June 27, 2013 - Public Employees Retirement Association of New ...

June 27, 2013 - Public Employees Retirement Association of New ...

June 27, 2013 - Public Employees Retirement Association of New ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

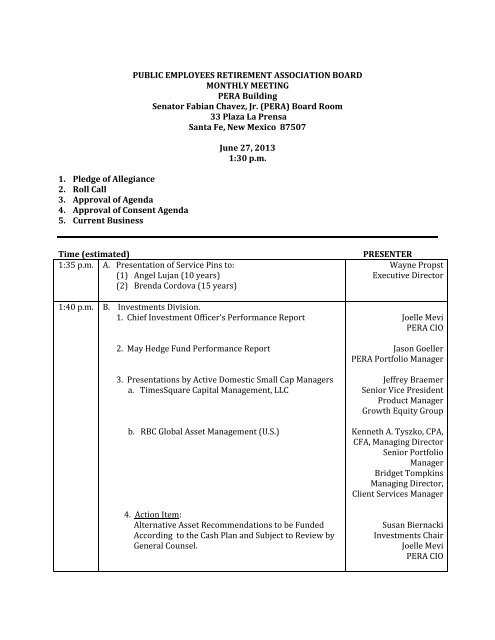

1. Pledge <strong>of</strong> Allegiance<br />

2. Roll Call<br />

3. Approval <strong>of</strong> Agenda<br />

4. Approval <strong>of</strong> Consent Agenda<br />

5. Current Business<br />

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION BOARD<br />

MONTHLY MEETING<br />

PERA Building<br />

Senator Fabian Chavez, Jr. (PERA) Board Room<br />

33 Plaza La Prensa<br />

Santa Fe, <strong>New</strong> Mexico 87507<br />

<strong>June</strong> <strong>27</strong>, <strong>2013</strong><br />

1:30 p.m.<br />

Time (estimated)<br />

1:35 p.m. A. Presentation <strong>of</strong> Service Pins to:<br />

(1) Angel Lujan (10 years)<br />

(2) Brenda Cordova (15 years)<br />

1:40 p.m. B. Investments Division.<br />

1. Chief Investment Officer’s Performance Report<br />

2. May Hedge Fund Performance Report<br />

3. Presentations by Active Domestic Small Cap Managers<br />

a. TimesSquare Capital Management, LLC<br />

b. RBC Global Asset Management (U.S.)<br />

4. Action Item:<br />

Alternative Asset Recommendations to be Funded<br />

According to the Cash Plan and Subject to Review by<br />

General Counsel.<br />

PRESENTER<br />

Wayne Propst<br />

Executive Director<br />

Joelle Mevi<br />

PERA CIO<br />

Jason Goeller<br />

PERA Portfolio Manager<br />

Jeffrey Braemer<br />

Senior Vice President<br />

Product Manager<br />

Growth Equity Group<br />

Kenneth A. Tyszko, CPA,<br />

CFA, Managing Director<br />

Senior Portfolio<br />

Manager<br />

Bridget Tompkins<br />

Managing Director,<br />

Client Services Manager<br />

Susan Biernacki<br />

Investments Chair<br />

Joelle Mevi<br />

PERA CIO

a. £26 Million Commitment to DRC Capital European<br />

Real Estate Debt Fund II, LP, a European<br />

Commercial Real Estate Fund for the Real Estate<br />

Portfolio<br />

b. $35 Million Commitment to Lime Rock Resources<br />

Fund III, LP, an Energy Fund for the Real Asset<br />

Portfolio<br />

3:00 p.m. C. Approval <strong>of</strong> Resolution No. 13-06 Declaring a Vacancy<br />

on the <strong>Public</strong> <strong>Employees</strong> <strong>Retirement</strong> <strong>Association</strong> Board<br />

Joaquin Lujan<br />

PERA Portfolio Manager<br />

Julian Baca<br />

Deputy CIO<br />

Patricia French<br />

Board Chair<br />

3:10 p.m. D. SB <strong>27</strong> Implementation – Legislative Changes Greg Portillos<br />

PERA CIO<br />

Vince Jaramillo<br />

User Administrator<br />

3:30 p.m. E. Trustee Report on Conference Loretta Naranjo-Lopez<br />

3:45 p.m. F. Executive Director’s Report Wayne Propst<br />

Executive Director<br />

4:00 p.m. G. Executive Session<br />

a. Attorney Reports<br />

Administrative Appeals (The Board will go into<br />

Executive Session under NMSA 1978, Section<br />

10-15-1(H)(3) to discuss this item)<br />

a. Bernard Raymond<br />

b. Andres S. Vargas<br />

Zachary Shandler<br />

Assistant Attorney<br />

General<br />

and/or<br />

Mark Reynolds<br />

Assistant Attorney<br />

General<br />

6. Other Business<br />

7. Adjournment<br />

Any person with a disability who is in need <strong>of</strong> a reader, amplifier, qualified sign language<br />

interpreter, or any other form <strong>of</strong> auxiliary aid or service to attend or participate in the<br />

hearing or meeting, please contact Judy Olson at (505) 476-9305 at least one week prior to<br />

the meeting, or as soon as possible. <strong>Public</strong> documents, including the agenda and minutes,<br />

can be provided in various accessible formats. Please contact Ms. Olson if a summary or<br />

other type <strong>of</strong> accessible format is needed.

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION<br />

MONTHLY MEETING<br />

<strong>June</strong> <strong>27</strong>, <strong>2013</strong><br />

CONSENT AGENDA<br />

1. Approval <strong>of</strong> Minutes: May 14, <strong>2013</strong> Special Board Meeting<br />

May 30, <strong>2013</strong> Board Meeting<br />

2. Ratification <strong>of</strong> <strong>Retirement</strong>s – Benefits processed through <strong>June</strong> 21, <strong>2013</strong>.<br />

a. Normal d. Non-Duty Death<br />

b. Deferred e. Non-Duty Disability<br />

c. Reciprocity to ERA f. Reciprocity to PERA<br />

3. Affidavits for Free Military Service:<br />

a. Christopher Baca, 10 months <strong>of</strong> Free Military Service<br />

b. John Zamora, 10 months <strong>of</strong> Free Military Service<br />

c. Damien Horne, 10 months <strong>of</strong> Free Military Service<br />

4. Duty and Non-Duty Death Determinations:<br />

a. Kenneth Griego, Non-duty death<br />

b. Vincent Sanchez, Non-duty death<br />

c. Rudolfo Rivera, Non-duty death<br />

d. Michael Baca, Non-duty death<br />

e. Kenneth Baca, Non-duty death<br />

5. Resolutions:<br />

1. A Resolution Authorizing a 24.39% Pick-Up <strong>of</strong> PERA Municipal Police<br />

Member Contributions for Police Non-Bargaining Unit Members Only, for<br />

the City <strong>of</strong> Hobbs.<br />

2. Carrizozo Soil and Water conservation District, Resolution No. 05-2012-<br />

<strong>2013</strong>. A Resolution to Adopt the State <strong>of</strong> <strong>New</strong> Mexico Deferred<br />

Compensation Plan.<br />

3. Southwest Solid Waste Authority, Resolution No. R-13-10. A Resolution<br />

to Adopt the State <strong>of</strong> <strong>New</strong> Mexico Deferred Compensation Plan.<br />

4. Albuquerque Bernalillo County Water Utility Authority, Resolution No.<br />

R-13-10. A Resolution to Adopt the State <strong>of</strong> <strong>New</strong> Mexico Deferred<br />

Compensation Plan.<br />

5. Albuquerque Bernalillo County Water Utility Authority Resolution<br />

Establishing Water Authority Policy Concerning the PERA <strong>Employees</strong>’<br />

Contribution Rate (Bill No. F/S R 13-12) approved <strong>June</strong> 19, <strong>2013</strong>.

Setting <strong>of</strong> Meetings – July, <strong>2013</strong><br />

a. Special Board Meeting 7/9/<strong>2013</strong> 9:00 a.m.<br />

b. Investments Committee 7/9/<strong>2013</strong> After Special Board Meeting<br />

c. Legislative Committee 7/9/<strong>2013</strong> After Investments Committee<br />

d. Audit & Budget Committee 7/9/<strong>2013</strong> After Legislative Committee<br />

e. Rules & Administration<br />

Committee<br />

7/9/<strong>2013</strong> After Audit & Budget Committee<br />

f. Disability Review Committee 7/9/<strong>2013</strong> 2:00 p.m. PERA Board Room<br />

g. PERA Board – <strong>New</strong> Board<br />

Member Orientation<br />

7/29/<strong>2013</strong> 1:00 p.m.<br />

Red River Conference Center<br />

101 West River Street<br />

Red River, <strong>New</strong> Mexico 87558<br />

h. PERA Board Retreat 7/30/<strong>2013</strong> 8:30 a.m. Red River Conference Center<br />

i. PERA Board Retreat 7/31/<strong>2013</strong> 8:30 a.m. Red River Conference Center<br />

j. Monthly Board Meeting 8/1/<strong>2013</strong> 9:00 a.m. Red River Conference Center

PERA Executive Investment Summary<br />

May <strong>2013</strong><br />

Market Review:<br />

After touching an all-time high in the middle <strong>of</strong> the month, comments by Federal Reserve chairman<br />

Bernanke that alluded to the eventual wind-down <strong>of</strong> the current quantitative easing unnerved<br />

investors, causing equity markets to decline and interest rates to rise. Despite the sell-<strong>of</strong>f, the US<br />

equity markets managed to finish higher than the previous month’s close with the S&P 500 up<br />

