LSGI Portfolio Comparative Performance* - LSGI Advisors Inc.

LSGI Portfolio Comparative Performance* - LSGI Advisors Inc.

LSGI Portfolio Comparative Performance* - LSGI Advisors Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>LSGI</strong> <strong>Advisors</strong>, <strong>Inc</strong>. – April 1, 2007<br />

1007 Beaver Creek Drive<br />

Duncanville, Texas 75137<br />

(972) 780-1805 (office)<br />

(214) 263-5201 (cell)<br />

Dear <strong>LSGI</strong> Investor:<br />

The <strong>LSGI</strong> Fund portfolio performed well last month. Due to our concerns about economic and market risks we have<br />

maintained a cash position that is well above average. Developments last month in the energy sector were positive for us,<br />

and earnings reported by firms in the <strong>LSGI</strong> portfolio were excellent.<br />

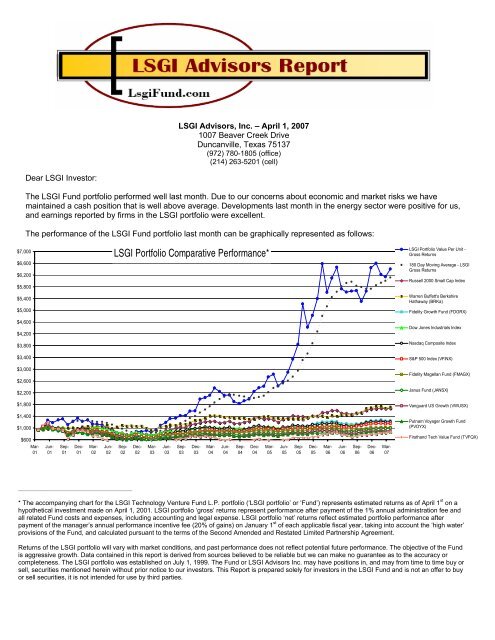

The performance of the <strong>LSGI</strong> Fund portfolio last month can be graphically represented as follows:<br />

$7,000<br />

$6,600<br />

$6,200<br />

$5,800<br />

$5,400<br />

$5,000<br />

$4,600<br />

$4,200<br />

$3,800<br />

<strong>LSGI</strong> <strong>Portfolio</strong> <strong>Comparative</strong> <strong>Performance*</strong><br />

<strong>LSGI</strong> <strong>Portfolio</strong> Value Per Unit -<br />

Gross Returns<br />

180 Day Moving Average - <strong>LSGI</strong><br />

Gross Returns<br />

Russell 2000 Small Cap Index<br />

Warren Buffett's Berkshire<br />

Hathaway (BRKa)<br />

Fidelity Growth Fund (FDGRX)<br />

Dow Jones Industrials Index<br />

Nasdaq Composite Index<br />

$3,400<br />

$3,000<br />

$2,600<br />

$2,200<br />

S&P 500 Index (VFINX)<br />

Fidelity Magellan Fund (FMAGX)<br />

Janus Fund (JANSX)<br />

$1,800<br />

$1,400<br />

$1,000<br />

Vanguard US Growth (VWUSX)<br />

Putnam Voyager Growth Fund<br />

(PVOYX)<br />

$600<br />

Firsthand Tech Value Fund (TVFQX)<br />

Mar-<br />

01<br />

Jun-<br />

01<br />

Sep-<br />

01<br />

Dec-<br />

01<br />

Mar-<br />

02<br />

Jun-<br />

02<br />

Sep-<br />

02<br />

Dec-<br />

02<br />

Mar-<br />

03<br />

Jun-<br />

03<br />

Sep-<br />

03<br />

Dec-<br />

03<br />

Mar-<br />

04<br />

Jun-<br />

04<br />

Sep-<br />

04<br />

Dec-<br />

04<br />

Mar-<br />

05<br />

Jun-<br />

05<br />

Sep-<br />

05<br />

Dec-<br />

05<br />

Mar-<br />

06<br />

Jun-<br />

06<br />

Sep-<br />

06<br />

Dec-<br />

06<br />

Mar-<br />

07<br />

_______________________________________________<br />

* The accompanying chart for the <strong>LSGI</strong> Technology Venture Fund L.P. portfolio (‘<strong>LSGI</strong> portfolio’ or ‘Fund’) represents estimated returns as of April 1 st on a<br />

hypothetical investment made on April 1, 2001. <strong>LSGI</strong> portfolio ‘gross’ returns represent performance after payment of the 1% annual administration fee and<br />

all related Fund costs and expenses, including accounting and legal expense. <strong>LSGI</strong> portfolio ‘net’ returns reflect estimated portfolio performance after<br />

payment of the manager’s annual performance incentive fee (20% of gains) on January 1 st of each applicable fiscal year, taking into account the ‘high water’<br />

provisions of the Fund, and calculated pursuant to the terms of the Second Amended and Restated Limited Partnership Agreement.<br />

Returns of the <strong>LSGI</strong> portfolio will vary with market conditions, and past performance does not reflect potential future performance. The objective of the Fund<br />

is aggressive growth. Data contained in this report is derived from sources believed to be reliable but we can make no guarantee as to the accuracy or<br />

completeness. The <strong>LSGI</strong> portfolio was established on July 1, 1999. The Fund or <strong>LSGI</strong> <strong>Advisors</strong> <strong>Inc</strong>. may have positions in, and may from time to time buy or<br />

sell, securities mentioned herein without prior notice to our investors. This Report is prepared solely for investors in the <strong>LSGI</strong> Fund and is not an offer to buy<br />

or sell securities, it is not intended for use by third parties.

<strong>LSGI</strong> <strong>Portfolio</strong> Commentary<br />

The Berkshire Hathaway annual report was published last month. Written by Warren Buffett, the annual report includes<br />

his opinions on the state of the markets and the business environment - and they help explain how he has consistently<br />

generated excess returns for investors.<br />

Reviewing the most recent annual report, and going back over the years and reviewing historical Berkshire Hathaway<br />

reports, three themes stand out that explain Buffett’s superior investment performance:<br />

• Good business sectors. Mr. Buffett focuses on firms in attractive sectors or business niches that allow companies<br />

to generate attractive margins. He notes that a great management will have difficulty making a poor business<br />

financially successful, but an average manager could do quite well operating in an attractive business niche.<br />

• Reasonable valuation and growth prospects. Noting the value-based philosophy of his college finance professor<br />

Ben Graham, Buffett and Berkshire have focused on paying a reasonable valuation for their ownership interests.<br />

Originally Buffett bought ownership interests by buying publicly traded shares on the open market. Due to the size<br />

and amount of capital they now manage he now prefers to acquire the entire enterprise through a negotiated sale.<br />

• Smaller firms and portfolios are at an advantage. Operating with large amounts of capital Buffett notes they<br />

cannot come close to generating returns as impressive as they did when they managed much smaller sums. He<br />

notes:<br />

Charlie Munger – my partner and Berkshire’s vice chairman – and I run what has turned out to<br />

a big business. . . We certainly didn’t plan it that way. Charlie began as a lawyer, and I thought of myself as a<br />

security analyst. Sitting those seats, we both grew skeptical about the ability of big entities of any type to<br />

function well. Size seems to make many organizations slow-thinking, resistant to change and smug.<br />

Buffett and Munger’s early focus were on small companies – firms that today would be referred to as ‘microcaps’.<br />

These firms trade in the most inefficient part of the market. Due to the market inefficiencies active portfolio<br />

managers can find attractive firms at reasonable valuations in this sector.<br />

While we did not intend to attempt to replicate Buffett’s strategy, the financial screens that we use to examine databases<br />

for good investment ideas tend to find firms: (1) in attractive business sectors, (2) with reasonable valuations and (3)<br />

attractive growth prospects, that are (4) small therefore (5) overlooked by most analysts. Our portfolio over the longer term<br />

has also tended to deliver excess returns to our investors.<br />

The historical performance of the <strong>LSGI</strong> Fund portfolio as of April 1 st is estimated as follows:<br />

Annualized Performance as of 4/1/07- Estimated * 1 Year 3 Year 5 Year 7+ Year Life of the Fund<br />

<strong>LSGI</strong> Technology Venture Fund - Gross Returns* 6.0% 40.1% 41.8% 27.1%<br />

<strong>LSGI</strong> Technology Venture Fund - Net Returns* 4.5% 33.6% 35.7% 22.9%<br />

