SET:CSS - KTB Securities (Thailand) Co.,Ltd.

SET:CSS - KTB Securities (Thailand) Co.,Ltd.

SET:CSS - KTB Securities (Thailand) Co.,Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Index Values<br />

<strong>Co</strong>mmunication and System Solution Public <strong>Co</strong>mpany Limited<br />

(<strong>SET</strong>:<strong>CSS</strong>)<br />

Industry<br />

Trading <strong>Co</strong>mpanies and Distributors<br />

06/10/2013<br />

475, 477 Moo 9 Bondstreet Road <strong>Co</strong>mmunication & System Solution Public <strong>Co</strong>mpany Limited is engaged in the trading of electrical<br />

Bangpood<br />

cable and wire, and electrical engineering products in <strong>Thailand</strong>. The company trades electrical<br />

Nonthaburi, 11120<br />

cables and wires, lighting products, conduits, switches and plugs, fire protection materials and<br />

<strong>Thailand</strong><br />

equipment, and transformers. It is also involved in the designing, procuring, and installing<br />

Phone: 66 2 960 1001<br />

communication system, which cover the mobile phone signal and fixed line; and fire protection<br />

http://www.cssthai.com system for closing pole of conduits or electrical systems, pipeline systems, and air condition<br />

systems in the wall or area of office, and residential area. The company serves private units,<br />

shops, and government units. <strong>Co</strong>mmunication & System Solution Public <strong>Co</strong>mpany Limited was<br />

incorporated in 1994 and is headquartered in Nonthaburi, <strong>Thailand</strong>.<br />

104<br />

102<br />

100<br />

98<br />

96<br />

94<br />

92<br />

90<br />

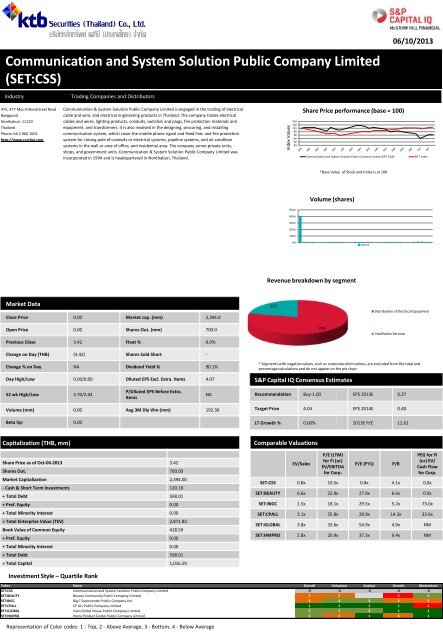

Share Price performance (base = 100)<br />

<strong>Co</strong>mmunication and System Solution Public <strong>Co</strong>mpany Limited (<strong>SET</strong>:<strong>CSS</strong>)<br />

<strong>SET</strong> Index<br />

*Base Value of Stock and Index is at 100<br />

Volume (shares)<br />

500m<br />

400m<br />

300m<br />

200m<br />

100m<br />

0m<br />

Volume<br />

Revenue breakdown by segment<br />

Market Data<br />

Close Price 0.00 Market cap. (mm) 2,394.0<br />

Open Price 0.00 Shares Out. (mm) 700.0<br />

Previous Close 3.42 Float % 0.0%<br />

Change on Day (THB) (3.42) Shares Sold Short -<br />

22%<br />

78%<br />

Distribution of Electrical Equipment<br />

Installation Services<br />

Change % on Day NA Dividend Yield % 90.1%<br />

Day High/Low 0.00/0.00 Diluted EPS Excl. Extra. Items 4.07<br />

* Segments with negative values, such as corporate eliminations, are excluded from the total and<br />

