Retail Research - HDFC Securities

Retail Research - HDFC Securities

Retail Research - HDFC Securities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Weekly Market, Sectoral And Stock Perspective – Technicals Oct 19, 2012<br />

Market View<br />

Markets are stuck in a narrow trading range. Considering that the technical indicators are weak, the odds seem<br />

higher of a break down. Many of the sectoral indices too are showing weak signals. Further weakness is likely once<br />

the supports of 18549/5633 are broken. Be however prepared to change your strategy if there is a break out on the<br />

upside.<br />

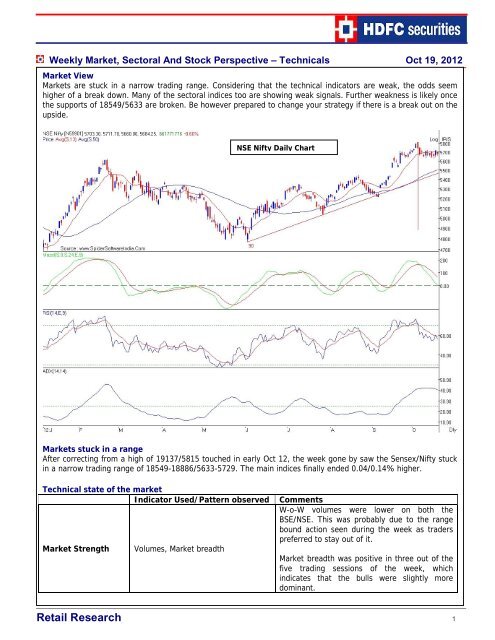

NSE Nifty Daily Chart<br />

Markets stuck in a range<br />

After correcting from a high of 19137/5815 touched in early Oct 12, the week gone by saw the Sensex/Nifty stuck<br />

in a narrow trading range of 18549-18886/5633-5729. The main indices finally ended 0.04/0.14% higher.<br />

Technical state of the market<br />

Indicator Used/Pattern observed<br />

Market Strength<br />

Volumes, Market breadth<br />

Comments<br />

W-o-W volumes were lower on both the<br />

BSE/NSE. This was probably due to the range<br />

bound action seen during the week as traders<br />

preferred to stay out of it.<br />

Market breadth was positive in three out of the<br />

five trading sessions of the week, which<br />

indicates that the bulls were slightly more<br />

dominant.<br />

<strong>Retail</strong> <strong>Research</strong> 1

Technical state of the market….contd.<br />

Indicator Used/Pattern observed<br />

Comments<br />

Trendiness<br />

ADX, Moving averages, Parabolic SAR<br />

The range bound action seen this week has led<br />

to the 13-day SMA flattening out and trading<br />

near the Sensex/Nifty.<br />

The main indices nevertheless remain in an<br />

uptrend on all time frames (Short Term,<br />

Intermediate and Long term). The Sensex/Nifty<br />

continue to remain well above the 13-week SMA<br />

(Red line) and the 200-day EMA.<br />

The weekly ADX readings have taken a breather<br />

after rising from oversold levels. The Daily ADX<br />

readings too have corrected from above 40<br />

levels, which indicates that the short-term<br />

uptrend is matured, and warrants caution (See<br />

chart on 1 st page).<br />

Volatility<br />

Bollinger Band, Average True Range<br />

(ATR)<br />

The Sensex/Nifty reacted from an upper band of<br />

the 20-week Bollinger Band last week. This is<br />

not a very positive signal as it implies that the<br />

index could now move towards its mid-band.<br />

The 20-day Bollinger Bands have also narrowed<br />

reflecting the range bound price action seen this<br />

week. As narrow ranges are usually followed by<br />

an expansion of the trading range, we can<br />

expect a breakout/breakdown of the 18549-<br />

18886/5633-5729 ranges soon.<br />

Momentum<br />

14 Day RSI, MACD, Stochastics<br />

Though the intermediate and long-term<br />

momentum indicators have eased in the last<br />

two weeks (14-week and 14-month RSI), they<br />

remain in uptrend and are not overbought,<br />

thereby giving healthy indications for the<br />

intermediate and long-term trend. Short-term<br />

momentum readings are however in decline<br />

mode with the 14-day RSI breaking its previous<br />

lows of 57.03 and trading below its 9-day EMA.<br />

The MACD too is trading below its 9-day EMA<br />

thereby indicating slow down in momentum and<br />

giving weak signals for the short term.<br />

Outlook<br />

With the Sensex/Nifty trading in a narrow range between the 18549-18886/5633-5729 levels in the last one<br />

week, traders now need to know in which direction the markets are likely to break out of this range. With most of<br />

the technical indicators like the Moving averages, ADX readings, Bollinger Bands, momentum readings giving weak<br />

signals, the odds do seem higher of a break down from this narrow range. Furthermore, most of the sectoral<br />

indices too are looking weak for the short term, which further increases the odds of a breakdown.<br />

<strong>Retail</strong> <strong>Research</strong> 2

Weakness is therefore likely to accelerate once the recent lows of 18549/5633 are broken. In this scenario, the next<br />

downside targets for the Sensex/Nifty are at 18291-17972/5534-5448.<br />

Having said that, traders need to be prepared for an upside breakout of this week’s narrow trading range. Buying<br />

Banking stocks seems like a good bet, as the BSE Bankex is one of the technically strongest sectors. In the scenario<br />

of a breakout, it is however quite likely that the breakout may not sustain and the Sensex/Nifty may fail to cross<br />

their recent intermediate highs of 19137/5816.<br />

Here are the key levels to watch for the coming week;<br />

Trading Strategy: Markets are stuck in a narrow trading range. Short term traders can trade in the direction of<br />

the breakout of this range. Considering that the technical indicators are weak, the odds seem higher of a break<br />

down. Be however prepared to change your strategy if there is a break out on the upside.<br />

