Pirate Busters - American Shipper

Pirate Busters - American Shipper

Pirate Busters - American Shipper

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

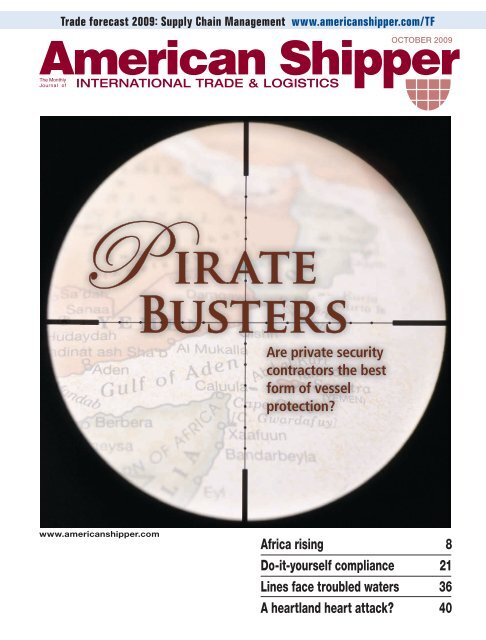

Trade forecast 2009: Supply Chain Management www.americanshipper.com/TF<br />

OCTOBER 2009<br />

P irate<br />

<strong>Busters</strong><br />

Are private security<br />

contractors the best<br />

form of vessel<br />

protection?<br />

www.americanshipper.com<br />

Africa rising 8<br />

Do-it-yourself compliance 21<br />

Lines face troubled waters 36<br />

A heartland heart attack? 40

SO HOW DID THEY GET THERE?<br />

UNUSUAL PROJECT CARGO CAN BE A REAL TRANSPORTATION CHALLENGE<br />

– BUT NOT FOR ACL. WE MEET THE CHALLENGE EVERY TIME WITH THE RIGHT<br />

VESSELS, EQUIPMENT AND EXPERIENCED PROFESSIONALS. THESE 72' LONG<br />

WINDMILL WINGS WERE DRIVEN DIRECTLY ONTO ACL’S RORO/CONTAINERSHIP<br />

FOR THE OCEAN VOYAGE. WE HANDLED ALL OF THE INLAND TRANSIT DETAILS<br />

INCLUDING SPECIAL OVER-THE-ROAD PERMITS, AND DELIVERED THE WINGS<br />

SAFELY TO THEIR FINAL DESTINATION.<br />

FOR CONTAINERS AND COMPLEX RORO SHIPMENTS, CALL ACL. WE ALWAYS<br />

OFFER EASY SOLUTIONS TO DIFFICULT TRANSPORT PROBLEMS.<br />

(800) ACL-1235<br />

www.ACLcargo.com<br />

RORO and Container Service to Europe, West Africa, Mediterranean and The World.

Vol. 51, No. 10<br />

October 2009<br />

r+<br />

<strong>American</strong> <strong>Shipper</strong><br />

TRADE FORECAST 2009<br />

Positioning supply chain for recovery<br />

<strong>American</strong> <strong>Shipper</strong>’s trade forecast program<br />

continues with research from TranSystems.<br />

An executive summary appears on page 6.<br />

To read the full report — and all Trade<br />

Forecast 2009 research reports — go to:<br />

www.<strong>American</strong><strong>Shipper</strong>.com/TF<br />

LOGISTICS 8<br />

Nurturing South African ties 12<br />

Safmarine serves its long-time base.<br />

Choice assignment 16<br />

Hitachi unit relies on critical parts 3PL.<br />

Giving degrees of freedom 17<br />

Deep’s temperature is at a boil.<br />

<strong>Shipper</strong>s’ IT 18<br />

Technology is the asset.<br />

FORWARDING/NVOs 20<br />

It’s in the import data.<br />

Do-it-yourself compliance 21<br />

U.S. Customs, industry bullish on BSA trial.<br />

TRANSPORT/AIR 24<br />

Battle over batteries.<br />

Security flight plan 26<br />

COAC, DHS tackle redundant air regs.<br />

TRANSPORT/OCEAN 28<br />

Rate increases seem like fuzzy math.<br />

TRANSPORT/INLAND 40<br />

In the depths 42<br />

Hydrokinetic power plants, barges coexist.<br />

PORTS 44<br />

Floating an intermodal option<br />

Trucking alternative to Oakland, Stockton.<br />

DEPARTMENTS<br />

Comments & Letters 2<br />

LETTER: ‘Reliability issue is always No. 1’<br />

... Time for a little saber rattling.<br />

The Strategic View 17<br />

<strong>Shipper</strong>s’ Case Law 45<br />

The fi sh (oil) that got away.<br />

Corporate Appointments 46<br />

On Second Thought ... 47<br />

How bad is it, really?<br />

Editorial 48<br />

Vulnerable middle.<br />

On the Cover<br />

<strong>Pirate</strong> busters 30<br />

<strong>Pirate</strong> attacks on commercial vessels<br />

in the Gulf of Aden and near Somalia<br />

are expected to spike again at the end<br />

of the monsoon season. Some vessel operators<br />

are turning to private security contractors.<br />

But is that the best form of protection?<br />

+<br />

<strong>American</strong> <strong>Shipper</strong> exclusive Web content<br />

Commentary Study needed better balance.<br />

Rent-a-navy Yemen offers protection — for a fee.<br />

Beware of dog! SEAL security goes to dogs.<br />

Piracy sparks insurance plunder Premiums<br />

rise due to increased attacks, security requirements.<br />

Africa rising 8<br />

U.S. trade with Sub-Sahara Africa has increased<br />

sharply this decade, with imports quadrupling<br />

since 2001 and exports doubling in the same period.<br />

U.S. trade has been bolstered by the African Growth<br />

and Opportunity Act, which benefits about<br />

40 nations. But Africa has taken a hit in the global<br />

economic crisis — how severe and long-lasting<br />

an impact is anyone’s guess.<br />

Troubled waters 36<br />

From Haifa to Valparaiso to Hamburg, some<br />

of the most famous names in ocean shipping<br />

are severely teetering, as Zim, CSAV and Hapag-Lloyd<br />

fight for their lives. As these multibillion-dollar<br />

brands have swiftly been placed in peril, their<br />

shareholders are being asked to retain faith<br />

in their business models.<br />

Avoiding a heartland heart attack 40<br />

The U.S. inland watwerays system comprises vital<br />

commercial arteries for some of the country’s<br />

biggest shippers by volume. However, locks<br />

and dams throughout the 12,000-mile system —<br />

many built in the 1930s and 1950s — are in desperate<br />

need of modernizing. “It’s a ticking time bomb,”<br />

warns one industry official.<br />

<strong>American</strong> <strong>Shipper</strong>+<br />

content available at www.<strong>American</strong><strong>Shipper</strong>.com/web<br />

AMERICAN SHIPPER: OCTOBER 2009 1

‘Reliability issue is always No. 1’<br />

I read with interest the letter to the editor, “Who gets the booking when rate is the<br />

same?” (September <strong>American</strong> <strong>Shipper</strong>, page 6, by Peter Spiller, president, Florida<br />

Shipowners Group Inc.). While I agree that personal knowledge of the individual with<br />

whom you are dealing is important, numerous market surveys over<br />

the years have revealed that there are basically five reasons why<br />

people chose carriers they do (assuming that the freight rates are<br />

relatively comparable):<br />

• Reliability. Do exactly what you say you’ll do. If you say<br />

it’s a 12-day transit time, do it in 12 days. If you say 25 spaces<br />

per vessel, give 25 spaces. <strong>Shipper</strong>s can plan with reliable services<br />

and that is paramount to selecting a carrier.<br />

• Total transit time. It’s nice to know your ship goes from<br />

point A to point B in five days, but my cargo moves from point X to point A, B, and<br />

Z, and in there are port/terminal delays, etc. So what is the actual total transit time<br />

from the real origin to the real destination?<br />

• Equipment. Give me the number of clean, serviceable pieces of equipment<br />

that I need, when and where I need them.<br />

• Customer Service. Give me access to a single point of contact where I can<br />

get all questions and problems resolved (either by phone or Internet); answers to all<br />

of my service questions quickly and correctly; and respond to and resolve all my<br />

problems quickly without repeating them.<br />

• Documentation. Give me accurate and timely finalized documentation.<br />

The reliability issue is always No. 1 in any market survey on “how we chose a carrier.”<br />