2.34% (15.37% CYTD and 22.24% FYTD). The EAFE index reversed the previous month’s gains by<br />

declining -2.31% (8.29% CYTD and 23.5% FYTD) while the EMF index declined -2.52% (-3.29% CYTD<br />

and 10.19% FYTD). The Barclays core bond index fell -1.78% (-0.91% CYTD and 0.89% FYTD) while<br />

High Yield bonds returned -0.58% (4.15% CYTD and 12.45% FYTD).<br />

US data releases during the month showed that consumer spending fell 0.2% m/m, retail sales<br />

climbed 0.1% (core was up 0.5%), consumer confidence rose to 76.2 in May from 68.1 in April, while<br />

the ISM manufacturing index declined to 50.7 from 51.3 and the ISM nonmanufacturing index fell to<br />

53.1 from 54.4. Nonfarm payrolls increased 165,000 while Gross Domestic Product grew by 2.4% in<br />

the first quarter. At its May meeting, the Federal Open Market Committee left the Fed funds rate<br />

unchanged at a range <strong>of</strong> 0 to 0.25%. It also maintained its program <strong>of</strong> buying $40 billion <strong>of</strong><br />

mortgage-backed securities and $45 billion <strong>of</strong> Treasury securities each month. In the<br />

accompanying statement the FOMC said that it “is prepared to increase or reduce the pace <strong>of</strong> its<br />

[securities] purchases to maintain appropriate policy accommodation as the outlook for the labor<br />

market or inflation changes.” There were also modest changes to the economic summary<br />

paragraph – labor market conditions have shown signs <strong>of</strong> improvement “on balance,” while fiscal<br />

policy “is restraining growth” (rather than “has become somewhat more restrictive”).<br />

Outside the US, the Euro area GDP contracted 0.2% in the first quarter, Japan’s GDP rose 3.5%, the<br />

Bank <strong>of</strong> England made no changes to its existing asset purchase program (375 billion) or <strong>of</strong>ficial<br />

interest rate (0.5%), and the Reserve Bank <strong>of</strong> Australia cut the cash rate 25 basis points to 2.75%.<br />

The PERA Fund has returned 15.76% for the FYTD and 0.02% in the month <strong>of</strong> May, bringing the Fund<br />

market value to $13.268 billion.<br />

Pension Systems Update:<br />

Fed data show public DB plans rise, corporate DC disappoints<br />

According to the Federal Reserve's Financial Accounts <strong>of</strong> the United States report issued <strong>June</strong> 6,<br />

defined benefit state and local government public pension assets rose 6.81% in the quarter ending<br />

March 31, <strong>2013</strong> to $3.41 trillion. U.S. corporate retirement plan assets rose just 2.78% in the<br />

quarter, to $6.82 trillion; corporate defined benefit plan assets totaled $2.57 trillion, up 0.73%<br />

from the previous quarter, and defined contribution plans had $4.26 trillion in assets, an increase<br />

<strong>of</strong> 4.06%. The real story, according to plan experts, was the level <strong>of</strong> net asset flows. A modest $4.4<br />

billion in net asset inflows for defined contribution plans was a surprise in light <strong>of</strong> strong market<br />

returns. Comparing the 4.06% increase in defined contribution assets to a typical return <strong>of</strong> 5%<br />

based on a composite portfolio tracked by J.P. Morgan Asset Management (JPM), “it appears that<br />

they underperformed the market,” said Mr. Barron. “If that is a trend, it would be disappointing. If<br />

defined contribution is going to replace defined benefit, this pattern has to be continuously on the<br />

upswing.” On the public plan side, the latest Federal Reserve data “show that state and local<br />

government retirement fund assets have rebounded since the financial crisis,” said Paul Zorn,<br />

director <strong>of</strong> governmental research for actuarial firm Gabriel, Roeder, Smith & Co., Southfield,<br />

Mich.<br />

~Read more http://www.pionline.com/.<br />

Quote for the Month:<br />

“ Bernanke may be driving in a fog…”<br />

~Bill Gross, the “Bond King <strong>of</strong> PIMCO,” at a <strong>June</strong> 19 th Bloomberg press conference<br />

following the release <strong>of</strong> the FOMC meeting minutes. 1

PERA Executive Investment Summary<br />

May <strong>2013</strong><br />

Market Values, Asset Allocation & Performance Data:<br />

TABLE I: Fund Market Values (in millions $)<br />

Asset Class 5/31/<strong>2013</strong> Prev. Month's Chg<br />

Total Equities 7,297 -8.01<br />

Domestic Equity 4,015 64.62<br />

Large Cap 2,732 6.26<br />

Small/Mid Cap 1,283 58.36<br />

International Equity 3,282 -72.63<br />

Total Fixed Income 3,363 -2.41<br />

Total Alternatives 2,441 3.33<br />

Absolute Return 1,133 8.91<br />

Private Equity 539 8.70<br />

Real Estate 428 -11.07<br />

Real Assets 341 -3.21<br />

STIF/STO Cash Balances 167 18.91<br />

TOTAL FUNDS 13,268 11.82<br />

TABLE II: Fund Asset Allocation Comparison<br />

Asset Class Actual Target Variance Ranges $ in Millions<br />

Total Equities 55.0% 49% 6.0% - 795.6<br />

Domestic Equity 30.3% 29% 1.3% 24-34% 166.9<br />

Large Cap 20.6% 20% 0.3% - 38.1<br />

Small/Mid Cap 9.7% 9% 1.0% - 128.8<br />

International Equity 24.7% 20% 4.7% 15-25% 628.7<br />

Total Fixed Income 25.3% 26% -0.7% 23-29% -86.7<br />

Liquid Alpha 0.0% 5% -5.0% 0-7% -<br />

Total Alternatives 18.4% 20% -1.6% - -212.5<br />

Absolute Return 8.5% 7% 1.5% 5-9% 204.0<br />

Private Equity 4.1% 5% -0.9% 3-7% -124.0<br />

Real Estate 3.2% 3% 0.2% 1-5% 30.1<br />

Real Assets 2.6% 5% -2.4% 3-7% -322.5<br />

STIF/STO Cash Balances 1.3% 0% 1.3% - 167.0<br />

TABLE III: PERA Performance for Month and Fiscal Year to Date (in percent %)<br />

5/31/<strong>2013</strong> Fiscal YTD 1 Year 3 Year<br />

Total Domestic Equity 3.28% 26.47% 31.18% 18.25%<br />

Russell 3000 Index 2.36% 23.06% <strong>27</strong>.88% 16.82%<br />

Value Added 0.92% 3.41% 3.31% 1.43%<br />

International Equity -2.16% 19.86% 26.15% 10.16%<br />

MSCI ACWI ex-US Index -2.18% 19.71% 26.83% 9.75%<br />

Value Added 0.02% 0.15% -0.68% 0.41%<br />

Fixed Income -2.12% 5.47% 6.52% 6.91%<br />

85/15 Barclays Index -1.95% 0.47% 0.51% 4.45%<br />

Value Added -0.17% 5.00% 6.01% 2.46%<br />

Alternative Assets 0.78% 10.42% 11.17% 9.46%<br />

Cash Equivalents 0.23% 3.29% 3.92% 5.88%<br />

TOTAL FUND 0.02% 15.76% 18.92% 11.46%<br />

Custom Benchmark -0.13% 13.29% 16.62% 10.53%<br />

Value Added 0.15% 2.47% 2.30% 0.93%<br />

2

PERA Executive Investment Summary<br />

May <strong>2013</strong><br />

Market Values, Asset Allocation & Performance:<br />

Market Value & Asset Allocation:<br />

The US equity markets were higher in May with the Total Fund market value up $12 million over<br />

the previous month to $13,268,240,000. The Board ratified a new strategic asset allocation in<br />

November by approving revisions to its IPS, which increased the target US equity allocation by 2%<br />

to 29%, reduced the Non-US equity allocation by 7% to 20%, added the 5% Liquid Alpha bucket,<br />

reduced hedge funds by 2% to 7%, and increased the Real Assets target by 2% to 5%. Based on<br />

current market values and the new strategic asset allocation targets, the non-US allocation is<br />

overweight by 4.7%, but still within the allowable range, pending the GTAA implementation. Along<br />

the same lines, the Absolute Return portfolio is overweight and the Real Assets portfolio is<br />

underweight pending an AR portfolio rebalance and the expansion <strong>of</strong> the RA portfolio.<br />

Asset Transfers:<br />

PERA transferred $30 million at month-end from the STIF account to supplement beneficiary<br />

payments and to pay refunds and agency expenses, including investment manager fees. For the<br />

fiscal-year-to-date, PERA has transferred $368 million to the PERA General account, $16.5 million<br />

to the Magistrate account, and $3 million to the Judicial fund to cover potential shortfalls in<br />

employer and employee contributions. PERA has made no transfers to the Volunteer Fire Fighter<br />

account for the fiscal-year-to-date. Excess cash <strong>of</strong> $70 million in the beta overlay account was<br />

rebalanced to core bond managers MacKay Shields and BlackRock. Hedge fund redemptions<br />

totaling $9.5 million were received in the month.<br />

Private partnerships called $10 million in the month <strong>of</strong> May, distributing $19.8 million. In the<br />

current fiscal year, capital calls have averaged $19 million per month and have totaled $210<br />

million. In fiscal year 2012 capital calls averaged $22.5 million per month and totaled $<strong>27</strong>0 million.<br />

