Scorecards in KnowledgeSTUDIO - Angoss Software Corporation

Scorecards in KnowledgeSTUDIO - Angoss Software Corporation

Scorecards in KnowledgeSTUDIO - Angoss Software Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

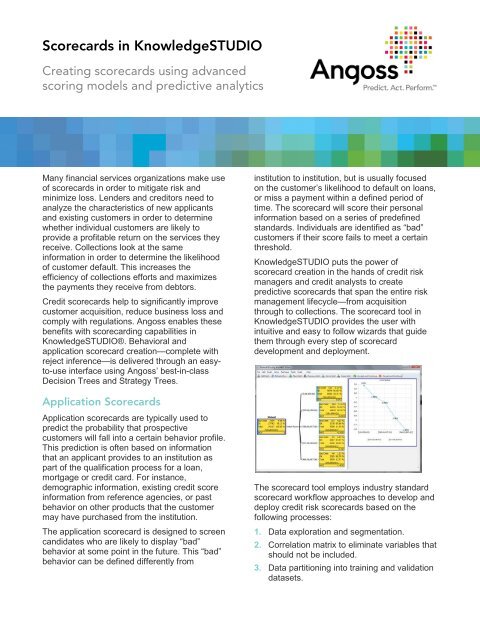

<strong>Scorecards</strong> <strong>in</strong> <strong>KnowledgeSTUDIO</strong><br />

Creat<strong>in</strong>g scorecards us<strong>in</strong>g advanced<br />

scor<strong>in</strong>g models and predictive analytics<br />

Many f<strong>in</strong>ancial services organizations make use<br />

of scorecards <strong>in</strong> order to mitigate risk and<br />

m<strong>in</strong>imize loss. Lenders and creditors need to<br />

analyze the characteristics of new applicants<br />

and exist<strong>in</strong>g customers <strong>in</strong> order to determ<strong>in</strong>e<br />

whether <strong>in</strong>dividual customers are likely to<br />

provide a profitable return on the services they<br />

receive. Collections look at the same<br />

<strong>in</strong>formation <strong>in</strong> order to determ<strong>in</strong>e the likelihood<br />

of customer default. This <strong>in</strong>creases the<br />

efficiency of collections efforts and maximizes<br />

the payments they receive from debtors.<br />

Credit scorecards help to significantly improve<br />

customer acquisition, reduce bus<strong>in</strong>ess loss and<br />

comply with regulations. <strong>Angoss</strong> enables these<br />

benefits with scorecard<strong>in</strong>g capabilities <strong>in</strong><br />

<strong>KnowledgeSTUDIO</strong>®. Behavioral and<br />

application scorecard creation—complete with<br />

reject <strong>in</strong>ference—is delivered through an easyto-use<br />

<strong>in</strong>terface us<strong>in</strong>g <strong>Angoss</strong>’ best-<strong>in</strong>-class<br />

Decision Trees and Strategy Trees.<br />

<strong>in</strong>stitution to <strong>in</strong>stitution, but is usually focused<br />

on the customer’s likelihood to default on loans,<br />

or miss a payment with<strong>in</strong> a def<strong>in</strong>ed period of<br />

time. The scorecard will score their personal<br />

<strong>in</strong>formation based on a series of predef<strong>in</strong>ed<br />

standards. Individuals are identified as “bad”<br />

customers if their score fails to meet a certa<strong>in</strong><br />

threshold.<br />

<strong>KnowledgeSTUDIO</strong> puts the power of<br />

scorecard creation <strong>in</strong> the hands of credit risk<br />

managers and credit analysts to create<br />

predictive scorecards that span the entire risk<br />

management lifecycle—from acquisition<br />

through to collections. The scorecard tool <strong>in</strong><br />

<strong>KnowledgeSTUDIO</strong> provides the user with<br />

<strong>in</strong>tuitive and easy to follow wizards that guide<br />

them through every step of scorecard<br />

development and deployment.<br />

Application <strong>Scorecards</strong><br />

Application scorecards are typically used to<br />

predict the probability that prospective<br />

customers will fall <strong>in</strong>to a certa<strong>in</strong> behavior profile.<br />

