Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

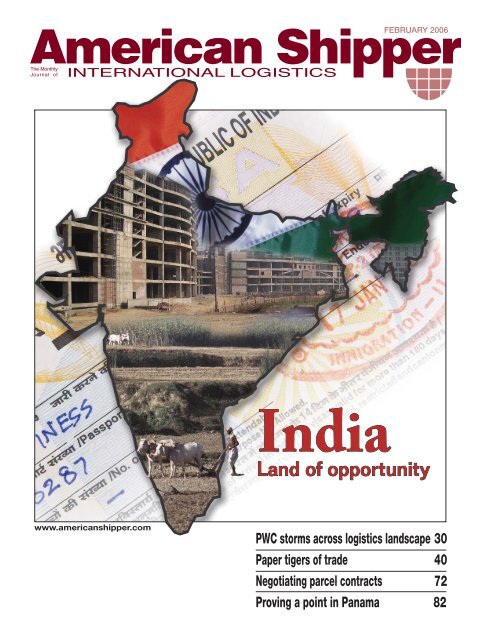

FEBRUARY <strong>2006</strong>IndiaLand of opportunitywww.americanshipper.comPWC storms across logistics landscape 30Paper tigers of trade 40Negotiating parcel contracts 72Proving a point in Panama 82

Tailoring your world.Who better to keep your products moving seamlessly?That’s what we do. That’s shore to door. That’s factory floor to your warehouse.That’s customizing solutions. That’s Maersk.maersksealand.commaersklogistics.com

YOUR CARGO SHOULDN’T BEOUTIN WEATHER LIKE THIS!If your present carrier tells you thatyour shipment will be securely stowedon deck, don’t believe it. Cargo reallytakes a beating on its journey across theNorth Atlantic – especially during thestormy winter months.As the premier carrier of Roll-on/Rolloff,special project cargo and containerson the Atlantic, ACL offers you the mostsecure environment for every shipmentto and from Europe. Uncontainerizedcargo is parked and secured in ourRORO garage, providing the optimumprotection against the elements. ACL’scontainers are secured in uniquelydesignedcell guides, unlike those carrierswhose containers are only lashed downon deck.Whatever the size, shape, height orweight of your shipment, ACL can carryit and our team of experts can handleevery detail – no matter what MotherNature has in mind!800-ACL-1235www.ACLcargo.com

Vol. 48, No. 2LOGISTICS 6Japan opens, shuts border to U.S. beef 42Logistics cotton bowl 44Byrd Amendment shot down 50Exports to Iran a dangerous game 52Get in touch with inner supply chain 54Keep trade simple 60Blasgen: ‘Consensus builder’ 62Asian 3PL perspectives 64FORWARDING/NVOs 68ACE gaining momentum 68Sidler out at Panalpina 68Court dismisses NSA challenge 69ALG companies unite under brand 69EGL settles war risk surcharge case 69Kuehne + Nagel closes ACR buy 69TRANSPORT/INTEGRATORS 70DHL’s case of the missing tape 70TRANSPORT/AIR 70United exits bankruptcy; now what? 70TRANSPORT/OCEAN 78Carrier services changes aplenty 78Miles, Webber relieved at the helm 79TRANSPORT/INLAND 80Better solutions in Chicago 80PORTS 82Proving a point in Panama 82Growing need to be green 85Cooperation a Sound judgment 87Seattle, Tacoma ‘gateways’ ranked 90SERVICE ANNOUNCEMENTSChina Shipping, CMA CGM plan Atlanticloop ... CP Ships to join Grand in transpacifi cservice ... MSC, Maersk add ship to U.S./Africa loop ... Radiance kicks off ro/roDEPARTMENTSComments & Letters 2<strong>Shipper</strong>s’ Case Law 92Corporate Appointments 93Service Announcements 94Editorial 96On the Cover<strong>February</strong> <strong>2006</strong>India: Land of opportunity 6The South Asian giant is on the vergeof flexing its industrial muscle. The shippingindustry knows this and is carefully exploringthe market. The underlying goal of interestedshippers, logistics providers and carriersis to stay a step ahead of future competition.India’s government and population appearcommitted to the developments necessaryto unleash the country’s entrepreneurial spirit.PWC storms across logistics landscape 30Ask any shipper, analyst or international trade specialistif they know about PWC Logistics and you are likelyto draw a blank stare. But those uninformed looksare likely to turn to nods of understanding in the next fewyears as the Kuwaiti-based logistics provider continuesits turbo-charged expansion into a full-service supplychain management company, fueled by hefty profitsfrom huge U.S. military contracts in Iraq and Kuwait.Paper tigers of trade 40Wastepaper is the United States’ most prominent exportin terms of number of TEUs, helping feed the packagingneeds of China with 6 million tons in 2004. Othermanufacturing powerhouses in the region claimedtheir share of U.S. used paper too. Yet even as U.S.wastepaper exporters send more product to Chinaeach year, the U.S. share of China’s paper exportsis shrinking.Negotiating parcel contracts 72More shippers are using integrated carriers for packagedeliveries than ever before. Negotiating contractswith UPS, FedEx, DHL and the U.S. Postal Service canbe complicated, requiring time and strategies that go farbeyond having accurate ZIP codes for recipients. Andlike other aspects of the logistics industry, muchof the success comes in paying attention to small details.<strong>Shipper</strong>s’ NewsWireDaily updates www.americanshipper.comTo subscribe call 1 (800) 874-6422 or on the Web at www.americanshipper.comAMERICAN SHIPPER: FEBRUARY <strong>2006</strong> 1

Promising pick for MarAd chiefDavid C. Sanborn has the maritime background that mayserve him well as the United States’ next maritime administrator.Sanborn, who was nominated to the post by President Bushin <strong>February</strong>, currently serves as director of operations forEurope and Latin America for DP World, the global marineterminal operator.Prior to this, Sanborn served as CMA-CGM’s senior vicepresident North America service delivery. He also served asvice president for network operations at APL, and earlier asdirector of operations at Sea-Land Service.In addition, Sanborn is a retired lieutenant in the U.S. NavalReserve and holds a bachelor’s degree from the U.S. MerchantMarine Academy.If confirmed by the Senate, Sanborn will succeed Capt.William G. Schubert, who resigned as chief of the MaritimeAdministration in January 2005. John Jamian, deputy administratorat MarAd, has since filled in as acting maritimeadministrator.The U.S. shipping industry is optimistic about Sanborn’snomination to maritime administrator.“He’s experienced and very knowledgeable in the industryand I’m sure he’ll do a fine job,” said World Shipping Councilpresident Christopher Koch in an interview. (Chris Gillis)<strong>Shipper</strong>s pay for Wal-Mart’s carrier ratesOne point not mentioned in your article on Wal-Mart (“ShelfLogistics,” December <strong>American</strong> <strong>Shipper</strong>, pages 8-16) is the additionalcosts every other importer faces due to the rate levelsocean carriers grant Wal-Mart.Carriers each year grant rate and spaceconcessions to Wal-Mart that artificiallyprop up the demand for space. This fabricatedshortage of space gives the carrierssufficient ammunition to demand higherrates from all other shippers and importers.Everyone else ends up paying for the concessionswhich are granted to Wal-Mart. Ican’t tell you how many times over the years I have heard, “wecan’t talk about rates in your service contract until we completeour negotiations with Wal-Mart.” It’s King Kong and Godzillarolled into one.Every one of us pays for Wal-Mart’s success. I’m wonderingwhere they would be without all the concessions from carriers,local and state governments, their employees and suppliers. If therewere a level playing field, things would certainly be different.Dennis J. WilkinsonWorldlink Logistics Inc.Park City, UtahVol. 48 No. 2 <strong>February</strong> <strong>2006</strong><strong>American</strong> <strong>Shipper</strong> is published monthly. Published on the15th of each preceding month by Howard Publications,Inc., 300 W. Adams St., Suite 600, P.O. Box 4728,Jacksonville, Florida 32201. Periodical postage paidat Jacksonville, Florida, and additional mailing offices.Subscriptions $36 per year for 12 issues; $180 for airmail. Telephone (904) 355-2601.<strong>American</strong> <strong>Shipper</strong> (ISSN) 1074-8350)POSTMASTER: Send Change of Address Form 3579to <strong>American</strong> <strong>Shipper</strong>, P.O. Box 4728, Jacksonville,Florida 32201.Printed in U.S.A.Copyright © <strong>2006</strong> Howard Publications, Inc.To subscribe call1 (800) 874-6422or on the Web atwww.americanshipper.comPublisherEditorialHayes H. HowardJacksonville hhoward@shippers.comChristopher Gillis, EditorWashington cgillis@shippers.comGary G. Burrows, Managing EditorJacksonville gburrows@shippers.comRobert Mottley, Feature writerNew York rmottley@shippers.comEric Kulisch, Associate EditorWashington ekulisch@shippers.comJim Dow, Associate EditorMiamijdow@shippers.comEric Johnson, Associate EditorLong Beach ejohnson@shippers.comSimon Heaney, ReporterLondon london@shippers.comFrancis Phillips, Shipping ResearchLondon fphillips@shippers.comStephen Wynn, Shipping ResearchJacksonville swynn@shippers.comBeth Voils, Art DirectorJacksonville evoils@shippers.comJason Braddock, Graphic DesignerJacksonville jbraddock@shippers.comAdvertising Ryan Kneipper, Advertising ManagerNew York rkneipper@shippers.comNancy B. Barry, Adv. Prod. ManagerJacksonville nbarry@shippers.comCirculation Karyl DeSousa, Kerry Cowart,Kathy HouserJacksonville circulation@shippers.comJacksonville (800) 874-6422(904) 355-2601Fax: (904) 791-8836300 W. Adams St., Suite 600P.O. Box 4728Jacksonville, FL 32201Washington (202) 347-1678Fax: (202) 783-3919National Press Bldg., Rm. 961Washington, DC 20045New York (212) 422-2420Fax: (212) 422-004761 Broadway, Suite 1603New York, N.Y. 10006London +44 (20) 8970-2623Fax: +44 (20) 8970-2625Empire HouseEmpire Way, WembleyNorth London HA9 0EW, EnglandLong Beach (949) 412-4304Fax: (626) 796-82462215 E. 2nd St., No. 1Long Beach, CA 90803Miami (954) 443-374610300 Iris CourtPembroke Pines, FL 330262 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>