Fund Returns & Performance:<br />

The Total Fund returned 0.02% for the month with active management in the domestic equity<br />

composite added value on both an absolute as well as a relative basis across most public market<br />

mandates. Hedge funds also generated a positive return on an absolute basis. Over the trailing<br />

one-year and three-year periods, the Fund has returned 18.92% (1YR) and 11.46% (3YR) compared<br />

to the Custom Index return <strong>of</strong> 16.62% (1YR) and 10.53% (3YR).<br />

The PERA Fund ranked 29 th for the quarter and 21 st for the year ending March 31, <strong>2013</strong> in the<br />

Wilshire TUCS universe <strong>of</strong> public funds > $1 billion.<br />

Watch List Update:<br />

None <strong>of</strong> PERA’s active domestic equity and fixed income managers are on the Watch List. The<br />

Wellington Emerging Markets Equity mandate is on Watch at present. The Investment Committee<br />

voted to terminate SSgA International Alpha Select at the August 2012 meeting. This account was<br />

held since late September with an interim manager and transitioned in early April to the Northern<br />

Trust passive ACWI ex-US account. The Board approved a recommendation to add Schroder<br />

International Equity Small Cap mandate to the watch list at the April meeting. Four <strong>of</strong> PERA’s<br />

alternative investments are on Cliffwater’s Watch List.<br />

3

PERA Executive Investment Summary<br />

May <strong>2013</strong><br />

Portfolio Manager Views:<br />

<strong>Public</strong> Equity:<br />

In May, small cap stocks outperformed large cap with the S&P 500 posting 2.34% and the Russell<br />

2000 Index posting 4.00%. The U.S. equity markets continued positively due to better than<br />

expected U.S. employment data and corporate earnings. May was the 7 th consecutive monthly rise<br />

in the S&P 500. NMPERA’s small cap value managers, DFA and MetWest both exceeded their<br />

benchmark in excess <strong>of</strong> 150 basis points, both managers underweighted REITS and utilities which<br />

helped since both sectors did poorly for the month. International equity saw a negative return for<br />

the month; the NMPERA managers had mixed results although the international small cap managers<br />

held up the best. Small and Smid Cap growth managers, RBC and TimesSquare, whose contracts<br />

were recently renewed, fared well for the month. For the 5 year return, both managers have<br />

exceeded their benchmarks by at least 350 basis points.<br />

~ LeAnne Larrañaga-Ruffy<br />

Fixed Income:<br />

In May, the fixed income markets were negative with the Barclays U.S. Aggregate bond index<br />

posting -1.78%. The Fed announced possible reduction <strong>of</strong> the quantitative easing stimulus which<br />

caused the Fixed Income markets to slide, with Treasuries being hit the hardest and riskier assets<br />

such as high yield and emerging markets also being impacted negatively. All <strong>of</strong> NMPERA’s managers<br />

struggled for the month, posting negative returns with only the global managers beating their<br />

respective benchmarks. Manulife, which was slow out <strong>of</strong> the gate after being hired in 2011, has<br />

exceeded their benchmark by 850 basis points for the one year return. In May they had an excess<br />

return <strong>of</strong> 101 basis points, due to their underweight exposure to U.S. Treasuries and a shorter<br />

duration. In addition their use <strong>of</strong> the British pound and Canadian dollar hedges, emerging market<br />

positions within Asia benefitted performance.<br />

~ LeAnne Larrañaga-Ruffy<br />

Real Assets:<br />

PERA’s Real Assets private partnerships called $1.7 million during the month <strong>of</strong> May. Distributions<br />

<strong>of</strong> $5.3 million were received during the month. Year to date the portfolio <strong>of</strong> sixteen partnerships<br />

drawn $243 million on $417 million in commitments. Cumulative distributions total $77.6 million,<br />

with an (unrealized) fair value <strong>of</strong> $208 million, resulting in an Internal Rate <strong>of</strong> Return <strong>of</strong> 10.43%, or<br />

1.22x cost since the inception <strong>of</strong> the program. Various areas <strong>of</strong> real assets provided modest results<br />

for the month <strong>of</strong> May. Crude oil, gold and natural gas in particular, provided divergent returns. WTI<br />

Brent spread increased to an eight month high given the increased geo-political volatility in the<br />

Middle East leaning towards possible reduced exports. Agriculture commodities were mixed with a<br />

couple <strong>of</strong> leaders: c<strong>of</strong>fee, wheat and soybeans.<br />

~ Christina Keyes<br />

Private Equity:<br />

As <strong>of</strong> May 31, <strong>2013</strong> the Private Equity portfolio is 65% drawn ($628 million) on $887 million<br />

committed. Residual fair value ($543 million) plus cumulative distributions ($224 million) make for<br />

a total fair value <strong>of</strong> $768 million, or 1.22 times cost, and a net since inception IRR <strong>of</strong> +8.26%.<br />

PERA’s $40mm <strong>2013</strong> commitment to Carlyle VI buyout fund is in the last stages <strong>of</strong> closing. This is<br />

PERA’s first <strong>of</strong> four private equity commitments slated for <strong>2013</strong>.<br />

~Joaquin Lujan<br />

4

PERA Executive Investment Summary<br />

May <strong>2013</strong><br />

Portfolio Manager Views, cont.:<br />

Hedge Funds:<br />

With the exception <strong>of</strong> a narrow (but volatile) decline in the Nikkei, May was a modestly good month<br />

for most developed market equities. The US S&P 500 led the way with a gain <strong>of</strong> +2.3% on<br />

improving US economic data and upbeat consumer confidence sentiment. Contributions came from<br />

all market capitalizations with sector strength from Technology, Financials and Healthcare. The<br />

real action for the month, however, came from fixed income. Trading in a huge range, the US 10<br />

year Treasury started May at a yield <strong>of</strong> 1.67% before rising to over 2.2% on May 29 th and then falling<br />

to 2.13% to finish the month, its worst since December 2009. It wasn’t only the US that suffered<br />

losses, as fixed income markets worldwide experienced large sell-<strong>of</strong>fs, with participants fearing<br />

that the Federal Reserve would exit its quantitative easing programs sooner than previously<br />

anticipated. May was one <strong>of</strong> the worst months for global government bonds in the past two<br />

decades. May was also a difficult month for commodities, with the DJ UBS Commodities Index<br />

losing -2.2% for the month – primarily on large declines in precious metals.<br />

Despite the volatility in the broader markets during the month, hedge funds continued along their<br />

positive trajectory in May. The HFRI Fund Weighted Composite Index advanced +0.54%, with solid<br />

gains from equity-focused funds. The HFRI Equity Hedge Index returned +1.78%, outperforming<br />

global equity markets. Additional contributions came from Event Driven strategies, with positive<br />

performance coming from the continuation <strong>of</strong> a dynamic market for corporate transactions. The<br />

HFRI Event Driven Index posted a gain <strong>of</strong> +1.7%. Global macro managers as a whole were the worst<br />

performers during the month, with particular weakness in quantitative trend-following CTAs and<br />

Commodity-focused strategies. CTAs with significant long exposure to fixed income were<br />

especially hard hit as government bonds sold <strong>of</strong>f sharply. The HFRI Systematic Diversified Index<br />

was down -2.22%.<br />

NM PERA’s Absolute Return portfolio fared relatively well, returning +1.32% (based on initial<br />

estimates) and outperforming both PERA’s benchmark <strong>of</strong> Libor + 4% and the broader HFRI indices by<br />

a fair margin. Consistent with the broader performance trend for May, PERA managers with<br />

significant equity exposure and dedicated Event Driven books performed strongly while the<br />

systematic trading strategies (CTAs) underperformed. PERA’s dedicated Market Neutral managers<br />

also posted notable positive returns.<br />

~ Jason Goeller<br />

Real Estate:<br />

As <strong>of</strong> May 31, <strong>2013</strong> the Real Estate portfolio excluding REITs is 58% drawn ($245 million) on $350<br />

million committed. Residual fair value ($192 million) plus cumulative distributions ($91 million)<br />

make for a total fair value <strong>of</strong> $283 million, or 1.17 times cost, and a net since inception IRR <strong>of</strong><br />

+7.82%. The PERA IC committee has forwarded to the Board a recommendation to commit $40<br />

million to ERED II, a European commercial real estate fund. This will be first <strong>of</strong> two real estate<br />

commitments slated for <strong>2013</strong>.<br />

~Joaquin Lujan<br />

5

PERA Executive Investment Summary<br />

May <strong>2013</strong><br />

Monthly Outlook: ‘Terra Incognita’<br />

Over the course <strong>of</strong> the perilous climb out <strong>of</strong> the depths <strong>of</strong> the dark recession to the economic recovery<br />

during the last few years, the U.S. Federal Reserve’s fiscal policies and practices <strong>of</strong> quantitative easing<br />

(QE) have taken various twists and turns leading to a grey area <strong>of</strong> terra incognita (Latin: ‘uncharted<br />

territory’). The Fed has worked tirelessly since 2009 to provide unprecedented interest rate<br />

accommodations bringing the rates to negative real levels and creating extensive liquidity injections to<br />

stimulate the American economy. They have committed to battling deflation and held fast against<br />

economic slippage by purchasing billions <strong>of</strong> dollars <strong>of</strong> debt and risky mortgage assets through a buy-back<br />

program. Currently, the Fed is buying $85 billion <strong>of</strong> Treasuries and mortgage-back securities each month<br />

in order to put downward pressure on borrowing costs and to help spur economic growth. The average<br />

economic recovery expansion <strong>of</strong> a post-war period typically lasts 63-65 months. The U.S. is currently in<br />

the 47 th month <strong>of</strong> the current economic recovery, assisted by the bond purchasing program; the bond<br />

purchasing program that was never intended to be permanent, but as an emergency measure. Gauging<br />

the full impact <strong>of</strong> Quantitative Easing (QE) measures has required a steel reserve <strong>of</strong> calm and patience.<br />

