Regulation of shadow banking

Shadow banking is given a large share of the blame for the financial crisis. This perception raises the question of what kind of shadow banking system should remain in place in the future.

Shadow banking is given a large share of the blame for the financial crisis. This perception raises the question of what kind of shadow banking system should remain in place in the future.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ankenverband<br />

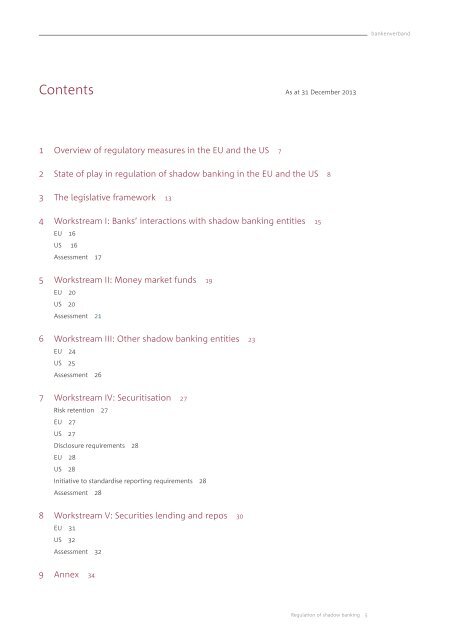

Contents As at 31 December 2013<br />

1 Overview <strong>of</strong> regulatory measures in the EU and the US 7<br />

2 State <strong>of</strong> play in regulation <strong>of</strong> <strong>shadow</strong> <strong>banking</strong> in the EU and the US 8<br />

3 The legislative framework 13<br />

4 Workstream I: Banks’ interactions with <strong>shadow</strong> <strong>banking</strong> entities 15<br />

EU 16<br />

US 16<br />

Assessment 17<br />

5 Workstream II: Money market funds 19<br />

EU 20<br />

US 20<br />

Assessment 21<br />

6 Workstream III: Other <strong>shadow</strong> <strong>banking</strong> entities 23<br />

EU 24<br />

US 25<br />

Assessment 26<br />

7 Workstream IV: Securitisation 27<br />

Risk retention 27<br />

EU 27<br />

US 27<br />

Disclosure requirements 28<br />

EU 28<br />

US 28<br />

Initiative to standardise reporting requirements 28<br />

Assessment 28<br />

8 Workstream V: Securities lending and repos 30<br />

EU 31<br />

US 32<br />

Assessment 32<br />

9 Annex 34<br />

<strong>Regulation</strong> <strong>of</strong> <strong>shadow</strong> <strong>banking</strong> 5