Prior Authorizations

Prior Authorizations

Prior Authorizations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

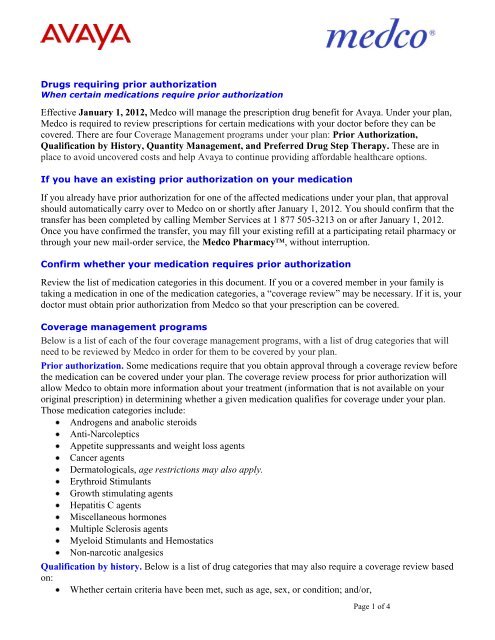

Drugs requiring prior authorization<br />

When certain medications require prior authorization<br />

Effective January 1, 2012, Medco will manage the prescription drug benefit for Avaya. Under your plan,<br />

Medco is required to review prescriptions for certain medications with your doctor before they can be<br />

covered. There are four Coverage Management programs under your plan: <strong>Prior</strong> Authorization,<br />

Qualification by History, Quantity Management, and Preferred Drug Step Therapy. These are in<br />

place to avoid uncovered costs and help Avaya to continue providing affordable healthcare options.<br />

If you have an existing prior authorization on your medication<br />

If you already have prior authorization for one of the affected medications under your plan, that approval<br />

should automatically carry over to Medco on or shortly after January 1, 2012. You should confirm that the<br />

transfer has been completed by calling Member Services at 1 877 505-3213 on or after January 1, 2012.<br />

Once you have confirmed the transfer, you may fill your existing refill at a participating retail pharmacy or<br />

through your new mail-order service, the Medco Pharmacy, without interruption.<br />

Confirm whether your medication requires prior authorization<br />

Review the list of medication categories in this document. If you or a covered member in your family is<br />

taking a medication in one of the medication categories, a “coverage review” may be necessary. If it is, your<br />

doctor must obtain prior authorization from Medco so that your prescription can be covered.<br />

Coverage management programs<br />

Below is a list of each of the four coverage management programs, with a list of drug categories that will<br />

need to be reviewed by Medco in order for them to be covered by your plan.<br />

<strong>Prior</strong> authorization. Some medications require that you obtain approval through a coverage review before<br />

the medication can be covered under your plan. The coverage review process for prior authorization will<br />

allow Medco to obtain more information about your treatment (information that is not available on your<br />

original prescription) in determining whether a given medication qualifies for coverage under your plan.<br />

Those medication categories include:<br />

Androgens and anabolic steroids<br />

Anti-Narcoleptics<br />

Appetite suppressants and weight loss agents<br />

Cancer agents<br />

Dermatologicals, age restrictions may also apply.<br />

Erythroid Stimulants<br />

Growth stimulating agents<br />

Hepatitis C agents<br />

Miscellaneous hormones<br />

Multiple Sclerosis agents<br />

Myeloid Stimulants and Hemostatics<br />

Non-narcotic analgesics<br />

Qualification by history. Below is a list of drug categories that may also require a coverage review based<br />

on:<br />

Whether certain criteria have been met, such as age, sex, or condition; and/or,<br />

Page 1 of 4

Whether treatment of an alternate therapy or course of treatment has failed or is not appropriate.<br />

In either of these instances, Medco pharmacists will review the prescription to ensure that all criteria<br />

required for a certain medication have been met. If the criteria have not been met, a coverage review will<br />

be required. If so, Medco will automatically notify the pharmacist, who will in turn tell you that the<br />

prescription needs to be reviewed for prior authorization. If you know in advance that your prescription<br />

requires a coverage review, ask your doctor to call the coverage management team before you go to the<br />

pharmacy. Examples of these drug categories include:<br />

Attention deficit hyperactivity disorder agents<br />

COX-2 inhibitors<br />

Non-sedating antihistamines<br />

Pain management — narcotic analgesics<br />

Pulmonary arterial hypertension agents<br />

Rheumatoid arthritis and other autoimmune disorder agents<br />

Quantity management. To promote safe and effective drug therapy, certain covered medications may<br />

have quantity restrictions. These quantity restrictions are based on product labeling or clinical guidelines<br />

and are subject to periodic review and change. Examples of drug categories include:<br />