In an attempt to foster a longer-term view for the remainder <strong>of</strong> the recovery and finding new techniques<br />

to keep inflation low while paring back on aggressive monetary stimulation, the Fed has taken on the<br />

discussion <strong>of</strong> tapering at their monthly bond purchases. Chairman Ben Bernanke told Congress’s Joint<br />

Economic Committee on May 22 nd that the Fed ‘could scale back stimulus efforts in the next few<br />

meetings’ if the employment outlook shows ‘sustainable’ improvement. He emphasized that any decision<br />

would hinge upon the economic data and that the Fed is prepared to stop tapering or even reverse it, if<br />

economic growth does not meet expectations.<br />

On <strong>June</strong> 18 th & 19 th , the Federal Open Market Committee met to focus on when and how they will tackle<br />

the process <strong>of</strong> retracting the QE and continuing the deleveraging process. The Fed has stated an<br />

unemployment rate <strong>of</strong> 6.5% as its threshold for pulling back on monetary policy. This level is interpreted<br />

as a healthy position in the recovery <strong>of</strong> the housing market and the economic impact <strong>of</strong> an improved<br />

labor market. At which time a reduction or ‘tapering’ <strong>of</strong> the bond purchase program should be<br />

implemented as an act <strong>of</strong> confidence in economic strength. Economic data has shown signs <strong>of</strong> a steady<br />

recovery in the U.S., which has led to robust discussions among Fed <strong>of</strong>ficials. The current talks have<br />

tentatively considered paring back the purchases from $85 billion to $65 billion per month possibly<br />

beginning in October, and eventually to $45 billion per month in late 2014. The steady decline in easing<br />

would last through 2015 in order to alleviate any potential spikes <strong>of</strong> inflationary reaction to the Fed’s<br />

attempts at a smooth adjustment. Since a reduction in bond purchases hinges upon the unemployment<br />

rate, movement towards the 6.5% threshold has been rather painfully slow thus far. The stock market<br />

and the housing market are resurgent and job market participation has been inching up, but the<br />

unemployment rate is still uncomfortably high. Even the most optimistic <strong>of</strong> economists hold the 6.5% rate<br />

as a target further out in the 2014 & 2015 calendar than the Fed. Importantly, once the tapering has<br />

been completed, only then will the Fed consider reassessing the interest rate and a possible move to<br />

increase it for the first time since 2006.<br />

The speculation over the unknown outcome <strong>of</strong> the discussions have led investors to recalibrate their<br />

interest rate expectations and outlook in various markets; domestic, international and in particular,<br />

emerging. Jim O’Neill, formerly <strong>of</strong> Goldman Sachs, has stated that concerns over changing Fed policy are<br />

especially front-and-center for emerging market investors. The global bond market stands to be exposed<br />

to high levels <strong>of</strong> market instability particularly for those countries with excessive account deficits and<br />

uncertainty over resolving them. Turkey, India, Brazil, South Africa, Indonesia and Thailand have all<br />

begun to feel the mounting volatility over U.S. interest rates. The market chatter over the Fed’s tapering<br />

process is leading to rising Treasury yields and strengthening USD, which is contributing to the early<br />

demise <strong>of</strong> the ‘great reach for yield’ trades which propped up the Emerging Markets. The emerging<br />

6

PERA Executive Investment Summary<br />

May <strong>2013</strong><br />

markets were the recipients <strong>of</strong> rampant interest from global investors through the relatively cheap<br />

liquidity which was created by the Fed’s aggressive monetary stimulation through its recovery program.<br />

One side effect in the shift in investor sentiment regarding the Fed’s recovery movements is a marked<br />

sell-<strong>of</strong>f in emerging market stocks, bonds and currencies, thus causing a tightening <strong>of</strong> liquidity during a<br />

crucial time for EM economies with economic growth below potential, low levels <strong>of</strong> inflation, price<br />

dislocations and currencies near their strongest levels. This pain has also been compounded by the<br />

contraction in China’s economic growth projections and the subsequent slow-down <strong>of</strong> the commodities<br />

market super-cycle. Foreign investors world-wide have been pulling their money out <strong>of</strong> emerging markets<br />

en masse, ($2.94 billion out <strong>of</strong> emerging market equity funds during the week <strong>of</strong> May 29 th alone) creating<br />

one <strong>of</strong> the biggest declines in four years.<br />

Market jitters and panic in the bond market have caught people <strong>of</strong>f guard and led to an increase in<br />

volatility. The U.S. Treasury market has declined dramatically with 10-year yields reaching nearly 2.25%,<br />

which will likely negatively impact global growth. Inflation expectations in the U.S. have lowered.<br />

Consumer Prices in May are seen rising by only 1.4% from a year ago, which is well below the Fed’s target<br />

2% inflation rate. Extensive sell-<strong>of</strong>fs in German, British and Japanese fixed income markets reflected the<br />

U.S. markets contributing to the May performance as one <strong>of</strong> the worst for global government bonds in 20<br />

years. Investors are split on the outcome <strong>of</strong> the Fed’s future actions which presents a choppy market.<br />

As a cautionary measure, the leaders <strong>of</strong> the G-8 nations say that the worst has passed for the global<br />

economy. The Fed has stated that the tapering will only go into effect when they perceive the economy<br />

to be on stable footing. Despite the mood swings <strong>of</strong> the markets and extensive investor rumblings, in<br />

anticipation <strong>of</strong> the Fed’s future easing calendar, Treasuries are still near historic lows, the VIX is still<br />

below its long-term average and the Dow is still up nearly 16% YTD. The course <strong>of</strong> the year thus far has<br />

proven a strengthening economy which should continue down a moderately bouncy road while absorbing<br />

the Fed’s subtle economic taming attempts.<br />

~Christina Keyes, Alternative Investments Analyst<br />

Historical Fed Interest Rates<br />

Historical U.S. Inflation (Consumer Price Index)<br />

7

Manager Update Memorandum<br />

To:<br />

Susan Biernacki, PERA Investment Committee Chair<br />

PERA Board Members<br />

From:<br />

Ben Rotenberg, Cliffwater LLC<br />

Regarding: Manager Update – TimesSquare Capital Management<br />

Mandate/Strategy: U.S. Small/Mid Cap Growth Equity / TimesSquare Capital Management Small/Mid<br />

Cap Growth Strategy<br />

Meeting Date: <strong>June</strong> <strong>27</strong>, <strong>2013</strong><br />

CC:<br />

Joelle Mevi, Chief Investment Officer<br />

Julian Baca, Deputy Chief Investment Officer<br />

LeAnne Larrañaga-Ruffy, Portfolio Manager<br />

Summary<br />

The <strong>Public</strong> <strong>Employees</strong> <strong>Retirement</strong> <strong>Association</strong> <strong>of</strong> <strong>New</strong> Mexico (“PERA”) hired TimesSquare Capital<br />

Management (“TSCM” or “TimesSquare” or “the firm”) to manage a U.S. small/mid cap growth equity<br />

mandate in 2005. TimesSquare is managing the portfolio in the style <strong>of</strong> the firm’s Small/Mid Cap Growth<br />

Equity strategy. PERA funded a separate account for TSCM in April 2005.<br />

TimesSquare manages $202.2 million for PERA as <strong>of</strong> April <strong>2013</strong>, representing 16.5% <strong>of</strong> PERA’s<br />

Small/Mid Cap Equity Composite, and 1.5% <strong>of</strong> PERA’s total plan.<br />

The firm is stable, and grew overall firm assets and strategy assets in the Small/Mid Cap Growth Equity<br />

strategy by 12% in 2012 through strong market performance. The firm has seen some outflows <strong>of</strong> client<br />

assets, with $100 million <strong>of</strong> net outflows from one client in the Small/Mid Cap Growth Equity strategy.<br />

Recent performance in the strategy has been strongly positive relative to its benchmark.<br />

Relative performance for PERA has also been very good. According to PERA’s custodian, TSCM has<br />

outperformed its benchmark (Russell 2500 Growth) by 3.92% annualized since inception in April 2005<br />

through April <strong>2013</strong>.<br />

Cliffwater believes that the firm is well positioned to continue to manage assets for PERA, and<br />

recommends no changes to the mandate at this time.<br />

Firm / Personnel Update<br />

The firm manages $16.6 billion as <strong>of</strong> March 31, <strong>2013</strong>. The firm employs 49 pr<strong>of</strong>essionals, including 22<br />

investment pr<strong>of</strong>essionals. The investment pr<strong>of</strong>essionals are comprised <strong>of</strong> four portfolio managers,<br />

fourteen research analysts, and four traders. The firm is stable, and grew assets under management by<br />

12% in 2012 through strong market performance. The firm and strategy experienced slight net outflows<br />

during 2012. The firm now manages $5.0 billion in the strategy, which has been closed to new clients for<br />

several years.<br />

TSCM’s Small/Mid Cap Growth team joined the firm in 2000 from their former firm, Fiduciary Trust<br />

Company International, where they had been managing the predecessor fund since 1985. The team is<br />

comprised <strong>of</strong> two portfolio managers, twelve research analysts, and three traders. This team has been<br />

fairly stable since Yvette Bockstein, the strategy’s founder, retired in 2007. Over the last three years, the<br />

team has added three research analysts, and has lost two research analysts.<br />

