SEC Form 20-IS - 7-Eleven

SEC Form 20-IS - 7-Eleven

SEC Form 20-IS - 7-Eleven

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

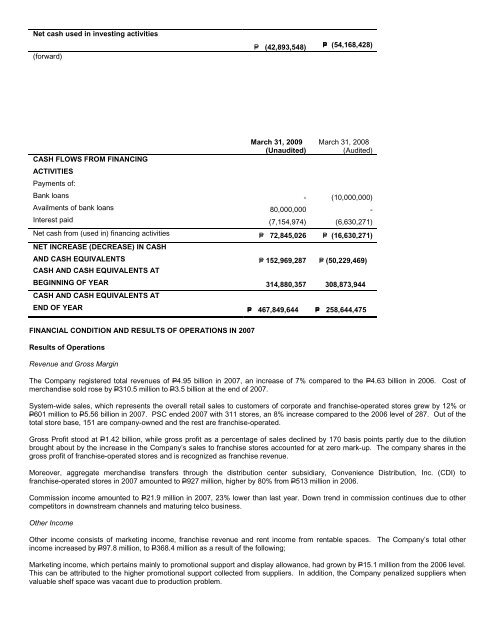

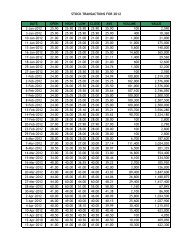

Net cash used in investing activities<br />

(forward)<br />

P= (42,893,548) P= (54,168,428)<br />

CASH FLOWS FROM FINANCING<br />

ACTIVITIES<br />

Payments of:<br />

March 31, <strong>20</strong>09<br />

(Unaudited)<br />

March 31, <strong>20</strong>08<br />

(Audited)<br />

Bank loans - (10,000,000)<br />

Availments of bank loans 80,000,000 -<br />

Interest paid (7,154,974) (6,630,271)<br />

Net cash from (used in) financing activities P= 72,845,026 P= (16,630,271)<br />

NET INCREASE (DECREASE) IN CASH<br />

AND CASH EQUIVALENTS P= 152,969,287 P= (50,229,469)<br />

CASH AND CASH EQUIVALENTS AT<br />

BEGINNING OF YEAR 314,880,357 308,873,944<br />

CASH AND CASH EQUIVALENTS AT<br />

END OF YEAR P= 467,849,644 P= 258,644,475<br />

FINANCIAL CONDITION AND RESULTS OF OPERATIONS IN <strong>20</strong>07<br />

Results of Operations<br />

Revenue and Gross Margin<br />

The Company registered total revenues of P4.95 billion in <strong>20</strong>07, an increase of 7% compared to the P4.63 billion in <strong>20</strong>06. Cost of<br />

merchandise sold rose by P310.5 million to P3.5 billion at the end of <strong>20</strong>07.<br />

System-wide sales, which represents the overall retail sales to customers of corporate and franchise-operated stores grew by 12% or<br />

P601 million to P5.56 billion in <strong>20</strong>07. PSC ended <strong>20</strong>07 with 311 stores, an 8% increase compared to the <strong>20</strong>06 level of 287. Out of the<br />

total store base, 151 are company-owned and the rest are franchise-operated.<br />

Gross Profit stood at P1.42 billion, while gross profit as a percentage of sales declined by 170 basis points partly due to the dilution<br />

brought about by the increase in the Company’s sales to franchise stores accounted for at zero mark-up. The company shares in the<br />

gross profit of franchise-operated stores and is recognized as franchise revenue.<br />

Moreover, aggregate merchandise transfers through the distribution center subsidiary, Convenience Distribution, Inc. (CDI) to<br />

franchise-operated stores in <strong>20</strong>07 amounted to P927 million, higher by 80% from P513 million in <strong>20</strong>06.<br />

Commission income amounted to P21.9 million in <strong>20</strong>07, 23% lower than last year. Down trend in commission continues due to other<br />

competitors in downstream channels and maturing telco business.<br />

Other Income<br />

Other income consists of marketing income, franchise revenue and rent income from rentable spaces. The Company’s total other<br />

income increased by P97.8 million, to P368.4 million as a result of the following;<br />

Marketing income, which pertains mainly to promotional support and display allowance, had grown by P15.1 million from the <strong>20</strong>06 level.<br />

This can be attributed to the higher promotional support collected from suppliers. In addition, the Company penalized suppliers when<br />

valuable shelf space was vacant due to production problem.