Private Equity - Luthra & Luthra

Private Equity - Luthra & Luthra

Private Equity - Luthra & Luthra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

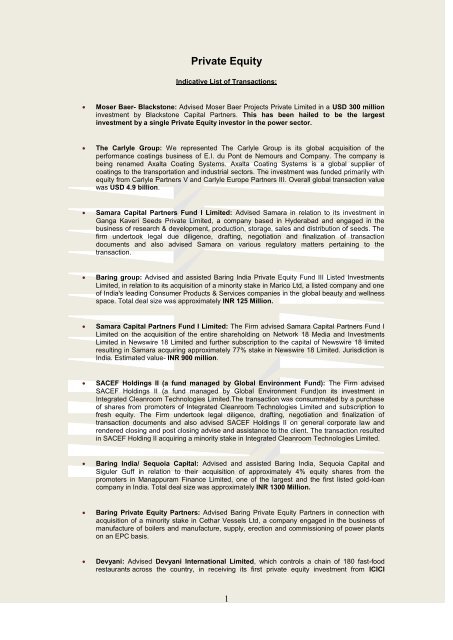

<strong>Private</strong> <strong>Equity</strong><br />

Indicative List of Transactions:<br />

<br />

Moser Baer- Blackstone: Advised Moser Baer Projects <strong>Private</strong> Limited in a USD 300 million<br />

investment by Blackstone Capital Partners. This has been hailed to be the largest<br />

investment by a single <strong>Private</strong> <strong>Equity</strong> investor in the power sector.<br />

<br />

The Carlyle Group: We represented The Carlyle Group is its global acquisition of the<br />

performance coatings business of E.I. du Pont de Nemours and Company. The company is<br />

being renamed Axalta Coating Systems. Axalta Coating Systems is a global supplier of<br />

coatings to the transportation and industrial sectors. The investment was funded primarily with<br />

equity from Carlyle Partners V and Carlyle Europe Partners III. Overall global transaction value<br />

was USD 4.9 billion.<br />

<br />

Samara Capital Partners Fund I Limited: Advised Samara in relation to its investment in<br />

Ganga Kaveri Seeds <strong>Private</strong> Limited, a company based in Hyderabad and engaged in the<br />

business of research & development, production, storage, sales and distribution of seeds. The<br />

firm undertook legal due diligence, drafting, negotiation and finalization of transaction<br />

documents and also advised Samara on various regulatory matters pertaining to the<br />

transaction.<br />

<br />

Baring group: Advised and assisted Baring India <strong>Private</strong> <strong>Equity</strong> Fund III Listed Investments<br />

Limited, in relation to its acquisition of a minority stake in Marico Ltd, a listed company and one<br />

of India's leading Consumer Products & Services companies in the global beauty and wellness<br />

space. Total deal size was approximately INR 125 Million.<br />

<br />

Samara Capital Partners Fund I Limited: The Firm advised Samara Capital Partners Fund I<br />

Limited on the acquisition of the entire shareholding on Network 18 Media and Investments<br />

Limited in Newswire 18 Limited and further subscription to the capital of Newswire 18 limited<br />

resulting in Samara acquiring approximately 77% stake in Newswire 18 Limited. Jurisdiction is<br />

India. Estimated value- INR 900 million.<br />

<br />

SACEF Holdings II (a fund managed by Global Environment Fund): The Firm advised<br />

SACEF Holdings II (a fund managed by Global Environment Fund)on its investment in<br />

Integrated Cleanroom Technologies Limited.The transaction was consummated by a purchase<br />

of shares from promoters of Integrated Cleanroom Technologies Limited and subscription to<br />

fresh equity. The Firm undertook legal diligence, drafting, negotiation and finalization of<br />

transaction documents and also advised SACEF Holdings II on general corporate law and<br />

rendered closing and post closing advise and assistance to the client. The transaction resulted<br />

in SACEF Holding II acquiring a minority stake in Integrated Cleanroom Technologies Limited.<br />

<br />

Baring India/ Sequoia Capital: Advised and assisted Baring India, Sequoia Capital and<br />

Siguler Guff in relation to their acquisition of approximately 4% equity shares from the<br />

promoters in Manappuram Finance Limited, one of the largest and the first listed gold-loan<br />

company in India. Total deal size was approximately INR 1300 Million.<br />

<br />

Baring <strong>Private</strong> <strong>Equity</strong> Partners: Advised Baring <strong>Private</strong> <strong>Equity</strong> Partners in connection with<br />

acquisition of a minority stake in Cethar Vessels Ltd, a company engaged in the business of<br />

manufacture of boilers and manufacture, supply, erection and commissioning of power plants<br />

on an EPC basis.<br />

<br />

Devyani: Advised Devyani International Limited, which controls a chain of 180 fast-food<br />

restaurants across the country, in receiving its first private equity investment from ICICI<br />