The other four reasons will change in rank from time to time, but they remain<br />

the same. If you are the shipper’s closest friend and have competitive rates, but have<br />

an unreliable service, you won’t keep the freight for long.<br />

At Sea-Land, I headed the centralization of customer service and documentation<br />

in the United States from 1992 to 1996 when we reduced those functions from 13<br />

locations to Dallas. We initially took a lot of flack, especially from freight forwarders<br />

who said “I used to be able to talk to Sally in your X office and get answers<br />

immediately. Now I call someplace in Texas and get someone who I don’t know and<br />

who doesn’t know me.” Over time, better service — we went from a 5 percent error<br />

rate in documentation to less than 1 percent and got our bills of lading back to the<br />

customers in less than 24 hours 96 percent of the time — softened those responses.<br />

However, when Maersk Line benchmarked us and tried to centralize initially in<br />

1997, the carrier got so much flack that it backed away from the concept for years.<br />

Now Maersk does it all from India and the error factors are terrible, but the costs are<br />

so attractive that the carrier can live with it. By the way, the Sea-Land project in the<br />

United States saved the company $21 million a year after about four years in place.<br />

Gary Ferrulli<br />

principal, Global Logistics & Transport Consulting LLC,<br />

Chandler, Ariz.<br />

Time for a little saber rattling<br />

CMA CGM founder and Chairman Jacques Saadé’s call for government protection<br />

of Europe’s three major container lines in early September whipped up a bit of<br />

controversy.<br />

Saadé, speaking at a meeting of the French employers’ federation Medef, blasted<br />

regulations on liner carriers that went into effect in 2008, preventing them from meeting<br />

to collectively decide rates and capacity. He said the decision to end an antitrust<br />

2 AMERICAN SHIPPER: OCTOBER 2009<br />

CEO<br />

Publisher<br />

Editorial<br />

Sales<br />

Hayes H. Howard<br />

Jacksonville (904) 355-8217<br />

Jim Blaeser<br />

New York (212) 464-8394<br />

Christopher Gillis, Editor<br />

Washington (202) 470-6082<br />

Gary G. Burrows, Managing Editor<br />

Jacksonville (904) 355-2601, ext. 14<br />

Eric Kulisch, Associate Editor<br />

Washington (703) 723-2833<br />

Eric Johnson, Associate Editor<br />

New Delhi (U.S.) (562) 366-4384<br />

Chris Dupin, Associate Editor<br />

New York (201) 984-3108<br />

Stephen Fontanella, Sales Manager<br />

(978) 807-4384<br />

Advertising Melodie Crites, Adv. Prod. Manager<br />

Production Jacksonville (904) 355-2601, ext. 13<br />

Art<br />

Joan Main, Art Director<br />

Jacksonville (904) 355-2601, ext. 15<br />

Shipping Francis Phillips<br />

Research London +44 (0) 1252 545333<br />

Jacksonville (904) 355-2601, ext. 23<br />

Stephen B. Wynn<br />

Randall Register<br />

Kim Williams<br />

Robert King<br />

Edward Howard<br />

Jordan E. Yates<br />

Circulation Karyl DeSousa (904) 355-2601, ext. 11<br />

Kerry Cowart<br />

Jacksonville (904) 355-2601, ext. 10<br />

Web/Tech Kathy Houser<br />

Support Jacksonville (904) 355-2601, ext. 20<br />

e-mail <strong>American</strong> <strong>Shipper</strong> staff from<br />

www.<strong>American</strong><strong>Shipper</strong>.com/<br />

company/contactus<br />

Vol. 51 No. 10 October 2009<br />

<strong>American</strong> <strong>Shipper</strong> is published monthly. Published<br />

on the 15th of each preceding month by Howard<br />

Publications, Inc., 300 W. Adams St., Suite 600, P.O. Box<br />

4728, Jacksonville, Florida 32201. Periodical postage<br />

paid at Jacksonville, Florida, and additional mailing<br />

offices. Subscriptions $36 per year for 12 issues; $180<br />

for foreign air mail. Telephone (904) 355-2601.<br />

<strong>American</strong> <strong>Shipper</strong> (ISSN) 1074-8350)<br />

POSTMASTER: Send Change of Address Form 3579<br />

to <strong>American</strong> <strong>Shipper</strong>, P.O. Box 4728, Jacksonville,<br />

Florida 32201.<br />

Printed in U.S.A.<br />

Copyright © 2009 Howard Publications, Inc.<br />

To subscribe, call 1 (800) 874-6422<br />

or visit www.americanshipper.com

Every Shipment<br />

Belongs To<br />

Someone.<br />

There’s more than freight inside<br />

a container. It’s your business.<br />

That’s why we pay attention and<br />

work hard to ensure on time,<br />

cost-effective and trouble-free<br />

service. Because you’ve got<br />

your livelihood riding on every<br />

shipment. So trust us with<br />

your Hawaii, Guam or global<br />

ocean and air freight needs.<br />

When it comes to quality<br />

service, we put our good<br />

name behind yours.<br />

Dependable.<br />

From Start to Finish.<br />

Toll Free (800) 488-4888<br />

www.dhx.com<br />

Member—World Cargo Alliance<br />

*ISO 9001: 2000 Certified<br />

Toll Free (888) 488-4888<br />

www.dgxshipping.com<br />

Member—World Cargo Alliance<br />

*ISO 9001: 2000 Certified<br />

C-TPAT Validated<br />

Toll Free (800) 700-385 8<br />

ISO 9001: 2000 Certified<br />

*IATA Member & TSA Certified<br />

Part of The Dependable Companies group.<br />

DGX, DAX, & DHX – Dependable Hawaiian Express, Dependable Global Express &<br />

Dependable Air Cargo Express & the color combination of purple and magenta are the trademarks<br />

of DHX – Dependable Hawaiian Express or its affiliated companies.

exemption for carriers combined with the global economic crisis has created an<br />

uneven playing field for carriers in Europe versus their Asian rivals.<br />

He added that European governments need to redress the balance, noting that carriers<br />

based in Asia were gaining unfair advantages from a relative lack of regulation.<br />

“I call on the competent authorities — banks and public bodies — to protect the<br />

three big European maritime companies and ensure the survival of the maritime<br />

sector in Europe,” he said at the meeting, as reported first by Lloyd’s List Sept. 4<br />

and then by international news outlets shortly afterward.<br />

Representatives from the Danish Shipowners’ Association and the European <strong>Shipper</strong>s’<br />

Council, however, responded quickly to the riposte from Saadé, with the ship<br />

owners suggesting that individual European governments shouldn’t be automatically<br />

compelled to use taxpayer money to save struggling lines. The ESC told Lloyd’s<br />

List Sept. 7 that the goal of governments worldwide should be to bring their liner<br />

regulations in line with those in Europe, not to erode the EU ban on conferences.<br />

The Danish Shipowners’ Association, in a Reuters report Sept. 8, pointed out<br />

that expecting governments to provide guarantees for big lines could also create an<br />

unlevel playing field within Europe — if, for instance, the French government were<br />

to back CMA CGM, but the Danish government were to balk at doing the same for<br />

Maersk Line.<br />

And one need not even use a hypothetical, since the German government and<br />

the City of Hamburg are expected to sign off this month on more than $1 billion<br />

in guarantees for German line Hapag-Lloyd.<br />

Saadé’s comments come at a time when he is clearly frustrated at the battering<br />

his line and his industry have taken the past year. The block on liner conferences<br />

coincided almost sadistically with the beginning of the global economic meltdown.<br />

But it’s also a hard position for Saadé to justify, given that Europe’s three biggest<br />

lines (Maersk, Mediterranean Shipping Co. and CMA CGM) are far and away the<br />

three biggest in the world, and growing. They’ve all spent massive amounts on new<br />

ships in recent years, trumping the most ambitious growth plans of any of their<br />

rivals. The three lines have also collaborated on a handful of services in the last<br />

two years, showing that carriers are not exactly operating in silos.<br />

His comments that lines in Asia are receiving preferential treatment also rings<br />

a little hollow since they have been affected by the same anti-conference regulations<br />

on the Asia/Europe trade as Europe’s big lines have. On the transpacific and<br />

transatlantic, the U.S. Ocean Shipping Reform Act affects carriers equally as well.<br />

Perhaps Saadé was referring to intra-Asia routes, where indeed there is little if<br />

any regulation, and where Europe’s big three are increasingly training their focus.<br />

Or perhaps he just needed to vent some steam after a brutal year. (Eric Johnson)<br />

