PDF version can be found here - Edmonton Opera

PDF version can be found here - Edmonton Opera

PDF version can be found here - Edmonton Opera

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Edmonton</strong> <strong>Opera</strong> Association<br />

Notes to the Financial Statements<br />

For the year ended June 30, 2013<br />

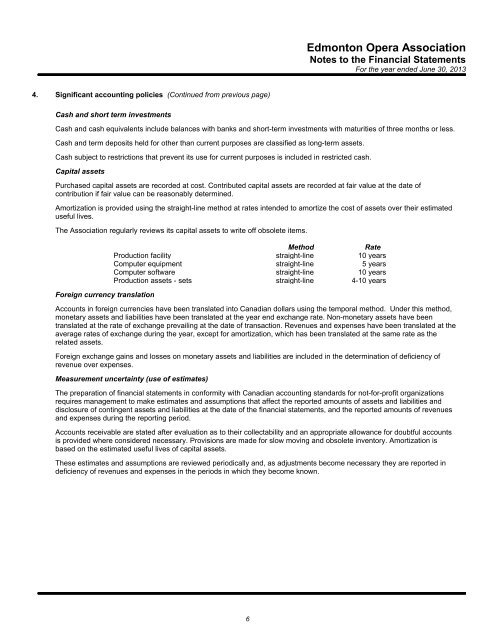

4. Signifi<strong>can</strong>t accounting policies (Continued from previous page)<br />

Cash and short term investments<br />

Cash and cash equivalents include balances with banks and short-term investments with maturities of three months or less.<br />

Cash and term deposits held for other than current purposes are classified as long-term assets.<br />

Cash subject to restrictions that prevent its use for current purposes is included in restricted cash.<br />

Capital assets<br />

Purchased capital assets are recorded at cost. Contributed capital assets are recorded at fair value at the date of<br />

contribution if fair value <strong>can</strong> <strong>be</strong> reasonably determined.<br />

Amortization is provided using the straight-line method at rates intended to amortize the cost of assets over their estimated<br />

useful lives.<br />

The Association regularly reviews its capital assets to write off obsolete items.<br />

Foreign currency translation<br />

Method<br />

Rate<br />

Production facility straight-line 10 years<br />

Computer equipment straight-line 5 years<br />

Computer software straight-line 10 years<br />

Production assets - sets straight-line 4-10 years<br />

Accounts in foreign currencies have <strong>be</strong>en translated into Canadian dollars using the temporal method. Under this method,<br />

monetary assets and liabilities have <strong>be</strong>en translated at the year end exchange rate. Non-monetary assets have <strong>be</strong>en<br />

translated at the rate of exchange prevailing at the date of transaction. Revenues and expenses have <strong>be</strong>en translated at the<br />

average rates of exchange during the year, except for amortization, which has <strong>be</strong>en translated at the same rate as the<br />

related assets.<br />

Foreign exchange gains and losses on monetary assets and liabilities are included in the determination of deficiency of<br />

revenue over expenses.<br />

Measurement uncertainty (use of estimates)<br />

The preparation of financial statements in conformity with Canadian accounting standards for not-for-profit organizations<br />

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and<br />

disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues<br />

and expenses during the reporting period.<br />

Accounts receivable are stated after evaluation as to their collectability and an appropriate allowance for doubtful accounts<br />

is provided w<strong>here</strong> considered necessary. Provisions are made for slow moving and obsolete inventory. Amortization is<br />

based on the estimated useful lives of capital assets.<br />

These estimates and assumptions are reviewed periodically and, as adjustments <strong>be</strong>come necessary they are reported in<br />

deficiency of revenues and expenses in the periods in which they <strong>be</strong>come known.<br />

6