abilityIntermarine.PEOPLE MAKING CARGO MOVE>www.intermarineusa.comProject transport requires more than just ships—it requires the right ship and the right people to assure safeand on–time delivery. Intermarine provides both. Whether your project requires our new shallow-draft CenturyClass vessels with 400 metric ton lift capacity, a modern RO–RO, or even semi–submersible vessels, our peopledetermine the most effective way to safely handle your cargo and deliver it on schedule. In fact, we handcraftmore than 200 voyages a year to meet our clients’ specifc needs. Don’t shoehorn your cargo into someone else’sitinerary; let Intermarine find the right ship for your schedule. At Intermarine, our people make your cargo move.MANAGING AGENT FOR INDUSTRIAL MARITIME CARRIERS

Keep the tequila flowingU.S. bottlers should toast U.S. trade officials for successfullyreaching an agreement with Mexico in mid-<strong>February</strong> tocontinue shipments of bulk Mexican tequila for bottling in theUnited States.In 2003, Mexico considered amending its tequila standards torequire its bottling in Mexico. The amendment, in effect, wouldhave banned bulk exports of the liquor.“We have resolved this important trade challenge in a waythat ensures U.S. bottlers will have continued access to bulktequila,” said U.S. Trade Representative Rob Portman in a Jan.17 statement.If the change in Mexico’s tequila regulations would havegone forwarded, it would have “threatened the huge investmentsby U.S. companies in building bottling plants and developingbrands in the United States,” Portman said.Other important provisions included in the agreementwere:• A prohibition on Mexican regulation of tequila labeling ormarketing, as well as the labeling, formulation, and marketingof distilled spirits outside Mexico.• Creation of a “tequila bottlers registry” that identifiesapproved bottlers of tequila.• Continuation of current practice with respect to addressingMexican concerns about manufacturing tequila in the UnitedStates.• Establishment of a working group to monitor the implementationof the agreement.The United States is Mexico’s largest export market fortequila and accounts for 50 percent of the Mexican product.In 2004, the United States imported more than $400 millionof Mexican tequila, of which 73 percent was shipped in bulkform. (Chris Gillis)Bonner’s back in townRobert Bonner returned to Washington Jan. 18, less thantwo months after leaving his post as head of U.S. Customs andBorder Protection, for a reception at the office of his law firmGibson, Dunn & Crutcher.Bonner recently rejoined Gibson Dunn, where he served asa partner prior to being named in 2001 to head the CustomsService. He is based in Los Angeles, but will split time in theWashington office.The event was billed as an executive briefing on homelandsecurity and challenges for the private sector. But the real purposewas to introduce Bonner to the firm’s clients and spreadthe word to prospective clients that he is ready to share hisexpertise.Although Bonner mostly discussed broad policy accomplishmentsat the Department of Homeland Security, he subtly usedthe occasion to let technology providers in particular know thatthey might need a little help getting their products noticed byDHS officials.Looking refreshed after four grueling years at CBP, he talkedabout how technology made possible container inspection andother programs instituted during his regime, and the technologyopportunities that are available as the government tries to rampup initiatives to gain control of the border to interdict and deterillegal immigrants.During a brief history lesson about DHS, Bonner explained4 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>how difficult it was to integrate multiple agencies with differentmissions and cultures in a consolidated organization.“This is important to know for technology and systems developmentcompanies, as well as those that might be regulatedby the department. Companies that have something to offerto help DHS perform its mission need to know how DHS isactually structured, and how and where decisions are made,”Bonner said.“DHS doesn’t have, yet, a mature organizational structure,doesn’t always have clear roles and responsibilities for operationalagencies” and doesn’t have a robust procurement-orientedculture like the Defense Department, “which makes it harderto navigate for the private sector,” he said.The unspoken message: Who better to help steer companiesthrough those complicated regulatory and acquisition waters thana DHS agency head fresh off his tour of duty? (Eric Kulisch)Farewell to CSCMP’s McIntyreThe unexpected departure of Maria McIntyre as chief operatingofficer of the Council of Supply Chain ManagementProfessionals is difficult to accept on the face of it. The officialCSCMP story is that McIntyre wanted to spend more time withher family. Yet imminent retirement was not a subject McIntyrementioned to anyone within earshot during a reception at thecouncil’s annual meeting in San Diego in late October. She wasenthusiastic about the CSCMP’s evolving plans for <strong>2006</strong>.It is fitting to salute McIntyre as a catalyst who inspired manylogisticians. In a September 2002 interview with <strong>American</strong><strong>Shipper</strong>, McIntyre recalled a career that began in 1966 when shestarted working as an administrative assistant for the <strong>American</strong>Warehousing Association, now the International WarehouseLogistics Association.Maria had married Donald McIntyre, a social worker whobecame an education counselor. They would have two children,Lisa and Deanna. In 1974, after her first daughter was born,McIntyre began working part-time for George Gecowets at theNational Council of Physical Distribution Management, helpingto plan the NCPDM’s annual fall conference which thendrew 500 attendees, compared to 3,400 in 2005. A decade later,McIntyre was Gecowets’s manager of administration. She hada say in changing the NCPDM’s name in 1985 to the Councilof Logistics Management. After Gecowets retired in 2000, asearch committee picked McIntyre to succeed him as CLM’sexecutive director, signing her to a multi-year contract.J. Thomas Mentzer, professor of logistics at the Universityof Tennessee and a former CLM president, said in 2002 thatthe search panel “had been impressed with her quarter-centuryof experience as well as her historical perspective of the fieldof logistics. She has been there for the evolution of the professionfrom a backroom activity to an executive-level globalfunction.”Perhaps McIntyre’s greatest challenge was in bringing off the2001 CLM annual conference in Kansas City in late Septemberof that year. It was one of the first industry gatherings to beheld after the trauma of Sept. 11, 2001.The aftermath of 9/11 hurt CLM, which again changed itsname and gradually built back its membership. Those weren’teasy days, and McIntyre provided the leadership to sustain anorganization that she had known for so long.To that end, she was indefatigable. (Robert Mottley)

Getting the latest fashion merchandise toyou and your customers in time for theupcoming season is what we do. And noone does it better than FMI! That's whyFMI is the best fit for fashion retailersand wholesalers. With operations atmany of the country's major gateways,our track record of reliable service andinnovative solutions has made FMI thelogistics provider of choice to many ofthe world's largest importers since 1979.Our team of experienced logisticsexecutives will study your transportationand distribution needs and help youdevelop an efficient cost effectivesupply chain.Let FMI show you how our single platform ofintegrated services, our state-of-the-art informationtechnology and our experience in flawlessexecution can work for you. Call us or visit ourwebsite today!www.fmiint.comSan Pedro, CA Mira Loma, CA Carteret, NJ Miami, FL Springfield Gardens (JFK), NY• 732-750-9000 • FAX: 732-750-4338 • Email: fmisales@fmiint.com

