May 30, 2013 - Public Employees Retirement Association of New ...

May 30, 2013 - Public Employees Retirement Association of New ...

May 30, 2013 - Public Employees Retirement Association of New ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

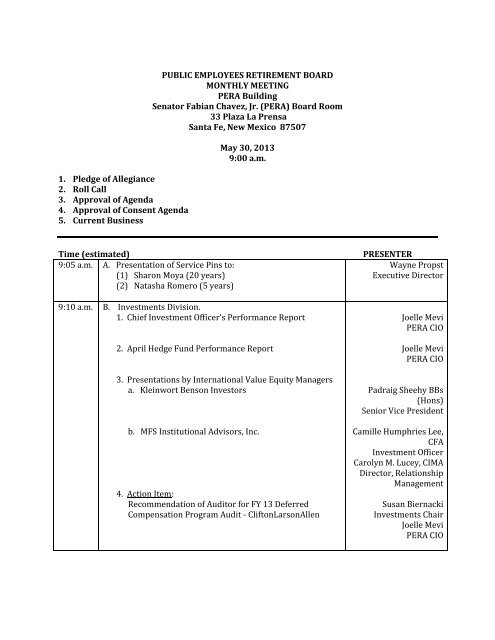

1. Pledge <strong>of</strong> Allegiance<br />

2. Roll Call<br />

3. Approval <strong>of</strong> Agenda<br />

4. Approval <strong>of</strong> Consent Agenda<br />

5. Current Business<br />

PUBLIC EMPLOYEES RETIREMENT BOARD<br />

MONTHLY MEETING<br />

PERA Building<br />

Senator Fabian Chavez, Jr. (PERA) Board Room<br />

33 Plaza La Prensa<br />

Santa Fe, <strong>New</strong> Mexico 87507<br />

<strong>May</strong> <strong>30</strong>, <strong>2013</strong><br />

9:00 a.m.<br />

Time (estimated)<br />

9:05 a.m. A. Presentation <strong>of</strong> Service Pins to:<br />

(1) Sharon Moya (20 years)<br />

(2) Natasha Romero (5 years)<br />

9:10 a.m. B. Investments Division.<br />

1. Chief Investment Officer’s Performance Report<br />

2. April Hedge Fund Performance Report<br />

3. Presentations by International Value Equity Managers<br />

a. Kleinwort Benson Investors<br />

b. MFS Institutional Advisors, Inc.<br />

4. Action Item:<br />

Recommendation <strong>of</strong> Auditor for FY 13 Deferred<br />

Compensation Program Audit - CliftonLarsonAllen<br />

PRESENTER<br />

Wayne Propst<br />

Executive Director<br />

Joelle Mevi<br />

PERA CIO<br />

Joelle Mevi<br />

PERA CIO<br />

Padraig Sheehy BBs<br />

(Hons)<br />

Senior Vice President<br />

Camille Humphries Lee,<br />

CFA<br />

Investment Officer<br />

Carolyn M. Lucey, CIMA<br />

Director, Relationship<br />

Management<br />

Susan Biernacki<br />

Investments Chair<br />

Joelle Mevi<br />

PERA CIO

10:<strong>30</strong><br />

a.m.<br />

C. Executive Director’s Report Wayne Propst<br />

Executive Director<br />

6. Other Business<br />

7. Adjournment<br />

Any person with a disability who is in need <strong>of</strong> a reader, amplifier, qualified sign language<br />

interpreter, or any other form <strong>of</strong> auxiliary aid or service to attend or participate in the<br />

hearing or meeting, please contact Judy Olson at (505) 476-9<strong>30</strong>5 at least one week prior to<br />

the meeting, or as soon as possible. <strong>Public</strong> documents, including the agenda and minutes,<br />

can be provided in various accessible formats. Please contact Ms. Olson if a summary or<br />

other type <strong>of</strong> accessible format is needed.

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION<br />

MONTHLY MEETING<br />

<strong>May</strong> <strong>30</strong>, <strong>2013</strong><br />

CONSENT AGENDA<br />

1. Approval <strong>of</strong> Minutes: April 9, <strong>2013</strong> Rules & Administration Committee Meeting<br />

April 25, <strong>2013</strong> Board Meeting<br />

2. Ratification <strong>of</strong> <strong>Retirement</strong>s – Benefits processed through <strong>May</strong> 23, <strong>2013</strong>.<br />

a. Normal d. Non-Duty Death<br />

b. Deferred e. Non-Duty Disability<br />

c. Reciprocity to ERA f. Reciprocity to PERA<br />

3. Affidavits for Free Military Service:<br />

a. Enrique Granillo, 11 months <strong>of</strong> free military service<br />

b. William W. Cordova, 1 year and 2 months <strong>of</strong> free military service<br />

c. Frank Caulfield, 3 years and 5 months <strong>of</strong> free military service<br />

4. Duty and Non-Duty Death Determinations:<br />

a. James O’Neill (Non-duty death)<br />

b. Raymond Chavez (Non-duty death)<br />

c. Michael J. Seeley (Non-duty death)<br />

d. Patricia Bryne (Non-duty death)<br />

5. Resolutions:<br />

CITY OF MORIARTY – The City <strong>of</strong> Moriarty submitted Resolution No. 12-13-<strong>30</strong><br />

authorizing an election for adoption <strong>of</strong> Municipal Police Member Coverage Plan 5.<br />

The election is scheduled for July 1, <strong>2013</strong>.<br />

TOWN OF CARRIZOZO – The Town <strong>of</strong> Carrizozo submitted Resolution No. R<strong>2013</strong>-05<br />

approving participation in the <strong>Public</strong> <strong>Employees</strong> <strong>Retirement</strong> <strong>Association</strong> Municipal<br />

Police Member Coverage Plan 3. The plan change is effective the first pay period in<br />

July <strong>2013</strong>.<br />

6. Educational Conferences:<br />

a. Daniel Esquibel – to attend the CAPP – Employee Pensions – Part 1<br />

June 25-26, <strong>2013</strong>, Chicago, Illinois (expenses paid by PERA)<br />

Setting <strong>of</strong> Meetings – June, <strong>2013</strong><br />

a. Investments Committee 6/11/<strong>2013</strong> 9:00 a.m.<br />

b. Audit & Budget Committee 6/11/<strong>2013</strong> After Investments Committee<br />

c. Rules & Administration Comm. 6/11/<strong>2013</strong> After Audit & Budget Committee<br />

d. Legislative Committee 6/11/<strong>2013</strong> After Rules & Administration Committee<br />

e. Disability Review Committee 6/11/<strong>2013</strong> 2:00 p.m. PERA Board Room<br />

f. Monthly Board Meeting 6/27/<strong>2013</strong> 9:00 a.m. PERA Board Room

Presentation to<br />

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION OF NEW MEXICO<br />

PUBLIC EMPLOYEES RETIREMENT BOARD

Firm overview<br />

Global client base<br />

Specialist<br />

investment firm<br />

Part <strong>of</strong> Kleinwort<br />

Benson Group<br />

Meet highest<br />

international<br />

regulatory<br />

requirements<br />

Passionate belief in<br />

products and<br />

processes<br />

AUM: $5.1bn<br />

Pioneers in<br />

dividend-based<br />

investment<br />

Pioneers in<br />

environmental<br />

equity investing

Dividend Plus investment team<br />

Key People Title Experience Tenure<br />

Noel O’Halloran Chief Investment Officer 25 21<br />

Gareth Maher Head <strong>of</strong> Portfolio Management 25 13<br />

David Hogarty Head <strong>of</strong> Strategy Development 22 18<br />

Ian Madden Portfolio Manager 12 12<br />

James Collery Portfolio Manager 12 12<br />

Ultan O’Kane Trader 7 6<br />

3

Market overview<br />

Asset Class Performance ( US $ returns) 2012<br />

<strong>2013</strong><br />

Q1<br />

Equities % %<br />

MSCI World Equity Index +16.5 + 7.9<br />

MSCI EAFE Equity Index +17.9 +5.2<br />

MSCI EMU Equity Index +22.5 - 0.3<br />

MSCI Emerging Market Equity Index +18.6 -1.6<br />

Source: Thomson Reuters Datastream,<br />

4

Key summary points Dividend Plus<br />

Investment<br />

Thesis:<br />

Strategy<br />

Delivers:<br />

Approach:<br />

KBI<br />

Consistent performance<br />

Quality, cash rich<br />

companies with better<br />

We target more Dividend<br />

Yield and Dividend<br />

Outperformed b/m on a<br />

consistent basis<br />

Downside protection<br />

balance sheets.<br />

Growth.<br />

Unique strategy that<br />

Lower risk, lower<br />

Better value companies<br />

Segmented construction:<br />

blends well<br />

volatility<br />

Total Return approach,<br />

not just income<br />

High Active Share<br />

All Cap portfolio<br />

Broadest opportunity<br />

(seek opportunities<br />

where other don’t look)<br />

Systematic approach to<br />

buy low and sell high<br />

Experienced specialist<br />

team<br />

Managing this approach<br />

since 2003<br />

set<br />

* Based on PERA vs MSCI EAFE value index<br />

5

Dividend Players<br />

North<br />

America<br />

Europe<br />

Pacific<br />

Basin<br />

Emerging<br />

Markets<br />

Total<br />

Number <strong>of</strong><br />

Payers<br />

Dividend Yield<br />

(avg).<br />

Dividend Payout<br />

(avg)<br />

Dividend Growth<br />

(avg)<br />

542 409 446 740 2137<br />

2.1% 3.5% 2.6% 2.7% 2.6%<br />

28% 40% 36% 35% 34%<br />

3.3% 3.8% 1.1% 6.2% 4.0%<br />

Source: Kleinwort Benson Investors December 31st, 2012. MSCI All Countries index data.<br />