Russell 2000 Small Capitalization Index 4.6% 10.7% 9.6% 7.5%<br />

Standard & Poor's 500 Index 9.7% 8.0% 4.4% 0.5%<br />

Nasdaq Composite Index 3.5% 6.6% 5.7% -1.4%<br />

At the end of the first quarter of 2007 – March 31 st – we prepared a linear regression analysis of the last five years of<br />

investment data to determine if we were adding value as an active manager. A linear regression is a method of organizing<br />

and analyzing a set of data points. It uses mathematical relationships to fit a straight line through the data set. This<br />

regression analysis is an important part of the Capital Asset Pricing Model (‘CAPM’) used in investment circles.<br />

Over the last five years the best performing index is the Russell 2000 Small Cap Index – so we will use that data set to<br />

determine if we are adding value. This index is also an appropriate benchmark since it also tracks the performance of<br />

small companies – firms that we tend to focus on when using our quantitative stock selection process.<br />

2

Going back over the last 60 months we draw a straight line<br />

through the set of data points using the linear regression<br />

methodology (see chart at right). Excess returns over and<br />

above what would be expected from movements of the market<br />

itself – known as alpha (‘α’) in the investment community –<br />

amounted to 1.52% per month net of all fees and expenses.<br />

It is rare for an actively managed portfolio to generate this<br />

degree of excess returns, or ‘alpha’. The results of the<br />

regression analysis are statistically significant.<br />

Note that the coefficient of determination – also known as “R<br />

squared” – is 0.402. That indicates that the performance of the<br />

<strong>LSGI</strong> portfolio is not explained well by movements of the<br />

Russell 2000 index. If the Russell 2000 index and our portfolio<br />

correlated perfectly R squared would be 1.000.<br />

The Russell 2000 index and the <strong>LSGI</strong> portfolio do not correlate<br />

closely, the movement in one variable does not explain the<br />

movement in the other. For our investors this is a very positive<br />

event – excess returns that don’t correlate closely with the<br />

market indices tend to reduce risk across an individual’s total<br />

portfolio.<br />

<strong>LSGI</strong> Net Returns (Monthly) .<br />

Y Axis<br />

<strong>LSGI</strong> Net Returns v. Russell 2000 Small Cap Index<br />

(last 60 months - monthly data)<br />

30.0%<br />

20.0%<br />

10.0%<br />

0.0%<br />

-15.0% -5.0% 5.0% 15.0%<br />

-10.0%<br />

-20.0%<br />

Russell 2000 Index Returns (Monthly)<br />

X Axis<br />

y = 1.2377x + 0.0152<br />

R 2 = 0.402<br />

The ‘beta’, or volatility, of the regression model is 1.2377, which means the <strong>LSGI</strong> portfolio is 1.2377 times as volatile as<br />

the Russell 2000 index. Volatility is considered a measure of risk according to some analysts, the higher the volatility the<br />

more risky the portfolio. Mr. Buffett considers the argument that volatility equals risk a ‘distortion’ according to some of his<br />

writings.<br />

Morningstar InvestorForce Database. In the Morningstar InvestorForce database as of<br />

April 1 st , on a total return basis their ranking placed us 55 th of 1149 portfolios over the last<br />

36 months. This ranks us in the top 5% of all funds in that database.<br />

Barron’s <strong>Portfolio</strong> Challenge. We used our <strong>LSGI</strong> screens again this year to identify companies to buy in the Barron’s<br />

Challenge portfolio management contest – companies we also bought for the <strong>LSGI</strong> Fund portfolio. Last year we finished<br />

the Barron’s contest in third place. This year, with a month remaining in the contest, we are in 18 th place in the contest out<br />

of 1,976 portfolios - in the top 1%.<br />

[<strong>Portfolio</strong>s ranked 1 st to 16 h omitted]<br />

[<strong>Portfolio</strong>s ranked 20 th to 1,976 th omitted]<br />

Looking forward, we remain optimistic that our portfolio will continue to perform well compared to the major market<br />

indexes.<br />

1 April 2007<br />

<strong>LSGI</strong> <strong>Advisors</strong> <strong>Inc</strong>.<br />

LsgiFund.com<br />

3

In this issue: (1) A review of <strong>LSGI</strong> portfolio performance and developments; (2) Developments in the energy sector; (3)<br />

<strong>LSGI</strong> Fund holdings and new additions Comtech Group (COGO), International Royalty Corp. (ROY), and Pioneer Drilling<br />

(PDC); (4) A discussion of developments in <strong>LSGI</strong> portfolio companies; and (5) Supplemental research and articles.<br />

<strong>LSGI</strong> PORTFOLIO<br />

Last month we made the following portfolio changes:<br />

• We sold our positions in EZ Corp. (EZPW) and PeopleSupport (PSPT).<br />

• We opened new positions in Comtech Group (COGO), International Royalty Corp. (ROY), and Pioneer Drilling<br />

Corp. (PDC).<br />

The ‘statistical profile’ – median valuation and growth characteristics - of the <strong>LSGI</strong> Fund portfolio as of April 1 st remains<br />

attractive:<br />

4

DEVELOPMENTS IN THE ENERGY SECTOR<br />

We found several developments of interest in the energy sector last month. The Congressional General Accounting Office<br />

(GAO) issued a report on the future availability of crude oil. Their conclusions included the following points:<br />

• Due to the large amount of crude oil used by the U.S. economy, and the large amounts of imports needed to meet<br />

demand, the U.S. economy is more vulnerable than most to any energy supply issues<br />

• Demand for crude oil has been increasing globally as economies expand and modernize, requiring additional<br />

supplies<br />

• Peak oil – maximum global crude oil production rates – is estimated to occur anywhere from now to 2040. The<br />

large band of uncertainty is due to the lack of transparent data on reserves, production declines, questions<br />

regarding the ability of technology to address supply and demand issues, and investment and political<br />

uncertainties<br />

• One-third of the world’s oil reserves are in politically ‘high risk’ areas, increasing the risk of global supply<br />

disruptions<br />

• One-third of the world’s oil reserves are in areas considered ‘high risk’ from an investment standpoint<br />

• National oil companies hold a majority of the reserves of the top 10 global energy companies. The main objective<br />

of these firms includes optimizing tax and transfer revenues, goals which might conflict with the incentive to<br />

maximize crude oil production rates<br />

• The potential for alternative fuels to replace oil in the transportation sector is limited, especially in the short term.<br />

Serious alternative fuels and vehicles will take decades to develop<br />

In addition to the GAO report, the following events also transpired:<br />

• Iran’s dispute with Britain over the fate of 15 sailors has not been resolved. Iran pumped about 4 million barrels of<br />

oil a day in 2006, ranking as the world's fourth-largest producer behind Russia, Saudi Arabia and the United<br />

States. Iran’s oil reserves are second only to Saudi Arabia's according to EIA.<br />

• Cantarell, located in the Gulf of Mexico and the world’s secondlargest<br />

oilfield, yielded more than 2 million barrels per day (bpd) as<br />

recently as 2005. Output from Mexico’s Cantarell fell by nearly<br />

500,000 bpd to about 1.5 million bpd in December 2006, a 25<br />

percent decline. Unless reversed, Cantarell’s production declines<br />

will be felt in the U.S. which will have to offset the loss by<br />

purchasing crude on the international market (see chart at right).<br />

• China's crude oil imports are expected to rise more than 10% in<br />

2007, the nation's top refiner said last month. China last year relied<br />

on imports for 47% of total oil consumed.<br />

• China plans to begin filling the tanks at its third strategic oil reserve<br />

in by mid-2007. China began building four oil strategic storage<br />

facilities in 2004. Two of these facilities are now in operation.<br />

• Passenger car sales in China's vehicle market soared by 33 per<br />

cent in the first two months of 2007 compared with the same<br />

period of 2006. Total vehicle sales, which also counts trucks and<br />

buses, rose 25 per cent. China surpassed Japan last year to<br />

become the world's No. 2 vehicle market after the United States.<br />

• Wholesale gasoline demand in the U.S. is cyclical and tends to begin rising in March. Despite the use of ethanol<br />

and a "slowing" economy U.S. gasoline demand remains well above the five year average, and is above the<br />

record consumption levels of 2006. The EIA estimates that overall U.S. gasoline consumption will increase by<br />

1.2% in 2007.<br />

5

• World oil demand growth, led by China and the United States, will increase in 2007, putting pressure on OPEC<br />

producers to boost production. Analysts forecast average world oil demand growth this year at 1.39 million barrels<br />

per day. That is up from demand growth of 800,000 barrels per day last year according to the International Energy<br />