6 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>

IndiaLand of opportunityThe South Asian giant India is on the verge of flexingits industrial muscle.The shipping industry knows this and is carefullyexploring the market for opportunities. The underlying goalof interested shippers, logistics providers and carriers is tostay a step ahead of future competition.Numerous studies and industry experts point to Indiaplaying a significant role in global commerce, but the realityis that it may take five to 10 years before the country’stransportation and port infrastructure catches up to the levelof China and other industrial powerhouses of Asia and theWestern world.India’s government and population appear committed tothese developments, allowing the country’s wealth of entrepreneurialspirit to be unleashed.For the industry, there are short- and long-term strategiesto ensure success in trade with India.AMERICAN SHIPPER: FEBRUARY <strong>2006</strong> 7

LOGISTICSRace for second placeIndia is positioned to become the world’s second mostpowerful goods manufacturer — if it can overcomeinfrastructure shortcomings and bureaucracy.Hidden under the giant boulder thatis China is the world’s secondmost-populousnation, India, acountry on course for a manufacturingrevolution of its own sure to have globalramifications for shippers in North America,Europe and the Middle East.India, with the backing of its hard-drivinggovernment, stands on the precipice ofconverting its predominantly services-basedeconomy into a manufacturing and logisticshub that it hopes will rival its neighbor tothe north.Yet problems persist, most notably aninfrastructure system that lags well behindrival China, and a political culture that canbe notoriously bureaucratic.At the heart of the question of whetherIndia will become the next manufacturingsuperpower, however, is whether the country,and foreign investors, can tap into a populationof hundreds of millions of poor urbanand rural citizens who have missed out onmuch of the country’s economic boom timesin the last decade.In October, APL Logistics and DrewryShipping Consultants released a report, ConnectingIndia — Transportation Challengesand Opportunities, describing what awaitsshippers looking to source in India, as wellas companies looking to set up manufacturingbases there.Kenneth Glenn, senior vice presidentSouth Asia and managing director Indiafor APL, spoke with <strong>American</strong> <strong>Shipper</strong> atlength about the exciting times facing thesubcontinent. Glenn has been working inAPL’s Bombay office since fall, shuttlingbetween the nation’s biggest city and itscapital, New Delhi.“All the hype you hear is accurate,” Glennsaid. “You can’t open a business magazine orread a newspaper without reading about Indiaand China in the same breath. The place isbooming in every respect. There’s excitementon the institutional level, the employmentlevel and the government level.”Glenn said India is well placed to becomea logistics hub, “if they can overcome the8 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>BY ERIC JOHNSONchallenges and hurdles. I see this countryat the very beginning of an upward curveof growth potential. They have a can-doattitude in terms of their willingness totackle things.”“All the hype you hearis accurate ... The placeis booming in every respect.there’s excitementon the institutional level,the employment leveland the government level.”Kenneth Glennsenior vice presidentSouth Asia & managingdirector India,APLTwo Employment Bases. In order tounderstand what cultural challenges awaitforeign investors in India, one must understandthe dichotomy of the country’s twobroad employment bases: the well-educated,English-speaking urban dwellers for whomservice, financial, and technology jobs are anatural fit; and the hundreds of millions ofrural citizens, who are poorer, less-educatedand have limited opportunities to tap intoIndia’s booming economy.It is these rural populations, and in thepoorer urban areas, where manufacturingcould take hold and elevate the economyof the entire nation, Glenn said.“When you’re moving to a manufacturingeconomy, you target a different demographicgroup,” he said. “As great as India’seconomic growth has been, the reason theparty changed in the last election was thatthey lost the rural vote.”Understanding India’s dizzying politicalsystem can be a chore. But a sea change occurredin 1998, when the Bharatiya JanataParty (BJP), which has fought hard forHindu nationalist causes, wrested controlof the central government away from thelong-ruling Congress Party.In the years that BJP ran the government,the country became a services-basedeconomic phenomenon, with scores ofEnglish-speaking businesses using thewell-educated population as outsource callcenter hubs.“The past five years have been accompaniedby higher levels of foreign direct investment,increased participation of the privatesector in industrial and commercial venturesand rising volumes of foreign trade,” theAPL-Drewry report says. “In particular, thelatter years of the BJP administration sawrelations with China thaw, and trade betweenthese two countries is now powering aheadat a very rapid rate.”Yet while the economy has boomed becauseof it, problems persisted.“BJP was very pro-business, but theproblem was as much as they did for theeconomy to position it for future growth, itdidn’t affect a lot of the people,” Glenn said.“Sixty percent of the country still dependson agriculture for income.”And so the Congress Party won backpower in 2004, primarily with the ruralvote. That rural population, Glenn said, iswell suited to help India undergo its nexttransformation.“India is predominantly a services sectoreconomy,” he said, pointing out that thesector represents about 50 percent of thenation’s GDP.In contrast, only 20 percent of GDP isattributed to manufacturing.“That’s almost exactly the reverse ofChina, where manufacturing accounts for50 percent of GDP and services about 30percent,” he said. “India is really only at the

On Course, On Time,On Top of theWorldMediterranean Shipping Company (MSC)has reached the summit in worldwidecontainer shipping.A young company driven by a spirit of maritime tradition, MSC nowranks number two in ocean transportation providing top-levelcustomer service. Geneva based, privately owned and financiallysolid, MSC credits its rising success to hard work, clear vision andfocused sense of direction. Networked with their own offices aroundthe world, MSC’s business performance is basic – offering moreservices, capacity, and reliable consistent delivery for good value.Foresight and a firm grip on the pulse of a progressive industryhave MSC – on course, on time and on top of the world.MEDITERRANEAN SHIPPING COMPANY(212) 764-4800, NEW YORKwww.mscgva.chWE BRINGTHE WORLDCLOSERATLANTA770-953-0037LONG BEACH714-708-3584BALTIMORE410-631-7567MIAMI305-477-9277BOSTON617-241-3700NEW ORLEANS504-837-9396CHARLESTON843-971-4100NORFOLK757-625-0132CHARLOTTE704-357-8000WILMINGTON, N.C.910-392-8200CHICAGO847-296-5151CLEVELAND440-871-6335BAHAMAS, FREEPORT/NASSAU242-351-1158DALLAS972-239-5715MONTREAL, CAN514-844-3711DETROIT734-955-6350TORONTO, CAN416-231-6434HOUSTON713-681-8880VANCOUVER, CAN604-685-0131

