LSGI Advisors, Inc. â February 10, 2005 In this issue: (1) Our ...

LSGI Advisors, Inc. â February 10, 2005 In this issue: (1) Our ...

LSGI Advisors, Inc. â February 10, 2005 In this issue: (1) Our ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>LSGI</strong> <strong>Advisors</strong>, <strong><strong>In</strong>c</strong>. – <strong>February</strong> <strong>10</strong>, <strong>2005</strong><br />

<strong>10</strong>07 Beaver Creek Drive<br />

Duncanville, Texas 75137<br />

(972)-780-1805<br />

<strong>In</strong> <strong>this</strong> <strong>issue</strong>: (1) <strong>Our</strong> comments on Arena Resources (ARD), Natural Gas Services (NGS),<br />

Mesabi Trust (MSB), and Roanoke Electric Steel (RESC) that appeared in the Wall Street Journal;<br />

(2) The iron ore market remains attractive as benchmark prices could skyrocket in <strong>2005</strong>; and (3)<br />

Supplemental research and articles.<br />

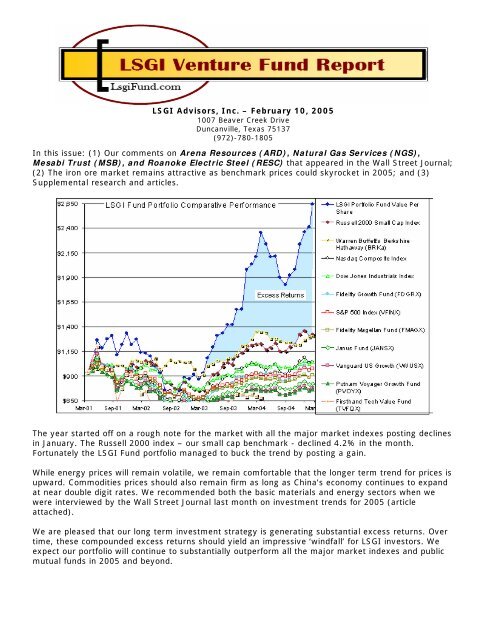

The year started off on a rough note for the market with all the major market indexes posting declines<br />

in January. The Russell 2000 index – our small cap benchmark - declined 4.2% in the month.<br />

Fortunately the <strong>LSGI</strong> Fund portfolio managed to buck the trend by posting a gain.<br />

While energy prices will remain volatile, we remain comfortable that the longer term trend for prices is<br />

upward. Commodities prices should also remain firm as long as China’s economy continues to expand<br />

at near double digit rates. We recommended both the basic materials and energy sectors when we<br />

were interviewed by the Wall Street Journal last month on investment trends for <strong>2005</strong> (article<br />

attached).<br />

We are pleased that our long term investment strategy is generating substantial excess returns. Over<br />

time, these compounded excess returns should yield an impressive ‘windfall’ for <strong>LSGI</strong> investors. We<br />

expect our portfolio will continue to substantially outperform all the major market indexes and public<br />

mutual funds in <strong>2005</strong> and beyond.

NEW YORK -- If it isn't broken, don't fix it.<br />

<strong>In</strong>vestors Stick With 2004 Winners<br />

Small-Stock Focus, By Karen Talley Dow Jones Newswires<br />

18 January <strong>2005</strong><br />

That appears to be the approach for a number of small-stock money managers as <strong>2005</strong> unfolds. They<br />

say they are sticking with the sectors that helped the Russell 2000 index of small-capitalization stocks<br />

rise 17% in 2004.<br />

Among sectors in the Russell 2000 that are projected to show the most profit growth in the fourth<br />

quarter of 2004 compared with the same period a year before, basic materials, like steel companies,<br />

lead the pack with a projected gain of 132%. The sector is followed by energy, including oil<br />

companies, ahead 42%; and construction companies, like homebuilders, rising 37%, according to<br />

Zacks <strong>In</strong>vestment Research. Small stocks are defined for <strong>this</strong> column as those with market<br />

capitalizations below $1.5 billion.<br />

The slowest profit gainers in the fourth quarter of 2004 compared with the prior year are seen as<br />

being transportation concerns, with earnings rising just 2%; conglomerates, advancing by 4%; and<br />

consumer staple companies, like household-goods providers, gaining 5%. All told, the Russell 2000<br />

index is expected to show 23% profit growth in the fourth quarter from a year-ago, Zacks says.<br />

If money managers follow through with their stick-to-it approach, they may be climbing a slippery<br />

slope since there is no guarantee the same sectors can lead the pack for two consecutive years.<br />

But then again, "There is no reason to change what's working," said Joe Dancy, fund<br />

manager of <strong>LSGI</strong> Technology Venture Fund. Mr. Dancy is maintaining his holdings in<br />

materials stocks, saying the good times aren't over for areas like steel and iron ore. He feels<br />

that, although China's economic growth will slow, it won't pull back enough to cause<br />

commodity prices to slip substantially. <strong>In</strong> the steel and iron-ore sectors, Mr. Dancy likes<br />

