOREIGN EXCESS OF ADDITIONAL ADDITIONAL PREMIUM ON RESERVE FOR UNAPPROPRIATED UNREALIZED CURRENCY PENSION LIABILITY COMMON PAID-IN BONDS TREASURY ASSETS LONG-TERM LEGAL SPECIAL EARNINGS LOSSES ON LONG- TRANSLATION OVER UNRECOGNIZED TREASURY STOCK CAPITAL PAYABLE STOCK REVALUATION INVESTMENTS RESERVE RESERVE (ACCUMULATED DEFICITS) TERM INVESTMENTS ADJUSTMENT PRIOR SERVICE COST STOCK TOTAL Balance at January 1, 2003 $51,062,011 $4,341,333 $1,833,671 $- $594,245 $804 $942,597 $1,981,158 $(3,562,883) $(3,399,247) $1,473,166 $(41,920) $(1,039,743) $54,185,192 Transfer of capital reserve , legal reserve and special reserve to offset accumulated deficits (Note 4) (639,128) (942,597) (1,981,158) 3,562,883 - Net income for 2003 948,126 948,126 Convertible bonds converted into common stock (Notes 2 and 4) 846,618 490,982 1,337,600 Capital increase by cash in premium (Note 4) 5,000,000 2,571,401 7,571,401 Issuance of GDSs representing common shares by cash in premium 2,000,000 955,301 2,955,301 Recovery gain on long-term investment-net of related tax effect (Notes 2 and 4) 201,615 201,615 Foreign currency translation adjustment-net of related tax effect (Notes 2 and 4) (397,111) (397,111) Deferred tax arising from revaluation of land (29,229) (29,229) Adjustment of unappropriated earnings arising from changes in ownership percentage in investees accounted for under the equity method (Note 2 ) (804) (8,168) (8,972) Excess of additional pension liabilities over unrecognized prior service cost (Notes 2 and 4) (116,791) (116,791) Transfer of treasury stock (Notes 2 and 4) 744 207,256 208,000 Acquisition of treasury stock (Notes 2 and 4) (207,256) (207,256) Balance at December 31, 2003 58,908,629 7,228,907 2,324,653 744 565,016 - - - 939,958 (3,197,632) 1,076,055 (158,711) (1,039,743) 66,647,876 Distribution of earnings in 2003 Legal reserve 93,996 (93,996) - Special reserve 845,962 (845,962) - Net income for 2004 10,321,883 10,321,883 Convertible bonds converted into common stock (Notes 2 and 4) 2,613,000 1,603,041 4,216,041 Capital increase by cash in premium (Note 4) 7,000,000 7,383,016 14,383,016 Recovery gain on long-term investment-net of related tax effect (Notes 2 and 4) 799,321 799,321 Foreign currency translation adjustment-net of related tax effect (Notes 2 and 4) (1,642,627) (1,642,627) Adjustment of unappropriated earnings arising from changes in ownership percentage in investees accounted for under the equity method (Note 2 ) (4,168) (4,168) Excess of additional pension liabilities over unrecognized prior service cost (Notes 2 and 4) 4,335 4,335 Excess of additional pension liabilities over unrecognized prior service cost accounted for under the equity method (6,382) (6,382) Issuance of common stock - exercise of stock option 42,530 14,248 56,778 Balance at December 31, 2004 $68,564,159 $14,626,171 $3,927,694 $744 $565,016 $- $93,996 $845,962 $10,317,715 $(2,398,311) $(566,572) $(160,758) $(1,039,743) $94,776,073 The accompanying notes are an integral part of the consolidated financial statements. 5