Anti-fungal agents<br />

Anti-influenza agents<br />

Anti-narcoleptic agents<br />

Cancer agents<br />

Dermatologicals<br />

Erectile dysfunction therapy<br />

Migraine agents<br />

Miscellaneous hormones<br />

Non-narcotic analgesics<br />

Pain management—narcotic analgesics<br />

Pulmonary arterial hypertension agents<br />

Rheumatoid arthritis and other autoimmune disorder agents<br />

Smoking deterrents<br />

Preferred Drug Step Therapy. Intended to reduce costs for you and your plan by encouraging the use of<br />

medications that are less expensive but can treat your condition effectively. Preferred step therapy may<br />

require you first to try one or more specified drugs to treat a particular condition before the plan will cover<br />

another (usually more expensive) drug that your doctor may have prescribed.<br />

If you’re taking a medication that requires step therapy, approximately 30 days prior to the effective date,<br />

you’ll receive a letter explaining that your plan will not cover it unless you try the alternative first. The<br />

letter will also have information on starting a coverage review if your doctor believes that you should take<br />

the original medication. Examples of drug categories include:<br />

Growth stimulating agents<br />

Rheumatoid arthritis and other autoimmune disorder agents<br />

Angiotensin receptor blockers<br />

Hypnotic agents<br />

Intranasal steroids agents<br />

Osteoporosis agents<br />

Proton pump inhibitors<br />

Migraine agents<br />

Selective serotonin receptor inhibitors<br />

Page 2 of 4

If a coverage review is required<br />

Beginning January 1, 2012, to arrange a review, ask your doctor to call Medco toll-free at 1 800<br />

753-2851, 8:00 a.m. to 9:00 p.m., Eastern time, Monday through Friday. If prior authorization is not<br />

obtained, you will be responsible for the full cost of the medication at retail. If you mail in the<br />

prescription to the Medco Pharmacy, your prescription will be returned unfilled. If coverage is approved,<br />

you will pay your normal copayment or coinsurance for the medication.<br />

Make sure you have a 2-week supply of medication on hand on January 1, 2012. The review may<br />

take several business days. To help avoid any interruption, you should have at least a 2-week supply of<br />

your medication on hand on January 1. You may want to ask your doctor for a short-term supply of up<br />

to 30 days in case of any delays.<br />

If you have any questions, please call Member Services toll-free at 1 877 505-3213.<br />

The process to determine if prior authorization is required<br />

To save you time and help avoid any confusion, you can check to see if your medication does require prior<br />

authorization (coverage review) per the aforementioned list, OR you can call Medco Member Services on<br />

or after January 1, 2012, at 1 877 505-3213. Below, we’d like to highlight the coverage review process,<br />

both for retail and mail-order prescriptions.<br />

At a participating retail pharmacy<br />

You can check yourself to see if your medication requires a coverage review prior to filling your<br />

prescription. Or, you can take your new prescription to your local pharmacist, who will submit the<br />

information to Medco on your behalf. If a coverage review is necessary, Medco will automatically<br />

notify the pharmacist, who in turn will tell you that the prescription needs to be reviewed for prior<br />

authorization.<br />

As an enrolled member, you or your doctor may start the review process by calling Medco toll-free<br />

at 1 800 753-2851, 8:00 a.m. to 9:00 p.m., Eastern time, Monday through Friday.<br />

Your doctor will contact Medco and provide further details. After receiving the necessary<br />

information, Medco will notify you and the doctor (usually within 2 business days) to confirm<br />

whether or not coverage has been authorized.<br />

If coverage is authorized, you will pay your normal copayment or coinsurance for the medication.<br />

If coverage is not authorized, you will be responsible for the full cost of the medication. If<br />

appropriate, you can talk to your doctor about alternatives that may be covered. (You have the right<br />

to appeal the decision. Information about the appeal process will be included in the letter that you<br />

receive.)<br />

Through your mail-order service, the Medco Pharmacy<br />

You can check yourself to see if your medication requires a coverage review prior to filling your<br />

prescription. Or, you can mail the prescription to Medco.<br />

If a coverage review is necessary to obtain coverage for the medication, Medco contacts your doctor,<br />

requesting more information than appears on the prescription. After receiving the necessary<br />

information, Medco notifies you and the doctor (usually within 1 to 2 business days), confirming<br />

whether or not coverage has been approved.<br />

If coverage is authorized, you will receive your medication and simply pay your normal copayment<br />

or coinsurance for the medication.<br />

Page 3 of 4

If coverage is not authorized, Medco will send you notification in the mail, along with your original<br />

prescription if it was mailed to the Medco Pharmacy. You have the right to appeal the decision.<br />

Information about the appeal process will be included in the letter that you receive.<br />

Special note: If your medication is subject to quantity management rules, you can obtain your medication<br />

up to the quantity allowed. If the prescription exceeds the limit allowed, Medco will alert the pharmacist as<br />

to whether a coverage review is needed for the additional amount.<br />

Note: The information outlined above is accurate as of September 1, 2010; however, it is subject to change. Please call Member<br />

Services at 1 877 505-3213 if you have any questions or for further verification.<br />

All rights in the product names of all third-party products appearing here, whether or not appearing in italics or with a trademark<br />

symbol, belong exclusively to their respective owners. © 2010 Medco Health Solutions, Inc. All rights reserved.<br />

Page 4 of 4