HDFC SECURITIES FORM FINAL PAGE 1 TO 42.cdr

HDFC SECURITIES FORM FINAL PAGE 1 TO 42.cdr

HDFC SECURITIES FORM FINAL PAGE 1 TO 42.cdr

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

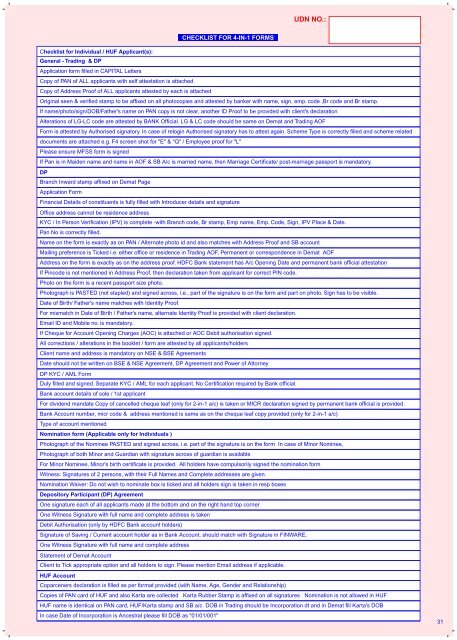

UDN NO.:CHECKLIST FOR 4-IN-1 <strong>FORM</strong>SChecklist for Individual / HUF Applicant(s):General - Trading & DPApplication form filled in CAPITAL LettersCopy of PAN of ALL applicants with self attestation is attachedCopy of Address Proof of ALL applicants attested by each is attachedOriginal seen & verified stamp to be affixed on all photocopies and attested by banker with name, sign, emp. code ,Br code and Br stamp.If name/photo/sign/DOB/Father's name on PAN copy is not clear, another ID Proof to be provided with client's declarationAlterations of LG-LC code are attested by BANK Official. LG & LC code should be same on Demat and Trading AOFForm is attested by Authorised signatory. In case of relogin Authorised signatory has to attest again. Scheme Type is correctly filled and scheme relateddocuments are attached e.g. F4 screen shot for "E" & "Q" / Employee proof for "L"Please ensure MFSS form is signedIf Pan is in Maiden name and name in AOF & SB A/c is married name, then Marriage Certificate/ post-marriage passport is mandatory.DPBranch Inward stamp affixed on Demat PageApplication FormFinancial Details of constituents is fully filled with Introducer details and signatureOffice address cannot be residence addressKYC / In Person Verification (IPV) is complete -with Branch code, Br stamp, Emp name, Emp. Code, Sign, IPV Place & Date.Pan No is correctly filled.Name on the form is exactly as on PAN / Alternate photo id and also matches with Address Proof and SB accountMailing preference is Ticked i.e. either office or residence in Trading AOF, Permanent or correspondence in Demat AOFAddress on the form is exactly as on the address proof. <strong>HDFC</strong> Bank statement has A/c Opening Date and permanent bank official attestationIf Pincode is not mentioned in Address Proof, then declaration taken from applicant for correct PIN code.Photo on the form is a recent passport size photo.Photograph is PASTED (not stapled) and signed across, i.e., part of the signature is on the form and part on photo. Sign has to be visible.Date of Birth/ Father's name matches with Identity Proof.For mismatch in Date of Birth / Father's name, alternate Identity Proof is provided with client declaration.Email ID and Mobile no. is mandatory.If Cheque for Account Opening Charges (AOC) is attached or AOC Debit authorisation signed.All corrections / alterations in the booklet / form are attested by all applicants/holdersClient name and address is mandatory on NSE & BSE AgreementsDate should not be written on BSE & NSE Agreement, DP Agreement and Power of AttorneyDP KYC / AML FormDuly filled and signed. Separate KYC / AML for each applicant. No Certification required by Bank official.Bank account details of sole / 1st applicantFor dividend mandate Copy of cancelled cheque leaf (only for 2-in-1 a/c) is taken or MICR declaration signed by permanent bank official is provided.Bank Account number, micr code & address mentioned is same as on the cheque leaf copy provided (only for 2-in-1 a/c)Type of account mentionedNomination form (Applicable only for Individuals )Photograph of the Nominee PASTED and signed across, i.e. part of the signature is on the form In case of Minor Nominee,Photograph of both Minor and Guardian with signature across of guardian is availableFor Minor Nominee, Minor's birth certificate is provided. All holders have compulsorily signed the nomination formWitness: Signatures of 2 persons, with their Full Names and Complete addresses are given.Nomination Waiver: Do not wish to nominate box is ticked and all holders sign is taken in resp boxesDepository Participant (DP) AgreementOne signature each of all applicants made at the bottom and on the right hand top cornerOne Witness Signature with full name and complete address is takenDebit Authorisation (only by <strong>HDFC</strong> Bank account holders)Signature of Saving / Current account holder as in Bank Account, should match with Signature in FINWARE.One Witness Signature with full name and complete addressStatement of Demat AccountClient to Tick appropriate option and all holders to sign. Please mention Email address if applicable.HUF AccountCoparceners declaration is filled as per format provided (with Name, Age, Gender and Relationship)Copies of PAN card of HUF and also Karta are collected Karta Rubber Stamp is affixed on all signatures Nomination is not allowed in HUFHUF name is identical on PAN card, HUF/Karta stamp and SB a/c DOB in Trading should be Incorporation dt and in Demat fill Karta's DOBIn case Date of Incorporation is Ancestral please fill DOB as "01/01/001"31