6

Performance<br />

Fund<br />

Performance<br />

%<br />

MSCI EAFE Value<br />

Index<br />

%<br />

Relative<br />

Return<br />

%<br />

Year to date (end March) +4.7 +3.6 +1.1<br />

1 Year +13.9 +11.7 +2.2<br />

3 Years (annualized) +5.8 +4.1 +1.7<br />

Source: Kleinwort Benson Investors. Returns quoted are in US$, Gross <strong>of</strong> Fees and as at 31 st March <strong>2013</strong>.<br />

Inception date 31 st March 2010<br />

7

Active Fund Positions v Benchmark<br />

Regional<br />

Allocations<br />

PERA<br />

MSCI<br />

VALUE<br />

DIFFERENCE<br />

EUROLAND 25.0 31.1 -6.1<br />

EUROPE EX<br />

EUROLAND<br />

33.6 32.15 1.5<br />

JAPAN 19.6 21.7 -2.1<br />

PACIFIC BASIN<br />

EX JAPAN<br />

EMERGING<br />

MARKETS<br />

13.0 14.4 -1.4<br />

7.6 0.0 7.6<br />

SECTOR<br />

ALLOCATION<br />

CONSUMER<br />

DISCRETIONARY<br />

CONSUMER<br />

STAPLES<br />

PERA<br />

MSCI<br />

VALUE<br />

DIFFERENCE<br />

8.9 7.2 +1.7<br />

11.7 2.3 +9.4<br />

ENERGY 7.1 11.0 -3.9<br />

FINANCIAL 22.4 37.1 -11.7<br />

HEALTHCARE 10.3 8.3 -2.0<br />

INDUSTRIAL 11.1 10.2 +0.9<br />

INFORMATION<br />

TECHNOLOGY<br />

3.2 3.7 -0.5<br />

MATERIALS 8.0 6.1 +1.9<br />

TELECOM<br />

SERVICES<br />

4.9 8.0 -3.1<br />

UTILITIES 3.6 6.1 -2.5

Attribution Analysis – 1 year to 31 st March <strong>2013</strong><br />

What worked<br />

Europe, Pacific Basin<br />

Best performing sectors<br />

Consumer Services<br />

TUI Travel<br />

Banks & Diversified Financials<br />

Swedbank, Aeon Credit<br />

What did not work<br />

Japan & Emerging Markets<br />

Worst performing sectors<br />

European Semiconductors<br />

ST Micro Electronics<br />

Pacific Basin Telecoms<br />

Singapore Telecom<br />

Materials<br />

Anglo America, BHP

Current International portfolio<br />

Mkt. Cap<br />

$bn<br />

Dividend<br />

Plus<br />

%<br />

MSCI<br />

EAFE<br />

Index %<br />

+/-<br />

%<br />

25 44.7 53.2 -8.4<br />

Dividend<br />

Plus<br />

Strategy<br />

MSCI<br />

EAFE<br />

Index<br />

Dividend Yield (%) 4.6 3.4<br />

Dividend Payout (%) 52.8 44.0<br />

Dividend Growth (%) 6.1 4.7<br />

Total Payout Yield (%) 4.7 2.4<br />

P/E 10.7 12.7<br />

Better Total<br />

Return<br />

Active Share Measure is 74%<br />

Active Share measures the difference in<br />

portfolio holdings from the benchmark.<br />

Expressed as an overall percentage this means<br />

that 74% <strong>of</strong> our exposures are different to the<br />

benchmark, while 26% are the same.<br />

So constituent holdings within regions and<br />

industries are very different to the broad<br />

market.<br />

Source: Kleinwort Benson Investors, Datastream, December 31st , 2012<br />

Price/Book 1.5 1.2<br />

Price/Cashflow 7.9 9.0<br />

Weighted Avg. Mkt.<br />

Cap $ (bn)<br />

Beta 0.97<br />

40.2 47.4<br />

Better Value<br />

and Risk<br />

ROE (realised, %) 15.8 12.6 Better<br />

ROIC (realised, %) 9.0 8.5<br />

Net Debt/ Equity (%) 39.9 44.2<br />

Accruals (%) 3.2 5.0<br />

Pr<strong>of</strong>it Surprises (%) -0.9 0.3<br />

Quality<br />

Management<br />

& Better<br />

Balance<br />

Sheets<br />

10

International portfolio characteristics<br />

7.7%<br />

Geographical Breakdown<br />

18.5%<br />

11.6%<br />

Sector Breakdown<br />

8.6% 0.3%<br />

24.4%<br />

13.1%<br />

60.7%<br />

Europe<br />

Asia ex Japan<br />

Emerging Markets Japan<br />

Top 10 holdings<br />

Name Country Weight%<br />

Astra Zeneca Plc UK 4.8<br />

British American Tobacco Plc UK 3.8<br />

BASF Germany 2.8<br />

UPM-KYMMENE Finland 2.5<br />

Bouygues France 2.4<br />

Boskalis Westminster Netherlands 2.4<br />

Nestle Switzerland 2.3<br />

Total France 2.2<br />

Enel Italy 2.0<br />

Vodafone UK 2.0<br />

Source: Kleinwort Benson Investors, Datastream, December 31 st 2012<br />

9.5%<br />

4.1%<br />

5.4%<br />

10.1%<br />

4.2%<br />

12.1%<br />

Financials<br />

Healthcare<br />

Industrials<br />

Information Technology<br />

Materials<br />

Telecommunications Services<br />

Utilities<br />

Consumer Discretionary<br />

Consumer Staples<br />

Energy<br />

Other<br />

9.6%<br />

11

Current Emerging Markets portfolio<br />

Mkt. Cap<br />

$bn<br />

Dividend<br />

Plus<br />

%<br />

MSCI<br />

Emerging<br />

Markets<br />

Index %<br />

+/-<br />

%<br />

25 25.5 27.7 -2.2<br />

Active Share Measure is 75%<br />

Active Share measures the difference in<br />

portfolio holdings from the benchmark.<br />

Expressed as an overall percentage this<br />

means that 75% <strong>of</strong> our exposures are<br />

different to the benchmark, while 25% are<br />

the same.<br />

So constituent holdings within regions and<br />

industries are very different to the broad<br />

market.<br />

Source: Kleinwort Benson Investors, Datastream, December 31st , 2012<br />

Dividend<br />

Plus<br />

Strategy<br />

MSCI<br />

Emerging<br />

Markets<br />

Dividend Yield (%) 4.5 2.7<br />

Dividend Payout (%) 48.0 35.5<br />

Dividend Growth (%) 9.5 8.2<br />

Total Payout Yield (%) 3.9 1.6<br />

P/E<br />

12.0 12.4<br />

Price/Book 1.7 1.7<br />

Price/Cashflow 9.0 9.2<br />

Weighted Avg. Mkt.<br />

Cap $ (bn)<br />

Beta 0.93<br />

17.3 22.0<br />

Better Total<br />

Return<br />

Better Value<br />

and Risk<br />

ROE (realised, %) 20.9 17.5 Better Quality<br />

ROIC (realised, %) 14.1 11.6 Management<br />

Net Debt/ Equity (%) 1.1 17.2<br />

& Better<br />

Balance<br />

Accruals (%) 4.2 6.6 Sheets<br />

Pr<strong>of</strong>it Surprises (%) -0.8 -1.7<br />

12

Emerging Markets portfolio characteristics<br />

Geographical Breakdown<br />

17.2%<br />

14%<br />

Sector Breakdown<br />

28%<br />

21.2%<br />

61.6%<br />

9%<br />

EM Asia EM Latin America EM EMEA<br />

7%<br />

2%<br />

8%<br />

Top 10 holdings<br />

Name Country Weight%<br />

Taiwan Semiconductor<br />

Manufacturing<br />

Taiwan 5.3<br />

China Construction Bank China 2.7<br />

Ecopetrol SA ADR Colombia 2.7<br />

Banco Santander Chile Chile 2.6<br />

TSRC Corporation Taiwan 2.5<br />

Industrial & Commercial Bank <strong>of</strong><br />

China<br />

China 2.5<br />

KT&G Corporation South Korea 2.3<br />

Bank <strong>of</strong> China Ltd China 2.2<br />

Kumba Iron Ore Ltd South Africa 2.2<br />

7%<br />

Financials<br />

Gazprom OAO Russia 2.2 Source: Kleinwort Benson Investors, Datastream, December 31 st , 2012 13<br />

12%<br />

Information Technology<br />

Telecommunications Services<br />

Consumer Discretionary<br />

Energy<br />

Industrials<br />

Materials<br />

Utilities<br />

14%<br />

Consumer Staples

Outlook<br />

Economic<br />

Economic growth in US and Asia will be solid, but will remain negative in the eurozone<br />

Real progress has been made in solving the eurozone fiscal crisis, but the crisis is far<br />

from over<br />

Interest rates in developed countries will remain exceptionally low for a prolonged<br />

period<br />

Inflation has peaked in emerging markets, and monetary policy is loosening, helping<br />

growth<br />

Markets<br />

Equities are close to fair value while corporate balance sheets are strong<br />

Equities to consolidate short term but then to move higher on 12-month view<br />

Core government bonds are expensive by any historic measure<br />

Earnings and dividend growth remain a strong support and driver to share prices<br />

We favour high quality companies (low debt, strong cash flow, strong management)<br />

Investing in companies that pay an above average and growing dividend should<br />

continue to be a winning strategy<br />

Emerging market equities are attractive and should outperform<br />

Source: Kleinwort Benson Investors<br />

14

Disclaimers<br />

USA/CANADA:<br />

IMPORTANT RISK DISCLOSURE STATEMENT. This material is provided for informational purposes only and does not constitute an <strong>of</strong>fer to sell or the solicitation <strong>of</strong> an <strong>of</strong>fer to purchase any security, product or<br />

service including any group trust or fund managed by Kleinwort Benson Investors International Ltd, or any <strong>of</strong> its affiliates (collectively, “Kleinwort Benson Investors”). The information contained herein does not set<br />

forth all <strong>of</strong> the risks associated with this strategy, and is qualified in its entirety by, and subject to, the information contained in other applicable disclosure documents relating to such a strategy. Kleinwort Benson<br />