percentage calculations and do not appear on the pie chart<br />

S&P Capital IQ <strong>Co</strong>nsensus Estimates<br />

52 wk High/Low 3.70/2.04<br />

P/Diluted EPS Before Extra.<br />

Items<br />

NA<br />

Recommendation Buy-1.00 EPS 2013E 0.27<br />

Volume (mm) 0.00 Avg 3M Dly Vlm (mm) 192.30<br />

Beta 5yr 0.00 <br />

Target Price 4.04 EPS 2014E 0.40<br />

LT Growth % 0.00% 2013E P/E 12.61<br />

Capitalization (THB, mm)<br />

Share Price as of Oct-06-2013 3.42<br />

Shares Out. 700.00<br />

Market Capitalization 2,394.00<br />

- Cash & Short Term Investments 120.18<br />

+ Total Debt 598.01<br />

+ Pref. Equity 0.00<br />

+ Total Minority Interest 0.00<br />

= Total Enterprise Value (TEV) 2,871.83<br />

Book Value of <strong>Co</strong>mmon Equity 418.59<br />

+ Pref. Equity 0.00<br />

+ Total Minority Interest 0.00<br />

+ Total Debt 598.01<br />

= Total Capital 1,016.59<br />

<strong>Co</strong>mparable Valuations<br />

EV/Sales<br />

P/E (LTM)<br />

for FI (or)<br />

EV/EBITDA<br />

for <strong>Co</strong>rp.<br />

P/E (FY1)<br />

P/B<br />

PEG for FI<br />

(or) EV/<br />

Cash Flow<br />

for <strong>Co</strong>rp.<br />

<strong>SET</strong>:<strong>CSS</strong> 0.8x 10.5x 0.8x 4.1x 0.0x<br />

<strong>SET</strong>:BEAUTY 6.6x 22.9x 27.9x 6.6x 0.0x<br />

<strong>SET</strong>:BIGC 1.5x 18.1x 29.5x 5.2x 73.0x<br />

<strong>SET</strong>:CPALL 2.1x 25.8x 28.9x 14.3x 32.6x<br />

<strong>SET</strong>:GLOBAL 3.8x 33.6x 54.9x 4.9x NM<br />

<strong>SET</strong>:HMPRO 2.8x 20.9x 37.3x 9.4x NM<br />

Investment Style – Quartile Rank<br />

Ticker Name Overall Valuation Analyst Growth Momentum<br />

<strong>SET</strong>:<strong>CSS</strong> <strong>Co</strong>mmunication and System Solution Public <strong>Co</strong>mpany Limited -5 -5 -5 -5 -5<br />

<strong>SET</strong>:BEAUTY Beauty <strong>Co</strong>mmunity Public <strong>Co</strong>mpany Limited 3 3 FALSE 4 2<br />

<strong>SET</strong>:BIGC Big C Supercenter Public <strong>Co</strong>mpany <strong>Ltd</strong>. 3 2 2 3 3<br />

<strong>SET</strong>:CPALL CP ALL Public <strong>Co</strong>mpany Limited 1 1 1 1 4<br />

<strong>SET</strong>:GLOBAL Siam Global House Public <strong>Co</strong>mpany Limited 2 2 2 1 1<br />

<strong>SET</strong>:HMPRO Home Product Center Public <strong>Co</strong>mpany Limited 2 3 1 3 1<br />

Representation of <strong>Co</strong>lor codes: 1 - Top, 2 - Above Average, 3 - Bottom, 4 - Below Average