Hazmat politics heats up<br />

A senior House lawmaker wants a U.S. Transportation Department agency responsible<br />

for regulating the transport of hazardous materials to end its perceived<br />

“cozy” relationship with the industry.<br />

“It appears that complacency and neglect permeate the culture of the Pipeline<br />

and Hazardous Materials Administration (PHMSA),” said House Transportation<br />

and Infrastructure Committee Chairman James Oberstar, in his opening statement<br />

during a hearing on Sept. 10 into concerns with transporting hazardous materials.<br />

“It seems PHMSA has become misguided in its mission,” he added. “The PHMSA<br />

culture appears plagued by a belief that the agency should make things as easy as<br />

possible for the industry it should be regulating.” (Chris Gillis)<br />

Correction<br />

In the recent Who’s Making Money (September <strong>American</strong> <strong>Shipper</strong>, pages 40-43),<br />

Hong Kong-based ocean carrier OOCL’s revenue, operating profit and profit margin<br />

were incorrectly reported. The numbers given in the report were group revenue, operating<br />

profit and profit margin for OOCL’s parent OOIL. In 2008, OOCL’s container transport<br />

division had revenue of $6.503 billion, operating profit of $392 million and a profit<br />

margin of 6 percent. Of note, the corrected figures move OOCL up one place in both<br />

the operating profit and profit margin rankings, taking them to No. 4 in operating profit<br />

(ahead of Hapag-Lloyd) and to No. 2 in profit margin (slightly ahead of “K” Line).<br />

4 AMERICAN SHIPPER: OCTOBER 2009<br />

Corporate Offices<br />

Jacksonville (800) 874-6422 (904) 355-2601<br />

Fax: (904) 791-8836<br />

300 W. Adams St., Suite 600<br />

P.O. Box 4728<br />

Jacksonville, FL 32201<br />

Washington (202) 470-6082<br />

1839 Millstream Drive<br />

Frederick, MD 21702<br />

New York (212) 422-2420<br />

Fax: (212) 422-0047<br />

P.O. Box 536<br />

New York, N.Y. 10014<br />

London +44 (0)1252 545333<br />

Fax: +44 (0)5603 116944<br />

16 Blunden Road<br />

Farnborough, Hampshire<br />

GU14 8QJ UK<br />

New Delhi<br />

Editorial Board<br />

Brian Amero<br />

corporate trade compliance manager,<br />

Teradyne Inc.<br />

Chris Antoniou<br />

vice president of global supply chain<br />

management, Interstate Batteries<br />

Timothy D. Brotzman Sr.<br />

manager of international transport<br />

and DG compliance,<br />

McCormick & Co. Inc.<br />

Joseph Burks<br />

director of logistics,<br />

Cooper Wiring Devices Inc.<br />

Brenda Chenault<br />

import/export compliance consultant,<br />

Wyeth<br />

Joseph L. De La Luz<br />

general manager, trade compliance,<br />

NEC Corp. of America<br />

David Fisher<br />

global logistics leader,<br />

Johns Manville<br />

Rick Gabrielson<br />

director of international transportation,<br />

Target<br />

Geoffrey N. Giovanetti<br />

managing director,<br />

Wine and Spirits <strong>Shipper</strong>s Association<br />

John T. Joseph<br />

senior manager of international<br />

transportation, Limited Brands<br />

Maryanna Kersten<br />

internal compliance program manager,<br />

global customs operations,<br />

Hewlett-Packard Co.<br />

Richard W. Macomber<br />

chairman of air transportation<br />

committee, National Industrial<br />

Transportation League<br />

(562) 366-4384 (U.S. number)<br />

Letters to Editor/Press Releases<br />

<strong>American</strong> <strong>Shipper</strong> welcomes letters from readers.<br />

All letters become the property of <strong>American</strong> <strong>Shipper</strong>,<br />

which reserves the right to edit them. Include your<br />

name, position and company affiliation (if applicable),<br />

location, a daytime telephone number and e-mail<br />

address. E-mail letters to: letters@shippers.com<br />

Press releases are welcome and may be e-mailed<br />

to: releases@shippers.com

A FIRM HAND<br />

AT THE HELM<br />

Mediterranean Shipping Company<br />

holds fast and firm at the helm on the<br />

ever-changing and often turbulent<br />

seas of global container shipping.<br />

Seasoned and wise, with decades of<br />

experience in logistical shipping, MSC<br />

has fostered client and executive loyalty<br />

that have steered them straight ahead<br />

to a top position in the industry.<br />

Through tradition, hard work, high energy,<br />

informed decisions and solid leadership –<br />

MSC stands firmly at the helm.<br />

as agents for MSC Mediterranean Shipping Company S.A .<br />

(212) 764-4800, NEW YORK<br />

www.mscgva.ch<br />

ATLANTA<br />

770-953-0037<br />

MIAMI<br />

305-477-9277<br />

BALTIMORE<br />

410-631-7567<br />

NEW ORLEANS<br />

504-837-9396<br />

BOSTON<br />

978-531-3981<br />

NORFOLK<br />

757-625-0132<br />

CHARLESTON<br />

843-971-4100<br />

WILMINGTON, N.C.<br />

910-392-8200<br />

CHARLOTTE<br />

704-357-8000<br />

CHICAGO<br />

847-296-5151<br />

BAHAMAS, FREEPORT/NASSAU<br />

242-351-1158<br />

CLEVELAND<br />

440-871-6335<br />

DETROIT<br />

734-955-6350<br />

MONTREAL, CAN<br />

514-844-3711<br />

HOUSTON<br />

713-681-8880<br />

TORONTO, CAN<br />

416-231-6434<br />

LONG BEACH<br />

714-708-3584<br />

VANCOUVER, CAN<br />

604-685-0131

Trade Forecast 2009<br />

Armageddon or Schumpeter redux?<br />

Positioning your supply chain for recovery<br />

EXECUTIVE SUMMARY<br />

Though many have<br />

quarreled with (or<br />

misinterpreted) some<br />

of the conclusions reached in<br />

Joseph Schumpeter’s 1942<br />

book Capitalism, Socialism<br />

and Democracy, few would<br />

deny his title to the concept<br />

of evolutionary creative destruction<br />

and its impact upon<br />

corporate demise, resiliency<br />

and survival throughout the<br />

past century.<br />

One need only look at the<br />

companies listed as components<br />

of the Dow Jones<br />

Industrial Average over the<br />

New orders/shipments<br />

40%<br />

30%<br />

20%<br />

10%<br />

10%<br />

20%<br />

30%<br />

40%<br />

Sources: U.S. Department of Commerce, Global Insight, Material Handling Industry of America, 2009<br />