Mesabi Trust and Roanoke Electric Steel Corp.<br />

Oil companies are also appealing because of increasing global demand that Mr. Dancy<br />

expects will continue, while production capacity isn't increasing the way it has in the past.<br />

As a result, the price of crude oil should stay above $40 a barrel <strong>this</strong> year and related stocks<br />

should remain robust, he said. Energy stocks that Mr. Dancy holds include Natural Gas<br />

Services Group <strong><strong>In</strong>c</strong>. and Arena Resources <strong><strong>In</strong>c</strong>.<br />

Energy, including oil stocks, is also an area in which John Kvantas, portfolio manager of BB&T Small<br />

Company Value Fund, is overweight. "We find the supply-demand dynamic is very appealing, with less<br />

of the resource available," Mr. Kvantas said. Berry Petroleum Co. is among the stocks he holds.<br />

Mr. Kvantas is also allowing himself to branch out. He likes health care, specifically service-oriented<br />

areas like health maintenance organizations. Although the health group doesn't make the top three as<br />

far as profit growth is projected, Mr. Kvantas says that there are often cases where it pays to choose<br />

stocks on an individual basis, not a wholesale one. Sierra Health Services <strong><strong>In</strong>c</strong>. is one of his picks.<br />

Conversely, a number of money managers are shying away from the areas that are expected to<br />

experience the lowest profit growth. For instance, consumer staples "is not our favorite area and we're<br />

underweight the sector," said David Jordan, managing director of Tributary Capital Management. "We<br />

feel the economy will do better than most people expect and believe consumer staples are more of a<br />

play on the defensive side when the economy is waning.<br />

2

Global Iron Ore Markets: Benchmark Prices Could Skyrocket in <strong>2005</strong><br />

According to industry analysts China’s steel sector has added the equivalent of the entire United States<br />

steel industry in the past three years. Since China became the largest steel consumer in the world in<br />

1994, year after year it continues to break records in terms of steel consumption. Consumption<br />

increased 22% in 2003, and increased 13% or more in 2004. Many analysts see China’s steel<br />

consumption growing 6% to <strong>10</strong>% in <strong>2005</strong>.<br />

Last week Chinese authorities announced that <strong>this</strong> incredible growth continued with their economy<br />

expanding by 9.5% last year - much higher than many analysts expected. Most importantly, their<br />

economy finished the year in a particularly strong manner, accelerating to a growth rate of almost<br />

13% in the last three months of the year.<br />

These figures were also supported by data released last week on China’s energy consumption. China,<br />

as the world's second-largest crude oil consumer, imported 31% more of the fuel in December than in<br />

the same month a year earlier. While economic growth might be slowing, the world's fastest growing<br />

major economy continues to see increased demand for gasoline, diesel, coal, zinc, limestone – and<br />

iron ore – creating opportunities for individual investors in the U.S.<br />

China’s Iron Ore Consumption<br />

While China’s domestic iron ore production capacity has expanded it has not kept pace with the<br />

demand generated from these new steel<br />

facilities. China purchases around one-third<br />

of the world’s production of iron ore.<br />

London shipbroker Simpson Spence &<br />

Young recently released an estimate of<br />

Chinese imports of iron ore in <strong>2005</strong>,<br />

forecasting imports will expand by around<br />

15%.<br />

AME Mineral Economics, a mining<br />

economics consulting group, also released a<br />

study predicting Chinese iron ore imports<br />

<strong>this</strong> year would increase 20-25% to the 250<br />

million metric tons range – up from 200-<br />

2<strong>10</strong> million metric tons in 2004 - and 150<br />

million metric tons in 2003.<br />

Other analysts are even more bullish: London-based shipbroker Howe Robinson expects Chinese iron<br />

ore imports to soar by 70 million metric tons in <strong>2005</strong> – a 35% increase - to support the country’s<br />

expected raw steel production of 330 million metric tons.<br />

Benchmark Iron Ore Prices Set to Rise<br />

Once each year the major iron ore producers<br />

negotiate with their major steelmaking clients to set<br />

a price per ton to be paid for the ensuing year.<br />

Under <strong>this</strong> arrangement world iron ore prices<br />

increased <strong>10</strong>% in 2003, then 18.6% more in 2004,<br />

as prices for iron ore are pushing highs not seen in a<br />

decade.<br />

Brazil's Companhia Vale do Rio Doce, or CVRD, the<br />

world's biggest iron ore miner, has set the<br />

benchmark for global prices for the last two years in<br />

3

agreement with European steel manufacturing titan Arcelor.<br />

Many expected CVRD to seek a 20% to 25% price increases on the <strong>2005</strong> supply contracts currently<br />

being negotiated, a very healthy gains considering pricing in the immediate past.<br />

Surprised might not be the term to describe the reaction when CVRD began negotiations last month.<br />

They asked for a 90% price increase for the raw material in the year starting April 1 st amid booming<br />

worldwide demand for steel used in the construction, homebuilding, and automotive industries. While<br />

the actual agreed to increase most likely will be below <strong>this</strong> level, the gain very well could be the<br />

largest increase in 25 years – and a much larger increase than expected.<br />

“I don't think it's at the top of the cycle," said John Brinzo, the chairman and chief executive of<br />