Agency.<br />

• About 80% of the crude oil consumed today was discovered before 1973. It has been estimated that for the last<br />

decade 5 barrels of oil have been produced on a global basis for every barrel of oil discovered.<br />

• The 2007 hurricane season should be "very active," with nine hurricanes and a good chance that at least one<br />

major hurricane will hit the U.S. coast, according to Dr. William Gray. He expects 17 named storms this year, five<br />

of them major hurricanes with sustained winds of 111 mph or greater. The probability of a major hurricane making<br />

landfall on the U.S. coast this year: 74 percent, compared with the average of 52 percent over the past century.<br />

**********************************************<br />

<strong>LSGI</strong> PORTFOLIO - CORPORATE DEVELOPMENTS<br />

The following firms were added to our portfolio or had developments of interest last month:<br />

ALLIS CHALMERS ENERGY (ALY - $16.25) announced fourth quarter net income increased to $0.40 from $0.14 in the<br />

year earlier period. Revenue increased to $114 million from $33. ALY provides services in the energy sector.<br />

ANGEION CORPORATION (ANGN - $14.72) announced first quarter net income increased to $0.12 from $0.02 in the<br />

year earlier period. ANGN produces medical devices and related products for the health industry.<br />

AMERIAN ORIENTAL BIOENGINEERING (AOB - $9.42) announced fourth quarter net income increased to $0.17 from<br />

$0.10 in the year earlier period. AOB manufactures and markets pharmaceutical products in China.<br />

ARENA RESOURCES INC. (ARD - $50.44) announced year end oil and natural gas reserves increased 43% from year<br />

earlier levels. Production during the fourth quarter increased 92% from year earlier levels. ARD is a domestic crude oil<br />

producer.<br />

COMTECH GROUP INC. (COGO - $17.81) is added to the <strong>LSGI</strong> portfolio this month. COGO designs mobile handset and<br />

telecom equipment primarily for manufacturers in China. The company makes our screens, and has compelling valuation<br />

and growth characteristics.<br />

FUEL TECH INC. (FTEK - $25.13) announced fourth quarter net income decreased to $0.06 from $0.11 in the year<br />

earlier period. Most of the decrease in the current quarter is due to tax liabilities that were not present a year ago. FTEK<br />

makes pollution control equipment.<br />

INTERNATIONAL ROYALTY CORPORATION (ROY - $5.86) is a new addition to the <strong>LSGI</strong> portfolio this month. The<br />

company is engaged in acquiring natural resource royalties with a specific emphasis on mineral royalties. ROY holds over<br />

60 royalties in numerous different commodities being mined or processed. ROY is a rare chance to invest in a true<br />

profitable micro-cap in the mining/mineral processing sector. We add the company to our portfolio this month.<br />

6

GIGAMEDIA LTD. (GIGM - $13.75) announced fourth quarter net income increased to $0.17 per share from $0.04 per<br />

share in the year earlier period. Revenue increased to $30 million from $12 million in the year earlier period. GIGM<br />

provides services and products in the online gaming sector, focusing on China and European markets.<br />

K-TRON INTERNATIONAL INC. (KTII - $71.50) announced fourth quarter net income increased to $1.57 per share from<br />

$0.63 per share in the year earlier period. Revenue increased to $44.3 million from $29.3 million in the year earlier period.<br />

KTII produces and markets material handling equipment for several industrial markets.<br />

OMEGA FLEX INC. (OFLX - $22.30) announced fourth quarter net income increased to $0.29 per share from $0.24 per<br />

share in the year earlier period. Revenue fell to $19.1 million from $20.0 million in the year earlier period. The company<br />

makes flexible tubular and braided metal (stainless steel, bronze) hoses for liquid and gas transportation.<br />

OMNI ENERGY SERVICES CORP. (OMNI - $10.42) announced fourth quarter net income increased to $0.27 per share<br />

from $0.03 per share in the year earlier period. Revenue increased to $26.1 million from $11.1 million in the year earlier<br />

period. OMNI provides services to the domestic energy sector.<br />

PIONEER DRILLING CO. (PDC - $12.86) is added to<br />

the <strong>LSGI</strong> portfolio this month. PDC provides contract<br />

land drilling services to independent, and oil and gas<br />

exploration and production companies in the United<br />

States. The company's rig fleet consisted of<br />

approximately 57 operating drilling rigs. We think that<br />

the value of the equipment owned by this company is<br />

roughly twice the market value of the stock - and the<br />

fundamentals are very impressive from both a growth<br />

and valuation standpoint. While the onshore drilling<br />

sector is currently not favored by investors, we think<br />

the stock price could double within the next 18-24<br />

months.<br />

Rig fleet utilization has continued to increase over the<br />

last few years, and higher prices for both crude oil and<br />

natural gas will support further increases in rig activity<br />

going forward.<br />

PRIME ENERGY (PNRG - $58.66) announced fourth quarter net income decreased to $0.60 per share from $1.65 per<br />

share in the year earlier period. Revenue fell to $21.1 million from $22.9 million in the year earlier period. PNRG is a<br />

domestic natural gas producer.<br />

********************************************************************************<br />

The Michigan Tech Applied <strong>Portfolio</strong> Management Program's team won the seventh annual RISE (Redefining Investment<br />

Strategy Education) portfolio management competition last week. RISE is the largest North American student investment<br />

and applied finance conference. The APMP won the "value" category with the highest risk-adjusted return for 2006 in the<br />

undergraduate division. This is the second year that the Michigan Tech APMP team has won top honors at RISE. More<br />

than 1,700 participants from 218 colleges and universities, representing every state and continent, attended this year's<br />

RISE symposium.<br />

<strong>LSGI</strong> <strong>Advisors</strong> <strong>Inc</strong>. awarded scholarships to current Michigan Tech APMP students, and we sit on the Board of <strong>Advisors</strong> to<br />

the program.<br />

As always we appreciate your support. Please call if you have questions.<br />

1 April 2007<br />

<strong>LSGI</strong> <strong>Advisors</strong> Report - LsgiFund.com<br />

(972)-780-1805 - Dallas, Texas<br />

7

Appendix<br />

The following articles and research materials on the energy sector, the markets, and the economy may be of<br />

interest to our investors.<br />

8

http://www.321energy.com/editorials/taylor/taylor040307.html?print=on<br />

Page 1 of 6<br />

4/3/2007<br />

« Return to 321energy.com<br />

Peak Oil, China, & India Will Send Oil Prices to the Moon<br />

Jay Taylor<br />

J Taylor’s Energy & Energy Tech Stocks<br />

April 3, 2007<br />

"It is evident that the fortunes of the world’s human population, for better or for worse, are<br />

inextricably interrelated with the use that is made of energy resources." (M. King Hubbert –<br />

1969)<br />

"There is no substitute for energy. The whole edifice of modern society is built upon it…It is<br />

not 'just another commodity' but the precondition of all commodities, a basic factor equal<br />

with air, water, and earth."E. F. Schumacher – 1973)<br />

“The Allies were carried to victory on a flood of oil…With the commencement of the war,<br />

oil and its products began to rank as among the principal agents by which they would<br />

conduct, and by which they could win it. Without oil, how could they have procured the<br />

mobility of the fleet, the transport of their troops, or the manufacture of several<br />

explosives?” (Britain’s Foreign Minister, Lord Curzon, commenting on the reason for the<br />

Allied victory in WWI)<br />

There is no doubt in your editor’s mind that empires cannot exist without control of the world’s oil<br />

supplies. If you don’t believe that, I would strongly suggest you read A Century of War, by F. William<br />

Engdahl. He points out that the rise of the existing Anglo-American empire was made possible by<br />

wrestling petroleum resources away from Germany prior to WWI. After WWI, the victors not only<br />

sucked the lifeblood out of Germany by imposing reparations three times the amount it could possibly<br />

pay, but in the process they deprived Germany of oil and other resources it needed to rebuild its<br />

economic interests. And so we had World War II, which set the stage for the existing Anglo-American<br />

empire and the major global institutions such as the World Bank, IMF, BIS, and United Nations that<br />

have continued to assist the U.S. and England in controlling the existing supplies of oil.<br />

Whenever various countries try to exercise their own sovereign rights to do as they wish with their own<br />

oil, and when those actions get in the way of the large corporate and banking interests of the Anglo-<br />

American empire, either covert or overt military action is taken to unseat the sovereign rights of those<br />

nations. The first example of that after WWII took place in Iran when that nation elected Dr.<br />