LOGISTICSbeginning stages of becoming an internationalsourcing location. It’s just beginningto realize its potential.“Looking 10 years down the road, that’slikely to be very different,” Glenn continued.“The government’s priority is to develop asa manufacturing base.”Of the products it does manufacture andexport, roughly 50 percent are garmentsand textiles. Auto parts are the next biggestcategory of goods, but those are almostentirely kept in the domestic market.“India’s export mix is changing withhigher value goods (e.g. high-tech, pharmaceuticals,engineering and automotivecomponents) growing at a faster pace thanresource-based and agricultural products,”the APL-Drewry report said.Glenn said India is on course to followa familiar pattern of development as otherAsian countries, like Korea, Taiwan andChina. “You start with a labor-intensivepattern, manufacturing things like shoes,toys and low-end electronics,” he said. “Thenyou climb the food chain into value-addedproducts.”Since 1995 the value of the country’sexports has almost doubled from $31 billionin 1995 to $57 billion in 2003, theAPL-Drewry report said. As a result, India’sshare of world exports has risen from 0.6percent in the mid-1990s to almost 0.9percent in 2004.By the end of this year, the governmentwants the country’s share of world exportsto reach 1 percent, a process it thinks willbe aided by a move up the value chain.English And Democratic. India’shuge English-speaking population and higheducation levels have afforded the countrya key advantage over China and other developingnations.“It really has led to their home as a servicecenter and that’s clearly been the backbone“India is uniquely suitedto expand its presencein the business processesoutsourcing sector and to usethis as a platform for morevalue-added service andresearch and developmenttype activities.”APL Logistics-DrewryShipping Consultantsreport10 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>Indian exports by countries of destination(% of total export value, 2003-2004)8%5% 5% United Arab Emirates5%United States4%18% Other3%3%3%JapanItalyBangladeshBelgiumSingapore3%Germany3%ChinaUnited Kingdom40%Hong KongThe pharmaceuticals, engineering and automotive components sectors are likely to becomemore important export cargoes in the future, with India also significantly increasingits involvement in the IT sector. In general this changing mix of cargoes will result in furtherunitization of the country’s general cargo trades.Sources: Indian Department of Commerce, Drewry Shipping Consultants Ltd.to their economic development to date,”Glenn said.“India is uniquely suited to expand its presencein the business processes outsourcingsector, and to use this as a platform for morevalue-added service and research and developmenttype activities,” the APL-Drewryreport says. “In addition to its English-speakingand generally well-educated population,it has a vibrant computer software industry,with exports of IT products and IT-enabledservices a major generator of revenues andemployer of people.“The contribution of this sector to theeconomy is expected to rise further, withanalysts at Morgan Stanley suggesting anat least four-fold increase in revenues overthe next five years.”The services sector has benefited fromloosening of restrictions during BJP’s turnat the helm, and the Indians it has employedhave fueled a consumer culture.“Economically, India benefits from havinga young English-speaking workforce thatis highly flexible, generally well educatedand well qualified to take on remote-servicesjobs, such as those offered in call centersand administrative/documentation processingcenters,” the report said. “Growth in theservices sector has also been attributable toIndia’s deregulation of its financial servicesand telecoms industries. Given the relativelywell-paid jobs available, it is the emergenceof this type of business that is helping fuelan active and relatively cash-rich middleclass, which in turn is feeding into risinglevels of consumer demand.”The report also said India has taken aninclusionary, consensual approach to its economicgrowth, or the opposite of the closedgovernmental system found in China.“One of the things India likes to do ishighlight the fact, especially in comparisonto China, that it is the world’s biggest democracy,”Glenn said. “The decision-making isconsidered slow and bureaucratic, but it isdemocratic.”Glenn said much of the country’s neartermsuccess will depend on whether thecontentious factions of government canreach consensus on pro-business goals.“It’s not necessarily going to be democracyalone that would make India more attractive,”he said. “The safety of investment,stability, and currency concerns would bemore important to shippers looking whereto source.”Infrastructure Upgrades. More thananything else, though, infrastructure improvementsare the key to progress.“If it’s not the key, it’s certainly near thetop of the list,” Glenn said. “You can’t have aconversation with anyone here, in the publicor private sector, where infrastructure needsdon’t come up.”How big a deal is it? Even the New YorkTimes had a front-page story Dec. 4 chroniclingIndia’s effort to upgrade its dilapidatedroads.“Everyone acknowledges there’s a woefullack of infrastructure today to complement thegovernment’s stated goals,” Glenn said.China’s expanding infrastructure, whichis still having trouble catching up withthat nation’s explosive trade growth, putsIndia’s infrastructure development to shame,Glenn said.“There’s no comparison at all betweenthe U.S. and India or China and India,” he

LOGISTICSsaid. “I would put China’s infrastructure inurban areas close to the U.S. They’ve madeincredible steps in the last 10 years.”The list of India’s problems is long— roads too narrow and in poor condition,rail inefficiencies, low throughputefficiency in marine terminals — and yetIndia’s growth as a hub of internationaltrade will depend largely on its transportationsystem.Seaport Growth. Glenn said seaportsare one area where private money hasflowed.“Huge private investment in ports beganabout 10 years ago,” he said. “You havea queue a mile long wanting to invest inports.”Yet, ports in India aren’t the efficientlogistical machines they are in other partsof Asia.“Port productivity is much lower in Indiathan in China,” Glenn said. “Customs clearancesare slower. And landside infrastructureis much slower because there are bottleneckseverywhere and a lack of capacity to handlethe volume.”All those slowdowns contribute to makinglead-time for a product sourced in Indiasignificantly longer than from China, Glennsaid in the APL-Drewry report.“In India the costs associated with movingfreight are some of the highest in theworld at 11 percent of the landed cost ofthe cargo,” the APL-Drewry report said.“This compares with a global averageof just 6 percent. The main reasons forthe higher costs are twofold — tariffsand the inadequate infrastructure, whichlimits productivity improvements, resultsin higher levels of damage and extendslead times.“The ports also play a role in the longerlead times required for Indian exports tothe USA, relative to China — since whilegeography is naturally a factor, it does notbegin to explain the contrast between the sixto 12 weeks for India and the two to threefor China,” the report said.Just as in the United States, the IndianWest Coast dominates container trade, havinghandled almost 3 million of India’s total4.4 million TEUs in 2004.APL sees growth in India’s automotivesector and theorizes that agricultural products(like grain and soybeans) that havemoved bulk or breakbulk will increasinglybe containerized. In the report Drewry estimatesthe level of container penetrationin India to be around 50 percent, but risingrapidly.According to Glenn, handling rates percrane have improved dramatically over thepast 10 to 15 years as well.12 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>“Prior to 1989, the average handling rateat India’s ports was just 12 to 13 containersper hour. This improved to 15 containersper crane per hour with the opening of theJawaharlal Nehru Port, then 18 to 19 withthe commissioning of Nhava Sheva InternationalContainer Terminal, and the pastthree years have seen rates rise further to25 containers per crane per hour.”The carriers are certainly recognizingIndia’s growing prominence.“Since 2000, the North <strong>American</strong> EastCoast trade has seen the phasing intoservice of a considerable amount of newcapacity and the launch of several newstrings to/from ports in the Mid-East/SouthAsia region, such that more than 80 percentAPL Logistics and Drewry Shippingcompiled a report in fall detailing thepotential rise of India as a global manufacturingpower. India is almost alwayslinked with its neighbor and rival, China.Yet China has stolen a march on India inthe manufacturing arms race. The APL-Drewry report lists some reasons:• First, the world’s largest democracyhas not had the political continuity thatChina has, with the election of differentgovernments resulting in changed policies,greater levels of bureaucracy andslower decision-making procedures, etc.Moreover, the democratic nature of thepolitical process in India does mean thatany movement for change needs to beconsensual and command popular support— which is seldom easy to achievein such a diverse country with so manycompeting interest groups.• The country has not been consideredas attractive as China from the foreigndirect investment (FDI) perspective,and particularly for manufacturing andassembly ventures. On average, recentFDI levels in India have been equivalentto just 1 percent of the country’s annualGDP ($4 to 5 billion), whereas China hasbeen able to attract $50 billion in recentyears. While India’s share of global FDIis less than 1 percent, China has a 12percent share.• A rigid labor market puts India at adistinct disadvantage compared to China’sflexible market.• A high tax burden, characterized bymany different taxes, including federallyimposed excise tax, central value-addedtax and service tax together with stateimplementedsales tax and a tax leviedof capacity assigned to the trade is nowprovided by dedicated direct-call services,”the APL-Drewry report said. “Thetwo principal liner services are operatedby Maersk Sealand (more than 250,000TEUs of annualized slots are deployed inthe westbound direction) and the Indamexgrouping (APL, CMA CGM, Contshipand MacAndrews — SCI withdrew fromthe consortium in the first half of 2005),which provides almost 200,000 TEUswestbound.“A priority in this trade in recent yearshas been to reduce transit times, particularlyfor Indian exports, and for this reason, manyof the operators involved in the markethave cut back on the number of way-portIndia and China, head-to-headat municipal government level for goodsbrought into the city for consumption. Anational VAT system, due to be implementedin April 2005 with a standardrate of 20 percent (compared with existingtaxes of 25 to 30 percent) has beendelayed, with many states unwilling toproceed.• Comparatively weak domesticdemand means Indian companies cannotreadily achieve the scale of similarChinese enterprises. Indeed, a 2004 MorganStanley report estimates that India’sdomestic market, across a broad spread ofmanufactured consumption items, is only10 to 20 percent of China’s and that it willtake 10 to 15 years for the Indian marketto become as large as China’s is now, interms of per capita consumption.• Poor infrastructure, which has notkept pace with the level of economicgrowth, industrialization and urbanization.China’s recent investment in infrastructurehas been eight times that of Indiain absolute terms. In 2002 China’s totalcapital spend on electricity, construction,transportation, telecoms and real estatewas $260 billion (20 percent of GDP)compared to India’s $31 billion (6 percentof GDP). Only in telecoms has India madesignificant advances in recent years, withcosts falling by 60 to 80 percent over thelast five years.• Lower levels of FDI, and of capitalinvestment generally, mean that not onlyis productivity in India below that ofChina in most sectors, but the costs ofmany basic services are also higher — forexample, Indian electricity charges areabout double those in China, while railtransport costs are triple.