1

Ventures, India’s largest private equity fund. The deal involved the acquisition of a minority<br />

stake by ICICI Ventures in Devyani International.<br />

<br />

Wolfensohn: Advised WCP Holdings III (a Wolfensohn Capital Partners fund) in connection<br />

with its US $ 7.5 million (approx) investment in Ujjivan Microfinance Services <strong>Private</strong> Limited,<br />

a leader in the Indian microfinance space.<br />

<br />

Creador I LLC: The Firm played the lead role in preparation of the term sheet and definitive<br />

agreements and their negotiation with Cholamandalam. The Firm also advised Creador during<br />

and opined on closing of the transaction.<br />

<br />

Temasek: Advised Temasek Holdings, in its secondary investment in Sobha Developers Ltd.,<br />

an Indian public listed company engaged in the business of construction development. Also<br />

advised Temasek Holdings in its proposed investment in a micro finance company.<br />

<br />

FINO-Blackstone: Advised FINO in relation to the investment by Blackstone which was<br />

consummated by subscription to preference shares. The Firm was involved in drafting,<br />

negotiation and finalization of transaction documents, advice on various administrative and<br />

regulatory matters and other general corporate advice related to the transaction.<br />

<br />

Wolfensohn Capital: Advised and assisted the sale of Wolfensohn Capital Partners’<br />

(“Wolfensohn Capital”) 7.4% stake in Fabindia Overseas Pvt. Ltd. (“Fabindia”) to L Capital.<br />

The firm was involved in provision of tax advice and related structuring, drafting of the<br />

transaction documentation, extensive negotiations with the counter party and closing of the<br />

transaction. The transaction required extremely quick turnarounds under stringent timelines<br />

and entailed extensive negotiations with the counter party on several issues and particularly on<br />

tax and other indemnities. The transaction also entailed addressing certain structuring and<br />

regulatory issues and is one of the large deals in the single brand retail space in the recent<br />

times.<br />

<br />

Baring group: Advised Baring group in a private equity investment of ordinary equity shares of<br />

Shilpa Mediacare Ltd, a listed Indian entity.<br />

<br />

Varun Beverages: Advised and assisted Varun Beverages (international) limited, the leading<br />

bottler of PepsiCo in South Asia, in receiving primary investment from Standard Chatered<br />

Bank’s Mauritius based private equity fund.<br />

<br />

Sequoia Capital: Transaction counsel to Sequoia, an existing investor (which also participated<br />

in the consortium), in the private equity investment in Goldsquare by a consortium led by<br />

Norwest Venture Partners.<br />

<br />

Ratnakar Bank: Assisted Ratnakar Bank with regards to the allotment of the unsubscribed<br />

shares of the company pursuant to its rights issue.<br />

<br />

Hitachi – Hi Rel Electronics: Assisted Hi Rel Electronics (the Company) in its transaction with<br />

Hitachi Ltd. wherein Hitachi Ltd. acquired a majority equity stake in the Company.<br />

<br />

India 2020 Ltd: Advised India 2020 Ltd., an investor in Innoventive Industries Ltd., in<br />

evaluating investment by Standard Chartered <strong>Private</strong> <strong>Equity</strong> in Innoventive Industries Ltd.<br />

2

Sequoia Capital: <strong>Luthra</strong> & <strong>Luthra</strong> represented Sequoia Capital in relation to its private equity<br />

investment in Knowlarity Communications <strong>Private</strong> Limited, a company which provides cloud<br />

based telephony solutions.<br />

<br />

DLF Group: Advised DLF Group entity on a number of <strong>Private</strong> equity transactions, including<br />

investments from Lehman Brothers for the development of integrated townships, investments<br />

from DE Shaw for the development of SEZ projects, investments from Deutsche Bank entity<br />

for the development of integrated townships and investments from Merrill Lynch & Co. for<br />

the development of six real estate projects across the country. The cumulative value of the<br />

transaction being USD 1.2 billion.<br />

Award: This deal won the ALB SE Asia Award for ‘Securitization & Structured Finance’ by<br />

ALB.<br />

<br />

Blackstone FP Capital Partners: Represented Blackstone FP Capital Partners in a proposed<br />

investment of approximately USD 275 million in a leading Media company.<br />

<br />

DE Shaw & co.: Advised DE Shaw & co. in connection with its investment aggregating to USD<br />

250 million in a group company of a listed real estate company.<br />

Award: This deal won the ‘India Deal of the Year’ by ALB.<br />

<br />

One <strong>Equity</strong> Partners: Advised One <strong>Equity</strong> Partners in relation to building specialty hospital in<br />