Mohammed Mossadegh as its leader in 1951. Mossadegh won election on a platform that would have<br />

required the Anglo-Iranian Oil Company to share profits on a 50/50 basis. The British did not want any<br />

part of that so it went to the Eisenhower Administration, and the CIA was put into action to overthrow<br />

Mossadegh, at which time Reza Shah Pahlavi was put into power—ensuring the oil would again flow to<br />

Anglo-American interests. In A Century of War, the author points out how Israel was implemented in<br />

Palestine as a means of enabling the Anglo-American empire to maintain a toehold in this oil-rich region<br />

of the world. As a result we in the American empire have managed to live an opulent lifestyle while the<br />

rest of the world lives in poverty.<br />

“The skylines lit up at dead of night, the air-conditioning systems cooling empty hotels in

http://www.321energy.com/editorials/taylor/taylor040307.html?print=on<br />

Page 2 of 6<br />

4/3/2007<br />

the desert, and artificial light in the middle of the day all have something both demented<br />

and admirable about them: the mindless luxury of a rich civilization, and yet of a<br />

civilization perhaps as sacred to see the lights go out as was the hunter in his primitive<br />

night.” (Jean Baudrillard – 1989)<br />

American and western European opulence have prevailed over the past 60+ years. We Americans have<br />

come to think it our natural-born right to be able to drive huge SUVs while most of the world lives in<br />

relative poverty. But our materialistic view of the world is on a collision course with a new reality that<br />

will be forced on us and will reduce our standard of living. The new reality I speak of is derived from a<br />

combination of declining production of oil, especially cheap oil, and rising competition from huge<br />

numbers of middle-class people from places like China and India as well as other lesser-developed<br />

countries. We are going to continue to pay much more for oil, as various geopolitical interests compete<br />

for dwindling supplies of oil, and as central bankers print more and more money in a self-deceptive<br />

move to try to pretend to society that we can afford expensive oil.<br />

Peak Oil as China and India Growth Rates Explode<br />

Another book I have recently read<br />

and highly recommend that you<br />

read is, The Party’s Over, by<br />

Richard Heinberg. This book<br />

discusses the arguments for and<br />

against Peak Oil, though the author<br />

admits he is a believer in peak oil<br />

theory. Unless there is some grand<br />

deception afoot to distort data on a<br />

wide front by a large number of<br />

people, in my view, peak oil theory<br />

has great credibility. Tellingly, it is<br />

the geologists who hunt for oil who<br />

are the strongest believers in peak oil, while economists who live in their theoretical world tend to<br />

dismiss claims that modern civilization is facing an energy, and thus an economic, crisis of epic<br />

proportions.<br />

Let’s take a look at some of the evidence presented in Mr. Heinberg’s book.<br />

During the 1920s, oil was discovered in western Pennsylvania. The relatively short life of those wells<br />

caused geologists and folks in general to believe in the notion that oil wells had a very limited lifespan.<br />

But then came some huge discoveries in western Texas and in the Persian Gulf that led people to scoff at<br />

the notion that we would need to worry any time soon about limited oil supplies.<br />

One person who did not scoff at that notion was Marion King Hubbert, who became one of the bestknown<br />

geophysicists in the world because of his disturbing prediction first announced in 1949 that the<br />

fossil-fuel era would prove to be very brief. He had actually started to do some work on petroleum and<br />

natural gas reserves while he was a student at the University of Chicago in 1926. In 1949, he used<br />

statistical and physical methods to calculate total world oil and natural gas supplies and documented<br />

their sharply increasing consumption. Then, in 1956, on the basis of his reserve estimate and his study of<br />

the lifetime production profile of typical oil reservoirs, he predicted that the peak of crude-oil production<br />

in the U.S. would occur between 1966 and 1972. At the time, most economists, oil companies, and<br />

government agencies, including the USGS, dismissed the prediction. But in fact, oil production did peak<br />

in 1971, as shown on the chart above. Roughly speaking, the production of oil from wells occurs over

http://www.321energy.com/editorials/taylor/taylor040307.html?print=on<br />

Page 3 of 6<br />

4/3/2007<br />

time on a normal distribution curve, as early production is slow until a peak is hit at about halfway<br />

through the life of a well and then declines begin to occur. With oil discoveries and heavy consumption<br />

taking place first in the U.S., and with an absence of wars to deter production, and with modern<br />

technologies being used first here, production from the lower 48 states has peaked earlier than<br />

international production, which is pictured on your left.<br />

One of Hubbert’s chief followers is Colin J.<br />

Campbell. After earning his Ph.D. at Oxford in 1957,<br />

Campbell worked first for Texaco and then Amoco<br />

as an exploration geologist, his career taking him to<br />

Borneo, Trinidad, Colombia, Australia, Papua New<br />

Guinea, the U.S., Ecuador, the U.K., Ireland, and<br />

Norway. He later was associated with<br />

Petroconsultants in Geneva, Switzerland, and in<br />

2001 brought about the creation of the Association<br />

for the Study of Peak Oil (ASPO), which has<br />

members affiliated with universities in Europe. He<br />

published extensively on the subject of petroleum depletion, and is author of the book The Coming Oil<br />

Crisis.<br />

Campbell’s most prominent and influential publication was the article “The End of Cheap Oil?” which<br />

appeared in the March 1998 issue of Scientific American. That article concluded the following: From an<br />

economic perspective, when the world runs completely out of oil is…not directly relevant: what matters<br />

is when production begins to taper off. Beyond that point, prices will rise unless demand declines<br />

commensurately. Using several different techniques to estimate the current reserves of conventional oil<br />

and the amount still left to be discovered, we conclude that the decline will begin before 2010.<br />

The chart of actual production as well as projected future<br />

production is noted above. Taken into consideration here are<br />

supplies of heavy oil and deepwater sources as well as<br />

assumptions of polar exploration as well. If this chart is close to<br />

being accurate—and I believe it is—then global supplies of oil<br />

are beginning to decline just as tens of millions of higher<br />

energyconsuming middle-class folks in China and India begin to<br />

enjoy the luxuries we in the West have known for decades. But<br />

can’t we find more oil if we simply look harder for it or if we<br />

opened up areas off the coast of the U.S. and in Alaska that have<br />

been off limits for so long? No doubt we would find some<br />

additional supplies of oil if we drilled for more in these off-limit<br />

places, but a stunning and sobering fact that we need to deal<br />

with is that it is becoming increasingly expensive and non<br />

economic to explore for oil and gas, as the two charts on your<br />

right illustrate. The top chart shows the decline in barrels of oil<br />

found per foot of drilling. Prior to 1950, between 30 and 52<br />

barrels of oil were found per foot of drilling. Since 1980, that<br />

number has ranged between 5 and 12 barrels of new oil per foot<br />

of drilling!<br />

The chart on your right tracks the cost per oil and gas well.<br />

What we are interested in here is the real cost after factoring out<br />

inflation. That figure is shown in the solid black line. Note how

http://www.321energy.com/editorials/taylor/taylor040307.html?print=on<br />

Page 4 of 6<br />

4/3/2007<br />

these costs per well have jumped from approximately $225,000 per well in 1960 to considerably over<br />

$800,000 per well in 2000. Moreover, the following illustration (which measures the net present value<br />

of oil and gas discoveries versus the net present value of exploration and development expenditures)<br />

shows that there is no good reason to continue exploring for oil and gas, because the returns (expressed<br />

in the net present value of exploring and developing as opposed to the net present value of oil and gas to<br />

be produced in the future) have turned negative over the past couple of years. In other words, factoring<br />

in the time value of money, on average it now costs more to explore and develop oil and gas wells than<br />

revenues that are returned out of the ground.<br />

Amazingly, we are seeing a very dramatic<br />

decline in return on investment, not over<br />

a long period of time but over the past<br />

few years. Note from the chart on your<br />

left that in 1999 and 2000, there was a net<br />

positive return as present value of future<br />

flows of oil and gas still exceeded the<br />

cost of exploration and development by a<br />

considerable margin. However, by 2001,<br />

the net present value of cost was around<br />

9%, while the net present value of future<br />

cash flows to be derived from the<br />

production of oil and gas was only about<br />

6%. During the next two years, the<br />

expense of exploring and developing cost companies a present value of 8%, while the returns slipped to<br />

less than 4% by 2003. These are the kinds of statistics that explain why oil companies are not plowing<br />

back their profits into more drilling even as the price of oil has risen dramatically. To me that is the best<br />

argument of all in favor of peak oil. If profits are to be had from exploration and development,<br />