This report reflects information only through the date here<strong>of</strong>. Our due diligence and reporting rely upon the accuracy and completeness <strong>of</strong> financial<br />

information (which may or may not be audited by the fund manager) and other information publicly available or provided to us by the fund manager, its<br />

pr<strong>of</strong>essional staff, and through other references we have contacted. We have not conducted an independent verification <strong>of</strong> the information provided<br />

other than as described in this report. Our conclusions do not reflect an audit <strong>of</strong> the investment nor should they be construed as providing legal<br />

advice. Past performance does not guarantee future performance. The information contained herein is confidential commercial or financial information,<br />

the disclosure <strong>of</strong> which would cause substantial competitive harm to you, Cliffwater LLC, or the person or entity from whom the information was<br />

obtained, and may not be disclosed except as required by applicable law.<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

Overview <strong>of</strong> Investment Process<br />

TSCM believes that fundamental equity research skills can generate superior risk-adjusted returns in an<br />

inefficient asset class like small/mid cap growth. TSCM’s fundamental research places a particular<br />

emphasis on the assessment <strong>of</strong> management quality and an in-depth understanding <strong>of</strong> superior business<br />

models. The team’s goal is to build a diversified portfolio <strong>of</strong> small- and mid-cap growth stocks which will<br />

generate superior risk-adjusted returns. The foundation <strong>of</strong> TSCM’s research is frequent meetings with a<br />

company’s management to assess the quality <strong>of</strong> management and the business model. This review <strong>of</strong>ten<br />

includes on-site company visits, meetings with customers, competitors, and suppliers as well as<br />

investment conferences and discussions with venture capitalists. Approximately 90% <strong>of</strong> TSCM’s<br />

investment ideas are derived from internal research, while 10% come from their contacts at venture<br />

capital and regional sell-side research firms. The team’s dedicated analysts are all sector specialists.<br />

Performance<br />

Relative performance against the benchmark has been very strong. According to PERA’s custodian,<br />

TSCM has outperformed its benchmark (Russell 2500 Growth Index) by 3.92% annualized since<br />

inception in April 2005.<br />

TimesSquare has delivered a +12.28% annualized rate <strong>of</strong> return, compared to +8.36% for the benchmark<br />

Russell 2500 Growth Index, since inception <strong>of</strong> the PERA account in April 2005. Over longer periods <strong>of</strong><br />

time, the strategy has also delivered very good absolute and relative returns as compared to its<br />

benchmark and peer group.<br />

Performance Notes: Please note that the PERA-specific performance comes from PERA’s custodian. All<br />

other performance data is shown gross <strong>of</strong> fees and comes from eVestment Alliance and/or the investment<br />

manager. This data is only shown through March <strong>2013</strong>.<br />

Exhibit 1<br />

TimesSquare Performance for <strong>New</strong> Mexico PERA<br />

As <strong>of</strong> April 30, <strong>2013</strong><br />

Portfolio Name Market Value % MTD 3 Mo FYTD YTD 1 Year 3 Year 5 Year<br />

Since<br />

Incep. Inception Date<br />

Times Square 202,206,260 1.53 (0.76) 5.71 24.24 12.65 19.61 17.38 11.44 12.28 01-Apr-2005<br />

Russell 2500 Grow th 0.35 5.36 20.58 12.59 15.08 13.77 7.83 8.36<br />

Excess Return (1.11) 0.35 3.66 0.05 4.53 3.60 3.62 3.92<br />

Exhibit 2<br />

TimesSquare Small/Mid Cap Growth Equity Strategy (gross <strong>of</strong> fees)<br />

Annualized Performance<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

Annualized Returns<br />

1 Yr 3 Yr 5 Yr 7 Yr 10 Yr Oct '00<br />

TSCM Small/Mid Growth 22.12% 19.25% 13.13% 10.37% 14.80% 8.31%<br />

Russell 2500 Growth 13.69% 14.95% 9.02% 6.04% 12.19% 3.62%<br />

Difference 8.43% 4.30% 4.11% 4.33% 2.61% 4.70%<br />

Manager Update Memorandum Page 2 <strong>of</strong> 7<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

Exhibit 3<br />

TimesSquare Small/Mid Cap Growth Equity Strategy (gross <strong>of</strong> fees)<br />

Calendar Year Performance<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

YTD <strong>2013</strong> 2012 2011 2010 2009 2008 2007<br />

TSCM Small/Mid Growth 13.40% 22.44% 3.40% 24.69% 44.63% -35.13% 16.33%<br />

Russell 2500 Growth 12.20% 16.14% -1.59% 28.87% 41.64% -41.50% 9.68%<br />

Difference 1.20% 6.30% 4.99% -4.18% 2.99% 6.36% 6.65%<br />

2006 2005 2004 2003 2002 2001 Oct-Dec'00<br />

TSCM Small/Mid Growth 14.09% 12.51% 12.77% 37.06% -17.57% -10.70% -4.89%<br />

Russell 2500 Growth 12.<strong>27</strong>% 8.18% 14.59% 46.29% -29.10% -10.83% -19.34%<br />

Difference 1.82% 4.33% -1.83% -9.23% 11.53% 0.13% 14.45%<br />

Exhibit 4<br />

TimesSquare Small/Mid Cap Growth Equity Strategy (gross <strong>of</strong> fees)<br />

Risk Statistics vs. Russell 2500 Growth Index<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

TSCM Small/Mid Growth<br />

vs. Russell 2500 Growth Index<br />

Return Risk<br />

Return /<br />

Risk<br />

Excess<br />

Return<br />

Excess<br />

Risk Info Ratio<br />

3 Yr 19.25% 18.11% 1.06 4.30% 3.76% 1.14<br />

5 Yr 13.13% 21.06% 0.62 4.11% 4.84% 0.85<br />

7 Yr 10.37% 18.79% 0.55 4.33% 4.42% 0.98<br />

10 Yr 14.80% 17.16% 0.86 2.61% 4.54% 0.57<br />

October 2000 (inception) 8.31% 18.96% 0.44 4.70% 6.36% 0.74<br />

Manager Update Memorandum Page 3 <strong>of</strong> 7<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

Exhibits 5 and 6 are “skill charts” which attempt to discern whether or not the manager’s outperformance<br />

is attributable to luck or skill. The blue line represents the manager’s gross <strong>of</strong> fees rolling three or five<br />

year performance relative to the Russell 2500 Growth Index. If the blue line is above 0, the manager has<br />

outperformed the index<br />

and conversely, if the blue line is below 0, the manager has underperformed the<br />

index. The black lines represent confidence bands at the 80% level which incorporate the manager’s<br />

tracking error (standard deviation <strong>of</strong> excess return) relative too the index. If the blue line is above the top<br />

black line, their outperformance can be attributable to skill. . Conversely, if the blue<br />

line is below the<br />

bottom black line, their underperformance can be attributable to a lack<br />

<strong>of</strong> skill. If the blue line<br />

is in<br />

between the two black<br />

lines, it is unclear whether or not their r relative performance is attributable to either<br />

luck or skill. These charts demonstrate that TimesSquare has added alpha over most rolling threee year<br />

and five year periods and has done so with skill at times.<br />

Exhibit 5<br />

TimesSquare Small/Mid Cap Growth Equity Strategy (gross <strong>of</strong> fees)<br />

Rolling Three-Year Returns<br />

October 20000 through March <strong>2013</strong><br />

Manager Update Memorandum<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.<br />

Page<br />

4 <strong>of</strong> 7

Exhibit 6<br />

TimesSquare Small/Mid Cap Growth Equity Strategy (gross <strong>of</strong> fees)<br />

Rolling Five-Year Returns<br />

October 20000 through March <strong>2013</strong><br />

Manager Update Memorandum<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.<br />

Page 5 <strong>of</strong> 7

Exhibit 7<br />

Performancee Universe for<br />

Small/Mid Cap Growth Strategies<br />

Gross <strong>of</strong> Fees<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

Source: Evestment Alliance.<br />

Exhibit 8<br />

MPT Statistics Universe for Small/Mid Cap<br />

Growth Strategies vs. Russell 2500 Growth Index<br />

Gross <strong>of</strong> Fees<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

Source: Evestment Alliance.<br />

Manager Update Memorandum<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.<br />

Page<br />

6 <strong>of</strong> 7

Watch List Test<br />

As stated in PERA’s investment policy, the following represent guidelines to be used in making a<br />

recommendation to the Investment Committee with regards to placing a traditional manager on the Watch<br />

List:<br />

Test 1: If the manager’s rolling three-year return (gross <strong>of</strong> fees) falls below the rolling three-year<br />

return <strong>of</strong> the benchmark for three consecutive quarters.<br />

Test 2: If the managers rolling three year return for three consecutive quarters ranks in the bottom<br />

third <strong>of</strong> the Consultant’s peer group universe.<br />

As <strong>of</strong> March 31, <strong>2013</strong>, the strategy did not pass either Watch List Test.<br />

Exhibit 9<br />

Watch List Test 1:<br />

TimesSquare Small/Mid Cap Growth Equity Strategy (gross <strong>of</strong> fees)<br />

Rolling Three Year Annualized Performance vs. Benchmark<br />

For Periods Ending 3/31/<strong>2013</strong>, 12/31/2012, and 9/30/2012<br />

3 Years<br />

ending<br />

3/31/<strong>2013</strong><br />

3 Years<br />

ending<br />

12/31/2012<br />

Exhibit 10<br />

Watch List Test 2:<br />

TimesSquare Small/Mid Cap Growth Equity Strategy (gross <strong>of</strong> fees)<br />

