After Sales Services - Jubilee Life Insurance

After Sales Services - Jubilee Life Insurance

After Sales Services - Jubilee Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

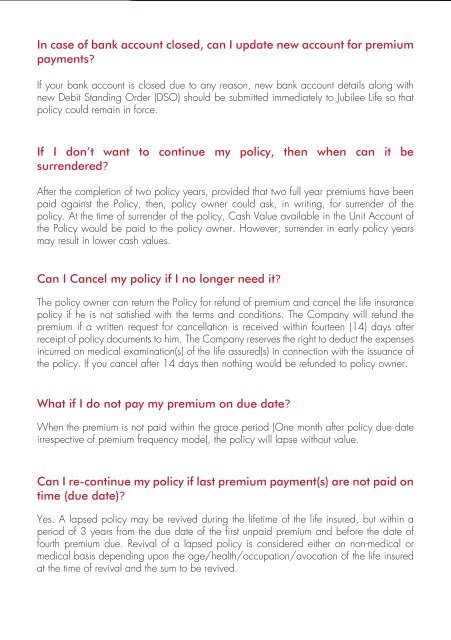

In case of bank account closed, can I update new account for premium<br />

payments?<br />

If your bank account is closed due to any reason, new bank account details along with<br />

new Debit Standing Order (DSO) should be submitted immediately to <strong>Jubilee</strong> <strong>Life</strong> so that<br />

policy could remain in force.<br />

If I don’t want to continue my policy, then when can it be<br />

surrendered?<br />

<strong>After</strong> the completion of two policy years, provided that two full year premiums have been<br />

paid against the Policy, then, policy owner could ask, in writing, for surrender of the<br />

policy. At the time of surrender of the policy, Cash Value available in the Unit Account of<br />

the Policy would be paid to the policy owner. However, surrender in early policy years<br />

may result in lower cash values.<br />

Can I Cancel my policy if I no longer need it?<br />

The policy owner can return the Policy for refund of premium and cancel the life insurance<br />

policy if he is not satisfied with the terms and conditions. The Company will refund the<br />

premium if a written request for cancellation is received within fourteen (14) days after<br />

receipt of policy documents to him. The Company reserves the right to deduct the expenses<br />

incurred on medical examination(s) of the life assured(s) in connection with the issuance of<br />

the policy. If you cancel after 14 days then nothing would be refunded to policy owner.<br />

What if I do not pay my premium on due date?<br />

When the premium is not paid within the grace period (One month after policy due date<br />

irrespective of premium frequency mode), the policy will lapse without value.<br />

Can I re-continue my policy if last premium payment(s) are not paid on<br />

time (due date)?<br />

Yes. A lapsed policy may be revived during the lifetime of the life insured, but within a<br />

period of 3 years from the due date of the first unpaid premium and before the date of<br />

fourth premium due. Revival of a lapsed policy is considered either on non-medical or<br />

medical basis depending upon the age/health/occupation/avocation of the life insured<br />

at the time of revival and the sum to be revived.