LOGISTICScalls scheduled in the Mediterraneanbasin. Partly, this is attributable to thegrowth in time-sensitive textile/garmentsand footwear cargoes moving from Indiato the U.S.”The report further said, “Despite India’sgrowing role in international trade and theincreased level of investment in its ports, asignificant proportion of India’s containertrade is still moved by feeder vessel to/fromhub ports such as Dubai, Salalah, Colombo,Port Tanjung Pelapas and Singapore. Partly,this is historical and stems from lineroperators’ use of ships deployed on themain east/west trades, such as that betweenEurope and the Far East, to link in marginalmarkets. However, direct-call mainlineservices to/from India (particularly themain ports of JNP and Chennai) are onthe rise and this will continue as overalltrading volumes pick up and direct linksbecome more economically viable thanfeeder/transshipment operations.”Roads And Rails. Highways and roadsare a major culprit for poor lead times. Thevast majority of roads are one or two lanesand they’re crowded with any and all typesof vehicles (including mammals).“Roads have not had a lot of successin terms of attracting FDI (foreign directinvestment),” Glenn said.Yet, there is hope on the horizon. Thegovernment is building a major pan-Indianhighway network connecting the nation’sbiggest cities — Calcutta in the east, NewDelhi in the northwest, Bombay in the west,and Chennai in the south.That project is about 85 percent complete,and Glenn said it signifies the government’sintent to follow through on infrastructureimprovements.Shantanu Dutta, a professor of marketingat the University of Southern CaliforniaMarshall School of Business, said the goldenquadrangle, as it’s called, is as significant aninfrastructure development as the <strong>American</strong>highway system built in the 1950s underDwight Eisenhower.It not only links India’s four biggest cities,and two of its biggest ports in Bombayand Chennai, but also 17 other major citieswith 3,625 miles of two-, four- and six-lanehighways where often single-lane roadsonce stood.An example of how the highway networkcan help lead the economic transformationof India can be found in Surat, a city in thestate of Gujarat that is heavily focused onthe diamond trade.Seven of every 10 diamonds worldwideare polished in India, Dutta said, and ruralcitizens are flocking to Surat from as faraway as Orissa, a state 900 miles to the east,More than anything, infrastructure upgrades are the key to India’s progress.for a chance to participate in the growingindustry.The APL-Drewry report notes that Indiais the world’s largest exporter of cut diamondsand is a significant participant inthe international gems and jewelry businessas a whole.India employs 750,000 to 1 million inthe diamond trade, fairly comparable to the1.5 to 2 million working in IT. Though ITjobs get much of the publicity, it is jobs indiamonds, and in auto parts and industrialequipment plants, that will make India themanufacturing giant analysts predict.“The government has invested in this roadbecause if they want to compete with China,they need to improve the infrastructure,”Dutta said.Meanwhile, the rail industry, which haslong been a public sector staple, is slowlyintegrating private investment. Last year’sbudget saw the approval of FDI in freightrail (not passenger rail), especially in relationto the movement of containers.Dutta said the rail system in India is ingood shape to accommodate growth infreight. Because of the paucity of soundroads, most freight moves on rail today,evidenced by 9 percent growth in 2004 and10 percent growth in 2005.And even though the government hasn’tadded to the system to the same extent ithas to the highway network, “there is a lotof slack in the system,” Dutta said. “It’s astate-run system, so there are inefficienciesthat can be improved.”What’s The Attraction? So exactlywhy does India hold so much promise,from the point of view of foreign shippersand investors?“What makes India attractive to potentialinvestors, in terms of setting up manufacturing,is you have a huge local market justbeginning to consume in the way more developedcountries have consumed before,”Glenn said.Between 2003 and 2005, vehicle saleshave risen 30 percent, PCs 65 percent, andcell phones 200 percent.“And those increases have been supportedby a small percent of the population,” hesaid.With a population of more than 1 billion,Glenn estimates conservatively that there are200 million households in India. Of those,130 million live on less than $1,500 a year,while another 50 million live on less than$4,000 annually.That means the remaining 20 millionhouseholds (or roughly 10 percent of thepopulation) are almost wholly responsiblefor driving up the volume of consumer goodssold. If that 10 percent’s spending powerincreases further, coupled with a modestrise in the consuming power of the other90 percent, the stakes can get quite high,Glenn argues.“So the growth has been in the top,maybe, 10 percent,” he said. “Now spreadthat through the rest of the population asthey become more upwardly mobile and itbecomes very attractive to an investor wantingto set up a manufacturing operation forboth export and domestic consumers. If youcan do that in conjunction with creating anexport market based on low-cost labor, nowyou have the best of both worlds.”And Glenn is not alone is seeing India asa retailer’s dream.“India is positioned as the leading destinationfor retail investment,” according toa report by Delhi-based firm Research andConsultancy OutSourcing Services. “Thisfollowed from the saturation in western retailmarkets and we find big western retailers14 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>

Your direct wavebetween the US Gulfand Southern AfricaJust as a wave takes the most direct route, so too doesGAL’s service between the US Gulf and Southern Africa.We sail straight between North America and SouthernAfrica. No extra stop-offs in Africa or Europe, so there’sno chance your shipment will miss a connecting vessel,no risk that a client will be kept waiting for freightstranded on the wrong side of the Atlantic.Our multi-purpose vessels sail 20 times a year, carryingcontainers, bulk and breakbulk cargo reliably and quickly.For more information, contact a GAL representative at877-GAL-SHIP, via email to gal@biehlco.com, or visit uson the web at www.galborg.com.GAL: Between the US Gulf and Southern Africa,we are the wave.©2005, GAL

LOGISTICSto foreign direct investment. Crucially, FDIwill become increasingly important for thenation’s various industrialization and infrastructuralimprovement programs.”“India is positioned as the leading destination for retail investment,” accordingto Delhi-based Research and Consultancy OutSourcing Services.like Wal-Mart and Tesco entering into theIndian market.”The report, Indian Retail Sector — AnOutlook (2005-2010), said India’s retailindustry accounts for 10 percent of its GDPand 8 percent of employment, which willcombine to reach $17 billion by 2010. Thereport said that cities are due to be hit withan influx of 300 new malls, 1,500 supermarketsand 325 department stores in thenext few years.“A shopping revolution is ushering inIndia where a large population between theages of 20 and 34 in the urban regions isboosting demand by 11.1 percent in 2004-2005,” the report said. “This has resultedin huge international retail investment anda more liberal FDI.”The APL-Drewry report, meanwhile, saidthat loosening of restrictions to date hasbeen focused mainly in giftware, durablesand light manufacturing sectors.“However, the heavy engineering,transportation, so-called ‘metal bashing’and chemicals industries remain largely inthe public domain,” the report says. “Theliberalized environment has also resulted inmany multinational companies establishingassembly/manufacturing bases in India.This has been especially true of the carmanufacturers, with Ford, Fiat, Mercedes-Benz and Toyota all producing cars in thecountry and keen to capitalize on the salesopportunities presented by the nation’s risingmiddle class.”A Question Of Pace. For Glenn, thequestion is not will India become a majorglobal manufacturing and logistics hub, butwhen. Or as he puts it, “At what pace?”“It’s an extremely fragmented democracyin terms of any one party having any actualpower,” he said. “You have this coalition16 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>government with differing views on what todo, and so progress is sometimes painfullyslow. So the question is, at what pace dothese reforms take place.”The populace is, however, aware of theneed for India to take advantage of the opportunitythat awaits, Glenn added. “The needfor economic reform is deeply ingrained inthe population here.”But there’s the politics, don’t forget.“No one party can win a clear majorityin the state elections and coalitions are anormal political way of life in India, butit makes for difficult decision making andfor highly compromised legislation andgenerally weak laws and statutes,” the APL-Drewry report said.In fact, in order for Congress to oustBJP, it had to rely on a coalition withthe country’s Communist party to secureenough votes. The Communist party, whichis tight with urban labor unions, is fightingdegradation of current labor laws, a policythat might dissuade foreign investment inthe country.“On the regulatory front, there are signsthat progress is being made, with one of themost recent and significant developmentsbeing the repeal of a six-year rule calledPress Note 18, which was perceived asaffecting India’s overall attractiveness toforeign investors,” the APL-Drewry reportsaid. “Press Note 18 stipulated that foreignparticipants in joint venture operations hadto seek government approval before settingup rival businesses in the same industry. Itmeans that such developments, includingnew collaborations, will now be based oncommercial considerations and contractualagreements.“This move is important because it sendsout the right message that the governmentis keen to reduce the number of obstaclesU.S.-India Relations. The relationshipbetween the United States and India hasbeen strained at times, with India leaningon its neighbor (and former U.S. enemy)Russia for support in the region. Similarly,India has not always been impressed by U.S.support for Pakistan.But business opportunities sometimestrump politics, and that seems to be thecase these days.“Clearly the Bush administration is veryfavorably deposed to India,” Glenn said.“Most people see India as a rising powerthat is not aligned with anybody. The numberof countries sending trade delegationsis astounding.”U.S. delegations aren’t the only onescoming through Bombay and Delhi.“Japanese delegations have quietly beenvisiting India,” USC’s Dutta said.The reason? Japan wants to diversify itssourcing options. Call it the “not puttingall your eggs in China” theory. And U.S.-Indian economic relations are growing forsimilar reasons.“I think the powers that be see India asa way to manage China,” Dutta said. “Ofcourse, China is doing its best to make surethe U.S. doesn’t get too close to India. Butthis is the best it’s ever been between theU.S. and India, and I think it will continueno what matter the administration.”The United States is by far the biggestconsumer of Indian exports, more thandouble the second biggest (United ArabEmirates), the APL-Drewry report said. TheUnited States is also the largest exporter ofgoods to India.Right Time? So the next question is, ofcourse, when to make the plunge?“I would say to closely watch the pace ofeconomic reform, and of FDI,” Glenn said.“The greatest gains are to those who getin early. Everyone is sort of dipping theirtoes in the pool right now. The countriesthat make that plunge early will realize thegreatest benefits.”Rachel Meyer, a business analyst forHoover’s, was even more emphatic.“The time is now,” she said. In earlyDecember, “Microsoft announced an investmentof more than $1 billion to go to Indiaover the next four years, and Intel announceda $250 million venture fund for the country.Red Hat also bought out its partner in itsIndian joint venture.“Waiting too long might end up beingmore costly, as wages are escalating rapidly