last 100 years to confirm the hypothesis. Schumpeter argued that<br />

entrepreneurs are the critical change agents whose challenges to<br />

status quo fuel and refuel economic growth.<br />

If ever there were a time for entrepreneurship, it would seem to<br />

be now. Our intent here is to take stock of where we are, assess<br />

the impact and issue a clarion call for proactive entrepreneurship<br />

to cut our losses, improve current performance and better position<br />

our organizations for accelerated recovery when the tide turns.<br />

Underestimates of the economic downturn’s impact on supply<br />

chain infrastructure have left a landscape of overcapacity, cancelled<br />

or deferred projects, and mothballed ships, trucks, warehouses and<br />

distribution centers across the country.<br />

• The Council of Supply Chain Management Professionals’ 2009<br />

State of Logistics Report puts the numbers in perspective. With a<br />

7.8 percent decline in industrial production in 2008, logistics costs<br />

as a percentage of gross domestic product dropped 3.5 percent to<br />

$1.3 trillion. CSCMP said the trend, which has devastated many<br />

service and equipment providers, will continue through 2009 and<br />

is unlikely to see a major correction before at least mid-2010.<br />

• U.S. freight transportation has stalled at its lowest level since<br />

1997, according to the U.S. Department of Transportation’s Bureau<br />

of Transportation Statistics. Total import volume at major U.S. ports<br />

is now expected to be 12.3 million TEUs for 2009, an 18.8 percent<br />

decline from 2008’s 15.2 million TEUs.<br />

• On the warehousing side of the equation, CB Richard Ellis<br />

said the national vacancy rate reached 10.2 percent at the end of<br />

June 2009, the highest since the second quarter of 2004.<br />

• Material handling suppliers have also been hit hard by the<br />

downturn. The Material Handling Industry of America reports<br />

that new orders for the first half of 2009 dropped 44.9 percent<br />

compared to the 2008 period, but forecasts the decline will slow<br />

in the second half, bringing the year-end total decline to about 35<br />

percent. Another 5 percent to 10 percent drop is expected in 2010<br />

with a return to growth in early 2011.<br />

0%<br />

Mar-00<br />

Sep-00<br />

Material handling equipment manufacturing<br />

forecast 2009-2010 vs. GDP<br />

Mar-01<br />

Sep-01<br />

Mar-02<br />

Sep-02<br />

Mar-03<br />

Sep-03<br />

Mar-04<br />

Sep-04<br />

Mar-05<br />

Sep-05<br />

Mar-06<br />

Sep-06<br />

Mar-07<br />

Sep-07<br />

Mar-08<br />

Sep-08<br />

Mar-09<br />

Sep-09<br />

Mar-10<br />

Sep-10<br />

Mar-11<br />

Sep-11<br />

We are not going to be rescued by another housing boom or the<br />

surge in consumer spending that took the Dow Jones Index above<br />

14,000 in October 2007. Further, “bailout” support is an unlikely<br />

option for any organization without a fairy godmother.<br />

What are the alternatives? “Waiting it out” is not an option;<br />

rather, it’s a prescription for potentially irrecoverable loss of market<br />

position — or worse.<br />

A corollary to Schumpeter’s creative destruction theorem, from<br />

Robert Simons of Harvard Business School, states that “the right<br />

of any corporation to exist is not perpetual, but has to be continuously<br />

earned.” Accordingly, whether it’s “thinking out of the box”<br />

or breaking it when it’s not broken, it’s time for us to do some<br />

entrepreneurial head clearing and take an innovative, bold but<br />

measured approach to assessment of how best to leverage the hidden<br />

opportunities within the current economic landscape. Given<br />

the latter, leadership should focus on gaining buy in and support<br />

from all employees by clearly articulating the challenges — and,<br />

collaboratively building and implementing action plans that address<br />

them showing specifically how individual performance impacts<br />

results — and then broadcasting actual results on a daily, if not<br />

hourly basis and explaining what has to be done to stay on target.<br />

Although the light at the end of your economic tunnel may only<br />

be a firefly today — regardless of where you are in the business<br />

cycle — there is no time like the present for fine-tuning strategies<br />

and action plans to be ready to charge out of the gate when the bell<br />

rings. In fact, if your industry lags those that appear to be bottoming<br />

out and on the way back up, there are still opportunities to batten<br />

the hatches, increase efficiencies and control costs to facilitate the<br />

recovery process. And, there’s good evidence that many organizations<br />

have already started.<br />

The balance of this article will focus upon how close examination<br />

of supply chain options can produce the short and longer-term benefits<br />

that sustain and differentiate world class corporate performers<br />

in good times and bad.<br />

Register and download the report at <strong>American</strong><strong>Shipper</strong>.com/TF<br />

6 AMERICAN SHIPPER: OCTOBER 2009<br />

Annual Rate of Change<br />

MH New Orders<br />

GDP Nominal +3Q<br />

MH Shipments<br />

Forecast<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

GDP four quarter percent change

Trade Forecast 2009<br />

Armageddon or Schumpeter redux?<br />

Positioning your supply chain for recovery<br />

EXECUTIVE SUMMARY<br />

Though many have<br />

quarreled with (or<br />

misinterpreted) some<br />

of the conclusions reached in<br />

Joseph Schumpeter’s 1942<br />

book Capitalism, Socialism<br />

and Democracy, few would<br />

deny his title to the concept<br />

of evolutionary creative destruction<br />

and its impact upon<br />

corporate demise, resiliency<br />

and survival throughout the<br />

past century.<br />

One need only look at the<br />

companies listed as components<br />

of the Dow Jones<br />

Industrial Average over the<br />

New orders/shipments<br />

40%<br />

30%<br />

20%<br />

10%<br />

10%<br />

20%<br />

30%<br />

40%<br />

Sources: U.S. Department of Commerce, Global Insight, Material Handling Industry of America, 2009<br />

last 100 years to confirm the hypothesis. Schumpeter argued that<br />

entrepreneurs are the critical change agents whose challenges to<br />

status quo fuel and refuel economic growth.<br />

If ever there were a time for entrepreneurship, it would seem to<br />

be now. Our intent here is to take stock of where we are, assess<br />

the impact and issue a clarion call for proactive entrepreneurship<br />

to cut our losses, improve current performance and better position<br />

our organizations for accelerated recovery when the tide turns.<br />

Underestimates of the economic downturn’s impact on supply<br />

chain infrastructure have left a landscape of overcapacity, cancelled<br />

or deferred projects, and mothballed ships, trucks, warehouses and<br />

distribution centers across the country.<br />

• The Council of Supply Chain Management Professionals’ 2009<br />

State of Logistics Report puts the numbers in perspective. With a<br />

7.8 percent decline in industrial production in 2008, logistics costs<br />

as a percentage of gross domestic product dropped 3.5 percent to<br />

$1.3 trillion. CSCMP said the trend, which has devastated many<br />

service and equipment providers, will continue through 2009 and<br />

is unlikely to see a major correction before at least mid-2010.<br />

• U.S. freight transportation has stalled at its lowest level since<br />

1997, according to the U.S. Department of Transportation’s Bureau<br />

of Transportation Statistics. Total import volume at major U.S. ports<br />

is now expected to be 12.3 million TEUs for 2009, an 18.8 percent<br />

decline from 2008’s 15.2 million TEUs.<br />

• On the warehousing side of the equation, CB Richard Ellis<br />

said the national vacancy rate reached 10.2 percent at the end of<br />

June 2009, the highest since the second quarter of 2004.<br />

• Material handling suppliers have also been hit hard by the<br />

downturn. The Material Handling Industry of America reports<br />

that new orders for the first half of 2009 dropped 44.9 percent<br />

compared to the 2008 period, but forecasts the decline will slow<br />

in the second half, bringing the year-end total decline to about 35<br />

percent. Another 5 percent to 10 percent drop is expected in 2010<br />

with a return to growth in early 2011.<br />

0%<br />

Mar-00<br />

Sep-00<br />

Material handling equipment manufacturing<br />

forecast 2009-2010 vs. GDP<br />

Mar-01<br />

Sep-01<br />

Mar-02<br />

Sep-02<br />

Mar-03<br />

Sep-03<br />

Mar-04<br />

Sep-04<br />

Mar-05<br />

Sep-05<br />

Mar-06<br />

Sep-06<br />

Mar-07<br />

Sep-07<br />

Mar-08<br />

Sep-08<br />

Mar-09<br />

Sep-09<br />

Mar-10<br />

Sep-10<br />

Mar-11<br />

Sep-11<br />

We are not going to be rescued by another housing boom or the<br />

surge in consumer spending that took the Dow Jones Index above<br />

14,000 in October 2007. Further, “bailout” support is an unlikely<br />

option for any organization without a fairy godmother.<br />

What are the alternatives? “Waiting it out” is not an option;<br />

rather, it’s a prescription for potentially irrecoverable loss of market<br />

position — or worse.<br />

A corollary to Schumpeter’s creative destruction theorem, from<br />

Robert Simons of Harvard Business School, states that “the right<br />

of any corporation to exist is not perpetual, but has to be continuously<br />

earned.” Accordingly, whether it’s “thinking out of the box”<br />

or breaking it when it’s not broken, it’s time for us to do some<br />

entrepreneurial head clearing and take an innovative, bold but<br />

measured approach to assessment of how best to leverage the hidden<br />

opportunities within the current economic landscape. Given<br />

the latter, leadership should focus on gaining buy in and support<br />

from all employees by clearly articulating the challenges — and,<br />

collaboratively building and implementing action plans that address<br />

them showing specifically how individual performance impacts<br />

results — and then broadcasting actual results on a daily, if not<br />

hourly basis and explaining what has to be done to stay on target.<br />

Although the light at the end of your economic tunnel may only<br />

be a firefly today — regardless of where you are in the business<br />

cycle — there is no time like the present for fine-tuning strategies<br />

and action plans to be ready to charge out of the gate when the bell<br />

rings. In fact, if your industry lags those that appear to be bottoming<br />

out and on the way back up, there are still opportunities to batten<br />

the hatches, increase efficiencies and control costs to facilitate the<br />

recovery process. And, there’s good evidence that many organizations<br />

have already started.<br />

The balance of this article will focus upon how close examination<br />

of supply chain options can produce the short and longer-term benefits<br />

that sustain and differentiate world class corporate performers<br />

in good times and bad.<br />

Register and download the report at <strong>American</strong><strong>Shipper</strong>.com/TF<br />