Rolling Three Year Annualized Performance vs. Peer Group Universe<br />

For Periods Ending 3/31/<strong>2013</strong>, 12/31/2012, and 9/30/2012<br />

3 Years<br />

ending<br />

9/30/2012<br />

TSCM Smid Growth 19.25% 16.44% 18.25%<br />

Russell 2500 Growth 14.95% 13.78% 15.17%<br />

Difference 4.30% 2.66% 3.08%<br />

3 Years<br />

ending<br />

3/31/<strong>2013</strong><br />

3 Years<br />

ending<br />

12/31/2012<br />

3 Years<br />

ending<br />

9/30/2012<br />

TSCM Smid Growth 19.25% 16.44% 18.25%<br />

eVestment Alliance Small/Mid Cap Growth Equity Universe Median 15.01% 13.54% 15.47%<br />

TSCM Rank in Universe 9 23 24<br />

Suggested Questions for the Investment Manager<br />

1) In what sectors are you currently finding opportunities?<br />

2) Are there any significant changes in portfolio positioning in the last year or so?<br />

3) What do you believe are the greatest risks in our portfolio today? What are the greatest<br />

opportunities?<br />

[As a reminder, we have not conducted full diligence on, or reviewed the legal documents for, this<br />

investment due to its legacy status in your portfolio.]<br />

Manager Update Memorandum Page 7 <strong>of</strong> 7<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

Jeffrey D. Braemer, CFA<br />

25 Years Experience<br />

Jeff is a Senior Vice President, Product Manager in TimesSquare’s growth equity group. His<br />

responsibilities include client servicing as well as portfolio and attribution analysis and general<br />

investment research. Prior to joining the firm, Jeff was a Director, Client Service and Marketing<br />

at Jacobs Levy Equity Management where he co-led the client service and portfolio analysis<br />

department. In that capacity, he was a primary point person for all client needs. Prior to Jacobs<br />

Levy, Jeff was a Product Specialist at Batterymarch Financial Management for U.S. and non-U.S.<br />

equity portfolios. Jeff has a B.A. in Political Science from Washington University in St. Louis and<br />

an M.S. in Management from Boston University. He is a member <strong>of</strong> the CFA Institute and the<br />

<strong>New</strong> York Society <strong>of</strong> Security Analysts. He holds FINRA Series 7 and 63 licenses

TIMESSQUARE CAPITAL MANAGEMENT, LLC<br />

A Small/Mid Cap Growth<br />

Portfolio Review Presentation To<br />

Jeffrey D. Braemer, CFA, Senior Vice President, Product Manager<br />

<strong>June</strong> <strong>27</strong>, <strong>2013</strong><br />

1 1 7 7 A v e n u e o f t h e A m e r i c a s , 3 9 th F l o o r ● N e w Y o r k , N Y 1 0 0 3 6 ● P h o n e: 8 0 0 – 5 4 1 – 5 1 5 6

TABLE OF CONTENTS<br />

I. TimesSquare Capital Management, LLC (TimesSquare)<br />

Organization<br />

Assets Under Management<br />

Representative Client List<br />

II. TimesSquare Small/Mid Cap Growth Strategy<br />

Team<br />

Philosophy<br />

Process<br />

III. Portfolio Results & Characteristics<br />

IV. Appendix<br />

Additional Performance Information<br />

Biographies<br />

Disclosures<br />

2

TimesSquare Capital Management, LLC<br />

(TimesSquare)<br />

3

TIMESSQUARE CAPITAL MANAGEMENT, LLC<br />

Investment manager focused on providing superior investment solutions<br />

exclusively to the institutional marketplace<br />

Experienced team <strong>of</strong> international and U.S. equity pr<strong>of</strong>essionals<br />

Time-tested investment strategies driven by internally generated research<br />

Significant employee ownership<br />

We are growth equity specialists.<br />

4

TIMESSQUARE CAPITAL MANAGEMENT, LLC<br />

Grant Babyak<br />

CEO, Portfolio Manager<br />

Management Committee<br />

Tony Rosenthal, CFA<br />

Portfolio Manager<br />

Stephen Green, CFA<br />

Head <strong>of</strong> Business Development<br />

International Equities<br />

U.S. Equities<br />

Trading<br />

Technology/Operations/<br />

Administration<br />

Marketing &<br />

Product Management<br />

Magnus Larsson<br />

Head <strong>of</strong> International Equities/<br />

Portfolio Manager<br />

Seth Bienstock<br />

Analyst<br />

Joshua Bisch<strong>of</strong>f<br />

Head Trader<br />

Mark Aaron<br />

Chief Operating Officer<br />

& Chief Compliance Officer<br />

Jeffrey Braemer, CFA<br />

Client Service &<br />

Product Management<br />

David Hirsh<br />

Analyst - Europe<br />

Robert Madsen, CFA<br />

Analyst - Asia<br />

Matthew D’Alto<br />

Analyst<br />

Kenneth Duca, CFA<br />

Portfolio Manager/Analyst<br />

Keith Ferguson, CFA<br />

Analyst<br />

Dr. Weidong Huang, CFA<br />

Analyst<br />

Timothy Corliss<br />

International Trader<br />

Christina Muk<strong>of</strong>sky<br />

U.S. Trader<br />

Adam Salomon<br />

U.S. Trader<br />

Carl Jano<br />

Chief Financial Officer<br />

Fred Kramer<br />

Operations & Systems<br />

John Metzner<br />

Technology Support<br />

Joseph DeVera<br />

Client Service &<br />

Product Management<br />

Siobhan Flannery<br />

Marketing &<br />

Product Management<br />

Brenda Le, CFA<br />

Marketing &<br />

Product Management<br />

Mark Grzymski<br />

Analyst<br />

Russell <strong>New</strong>man<br />

International Trade Support<br />

Joy Ragland<br />

Client Service &<br />

Product Management<br />

Michael Russell<br />

Analyst<br />

James Russo<br />

Analyst<br />

Valerie Vazquez<br />

Office Manager<br />

Michael Ray<br />

Client Service &<br />

Product Management<br />

5

GROWTH EQUITY STRATEGIES<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

International<br />

International Small Cap<br />

Total Assets ($M)<br />

$6<br />

U.S.<br />

Small Cap Growth<br />

(CLOSED)<br />

Small/Mid Cap Growth<br />

(CLOSED)<br />

Mid Cap Growth<br />

(CLOSED)<br />

FOCUS Growth<br />

$4,1<strong>27</strong><br />

$4,969<br />

$6,952<br />

$435<br />

All-Cap Growth<br />

$<strong>27</strong>8*<br />

$16.77* Billion<br />

*Includes an All-Cap Growth account funded in April <strong>2013</strong><br />

6

REPRESENTATIVE CLIENT LIST<br />

Corporate<br />

Allergan<br />

AMETEK<br />

Barnes Group<br />

Baxter International<br />

Boeing<br />

Bombardier Trust Canada, U.K., U.S.<br />

Bowne & Co.<br />

Catholic Health Partners<br />

CBS Corporation<br />

CenturyLink<br />

Chevron Corporation<br />

Colgate-Palmolive Company<br />

Cox Enterprises<br />

Dell Inc.<br />

DuPont and Related Companies Defined<br />

Contribution Plan Master Trust<br />

General Mills<br />

Hallmark Cards<br />

Illinois Tool Works Inc.<br />

Invensys<br />

Jefferson Regional Medical Center<br />

Blue Cross and Blue Shield <strong>of</strong> Minnesota<br />

Nestlé<br />

Pacific Gas and Electric Company<br />

PCA <strong>Retirement</strong> & Benefits, Inc.<br />

Providence Health System<br />

Realdania<br />

Ricoh Americas Corporation<br />

St. Joseph Health System<br />

SCANA Corporation<br />

Textron<br />

UL<br />

Wells Fargo Advisors<br />

<strong>Public</strong><br />

Arizona State <strong>Retirement</strong> System<br />

Colorado <strong>Public</strong> <strong>Employees</strong>’ <strong>Retirement</strong> <strong>Association</strong><br />

HEB Manitoba<br />

Imperial County <strong>Employees</strong>’ <strong>Retirement</strong> System<br />

Indiana <strong>Public</strong> <strong>Retirement</strong> System<br />

Manhattan and Bronx Surface Transit Operating Authority<br />

Montana Board <strong>of</strong> Investments<br />

<strong>Public</strong> <strong>Employees</strong> <strong>Retirement</strong> <strong>Association</strong> <strong>of</strong> <strong>New</strong> Mexico<br />

Oakland County <strong>Employees</strong>’ <strong>Retirement</strong> System<br />

Oklahoma City Employee <strong>Retirement</strong> System<br />

Oklahoma Municipal <strong>Retirement</strong> Fund<br />

Metropolitan St. Louis Sewer District<br />

Regional Transportation Authority<br />

South Carolina <strong>Retirement</strong> Systems<br />

Stilllegungsfonds für Kernanlagen/Entsorgungsfonds für Kernkraftwerke<br />

Virginia <strong>Retirement</strong> System<br />

Worldwide Assurance for <strong>Employees</strong> <strong>of</strong> <strong>Public</strong> Agencies<br />

Taft-Hartley<br />

Carpenters Pension Trust Fund for Northern California<br />

Laborers’ District Council & Contractors Pension Fund <strong>of</strong> Ohio<br />