Cleveland Cliffs, which has been mining iron ore from Michigan and other parts of North America since<br />

1891. "I think it has got a good way to run and I'm not so sure we're going to see a traditional cycle in<br />

steel <strong>this</strong> time," he said. Brinzo’s comments were made when Cleveland Cliffs announced the<br />

acquisition of an Austrialian mining company last month, an addition it hopes to utilize in meeting<br />

growing Chinese ore demand.<br />

<strong>In</strong> addition to tight iron ore markets, China’s growth has also created short supplies of alloys such as<br />

zinc, along with metallurgical coal used in the steelmaking process.<br />

Mesabi Trust (NYSE: MSB)<br />

While China is the focal point of the increase<br />

in demand in the steel sector, the iron ore<br />

market is to a large degree a global one. As<br />

the economics have improved, shipments of<br />

iron ore on the Great Lakes in 2004 increased<br />

substantially over year earlier levels. Higher<br />

water levels in the Great Lakes also<br />

encouraged strong gains in shipping levels.<br />

<strong>In</strong> <strong>this</strong> environment we find firms such as<br />

Mesabi Trust (MSB) a very attractive stock<br />

and income idea. Mesabi collects royalties and<br />

bonuses from the sale of iron ore that is<br />

shipped from Northshore Mining's Silver Bay,<br />

Minnesota facility.<br />

Northshore is a wholly owned subsidiary of<br />

Cleveland-Cliffs, a supplier of iron ore<br />

products to the steel industry. <strong>In</strong> the latest earnings announcement Cleveland-Cliffs noted that<br />

Northshore would expand production capacity from 5.0 million tons per year to 5.8 million tons per<br />

year, and that the “North American steel business continues to be very strong, with steel producers<br />

operating at or near capacity and steel pricing near record levels.”<br />

Mesabi has posted some impressive financial results in the last year, revenue growing at a 69% rate<br />

on a trailing twelve month basis. Earnings during the period increased 74.4%. Technically, the 12<br />

month relative strength is 98 and the company sells above the 200 day moving average on increasing<br />

volume. Distributions account for an annual yield of over 7%.<br />

Pictures: <strong>In</strong>land Steel’s iron ore carrier Wilfred Sykes approaches the pier from Lake Michigan in<br />

Escanaba, Michigan [top], while Great Lake ore carriers Lee A. Tregurha [middle] and the Kaye E.<br />

Barker [lower] wait to be loaded. Photos courtesy of Lee Rowe of Gwinn, Michigan -<br />

http://pasty.com/pcam/LRowe<br />

4

**********************************<br />

Once again we were asked to provide our best investment idea for <strong>2005</strong> to the Dick Davis Digest.<br />

Mesabi Trust (MSB) is our Dick Davis <strong><strong>In</strong>c</strong>ome Digest “Best idea for <strong>2005</strong>”:<br />

<strong>LSGI</strong> ADVISORS INC. VENTURE FUND REPORT<br />

<strong>Our</strong> <strong>LSGI</strong> Fund investors and full <strong>LSGI</strong> Venture Fund Report subscribers can access the link to the<br />

restricted area on our website to see what changes (if any) we have made to the portfolio during the<br />

month, and what companies our databases and screens are telling us to buy or sell. As always, please<br />

call should you have questions.<br />

<strong>10</strong> <strong>February</strong> <strong>2005</strong><br />

Lone Star Growth <strong>In</strong>vestor - LsgiFund.com<br />

(972)-780-1805 (Dallas, Texas)<br />

5

We found the following discussion regarding the energy sector of interest:<br />

6

Randolph Buss of the Der <strong>In</strong>vest <strong>In</strong>formant wrote an interesting article last month entitled<br />

“Swallow Iraq: The Little Bird Knew”. Three charts that accompanied his article are a great summary<br />

of trends we see in the U.S. energy sector:<br />

U.S. Petroleum Production:<br />

U.S. Consumption:<br />

U.S. Imports:<br />

9

Money in the Bank<br />

Ore carrier Wilfred Sykes was built by American Shipbuilding Co., Lorain, Ohio in 1949 for <strong>In</strong>land Steel Co. The<br />

streamlined bulk freighter was the first new American-built Great Lakes vessel constructed after World War II. At the<br />

time of her launch, she was the largest vessel on the Great Lakes.<br />

The Sykes is powered by 2 steam turbine engines producing a combined 7,000 horsepower driving an 18 1/2 foot<br />

diameter four-blade propeller giving her a speed of up to 16 mph. Being the first steamship built to burn "bunker C"<br />

heavy oil for fuel instead of coal, her fuel tanks can hold 165,000 gallons giving her a cruising range of 4,500 miles<br />

(source: George Wharton, Boatnerd.com).<br />

With the recent global increases in the price of iron ore we title <strong>this</strong> picture – one of the most strikingly beautiful<br />

pictures of a bulk iron ore freighter we have seen - “Money in the Bank”<br />

Photo courtesy of Lee Rowe of Gwinn, Michigan – Additional works can be viewed at<br />

http://pasty.com/pcam/LRowe<br />

<strong>10</strong>