SEC Form 20-IS - 7-Eleven

SEC Form 20-IS - 7-Eleven

SEC Form 20-IS - 7-Eleven

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Cash flows generated from our retailing operations and franchising activities<br />

Borrowings under our revolving credit facility<br />

We believe that operating activities and available working capital sources will provide sufficient liquidity in <strong>20</strong>08 to fund our operating<br />

costs, capital expenditures and debt service. The following are the discussion of the sources and uses of cash for the year <strong>20</strong>07.<br />

Cash Flows from Operating Activities<br />

Net cash generated by operating activities in <strong>20</strong>07 reached P266 million, lower compared to the P358 million generated in <strong>20</strong>06.<br />

Although pre-tax income in <strong>20</strong>07 is higher compared to a year ago, the decline in net cash from operating activities was due to the<br />

increase in receivables and the payment of accounts payable, accrued expenses and current portion of long term debt.<br />

Cash Flows from Investing Activities<br />

Net cash used in investing activities reached P243 million in <strong>20</strong>06 compared to net cash out flow of P218 million in <strong>20</strong>07. Major cash<br />

outlay went to the procurement of store equipment, new store constructions and store renovations. Total acquisitions of property and<br />

equipment dropped this year by P23.7 million against <strong>20</strong>06. Significant investment in <strong>20</strong>06 went to the procurement of POS Machines<br />

and the roll-out of batches of store renovations.<br />

Majority of the company’s commitments for capital expenditures for the year are for new store constructions and renovations. Funds for<br />

these expenditures are expected to come from the anticipated increase in cash flows from retail operations and from additional<br />

borrowings if the need for such may arise.<br />

Cash Flows from Financing Activities<br />

Net cash outflow from financing activities during the year was P68.4 million. The year ended with outstanding bank loans of P375<br />

million, an improvement from P411.2 million at the beginning of the year. The Company was able to pre-pay some of its loan as a<br />

result of improved profitability in <strong>20</strong>07.<br />

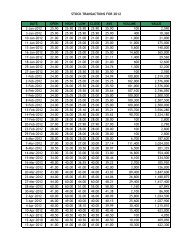

D<strong>IS</strong>CUSSION OF THE COMPANY’S KEY PERFORMANCE INDICATORS<br />

System Wide Sales<br />

System-wide sales represents the overall retail sales to customers of corporate and franchise-operated stores.<br />

Sales per Store Day<br />

Average daily sales of mature and new stores computed periodically and determine growth of all stores.<br />

Gross Margin<br />

This is the ratio of sales, less cost of sales but before considering selling and general expense, other income and income deduction<br />

over sales and expressed in terms of percentage.<br />

Return on Sales (ROS)<br />

Measures the level of recurring income generated by continuing operations relative to revenues and is calculated by dividing net<br />

income over sales.<br />

Return on Equity (ROE)<br />

The ratio of the net income over stockholders’ equity and indicates the level of efficiency with which a company utilizes owners’ capital.<br />

PLANS FOR THE NEXT 12 MONTHS<br />

In the year ahead, we intend to take strides to facilitate our expansion in new and traditional markets to expedite growth.<br />

We believe that the Company’s strong performance reflects the soundness of our business model and overall strategies. Looking<br />

ahead into <strong>20</strong>09, we intend to retain our competitiveness in the C-store industry. We remain determined to follow the strategic plan we<br />

have set to remain resilient in these turbulent times.<br />

We will go on to build on the success of our franchising initiatives by strengthening our franchise selection process and implementing<br />

our market development plan. This will be complemented by our HQ-level plans and programs aimed at supporting corporate and<br />

franchise stores.