Mumbai and other region with a proposed investment of over USD 150 million along with a<br />

very successful hospital chain in India.<br />

<br />

Avenue Capital Group: Acted for the Avenue Capital Group, one of world's leading Distress<br />

Funds in its investment in approximately USD 190 million in Morepen Laboratories Limited<br />

and a proposed hospitality project.<br />

<br />

Moser Baer: Advised Moser Baer in relation to investments in different tranches by a<br />

consortium of investors in Moser Baer Group companies engaged in the thin films and photo<br />

voltaic cell business, to the tune of USD 250 million. The consortium consisted of - CDC<br />

Group, GIC, Nomura, Credit Suisse, Morgan Stanley, IDFC <strong>Private</strong> <strong>Equity</strong> and IDFC.<br />

<br />

Lehman Brothers Real Estate Partners: Acted for Lehman Brothers Real Estate Partners in<br />

a large private equity transaction pertaining to investment in an affiliate of Unitech Limited<br />

which was engaged in slum rehabilitation in Mumbai. The total deal value of this transaction is<br />

approximately USD 200 million.<br />

<br />

Oman Investment Fund: Advised Oman Investment Fund (OIF) in relation to its investment of<br />

USD 100 million in Quippo Telecom Infrastructure Limited. Also assisted in negotiation of<br />

complex shareholder agreements with existing private equity investors in QTIL.<br />

Award: This deal won the ‘<strong>Private</strong> <strong>Equity</strong> Deal of the Year’ at the IFLR India Awards.<br />

<br />

LN Mittal Group: Acted for the private equity arm of LN Mittal Group regarding the investment<br />

of USD 150 million in India Bulls Power Company, an India Bulls group promoted company to<br />

set up power plants across the country. The LN Mittal group along with the American Hedge<br />

fund Farallon Capital acquired a 28.6% stake in India Bulls Power Services.<br />

<br />

Jagran Group: Advised Jagran Group in relation to Blackstone FP Capital Partners’<br />

investment in the company. The transaction was valued at approximately USD 50 million.<br />

3

Kleiner Perkins Caufield & Byers and Sherpalo Ventures: Acted for Kleiner Perkins<br />

Caufield & Byers and Sherpalo Ventures, both prominent Silicon Valley based venture capital<br />

firms, in their acquisition of an approximately 28% stake in CE Infosystems <strong>Private</strong> Limited and<br />

the acquisition of an approximately 33% stake in Paymate India <strong>Private</strong> Limited. CE<br />

Infosystems is the leading GIS solution provider in India. Paymate is the first mobile payment<br />

service in India.<br />

<br />

Oman Investment Fund: Advised Oman Investment Fund with regard to substantial<br />

investment in Nimbus Communications Limited; India's leading media and entertainment<br />

businesses focused on TV, advertising and sports rights management. The other two investors<br />

were 3i Sports Media (Mauritius) Ltd and CSI BD (Mauritius) Ltd.<br />

<br />

Old Lane: Advised Old Lane; a private equity arm of Citigroup in a deal involving substantial<br />

financial investment into KVK Energy, an investing company in various companies engaged in<br />

the power sector.<br />

<br />

Merrill Lynch: Acted for Merrill Lynch in its investment in Religare Enterprises Limited, a nonbanking<br />

financing company in its pre-IPO placement. The transaction value amounted to USD<br />

15.15 million.<br />

<br />

Fire Capital Investments Mauritius <strong>Private</strong> Limited: Advised Fire Capital Investments<br />

Mauritius <strong>Private</strong> Limited, an Indian focused real estate private equity fund, in its investment of<br />

approximately USD 100 million for development of integrated townships across several cities,<br />

including Chennai, Nagpur, Indore, Ahmedabad and Bangalore in India.<br />

<br />

One <strong>Equity</strong> Partners: Advised, One <strong>Equity</strong> Partners, the private equity investment arm of JP<br />

Morgan, in its recent acquisition of a 49% stake in Patil Rail Infrastructure <strong>Private</strong> Limited<br />

located in Hyderabad India, which (through itself and its subsidiaries and affiliates) is engaged<br />

in the business of rail track engineering and is one of the largest suppliers of railway sleepers<br />

and other rail track equipment to the Indian Railways. The deal value amounted to USD 37<br />

million.<br />

<br />

Real IS AG: Acted as counsel to Real IS AG, a fund based in Germany, with respect to USD<br />

20 million investment, through an intermediate vehicle, in a real estate construction project at<br />