Investors International Ltd’s investment products, like all investments, involve the risk <strong>of</strong> loss and may not be suitable for all investors, especially those who are unable to sustain a loss <strong>of</strong> their investment.<br />

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.<br />

This introductory material may not be reproduced or distributed, in whole or in part, without the express prior written consent <strong>of</strong> Kleinwort Benson Investors International Ltd. The information contained in this<br />

introductory material has not been filed with, reviewed by or approved by any United States regulatory authority or self-regulatory authority and recipients are advised to consult with their own independent<br />

advisors, including tax advisors, regarding the products and services described therein. The views expressed are those <strong>of</strong> Kleinwort Benson Investors International Ltd. and should not be construed as investment<br />

advice. We do not represent that this information is accurate or complete and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The products mentioned in this<br />

Document may not be eligible for sale in some states or countries, nor suitable for all types <strong>of</strong> investors; their value and the income they produce may fluctuate and/or be adversely affected by exchange rates,<br />

interest rates, or other factors. Additional information will be provided upon request. Kleinwort Benson Investors International Ltd. is a registered investment adviser with the SEC and regulated by the Central Bank<br />

<strong>of</strong> Ireland. Kleinwort Benson Investors International Ltd. is 100% owned by Kleinwort Benson Investors Dublin Ltd. Form ADV Part 1 and Part 2 are available on request.<br />

Gross results shown do not show the deduction <strong>of</strong> Adviser's fees. A client’s actual return will be reduced by the advisory fees and any other expenses which may be incurred in the management <strong>of</strong> an investment<br />

advisory account. See Part II <strong>of</strong> Adviser's Form ADV for a complete description <strong>of</strong> the investment advisory fees customarily charged by Adviser. Kleinwort Benson International will provide net performance figures<br />

for any account size on request. The performance results are that <strong>of</strong> a representative strategy which has been managed on a discretionary basis since its inception. Performance returns for individual investors may<br />

differ due to the timing <strong>of</strong> investments, subsequent subscriptions/redemptions, share classes, fees and expenses. Performance for periods <strong>of</strong> more than 1 year is annualized. Information about indices is provided to<br />

allow for comparison <strong>of</strong> the performance <strong>of</strong> the Adviser to that <strong>of</strong> certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.<br />

You cannot invest directly in an index, which also does not take into account trading commissions and costs. Investments denominated in foreign currencies are subject to changes in exchange rates that may have<br />

an adverse effect on the value, price and income <strong>of</strong> the product. Income generated from an investment may fluctuate in accordance with market conditions and taxation arrangement. PAST PERFORMANCE IS NOT A<br />

RELIABLE GUIDE TO FUTURE PERFORMANCE AND THE VALUE OF INVESTMENTS MAY GO DOWN AS WELL AS UP. Stocks mentioned in this document may or may not be held in this strategy at this time. Any<br />

projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may<br />

significantly affect the returns or performance <strong>of</strong> the strategy. Any projections, outlooks or assumptions should not be construed to be indicative <strong>of</strong> the actual events which will occur. Discussions <strong>of</strong> market<br />

conditions, market high/lows, objectives, strategies, styles, positions, and similar information set forth herein is specifically subject to change if market conditions change, or if KBII believes, in its discretion, that<br />

investors returns can better be achieved by such changes and/or modification. Style descriptions, market movements over time and similar items are meant to be illustrative, and may not represent all market<br />

information over the period discussed. All MSCI data is provided “as is”. In no event shall MSCI, its affiliates, or any MSCI data provider have any liability <strong>of</strong> any kind in connection with the MSCI data. No further<br />

distribution or dissemination <strong>of</strong> the MSCI data is permitted without MSCI’s prior express written consent.<br />

Environmental Strategies USA/Canada: Renewable Energy Performance Disclaimer: Returns up to 04/<strong>30</strong>/08 are based on a Belgian Fund which followed the Renewable Energy Strategy and was managed by KBI.<br />

Returns from 05/01/08 are based on the KBI Renewable Energy Strategy. Water Performance Disclaimer: Returns up to 09/<strong>30</strong>/07 are based on a Belgian Fund which followed the same strategy as the Kleinwort<br />

Benson Investors Water Strategy and was managed by KBI. Returns from 10/01/07 are actual returns from the Kleinwort Benson Investors Water Strategy. AGRI Performance Disclaimer: Returns since inception<br />

are based on the KBI Agri Strategy. GESS Performance Disclaimer: Returns since inception are based on the KBI Global Environmental Solutions Strategy. Blended Environmental Index is made up <strong>of</strong>: Ardour Global<br />

Alternative Energy Index (25%), S-Network GlobalWater Index (25%), DAXglobal Agribusiness Index (25%), HSBC Climate Change Index (25%).<br />

Dividend Plus Strategies USA/Canada: Dividend Plus Global Performance Disclaimer: Returns reflect a combination <strong>of</strong> “simulated” or “backtested” returns <strong>of</strong> a portfolio <strong>of</strong> stocks that were selected under the KBI<br />

Dividend Plus Global Strategy up to 05/31/03 using step 1 <strong>of</strong> our investment process. Returns from 06/01/03 to 07/31/2004 are based on a Belgian Fund which followed the Dividend Plus Global Strategy and was<br />

managed by KBI. Returns from 08/01/2004 are actual returns from the KBI Dividend Plus Global Strategy. Simulated performance is not a reliable guide to future performance. Dividend Plus Global Developed<br />

Equity Performance Disclaimer: Returns reflect a combination <strong>of</strong> “simulated” or “backtested” returns <strong>of</strong> a portfolio <strong>of</strong> stocks that were selected under the KBI Dividend Plus Developed Equity Strategy up to<br />

05/31/03 using step 1 <strong>of</strong> our investment process. Returns from 06/01/03 to 07/31/2004 are based on a Belgian Fund which followed the Dividend Plus Developed Equity Strategy and was managed by KBI. Returns<br />

from 08/01/2004 are actual returns from the KBI Dividend Plus Developed Equity Strategy. Simulated performance is not a reliable guide to future performance. Dividend Plus Emerging Markets Performance<br />

Disclaimer: Returns reflect a combination <strong>of</strong> “simulated” or “backtested” returns <strong>of</strong> a portfolio <strong>of</strong> stocks that were selected under the KBI Dividend Plus Emerging Markets Strategy up to 04/<strong>30</strong>/10 using step 1 <strong>of</strong><br />

our investment process. Returns from 05/01/10 to 07/31/2010 are based on the Emerging Markets component <strong>of</strong> a segregated account managed by KBI to an identical process applied to all KBI Dividend Plus<br />

Strategies. Returns from 08/01/2010 are actual returns from the KBI Dividend Plus Emerging Markets Strategy. Simulated performance is not a reliable guide to future performance. Dividend Plus International<br />

Developed Equity Performance Disclaimer: Returns reflect a combination <strong>of</strong> “simulated” or “backtested” returns <strong>of</strong> a portfolio <strong>of</strong> stocks that were selected under the KBI Dividend Plus International Developed<br />

Equity Strategy up to 05/31/03 using step 1 <strong>of</strong> our investment process. Returns from 06/01/03 to 07/31/04 are based on the International Developed Equity component <strong>of</strong> a Dividend Plus Global Belgian Fund which<br />

was managed by KBI. Returns from 08/01/04 to 06/<strong>30</strong>/05 are based on the International Developed Equity component <strong>of</strong> the KBI Dividend Plus Global Equity Strategy. Returns from 07/01/05 are based on the KBI<br />

Dividend Plus Intl Developed Equity Strategy. Simulated performance is not a reliable guide to future performance.

Manager Update Memorandum<br />

To:<br />

Susan Biernacki, PERA Investment Committee Chair<br />

PERA Board Members<br />

From:<br />

Ben Rotenberg, Cliffwater LLC<br />

Regarding: Manager Update – Kleinwort Benson Investors Int’l Ltd. (formerly known as KBC)<br />

Mandate/Strategy: International Developed Equity / Kleinwort Benson International Dividend Plus EAFE<br />

Developed Strategy<br />

Meeting Date: <strong>May</strong> <strong>30</strong>, <strong>2013</strong><br />

CC:<br />

Joelle Mevi, Chief Investment Officer<br />

Julian Baca, Deputy Chief Investment Officer<br />

LeAnne Larrañaga-Ruffy, Portfolio Manager<br />

Summary<br />

The <strong>Public</strong> <strong>Employees</strong> <strong>Retirement</strong> <strong>Association</strong> <strong>of</strong> <strong>New</strong> Mexico (“PERA”) hired Kleinwort Benson Investors<br />

International Ltd. (“KBI” or “Kleinwort Benson” or “the firm”) to manage an international value equity<br />

mandate in 2010. KBI is managing the portfolio in the style <strong>of</strong> the firm’s Dividend Plus EAFE Developed<br />

strategy. PERA funded a separate account for Kleinwort Benson in April 2010. From 2000 to 2010, the<br />

firm was known as KBC and was owned by the Kleinwort Benson Group.<br />

KBI manages $111.3 million for PERA as <strong>of</strong> March <strong>2013</strong>, representing 3.4% <strong>of</strong> PERA’s International<br />

Equity Composite, and 0.9% <strong>of</strong> PERA’s total plan.<br />

The firm is stable, and grew its assets under management by <strong>30</strong>% in 2012, through a combination <strong>of</strong> net<br />

asset inflows and market performance. Inflows were positive in the Dividend Plus EAFE Developed<br />

strategy in 2012; strategy assets grew 27% as the strategy took on $250 million <strong>of</strong> net inflows.<br />

Performance in the strategy has been slightly positive relative to its benchmark recently.<br />