LOGISTICSfor workers in India, primarily due to the informationtechnology and business processoutsourcing boom, as employees move fromone job to another to obtain higher salariesor better benefits.”But the outlook for India only gets betterfor those who invest early, Meyer said.“India’s investment potential will continueto grow for many years,” she said.“Its rising middle class and young, highlyeducated population is buying at an acceleratingpace. We’ve also seen significantgovernment investment in the country’sinfrastructure, such as power plants, roads,ports, airports, irrigation and water supplies,and telecommunications.”Content With 2nd? “It’s clear Indiawill be a follower to China,” said UdayKarmarkar, a professor of decisions, operationsand technology management atUCLA’s Anderson School of Management.“There was a time they could have followedKorea as the next big manufacturer, but thatopportunity was missed.”Karmarkar said that failure to take advantagestill haunts the country today. He saidIndia’s manufacturing sector slowly suffocatedduring Britain’s colonization, whichended in 1947 when India gained independenceand partitioned with Pakistan.Despite its clear place in line behindChina, Karmarkar said India can transitionsmoothly to a manufacturing-basedeconomy. After all, its long produced textiles— dungarees and khakis both originatedin India.“China has grabbed the lead and theywill be impossible to catch,” he said. “Theyare amazingly good at manufacturing.They make everyone else look slow. So theproblem for India will be that it’s the secondchoice. There are clear thinkers who knowwhat’s going on. Unfortunately, when youmake progress, it doesn’t happen uniformly.When you invest $5 in something, otherswonder why they don’t have $5 themselves.As (former Prime Minister) Indira Gandhisaid, ‘Progress is not in a straight line.’ ”Karmarkar said India only needs foreigninvestment to turn it into a global manufacturinggiant.“India is quite well-positioned to exportto the Middle East and Europe,” he said.“There’s not a shortage of capability. It’sjust a matter of investment.”Chemicals, pharmaceuticals, auto partsand apparel are the markets India is likelyto quickly find success in the global market,Karmarkar said, as well as microchip andindustrial equipment manufacturing.Dutta said India realizes it is fighting forsecond place in the global pecking order, butthat that’s a pretty good position to be in.18 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>“There’s a reality at this point in time,”Dutta said. “You look at the trajectoryChina has been on, and you see that theyhave had at least a 15-year lead in openingtheir country to investment. But there arestill specialized electronic components thatare more cost-effective here than in China.There are manufacturing niche markets thatrequire technological skills. That said, Indiawon’t overtake China in terms of mass-scalemanufacturing.”But as India relaxes its policies on foreigninvestment and grapples with how to makelabor laws less daunting for investors abroad,things are changing.From Ag To Manufacturing. Duttasaid the diamond trade in Surat, and textilesmanufacturing in other smaller cities, providea keyhole through which the future ofthe economy can be glimpsed. Industry willset up in smaller cities along the highwaynetwork, near large rural populations eagerto work, and away from cities, where labormovements are strong.“In India, the costsassociated with movingfreight are someof the highest in the worldat 11 percent of the landedcost of cargo. Thiscompares with a globalaverage of just 6 percent.”He also expects to see India followChina’s lead in developing special exportzones, where businesses are not governedby labor laws.“These people from the villages come toSurat and earn five times what they are makingback home,” he said. “Even (technologyofficials) recognize employment generationwill come from these manufacturing sectors,not IT.”Karmarkar said the remnants of the feudalland ownership system first implementedafter independence — where no landownercould own more than 40 acres — havecreated a dependence on agriculture foremployment, without ever being terriblyefficient from a bottom line standpoint.He said the country’s output of agricultureaccounts for only 20 percent of GDP,yet 60 percent of employment in India istied to agriculture. India’s IT employees,for example, account for only 10 percentof the country’s workforce.“The county boys want to go to the city— that’s the same everywhere,” Karmarkarsaid. “If you’re a farmer, you’re not doingwell. A lot of people are on the brink ofstarvation. There’s a large young populationmoving to the cities and bringing withit problems of their own. The real solutionis to move people out of agriculture intomanufacturing.”Again, it’s a question of tapping into adifferent demographic than the people likelyto work in IT or other services.“Farm boys can work in factories,” Karmarkarsaid. “That’s sort of the <strong>American</strong>model. But they can’t move to softwaredesign. Right now, we lack those entrepreneurslike John Deere.”Yet India still has enough skilled employeesto lure sophisticated manufacturing awayfrom China in some markets.“India is still viewed as a preferred globaloffshore location for information technologyand business process outsourcing. Butit is also moving beyond call-center workand basic software development to moresophisticated labor, such as semiconductordesign and manufacturing,” Hoover’sMeyer said. “Skills in precision engineeringalso make the auto components and medicalinstruments manufacturing industries areasto look to for further growth.”Problem Areas. Along with transportationinfrastructure comes the problemof power. Like China, India is becominga consumer of energy to rival the UnitedStates, and the three nations are racing tosecure energy sources worldwide.Dutta said Indian industrial facilities,like its well-chronicled IT campuses inBangalore, often rely on their own powergeneration to get around frequent blackoutsin the government-run grid.Yet it’s expensive, and adds to the costof making goods if power to run plants ismore expensive.India is tying up long-term natural gasagreements with Russia and is likely todevelop more nuclear power plants.“I’m less hopeful on that system than Iam on infrastructure,” Dutta said. “Maybein another 10 years.”But to Glenn, time is the main problem.“The only real risk I see is that economicreforms get bogged down in politics,” hesaid. “Political realities could affect the paceof reform. I wouldn’t rate that risk as veryhigh, but then again, politics is an endlessgame of compromise. Beyond that, I don’tview anything as even remotely likely tointerrupt or reverse the progress that’s beenmade so far.”