6 AMERICAN SHIPPER: OCTOBER 2009<br />

Annual Rate of Change<br />

MH New Orders<br />

GDP Nominal +3Q<br />

MH Shipments<br />

Forecast<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

GDP four quarter percent change

Africa Rising<br />

Helping continent’s Sub-Saharan region reach its<br />

potential through world trade and development.<br />

BY CHRIS DUPIN<br />

U.S. trade with Sub-Sahara Africa has increased<br />

sharply this decade, with imports quadrupling<br />

since 2001 to more than $86 billion in 2008 and<br />

exports doubling in the same period to $18.6 billion.<br />

Last year U.S. exports to Africa rose 29.2 percent over<br />

2007 and imports were up 27.8 percent.<br />

Globally, the World Trade Organization said last year<br />

African exports increased 29 percent to $561 billion, and<br />

imports rose 27 percent to $466 billion.<br />

The increases reflect basic commodity<br />

and mineral exports, but also a surge in<br />

imported consumer goods, said Hans-Ole<br />

Madsen, vice president for business development<br />

at APM Terminals in the Africa,<br />

Middle East and India region.<br />

“Trade is a critical platform for Africa’s<br />

economic growth,” said Secretary of State<br />

Hillary Clinton in an August speech in<br />

Nairobi, Kenya. “Today, Africa accounts<br />

for 2 percent of global trade. If Sub-Saharan<br />

Africa were to increase that share by only 1<br />

percent, it would generate additional export<br />

revenues each year greater than the total<br />

amount of annual assistance that Africa<br />

currently receives.”<br />

Trade with the United States has been<br />

bolstered by the African Growth and Opportunity<br />

Act (AGOA), a 2000 law that<br />

allows about 40 Sub-Saharan Africa nations<br />

to export qualifying goods to the United<br />

States without import duties.<br />

But in the past year Africa has taken a<br />

hit from the global economic crisis. A June<br />

report from the United Nations Economic<br />

Commission for Africa warned: “eight<br />

years of economic growth in Africa could<br />

be entirely consumed by the current global<br />

downturn.” It forecast that “following half a<br />

decade of above 5 percent economic growth<br />

the continent can expect only 2.8 percent in<br />

2009, less than half the 5.7 percent expected<br />

before the crisis.”<br />

How severe or long lasting an impact that<br />

will have on trade and shipping volumes<br />

is not yet clear.<br />

“The most striking impact of the crisis<br />

has been the reduction in export revenues.<br />

Prices of minerals and oil have stumbled<br />

and consequently it has reduced revenue<br />

for African countries, especially from oil,<br />

but also copper and agricultural items as<br />

well,” said Dominique Lafont, executive<br />

vice president for Africa at Bolloré Africa<br />

Logistics.<br />

An arm of a French conglomerate involved<br />

in everything from broadcasting to<br />

the manufacture of batteries and capacitors,<br />

Bolloré Africa Logistics has operated in<br />

Hillary Clinton<br />

U.S. Secretary<br />

of State<br />

“Trade is a critical<br />

platform for Africa’s<br />

economic growth.”<br />

8 AMERICAN SHIPPER: OCTOBER 2009

LOGISTICS<br />

Africa for 50 years and employs nearly<br />

20,000 people in 41 countries. With 6,000<br />

trucks, 64 million square feet of warehouse<br />

space, and operations in eight ports, it said<br />

it has the largest stevedoring and logistics<br />

network on the continent. In the United<br />

States, Bolloré is represented by its sister<br />

company SDV International Logistics.<br />

Besides reduced export revenues, Lafont<br />

said, “the second impact has been the reduction<br />

of foreign investment. Some projects<br />

have been cancelled, other projects have<br />

been postponed, and also competition over<br />

current projects has reduced. And the most<br />

developed country on the continent, South<br />

Africa, has also slowed down.”<br />

The global recession has not had as<br />

much impact on import volumes in lesserdeveloped<br />

countries. “Demand is largely<br />

for basic products and less vulnerable to<br />

the crisis,” he explained.<br />

Maersk Line said its first half volumes<br />

on Africa routes fell 14 percent. Volumes<br />

at affiliate Safmarine were flat. (Safmarine<br />

has some activity on east/west routes, but<br />

Africa-related activities are by far the<br />

majority of its business.)<br />

Stephen Hayes<br />

president,<br />

Corporate Council<br />

on Africa<br />

“Once you take energy<br />

out of the equation, even<br />

South Africa is a larger<br />

investor in the West<br />

of Africa than the U.S.”<br />

“Between us and our big brother, we<br />

probably have 40-45 percent of the West<br />

African market,” said John Boudreau,<br />

president of Safmarine Inc., Maersk’s U.S.<br />

arm. “In some countries Maersk is bigger,<br />

some countries Safmarine is bigger.”<br />

U.S. TRADE WITH SUB-SAHARAN AFRICA<br />

(Export, import values in $ millions)<br />

Despite its growth, U.S.-Africa trade<br />

has been a disappointment to some. It is<br />

still dominated by oil and a small number<br />

of other commodities, and most trade is<br />

concentrated with a few countries.<br />

Sub-Saharan Africa accounted for slightly<br />

more than 3 percent of U.S. merchandise<br />

imports. Petroleum products dominate,<br />

accounting for about 81 percent of total<br />

U.S. imports from Sub-Saharan Africa.<br />

As a result, big oil producers Nigeria and<br />

Angola account for nearly two-thirds of<br />

U.S. imports. Congo, Chad, Equatorial<br />

Guinea and Gabon are other large African<br />

oil exporters to the United States.<br />

South Africa accounted for 11.6 percent<br />

of U.S. imports from Africa in 2008. Among<br />

the major commodities from South Africa,<br />

platinum and diamond imports declined<br />

while vehicles, iron and steel were up.<br />

Leading U.S export commodities to<br />

Sub-Saharan Africa include motor vehicles,<br />

oilseeds and grain, petroleum and coal<br />

products, aircraft and parts, oil and gas<br />

machinery, and construction equipment.<br />

Most of the U.S. imports from Sub-<br />

Saharan Africa, including oil, are eligible<br />

U.S. Exports<br />

U.S. Imports<br />

2.4%<br />

3.3%<br />

4.6%<br />

21.5%<br />

10.9%<br />

22.2%<br />

35.1%<br />

South Africa<br />

Nigeria<br />

Angola<br />

Benin<br />

Ghana<br />

Kenya<br />

Other<br />

2.6%<br />

3.9% 5.9%<br />

3.9%<br />

5.9%<br />

11.6%<br />

22.0%<br />

44.2%<br />

Nigeria<br />

Angola<br />

South Africa<br />

Congo<br />

Equatorial<br />

Guinea<br />

Chad<br />

Gabon<br />

Other<br />

Item<br />

Value<br />

Motor vehicles $2,204.4<br />

Oilseeds & grains $1,617.4<br />

Petroleum & coal products $1,403.8<br />

Aircraft, engines, & parts $1,358.7<br />

Oil & gas field machinery & equipment $1,344.2<br />

Construction machinery $1,142.4<br />

Other general purpose machinery 1 $596.4<br />

Industrial chemicals $447.0<br />

Navigational, measuring,<br />

$427.7<br />

electromedical & control instruments<br />

Grain and oilseed milling products $426.6<br />

Communications equipment $394.1<br />

Item<br />

Value<br />

Oil (crude & non-crude) $71,208.2<br />

Platinum $2,966.9<br />

Motor vehicles and parts $1,932.7<br />

Diamonds $1,572.7<br />

Iron and steel $1,235.9<br />

Woven & knit apparel $1,151.5<br />

Ores, slag, & ash $896.8<br />

Cocoa $695.0<br />

Organic chemicals $627.5<br />

Petroleum gases & other gases $513.4<br />

1<br />

Includes pumps and pumping equipment, air and gas compressors, and material handling equipment.<br />

Sources: U.S. International Trade Commission DataWeb and U.S. Commerce Department, Census Bureau.<br />