Relative performance for PERA has been positive. According to PERA’s custodian, KBI has<br />

outperformed its benchmark (MSCI EAFE Value - GD) by 1.67% since inception in April 2010 through<br />

March <strong>2013</strong>.<br />

Cliffwater believes that KBI is well positioned to continue to manage assets for PERA, and recommends<br />

no changes to the mandate at this time.<br />

Firm / Personnel Update<br />

As <strong>of</strong> March 31, <strong>2013</strong>, the firm manages $5.1 billion. The firm employs 47 pr<strong>of</strong>essionals, including 14<br />

investment pr<strong>of</strong>essionals. The investment pr<strong>of</strong>essionals are comprised <strong>of</strong> 12 portfolio manager/research<br />

analysts, one economist and one trader. The firm is stable, and grew assets under management by <strong>30</strong>%<br />

in 2012, through a combination <strong>of</strong> net asset inflows and market performance. Inflows have also been<br />

positive in the strategy. The firm now manages $1.8 billion in the strategy.<br />

KBI’s Dividend Plus team manages several other variations <strong>of</strong> the Dividend Plus strategy (one is<br />

Emerging Markets focused, while another is Global). The team is comprised <strong>of</strong> 12 portfolio managers /<br />

research analysts, one trader, and one economist. This team has stayed fairly static over the last three<br />

years. The firm has added one portfolio manager / analyst, and has not seen any departures.<br />

This report reflects information only through the date here<strong>of</strong>. Our due diligence and reporting rely upon the accuracy and completeness <strong>of</strong> financial<br />

information (which may or may not be audited by the fund manager) and other information publicly available or provided to us by the fund manager, its<br />

pr<strong>of</strong>essional staff, and through other references we have contacted. We have not conducted an independent verification <strong>of</strong> the information provided<br />

other than as described in this report. Our conclusions do not reflect an audit <strong>of</strong> the investment nor should they be construed as providing legal<br />

advice. Past performance does not guarantee future performance. The information contained herein is confidential commercial or financial information,<br />

the disclosure <strong>of</strong> which would cause substantial competitive harm to you, Cliffwater LLC, or the person or entity from whom the information was<br />

obtained, and may not be disclosed except as required by applicable law.<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

Overview <strong>of</strong> Investment Process<br />

Kleinwort Benson’s investment philosophy is that global investment markets are inefficient. Rather than<br />

focusing solely on dividends, KBI believes that investors should focus on quality, sustainability, and<br />

growth <strong>of</strong> those dividends. KBI’s investment process is systematic and rules based. The firm uses<br />

quantitative methods to execute their investment ideas. The team uses three steps to create a portfolio<br />

with their preferred financial characteristics. Firstly, to achieve a diversified dividend framework, the team<br />

divides the MSCI World into its Regional Industry Groups and calculates a yield hurdle for each. Stocks<br />

that achieve this yield hurdle are selected for further consideration. Next the team searches for<br />

companies with the financial strength to maintain and grow their payout commitments (and avoid dividend<br />

cuts and rights issues). KBI’s screening factors normally include a combination <strong>of</strong> free cash flow,<br />

dividend coverage, dividend growth and total payout measures. Finally, the portfolio is optimized using<br />

BARRA to create a portfolio with KBI’s preferred characteristics and financial “style”. These include better<br />

total return, better quality and governance and better value.<br />

Performance<br />

Relative performance against the benchmark has been positive. According to PERA’s custodian, KBI has<br />

outperformed its benchmark (MSCI EAFE Value - GD Index) by 1.67% since inception in April 2010.<br />

Since inception, Kleinwort Benson has delivered a +5.75% rate <strong>of</strong> return, compared to +4.09% for the<br />

benchmark MSCI EAFE Value - GD Index. Over longer periods <strong>of</strong> time, the strategy has delivered good<br />

absolute returns and modest returns relative to its benchmark and peer group.<br />

Performance Notes: Please note that the PERA-specific performance comes from PERA’s custodian. All<br />

other performance data is shown gross <strong>of</strong> fees and comes from eVestment Alliance and/or the investment<br />

manager.<br />

Exhibit 1<br />

Kleinwort Benson Performance for <strong>New</strong> Mexico PERA<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

Portfolio Name Market Value<br />

% <strong>of</strong> Total<br />

Plan MTD 3 Mo FYTD YTD 1 Year 3 Year<br />

Since<br />

Incep. Inception Date<br />

KBC 111,288,644 0.86 0.65 4.66 20.65 4.66 13.77 5.75 5.75 01-Apr-2010<br />

MSCI EAFE Value 0.17 3.63 19.75 3.63 11.73 4.09 4.09<br />

Excess Return 0.48 1.02 0.89 1.02 2.04 1.67 1.67<br />

Exhibit 2<br />

Kleinwort Benson Dividend Plus EAFE Developed Strategy (gross <strong>of</strong> fees)<br />

Annualized Performance<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

Annualized Returns<br />

1 Yr 3 Yr 5 Yr 7 Yr 10 Yr 15 Yr Apr '98<br />

KBI Dividend Plus EAFE Developed 14.43% 5.95% -0.02% 2.27% 11.77% 7.79% 7.79%<br />

MSCI EAFE Value - GD Index 11.72% 4.09% -1.09% 1.20% 10.52% 5.09% 5.09%<br />

Difference 2.71% 1.87% 1.07% 1.07% 1.25% 2.70% 2.70%<br />

Manager Update Memorandum Page 2 <strong>of</strong> 7<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

Exhibit 3<br />

Kleinwort Benson Dividend Plus EAFE Developed Strategy (gross <strong>of</strong> fees)<br />

Calendar Year Performance<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

YTD <strong>2013</strong> 2012 2011 2010 2009 2008<br />

KBI Dividend Plus EAFE Developed 5.13% 19.24% -10.56% 6.73% 31.34% -41.76%<br />

MSCI EAFE Value - GD Index 3.63% 18.43% -11.64% 3.80% 35.04% -43.68%<br />

Difference 1.50% 0.81% 1.08% 2.93% -3.70% 1.92%<br />

2007 2006 2005 2004 2003<br />

KBI Dividend Plus EAFE Developed 7.19% 31.22% 16.96% 34.02% 42.21%<br />

MSCI EAFE Value - GD Index 6.47% 31.05% 14.40% 24.89% 45.97%<br />

Difference 0.72% 0.17% 2.55% 9.12% -3.76%<br />

2002 2001 2000 1999 Apr-Dec'98<br />

KBI Dividend Plus EAFE Developed -7.62% -14.29% 0.73% 28.40% 4.89%<br />

MSCI EAFE Value - GD Index -15.60% -18.23% -2.81% 24.53% 1.22%<br />

Difference 7.98% 3.93% 3.53% 3.86% 3.67%<br />

Exhibit 4<br />

Kleinwort Benson Dividend Plus EAFE Developed Strategy (gross <strong>of</strong> fees)<br />

Risk Statistics vs. MSCI EAFE Value - GD Index<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

KBI Dividend Plus EAFE Developed<br />

vs. MSCI EAFE Value - GD Index<br />

Return Risk<br />

Return /<br />

Risk<br />

Excess<br />

Return<br />

Excess<br />

Risk Info Ratio<br />

3 Yr 5.95% 18.88% 0.32 1.87% 3.05% 0.61<br />

5 Yr -0.02% 22.43% (0.00) 1.07% 4.01% 0.27<br />

7 Yr 2.27% 19.99% 0.11 1.07% 3.75% 0.29<br />

10 Yr 11.77% 18.22% 0.65 1.25% 3.77% 0.33<br />

15 Yr 7.79% 17.62% 0.44 2.70% 3.90% 0.69<br />

April 1998 (inception) 7.79% 17.57% 0.44 2.70% 3.90% 0.69<br />

Manager Update Memorandum Page 3 <strong>of</strong> 7<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

Exhibits 5 and 6 are “skill charts” which attempt to discern whether or not the manager’s outperformance<br />

is attributable to luck or skill. The blue line represents the manager’s gross <strong>of</strong> fees rolling three or five<br />

year performance relative to the MSCI EAFE Value - GD Index. If the blue line is above 0, the manager<br />

has outperformed the index and conversely, if the blue line iss below 0, the<br />

manager has underperformed<br />

the index.<br />

The black lines represent confidence bands at thee 80% level which incorporate the manager’s<br />

tracking error (standard deviation <strong>of</strong> excess return) relative too the index. If the blue line is above the top<br />

black line, their outperformance can be attributable to skill. . Conversely, if the blue<br />

line is below the<br />

bottom black line, their underperformance can be attributable to a lack<br />

<strong>of</strong> skill. If the blue line<br />

is in<br />

between the two black<br />

lines, it is unclear whether or not their r relative performance is attributable to either<br />

luck or skill. These charts demonstrate that KBl has added alpha over most rolling three year and five<br />

year periods, but the level <strong>of</strong> alpha and consistency has comee down over recent years.<br />

Exhibit 5<br />

Kleinwort Bensonn Dividend Plus EAFE Equity Strategy (gross <strong>of</strong> fees)<br />

Rolling Three-Year Returns<br />

April 1998 through March <strong>2013</strong><br />

Manager Update Memorandum<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.<br />

Page<br />

4 <strong>of</strong> 7

Exhibit 6<br />

Kleinwort Benson Dividend Plus EAFE Equity Strategy (gross <strong>of</strong> fees)<br />

Rolling Five-Year Returns<br />

April 1998 through March <strong>2013</strong><br />

Manager Update Memorandum<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.<br />

Page<br />

5 <strong>of</strong> 7

Exhibit 7<br />

Performance Universe for EAFE All Cap Value Strategies<br />

Gross <strong>of</strong> Fees<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

Source: Evestment Alliance.<br />

Exhibit 8<br />

MPT Statistics Universe for EAFE All Cap<br />

Value Strategies vs. MSCI EAFE Value-GD Index<br />

Gross <strong>of</strong> Fees<br />

As <strong>of</strong> March 31, <strong>2013</strong><br />

Source: Evestment Alliance.<br />

Manager Update Memorandum<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.<br />