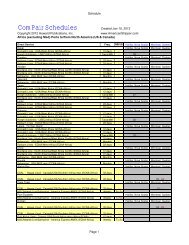

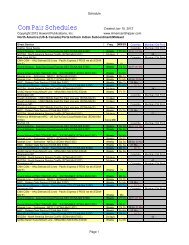

LOGISTICSIndia’s formulaLogistics companies should understand contextof nation’s boom before diving into the market.20 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>BY DEEP R. PAREKHThere is an Indian saying that bathingin the holy River Ganges is never thesame experience twice — becauseyou’ve changed and the river has changedeach time you visit. The same can be saidof the logistics industry and the players inIndia with each passing year of liberalizationand the “boom” years.India’s boom is still in its infancy. It isimportant to understand its context in somedepth before addressing the scope of the truepotential of India’s economic future and,more to the point, how its economic potentialand growth pattern crosses paths withthe strategy that logistics service providers(LSPs) should consider when thinking aboutthe “India formula.”An October 1997 issue of the Times ofIndia quoted K. Rameshwaram, then directorof the economic coordination unit forIndia’s Ministry of External Affairs: “Theseventh-largest and second-most-populouscountry in the world, India has long beenconsidered a country of unrealized potential.A new spirit of economic freedom is nowstirring in the country, bringing sweepingchanges in its wake. A series of ambitiouseconomic reforms aimed at deregulating theeconomy and stimulating foreign investmenthas moved India firmly into the front ranks ofthe rapidly growing Asia Pacific region, andunleashed the latent strengths of a complexand rapidly changing nation.”Almost 10 years later, that statement hasbecome vibrantly true and almost understatedwhen we consider the growth thathas been already realized, and the expansionthat lies ahead.More recently, the McKinsey Quarterlywrote, “the rise of the IT and biotechnologysectors is a great story, but they alonearen’t enough to create the kinds of employmentopportunities that will bring broadereconomic and social progress.” Whatholds India back is lack of public health;inadequate infrastructure; needed modernizationof maritime ports, roads, airportsand railways; and substantially reduced,yet still-excessive government regulatoryintervention. The financial system is alsoundergoing a metamorphosis, as are relateditems such as lending, banking, and corporategovernance.Raghuram G. Rajan, chief economist ofthe International Monetary Fund, said, “theeconomy isn’t as open to foreign goods andservices, labor, or knowledge as it should be.That could keep India from becoming moreof a player in the global economy.”When we consider the India formula, wemust define the variables of the formula.Amongst the major variables we recommendto consider are:• General trade increases.• Specific industry hotspots.• Logistics trends in India.• Governmental factors.• LSP’s business strategy.This article will present each of thesevariables in more detail, so as to understandbetter the lay of the land, some critical successfactors, as well as what to consider whendeciding when, how, and where to get intothe logistics industry in India.General trade increaseIt is important to ground ourselves withsome factual statistics about the developmentof India, its recent boom and its correctcontext.BRIC Context. Goldman Sachs issued aglobal economics paper in late 2003, whichChinaIndiaRussiaBrazilUKItalyItalyoutlined some of the trends they are seeingfor four major global economies — Brazil,Russia, India, and China — together calledthe BRIC economies. In this report, theysummarized the following:• Over the next 50 years, the BRICeconomies could become a much largerforce in the world economy.• In less than 40 years, the BRIC economiestogether could be larger than the G6(Italy, France, Germany, Japan, UnitedKingdom, United States) in dollar terms,and by 2025 could account for half thesize of the G6.• The shift in GDP relative to the G6takes place steadily over the period, but ismost dramatic in the first 30 years. Growthfor the BRICs is likely to significantly slowtoward the end of the period, with only Indiaseeing growth rates significantly above 3percent by 2050.• As early as 2009, the annual increase inU.S. dollar spending from the BRICs couldbe greater than that from the G6, and morethan twice as much in dollar terms as in2003. By 2025 the annual increase in U.S.dollar spending from the BRICs could betwice that of the G6 and four times higherby 2050.• The relative importance of the BRICsas an engine of new demand growth andspending power may come more dramaticallyand quickly than expected. Highergrowth in these economies could offset theimpact of the graying populations and slowergrowth in the advanced economies.• Higher growth may lead to higherreturns and increased demand for capital.The weight of the BRICs in investmentportfolios could sharply rise. Capital flowsmight move further in their favor, promptingmajor currency realignments.• Rising incomes may also see theseOvertaking the G6:When BRICs’ GDP would exceed G6Germany Japan USFranceGermanyBRICs*cars indicate when BRICs $GDP exceeds $GDP in the G62000 2005 2010 2015 2020 2025 2030 2035 2040 2045 2050Source: Goldman Sachs Report.FranceItalyGermanyJapanFranceGermanyG6

LOGISTICSeconomies move through the“sweet spot” of growth for differentkinds of products, as localspending patterns change. Thiscould be an important determinantof demand and pricing patterns fora range of commodities.• As today’s advanced economiesbecome a shrinking part ofthe world economy, the accompanyingshifts in spending couldprovide significant opportunitiesfor global companies. Beinginvested in and involved in theright markets — particularly theright emerging markets — may become anincreasingly important strategic choice.• The list of the world’s 10 largest economiesmay look quite different in 2050. Thelargest economies may no longer be the richest(by income per capita), making strategicchoices for firms more complex.Looking Inwards. India’s economyranks 10th in the world today. Varioussources predict it will rank amongst thetop five by 2025. We are seeing India inthe midst of some fundamental shifts inindustry and service trends.Between 1990 and 2003, McKinsey &Co.’s research group showed the GDP increasedfrom $272 billion to $550 billion,representing a Compound Annual GrowthRate (CAGR) of 5.4 percent. During thistime, the share of agriculture as part of theGDP contributor fell from 30 percent to 22percent, most of that being shifted to theservices sector, which rose as a contributorby 8 percent. The CAGR of services hasbeen almost 7 percent, a dramatic growthrate. Manufacturing, on the other hand, hasseen a 5.4 percent CAGR, but still representsonly 15 percent of India’s GDP. We viewthis as an immense source of potential forlogistics service providers, as the manufacturingbase and share of GDP goes up, asit is bound to.Employment Structure. The employmentpicture, however, is interestinglyinverted. Whereas only 22 percent of theGDP comes from agriculture, it employedabout 67 percent of the people in 2004.Services, meanwhile, employed only 21percent of the people, and manufacturingonly 12 percent. Further, we see that about65 percent of the GDP is derived from privateconsumption, about 13 percent from publicconsumption, and 22 percent from investment.It’s important to keep these figuresin mind when we consider the structure andsegmentation of the population’s literacystatistics and age-group statistics, to seewhy we predict that the boom is a long wayfrom being over, just with the sheer mass22 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>Largest economies in 2050GDP (2003 $trillions)ChinaUnited StatesIndiaJapanBrazilRussiaUnited KingdomGermanyFranceItaly0 5 10 15 20 25 30 35 40 45 50Source: Goldman Sachs BRICs Model Projections.and magnitude of the population and theresources available to it.Business Climate. McKinsey’s 2005study also showed that the business climateas a consumer market is steadily increasing.Some alarmingly positive statistics haveshown that “since 1996, the number of airlinepassengers has increased six-fold.” India isprojected to be the second-largest globalmobile telephone market by as early as <strong>2006</strong>,and a top 15 global market for airlines thisyear, with 47 million passengers in 2004.The automobile market is projected to be thefifth-largest by 2015, and the second-largestmotorcycle market this year. In addition, wesee that since economic liberalization in1991, the number of players in the telecomindustry has increased from two to more than15, those in the auto industry from three tomore than 12, and those in the domesticairline industry from one to eight.Standards of Living. Since becomingan independent country in 1947, we seedramatic strides of progress in the standardsof living, urbanism and education,all of which lead to economic growth. Lifeexpectancy of an average Indian has nearlydoubled, and infant mortality rates havehalved. Adult literacy rates have increasedfrom 58 percent to 68 percent for men, andfrom 31 percent to 45 percent for women(still low, but growing nonetheless). Thenumber of Indians living below the povertyline has reduced from 55 percent in 1973 to26 percent in 2000. Whereas these might notseem overtly positive figures, the importantaspect to consider is the trend, which is verypositive, and not showing signs of reducing.Companies investing in India need to keepthese statistics in mind, as they considerstaffing, overheads, and labor considerationsfor expansion.Infrastructure. Many executives ofglobal companies consider India’s inadequateinfrastructure as its largest constrainton growth. Although fixing this problem willnot be a short-term initiative, the work hasbegun, and we are seeing signs of progressacross the country. Various sources such asthe CIA World Factbook, IndianRailways, Ministry of Power,National Highways Authorityof India and the Planning Commissionof India agree with thefollowing numbers: Road densityin 2002 (kilometers of paved roadper 1,000 square kilometers ofland) for India was 441, comparedwith a maximum of 1,539 forthe United Kingdom, and 11 forBrazil. Railroad density in 2002(kilometers of track per 1,000square kilometers of land) was 21,as opposed to a high of 127 forGermany, and a low of four for Brazil. Thereis also a gap between the nation’s demandand supply of energy, which is growing.Geographic Spread of Wealth. If wedivide the country into two categories, thewealthiest states and the poorest states, we seethat the population is fairly evenly divided betweenthe two. The wealthiest states, however,contribute about $720 per capita, versus $330per capita by the poorest states. The CAGRfor the wealthiest states is about 4.7 percentcompared to 1.7 percent in the poorest states.The wealthiest states comprise the southernhalf of India, the northwest frontier, and afew scattered states in the east.Population Segmentation. We viewIndia not as one homogenous population,but as four distinct Indias within the country,each a segment of its own. At the top andmost affluent is what we call “InternationalIndia,” which comprises about 1 millionhouseholds (about 4-5 million people).International India typically owns a one- ortwo-bedroom house, with a color TV, mobilephones, refrigerator, washing machine, anda mid- to high-priced car. People belongingto this stratum typically include businesspeoplein small to midsized enterprises,corporate or select government employees,and wealthy agriculturalists.The second rung is “Aspiring India,”which is a segment of about 40 millionhouseholds (about 160 million to 200 millionpeople), representing typically salaried employees,services/outsourcing employees,and shopkeepers. The typical assets ownedby this stratum include a color TV, refrigerator,telephone, a scooter or motorcycle, orperhaps a low-end car.Then comes the “Emerging India,” whichcomprises the largest population belt ofabout 110 million households (about 440million to 550 million people), who areat the lower-end of the services industry,such as wait-persons in restaurants, maids,drivers, shopkeepers and most farmers.They typically have a bicycle, radio, and ablack & white TV.The lowest of the strata are the “Poor