This prediction is often based on <strong>in</strong>formation<br />

that an applicant provides to an <strong>in</strong>stitution as<br />

part of the qualification process for a loan,<br />

mortgage or credit card. For <strong>in</strong>stance,<br />

demographic <strong>in</strong>formation, exist<strong>in</strong>g credit score<br />

<strong>in</strong>formation from reference agencies, or past<br />

behavior on other products that the customer<br />

may have purchased from the <strong>in</strong>stitution.<br />

The application scorecard is designed to screen<br />

candidates who are likely to display “bad”<br />

behavior at some po<strong>in</strong>t <strong>in</strong> the future. This “bad”<br />

behavior can be def<strong>in</strong>ed differently from<br />

The scorecard tool employs <strong>in</strong>dustry standard<br />

scorecard workflow approaches to develop and<br />

deploy credit risk scorecards based on the<br />

follow<strong>in</strong>g processes:<br />

1. Data exploration and segmentation.<br />

2. Correlation matrix to elim<strong>in</strong>ate variables that<br />

should not be <strong>in</strong>cluded.<br />

3. Data partition<strong>in</strong>g <strong>in</strong>to tra<strong>in</strong><strong>in</strong>g and validation<br />

datasets.

4. Generation of the Weight Of Evidence<br />

(WOE) transformation us<strong>in</strong>g the visual<br />

Decision Tree editor to allow optimal b<strong>in</strong>n<strong>in</strong>g<br />

of characteristics <strong>in</strong> order to maximize the<br />

dist<strong>in</strong>ction between good and bad accounts.<br />

5. Multivariate analysis and model<strong>in</strong>g—build<br />

stepwise logistic regression models.<br />

6. Model validation—visually evaluate and<br />

compare model performance and choose<br />

the best model for scorecard development.<br />

7. Model scal<strong>in</strong>g—scale model probabilities<br />

<strong>in</strong>to the desired scorecard, and determ<strong>in</strong>e<br />

basel<strong>in</strong>e and the scorecard factor. Includes<br />

options such as: Po<strong>in</strong>ts to Double the Odds,<br />

Base po<strong>in</strong>ts, Reverse Scal<strong>in</strong>g and Odds at<br />

Base Po<strong>in</strong>ts.<br />

8. F<strong>in</strong>al scorecards are generated <strong>in</strong> standard<br />

tabular form that can be copied and pasted<br />

<strong>in</strong>to Microsoft Office applications, or<br />

exported <strong>in</strong> SAS, SQL, PMML and XML<br />

code.<br />

9. Direct scor<strong>in</strong>g of scorecards can be<br />

performed on <strong>Angoss</strong> datasets and external<br />

files or tables.<br />

10. Scorecard performance can be visually<br />

assessed us<strong>in</strong>g the Model Analyzer.<br />

11. The Process Map keeps an audit trial of the<br />

entire scorecard workflow.<br />

Reject Inference<br />

Traditional application scorecards make certa<strong>in</strong><br />

generalizations that make it difficult for f<strong>in</strong>ancial<br />

<strong>in</strong>stitutions to capture all “good” customers.<br />

Inevitably, some customers that are accepted<br />

will end up default<strong>in</strong>g on a loan, or miss<strong>in</strong>g<br />

payment, while some customers that are<br />

categorized as “bad” and are subsequently<br />

rejected might actually be credit worthy<br />

(profitable) customers. This “selection bias” can<br />

be m<strong>in</strong>imized to ensure credit scorecards can<br />

predict the behavior of the total applicant<br />

population.<br />

Reject <strong>in</strong>ference methods are used to <strong>in</strong>fer the<br />

behavior of rejected applicants. This helps to<br />

ensure more accurate and realistic performance<br />

of credit scor<strong>in</strong>g models for all applicants, while<br />

identify<strong>in</strong>g new customers at lower potential<br />

risk. Ultimately, this enables lend<strong>in</strong>g and credit<br />

organizations to maximize their bus<strong>in</strong>ess<br />

growth by optimiz<strong>in</strong>g the risks and rewards for<br />

<strong>in</strong>dividual lend<strong>in</strong>g decisions.<br />

<strong>KnowledgeSTUDIO</strong> provides 3 reject <strong>in</strong>ference<br />

methods for credit application scorecards:<br />

• Proportional Assignment – Assigns the reject<br />

population <strong>in</strong>to ”good” and “bad” categories at<br />

random, ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g a set proportion of “bad”<br />

records.<br />

• Hard Cutoff – Scores the population and<br />

assigns the reject population <strong>in</strong>to “good” or<br />

“bad” categories based on a specific score<br />

cutoff.<br />

• Parcel<strong>in</strong>g – Assigns the reject population <strong>in</strong>to<br />