10 AMERICAN SHIPPER: OCTOBER 2009

YOU NEED TO SOURCE FROM EMERGING MARKETS.<br />

YOU NEED HANS MIEDEMA.<br />

For 37,000 Agility employees in over 120 countries around the world, success<br />

isn’t measured in parts assembled or products shipped. Success occurs when our<br />

business partners achieve their goals. It’s an intimate approach to global logistics<br />

that demands individual attention and personal ownership. It’s how Hans<br />

Miedema brings Agility to supply chain challenges.<br />

Hans Miedema<br />

Regional Support Leader<br />

Agility Global Account Team<br />

agilitylogistics.com

LOGISTICS<br />

for preferential treatment under AGOA.<br />

Clinton noted there are 6,999 items that<br />

can be sent from Africa to the United States<br />

duty-free, but, “we need more product<br />

diversification.”<br />

She said this is an area of focus for U.S.<br />

Trade Representative<br />

Ron Kirk, and that<br />

a number of AGOA<br />

countries are in the<br />

early stages of supplying<br />

the <strong>American</strong><br />

market with new products.<br />

These include<br />

footwear from Ethiopia,<br />

cut flowers from<br />

Kirk<br />

Tanzania, eyewear from Mauritius, and<br />

processed fruits and jams in Swaziland.<br />

“We’re also seeing some countries take<br />

advantage of the fact that they can produce<br />

industrial products in partnership with<br />

international firms, and then export them<br />

duty-free to the United States,” Clinton said.<br />

In a report issued in August the Government<br />

Accountability Office examined why<br />

Sub-Saharan Africa’s textile and apparel<br />

industry has not achieved the growth anticipated<br />

under AGOA, which was signed<br />

into law by President Bill Clinton in 2000,<br />

and offered suggestions for improvements.<br />

“Industrialization in many developed<br />

countries was initiated in the textiles and<br />

apparel sectors, and some developing<br />

countries have relied on these sectors to<br />

significantly increase and diversify exports,<br />

with positive effects on incomes, employment<br />

and poverty levels,” GAO said.<br />

By providing generous preferences for<br />

African textile and apparel imports, the<br />

expectation was “AGOA beneficiaries<br />

would be able to leverage these advantages<br />

to replicate this industrialization process.”<br />

There was an initial surge of U.S. textile<br />

and apparel imports Sub-Saharan Africa<br />

— from about $776 million in 2000 to<br />

$1.78 billion in 2004. However, after global<br />

quotas under the multifiber arrangement<br />

were removed after 2004, U.S. imports<br />

from Africa dropped to $1.18 billion in<br />

2008. That’s only about 1.3 percent of total<br />

U.S. textile and apparel imports compared<br />

to China’s 35 percent share or Bangladesh’s<br />

3.8 percent share.<br />

U.S. exports of yarn and fabric to Africa<br />

have also fallen, from $24.2 million in 1998<br />

to $15.6 million in 2008.<br />

GAO said many African countries “face<br />

infrastructure and development challenges<br />

that must be addressed before they can fully<br />

take advantage of these benefits. It noted<br />

low-cost Asian producers such as China,<br />

India and Bangladesh have relatively modern<br />

production facilities and have developed<br />

a competitive advantage.<br />

Also, GAO said consolidation in the U.S.<br />

retail market has led to “lean retailing methods,”<br />

a combination of low inventories and<br />

frequent restocking. Retailers closely track<br />

sales using electronic data to facilitate fast<br />

communications with suppliers, who must<br />

be highly f lexible and able to adjust output,<br />

and ship and deliver products quickly.<br />

“Aspects of the lean retailing method<br />

do not favor African suppliers that have<br />

less advanced production technology that<br />

limits their flexibility to meet changing<br />

demands,” the agency explained.<br />

Among the options the U.S. government<br />

should examine to help the continent’s<br />

textile and apparel industry are extending<br />

the duration of a provision that allows<br />

AGOA countries to use fabric from third<br />

countries in exports that qualify under<br />

AGOA and extend the duration of overall<br />

NURTURING S0UTH AFRICAN TIES<br />

This summer marked the 10th anniversary<br />

of Safmarine’s purchase<br />

by A.P. Moller - Maersk.<br />

The former South Africa carrier has<br />

grown rapidly under its Danish parent,<br />

moving about 1.5 million TEUs annually<br />

on a fleet of about 20<br />

owned and 19 chartered<br />

containerships,<br />

up from about 380,000<br />

TEUs in 1999.<br />

“The company and<br />

our customers get the<br />

benefit of being part<br />

of a large organization<br />

while we still retain<br />

Safmarine serves its long-time base while<br />

benefiting as part of behemoth Maersk.<br />

Boudreau<br />

a lot of independence, creativity, and the<br />

ability and freedom to do things to grow the<br />

business, satisfy our customers and produce<br />

profits,” said John Boudreau, president of<br />

Safmarine Inc., the company’s U.S. subsidiary.<br />

“The company is 63 years old so it<br />

has quite a history, but the last 10 years is<br />

12 AMERICAN SHIPPER: OCTOBER 2009<br />

BY CHRIS DUPIN<br />

quite a quantum leap as far as growth and<br />

reinvigoration of the brand.”<br />

In terms of overall U.S. container trade<br />

Safmarine is relatively small, with only<br />

about a 1 percent to 1.5 percent market<br />

share in all trades. It is a bigger player<br />

on selected trade lanes, including those<br />

touching Africa, the Middle East and India.<br />

Boudreau said the company moves<br />

about 28 percent of the trade between the<br />

U.S. and South Africa, and together with<br />

Maersk about 40 percent to 45 percent of<br />

the West African market. Safmarine is also<br />

a major player in the trades between Africa<br />

and Europe and Asia.<br />

Maersk decided to preserve the Safmarine<br />

brand, he said, because of its high profile in<br />

Africa and “it’s a great business model that<br />

we have within the A.P. Moller - Maersk<br />

group to be able to take two bites of the apple<br />

and approach customers from two different<br />

angles, different philosophies about what<br />

those customers are looking for in transport.”<br />

At the same time it gets the benefit of<br />

access to the Maersk network and the<br />

economies of scale that the world’s largest<br />

container shipping company affords.<br />

Though it has deep roots in Africa,<br />

Safmarine is actually headquartered in<br />

Belgium, a reflection of Safmarine’s 1996<br />

acquisition of CMB Transport. (Safmarine<br />

had actually owned a 49 percent stake in<br />

CMBT since 1991.)<br />

It has expanded globally, with growing<br />

involvement in east-west as well as northsouth<br />

services.<br />

“Safmarine has often specialized in<br />

midsize companies as well as some of the<br />

household name companies that we all know.<br />

But the relationships that have built within<br />

Safmarine many of them had their roots in<br />

the original company,” Boudreau said. “We<br />

are not big enough to cater to everyone.”<br />

When it works with big companies — say<br />

with the Big 3 U.S. automakers — “we’re<br />

generally going after more the north-south<br />

business and Maersk is more involved in the<br />

east-west. It’s not a fixed line of demarcation,<br />

but Safmarine’s relationship with the<br />

auto manufacturers has always been based<br />

on the branches of those companies in South<br />

Africa,” he said.<br />

“We work on a slightly different business<br />

model and approach to customers, not just<br />

Maersk, but the rest of the industry,” he<br />

said. “We share the same IT systems and<br />

platform that Maersk does, we utilize the

AGOA benefits beyond 2015.<br />

Lafont said Africa’s farmers and agriculture<br />

industry faces many challenges.<br />

“International competition is not very<br />

fair to Africa. There are a lot of subsidies,<br />

and it is difficult for Africa to stabilize its<br />

agriculture because of the great variation<br />

in commodity prices,” he said. A stronger<br />

agricultural sector could benefit the continent<br />

greatly, he added, encouraging people<br />

to farm rather than move to the city.<br />

Madsen of APM said that going back<br />

to colonial times, Europe dominated trade<br />

with Africa. But there has been a big shift<br />

over the past decade with Asia, particularly<br />

China, becoming the region’s biggest trading<br />

partner, particularly as an exporter of<br />

consumer goods.<br />

Except for a small number of countries<br />

,such as South Africa or Egypt, not many<br />

consumer goods are produced in Africa,<br />

and China has become a major source for<br />

products such as clothing and electronics,<br />

he said.<br />

Africa is “a continent where you import<br />

consumer goods and you export raw materials,”<br />

Madsen said.<br />

That has a big effect on shipping, with<br />

many exports leaving on bulk or breakbulk<br />

vessels, while many imports arrive in<br />

containers. Many export containers, carry<br />

“fresh air,” he said.<br />

As containerization has become more<br />

prevalent over that past 10 to 15 years,<br />

many African ports have expanded container<br />

facilities, converting old general<br />

cargo docks into container ports. Many<br />

also handle roll-on/roll-off ships as imports<br />