Hyderabad spread across approximately 8 acres.<br />

<br />

Oman Investment Fund: Acted as counsel to the Oman Investment Fund, the fully owned<br />

investment arm of the Government of Oman, with respect to its investment, through an<br />

intermediate vehicle, in a real estate township project in Mangalore, southern India of<br />

approximately USD 19 million.<br />

<br />

Abraaj capital: Advised Abraaj capital, a Dubai based private equity investor in its investment,<br />

through a subsidiary, in an Indian company engaged in auctioneering of art, antiquities and film<br />

memorabilia, art related publications, etc<br />

<br />

Wardferry India Reconnaissance Limited: Acted for Wardferry India Reconnaissance<br />

Limited, a Hong Kong based private equity firm, in its pre-IPO placement in OnMobile Global, a<br />

telecom value added services company, other investment in OnMobile Global includes George<br />

Soros’ Quantum Fund and Bessemer India Capital.<br />

<br />

SBI Holdings, Japan and SBICAPS Ventures Limited: Advised SBI Holdings of Japan and<br />

SBICAPS Ventures Ltd.; a group company of State Bank of India in their proposed acquisition<br />

of strategic stake in the business of a knowledge company in India.<br />

4

Istithmar World Capital: Acted for Istithmar World Capital (“Istithmar”) one of the top private<br />

equity funds owned by the Government of Dubai, in connection with proposed investment of<br />

around USD 120 million in a leading media company.<br />

<br />

Good Energies, Inc. and Wolfensohn & Company: Advised Good Energies, Inc. and<br />

Wolfensohn & Company in relation to their investment of approximately USD 20 million in a<br />

company engaged in Power sector in India.<br />

Some transactions prior to January 2007:<br />

<br />

Blackstone Real Estate Partners: Advised Blackstone Group with regards to certain<br />

investment opportunities in Real Estate in India.<br />

<br />

Development Credit Bank: Advised Development Credit Bank in relation of USD 70 million<br />

investment by Lehman Brothers & Schroders Capital.<br />

<br />

Kleiner Perkins Caufield & Byers and Sherpalo: Acted for Kleiner Perkins Caufield & Byers<br />

and Sherpalo, two of Silicon Valley’s prominent venture capital funds in the pre-IPO acquisition<br />

of a minority stake in Info Edge India Limited, the company which owns and operates internet<br />

properties such as www.naukri.com, www.99acres.com; and www.jeevansathi.com.<br />

<br />

IL&FS Group: Advised IL&FS Group in seeking investment from Goldman Sachs (Asia) L.L.C<br />

in IL&FS Transportation Networks Limited, a group company of IL&FS to the tune of USD 883<br />

million.<br />

<br />

Goldman Sachs: Advised Goldman Sachs in its investment in SpiceJet, a low cost airline.<br />

<br />

Temasek: Advised Temasek in its acquisition of equity stake in Apollo Hospital Enterprises<br />

Limited, owner of ‘Apollo’ hospitals in India.<br />

<br />

Temasek Advised Temasek in its investment in Punj Lloyd Limited; a leading construction and<br />

engineering company in India.<br />

<br />

Temasek: Advised Temasek in the acquisition of a substantial stake in Medreich, a generic<br />

pharma company.<br />

<br />

Makemytrip.com: Advised Makemytrip.com, an Indian tour and travel major in connection with<br />

the Softbank investment.<br />

<br />

Globeleq: Advised Globeleq (affiliate of CDC Advisors) in connection with its proposed<br />

investment in various power projects in India and Bangladesh.<br />

<br />

Ishtitmar: Advised Ishtitmar in its subscription to FCCBs issued by Spice Jet.<br />

<br />

Schroders: Advised Schroders with respect to acquisition of stake in Lodhi Hotels.<br />

<br />

Temasek Advised Temasek in relation to their investment in Apollo Health Street Limited; a<br />

health care Knowledge Process Outsourcing company in India.<br />

5

Moser Baer: Advised with respect to Warburg Pincus’ investment in Moser Baer, a company<br />

engaged in the manufacture of removable data storage media (GDR on a private placement<br />

basis).<br />

<br />

CDC Advisors: Advised CDC Advisors in their investment in two greenfield power projects in<br />

Sri Lanka, which has been since then financially closed, and under operation.<br />

<br />

Dr. Lals PathLabs Pvt. Ltd: Advised and assisted Dr. Lals PathLabs Pvt. Ltd (DLPL), a<br />

renowned pathology laboratory in structuring, negotiating and closing a transaction involving<br />

private equity investment by West Bridge Ventures Investment Holding in DLPL.<br />

<br />

Hindustan Sanitaryware & Industries Limited (HSIL): Advised Hindustan Sanitaryware &<br />

Industries Limited (HSIL), an Indian public listed company, in its issuance of fully convertible<br />

debentures to Henderson (Mauritius) Ltd.<br />

6