If Waiting is Not an Option...MOL Delivers.Tired of playing the U.S. West Coast waiting game? Stop the madness! BookMOL's Pacific Southwest Express Service (PSX) for a clear channel betweenvessel and landside operations. The PSX expedites cargo flow by making Oaklandthe first inbound port of call, berthing at one of MOL's high-tech TraPac terminals,and offering dedicated double-stack rail service. Put reliability back into yourdelivery schedule with priority docking, rapid throughput and a fast track to all keyU.S. markets. If waiting isn't an option, call MOL –– the ocean carrier that delivers!Atlanta 404-763-0111 ● Chicago 630-592-7300 ● Long Beach 562-983-6200Edison 732-512-5200 ● Seattle 206-444-6900 ● 1(800) OK GATORwww.MOLpower.com

LOGISTICSIndia,” which is about the same size as theAspiring India (about 160 million to 200million people), and comprises subsistencefarmers and their workstaff, owning assetsof value not much more than a watch.Whereas the top International Indiais where there is tremendous purchasingpower, it should be viewed in a constrainedmanner, as simply a great market forprestige products andglobal standards, butnot a scale or volumemarket. Companiesentering India to caterto this stratum aremissing the point, albeitmaking money.The retail industryshould be catering tothe Aspiring India andthe Emerging India,with the former beingthe immediatepriority. The first 160 million to 200 millionpeople in Aspiring India will gain theplayers in the retail industry their riches,with which they can fund the developmentand advancement of the Emerging India.To give some sense to the size of AspiringIndia, the U.S. population is about 280 millionpeople, and the Brazilian population isabout 170 million people.To give some idea of the size of success,McKinsey & Co. researched severalindustries with respect to market size andmarket share between 1992 and 2004. Thefindings were as follows: The breakfastcereals market increased from $2 millionto $25 million, and multinationalsgained market share from 0 percent to48 percent. For potato chips, the marketsize grew from $6 million to $35 million,with multinational share increasing from0 percent to 63 percent. Washing machinesfaced a similar situation, where marketsize rose from $40 million to $570 million,and share increased from 2 percentto 49 percent. In the TV industry, marketsize grew five-fold, from $630 million to$3.03 billion, and multinational share grewfrom 3 percent to 51 percent. Whereasthe growth numbers are nothing less thanspectacular, it is important to note that eventhe absolute market size in 2004 in eachof these product lines is just a fraction ofwhat it is in the western countries, or evenin China for that matter. This leads us tobelieve that we have not even scratchedthe surface yet, in terms of growing themarket size to its true potential.Retail Market. India has the potentialto be a tremendous retail market. With 70percent of the Indian population being lessthan 36 years old, and half of these below 18,24 AMERICAN SHIPPER: FEBRUARY <strong>2006</strong>With 70 percent of theIndian population beingless than 36 years old,and half of those below 18,the potential to sell to theseup-and-coming youngstersis almost incredible.the potential to sell to these up-and-comingyoungsters is almost incredible. Whereasthey might be rooted in their traditionsand customs, they are quite aware of theWest, with a growing desire to purchasethe products that their counterparts in theoccidental countries have.We see this population having growingincomes but yet-limited budgets, which havea great impact on theirmindset and prioritiesin the product selectionand purchaseprocess. Whereaspeople in the AspiringIndia stratum stillspend about half theirmonthly budgets ondaily necessities, wefind that disposableincome is increasing,stimulating consumptiontrends. The mentalityof Indians is to ensure a better futurefor their children, so the first priority isto spend disposable income on categoriesof products which benefit their children’shealth and well-being, and education.Hence, such industries related to these areashave shown strong growth.Industry hotspotsNow that we have established how thereis a significant unexploited and yet-unreachedmarket inIndia, let’s turn towhat industry areasare the hotspots, sothat logistics serviceproviders can evaluatehow to enter or expandin the country withmaximum impact andbenefit. We view fourindustry verticals asthe hotspots for LSPsto be targeting as clientbases, and investingin these so as toride the wave of theincreasing popularity for using India as amanufacturing base:• Automotive.• Specialty chemicals.• Electrical and electronic products.• Retail.We see these as four verticals that arerapidly growing and will continue to do sofor the foreseeable future.According to McKinsey Global Insightresearch, the manufacturing share of GDPper capita (adjusted for purchasing powerparity) in 2004 ranged from 37 percent forThailand, 36 percent for China, 33 percent“Greater integration of rail,road and water transportsystems is requiredand is vital for the eastto have a competitive edgein the pan-Indian context.”for Malaysia, 18 percent for Mexico, andonly 16 percent for India (only about halfthat of China and Thailand).Manufacturing exports, as a percent ofGDP in 2004, was also quite varied, withMalaysia leading the pack at 93 percent,followed by Thailand at 54 percent, Chinaat 30 percent, Mexico at 27 percent andIndia lagging at only 8 percent. Granted,this is partly because of the significant GDPcontribution of India’s services industry,which is not as strong in the other Asiancountries or Mexico. Yet, showing that thereis a significant potential for India to be aglobal player of some consequence in themanufacturing sector.One of the common complaints we hearfrom manufacturing companies is that, eventhough they wish to go to India, viewinglabor costs as attractive, they find thatseveral of the local suppliers cannot meetthe scale requirements that the companiesneed in order to have a desirable return oninvestment. One of the major reasons forthis is that India has never known suchscale, due to the fragmented nature of itsmanufacturing base. Because the road, rail,and port infrastructure is not adequate for theneeds of serving the subcontinent as a whole,companies had several manufacturing andsupply bases scattered around the nation asa viable alternative to consolidated regionalor national manufacturing and distribution.Due to this factor, suppliers were neverincentivized to scaleup beyond a certainlocal or sub-regionalrequirement. Hence,lack of availabilityof scale is one of thebiggest issues thatpose a roadblock inconsidering India tobe a manufacturingbase.We view China orother Asian countriesas an excellent manufacturingbase oncethe technology andprocess has been well defined and established(Scale-Oriented Manufacturing orSOM), whereas we view India as adding asignificant element from a process designand innovation perspective (Design-OrientedManufacturing or DOM). Indianengineers are by nature “tinkerers” (and wemean this in a good way). They are orientedtowards constant “upgrades” of the processso as to make the operation more efficient.This nature is deep-rooted in the engineersfrom a perspective of scarcity and expensefor resources, and the desire to get the mostout of what little has been available. LSPsA.K. Chandrachairman,Kolkata Port Trust