of new and second-hand cars move to the<br />

continent from Europe or the United States.<br />

Stephen Hayes, president of the Corporate<br />

Council on Africa, believes “the U.S.<br />

needs to be much more actively engaged<br />

in Africa. The U.S. technically is still the<br />

largest investor in Africa but about 70 to<br />

80 percent is oil and oil-related matters, so<br />

it’s not long-term investment. It’s not like<br />

a 50-year investment, but probably a 10-20<br />

year investment.<br />

“We need to invest in just about every<br />

other sector and throughout the continent,”<br />

he continued. “If you take several countries<br />

out of the picture, then the U.S has very<br />

little investment in Africa. Compare that to<br />

China, which is invested in just about every<br />

country in Africa. Also Japan, India and<br />

LOGISTICS<br />

the Gulf states are increasing investment.<br />

Once you take energy out of the equation,<br />

even South Africa is a larger investor in<br />

the West of Africa than the U.S.”<br />

Lack of infrastructure has a strong effect<br />

on how the shipping industry operates<br />

in Africa.<br />

“If containers are bound for delivery in<br />

consumer areas of big cities, it goes out to<br />

distribution warehouses,” Madsen said.<br />

But in many locations if cargo is bound<br />

for or originates far inland, it is stripped<br />

or stuffed at the port because roads are<br />

not good enough to run container trucks.<br />

Lafont agrees. “Unfortunately the roads<br />

are not good enough, and I am afraid to say<br />

they are probably deteriorating” in many<br />

locations. Weight restrictions are often<br />

ignored, though he said some countries<br />

are installing scales to prevent overloading<br />

of containers.<br />

However, there are some exceptions.<br />

South Africa has a well developed rail<br />

and road system. Safmarine has its own<br />

trucking company and it uses the national<br />

rail system to move containers inland to<br />

reach population centers like Johannesburg.<br />

Madsen said there are container trains<br />

‘Between us and our big brother (Maersk), we probably have 40-45 percent<br />

of the West African market,’ Safmarine’s John Boudreau said.<br />

same operations and facilities, and in many<br />

cases we’re loading on the same vessel<br />

at the same port terminals. The Maersk<br />

model of operational excellence is one that<br />

we benefit from, having as few exceptions<br />

as possible.”<br />

Safmarine offers direct, fully containerized<br />

weekly sailings from the U.S. East and<br />

Gulf coasts to South Africa. Cargo to West<br />

Africa is often relayed via Mediterranean<br />

ports or Las Palmas in the Canary Islands.<br />

It serves East Africa, generally by transshipping<br />

through Durban in South Africa<br />

or Salalah in Oman.<br />

Boudreau said the company tries to distinguish<br />

itself from competitors by offering<br />

intensive customer service.<br />

“We will expend a lot of energy with our<br />

own people to protect our customers from<br />

any internal snafus or any problems we<br />

might have with a system. And if there are<br />

exceptions we deal with them as personally<br />

as we can to solve their problems.<br />

“Our business is a little bit less predictable<br />

coming from a broader number of customers<br />

generally smaller in size,” he added.<br />

The company can face challenging<br />

conditions in some ports, though he said<br />

the economic slowdown has given some a<br />

breather to catch up on growing volume.<br />

Maersk has grown its fleet substantially<br />

in recent years, taking seven new vessels<br />

in 2008 and two earlier this year. No more<br />

are planned in 2009, but the company will<br />

add to its fleet in 2010 and 2011.<br />

Safmarine has done better than many<br />

carriers during the downturn in container<br />

business this year, maintaining container<br />

volumes at the same level in the first half<br />

of 2009 as in the same 2008 period. But it<br />

is not unscathed; in late July it said it would<br />

withdraw from the transpacific at the end<br />

of June 2010, telling customers profitable<br />

participation in the trade lane was difficult<br />

because of its small size and poor conditions<br />

in the market.<br />

“There is a huge tie-in between Safmarine<br />

and South Africa. The company began<br />

as a venture starting service between New<br />

York and South Africa. The roots run very<br />

deep we have in many cases South African<br />

officers,” Boudreau said.<br />

The company has built a maritime academy<br />

in South Africa to train workers, and it<br />

has an active program called Containers in<br />

the Community, where it donates containers<br />

to build schools and other community<br />

facilities.<br />

AMERICAN SHIPPER: OCTOBER 2009 13

LOGISTICS<br />

that run from the East Coast of Africa from<br />

Kenya to Uganda, for example.<br />

Bolloré has a fleet of 6,000 trucks and<br />

operates trains between Burkina Faso and<br />

the Ivory Coast and the Camrail network<br />

within Cameroon. It also operates inland<br />

container ports in Mombasa in Kenya<br />

and in Dar es Salaam in Tanzania, and<br />

river barges on the Ubangi River between<br />

Central Africa and the ports of Brazzaville<br />

and Pointe Noire.<br />

Bolloré operates corridors throughout<br />

Africa, Lafont said, extending from ports<br />

such as Dakar in Senegal in West Africa,<br />

Port Sudan on the Red Sea, or Mombassa<br />

in Kenya on the Indian Ocean. For example,<br />

for a shipment moving from Mombasa it<br />

will handle customs clearance, storage of<br />

goods, transshipping cargo on trucks or by<br />

rail to Kitale in the Northern part of Kenya<br />

or Kampala in Uganda.<br />

“Our strategy is to offer door-to-door<br />

service,” Lafont said.<br />

Boudreau said Safmarine offers a variety<br />

of services that are appealing to shippers in<br />

Africa, and some other trades. For example,<br />

in addition to its fleet of containerships,<br />

Safmarine charters a fleet of about 40<br />

breakbulk vessels. These are useful for<br />

moving pipe and drilling equipment, and<br />

other supplies for the oil industry in Nigeria<br />

and Angola, for instance.<br />

Safmarine works with customers who<br />

may need containers for extended periods,<br />

or if it wants to buy containers, it can arrange<br />

programs for that. The company worked<br />

with Daimler Benz and a third-party vendor<br />

to develop a system for loading automobiles<br />

into racks that are then slid into shipping<br />

containers.<br />

Reefer is a big area of focus for Safmarine.<br />

Boudreau said South Africa, like Chile, is a<br />

major producer of citrus, grapes and other<br />

fruit. He expects that business to grow as<br />

more fruit moves in reefer containers, offering<br />

exporters advantages over moving<br />

their harvest in conventional reefer ships.<br />

“The cargo arrives in better shape. It<br />

doesn’t come to market in such large lots that<br />

it depresses the price. There’s less spoilage,<br />

less pilferage and it fits the supply chain<br />

better to plan for 40-foot containers rather<br />

than hundreds of pallets of fruit that need<br />

to be warehoused,” he said.<br />

GAL/Galborg, which formerly traded<br />

under the name Gulf Africa Line, has<br />

operated liner services between the United<br />

States, Mexico and Southern Africa for 11<br />

years, carrying breakbulk and containers<br />

on 30,000-deadweight-ton multipurpose<br />

ships. In the United States it calls at Houston,<br />

New Orleans, and Jacksonville, Fla.<br />

“We had a very balanced trade for many<br />

years until cargo slowed,” said David<br />

14 AMERICAN SHIPPER: OCTOBER 2009<br />

Groves, owner’s representative for Galborg<br />

in Houston. His company’s ships are<br />

relatively full southbound, but northbound<br />

business was very quiet in the first half<br />

of this year. But volumes are picking up<br />

northbound, where major commodities<br />

include ferroalloys and steel products like<br />

pipe and coil and wire rod.<br />

GAL is a joint venture between Nordana,<br />

which has its own service between the<br />

United States, South America and Africa,<br />

and MACS Maritime Carrier, which serves<br />

North Europe/Africa. It has recently expanded<br />

its port coverage through connecting<br />

agreements with two feeder companies:<br />

MACS East Africa, which calls ports along<br />

the East Coast of Africa from Durban, South<br />

Africa to Mombasa, Kenya; and Angola<br />

South Line, where GAL will connect with<br />

Angola South Line in Walvis Bay Namibia<br />

for cargo bound to and from Angola.<br />

Hans-Ole Madsen<br />

vice president<br />

for business<br />

development,<br />

APM Terminals<br />

“Through privatization,<br />

and I’d hope we have<br />

played a good part<br />

in that, ports are getting<br />

more efficient.”<br />

“Angola is definitely a booming country<br />

with a lot of Chinese money going in<br />

there for redevelopment of infrastructure,”<br />

Groves said.<br />

The connecting carrier agreements allow<br />

GAL to reach shallow-draft ports in Angola<br />

that may only be able to accommodate 5,000<br />

dwt vessels, he said.<br />

Shipping executives say ports in Africa<br />

are a mixed bag from the super-sophisticated<br />

transshipment terminals that APM<br />

operates in Tangier, Morocco and Port Said,<br />

Egypt, to ports in West Africa where ships<br />

may have to wait days, sometimes weeks<br />

