U.S. Bank Loan Capital Markets – Market Snapshot

U.S. Bank Loan Capital Markets – Market Snapshot

U.S. Bank Loan Capital Markets – Market Snapshot

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

U.S. <strong>Bank</strong> <strong>Loan</strong> <strong>Capital</strong> <strong><strong>Market</strong>s</strong> <strong>–</strong> <strong>Market</strong> <strong>Snapshot</strong><br />

April 2, 2012<br />

Peter Kline 312-325-8983 Richard Jones 312-325-8906 Kavian Boots 312-325-8723<br />

Daniel Chapman 877-673-2258 Jeffrey Duncan 704-335-4570 Michael Mahoney 314-418-3571<br />

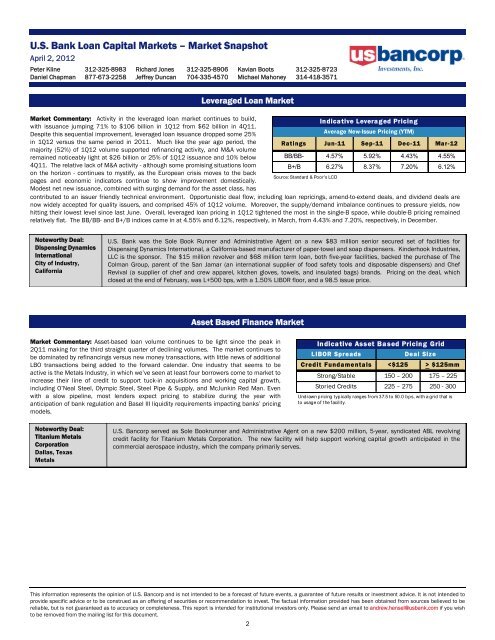

Leveraged <strong>Loan</strong> <strong>Market</strong><br />

<strong>Market</strong> Commentary: Activity in the leveraged loan market continues to build,<br />

with issuance jumping 71% to $106 billion in 1Q12 from $62 billion in 4Q11.<br />

Despite this sequential improvement, leveraged loan issuance dropped some 25%<br />

Indicative Leveraged Pricing<br />

Average New-Issue Pricing (YTM)<br />

in 1Q12 versus the same period in 2011. Much like the year ago period, the<br />

majority (52%) of 1Q12 volume supported refinancing activity, and M&A volume<br />

Ratings Jun-11 Sep-11 Dec-11 Mar-12<br />

remained noticeably light at $26 billion or 25% of 1Q12 issuance and 10% below BB/BB- 4.57% 5.92% 4.43% 4.55%<br />

4Q11. The relative lack of M&A activity - although some promising situations loom<br />

on the horizon - continues to mystify, as the European crisis moves to the back<br />

pages and economic indicators continue to show improvement domestically.<br />

Modest net new issuance, combined with surging demand for the asset class, has<br />

B+/B 6.27%<br />

Source: Standard & Poor's LCD<br />

8.37% 7.20% 6.12%<br />

contributed to an issuer friendly technical environment. Opportunistic deal flow, including loan repricings, amend-to-extend deals, and dividend dealsare<br />

now widely accepted for quality issuers, and comprised 45% of 1Q12 volume. Moreover, the supply/demand imbalance continues to pressure yields, now<br />

hitting their lowest level since last June. Overall, leveraged loan pricing in 1Q12 tightened the most in the single-B space, while double-B pricing remained<br />

relatively flat. The BB/BB- and B+/B indices came in at 4.55% and 6.12%, respectively, in March, from 4.43% and 7.20%, respectively, in December.<br />

Noteworthy Deal:<br />

Dispensing Dynamics<br />

International<br />

City of Industry,<br />

California<br />

Asset Based Finance <strong>Market</strong><br />

<strong>Market</strong> Commentary: Asset-based loan volume continues to be light since the peak in<br />

2Q11 making for the third straight quarter of declining volumes. The market continues to<br />

be dominated by refinancings versus new money transactions, with little news of additional<br />

LBO transactions being added to the forward calendar. One industry that seems to be<br />

active is the Metals Industry, in which we’ve seen at least four borrowers come to market to<br />

increase their line of credit to support tuck-in acquisitions and working capital growth,<br />

including O’Neal Steel, Olympic Steel, Steel Pipe & Supply, and McJunkin Red Man. Even<br />

with a slow pipeline, most lenders expect pricing to stabilize during the year with<br />

anticipation of bank regulation and Basel III liquidity requirements impacting banks’ pricing<br />

models.<br />

Noteworthy Deal:<br />

Titanium Metals<br />

Corporation<br />

Dallas, Texas<br />

Metals<br />

U.S. <strong>Bank</strong> was the Sole Book Runner and Administrative Agent on a new $83 million senior secured set of facilities for<br />

Dispensing Dynamics International, a California-based manufacturer of paper-towel and soap dispensers. Kinderhook Industries,<br />

LLC is the sponsor. The $15 million revolver and $68 million term loan, both five-year facilities, backed the purchase of The<br />

Colman Group, parent of the San Jamar (an international supplier of food safety tools and disposable dispensers) and Chef<br />

Revival (a supplier of chef and crew apparel, kitchen gloves, towels, and insulated bags) brands. Pricing on the deal, which<br />

closed at the end of February, was L+500 bps, with a 1.50% LIBOR floor, and a 98.5 issue price.<br />

U.S. Bancorp served as Sole Bookrunner and Administrative Agent on a new $200 million, 5-year, syndicated ABL revolving<br />

credit facility for Titanium Metals Corporation. The new facility will help support working capital growth anticipated in the<br />

commercial aerospace industry, which the company primarily serves.<br />

This information represents the opinion of U.S. Bancorp and is not intended to be a forecast of future events, a guarantee of future results or investment advice. It is not intended to<br />

provide specific advice or to be construed as an offering of securities or recommendation to invest. The factual information provided has been obtained from sources believed to be<br />

reliable, but is not guaranteed as to accuracy or completeness. This report is intended for institutional investors only. Please send an email to andrew.hensel@usbank.com if you wish<br />

to be removed from the mailing list for this document.<br />

2<br />

Indicative Asset Based Pricing Grid<br />

LIBOR Spreads<br />

Deal Size<br />

Credit Fundamentals $125mm<br />

Strong/Stable 150 <strong>–</strong> 200 175 <strong>–</strong> 225<br />

Storied Credits 225 <strong>–</strong> 275 250 - 300<br />

Undrawn pricing typically ranges from 37.5 to 50.0 bps, with a grid t hat is<br />

to usage of the facility.