companies will carry out those activities. But if they are not there, they won’t. It’s as simple as that. Of<br />

course, production can and has continued to decline even as new discoveries drop dramatically, as<br />

illustrated by the next chart, which shows a growing gap between current production and past and future<br />

discoveries.<br />

Amazingly, about 80% of the oil consumed today was<br />

discovered before 1973. But most Americans could care<br />

less about the declining discoveries of new oil supplies as<br />

long as they can afford to keep fueling up their SUVs. And<br />

even though the price of oil has been on the rise, so far<br />

there have been no shortages as production continues to<br />

rise. The chart on your right, however, which shows past<br />

and future discoveries of oil and existing production,<br />

suggests that while consumers may not care now, it won’t<br />

be long before they do, because if these statistics are in<br />

fact true, it is only a matter of time before there will be a substantial reduction in the quantity of oil<br />

available to the markets. If/when that takes place, one of two outcomes can be expected. If central<br />

bankers around the world choose not to accommodate their economies by cutting back on the creation of<br />

new money from thin air, the global economy is likely to be thrust into a global depression the likes of<br />

which we have not seen in the West since the 1930s. If, as now appears more likely, central bankers<br />

continue to print more and more money in an illfated attempt to accommodate higher oil prices, we may<br />

well be facing a hyperinflationary scenario, as independent economist John Williams has predicted.<br />

Interestingly, John is predicting hyperinflation around the year 2010, a time by when we would expect<br />

oil supplies to start declining rather dramatically. (For more on John William's theories , subscribe to J

http://www.321energy.com/editorials/taylor/taylor040307.html?print=on<br />

Page 5 of 6<br />

4/3/2007<br />

Taylor's Gold & Technology Stocks, and we will send you a complimentary copy of an article we<br />

published in last weekend's Hotline message that lays out the arguments for an impending hyperinflation<br />

in America.)<br />

Of more immediate concerns are tensions now brewing in the Middle East again over disagreements<br />

with Iran. With regard to that issue, I would direct your attention for a second time to the words of<br />

Britain’s Foreign Minister, Lord Curzon, who recognized that oil supplies were crucial to the success of<br />

the Allied Powers in WWI. Modern-day empires require oil to sustain themselves. Iran seeks to preserve<br />

its own oil supply, which will in time be inadequate to meet its own needs. And so it seeks to establish<br />

nuclear power plants to preserve this precious resource. As Scott Ridder has recently written, the chance<br />

of nuclear power plants in Iran leading to its threat to the U.S. is slim to none.<br />

What is at stake here is the continued domination of the post-World War II Anglo-American centric<br />

global power structure. If the U.S. loses its ability to access oil from the Middle East, it will be finished<br />

as the world’s lone superpower. In A Century of War, F. William Engdahl points out oil is the reason we<br />

are in Iraq and is why England and the U.S. forced Palestinians off their land and created Israel in 1948.<br />

The following chart shows why it is so imperative, for the preservation of the Anglo-American empire,<br />

that the oil keeps flowing from the Middle East. Recall above on page two that we discussed how the<br />

U.S. reached its peak oil production in<br />

1971. As you can see from the chart on<br />

your left, up until about that time, the U.S.<br />

exported just about as much oil as it<br />

imported. Then came the oil crisis of the<br />

early 1970s, and thanks to pricefixing<br />

(Marxist) policies of the Ford and Carter<br />

administrations, we actually had gas<br />

shortages and long lines at gas stations in<br />

the U.S.<br />

The reliance of the U.S. on imported oil<br />

gave rise to Iranian political in the in the<br />

1970s and to the overthrow of the Shaw,<br />

America’s choice dictator because he co-operated with America’s global interests. As the chart above<br />

shows, U.S. imports are now far greater than ever before, so that any disruption in that part of the world<br />

could bring about disastrous consequences for the global economy; and unless our access to oil<br />

continues from the Middle East, the Anglo-American status as lone superpower and owner of the<br />

world’s reserve currency could go up in hyperinflationary smoke. Because of the importance of oil in<br />

terms of military dominance, I fully agree with Jim Dines, who suggests that in a few short years all the<br />

major oilfields of the world are likely to be in the hands of the militaries of various governments. What<br />

we are seeing in Iran and the geopolitical games being played among China, Russia, and Iran on the one<br />

hand and the U.S. and western Europe on the other is just the beginning of what is likely to become<br />

increasingly hostile and hot areas of military conflict.<br />

We have not even begun to address the issue of global warming, which most scientists now believe is<br />

being rapidly caused by the use of hydrocarbons including oil, gas, and coal. If the majority of scientists<br />

are right, we may have life-threatening climate problems to deal with in addition to shortages of<br />

lifesustaining energy forms. The environment, peak oil, and rising political instability of sources of oil<br />

are all good reasons why I believe uranium and nuclear power are in the very early stages of what James<br />

Dines suggests may be the greatest bull market ever.<br />

Jay Taylor

http://www.321energy.com/editorials/taylor/taylor040307.html?print=on<br />

Page 6 of 6<br />

4/3/2007<br />

April 3, 2007<br />

J Taylor’s Energy & Energy Tech Stocks is published monthly as a copyright publication of Taylor<br />

Hard Money <strong>Advisors</strong>, <strong>Inc</strong>. (THMA), Box 770871, Woodside, N.Y. Tel.: (718) 457-1426. Web Site:<br />

WWW.JAYSENERGYSTOCKS.COM. Closed Positions: Cameco Corp (+5.7%), High Plains Uranium<br />

(+41.3%), Urasia Energy ltd. (+136.1%). THMA provides investment advice solely on a paid<br />

subscription basis. Companies are selected for presentation in this publication strictly on their merits. No<br />

fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar<br />

unless otherwise noted. The material contained herein is solely for information purposes. Readers are<br />

encouraged to conduct their own research and due diligence, and/or obtain professional advice. The<br />

information contained herein is based on sources, which the publisher believes to be reliable, but is not<br />

guaranteed to be accurate, and does not purport to be a complete statement or summary of the available<br />

information. Any opinions expressed are subject to change without notice. The editor, his family and<br />

associates, and THMA are not responsible for errors or omissions. They may from time to time have a<br />

position in the securities of the companies mentioned herein. All such positions are denoted by an<br />

asterisk next to the name of the security in the chart above. No statement or expression of any opinions<br />

contained in this publication constitute an offer to buy or sell the securities mentioned herein. Under<br />

copyright law, and upon request, companies mentioned herein from time to time pay THMA a fee of<br />

$500 per page for the right to reprint articles that are otherwise restricted for the benefit of paid<br />

subscribers. Subscription rates: Six Months $99; One Year $179; Two Years $329. Foreign delivery<br />

postal system, add 25% to regular prices.

Falls Church News-Press - Falls Church News-Press :: The Peak Oil Crisis: The Studies<br />

http://www.fcnp.com/index2.php?option=com_content&task=view&id=510&Itemid=33&...<br />

Page 1 of 2<br />

3/31/2007<br />

The Peak Oil Crisis: The Studies<br />

By Tom Whipple<br />

Thursday, 16 November 2006<br />

Across the world governments are scrambling faster and faster preparing for the coming energy crisis. Delegations from China<br />

are everywhere making deals for a share of the soon-to-dwindle oil flow. Almost weekly there is a new announcement from<br />

Beijing regarding plans for more wind, solar and biofuels. Japan and Korea are looking for alternative sources of energy supply.<br />

Sweden is saying, flat out, that peak oil is coming and is making plans for a fossil fuel-less future.<br />

The European Union is all over the map with plans for alternative fuels, new regulations on energy consumption, and efforts to<br />

guarantee an energy supply for the continent.<br />

Meanwhile, energy exporters are reveling in their newfound wealth and influence while in the poorer corners of the world people<br />

are quietly shutting off the lights. For many, the oil age ended when oil reached $60 a barrel.<br />

Here in America, however, there is as yet little sense of urgency about the future of our energy supply. Last summer when<br />

gasoline was $3+ a gallon and warnings of devastating hurricanes were in the air, Congress was indeed thrashing about in an<br />

attempt to reassure the voters they would do something prior to the fall elections. But the storm subsided, the hurricanes went<br />

away, oil stockpiles climbed, gasoline settled back to $2, and all was well. With a sigh of relief, the Dow-Jones surged to a new<br />

all-time high.<br />

Should any of you be feeling complacent, however, let me reassure you that the world is still burning 85 million barrels a day<br />