Action Points Sensex Nifty Action<br />

Current Close 18682 5684<br />

Immediate Resistances 18886-18969 5729-5752<br />

Close above 18886/5729 could<br />

give bulls an upper hand<br />

Immediate Supports 18549-18423 5633-5607<br />

18549/5633 are the ST<br />

Reversal Levels<br />

Further Downsides 18291-17972 5534-5448<br />

Further Upside Targets 19137-19698 5816-5907 Previous intermediate highs<br />

Stock Pick – Short Chambal Fert<br />

Chambal Fert has been making lower tops and lower bottoms for the last few weeks. On Friday, the stock<br />

broke the 69.25 supports.<br />

Technical indicators are giving weak signals as the stock trades below the 13-day SMA and the 14-day RSI is<br />

in decline mode and below its 9-day EMA. The MACD indicator too is in decline mode and trading below its<br />

9-day EMA thereby indicating slow down in momentum and giving weak signals for the short term.<br />

We recommend a short and our entry levels are between `68.40-69.50. Stop loss is at `70.50, while<br />

downside targets are at `64.20. CMP is `68.45. Holding period is 3-5 days.<br />

Note: Once the market opens for trade, the analyst will review it and decide to give the call through an internal<br />

mail/SMS at the same or different levels of entry, target and stop loss or not give the call at all. Clients could get in touch<br />

with the analyst through their designated dealers to check about this.<br />

<strong>Retail</strong> <strong>Research</strong> 3

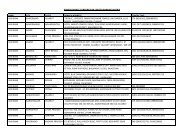

Sectoral studies<br />

Indices<br />

Last<br />

close<br />

W-o-W %<br />

Chg<br />

ST/ IT/ LT trend<br />

BSE FMCG 5902.0 2.6 ST, IT & LT up<br />

BSE Cons Durab 7333.8 1.9 ST, IT & LT up<br />

BSE Small Cap 7169.8 0.8 ST, IT & LT up<br />

BSE Banks 13193.1 0.8 ST, IT & LT up<br />

Comments<br />

At Lifetime Highs.<br />

ST Momentum OB.<br />

STR at 5654.<br />

At Lifetime Highs.<br />

ST Momentum OB.<br />

STR at 7401.<br />

Reacted from Upper<br />

Band of weekly Bollinger<br />

Bands.14-day RSI<br />

giving divergence<br />

signals<br />

Stocks likely<br />

to outperform<br />

ITC, HUL<br />

Consolidating in a range<br />

Canara Bank,<br />

between the 12917-<br />

Bank of Baroda<br />

13320 levels.<br />

BSE Sensex 18682.3 0.0 ST, IT & LT up<br />

BSE 500 7214.0 0.0 ST, IT & LT Up<br />

BSE Mid Cap 6671.6 -0.1 ST, IT & LT Up<br />

BSE Auto 10249.3 -0.2 ST, IT & LT up<br />

Made a lower top,<br />

Momentum weak.<br />

STR at 10178<br />

Stuck in a range<br />

BSE IT 5700.4 -0.5 ST Down, IT & LT Up between the 5651-5758<br />

levels.<br />

Unable to cross the<br />

BSE Healthcare 7520.6 -0.7 ST, IT & LT Up 7650 resistances.<br />

Momentum weak.<br />

BSE Power 2018.3 -0.9 ST, IT & LT Up<br />

Found resistance at<br />

2058. Below 13-day<br />

SMA. 14-day RSI and<br />

MACD in decline mode.<br />

BSE Capital Goods 11068.9 -1.0 ST, IT & LT up<br />

In consolidation mode.<br />

STR at 10942.<br />

BSE Oil/Gas 8437.2 -1.2 ST, IT Up & LT Down<br />

Could slide down<br />

towards trend line<br />

supports of 8400<br />

BSE Realty 1844.2 -1.4 ST, IT & LT Up<br />

BSE Metal 10351.4 -2.5 ST, IT & LT Up<br />

Closed below Mid-Band<br />

of 20-week Bollinger<br />

Bands. Momentum<br />

readings are also weak.<br />

ST = Short Term, IT = Intermediate Term, LT = Long Term, OB = Overbought, RSC = Relative Strength<br />

Comparative, STR = Short Term Reversal Level, SMA = Simple Moving Average<br />

<strong>Retail</strong> <strong>Research</strong> 4

BSE Bankex Daily chart<br />

BSE Bankex is consolidating in a<br />

range with a positive bias.<br />

BSE Power Index Daily chart<br />

Reacted from the 2058 resistances.<br />

Below 13-day SMA and momentum<br />

readings like MACD and 14-day RSI<br />

are in decline mode.<br />

<strong>Retail</strong> <strong>Research</strong> 5

Analyst: Subash Gangadharan (subash.gangadharan@hdfcsec.com)<br />

<strong>HDFC</strong> <strong>Securities</strong> Limited, I Think Techno Campus, Building – B, “Alpha”, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves,<br />

Kanjurmarg (East), Mumbai 400 042 Fax: (022) 3075 3435<br />

Disclaimer: This document has been prepared by <strong>HDFC</strong> <strong>Securities</strong> Limited and is meant for sole use by the recipient and not for circulation. This<br />

document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to<br />

buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it<br />

should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may<br />

from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended<br />

for non-Institutional Clients<br />

<strong>Retail</strong> <strong>Research</strong> 6