Page<br />

6 <strong>of</strong> 7

Watch List Test<br />

As stated in PERA’s investment policy, the following represent guidelines to be used in making a<br />

recommendation to the Investment Committee with regards to placing a traditional manager on the Watch<br />

List:<br />

Test 1: If the manager’s rolling three-year return (gross <strong>of</strong> fees) falls below the rolling three-year<br />

return <strong>of</strong> the benchmark for three consecutive quarters.<br />

Test 2: If the managers rolling three year return for three consecutive quarters ranks in the bottom<br />

third <strong>of</strong> the Consultant’s peer group universe.<br />

As <strong>of</strong> March 31, <strong>2013</strong>, the strategy did not pass either Watch List Test.<br />

Exhibit 9<br />

Watch List Test 1:<br />

Kleinwort Benson Dividend Plus Strategy (gross <strong>of</strong> fees)<br />

Rolling Three Year Annualized Performance vs. Benchmark<br />

For Periods Ending 3/31/<strong>2013</strong>, 12/31/2012, and 9/<strong>30</strong>/2012<br />

3 Years<br />

ending<br />

3/31/<strong>2013</strong><br />

3 Years<br />

ending<br />

12/31/2012<br />

Exhibit 10<br />

Watch List Test 2:<br />

Kleinwort Benson Dividend Plus Strategy (gross <strong>of</strong> fees)<br />

Rolling Three Year Annualized Performance vs. Peer Group Universe<br />

For Periods Ending 3/31/<strong>2013</strong>, 12/31/2012, and 9/<strong>30</strong>/2012<br />

3 Years<br />

ending<br />

9/<strong>30</strong>/2012<br />

KBI Dividend Plus EAFE Developed 5.95% 4.41% 2.95%<br />

MSCI EAFE Value - GD Index 4.09% 2.80% 0.47%<br />

Difference 1.87% 1.61% 2.48%<br />

3 Years<br />

ending<br />

3/31/<strong>2013</strong><br />

3 Years<br />

ending<br />

12/31/2012<br />

3 Years<br />

ending<br />

9/<strong>30</strong>/2012<br />

KBI Dividend Plus EAFE Developed 5.95% 4.41% 2.95%<br />

eVestment Alliance EAFE All Cap Value Equity Universe Median 6.79% 5.40% 4.08%<br />

KBI Rank in Universe 58 71 71<br />

Suggested Questions for the Investment Manager<br />

1) What do you believe are the greatest risks in our portfolio today? When interest rates go up, will<br />

that affect your dividend strategy?<br />

2) What is your view on Europe today?<br />

3) Are there any significant changes in portfolio positioning in the last year or so?<br />

[As a reminder, we have not conducted full diligence on, or reviewed the legal documents for, this<br />

investment due to its legacy status in your portfolio.]<br />

Manager Update Memorandum Page 7 <strong>of</strong> 7<br />

© <strong>2013</strong> Cliffwater LLC. All rights reserved.

MFS ® INTERNATIONAL VALUE EQUITY<br />

Presented to<br />

<strong>Public</strong> <strong>Employees</strong> <strong>Retirement</strong> <strong>Association</strong><br />

<strong>of</strong> <strong>New</strong> Mexico<br />

<strong>30</strong> <strong>May</strong> <strong>2013</strong><br />

FOR INSTITUTIONAL USE ONLY<br />

MFS Institutional Advisors, Inc.<br />

19964.3.exJUN13.US

Presenters<br />

Camille Humphries Lee, CFA<br />

Carolyn Lucey, CIMA<br />

- Investment Officer<br />

- Institutional Equity Portfolio Manager<br />

- As an Institutional Portfolio Manager, participates in the research process and strategy discussions.<br />

Assesses portfolio risk, customizes portfolios to client objectives and guidelines, and manages daily<br />

cash flows. Communicates investment policy, strategy, and positioning.<br />

- Joined MFS in 2000.<br />

- Previous experience includes 3 years as Research Analyst at SG Cowen Securities Corporation; 8 years as<br />

Research Analyst and Associate Analyst at Alex Brown.<br />

- Affiliations include CFA Institute, Boston Security Analysts Society, Inc.<br />

- University <strong>of</strong> Virginia, MBA<br />

- University <strong>of</strong> Virginia, BA<br />

- Director, Relationship Management<br />

- As a Relationship Manager, responsible for the overall client experience including communicating<br />

portfolio positioning, strategy, and performance attribution and ensuring that our clients' ongoing service<br />

needs are met.<br />

- Joined MFS in 1998; previous positions include Investment Director for Private Portfolio Services; Vice<br />

President, Director <strong>of</strong> Product Management; Assistant Vice President, Domestic Equity Product Manager.<br />

- Previous experience includes 1 year as Product Manager at Van Kampen American Capital; 6 years as<br />

Product Manager at John Hancock Funds; 2 years as Associate at Putnam Investments.<br />

- Affiliations include Investment Management Consultants <strong>Association</strong> (IMCA)<br />

- Manhattanville College, BA<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.2<br />

2

Table <strong>of</strong> contents<br />

Contents<br />

Tab<br />

Corporate organization 1<br />

Investment overview 2<br />

Appendix 3<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.3<br />

3

MFS ® overview<br />

Integrated Research<br />

We look at investment opportunities across the globe by<br />

integrating fundamental equity, quantitative and credit<br />

disciplines in our analysis.<br />

Global Collaboration<br />

Our team philosophy and incentive structure<br />

ensure strong collaboration across the firm.<br />

Active Risk Management<br />

We take a holistic approach to actively managing risk with<br />

reviews in place at security, portfolio and firm levels and a<br />

clear focus on generating alpha for our clients.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.1<br />

We apply a uniquely collaborative approach to build better insights for our clients<br />

1<br />

1

Business pr<strong>of</strong>ile (USD)<br />

348 billion total MFS AUM<br />

Diversified client and asset base 1<br />

Assets 2<br />

Multi-Strategy (5%)<br />

Assets<br />

Global equities<br />

65.7 billion<br />

Fixed Income (18%)<br />

Global equities (20%)<br />

EAFE/international equities<br />

64.1 billion<br />

US equities<br />

Regional equities<br />

Fixed Income<br />

98.9 billion<br />

23.4 billion<br />

59.8 billion<br />

Regional equities (7%)<br />

EAFE/<br />

International<br />

equities (19%)<br />

Multi-strategy/Other<br />

17.9 billion<br />

US equities (<strong>30</strong>%)<br />

Institutional business by client type and region 1,3<br />

Regions<br />

Client types<br />

• Defined benefit/defined contribution<br />

• Endowment and foundation<br />

• Sovereign wealth fund/government agency<br />

• Institutional platform/insurance subadvisory<br />

North<br />

America (34%)<br />

Asia<br />

Pacific (34%)<br />

As <strong>of</strong> 31-Mar-13.<br />

1<br />

Does not include assets <strong>of</strong> MFS’ subsidiary MFS McLean Budden.<br />

2<br />

Data is rounded to the nearest figure.<br />

3<br />

Represents global clients in institutional vehicles only.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.2<br />

EMEA (32%)<br />

Well-diversified business across clients, regions, and investment strategies<br />

2<br />

2

A holistic, multi-faceted approach to risk management<br />

Controls in place at security, portfolio, and firm levels<br />

Broad portfolio level controls<br />

• Daily review <strong>of</strong> portfolio guidelines and risk exposures<br />

• Pre- and post-trade compliance system for each portfolio’s guidelines<br />

• Semiannual strategy review by Investment Management Committee<br />

Sound business management<br />

• Stable, well-capitalized, pr<strong>of</strong>itable enterprise<br />

• Strong, established parent<br />

• Diversified by business channel,<br />

geography, and asset class<br />

• Rigorous capacity management<br />

Portfolio<br />

Operational excellence<br />

• Conservative approach to selection<br />

and monitoring <strong>of</strong> counterparties<br />

• Highly liquid investment strategies<br />

• Experienced traders (average 17 years)<br />

focused on best execution<br />

• Independent audit annually (SSAE 16, Type II)<br />

As <strong>of</strong> 31-Mar-13.<br />

Deep understanding <strong>of</strong> risks at security-level (Know what you own)<br />

• Specialization by sector and industry<br />

• Integration <strong>of</strong> fundamental equity, fixed income credit, and quantitative analysts<br />

• Experienced investors (Analysts average 13 years, Portfolio Managers average 20 years)<br />

• Emphasis on global collaboration<br />

A balance <strong>of</strong> quantitative discipline and qualitative assessment<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.3<br />

3<br />

3

EAFE/International equity capabilities (USD)<br />

Composite performance as <strong>of</strong> 31 March <strong>2013</strong> – gross <strong>of</strong> fees<br />

YTD 1 Year 3 Years 5 Years 7 Years 10 Years Since Inception<br />

MFS Blended Research International Equity 3.2 6.3 – – – – -1.5 01-<strong>May</strong>-11<br />

MSCI All Country World (ex-US) Index (net div) 3.2 8.4 – – – – -2.2<br />

Excess Returns 0.0 -2.1 – – – – 0.7<br />

MFS International Equity 3.7 11.8 8.7 3.7 5.6 12.2 9.1 01-Mar-96<br />

MSCI EAFE (Europe, Australasia, Far East) Index (net div) 5.1 11.3 5.0 -0.9 1.6 9.7 4.6<br />

Excess Returns -1.4 0.5 3.7 4.6 4.0 2.5 4.5<br />

MFS International Research Equity 4.3 10.5 7.3 0.9 3.5 11.4 7.4 01-Jul-98<br />

MSCI EAFE (Europe, Australasia, Far East) Index (net div) 5.1 11.3 5.0 -0.9 1.6 9.7 3.8<br />