(b/d), there really have not been any important new discoveries, no world-saving technological breakthroughs have come to light,<br />

and you are only continuing to drive because so many of the world's peoples can't afford $60 oil.<br />

Beneath the surface in America, however, there is movement. The Democrats now control the Congress and are already floating<br />

proposals that could help with the coming crisis. These include rolling back tax breaks for the major oil companies, probing offshore<br />

lease deals, providing more money for renewable fuels, pushing for diesel and electric cars, and settling the spent nuclear<br />

fuel issue.<br />

Of more long-term significance, however, two major studies of the prospects for world energy supplies are currently underway in<br />

Washington. The first of these is being done by the Government Accountability Office and is to be released on February 28. This<br />

study will actually deal with the prospects for "peak oil" -- when it will come and what can be done to mitigate the consequences.<br />

The GAO was asked by the House of Representatives Science Committee to undertake this study that has been underway for<br />

over a year.<br />

The second and what on the surface sounds the most in-depth study of world energy resources ever undertaken is being done<br />

under the auspices of the National Petroleum Council (NPC). This council, a federally chartered and privately funded advisory<br />

committee to the Secretary of Energy, was established by President Truman in 1946. Its purpose is to represent the views of the<br />

oil and natural gas industries with respect to any matter relating to oil and natural gas. Note the words "the views of the oil and<br />

natural gas industries" as they just may come back to haunt us after the two studies are released.<br />

On October 5, 2005, Energy Secretary Bodman sent a letter to the NPC asking what the future holds for oil and gas supplies, can<br />

supplies continue to be found at affordable prices, and just what does the oil and gas industry recommend to ensure our<br />

prosperity? The issue was promptly accepted for study and the next seven months were spent planning and getting organized.<br />

Two weeks ago the NPC released an updated status report outlining the details of just who is studying what.<br />

The scope and work plan for the study are truly impressive. Task groups are to work on supply, demand, technology, and<br />

geopolitics. The task groups are to be overseen by a coordinating sub-committee that in turn reports to a Global Committee and<br />

finally to the NPC leadership itself. These task groups are supported by 25 "cross-cutting" subgroups, which are to examine<br />

smaller topics such as biomass, nuclear power, and "non-proprietary data." At last word some 200 people were involved in the<br />

NPC effort. The study also is reaching out to nearly everyone who can spell "oil" -- academia, laboratories, professional societies,<br />

consultants, governments, industry and you-name-it.<br />

From reading the work plan for the study, one can't help but be impressed by how thorough and comprehensive the study will be.<br />

Of particular interest is the opportunity to use and assess proprietary information about the world's oil reserves and prospects for<br />

production held by participating oil companies.<br />

What can we expect from these studies? The GAO effort will almost certainly be the straightforward professional exercise we<br />

have come to expect from this organization. The study will probably acknowledge that world oil production will peak someday and<br />

the researchers, who work for the Congress, will do their best to give a balanced answer to questions of when production will

Falls Church News-Press - Falls Church News-Press :: The Peak Oil Crisis: The Studies<br />

http://www.fcnp.com/index2.php?option=com_content&task=view&id=510&Itemid=33&...<br />

Page 2 of 2<br />

3/31/2007<br />

peak and what might we do about it.<br />

As for the NPC study, it would be unfair to prejudge something that has not yet been written. Considering its proposed scope and<br />

the number of people involved in the drafting, it may provide much valuable new data and many insights into the prospects for the<br />

earth's energy resources. It could even turn out to support the idea that severe energy shortages lie just ahead and give a<br />

balanced presentation of the prospects for energy during the next 25 years.<br />

On the other hand it is hard to avoid noting that several of the leaders of the NPC study have long records of vehemently<br />

opposing the idea that world oil production will peak within the next 10 years. Moat notable of these are the study's chairman, Lee<br />

Raymond, formerly of ExxonMobil, and Daniel Yergin of Cambridge Research Associates.<br />

If one were cynical, you could believe that the NPC study, which by definition is to provide the oil and gas industry's position, was<br />

commissioned to provide a counterweight to the independent GAO study should it conclude that peak oil is for real and imminent.<br />

The timing of the two studies' release will of course give the NPC plenty of time to incorporate or attempt to refute whatever<br />

evidence or logic the GAO cites in reaching its conclusions.<br />

No matter what the studies conclude, the possibility that our oil supplies will decline in the near future is one of the most, if not the<br />

most important issue facing the world in the coming century. These studies are bound to play a major role in the coming debate.<br />

Spread the Word:<br />

Close Window

Rockford's Newspaper Rock River Times | rockford illinois news information<br />

http://www.rockrivertimes.com/index.pl?cmd=printstory&id=15880&cat=2<br />

Page 1 of 3<br />

3/9/2007<br />

The giant sucking sound, revisited<br />

By Michael Vickerman, RENEW Wisconsin<br />

Back<br />

Remember the metaphorical “giant sucking sound” Ross Perot invoked in the 1992<br />

presidential debates? Perot employed that image to characterize the rapid exodus of jobs to<br />

Mexico that would surely result from ratifying the North American Free Trade<br />

Agreement.<br />

Fifteen years later, that vivid phrase could appropriately describe the increasingly<br />

desperate circumstances befalling Cantarell, Mexico’s largest oilfield, situated about 50<br />

miles off the coast of the Yucatan Peninsula.<br />

The giant sucking sound you might hear at Cantarell is what happens when hundreds of oil<br />

wells begin drawing gas and water from the very reservoirs that used to yield copious<br />

quantities of petroleum. It’s the sound of an oilfield rolling over its peak.<br />

To American ears, the name Cantarell evokes a casual, Southwestern feeling, more<br />

suggestive of a dude ranch than the world’s No. 2 oil field. By far the most productive oil<br />

reservoir in the Western Hemisphere, Cantarell was yielding more than 2 million barrels<br />

per day (bpd) as recently as 2005, outperforming all other fields, save mighty Ghawar in<br />

Saudi Arabia. At $50 per barrel, that level of production translated to $100 million a day.<br />

When a wealth generator of that magnitude starts to sputter and lose productivity, other<br />

oilfields must pick up the slack, or else the Mexican economy is bound to take a hit.<br />

Unfortunately, the most recent numbers from PEMEX, the state-owned oil company,<br />

don’t justify confidence. Output from Cantarell fell by nearly 500,000 bpd to about 1.5<br />

million bpd in December 2006, a 25 percent decline from 2005’s totals. Cantarell’s swoon<br />

took PEMEX’s total output below the 3 million bpd level for the first time in six years.<br />

PEMEX exports more than half of its crude to the United States alone; only Canada<br />

exports a larger volume. Since Cantarell’s output is roughly equivalent to Mexico’s total<br />

exports, production declines will be felt in the United States, which will have no choice<br />

but to offset the loss by purchasing more expensive crude on the international market.<br />

Make no mistake, a production crash at the world’s second-largest oilfield will have an<br />

effect on import volumes and the price of crude. In fact, oil markets have already taken<br />

notice. In mid-January, the per-barrel price of crude briefly sagged below the $50 mark.<br />

Since PEMEX’s admission two weeks ago, the markets have rebounded somewhat.<br />

PEMEX is working to expand output from other fields to offset continued losses at

Rockford's Newspaper Rock River Times | rockford illinois news information<br />

http://www.rockrivertimes.com/index.pl?cmd=printstory&id=15880&cat=2<br />

Page 2 of 3<br />

3/9/2007<br />

Cantarell, which are expected to average 15 percent a year. To meet that objective,<br />

PEMEX will inject nitrogen into the largest of the remaining oilfields, increasing reservoir<br />

pressure and flow rates. No doubt that will help, as Mexican crude is on the heavy side of<br />

the spectrum. But as demonstrated at Cantarell, where nitrogen injections since 2000<br />

produced substantial gains in flow rates, once the practice is discontinued, output drops<br />

sharply.<br />

If the projected annual decline rate is accurate, Cantarell will drop out of the million bpd<br />

club by 2010. As noted in the Wikipedia entry for Cantarell: “This rapid decline is<br />

postulated to be a result of production enhancement techniques causing faster oil<br />

extraction at the expense of field longevity.” Indeed, the consequences of nitrogen<br />

injection on an oilfield are not at all dissimilar to the effects of anabolic steroids on power<br />

hitters, both during and after usage.<br />

To increase output at Cantarell, PEMEX constructed the world’s largest nitrogenproducing<br />

plant. This facility, which was dedicated entirely to Cantarell, consists of four<br />

production lines, each with their own air separation units and natural gas-fired tubines. A<br />

fair amount of natural gas is sacrificed to capture nitrogen and pipe the gas 50 miles away<br />

to liberate more of Cantarell’s crude from the sea bottom. From the perspective of the<br />