Maritime <strong>Association</strong> - I.L.A. Pension Fund<br />

Operating Engineers Pension Trust Fund <strong>of</strong> Washington, DC<br />

San Diego Electrical Industry Trust<br />

Twin City Iron Workers<br />

UFCW Denver Area Meat Cutters & Employers Pension Plan<br />

UFCW Rocky Mountain Unions & Employers Pension Plan<br />

Endowment/Foundation<br />

American College <strong>of</strong> Surgeons<br />

American Legacy Foundation<br />

UCLA Foundation<br />

Foundation for the Carolinas<br />

Cook Children’s Health Foundation<br />

Howard University<br />

Idaho Endowment Fund Investment Board<br />

Kansas Health Foundation<br />

Kemper & Ethel Marley Foundation<br />

Silicon Valley Community Foundation<br />

Spectrum Health Foundation<br />

Texas Tech University System<br />

University <strong>of</strong> Arizona Foundation<br />

Wichita State University Foundation<br />

Sub-Advisory<br />

Aon Group Trust<br />

GuideStone Capital Management<br />

Managers Investment Group<br />

Nestlé Capital Advisers<br />

Old Mutual Global Investors<br />

Prudential Financial<br />

Vantagepoint Funds<br />

Please see the Appendix for important disclosures regarding this list.<br />

7

TimesSquare Small/Mid Cap Growth Strategy<br />

8

SMALL/MID CAP GROWTH INVESTMENT TEAM<br />

Portfolio Managers<br />

Credentials<br />

Investment Focus<br />

Years <strong>of</strong> Experience<br />

Grant R. Babyak<br />

MBA/<strong>New</strong> York University<br />

BA/Yale University<br />

Generalist<br />

25<br />

Tony Rosenthal, CFA<br />

MBA/Columbia Business School<br />

BA/Wesleyan University<br />

Generalist<br />

24<br />

Small/Mid Cap Analysts<br />

Credentials<br />

Investment Focus<br />

Years <strong>of</strong> Experience<br />

Seth M. Bienstock<br />

BS/Wharton School<br />

Financial Services<br />

16<br />

Matthew T. D’Alto<br />

MBA/University <strong>of</strong> Chicago<br />

BA/Fairfield University<br />

Energy<br />

15<br />

Kenneth C. Duca, CFA<br />

MBA/Rutgers University<br />

BA/Muhlenberg College<br />

Business Services,<br />

Transaction Processing<br />

23<br />

Keith E. Ferguson, CFA<br />

MBA/<strong>New</strong> York University<br />

BBA/H<strong>of</strong>stra University<br />

Communications, Data Networking,<br />

Data Storage, Lodging, Transportation<br />

21<br />

Mark E. Grzymski<br />

MBA/Fordham University<br />

BSBA/Bucknell University<br />

Industrials, Materials & Processing,<br />

Machinery<br />

16<br />

Dr. Weidong Huang, CFA<br />

PhD/Harvard University<br />

AB/Princeton University<br />

Biotechnology, Pharmaceuticals,<br />

Medical Devices, Healthcare Services<br />

17<br />

Michael J. Russell<br />

MBA/Harvard University<br />

AB/Princeton University<br />

Consumer, Media, Marketing Services<br />

20<br />

James J. Russo<br />

BS/Boston College<br />

Semiconductor, S<strong>of</strong>tware, Internet,<br />

Computer Hardware<br />

10<br />

9

SMALL/MID CAP GROWTH INVESTMENT PHILOSOPHY<br />

“We believe that our proprietary fundamental Small/Mid cap<br />

research skills, which place a particular emphasis on the<br />

assessment <strong>of</strong> management quality and an in-depth understanding<br />

<strong>of</strong> superior business models, enable us to build a diversified<br />

portfolio <strong>of</strong> Small/Mid cap growth stocks that will generate<br />

superior risk-adjusted returns.”<br />

10

SMALL/MID CAP GROWTH INVESTMENT PROCESS<br />

Research-Driven, Bottom-Up Discipline<br />

STEP 1 STEP 2 STEP 3<br />

Market Cap<br />

Criteria<br />

≥$300 million<br />

≤$5 billion<br />

2,500 stocks<br />

Growth Criteria<br />

3 Yrs. Projected<br />

EPS/Sales growth<br />

≥15%<br />

1,000 stocks<br />

PRIMARY<br />

REQUIREMENTS<br />

Exceptional<br />

management<br />

Distinct, sustainable<br />

competitive<br />

advantage<br />

Strong, consistent<br />

growth<br />

WORKING<br />

UNIVERSE<br />

400 STOCKS<br />

FURTHER<br />

IN-DEPTH<br />

ANALYSIS<br />

Management<br />

scrutiny<br />

Financial<br />

modeling<br />

Valuation<br />

Price<br />

targets<br />

PORTFOLIO<br />

CONSTRUCTION/<br />

RISK MANAGEMENT<br />

Sector/security<br />

diversification<br />

Active<br />

oversight<br />

Sell<br />

discipline<br />

PORTFOLIO<br />

100<br />

STOCKS<br />

11

SMALL/MID CAP GROWTH INVESTMENT PROCESS<br />

Identifying “Superior Growth Businesses”<br />

Exceptional management<br />

Clear goals and viable business model<br />

<br />

<br />

<br />

<br />

Alignment <strong>of</strong> interests with shareholders<br />

Experience and integrity<br />

Meaningful proportion <strong>of</strong> net worth tied<br />

to company<br />

Track record <strong>of</strong> success<br />

PRIMARY<br />

REQUIREMENTS<br />

Exceptional<br />

management<br />

Distinct, sustainable<br />

competitive<br />

advantage<br />

Strong, consistent<br />

growth<br />

WORKING<br />

UNIVERSE<br />

400 STOCKS<br />

Distinct, sustainable competitive advantage<br />

Proprietary products, services,<br />

distribution/manufacturing advantages<br />

<br />

<br />

<br />

<br />

<br />

Demonstrated franchise value<br />

High barriers to entry<br />

Relatively few competitors<br />

Brand name recognition<br />

Patents<br />

Strong, consistent growth<br />

Both top line (revenue) and bottom line (earnings)<br />

<br />

<br />

<br />

<br />

<br />

<br />

Strong probability <strong>of</strong> retaining or widening margins<br />

High proportion <strong>of</strong> recurring revenues<br />

Sales to many customers in multiple markets<br />

Strong balance sheet, conservative accounting,<br />

sufficient cash flow<br />

Visibility <strong>of</strong> earnings<br />

Growth rate potential unidentified<br />

12

SMALL/MID CAP GROWTH INVESTMENT PROCESS<br />

Further In-Depth Analysis<br />

Management scrutiny<br />

Approximately 1,500 management<br />

meetings per year<br />

On site due diligence <strong>of</strong> manufacturing/<br />

production facilities<br />

Further management discussions<br />

Financial Modeling<br />

Traditional financial analysis<br />

Models based on internally generated<br />

growth forecasts<br />

WORKING<br />

UNIVERSE<br />

400 STOCKS<br />

FURTHER<br />

IN-DEPTH<br />

ANALYSIS<br />

Management<br />

scrutiny<br />

Financial<br />

modeling<br />

Valuation<br />

Price<br />

targets<br />

Valuation tailored to industry<br />

Price/earnings at a discount to<br />

earnings growth<br />

Attractive price/earnings relative to<br />

industry group<br />

Price/revenue, price/cash flow, etc.,<br />

as appropriate<br />

Establish targets for each stock<br />

25-50% price appreciation potential over 12<br />

to 18 months<br />

<br />

Re-evaluate based on evolving fundamentals<br />

and current market conditions<br />

13

SMALL/MID CAP GROWTH INVESTMENT PROCESS<br />

Portfolio Construction/Risk Management<br />

Sector/Security Diversification<br />

Approximately 100 stocks in a portfolio<br />

<br />

<br />

<br />

<br />

No one issue greater than 5% at market<br />

No one major industry greater than 2x<br />

the index weight<br />

No one sector greater than 45% <strong>of</strong> portfolio<br />

market value<br />

Top 15 positions targeted to represent<br />

30% <strong>of</strong> the portfolio<br />

PORTFOLIO<br />

CONSTRUCTION/<br />

RISK MANAGEMENT<br />

Sector/security<br />

diversification<br />

Active<br />

oversight<br />

Sell<br />

discipline<br />

PORTFOLIO<br />

100<br />

STOCKS<br />

Active Oversight<br />

Trading system with built-in<br />

pre-trade compliance<br />

<br />

<br />

<br />

<br />

Daily compliance review<br />

Formal weekly review versus<br />

client guidelines and peer group review<br />

Daily and weekly strategy/<br />

research meetings<br />

Monthly attribution analysis<br />

Sell Discipline<br />

Operating objectives not met<br />

<br />

<br />

<br />

<br />

<br />

Management unable to sustain<br />

competitive advantage<br />

Anticipated deterioration in<br />

fundamentals<br />

Reasons for purchase changed<br />

Overvaluation<br />

Prudent pr<strong>of</strong>it-taking/trimming<br />

14

Portfolio Results & Characteristics<br />

15

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION OF NEW MEXICO<br />

Total Returns for the Period Ending May 31, <strong>2013</strong><br />

33.3<br />

32.5<br />

Percent Return<br />

16.9 16.7<br />

17.2<br />

29.6<br />

22.2 21.3<br />

18.0<br />

11.7<br />

10.7<br />

12.8<br />

11.9<br />

8.8<br />

11.5 10.5<br />

7.6<br />

7.6<br />

YTD 1 YR 3 YR 5 YR 7 YR Since Ince ption<br />

(04/01/05)<br />

<strong>New</strong> Mexico (Gross) <strong>New</strong> Mexico (Net) Russell 2500 Growth Index<br />