Excess Returns -0.8 -0.8 2.3 1.8 1.9 1.7 3.6<br />

MFS International Value Equity 8.5 16.4 11.1 5.0 6.5 14.1 9.9 01-Dec-97<br />

MSCI EAFE (Europe, Australasia, Far East) Value Index (net div) 3.5 11.0 3.5 -1.7 0.6 9.9 5.6<br />

Excess Returns 5.0 5.4 7.6 6.7 5.9 4.2 4.3<br />

MFS International Growth Equity 4.6 10.1 9.4 4.1 6.3 13.5 10.7 01-Oct-01<br />

MSCI All Country World (ex-US) Growth Index (net div) 4.5 9.1 5.5 -0.2 3.1 10.3 7.7<br />

Excess Returns 0.1 1.0 3.9 4.3 3.2 3.2 3.0<br />

MFS Emerging Markets Equity -1.9 2.6 5.6 1.0 6.3 17.8 10.4 01-Jan-00<br />

MSCI Emerging Markets Index (gross div) -1.6 2.3 3.6 1.4 6.7 17.4 8.6<br />

Excess Returns -0.3 0.3 2.0 -0.4 -0.4 0.4 1.8<br />

MFS International Concentrated Equity 4.5 11.5 7.8 3.7 – – 3.8 01-Apr-07<br />

MSCI EAFE (Europe, Australasia, Far East) Index (net div) 5.1 11.3 5.0 -0.9 – – -1.2<br />

Excess Returns -0.6 0.2 2.8 4.6 – – 5.0<br />

MFS International Small Cap Equity 6.9 17.2 13.5 6.8 7.5 16.4 11.5 01-Jan-01<br />

Blended Benchmark 2 5.1 9.4 6.6 1.6 3.8 14.1 8.9<br />

Excess Returns 1.8 7.8 6.9 5.2 3.7 2.3 2.6<br />

1<br />

MFS uses MSCI EMF gross dividends performance due to its longer track record.<br />

2<br />

The benchmark for the International Small Cap strategy was S&P Citigroup EMI Global ex-US Index prior to 1-Dec-11. After 1-Dec-11, the benchmark changed to the MSCI AC World<br />

ex-US Small Mid Cap Index.<br />

Please see the appendix for composite reports.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.4<br />

4<br />

4

Global equity capabilities (USD)<br />

Composite performance as <strong>of</strong> 31 March <strong>2013</strong> – gross <strong>of</strong> fees<br />

YTD 1 Year 3 Years 5 Years 7 Years 10 Years Since Inception<br />

MFS Global Equity 9.5 18.6 13.0 6.8 8.0 12.7 10.5 01-Jan-88<br />

MSCI World Index (net div) 7.7 11.8 8.5 2.2 3.2 8.9 6.9<br />

Excess Returns 1.8 6.8 4.5 4.6 4.8 3.8 3.6<br />

MFS Global Value Equity 10.4 16.8 11.8 5.6 6.6 – 11.1 01-Jul-03<br />

MSCI World Value Index (net div) 7.7 13.2 7.4 1.3 2.2 – 7.2<br />

Excess Returns 2.7 3.6 4.4 4.3 4.4 – 3.9<br />

MFS Global Growth Equity 6.5 11.5 10.1 5.5 6.2 – 9.0 01-Dec-03<br />

MSCI All Country World Growth Index (net div) 6.6 9.8 8.8 2.8 4.1 – 6.7<br />

Excess Returns -0.1 1.7 1.3 2.7 2.1 – 2.3<br />

MFS Global Concentrated Equity 10.0 20.4 13.5 8.2 – – 7.3 01-Apr-07<br />

MSCI World Index (net div) 7.7 11.8 8.5 2.2 – – 1.3<br />

Excess Returns 2.3 8.6 5.0 6.0 – – 6.0<br />

MFS Blended Research - AC Global Equity Extension 4.3 8.3 9.9 – – – 5.3 01-Jul-08<br />

MSCI All Country World Index (net div) 6.5 10.6 7.8 – – – 2.5<br />

Excess Returns -2.2 -2.3 2.1 – – – 2.8<br />

MFS Global Equity Research 6.7 10.7 9.1 – – – 13.5 01-Nov-08<br />

MSCI All Country World Index (net div) 6.5 10.6 7.8 – – – 12.5<br />

Excess Returns 0.2 0.1 1.3 – – – 1.0<br />

MFS Blended Research Global Equity 6.6 11.1 – – – – 5.4 01-<strong>May</strong>-11<br />

MSCI All Country World Index (net div) 6.5 10.6 – – – – 2.8<br />

Excess Returns 0.1 0.5 – – – – 2.6<br />

1<br />

Closed.<br />

Please see the appendix for composite reports.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.5<br />

5<br />

5

US equity capabilities (USD)<br />

Composite performance as <strong>of</strong> 31 March <strong>2013</strong> – gross <strong>of</strong> fees<br />

YTD 1 Year 3 Years 5 Years 7 Years 10 Years Since Inception<br />

MFS Blended Research ® - US Core Equity 10.6 13.6 12.9 7.1 6.5 10.0 4.1 01-Feb-01<br />

Standard & Poor's 500 Stock Index 10.6 14.0 12.7 5.8 5.0 8.5 3.1<br />

Excess Returns 0.0 -0.4 0.2 1.3 1.5 1.5 1.0<br />

MFS Core Equity 10.6 16.0 12.1 6.6 6.7 9.8 9.3 01-Mar-93<br />

Standard & Poor's 500 Stock Index 10.6 14.0 12.7 5.8 5.0 8.5 8.6<br />

Excess Returns 0.0 2.0 -0.6 0.8 1.7 1.3 0.7<br />

MFS Research Equity 10.6 15.3 13.0 7.3 6.7 10.4 11.6 01-Jan-89<br />

Standard & Poor's 500 Stock Index 10.6 14.0 12.7 5.8 5.0 8.5 9.8<br />

Excess Returns 0.0 1.3 0.3 1.5 1.7 1.9 1.8<br />

MFS Blended Research ® - Large Cap Value 12.2 16.1 12.8 6.6 – – 4.2 01-Jan-08<br />

Russell 1000 Value Index 12.3 18.8 12.7 4.8 – – 2.8<br />

Excess Returns -0.1 -2.7 0.1 1.8 – – 1.4<br />

MFS Large Cap Value Equity 12.3 16.8 12.5 6.3 6.5 10.6 11.6 01-Feb-89<br />

Russell 1000 Value Index 12.3 18.8 12.7 4.8 4.2 9.2 9.9<br />

Excess Returns 0.0 -2.0 -0.2 1.5 2.3 1.4 1.7<br />

MFS Blended Research ® - Large Cap Growth 10.1 13.6 14.4 8.8 – – 5.8 01-Jan-08<br />

Russell 1000 Growth Index 9.5 10.1 13.1 7.3 – – 4.8<br />

Excess Returns 0.6 3.5 1.3 1.5 – – 1.0<br />

MFS Large Cap Growth Equity 8.9 11.8 13.3 8.1 7.0 9.3 10.9 01-Jan-88<br />

Russell 1000 Growth Index 9.5 10.1 13.1 7.3 6.1 8.6 9.4<br />

Excess Returns -0.6 1.7 0.2 0.8 0.9 0.7 1.5<br />

MFS Large Cap Growth Concentrated 9.0 11.8 12.2 8.7 – – 6.4 01-Nov-07<br />

Russell 1000 Growth Index 9.5 10.1 13.1 7.3 – – 3.8<br />

Excess Returns -0.5 1.7 -0.9 1.4 – – 2.6<br />

MFS Growth Equity 9.9 12.4 13.2 8.4 7.7 11.4 7.4 01-Aug-95<br />

Russell 1000 Growth Index 9.5 10.1 13.1 7.3 6.1 8.6 6.9<br />

Excess Returns 0.4 2.3 0.1 1.1 1.6 2.8 0.5<br />

MFS Institutional Mid Cap Growth Equity 11.6 13.7 12.9 9.2 – – 7.1 01-Oct-07<br />

Russell Midcap Growth Index 11.5 12.8 14.2 8.0 – – 4.7<br />

Excess Returns 0.1 0.9 -1.3 1.2 – – 2.4<br />

MFS Small Cap Growth Equity* 14.4 20.4 17.2 14.5 9.3 12.9 14.3 01-Jan-88<br />

Russell 2000 Growth Index 13.2 14.5 14.7 9.0 5.2 11.6 8.2<br />

Excess Returns 1.2 5.9 2.5 5.5 4.1 1.3 6.1<br />

* Only available in pooled vehicles.<br />

Please see the appendix for composite reports.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.6<br />

6<br />

6

Blended research capabilities (USD)<br />

Composite performance as <strong>of</strong> 31 March <strong>2013</strong> – gross <strong>of</strong> fees<br />

YTD 1 Year 3 Years 5 Years 7 Years 10 Years Since Inception<br />

MFS Blended Research - US Core Equity 10.6 13.6 12.9 7.1 6.5 10.0 4.1 01-Feb-01<br />

Standard & Poor's 500 Stock Index 10.6 14.0 12.7 5.8 5.0 8.5 3.1<br />

Excess Returns 0.0 -0.4 0.2 1.3 1.5 1.5 1.0<br />

MFS Blended Research - Focused US Core 13.3 18.2 16.7 – – – 19.3 01-Mar-10<br />

Russell 1000 Index 11.0 14.4 12.9 – – – 14.8<br />

Excess Returns 2.3 3.8 3.8 – – – 4.5<br />

MFS Blended Research - US Core Equity Extension 9.8 15.7 14.2 7.8 – – 6.6 01-Oct-06<br />

Standard & Poor's 500 Stock Index 10.6 14.0 12.7 5.8 – – 4.7<br />

Excess Returns -0.8 1.7 1.5 2.0 – – 1.9<br />

MFS Blended Research - Large Cap Value 12.2 16.1 12.8 6.6 – – 4.2 01-Jan-08<br />