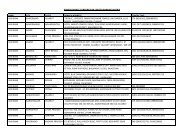

UDN NO.:CHECKLIST FOR 4-IN-1 <strong>FORM</strong>SProof of Identity and Proof of Address is compulsory for all holdersIntroduction Documents furnished () for Proof of Identity and Permanent/Correspondence AddressProof of Identity (Any one) HSL DP SBPan Card (Mandatory) Y Y YALTERNATE PHO<strong>TO</strong> IDPassport (with valid date)Voter ID CardDriving License (with valid date)Photo Credit Cards / Photo Debit Cards Issued by Banks.Identity card/Document with Applicant’s Photo issued bya) Central/State Government and its departmentsb) Statutory/Regulatory Authoritiesc) Public Sector Undertakingsd) Scheduled Commercial Bankse) Public Financial Institutionsf) Colleges affiliated to Universities (this can be treated asvalid only till the time the applicant is a student)g) Professional Bodies such as ICAI, ICWAI, ICSI,Bar Council etc. to their Members.Documentary evidence of financial details to trade in Derivatives segment.1.Copy of ITR Acknowledgement (For last financial year)2.Copy of Annual Accounts (for last financial year )3.Copy of Form 16 in case of salary income (for last financial year)4.Net worth certificate (latest one or at the end of last financial year)5.Salary Slip (for one month in current financial year)6.Bank account statement (for last 6 months)7.Copy of demat account Holding statement (not more than 3 months old)8.Any other relevant documents substantiating ownership of assets.YYYNNNNNNNNYYYYYYYYYYYYYYYYYYYYNNProof of Address (Any one) HSL DP SBPERMANENT ADDRESS PROOFRation CardPassport (with valid date)Voter ID CardDriving License (with valid date)Bank Passbook (Not valid for Co-op Banks)$Verified documents ofElectricity Bill (not more than 2 months old from the bill date)Land Line Telephone Bill(not more than 2 months old from the bill date)Valid Rent Agreement (banker CPV & Landlord's utility bill)Leave and License Agreement/Agreement for SaleCORRESPONDENCE ADDRESS PROOF (Apart from above)Identity card/document with Applicant’s photo & address issued bya) Central/State Government and its Departmentsb) Statutory/Regulatory Authoritiesc) Public Sector Undertakingsd) Scheduled Commercial Bankse) Public Financial Institutionsf) Colleges affiliated to Universities (this can be treatedas valid only till the time the applicant is a student)g) Prof.bodies i.e.ICAI,ICWAI,ICSI, Bar Council,etc. to its membersSelf-declaration by High Court & Supreme Court Judges,giving the new address in respect of their own accounts.YYYYYYYYYYYYYYYYYYYYYYYYYYYYYYN Y YN Y YN Y YN Y YN Y YN Y YN Y NN Y NN Y N$ 3 months for EB-DP and 2 months for SB. Co-op bk st not valid for SB.INTERNAL TRACK SHEET - FOR CPU USESr. No. Stages Entry Person's Name Date Signature1. LoginMaker HSLCheckerHSLHSL2.3.4.System CheckedPAN CheckedVerificationAcceptedRejectedHSLHSL5.6.7.Funds CheckedSeparation DoneData Entry Done by(1)HSLHSLHSL8. Data Entry Done by(2)HSL9. DSA/ Authorised(1)HSL10. DSA/ Authorised(2)HSLOFFICE COPYDear Customer,We acknowledge the receipt from Mr. / Mrs.the below mentioned documents on (date)1.Application form 2.Cheque no.Dated drawn on for Rs.towards Account Opening Charges of SecuritiesTrading Account. 3.Cheque no. Dated drawn on for Rs.(Mandatory proof, Address Proof, Photograph)“PLEASE PAY BY CHEQUE ONLY. DO NOT PAY CASH OR BEARER CHEQUE.”towards Initial Payment for opening <strong>HDFC</strong> Bank Savings Account. 4. Supporting documentsRegistered and Corporate Office: <strong>HDFC</strong> Securities Limited I Think Techno Campus, Building - B, "Alpha", Office Floor 8,Kanjurmarg (East), Mumbai 400 042. www.hdfcsec.com32