“good” or “bad” categories based on the<br />

relative amount of “bad” customers with<strong>in</strong> a<br />

set of user def<strong>in</strong>ed score ranges.<br />

2

Behavior <strong>Scorecards</strong><br />

Rather than screen<strong>in</strong>g new candidates for<br />

approval, behavior scorecards score exist<strong>in</strong>g<br />

customers <strong>in</strong> order to predict the probability<br />

they will exhibit certa<strong>in</strong> types of behavior. This<br />

can work both ways, allow<strong>in</strong>g the service<br />

provider to identify customers who are likely to<br />

default, commit fraud, miss payments,<br />

bankruptcy, write-offs etc., as well as recognize<br />

customers who are likely to cont<strong>in</strong>ue “good”<br />

behavior, or qualify for further credit or<br />

improved services.<br />

This risk and reward management approach is<br />

valuable <strong>in</strong> a variety of different scenarios.<br />

Regulations, such as the Basel Accords, place<br />

str<strong>in</strong>gent requirements on <strong>in</strong>stitutions with<br />

respect to transparency and accountability.<br />

Meanwhile, these organizations are constantly<br />

pressed to modify their scor<strong>in</strong>g systems to<br />

maximize profitability while mitigat<strong>in</strong>g losses<br />

and m<strong>in</strong>imiz<strong>in</strong>g costs.<br />

To comply with these pressures, credit risk<br />

models are be<strong>in</strong>g extended throughout the<br />

entire lifecycle of f<strong>in</strong>ancial products and<br />

services. Behavioral scor<strong>in</strong>g can feed <strong>in</strong>to many<br />

different models such as retention, account<br />

management and collections services.<br />

Retention<br />

• Optimize <strong>in</strong>terest rates, premium values or<br />

credit amounts, i.e. <strong>in</strong>crease the <strong>in</strong>terest rate<br />

on a loan or approve/reject l<strong>in</strong>e of credit<br />

<strong>in</strong>creases.<br />

• Focus market<strong>in</strong>g campaigns and customer<br />

retention strategies on low risk customers.<br />

Account Management<br />

• Allow “good” customers to go over credit<br />

limits or past due dates.<br />

• Determ<strong>in</strong>e if a credit card should be reissued.<br />

• Offer better pric<strong>in</strong>g on services or products.<br />

Collections<br />

• Improve collections and recovery strategies.<br />

• Separate customers <strong>in</strong>to low and high risk to<br />

focus collections resources at appropriate<br />

stages.<br />

• Direct del<strong>in</strong>quent accounts to the best<br />

collection strategy and channels: mail<strong>in</strong>g, call<br />

center, legal, doorstep.<br />

• Optimize dialer lists.<br />

• Suggest the next best action.<br />

Strategy Trees<br />

<strong>KnowledgeSTUDIO</strong> goes beyond the scorecard<br />

capabilities that help to def<strong>in</strong>e the categories<br />

used <strong>in</strong> behavioral risk and reward analysis.<br />

Users can extend the benefits derived from<br />

Decision Trees with <strong>Angoss</strong>’ unique Strategy<br />

Trees.<br />

Strategy Trees provide a familiar structure that<br />

allows users to develop dist<strong>in</strong>ct customer<br />

segments us<strong>in</strong>g multiple target variables. This<br />

provides more feedback and control when<br />

monitor<strong>in</strong>g key performance <strong>in</strong>dicators (KPIs)<br />

used to classify consumers.<br />

3

This feedback is presented <strong>in</strong> a s<strong>in</strong>gle Decision<br />