Mexican government, whose taxes on PEMEX profits account for 37 percent of its budget,<br />

the effort was worth it, at least while production was going up.<br />

But now, having reached Cantarell’s downslope, the Calderón government finds itself<br />

hopelessly squeezed between an implacable geological reality and the need to find a<br />

replacement cash cow. But if the news from Cantarell means that Mexico’s overall oilexporting<br />

capacity is also in decline, then the government will have no choice but to limit<br />

petroleum consumption at home to prop up PEMEX’s export earnings, on which it is so<br />

dependent.<br />

The other large revenue generator for Mexico is tourism. <strong>Inc</strong>reasing oil extraction activity<br />

has been a long-time pillar of Mexico’s economic strategy, to keep the cost of jet fuel low<br />

enough to ensure more and more planefuls of Yankee and European tourists coming over<br />

to visit its beaches, mountains and ruins. Mexico’s dependence on tourism revenues<br />

provides additional motivation to emphasize oil exports over domestic consumption.<br />

An America that is distracted by loonball astronauts and celebrity inquests has no clue<br />

about the meaning of Cantarell’s decline, nor is it in any position to appreciate the<br />

unprecedented gyrations that await Mexico’s economy and society. There will be<br />

ramifications to the United States, of course, especially if the Mexican government’s<br />

predictions that oil exports will remain steady turns out to be too optimistic. It stands to<br />

reason that a decline in Mexico’s public spending will result in greater economic hardship,<br />

which would likely hasten the volume of illegal immigration into the United States. At<br />

that point it may not be possible to hear the giant sucking sounds at Cantarell above the<br />

cacophony occasioned by a swell of economic refugees surging north of the border.<br />

From the March 7-13, 2007, issue<br />

Copyright 2002-2007 - The Rock River Times

Rockford's Newspaper Rock River Times | rockford illinois news information<br />

http://www.rockrivertimes.com/index.pl?cmd=printstory&id=15880&cat=2<br />

Page 3 of 3<br />

3/9/2007<br />

Copyright © 2002-2007 - The Rock River Times

http://bioage.typepad.com/photos/uncategorized/cantarell.png<br />

Page 1 of 1<br />

3/13/2007

FIN24 : Empowering Financial Decisions<br />

http://www.fin24.co.za/articles/print_article.asp?articleid=1518-1783_2080445<br />

Page 1 of 1<br />

3/8/2007<br />

Print<br />

China's oil imports to top 10%<br />

08/03/2007 12:34<br />

Beijing - China's crude oil imports are expected to rise more than 10% to top 160 million tonnes in 2007, the nation's<br />

top refiner said on Thursday.<br />

The figure, published in the China PetroChemical News, a newspaper owned by China Petroleum Chemical Corp<br />

(Sinopec), compared with crude imports of 145 million tonnes in 2006.<br />

With nearly stagnant oil production at home, China last year relied on imports for 47% of total oil consumed.<br />

The booming Chinese economy, which grew 10.7% in 2006, the fourth year of double-digit expansion, has forced the<br />

country to source energy and resources throughout the world.<br />

China's key economic planning body announced last month that energy industries in nine oil producing countries<br />

were on a short list of "suitable" sites for Chinese investment.<br />

Among them were Kuwait, Qatar, Amman, Morocco, Libya, Nigeria, Norway, Ecuador and Bolivia.

People's Daily Online -- China to fill its third strategic oil reserve in mid-2007<br />

http://english.people.com.cn/200703/08/print20070308_355650.html<br />

Page 1 of 1<br />

3/8/2007<br />

China to fill its third strategic oil reserve in mid-2007<br />

China plans to begin filling the tanks at its third strategic oil reserve in east China's Shandong Province by<br />

the middle of this year to help secure the country's fuel supplies.<br />

China Petroleum and Chemical Corporation (Sinopec) will complete the Huangdao base in Shandong, said<br />

Du Guosheng, assistant to the president of Sinopec.<br />

The capacity of the Huangdao base is expected to reach 19 million barrels, Du said.<br />

China began building four oil reserves in 2004. Two are in Zhejiang Province, both of which have started<br />

operating. The others are respectively in northeast China's Liaoning Province, which has not be completed,<br />

and in Shandong Province, which will be in operation by the middle of this year.<br />

Some 6 billion yuan have been invested to secure reserve capacity of 10 million tons at the four sites.<br />

China is planning to build the second set of strategic oil reserves, which are expected to add another 28<br />

million tons of storage capacity,according to sources with NDRC.<br />

Gansu Province in the northwest has been selected as a site for one of the new reserve, while southern<br />

Guangdong and Hainan provinces are hoping to be chosen as other sites as they are close to Petro China's<br />

oil refineries in southern China.<br />

Du also said the company will complete talks with Saudi Aramco, which is looking to buy a 25-percent stake<br />

in the Sinopec's Qingdao refinery, which has a processing capacity of 200,000 barrels a day.<br />

The country imported 138.8 million tons of crude oil in 2006, up 16.9 percent from 2005. Imports that year<br />

accounted for 47 percent of the country's consumption. Industry observers have warned China will likely<br />

need to import more than 50 percent of its petroleum needs in a year or two. .<br />

Source: Xinhua<br />

People's Daily Online --- http://english.people.com.cn/

globeandmail.com: Chinese car sales soar 33 per cent<br />

http://www.theglobeandmail.com/servlet/story/RTGAM.20070309.wchinacar0309/BNStory...<br />

Page 1 of 4<br />

3/9/2007<br />

Posted AT 7:08 AM EST ON 09/03/07<br />

Chinese car sales soar 33 per cent<br />

ASSOCIATED PRESS<br />

BEIJING — Passenger car sales in China's booming vehicle market soared by 33 per cent in the<br />

first two months of this year compared with the same period of 2006, an industry association said<br />

Friday.<br />

Total vehicle sales, which also counts trucks and buses, rose 25 per cent, the China Association of<br />

Automobile Manufacturers said.<br />

China surpassed Japan last year to become the world's No. 2 vehicle market after the United States<br />

based on strong truck and bus sales, but is still in third place for sedans.<br />

Sedan sales in January and February totalled 712,200 units, while total vehicle sales were 1.3<br />

million units, said the CAAM, the main government-authorized industry group.<br />

Related to this article<br />

Latest Comments<br />

• Start a conversation on this story<br />

China's vehicle sales, including trucks and buses, rose 25.1 per cent last year to 7.2 million units,<br />

according to the CAAM. Passenger car sales rose to 3.8 million.<br />

In January and February, the top-selling auto model in China was the Santana sedan made by<br />

Shanghai Volkswagen Automotive Co., a joint venture involving German's Volkswagen AG, with<br />

30,500 units sold, according to the CAAM.<br />

The top-selling auto maker was General Motors Corp.'s Shanghai General Motors joint venture at<br />

67,500 units, according to the CAAM.<br />

The top Chinese auto maker was Chery Automobile Co., with 51,600 units sold, the group said.<br />

SPONSORED LINKS<br />

Discount Brokerage<br />

Direct Fills offers deep discount rates with Full trader support and so much more. Find out more!<br />

www.DirectFills.com<br />

What is Forex Trading? Learn with a Free Demo<br />

One-on-one training, charts & more! Realize your trading potential in the world's largest market!<br />

http://www.gftforex.com<br />

Free Retirement Guide<br />

Learn ways to invest wisely and feel comfortable with your retirement plan. Get your free retirement guide from Ameriprise<br />

Financial today.

globeandmail.com: Chinese car sales soar 33 per cent<br />

http://www.theglobeandmail.com/servlet/story/RTGAM.20070309.wchinacar0309/BNStory...<br />

Page 2 of 4<br />

3/9/2007<br />

www.ameriprise.com<br />

Our #1 Small Cap Pick for 2007!<br />

An Exclusive FREE Report Revealing Our Top Small Cap Pick for 2007. Find Out Why. Get it NOW.<br />

www.smallcapnetwork.com<br />

Foreign Exchange is HOT!<br />

Forex markets are still smoking hot – practice trading with a Free $50,000 MiniFX Demo Account Now!<br />

www.xpresstrade.com<br />

Buy a link Now<br />

© Copyright 2007 CTVglobemedia Publishing <strong>Inc</strong>. All Rights Reserved.<br />

globeandmail.com and The Globe and Mail are divisions of CTVglobemedia Publishing <strong>Inc</strong>., 444<br />