Key Statistics (THB, mm)<br />

Key Statistics<br />

3 Months 3 Months 12 Months 12 Months 0 Months<br />

Mar-31-<br />

2013Q<br />

Mar-31-<br />

2012Q<br />

Dec-31-<br />

2012A<br />

Dec-31-<br />

2011A<br />

Jan-00-<br />

1900A<br />

Total Revenue 840.73 633.48 3,302.11 2,339.39 0.00<br />

Growth Over Prior<br />

Year<br />

32.7% 0.0% 41.2% 0.0% 0.0%<br />

Total Expenditure 64.03 59.73 250.36 218.82 0.00<br />

EBITDA 66.22 36.95 245.22 108.22 0.00<br />

EBIT 62.00 33.00 228.57 92.32 0.00<br />

Net income 44.23 20.47 158.27 40.36 0.00<br />

Diluted EPS Excl.<br />

Extra. Items<br />

YOY % Change<br />

Diluted EPS Excl.<br />

Extra. Items<br />

Total Cash and ST<br />

investments<br />

Total current<br />

assets<br />

0.11 0.05 3.96 1.01 0.00<br />

106.3% 0.0% 292.5% 0.0% 0.0%<br />

120.18 17.16 60.26 17.16 0.00<br />

1603.31 0.00 1695.30 919.23 0.00<br />

Net PPE 261.96 0.00 116.80 97.65 0.00<br />

Total Assets 2067.97 0.00 1987.41 1160.15 0.00<br />

Total Current<br />

Liabilities<br />

1623.27 0.00 1550.80 872.93 0.00<br />

Short term debt 576.99 0.00 437.07 360.86 0.00<br />

Long term debt 4.25 0.00 6.21 13.81 0.00<br />

Gross Profit<br />

Margin (%)<br />

Net Income<br />

Margin (%)<br />

3 Months 3 Months 12 Months 12 Months 0 Months<br />

Mar-31-<br />

2013Q<br />

Mar-31-<br />

2012Q<br />

Dec-31-2012A Dec-31-2011A Jan-00-1900A<br />

14.99% 14.64% 14.50% 13.30% 0.00%<br />

5.26% 3.23% 4.79% 1.73% 0.00%<br />

ROE(%) 0.00% 0.00% 47.40% 0.00% 0.00%<br />

ROA(%) 0.00% 0.00% 9.08% 0.00% 0.00%<br />

ROCE(%),<br />

Return on<br />

capital<br />

employed<br />

Total Asset<br />

Turnover<br />

Fixed Asset<br />

Turnover<br />

Inventory<br />

Turnover<br />

0.00% 0.00% 18.90% 0.00% 0.00%<br />

0.00x 0.00x 2.10x 0.00x 0.00x<br />

0.00x 0.00x 30.80x 0.00x 0.00x<br />

0.00x 0.00x 11.64x 0.00x 0.00x<br />

Current Ratio 0.99x 0.00x 1.09x 1.05x 0.00x<br />

Quick Ratio 0.76x 0.00x 0.90x 0.80x 0.00x<br />

Cash<br />

<strong>Co</strong>nversion<br />

Cycle (Days)<br />

EBIT Interest<br />

<strong>Co</strong>verage<br />

EBITDA<br />

Interest<br />

<strong>Co</strong>verage<br />

0.00 0.00 64.72 0.00 0.00<br />

8.63x 6.01x 11.35x 3.54x 0.00x<br />

9.22x 6.73x 12.18x 4.15x 0.00x<br />

Debt/Equity 1.43x 1.47x 1.13x 1.47x 0.00x<br />

Total Liabilities 1649.39 0.00 1579.99 899.81 0.00<br />

<strong>Co</strong>mmon Stock &<br />

APIC<br />

250.00 0.00 200.00 200.00 0.00<br />

Minority Interest 0.00 0.00 0.00 0.00 0.00<br />

Preferred Stock 0 0 0 0 0<br />

Total Equity 418.59 260.35 407.42 260.35 0.00<br />

Key Developments<br />

Top Holders<br />

Date/Time<br />

Aug-30-2013<br />

Aug-30-2013<br />

Mar-26-2013<br />

Key Development<br />

<strong>Co</strong>mmunication and System Solution Public <strong>Co</strong>mpany Limited Reports <strong>Co</strong>nsolidated and<br />

<strong>Co</strong>mpany Earnings Results for the Second Quarter and Six Months Ended June 30, 2013<br />

<strong>Co</strong>mmunication And System Solution Public <strong>Co</strong>mpany Limited has completed an IPO in the<br />

amount of THB 600.00 million.<br />

<strong>Co</strong>mmunication And System Solution Public <strong>Co</strong>mpany Limited has filed an IPO.<br />

Holder<br />

<strong>Co</strong>mmon Stock<br />

Equivalent Held<br />

% of Total<br />

Shares<br />

Outstanding<br />

Market Value<br />

(THB mm)<br />

0 0 0.00 0.0<br />

0 0 0.00 0.0<br />

0 0 0.00 0.0<br />

0 0 0.00 0.0<br />

0 0 0.00 0.0<br />

0 0 0.00 0.0<br />

Board Members<br />

Key Executives<br />

Kangsawiwat, Sompong<br />

Sawatwannarat, Panida<br />

Temeesrisuk, Nongnuch<br />

Tiyawattanaroj, Opas<br />

Mekmanee, Kittirat<br />

Chairman and Chief Executive Officer<br />

Chief Financial Officer and Executive Director<br />

Acting Chief Administrative Officer and Executive Director<br />

Chief Telecommunication Officer and Executive Director<br />

Chief Business Officer and Executive Director<br />

Kangsawiwat,<br />

Sompong<br />

Sawatwannarat,<br />

Panida<br />

Temeesrisuk,<br />

Nongnuch<br />

Tiyawattanaroj, Opas<br />

Mekmanee, Kittirat<br />

Chataccaraphat,<br />

Pitiphat<br />

Chairman and Chief Executive Officer<br />

Chief Financial Officer and Executive Director<br />

Acting Chief Administrative Officer and Executive Director<br />

Chief Telecommunication Officer and Executive Director<br />

Chief Business Officer and Executive Director<br />

Independent Director and Chairman of Audit <strong>Co</strong>mmittee<br />

Tharnthong, Banyawake Deputy Chief Telecommunication Officer 2<br />

Source: S&P Capital IQ