Market Value as <strong>of</strong> May 31, <strong>2013</strong>: $209,854,015<br />

Returns are Annualized greater than 1 YR<br />

16

RUSSELL 2500 GROWTH INDEX BREAKDOWN<br />

RUSSELL 2500 GROWTH INDEX<br />

(AS OF 5/31/13)<br />

MACRO GROUP<br />

Y-T-D<br />

RETURN (%)<br />

INDEX<br />

WEIGHT (%)<br />

<strong>New</strong> Mexico<br />

WEIGHT (%)<br />

Consumer Discretionary 24.1 20.3 12.1<br />

Consumer Staples 30.5 3.8 4.1<br />

Energy 16.1 5.2 5.8<br />

Financial Services 16.8 14.3 19.1<br />

Healthcare 19.0 15.1 12.8<br />

Materials & Processing 8.8 9.1 5.0<br />

Producer Durables 16.9 16.1 20.4<br />

Technology 11.0 14.6 20.8<br />

Utilities 11.6 1.5 0.0<br />

Index Total 17.2 100 100<br />

Source: FactSet<br />

17

RUSSELL 2500 GROWTH INDEX BREAKDOWN<br />

RUSSELL 2500 GROWTH INDEX<br />

(AS OF 5/31/12)<br />

MACRO GROUP<br />

INDEX<br />

WEIGHT (%)<br />

<strong>New</strong> Mexico<br />

WEIGHT (%)<br />

Consumer Discretionary 16.8 12.4<br />

Consumer Staples 3.7 2.0<br />

Energy 7.5 7.1<br />

Financial Services 11.5 18.5<br />

Healthcare 16.3 15.0<br />

Materials & Processing 9.4 3.6<br />

Producer Durables 16.5 22.7<br />

Technology 16.9 18.7<br />

Utilities 1.2 0.0<br />

Index Total 100 100<br />

Source: FactSet<br />

18

RUSSELL 2500 GROWTH INDEX BREAKDOWN<br />

MACRO GROUP<br />

RUSSELL 2500 GROWTH INDEX<br />

(AS OF 3/31/05)<br />

REPRESENTATIVE<br />

INDEX<br />

ACCOUNT<br />

WEIGHT (%)<br />

WEIGHT (%)<br />

Auto & Transportation 3.6 3.4<br />

Consumer Discretionary 26.1 26.5<br />

Consumer Staples 0.9 0.8<br />

Energy 5.4 6.5<br />

Financial Services 12.0 20.2<br />

Health Care 18.4 17.9<br />

Materials & Processing 5.7 4.1<br />

Producer Durables 8.6 3.8<br />

Technology 17.4 16.7<br />

Utilities / Telecom. 1.4 0.0<br />

Other 0.4 0.0<br />

Index Total 100 100<br />

Source: Vestek<br />

19

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION OF NEW MEXICO<br />

ATTRIBUTION HIGHLIGHTS: TRAILING 1 YEAR (5/31/<strong>2013</strong>)<br />

Performance Contribution by Sector<br />

Relative to Russell 2500 TM Growth Index<br />

SECTOR STOCK ACTIVE<br />

RUSSELL GLOBAL ECONOMIC SECTORS ALLOCATION SELECTION CONTRIBUTION<br />

Consumer Discretionary -0.46 0.07 -0.39<br />

Consumer Staples 0.05 -1.16 -1.11<br />

Energy 0.21 -0.28 -0.07<br />

Financial Services 0.15 1.90 2.06<br />

Health Care 0.04 1.78 1.81<br />

Materials & Processing -0.15 0.06 -0.09<br />

Producer Durables 0.05 0.94 0.98<br />

Technology -0.26 1.49 1.23<br />

Utilities 0.09 0.00 0.09<br />

TOTAL (Includes Cash & Equivalents) -1.05 4.80 3.75<br />

Greatest Contributors<br />

Greatest Detractors<br />

Contrib to Equity<br />

Contrib to Equity<br />

Security Sector Return % Security Sector Return %<br />

DaVita HealthCare Partners Health Care 1.64 Tempur-Pedic International Consumer Discretionary -0.55<br />

SBA Communications Corp. Technology 1.51 Green Dot Corp. Cl A Financial Services -0.39<br />

Genesee & Wyoming Inc. Producer Durables 1.45 VIVUS Inc. Health Care -0.33<br />

FleetCor Technologies Inc. Financial Services 1.39 Micros Systems Inc. Technology -0.30<br />

Apollo Global Management Financial Services 1.08 Volcano Corp. Health Care -0.26<br />

Source: FactSet<br />

20

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION OF NEW MEXICO<br />

PORTFOLIO TEN LARGEST HOLDINGS<br />

YTD Thru<br />

5/31/<strong>2013</strong> Cap 5/31/<strong>2013</strong> Contribution<br />

% <strong>of</strong> Size Portfolio Portfolio<br />

Security Name Description (Year <strong>of</strong> Initial Purchase) Total Price ($ mil) Return (%) Return (%)<br />

SBA Communications Corp. Owns & operates wireless communications<br />

3.01 $75.<strong>27</strong> 9,582 6.02 0.23<br />

infrastructure in the U.S. (2006)<br />

Genesee & Wyoming Inc. Operates short line & regional freight railroads (2012) 2.04 $89.05 4,741 16.83 0.37<br />

Jack Henry & Associates Inc. Develops, markets, & installs integrated computer<br />

systems for in-house & service bureau data processing<br />

to banks & other financial institutions (2000)<br />

1.98 $46.93 4,040 20.35 0.37<br />

Alliance Data Systems Corp<br />

RenaissanceRe Holdings<br />

Clean Harbors<br />

WEX Inc.<br />

RPM International Inc.<br />

Qlik Technologies<br />

Ultimate S<strong>of</strong>tware Group<br />

Provides transaction services, credit services, &<br />

marketing services (2001)<br />

Provides reinsurance & insurance products & services<br />

worldwide (2009)<br />

Provides hazardous waste collection & disposal<br />

services (2009)<br />

Provides payment processing & information<br />

management services to the U.S. commercial &<br />

government vehicle fleet industry (2005)<br />

Manufactures & markets various specialty chemical<br />

products to industrial & consumer markets worldwide<br />

(2011)<br />

Designs business intelligence s<strong>of</strong>tware that visually<br />

analyzes data from multiple sources in real time (2012)<br />

Designs, markets, implements & supports Web-based &<br />

client/server cross-industry human resource<br />

management & payroll s<strong>of</strong>tware solutions (2012)<br />

1.97 $177.09 8,789 22.50 0.48<br />

1.84 $85.96 3,826 6.13 0.15<br />

1.81 $57.20 3,460 4.08 0.05<br />

1.72 $73.87 2,873 -1.93 -0.02<br />

1.64 $33.13 4,390 13.55 0.26<br />

1.63 $30.76 2,674 41.37 0.51<br />

1.55 $111.30 3,076 17.87 0.28<br />

19.21 2.68<br />

Source: FactSet<br />

21

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION OF NEW MEXICO<br />

HISTORICAL TEN LARGEST HOLDINGS<br />

5/31/2012 Years <strong>of</strong> 3/31/2005 Years <strong>of</strong><br />

% <strong>of</strong> Initial % <strong>of</strong> Initial<br />

Security Name Total Purchase Security Name Total Purchase<br />

DaVita 3.85 2000 DaVita 3.96 2000<br />

SBA Communications Corp. 3.13 2006 Alliance Data Systems Corp 3.18 2001<br />

Alliance Data Systems Corp 2.16 2001 SCP Pool 2.72 1997<br />

Solera Holdings Inc. 1.95 2009 Investors Financial Services 2.67 1998<br />

Wright Express Corp. 1.91 2005 Education Management 2.31 2000<br />

Clean Harbors 1.81 2009 Capital Source 2.14 2003<br />

CoStar Group Inc. 1.78 2005 Global Payments Inc. 2.04 2001<br />

Global Payments Inc. 1.62 2001 Getty Images 1.99 2001<br />

Genesee & Wyoming Inc. 1.61 2012 Markel 1.93 1998<br />

Jack Henry & Associates Inc. 1.55 2000 Corporate Executive Board 1.82 1999<br />

21.37 24.76<br />

Source:Vestek<br />

22

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION OF NEW MEXICO<br />

PORTFOLIO CHARACTERISTICS<br />

As <strong>of</strong> May 31, <strong>2013</strong><br />

Median Market<br />

Capitalization ($ Billions)<br />

Weighted Median Market<br />

Capitalization ($ Billions)<br />

<strong>New</strong> Mexico<br />

3.2<br />

3.3<br />

Russell 2500 <br />

Growth Index<br />

1.0<br />

3.2<br />

Weighted Average Market<br />

Capitalization ($ Billions)<br />

3.8<br />

3.7<br />

P/E (FY1 Forecast) 1 17.4x<br />

19.1x<br />

L.T. Earnings Growth Forecast 1 15.6%<br />

17.3%<br />

Number <strong>of</strong> Holdings<br />

98<br />

1,376<br />

Active Share<br />

86%<br />

-<br />

¹ Source: FactSet Estimates<br />

23

Appendix<br />

24

SMALL/MID CAP GROWTH HISTORICAL PERFORMANCE<br />

Calendar Year Gross-<strong>of</strong>-Fee Returns<br />

Calendar<br />

Years<br />

Small/Mid Cap<br />

Growth Composite<br />

Russell 2500 <br />

Growth Index<br />

2012 22.44% 16.13%<br />

2011 3.41 -1.57<br />