Tree <strong>in</strong>terface, elim<strong>in</strong>at<strong>in</strong>g the need to create<br />

multiple trees and significantly reduc<strong>in</strong>g the<br />

time it takes to arrive at various decisions.<br />

Smarter lists contribute to <strong>in</strong>creased revenues,<br />

reduced costs, and lower risk profiles by<br />

help<strong>in</strong>g to improve customer account<br />

management—before and after del<strong>in</strong>quency—<br />

while proactively help<strong>in</strong>g to detect and reduce<br />

<strong>in</strong>cidents of fraud and abuse.<br />

SCORECARD HIGHLIGHTS:<br />

Once segments have been def<strong>in</strong>ed with<strong>in</strong> a<br />

Strategy Tree, users can assign treatments or<br />

actions to these segments, based on where<br />

they fall with<strong>in</strong> the “good” and “bad” spectrum<br />

and the rules assigned to these classifications.<br />

Treatments can <strong>in</strong>clude activities such as<br />

vary<strong>in</strong>g credit limits, collections strategies<br />

options or market<strong>in</strong>g campaign options. The<br />

applied treatments can be cont<strong>in</strong>ously<br />

monitored by the validate strategy function.<br />

Analysts can comb<strong>in</strong>e data m<strong>in</strong><strong>in</strong>g models and<br />

customer scores with user-def<strong>in</strong>ed strategies<br />

and treatments to produce highly targeted lists<br />

<strong>in</strong> support of direct and database market<strong>in</strong>g, as<br />

well as credit and collections processes.<br />

• Comprehensive data profil<strong>in</strong>g and partition<strong>in</strong>g<br />

• Optimal b<strong>in</strong>n<strong>in</strong>g us<strong>in</strong>g Weight of Evidence for<br />

coarse class<strong>in</strong>g of variables<br />

• Logistic regression models<br />

• Reject <strong>in</strong>ference techniques for <strong>in</strong>ferr<strong>in</strong>g the<br />

behavior of rejected applicants<br />

• Model analysis and validation tools<br />

• Scorecard scal<strong>in</strong>g<br />

• SAS, SQL, PMML and XML code generation<br />

• Direct deployment capabilities<br />

• Process Map for scorecard workflow audit<br />

STRATEGY TREE HIGHLIGHTS:<br />

• Intuitive, user-friendly tree structure to develop<br />

segments faster<br />

• Visualizes multiple target variables, KPIs and<br />

treatments for significantly faster speed to<br />

decision mak<strong>in</strong>g and action<br />

• Strategy verification and monitor<strong>in</strong>g for on-go<strong>in</strong>g<br />

development of strategies<br />

4

About <strong>Angoss</strong> <strong>Software</strong><br />

As a global leader <strong>in</strong> predictive analytics, <strong>Angoss</strong><br />

helps bus<strong>in</strong>esses <strong>in</strong>crease sales and profitability,<br />

and reduce risk. <strong>Angoss</strong> helps bus<strong>in</strong>esses<br />

discover valuable <strong>in</strong>sight and <strong>in</strong>telligence from<br />

their data while provid<strong>in</strong>g clear and detailed<br />

recommendations on the best and most<br />

profitable opportunities to pursue to improve<br />

sales, market<strong>in</strong>g and risk performance.<br />

Our suite of desktop, client-server and big data<br />

analytics software products and Cloud solutions<br />

make predictive analytics accessible and easy to<br />

use for technical and bus<strong>in</strong>ess users. Many of<br />

the world's lead<strong>in</strong>g organizations use <strong>Angoss</strong><br />

software products and solutions to grow<br />

revenue, <strong>in</strong>crease sales productivity and improve<br />

market<strong>in</strong>g effectiveness while reduc<strong>in</strong>g risk and<br />

cost.<br />

Corporate Headquarters<br />

111 George Street, Suite 200<br />

Toronto, Ontario M5A 2N4<br />

Canada<br />

Tel: 416-593-1122<br />

Fax: 416-593-5077<br />

European Headquarters<br />

Surrey Technology Centre<br />

40 Occam Road<br />

The Surrey Research Park<br />

Guildford, Surrey GU2 7YG<br />

Tel: +44 (0) 1483-685-770<br />

www.angoss.com<br />

©Copyright 2013. <strong>Angoss</strong> <strong>Software</strong> <strong>Corporation</strong> – www.angoss.com<br />

5