to discharge cargo.<br />

But Madsen said, “Through privatization,<br />

and I’d hope we have played a good<br />

part in that, ports are getting more efficient.”<br />

Lafont, of Bollore, said Africa first<br />

opened itself to the concession model in the<br />

mid-1990s. “I think it is well understood<br />

and produced good effects,” he said. His<br />

company has won concessions in eight<br />

ports: Abidjan in the Ivory Coast, Tema in<br />

Ghana, Tincan Island in Nigeria, Douala<br />

in Cameroon, Cotonou in Benin, Libreville<br />

in Gabon and Pointe Noire in Congo, and<br />

Pointe des Galets on the French Island of<br />

La Réunion off the coast of Madagascar.<br />

Lafont said there is stiff competition from<br />

many of the large global port companies<br />

to develop ports on the continent, including<br />

APM, the Terminal Link subsidiary<br />

of CMA CGM, DP World, Hutchison and<br />

ICTS.<br />

But these companies are sometimes<br />

allies as well. For example, in May APM<br />

will become a member of the Bolloré consortium<br />

that has been selected to develop<br />

a new deepwater container terminal at the<br />

port of Pointe-Noire. The companies also<br />

have an association in Abidjan, Douala<br />

and Tema. And Zim is Bollore’s partner at<br />

Tincan Island in Nigeria.<br />

The improvements in Pointe-Noire and<br />

Cotonou will allow those ports to handle<br />

much larger ships, increasing the size of<br />

container vessels from a maximum of<br />

about 3,000 TEUs to 7,000 TEUs, Lafont<br />

said. He believes these larger ships will<br />

encourage more direct service to Africa<br />

and a reduced reliance on feeder ships,<br />

which he said may reduce congestion at<br />

some African ports.<br />

Hayes thinks there are big opportunities<br />

for U.S. companies to increase sales<br />

in Africa to help build infrastructure,<br />

including roads, agribusiness, power and<br />

alternative energy.<br />

Improvements such as ports and roads<br />

can not only help Africans trade better,<br />

but can reduce isolation and tribal affects,<br />

he says.<br />

Better roads and storage facilities would<br />

reduce crop spoilage, bring more crops to<br />

market and increase incomes.<br />

And improvements in telecommunications,<br />

including increased access to<br />

broadband technology, could help improve<br />

education.<br />

“In the long run, we are optimistic<br />

because we believe the continent has now<br />

embarked on a development cycle, and this<br />

is largely due to the globalization factor<br />

— the world is becoming smaller,” Hayes<br />

said. “Information technology has enabled<br />

Africa to make a great leap forward. The<br />

ratio of people with a mobile phone is far<br />

greater than most people would have anticipated<br />

a few years ago. A lot of Africa is<br />

connected to the rest of the world and that<br />

creates a desire for people to have more<br />

transparency, democracy and money, which<br />

is all a positive factor in terms of economic<br />

development.”<br />

■

Products to<br />

Play, Work<br />

...Live!<br />

2001-2009<br />

SM<br />

Whether in work or play, our clients bring products to market that<br />

provide access to a world of new ideas. Hyundai Merchant Marine<br />

offers services from online bookings and documentations to Track<br />

& Trace on the web plus U.S.-based customer service centers, our<br />

support means smooth sailing ahead.<br />

Depend on us for reliable, multimodal transportation for North<br />

America, Asia, Middle East, and Europe. On time. Online.

LOGISTICS<br />

Choice assignment<br />

Hitachi data storage manufacturing unit<br />

relies on critical parts logistics provider.<br />

Many businesses need to warehouse<br />

huge amounts of data, and<br />

one of the leading manufacturers<br />

of storage systems is Hitachi Data Systems<br />

(HDS), a subsidiary of Tokyo-headquartered<br />

electronic giant Hitachi Ltd.<br />

Based in Santa Clara, Calif., HDS<br />

manufactures storage systems that are a far<br />

cry from the hard drive spinning inside of<br />

your PC. Some HDS systems have multiple<br />

drives that can store petabytes of data — a<br />

petabyte is a million gigabytes — and use<br />

technology such as redundant arrays of<br />

independent disk (RAID) systems so that if<br />

a drive or multiple drives fail, data at banks,<br />

brokerages, hospitals and airlines remains<br />

sound and can continue to be accessed.<br />

When systems fail, many companies are<br />

eager to replace hardware as soon as possible,<br />

and to do this, HDS relies on a New Yorkbased<br />

company that specializes in critical<br />

parts logistics called Choice Logistics.<br />

“They’ve been really good partners for<br />

us,” said Alan Burks, director of logistics<br />

for HDS. He is responsible for finished<br />

goods logistics for HDS outside of Europe,<br />

both products manufactured at its plants<br />

and service logistics like that supplied to<br />

the company by Choice.<br />

Choice is “the best for the stuff that<br />

you’ve got to have in two, three, four hours,<br />

that kind of thing. It’s tied into service levels<br />

and customer expectations,” Burks said.<br />

When a part in an HDS unit fails, an order<br />

for a repair and replacement part is placed,<br />

and it is dispatched from one of Choice’s<br />

strategic stocking locations to arrive at a<br />

customer’s site where a Hitachi technician<br />

can swap out the bad part. (Some Hitachi<br />

units actually monitor themselves and can<br />

call a repairman when a problem begins to<br />

develop.) Choice also handles returns of bad<br />

parts for HDS, some of which are worth<br />

hundreds of thousands of dollars each.<br />

“While what we do for Hitachi is indicative<br />

of what we can do, I don’t think you<br />

will find any two clients where we have<br />

the exact service,” said Gary Weiss, executive<br />

vice president of global operations for<br />

Choice. “We have a variety of offerings that<br />

are somewhat modular and we customize<br />

it for each client.”<br />

16 AMERICAN SHIPPER: OCTOBER 2009<br />

BY CHRIS DUPIN<br />

Gary Weiss<br />

executive vice<br />

president of global<br />

operations,<br />

Choice Logistics<br />

“What we try to understand<br />

is not just what the client<br />

achieves short term, but<br />

where they want to be<br />

positioned beyond that.”<br />

The company commonly offers delivery<br />

of parts within windows of 90 minutes to<br />

four hours.<br />

Weiss said Choice’s preferred method of<br />

interacting with customers is through an<br />

electronic data interchange, and Hitachi<br />

wanted a direct connection so there was<br />

a seamless feed from its call center and<br />

customer relation management software<br />

directly to Choice.<br />

“They also wanted someone to do white<br />

board sessions with them to help do some<br />

of their planning,” he said.<br />

Choice initially won a contract with<br />

Hitachi about six years ago to stock its<br />

parts at some 64 U.S. locations, and the<br />

two companies have expanded their relationship<br />

so that Choice performs work for<br />

it throughout the Americas.<br />

When Hitachi first began working with<br />

Choice its footprint did not yet extend to<br />

Asia or Europe, Burks said. But as Choice<br />

has added offices and strategic stocking locations<br />

in those areas, it would consider doing<br />

business with them throughout the world.<br />

Burks said HDS’s need for Choice to do<br />

super speedy deliveries may actually ebb<br />

because of technology. In Europe, for example,<br />

it has become standard for customers<br />

to expect and accept next-business-day<br />

delivery of drives when they fail. That’s<br />

because inside of a RAID device there is<br />

already a redundant copy of the information<br />

in the unit, and the spare is generally<br />

not replaced until all the information on<br />

the bad drive is copied, a process that can<br />

take 12 to 14 hours.<br />

“So is there any value in delivering a<br />

product that you can’t swap out until 12<br />

hours later?” Burks said.<br />

Yet some customers still want or need<br />

spare parts delivered in a matter of hours,<br />

and Hitachi continues to provide that service.<br />

Burks said Hitachi also uses Choice for<br />

next-day delivery. It even has made its own<br />

Hitachi distribution center in Indianapolis<br />

a node on the Choice network so that it can<br />

use the Choice system to track deliveries<br />

that it ships from its own warehouse.<br />

“We have also helped a lot of companies<br />

to reduce their spend by reducing the numbers<br />

of parts that they store with us,” Weiss<br />

said. “Many companies don’t need to store<br />

as many parts as they do. It becomes very<br />

easy to put more parts in the field, and that’s<br />

inventory creep and can cost customers.”<br />

HDS also relies on Choice to track the<br />

return of parts within its system so it can<br />

credit customers or send them a bill when<br />

parts are not returned. (That, by the way, is<br />

the preference of some HDS clients like the<br />

Central Intelligence Agency and National<br />

Security Agency, who prefer to destroy<br />

their hard drives rather than let it get out of<br />

their control.)<br />

Weiss said Choice is also able to assist<br />

HDS in foreign countries with fulfilling<br />

importer of record requirements so that parts<br />

can be brought into country and contracts<br />

supported.<br />