<strong>CHUNGHWA</strong> <strong>PICTURE</strong> <strong>TUBES</strong>, <strong>LTD</strong>. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2003 AND 2004 (Expressed in Thousands of New Taiwan Dollars) Years Ended December 31, 2003 2004 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $948,126 $10,321,883 Minority interests 212,070 456,328 Total 1,160,196 10,778,211 Adjustments to reconcile net income to net cash provided by operating activities: Exchange rate effect (Note 2) 67,773 458,663 Depreciation (Note 2) 10,798,613 11,893,134 Provision for loss on impairment in value of property, plant and equipment (Note 4) 2,096,515 - Amortization (Note 2) 937,507 740,416 Amortization of convertible bonds - (101,411) Investment income recognized by equity method (Note 4) (151,280) (206,480) Cash dividend received from long-term investee accounted for under equity method 48,000 68,163 Provision for diminution in value of long-term investment (Notes 2 and 4) 217,346 370,667 Transfer of property, plant and equipment to expense 193,270 201,397 (Gain) loss on disposal of property, plant and equipment (Note 2) (60,572) 115,918 Loss on disposal of other assets (Notes 2 and 4) 1,377,240 53,489 Forfeited interest on convertible bonds (Note 2) 36,881 1,863 Change in operating assets and liabilities: Decrease in notes receivable 252,489 63,323 Increase in accounts receivable-trade (1,435,384) (57,162) (Increase) decrease in due from affiliates-trade (2,991,001) 1,612,987 Decrease in forward exchange contract receivable, net 4,566 - Increase in accounts receivable-others (274,497) (902,615) (Increase) decrease in inventories 540,693 (2,745,526) Increase in prepayments (7,317) (2,641) (Increase) decrease in deferred tax assets 292,219 (16,616) Increase in accounts payable 6,632,240 1,537,794 (Decrease) increase in due to affiliates-trade (1,454,869) 2,589,695 Increase in accounts payable-others 2,261,883 6,866,510 Decrease in accrued expenses (129,032) (85,756) Increase in forward exchange contract payable - 26,891 Increase (decrease) in income tax payable (183) 64,681 Increase in accrued pension liabilities (Note 2) 323,924 248,997 Payments for pension (155,182) (149,026) Decrease in deferred debits 1,532 - Increase in compensation interest payable 86,578 71,357 Decrease in deferred tax liability (943,809) (270,452) Net cash provided by operating activities 19,726,339 33,226,471 CASH FLOWS FROM INVESTING ACTIVITIES: (Increase) decrease in pledged time deposits 11,550 (2,284,907) (Increase) decrease in due from affiliates-others (3,371) 3,121 Decrease in marketable securities (62,166) (285,274) Decrease in other financial assets 139,120 - Increase in deferred charges (419,820) (1,728,487) Proceeds from disposal of property, plant and equipment 792,709 1,119,232 Proceeds from disposal of other assets 57,801 70,373 Additions to property, plant and equipment (25,300,869) (56,410,700) Increase in refundable deposits (29,321) (9,919) Decrease in long-term receivable-other 1,849 18,169 Net cash used in investing activities (24,812,518) (59,508,392) CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of bonds payable - 14,885,985 Increase in short-term bank loans 2,822,963 9,066,644 Increase in due to affiliates-others 150,275 1,329,395 Redemption and discharge of bonds payable (2,122,435) (638,507) Repayments of bonds payable (2,500,000) - Increase in long-term bank loans 16,665,749 7,685,298 Repayments of long-term bank loans (4,983,114) (3,304,380) Early redemption of long-term bank loans (6,291,773) - Decrease in long-term deferred revenue (515) - Increase (decrease) in other current liabilities (626,017) 122,187 Increase in long-term payable - 108,611 Increase (decrease) in investment of minority interest 27,858 (224,067) Capital increase by cash in premium 10,526,702 14,383,016 Transfer of treasury stock 208,000 - Acquisition of treasury stock (207,256) - Proceeds from exercise of stock options - 56,778 Net cash provided by financing activities 13,670,437 43,470,960 EXCHANGE RATE EFFECT (684,428) (1,699,545) INCREASE IN CASH AND CASH EQUIVALENTS 7,899,830 15,489,494 CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 19,466,894 27,366,724 CASH AND CASH EQUIVALENTS AT END OF YEAR $27,366,724 $42,856,218 SUPPLEMENT DISCLOSURES OF CASH FLOWS INFORMATION: Interest expenses paid (excluding interest capitalized) $1,209,233 $1,084,258 Income tax paid $928,375 $269,156 INVESTING AND FINANCING ACTIVITIES NOT AFFECTING CASH FLOWS: Current portion of long-term debt $7,748,327 $17,596,435 Property, plant and equipment transferred to other assets held for sale $122,033 $135,769 Conversion of convertible bonds into common stock $1,337,600 $4,216,041 The accompanying notes are an integral part of the consolidated financial statements. 6

- Page 1 and 2: CHUNGHWA PICTURE TUBES, LTD. AND SU

- Page 3 and 4: CHUNGHWA PICTURE TUBES, LTD. AND SU

- Page 5: CHUNGHWA PICTURE TUBES, LTD. AND SU

- Page 9 and 10: The following diagram presents the

- Page 11 and 12: Allowance for Doubtful Accounts The

- Page 13 and 14: Convertible Bonds The excess of the

- Page 15 and 16: customer, transfer of title and acc

- Page 17 and 18: Net 2,305,908 2,695,770 Equity meth

- Page 19 and 20: (9) Short-term bank loans December

- Page 21 and 22: .Conversion The conversion price is

- Page 23 and 24: .Converting All bonds have been A t

- Page 25 and 26: December 31, 2003 2004 Discount rat

- Page 27 and 28: Approval (in dollars) Life (in year

- Page 29 and 30: Number of Shares Repurchased Purpos

- Page 31 and 32: Others 3,248 9,606 Income tax expen

- Page 33 and 34: share: Numerator: Net income availa

- Page 35 and 36: Corporation September 2006 for usin

- Page 37 and 38: 2003 2004 Region Related parties Or

- Page 39 and 40: Name of Related Parties Amount % Am

- Page 41 and 42: Certificate of deposit restricted T

- Page 43 and 44: Depreciation expenses $2,535,787 $8

- Page 45 and 46: (3) Export sales Export sales by re

- Page 47 and 48: Market price risk relating to deriv

- Page 49 and 50: December 31, 2004 Non-derivative Ca