Front St. W., Toronto, ON Canada M5V 2S9<br />

Phillip Crawley, Publisher

globeandmail.com: Chinese car sales soar 33 per cent<br />

http://www.theglobeandmail.com/servlet/story/RTGAM.20070309.wchinacar0309/BNStory...<br />

Page 3 of 4<br />

3/9/2007

globeandmail.com: Chinese car sales soar 33 per cent<br />

http://www.theglobeandmail.com/servlet/story/RTGAM.20070309.wchinacar0309/BNStory...<br />

Page 4 of 4<br />

3/9/2007

Midwest Has 'Coal Rush,' Seeing No Alternative - washingtonpost.com<br />

http://www.washingtonpost.com/wp-dyn/content/article/2007/03/09/AR2007030902302_p...<br />

Page 1 of 4<br />

3/10/2007<br />

Midwest Has 'Coal Rush,' Seeing<br />

No Alternative<br />

Energy Demand Causes Boom in Plant Construction<br />

By Steven Mufson<br />

Washington Post Staff Writer<br />

Saturday, March 10, 2007; A01<br />

COUNCIL BLUFFS, Iowa -- From the top of a new<br />

coal-fired power plant with its 550-foot exhaust stack<br />

poking up from the flat western Iowa landscape,<br />

MidAmerican Energy Holdings chief executive David<br />

L. Sokol peered down at a train looping around a<br />

sizable mound of coal.<br />

At this bend in the Missouri River, with Omaha visible in the distance, the new MidAmerican plant is<br />

the leading edge of what many people are calling the "coal rush." Due to start up this spring, it will<br />

probably be the next coal-fired generating station to come online in the United States. A dozen more are<br />

under construction, and about 40 others are likely to start up within five years -- the biggest wave of coal<br />

plant construction since the 1970s.<br />

The coal rush in America's heartland is on a collision course with Congress. While lawmakers are<br />

drawing up ways to cap and reduce emissions of greenhouse gases, the Energy Department says as many<br />

as 150 new coal-fired plants could be built by 2030, adding volumes to the nation's emissions of carbon<br />

dioxide, the most prevalent of half a dozen greenhouse gases scientists blame for global warming.<br />

Even after a pledge last month by a consortium of private equity firms to shelve eight of 11 planned coal<br />

plants as part of their proposed $45 billion buyout of TXU, the largest utility in Texas, many daunting<br />

projects remain on drawing boards. Any one of the three biggest projects could churn out more carbon<br />

dioxide than the savings that a group of Northeast states hope to achieve by 2018.<br />

Utility executives say that the coal expansion is needed to meet rising electricity demand as the U.S.<br />

population and economy grow. Coal-fired plants provide half the electricity supply in the country.<br />

"A lot of congressmen ask me, 'Dave, why are you building that coal plant?' " says MidAmerican's<br />

Sokol. "And I say, 'What are my options?' "<br />

Sokol says he wants to help customers improve efficiency by 10 percent. His holding company, which is<br />

more than 80 percent owned by Berkshire Hathaway, includes the utility PacifiCorp in the Northwest<br />

and Rocky Mountains as well as MidAmerican; together they generate 16.7 percent of their power from<br />

renewable resources. The Iowa subsidiary alone gets 10 percent from renewables. Between 2000 and<br />

2005, the company cut the amount of carbon emitted for every unit of energy generated by 9 percent.<br />

But half of that reduction in the rate of emissions was offset by higher overall output. Electricity demand<br />

in Iowa is growing at a rate of 1.25 percent a year, and Sokol says that until new technologies become<br />

commercial or nuclear power becomes more accepted, coal is the way to meet that demand.<br />

It remains unclear how Congress will cope with this problem. Although climate-change experts hope

Midwest Has 'Coal Rush,' Seeing No Alternative - washingtonpost.com<br />

http://www.washingtonpost.com/wp-dyn/content/article/2007/03/09/AR2007030902302_p...<br />

Page 2 of 4<br />

3/10/2007<br />

that new technology will deliver a way to capture and store carbon dioxide produced by coal plants, that<br />

technology remains in the pilot stage; it could take another decade before it is proven.<br />

Companies say the new coal plants are better than old ones, though both use the same approach:<br />

pulverizing coal, then burning it in huge boilers to power giant turbines. The new $1.1 billion<br />

MidAmerican facility will be one of the nation's biggest, with 790 megawatts of capacity. Its boilers and<br />

pulverizers will devour 400 tons of coal every hour, 3.5 million tons a year, Sokol says. Combined with<br />

an existing plant next door, it will require a fresh train of coal every 16 to 17 hours; each train will be<br />

nearly 1.5 miles long and lug 135 cars about 650 miles from Wyoming's Powder River Basin.<br />

While newly constructed plants cough up a tiny fraction of the pollutants environmental regulators have<br />

focused on in the past -- sulfur dioxide, mercury and nitrogen oxides -- they emit only 15 percent less<br />

carbon dioxide. They do that simply by being more efficient. Scrubbers like those used to extract other<br />

pollutants from a plant's exhaust don't exist for carbon dioxide.<br />

Environmentalists worry that the new pulverized-coal plants, built to last 40 to 50 years, will saddle the<br />

country with high greenhouse-gas emissions for decades. Peabody Energy, for instance, has proposed<br />

two giant 1,500 megawatt plants, one for western Kentucky and one for southern Illinois.<br />

"Each of these coal plants is making bad global-warming policy, project by project," says Bruce Nilles,<br />

a Madison, Wis.-based Sierra Club lawyer who is fighting the Midwest plants. "It's a high priority to<br />

convert these investments in coal plants into something cleaner and smarter."<br />

If coal plants must be built, environmentalists prefer integrated gasification combined cycle (IGCC)<br />

plants that they say will make it easier later to capture carbon dioxide and store it underground. Only a<br />

handful of those are being planned.<br />

"We're making investment decisions today that will make it impossible in 2020 to get the next increment<br />

of [greenhouse gas] reduction," Nilles says.<br />

But the IGCC plants can add as much as $200 million to construction costs; only two are operating<br />

today. Companies that make the plants, such as Siemens and General Electric, aren't willing to guarantee<br />

certain levels of performance, utility executives say. Referring to GE's chief executive Jeffrey R. Immelt<br />

and GE's "ecomagination" ad campaign, one utility executive who spoke on condition of anonymity<br />

because his company might still do business with GE said, "I think Immelt's ecomagination got away<br />

from him."<br />

State regulators, who give thumbs up or down to coal plant proposals, worry mostly about reliability and<br />

costs to consumers. In the 1990s, many utilities built natural-gas-fired plants, but in the past two years<br />

gas prices have soared. Now, coal backers say that coal is cheaper than other fuels such as natural gas.<br />

One wrinkle: The cost of building coal plants is climbing as demand for engineers and equipment rises.<br />

In December, Westar Energy, the largest electric utility in Kansas, shelved its plan to add a 600- to 800-<br />

megawatt coal-fired plant. Greg A. Greenwood, vice president of generation construction at Westar, said<br />

that in the previous 18 months the estimated construction cost had soared $400 million.<br />

Environmentalists and many economists argue that the price of coal plants is higher when environmental<br />

costs are included.<br />

One of the Sierra Club's targets has been a $2.2 billion project belonging to We Energies, part of

Midwest Has 'Coal Rush,' Seeing No Alternative - washingtonpost.com<br />

http://www.washingtonpost.com/wp-dyn/content/article/2007/03/09/AR2007030902302_p...<br />

Page 3 of 4<br />

3/10/2007<br />

Wisconsin Energy. In the town of Oak Creek, just south of Milwaukee, the company has carved 6<br />

million cubic yards of earth from a bluff along Lake Michigan to create a bowl for two 615-megawatt<br />

coal-fired power plants, the first due to open in 2009. Trucks and workers are crawling over the site; five<br />

enormous boilers stand side by side, waiting for duty. Cranes lean in over the steel scaffolding, and a<br />

completed exhaust stack points into the winter sky.<br />

The plan for the plants was hatched after a hot 1997 summer, when the utility came close to ordering<br />

rolling blackouts to deal with heavy electricity demand. The state had not built a new power plant since<br />

1984, and the crisis helped ensure a unanimous vote by the Wisconsin Public Service Commission for<br />

more coal plants.<br />

But the Oak Creek project sparked a range of protests that landed it before the state Supreme Court,<br />

which ruled 4 to 3 in favor of the plant. Construction began the next day.<br />