Russell 1000 Value Index 12.3 18.8 12.7 4.8 – – 2.8<br />

Excess Returns -0.1 -2.7 0.1 1.8 – – 1.4<br />

MFS Blended Research - Large Cap Growth 10.1 13.6 14.4 8.8 – – 5.8 01-Jan-08<br />

Russell 1000 Growth Index 9.5 10.1 13.1 7.3 – – 4.8<br />

Excess Returns 0.6 3.5 1.3 1.5 – – 1.0<br />

MFS Blended Research Global Equity 6.6 11.1 – – – – 5.4 01-<strong>May</strong>-11<br />

MSCI All Country World Index (net div) 6.5 10.6 – – – – 2.8<br />

Excess Returns 0.1 0.5 – – – – 2.6<br />

MFS Blended Research - AC Global Equity Extension 4.3 8.3 9.9 – – – 5.3 01-Jul-08<br />

MSCI All Country World Index (net div) 6.5 10.6 7.8 – – – 2.5<br />

Excess Returns -2.2 -2.3 2.1 – – – 2.8<br />

MFS Blended Research International Equity 3.2 6.3 – – – – -1.5 01-<strong>May</strong>-11<br />

MSCI All Country World (ex-US) Index (net div) 3.2 8.4 – – – – -2.2<br />

Excess Returns 0.0 -2.1 – – – – 0.7<br />

MFS Blended Research - Emerging Markets Equity -1.3 4.4 – – – – 17.0 01-Oct-11<br />

MSCI Emerging Markets Index (gross div) -1.6 2.3 – – – – 14.2<br />

Excess Returns 0.3 2.1 – – – – 2.8<br />

Please see the appendix for composite reports.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.7<br />

7<br />

7

Fixed income capabilities (USD)<br />

Composite performance as <strong>of</strong> 31 March <strong>2013</strong> – gross <strong>of</strong> fees<br />

YTD 1 Year 3 Years 5 Years 10 Years Since Inception<br />

Short Term MFS Limited Maturity Fixed Income 0.50 2.98 3.17 3.65 3.59 5.82 01-Jan-88<br />

Barclays 1-3 Year U.S. Government/Credit Bond Index 0.20 1.09 1.65 2.37 3.06 5.45<br />

Excess Returns 0.<strong>30</strong> 1.89 1.52 1.28 0.53 0.37<br />

Aggregate MFS Core Plus Research Fixed Income 0.22 6.51 7.21 7.65 6.14 6.91 01-Mar-99<br />

Barclays U.S. Aggregate Bond Index -0.12 3.77 5.52 5.47 5.02 5.81<br />

Excess Returns 0.34 2.74 1.69 2.18 1.12 1.10<br />

MFS Global Aggregate Core Plus Fixed Income Unhedged -2.45 1.75 5.23 – – 5.23 01-Apr-10<br />

Barclays Global Aggregate Index (USD Unhedged) -2.10 1.25 4.52 – – 4.52<br />

Excess Returns -0.35 0.50 0.71 – – 0.71<br />

Corporate MFS Investment Grade Corporate Fixed Income 0.07 8.25 8.58 – – 11.02 01-Jul-09<br />

Barclays U.S. Credit Bond Index -0.17 7.00 7.86 – – 9.25<br />

Excess Returns 0.24 1.25 0.72 – – 1.77<br />

MFS Corporate Fixed Income 0.45 8.46 9.00 9.64 7.49 8.57 01-Jan-88<br />

Blend BC Govt & Credit 98 prior - BC Credit 99 forward 1 -0.17 7.00 7.86 7.52 5.96 7.55<br />

Excess Returns 0.62 1.46 1.14 2.12 1.53 1.02<br />

High Yield MFS US Core High Yield Fixed Income 2.43 12.16 11.25 9.57 8.68 8.64 01-Jan-88<br />

Blend BC US HY & 2% Capped at 2-1-12 2 2.89 13.08 11.23 11.64 10.12 8.93<br />

Excess Returns -0.46 -0.92 0.02 -2.07 -1.44 -0.29<br />

MFS Global High Yield 2.32 12.37 11.55 10.02 9.83 8.81 01-Dec-98<br />

B<strong>of</strong>A Merrill Lynch Global High Yield - Constrained Index (USD Hedged) 2.57 13.99 11.17 12.13 10.28 7.55<br />

Excess Returns -0.25 -1.62 0.38 -2.11 -0.45 1.26<br />

EM MFS Emerging Markets Debt 3 -1.36 11.68 10.88 11.27 12.69 12.93 01-Feb-97<br />

JPMorgan Emerging Markets Bond Index Global -2.<strong>30</strong> 10.44 10.55 9.81 10.59 9.85<br />

Excess Returns 0.94 1.24 0.33 1.46 2.10 3.08<br />

MFS Emerging Markets Local Currency Debt -0.45 7.57 6.80 7.58 – 10.25 01-Nov-06<br />

JPMorgan Government Bond Index Emerging Markets Global Diversified -0.12 7.68 7.92 8.43 – 10.62<br />

Excess Returns -0.33 -0.11 -1.12 -0.85 – -0.37<br />

1<br />

Benchmark methodology: Barclays Capital Aggregate Government & Credit Index from 1-Jan-98 to 31-Dec-98 and Barclays Capital US Aggregate Credit Index 1-Jan-99 forward.<br />

2<br />

Benchmark methodology: Barclays Capital U.S. High-Yield Corporate Bond Index from 1-Dec-98 to 31-Dec-11 and Barclays US Corporate High Yield – 2% Issuer Capped Index 1-Jan-12 forward.<br />

3<br />

Limited availability. Please consult your MFS representative.<br />

Please see the appendix for composite reports.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.8<br />

8<br />

8

Executive summary<br />

Performance (%) Gross and net <strong>of</strong> fees (USD), as <strong>of</strong> <strong>30</strong>-Apr-13<br />

Portfolio gross Portfolio net MSCI EAFE Value<br />

8.7 8.6<br />

3.6<br />

24.4 23.6<br />

22.4<br />

13.1 12.6<br />

1Q13 1 Year Since PERA's inception<br />

(1-Apr-10)<br />

12 month performance review relative to MSCI EAFE Value Index<br />

• Underweight position and stock selection in basic materials added value<br />

• Stock selection in special products & services and utilities & communication benefitted<br />

relative returns<br />

• Underweight position in financial services detracted from returns<br />

6.1<br />

Asset summary (%) (USD)<br />

Beginning value as <strong>of</strong> <strong>30</strong>-Apr-12 165,482,960<br />

Contributions 0<br />

Withdrawals 0<br />

Change in market value 40,321,107<br />

Ending value as <strong>of</strong> <strong>30</strong>-Apr-13 205,804,068<br />

Sector weights (%)<br />

As <strong>of</strong> <strong>30</strong>-Apr-13<br />

Portfolio Benchmark^<br />

Top overweights<br />

Consumer Staples 20.6 0.5<br />

Technology 8.6 4.5<br />

Special Products & Services 6.9 3.0<br />

Top underweights<br />

Financial Services 18.9 37.7<br />

Energy 4.5 10.8<br />

Utilities & Communications 9.5 14.9<br />

^ MSCI EAFE (Europe, Australasia, Far East) Value Index<br />

(gross div).<br />

Source for benchmark performance: SPAR, FactSet Research<br />

Systems Inc.<br />

Past performance is no guarantee <strong>of</strong> future results. All<br />

periods greater than one year are annualized.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.9<br />

9<br />

9

Market overview<br />

Region performance (%) 1 , as <strong>of</strong> <strong>30</strong>-Apr-13<br />

MSCI EAFE Value sector performance (%) 2 , as <strong>of</strong> <strong>30</strong>-Apr-13<br />

22.8 22.0 21.6<br />

1 Year<br />

36.9 36.1<br />

<strong>30</strong>.1<br />

1 Year<br />

16.1<br />

11.7<br />

23.0 22.2<br />

19.2 19.0<br />

16.5 15.4<br />

12.8<br />

6.2 6.0<br />

4.0<br />

1.4<br />

-7.1<br />

Pacific<br />

ex Japan<br />

Japan<br />

Europe<br />

ex U.K.<br />

United<br />

States<br />

U.K.<br />

Emerging<br />

Markets<br />

Canada<br />

Health Care<br />

Financial Services<br />

Consumer Staples<br />

Retailing<br />

Leisure<br />

Autos & Housing<br />

Transportation<br />

Industrial Goods<br />

& Services<br />

Technology<br />

Utilities &<br />

Communications<br />

Energy<br />

Special Products<br />

& Services<br />

Basic Materials<br />

Market review as <strong>of</strong> <strong>30</strong>-Apr-13<br />

• Global equity markets have continued to rally in <strong>2013</strong>, helped by accommodative monetary policies and modestly improving economic growth<br />

• Our outlook for global equity markets is cautious, considering the excessive levels <strong>of</strong> government debt for most developed countries, the structural imbalance<br />

<strong>of</strong> the common currency in Europe and the potential for adverse consequences from the unprecedented levels <strong>of</strong> quantitative easing around the world.<br />

• Ultimately, to see markets move sustainably higher, a reduction in government debt levels and meaningful progress toward the resolution <strong>of</strong> the banking and<br />

common currency problems in Europe are needed<br />

1<br />

Source: FactSet. Region performance based on MSCI regional/country indexes.<br />

2<br />

Source: FactSet. Sector performance based on MFS sector classification. The analysis <strong>of</strong> MSCI EAFE Value constituents are broken out by MFS Sectors.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.10<br />

10<br />

10

Experienced MFS International Value Equity team<br />

Barnaby Wiener<br />

Portfolio Manager<br />

19 years industry experience<br />

Benjamin Stone<br />

Portfolio Manager<br />

17 years industry experience<br />

Camille Lee, CFA<br />

Institutional Portfolio Manager<br />

23 years industry experience<br />

Additional resources<br />

Nevin Chitkara<br />

Steven Gorham, CFA<br />

Katrina Mead, CFA<br />

Ann Marie Costello<br />

Portfolio Manager<br />

20 years industry experience<br />

Portfolio Manager<br />

23 years industry experience<br />

Institutional Portfolio Manager<br />

18 years industry experience<br />

Investment Product Specialist<br />

25 years industry experience<br />

Experienced management, tested by markets, backed by depth<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.11<br />

11<br />

11

Investment approach<br />

Goal<br />

Outperform the MSCI EAFE Value Index over full market cycles with below average volatility.<br />

The MSCI EAFE Index is a secondary benchmark.<br />

Invest rather than speculate<br />

Most market participants speculate on near-term information and over-react to short-term newsflow.<br />

• We invest on a 3 to 5 year time horizon. Our global research platform, collaborative investment<br />

approach and compensation structure are all aligned with this timeframe.<br />

Strategy<br />

Analyze rather than forecast<br />

Most market participants attach too much weight to forecasts, which <strong>of</strong>ten prove inaccurate, particularly<br />

at inflection points.<br />

• Typically, we seek an analytical advantage by evaluating the long-term quality, sustainability,<br />

improvement potential and intrinsic value <strong>of</strong> businesses.<br />

Focus on downside risk<br />

Most market participants overemphasize upside potential vs. downside risk.<br />

• We manage capital with the goal <strong>of</strong> avoiding stocks with substantial downside risk, and only invest<br />

where valuations more than compensate for inherent risks.<br />

Leverage long-term analysis to exploit market inefficiencies<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.12<br />

12<br />

12

Historically consistent performance in diverse markets (USD)<br />

Number <strong>of</strong> quarters above/below benchmark<br />

25<br />

20<br />

15<br />

10<br />

5<br />

MFS International Value composite (gross <strong>of</strong> fees) vs MSCI EAFE Value 1 , October 2003 – March <strong>2013</strong><br />

Number <strong>of</strong> outperforming quarters<br />

Number <strong>of</strong> underperforming quarters<br />

0<br />

Market return<br />

less than -5%<br />

Market return<br />

-5% to 5%<br />

Market return<br />

greater than 5%<br />

Average quarterly +5.0% +1.2% -1.4% +0.9%<br />

relative performance<br />

Total<br />

1<br />

MSCI EAFE Value with net dividends reinvested.<br />

Source: benchmark performance from SPAR, FactSet Research Systems Inc.<br />

Based on quarterly returns in USD.<br />

Downside risk management, upside participation<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.13<br />

13<br />

13

Investment process overview<br />

Idea generation<br />

Stock analysis<br />

Portfolio construction<br />

MFS ® International<br />

Value Equity<br />

Invest rather than speculate<br />

Analyze rather than forecast<br />

Focus on downside risk<br />

Research analysts<br />

Portfolio managers<br />

Quantitative analysis<br />

Evaluate quality<br />

Assess improvement potential<br />

Determine appropriate valuation<br />

Attractive valuation<br />

Risk/return<br />

Risk review<br />

Best<br />

high-quality<br />

value ideas<br />

80 to 100 holdings<br />

150 to 200 stocks that fit<br />

investment approach<br />

<strong>30</strong>0 to 400 buy candidates<br />

750 – 850 stocks rated by non U.S.<br />

analyst team<br />

Rigorous analysis <strong>of</strong> business, risk and valuation<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.14<br />

14<br />

14

Performance results – gross and net <strong>of</strong> fees (USD)<br />

As <strong>of</strong> <strong>30</strong>-Apr-13 Period Portfolio gross (%) Portfolio net (%) Benchmark^ (%)<br />

Quarterly returns 1Q13 8.7 8.6 3.6<br />

4Q12 2.3 2.1 7.4<br />

3Q12 7.5 7.3 7.6<br />

2Q12 -2.5 -2.7 -6.7<br />

Annual returns <strong>2013</strong> year to date 16.1 15.8 10.2<br />

2012 17.0 16.3 18.4<br />

2011 -0.8 -1.2 -11.6<br />

Annualized returns 1 Year 24.4 23.6 22.4<br />

3 Years 13.8 13.3 6.9<br />

Since Inception (1-Apr-10) 13.1 12.6 6.1<br />

^ MSCI EAFE (Europe, Australasia, Far East) Value Index (gross div).<br />

Source for benchmark performance: SPAR, FactSet Research Systems Inc.<br />

Past performance is no guarantee <strong>of</strong> future results. All periods greater than one year are annualized.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.15<br />

15<br />

15

Performance drivers – sectors<br />

Relative to MSCI EAFE (Europe, Australasia, Far East) Value Index (USD)<br />

One year as <strong>of</strong> <strong>30</strong> April <strong>2013</strong><br />

Average relative Sector Stock Currency Relative<br />

weighting (%) selection (%) + selection (%) + effect (%) = contribution (%)<br />

Contributors Basic Materials -2.3 0.8 1.1 0.1 1.9<br />

Special Products & Services 3.3 -0.2 1.3 0.2 1.3<br />

Utilities & Communications -5.3 0.5 1.2 -0.8 0.9<br />

Energy -5.7 1.0 -0.4 -0.1 0.5<br />

Consumer Staples 19.4 1.6 -0.6 -0.6 0.4<br />

Autos & Housing -4.1 0.1 0.2 0.0 0.3<br />

Industrial Goods & Services 0.8 0.0 0.3 0.0 0.3<br />

Transportation -0.4 0.0 0.4 -0.2 0.2<br />

Currency Options 0.1 0.2 .– 0.0 0.2<br />

Technology 4.9 0.1 -0.2 0.3 0.1<br />

Health Care 2.0 0.3 -0.2 -0.1 0.0<br />

Detractors Financial Services -18.4 -2.1 0.2 -0.8 -2.6<br />

Cash 3.9 -1.0 .– 0.2 -0.8<br />

Retailing -0.3 0.0 -0.1 -0.1 -0.3<br />

Leisure 2.1 0.0 0.0 -0.3 -0.3<br />

Total 1.5 3.1 -2.3 2.3<br />

Attribution results are generated by the FactSet application utilising a methodology which is widely accepted in the investment industry. Results are based upon daily holdings using a buy and hold<br />

methodology to generate individual security returns and do not include expenses. As such, attribution results are essentially estimates and may not aggregate to the total return <strong>of</strong> the portfolio or <strong>of</strong><br />

the benchmark which can be found elsewhere in this presentation.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.16<br />

16<br />

16

Performance drivers – stocks<br />

Relative to MSCI EAFE (Europe, Australasia, Far East) Value Index (USD)<br />

One year as <strong>of</strong> <strong>30</strong> April <strong>2013</strong><br />

Average Weighting Returns Relative<br />

Portfolio (%) Benchmark (%) Portfolio (%) 1 Benchmark (%) contribution (%)<br />

Contributors Daiwa Securities 1.0 0.1 139.2 17.4 0.8<br />

KDDI Corp. 3.5 0.3 50.0 50.0 0.7<br />

Roche Holding Ltd. 2.5 .– 41.7 .– 0.4<br />

Bayer 2.0 0.4 51.8 28.4 0.4<br />

Japan Tobacco Inc 2.4 .– 39.7 .– 0.3<br />

Detractors Westpac Banking Corp .– 1.5 .– 58.9 -0.5<br />

Esprit Holdings 0.5 .– -25.5 .– -0.4<br />

Cmnwlth Bk Of Aust .– 1.6 .– 49.5 -0.4<br />

Cairn Energy PLC 0.7 .– -19.5 .– -0.4<br />

Novartis AG 0.3 2.7 11.4 39.8 -0.3<br />

1<br />

Represents performance for the time period stock was held in portfolio.<br />

Attribution results are generated by the Factset application utilising a methodology which is widely accepted in the investment industry. Results are based upon daily holdings using a buy and hold<br />

methodology to generate individual security returns and do not include expenses. As such, attribution results are essentially estimates and may not aggregate to the total return <strong>of</strong> the portfolio or <strong>of</strong><br />

the benchmark which can be found elsewhere in this presentation.<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.17<br />

17<br />

17

Significant transactions<br />

Ending<br />

From 1-<strong>May</strong>-12 to <strong>30</strong>-Apr-13 Security Sector Transaction type Trade (%) weight (%)<br />

Purchases NOVARTIS AG NEW Health Care <strong>New</strong> position 1.5 1.5<br />

CANON INC Technology <strong>New</strong> position 1.4 1.2<br />

DANONE Consumer Staples Add 1.1 3.6<br />

SONY CORP Financial Services <strong>New</strong> position 0.8 0.7<br />

GLAXOSMITHKLINE PLC Health Care Add 0.7 3.1<br />

Sales SANOFI Health Care Eliminate position -1.2 –<br />

HEINEKEN HOLDING NV Consumer Staples Trim -1.1 2.1<br />

SAMSUNG ELECTRONICS CO LTD Technology Eliminate position -1.0 –<br />

SHIN-ETSU CHEMICAL Basic Materials Eliminate position -1.0 –<br />

SYNTHES INC Health Care Eliminate position -1.0 –<br />

MFS ® International Value Equity<br />

225-I-CT-IV-<strong>30</strong><strong>May</strong>13.18<br />

18<br />

18

Change in portfolio sector weights<br />

Portfolio as <strong>of</strong><br />

<strong>30</strong>-Apr-12 (%)<br />

Portfolio as <strong>of</strong><br />

<strong>30</strong>-Apr-13 (%)<br />

Financial Services 16.9 18.9<br />

Technology 7.8 8.6<br />

Special Products & Services 6.1 6.9<br />

Transportation 1.3 1.7<br />

Cash & Other 4.6 4.8<br />

Autos & Housing 1.4 1.4<br />

Utilities & Communications 9.5 9.5<br />

Industrial Goods & Services 4.7 4.6<br />